- •BUSINESSES IN THE BOOK

- •Preface

- •Brief Contents

- •CONTENTS

- •Why Study Strategy?

- •Why Economics?

- •The Need for Principles

- •So What’s the Problem?

- •Firms or Markets?

- •A Framework for Strategy

- •Boundaries of the Firm

- •Market and Competitive Analysis

- •Positioning and Dynamics

- •Internal Organization

- •The Book

- •Endnotes

- •Costs

- •Cost Functions

- •Total Cost Functions

- •Fixed and Variable Costs

- •Average and Marginal Cost Functions

- •The Importance of the Time Period: Long-Run versus Short-Run Cost Functions

- •Sunk versus Avoidable Costs

- •Economic Costs and Profitability

- •Economic versus Accounting Costs

- •Economic Profit versus Accounting Profit

- •Demand and Revenues

- •Demand Curve

- •The Price Elasticity of Demand

- •Brand-Level versus Industry-Level Elasticities

- •Total Revenue and Marginal Revenue Functions

- •Theory of the Firm: Pricing and Output Decisions

- •Perfect Competition

- •Game Theory

- •Games in Matrix Form and the Concept of Nash Equilibrium

- •Game Trees and Subgame Perfection

- •Chapter Summary

- •Questions

- •Endnotes

- •Doing Business in 1840

- •Transportation

- •Communications

- •Finance

- •Production Technology

- •Government

- •Doing Business in 1910

- •Business Conditions in 1910: A “Modern” Infrastructure

- •Production Technology

- •Transportation

- •Communications

- •Finance

- •Government

- •Doing Business Today

- •Modern Infrastructure

- •Transportation

- •Communications

- •Finance

- •Production Technology

- •Government

- •Infrastructure in Emerging Markets

- •Three Different Worlds: Consistent Principles, Changing Conditions, and Adaptive Strategies

- •Chapter Summary

- •Questions

- •Endnotes

- •Definitions

- •Definition of Economies of Scale

- •Definition of Economies of Scope

- •Economies of Scale Due to Spreading of Product-Specific Fixed Costs

- •Economies of Scale Due to Trade-offs among Alternative Technologies

- •“The Division of Labor Is Limited by the Extent of the Market”

- •Special Sources of Economies of Scale and Scope

- •Density

- •Purchasing

- •Advertising

- •Costs of Sending Messages per Potential Consumer

- •Advertising Reach and Umbrella Branding

- •Research and Development

- •Physical Properties of Production

- •Inventories

- •Complementarities and Strategic Fit

- •Sources of Diseconomies of Scale

- •Labor Costs and Firm Size

- •Spreading Specialized Resources Too Thin

- •Bureaucracy

- •Economies of Scale: A Summary

- •The Learning Curve

- •The Concept of the Learning Curve

- •Expanding Output to Obtain a Cost Advantage

- •Learning and Organization

- •The Learning Curve versus Economies of Scale

- •Diversification

- •Why Do Firms Diversify?

- •Efficiency-Based Reasons for Diversification

- •Scope Economies

- •Internal Capital Markets

- •Problematic Justifications for Diversification

- •Diversifying Shareholders’ Portfolios

- •Identifying Undervalued Firms

- •Reasons Not to Diversify

- •Managerial Reasons for Diversification

- •Benefits to Managers from Acquisitions

- •Problems of Corporate Governance

- •The Market for Corporate Control and Recent Changes in Corporate Governance

- •Performance of Diversified Firms

- •Chapter Summary

- •Questions

- •Endnotes

- •Make versus Buy

- •Upstream, Downstream

- •Defining Boundaries

- •Some Make-or-Buy Fallacies

- •Avoiding Peak Prices

- •Tying Up Channels: Vertical Foreclosure

- •Reasons to “Buy”

- •Exploiting Scale and Learning Economies

- •Bureaucracy Effects: Avoiding Agency and Influence Costs

- •Agency Costs

- •Influence Costs

- •Organizational Design

- •Reasons to “Make”

- •The Economic Foundations of Contracts

- •Complete versus Incomplete Contracting

- •Bounded Rationality

- •Difficulties Specifying or Measuring Performance

- •Asymmetric Information

- •The Role of Contract Law

- •Coordination of Production Flows through the Vertical Chain

- •Leakage of Private Information

- •Transactions Costs

- •Relationship-Specific Assets

- •Forms of Asset Specificity

- •The Fundamental Transformation

- •Rents and Quasi-Rents

- •The Holdup Problem

- •Holdup and Ex Post Cooperation

- •The Holdup Problem and Transactions Costs

- •Contract Negotiation and Renegotiation

- •Investments to Improve Ex Post Bargaining Positions

- •Distrust

- •Reduced Investment

- •Recap: From Relationship-Specific Assets to Transactions Costs

- •Chapter Summary

- •Questions

- •Endnotes

- •What Does It Mean to Be “Integrated?”

- •The Property Rights Theory of the Firm

- •Alternative Forms of Organizing Transactions

- •Governance

- •Delegation

- •Recapping PRT

- •Path Dependence

- •Making the Integration Decision

- •Technical Efficiency versus Agency Efficiency

- •The Technical Efficiency/Agency Efficiency Trade-off

- •Real-World Evidence

- •Double Marginalization: A Final Integration Consideration

- •Alternatives to Vertical Integration

- •Tapered Integration: Make and Buy

- •Franchising

- •Strategic Alliances and Joint Ventures

- •Implicit Contracts and Long-Term Relationships

- •Business Groups

- •Keiretsu

- •Chaebol

- •Business Groups in Emerging Markets

- •Chapter Summary

- •Questions

- •Endnotes

- •Competitor Identification and Market Definition

- •The Basics of Competitor Identification

- •Example 5.1 The SSNIP in Action: Defining Hospital Markets

- •Putting Competitor Identification into Practice

- •Empirical Approaches to Competitor Identification

- •Geographic Competitor Identification

- •Measuring Market Structure

- •Market Structure and Competition

- •Perfect Competition

- •Many Sellers

- •Homogeneous Products

- •Excess Capacity

- •Monopoly

- •Monopolistic Competition

- •Demand for Differentiated Goods

- •Entry into Monopolistically Competitive Markets

- •Oligopoly

- •Cournot Quantity Competition

- •The Revenue Destruction Effect

- •Cournot’s Model in Practice

- •Bertrand Price Competition

- •Why Are Cournot and Bertrand Different?

- •Evidence on Market Structure and Performance

- •Price and Concentration

- •Chapter Summary

- •Questions

- •Endnotes

- •6: Entry and Exit

- •Some Facts about Entry and Exit

- •Entry and Exit Decisions: Basic Concepts

- •Barriers to Entry

- •Bain’s Typology of Entry Conditions

- •Analyzing Entry Conditions: The Asymmetry Requirement

- •Structural Entry Barriers

- •Control of Essential Resources

- •Economies of Scale and Scope

- •Marketing Advantages of Incumbency

- •Barriers to Exit

- •Entry-Deterring Strategies

- •Limit Pricing

- •Is Strategic Limit Pricing Rational?

- •Predatory Pricing

- •The Chain-Store Paradox

- •Rescuing Limit Pricing and Predation: The Importance of Uncertainty and Reputation

- •Wars of Attrition

- •Predation and Capacity Expansion

- •Strategic Bundling

- •“Judo Economics”

- •Evidence on Entry-Deterring Behavior

- •Contestable Markets

- •An Entry Deterrence Checklist

- •Entering a New Market

- •Preemptive Entry and Rent Seeking Behavior

- •Chapter Summary

- •Questions

- •Endnotes

- •Microdynamics

- •Strategic Commitment

- •Strategic Substitutes and Strategic Complements

- •The Strategic Effect of Commitments

- •Tough and Soft Commitments

- •A Taxonomy of Commitment Strategies

- •The Informational Benefits of Flexibility

- •Real Options

- •Competitive Discipline

- •Dynamic Pricing Rivalry and Tit-for-Tat Pricing

- •Why Is Tit-for-Tat So Compelling?

- •Coordinating on the Right Price

- •Impediments to Coordination

- •The Misread Problem

- •Lumpiness of Orders

- •Information about the Sales Transaction

- •Volatility of Demand Conditions

- •Facilitating Practices

- •Price Leadership

- •Advance Announcement of Price Changes

- •Most Favored Customer Clauses

- •Uniform Delivered Prices

- •Where Does Market Structure Come From?

- •Sutton’s Endogenous Sunk Costs

- •Innovation and Market Evolution

- •Learning and Industry Dynamics

- •Chapter Summary

- •Questions

- •Endnotes

- •8: Industry Analysis

- •Performing a Five-Forces Analysis

- •Internal Rivalry

- •Entry

- •Substitutes and Complements

- •Supplier Power and Buyer Power

- •Strategies for Coping with the Five Forces

- •Coopetition and the Value Net

- •Applying the Five Forces: Some Industry Analyses

- •Chicago Hospital Markets Then and Now

- •Market Definition

- •Internal Rivalry

- •Entry

- •Substitutes and Complements

- •Supplier Power

- •Buyer Power

- •Commercial Airframe Manufacturing

- •Market Definition

- •Internal Rivalry

- •Barriers to Entry

- •Substitutes and Complements

- •Supplier Power

- •Buyer Power

- •Professional Sports

- •Market Definition

- •Internal Rivalry

- •Entry

- •Substitutes and Complements

- •Supplier Power

- •Buyer Power

- •Conclusion

- •Professional Search Firms

- •Market Definition

- •Internal Rivalry

- •Entry

- •Substitutes and Complements

- •Supplier Power

- •Buyer Power

- •Conclusion

- •Chapter Summary

- •Questions

- •Endnotes

- •Competitive Advantage Defined

- •Maximum Willingness-to-Pay and Consumer Surplus

- •From Maximum Willingness-to-Pay to Consumer Surplus

- •Value-Created

- •Value Creation and “Win–Win” Business Opportunities

- •Value Creation and Competitive Advantage

- •Analyzing Value Creation

- •Value Creation and the Value Chain

- •Value Creation, Resources, and Capabilities

- •Generic Strategies

- •The Strategic Logic of Cost Leadership

- •The Strategic Logic of Benefit Leadership

- •Extracting Profits from Cost and Benefit Advantage

- •Comparing Cost and Benefit Advantages

- •“Stuck in the Middle”

- •Diagnosing Cost and Benefit Drivers

- •Cost Drivers

- •Cost Drivers Related to Firm Size, Scope, and Cumulative Experience

- •Cost Drivers Independent of Firm Size, Scope, or Cumulative Experience

- •Cost Drivers Related to Organization of the Transactions

- •Benefit Drivers

- •Methods for Estimating and Characterizing Costs and Perceived Benefits

- •Estimating Costs

- •Estimating Benefits

- •Strategic Positioning: Broad Coverage versus Focus Strategies

- •Segmenting an Industry

- •Broad Coverage Strategies

- •Focus Strategies

- •Chapter Summary

- •Questions

- •Endnotes

- •The “Shopping Problem”

- •Unraveling

- •Alternatives to Disclosure

- •Nonprofit Firms

- •Report Cards

- •Multitasking: Teaching to the Test

- •What to Measure

- •Risk Adjustment

- •Presenting Report Card Results

- •Gaming Report Cards

- •The Certifier Market

- •Certification Bias

- •Matchmaking

- •When Sellers Search for Buyers

- •Chapter Summary

- •Questions

- •Endnotes

- •Market Structure and Threats to Sustainability

- •Threats to Sustainability in Competitive and Monopolistically Competitive Markets

- •Threats to Sustainability under All Market Structures

- •Evidence: The Persistence of Profitability

- •The Resource-Based Theory of the Firm

- •Imperfect Mobility and Cospecialization

- •Isolating Mechanisms

- •Impediments to Imitation

- •Legal Restrictions

- •Superior Access to Inputs or Customers

- •The Winner’s Curse

- •Market Size and Scale Economies

- •Intangible Barriers to Imitation

- •Causal Ambiguity

- •Dependence on Historical Circumstances

- •Social Complexity

- •Early-Mover Advantages

- •Learning Curve

- •Reputation and Buyer Uncertainty

- •Buyer Switching Costs

- •Network Effects

- •Networks and Standards

- •Competing “For the Market” versus “In the Market”

- •Knocking off a Dominant Standard

- •Early-Mover Disadvantages

- •Imperfect Imitability and Industry Equilibrium

- •Creating Advantage and Creative Destruction

- •Disruptive Technologies

- •The Productivity Effect

- •The Sunk Cost Effect

- •The Replacement Effect

- •The Efficiency Effect

- •Disruption versus the Resource-Based Theory of the Firm

- •Innovation and the Market for Ideas

- •The Environment

- •Factor Conditions

- •Demand Conditions

- •Related Supplier or Support Industries

- •Strategy, Structure, and Rivalry

- •Chapter Summary

- •Questions

- •Endnotes

- •The Principal–Agent Relationship

- •Combating Agency Problems

- •Performance-Based Incentives

- •Problems with Performance-Based Incentives

- •Preferences over Risky Outcomes

- •Risk Sharing

- •Risk and Incentives

- •Selecting Performance Measures: Managing Trade-offs between Costs

- •Do Pay-for-Performance Incentives Work?

- •Implicit Incentive Contracts

- •Subjective Performance Evaluation

- •Promotion Tournaments

- •Efficiency Wages and the Threat of Termination

- •Incentives in Teams

- •Chapter Summary

- •Questions

- •Endnotes

- •13: Strategy and Structure

- •An Introduction to Structure

- •Individuals, Teams, and Hierarchies

- •Complex Hierarchy

- •Departmentalization

- •Coordination and Control

- •Approaches to Coordination

- •Types of Organizational Structures

- •Functional Structure (U-form)

- •Multidivisional Structure (M-form)

- •Matrix Structure

- •Matrix or Division? A Model of Optimal Structure

- •Network Structure

- •Why Are There So Few Structural Types?

- •Structure—Environment Coherence

- •Technology and Task Interdependence

- •Efficient Information Processing

- •Structure Follows Strategy

- •Strategy, Structure, and the Multinational Firm

- •Chapter Summary

- •Questions

- •Endnotes

- •The Social Context of Firm Behavior

- •Internal Context

- •Power

- •The Sources of Power

- •Structural Views of Power

- •Do Successful Organizations Need Powerful Managers?

- •The Decision to Allocate Formal Power to Individuals

- •Culture

- •Culture Complements Formal Controls

- •Culture Facilitates Cooperation and Reduces Bargaining Costs

- •Culture, Inertia, and Performance

- •A Word of Caution about Culture

- •External Context, Institutions, and Strategies

- •Institutions and Regulation

- •Interfirm Resource Dependence Relationships

- •Industry Logics: Beliefs, Values, and Behavioral Norms

- •Chapter Summary

- •Questions

- •Endnotes

- •Glossary

- •Name Index

- •Subject Index

106 • Chapter 3 • The Vertical Boundaries of the Firm

accountants after they have completed university training.

When scale economies are less important, firms often offer training in-house. Consider, as an example, the “mini-MBA” program offered by the consulting firm McKinsey and Company. The firm offers this program to employees who have strong analytical backgrounds—often individuals with MDs or PhDs in hard sciences—but lack direct business experience. While most top MBA programs aim to offer both business knowledge and training in analytical skills, the McKinsey “mini-MBA” program focuses only on business knowledge. Peter Attia, an associate who joined the firm in 2006, is a typical participant. Trained as a surgeon, Attia left medicine after determining it wasn’t a good fit for him; he described the miniMBA as a “boot camp covering all the aspects of business that I didn’t have coming in.”8 Because the McKinsey program is somewhat more specialized than, say, a bachelor’s degree in accounting, the firm is not at a large cost disadvantage relative to outside providers of education.

Using the market for procuring employee skills has several additional advantages. First, education often generates information that is useful in matching the right employee to the right employer. Suppose two firms each need to hire a computer programmer. One firm’s programming tasks are quite complex, and so this firm is willing to pay a very high wage to attract a programmer from the top of his or her class. The second firm’s tasks are not as complex, and so it has a lower willingness to pay for programming ability. By going to the market to hire programmers, the firms can each make their hiring decisions contingent on how individuals did in their bachelors of computer science coursework. If the firms adopted a “make” strategy where they hired individuals with no

programming background and then offered training, it might be difficult for the first firm to identify which of two prospective programmers would turn out to be a star.

Second, potential employees often develop valuable networks with other students when attending college or graduate school. For example, an investment bank that hires a Kellogg School MBA is also importing connections with that MBA’s classmates. It would be very difficult for the bank to match this “network effect” if it relied on in-house training.

As the Nobel Prize–winning economist Gary Becker has pointed out, the problem of determining the best way to invest in employees’ skills is complicated by the fact that returns to human capital investments are inalienable.9 That is, unlike physical capital, human capital cannot be separated from the person making the investment. A firm that pays for an employee to gain skills that are valued by other employers—what Becker refers to as “general-purpose” human capital— may find the employee’s wage is bid up after the skills are acquired. Thus, while the employee’s productivity may rise as he or she gains skills, the firm does not benefit because of the increased wage bill. Firms that offer general-purpose training (such as McKinsey’s mini-MBA) need to think about how to earn a return on this investment in the face of labor-market competition.

While firms may thus be hesitant to invest in building employees’ general-purpose skills, employees may be similarly concerned about investing in firm-specific skills. Employees’ investments in specific human capital are subject to the holdup problem, which we discuss later in this chapter. Adobe’s sales force, for example, may worry that investments in learning how to sell the PDF standard will not be rewarded by the firm, because there is no other employer willing to pay for skills that are specific to PDF.

REASONS TO “BUY”

Firms use the market (or “buy”) primarily because market firms are often more efficient. Market firms enjoy two distinct types of efficiencies: they exploit economies of scale and the learning curve, and they eliminate “bureaucracy.”

Reasons to “Buy” • 107

Exploiting Scale and Learning Economies

It is conventional wisdom that firms should focus their activities on what they do best and leave everything else to market firms. There are several reasons for this. First, market firms may possess proprietary information or patents that enable them to produce at lower cost. Second, market firms might be able to aggregate the needs of many customers, thereby enjoying economies of scale. Third, market firms might exploit their experience in producing for many customers to obtain learning economies.

The first argument requires no additional analysis; the last two arguments are more subtle. Recall from Chapter 2 that when economies of scale or learning economies are present, firms with low production levels or little experience in production may be at a severe cost disadvantage relative to their larger, more experienced rivals. Market firms can often aggregate the demands of many potential buyers, whereas a vertically integrated firm typically produces only for its own needs. Market firms can therefore often achieve greater scale, and thus lower unit costs, than can the downstream firms that use the input.

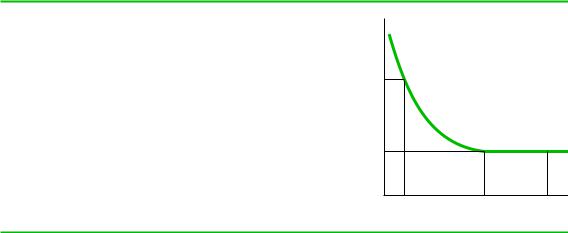

To illustrate this point, consider automobile production. An automobile manufacturer requires a vast variety of upstream inputs: steel, tires, antilock brakes, stereos, computer equipment, and so forth. A manufacturer, Audi, for example, could backward integrate and produce inputs such as antilock brakes itself, or it could obtain them from an independent supplier, such as Bosch or Denso. Figure 3.2 illustrates an average cost function for antilock brakes. According to the figure, the production of antilock brakes displays L-shaped average costs, indicating that there are economies of scale in production. In this example, the minimum efficient scale of production—the smallest level of output at which average cost is minimized—is output level A*, with resulting average cost C*.

Suppose that Audi expects to sell A9 automobiles with antilock brakes, where A9 . A*. Thus, Audi expects to sell enough automobiles to achieve minimum efficient scale in the production of antilock brakes by producing for its own needs alone. This is seen in Figure 3.2, where the average cost of output A9 roughly equals C*. From a cost perspective, Audi gets no advantage by using the market.

FIGURE 3.2

Production Costs and the Make-or-Buy Decision

Firms need to produce quantity A* to reach minimum efficient scale and achieve average costs of C*. A firm that requires only A9 units to meet its own needs will incur average costs of C9, well above C*. A firm that requires output in excess of A*, such as A0, will have costs equal to C* and will not be at a competitive disadvantage.

Average cost |

C ′ |

|

C * |

||

|

A′ |

A* |

A″ |

Quantity of antilock brakes