- •BUSINESSES IN THE BOOK

- •Preface

- •Brief Contents

- •CONTENTS

- •Why Study Strategy?

- •Why Economics?

- •The Need for Principles

- •So What’s the Problem?

- •Firms or Markets?

- •A Framework for Strategy

- •Boundaries of the Firm

- •Market and Competitive Analysis

- •Positioning and Dynamics

- •Internal Organization

- •The Book

- •Endnotes

- •Costs

- •Cost Functions

- •Total Cost Functions

- •Fixed and Variable Costs

- •Average and Marginal Cost Functions

- •The Importance of the Time Period: Long-Run versus Short-Run Cost Functions

- •Sunk versus Avoidable Costs

- •Economic Costs and Profitability

- •Economic versus Accounting Costs

- •Economic Profit versus Accounting Profit

- •Demand and Revenues

- •Demand Curve

- •The Price Elasticity of Demand

- •Brand-Level versus Industry-Level Elasticities

- •Total Revenue and Marginal Revenue Functions

- •Theory of the Firm: Pricing and Output Decisions

- •Perfect Competition

- •Game Theory

- •Games in Matrix Form and the Concept of Nash Equilibrium

- •Game Trees and Subgame Perfection

- •Chapter Summary

- •Questions

- •Endnotes

- •Doing Business in 1840

- •Transportation

- •Communications

- •Finance

- •Production Technology

- •Government

- •Doing Business in 1910

- •Business Conditions in 1910: A “Modern” Infrastructure

- •Production Technology

- •Transportation

- •Communications

- •Finance

- •Government

- •Doing Business Today

- •Modern Infrastructure

- •Transportation

- •Communications

- •Finance

- •Production Technology

- •Government

- •Infrastructure in Emerging Markets

- •Three Different Worlds: Consistent Principles, Changing Conditions, and Adaptive Strategies

- •Chapter Summary

- •Questions

- •Endnotes

- •Definitions

- •Definition of Economies of Scale

- •Definition of Economies of Scope

- •Economies of Scale Due to Spreading of Product-Specific Fixed Costs

- •Economies of Scale Due to Trade-offs among Alternative Technologies

- •“The Division of Labor Is Limited by the Extent of the Market”

- •Special Sources of Economies of Scale and Scope

- •Density

- •Purchasing

- •Advertising

- •Costs of Sending Messages per Potential Consumer

- •Advertising Reach and Umbrella Branding

- •Research and Development

- •Physical Properties of Production

- •Inventories

- •Complementarities and Strategic Fit

- •Sources of Diseconomies of Scale

- •Labor Costs and Firm Size

- •Spreading Specialized Resources Too Thin

- •Bureaucracy

- •Economies of Scale: A Summary

- •The Learning Curve

- •The Concept of the Learning Curve

- •Expanding Output to Obtain a Cost Advantage

- •Learning and Organization

- •The Learning Curve versus Economies of Scale

- •Diversification

- •Why Do Firms Diversify?

- •Efficiency-Based Reasons for Diversification

- •Scope Economies

- •Internal Capital Markets

- •Problematic Justifications for Diversification

- •Diversifying Shareholders’ Portfolios

- •Identifying Undervalued Firms

- •Reasons Not to Diversify

- •Managerial Reasons for Diversification

- •Benefits to Managers from Acquisitions

- •Problems of Corporate Governance

- •The Market for Corporate Control and Recent Changes in Corporate Governance

- •Performance of Diversified Firms

- •Chapter Summary

- •Questions

- •Endnotes

- •Make versus Buy

- •Upstream, Downstream

- •Defining Boundaries

- •Some Make-or-Buy Fallacies

- •Avoiding Peak Prices

- •Tying Up Channels: Vertical Foreclosure

- •Reasons to “Buy”

- •Exploiting Scale and Learning Economies

- •Bureaucracy Effects: Avoiding Agency and Influence Costs

- •Agency Costs

- •Influence Costs

- •Organizational Design

- •Reasons to “Make”

- •The Economic Foundations of Contracts

- •Complete versus Incomplete Contracting

- •Bounded Rationality

- •Difficulties Specifying or Measuring Performance

- •Asymmetric Information

- •The Role of Contract Law

- •Coordination of Production Flows through the Vertical Chain

- •Leakage of Private Information

- •Transactions Costs

- •Relationship-Specific Assets

- •Forms of Asset Specificity

- •The Fundamental Transformation

- •Rents and Quasi-Rents

- •The Holdup Problem

- •Holdup and Ex Post Cooperation

- •The Holdup Problem and Transactions Costs

- •Contract Negotiation and Renegotiation

- •Investments to Improve Ex Post Bargaining Positions

- •Distrust

- •Reduced Investment

- •Recap: From Relationship-Specific Assets to Transactions Costs

- •Chapter Summary

- •Questions

- •Endnotes

- •What Does It Mean to Be “Integrated?”

- •The Property Rights Theory of the Firm

- •Alternative Forms of Organizing Transactions

- •Governance

- •Delegation

- •Recapping PRT

- •Path Dependence

- •Making the Integration Decision

- •Technical Efficiency versus Agency Efficiency

- •The Technical Efficiency/Agency Efficiency Trade-off

- •Real-World Evidence

- •Double Marginalization: A Final Integration Consideration

- •Alternatives to Vertical Integration

- •Tapered Integration: Make and Buy

- •Franchising

- •Strategic Alliances and Joint Ventures

- •Implicit Contracts and Long-Term Relationships

- •Business Groups

- •Keiretsu

- •Chaebol

- •Business Groups in Emerging Markets

- •Chapter Summary

- •Questions

- •Endnotes

- •Competitor Identification and Market Definition

- •The Basics of Competitor Identification

- •Example 5.1 The SSNIP in Action: Defining Hospital Markets

- •Putting Competitor Identification into Practice

- •Empirical Approaches to Competitor Identification

- •Geographic Competitor Identification

- •Measuring Market Structure

- •Market Structure and Competition

- •Perfect Competition

- •Many Sellers

- •Homogeneous Products

- •Excess Capacity

- •Monopoly

- •Monopolistic Competition

- •Demand for Differentiated Goods

- •Entry into Monopolistically Competitive Markets

- •Oligopoly

- •Cournot Quantity Competition

- •The Revenue Destruction Effect

- •Cournot’s Model in Practice

- •Bertrand Price Competition

- •Why Are Cournot and Bertrand Different?

- •Evidence on Market Structure and Performance

- •Price and Concentration

- •Chapter Summary

- •Questions

- •Endnotes

- •6: Entry and Exit

- •Some Facts about Entry and Exit

- •Entry and Exit Decisions: Basic Concepts

- •Barriers to Entry

- •Bain’s Typology of Entry Conditions

- •Analyzing Entry Conditions: The Asymmetry Requirement

- •Structural Entry Barriers

- •Control of Essential Resources

- •Economies of Scale and Scope

- •Marketing Advantages of Incumbency

- •Barriers to Exit

- •Entry-Deterring Strategies

- •Limit Pricing

- •Is Strategic Limit Pricing Rational?

- •Predatory Pricing

- •The Chain-Store Paradox

- •Rescuing Limit Pricing and Predation: The Importance of Uncertainty and Reputation

- •Wars of Attrition

- •Predation and Capacity Expansion

- •Strategic Bundling

- •“Judo Economics”

- •Evidence on Entry-Deterring Behavior

- •Contestable Markets

- •An Entry Deterrence Checklist

- •Entering a New Market

- •Preemptive Entry and Rent Seeking Behavior

- •Chapter Summary

- •Questions

- •Endnotes

- •Microdynamics

- •Strategic Commitment

- •Strategic Substitutes and Strategic Complements

- •The Strategic Effect of Commitments

- •Tough and Soft Commitments

- •A Taxonomy of Commitment Strategies

- •The Informational Benefits of Flexibility

- •Real Options

- •Competitive Discipline

- •Dynamic Pricing Rivalry and Tit-for-Tat Pricing

- •Why Is Tit-for-Tat So Compelling?

- •Coordinating on the Right Price

- •Impediments to Coordination

- •The Misread Problem

- •Lumpiness of Orders

- •Information about the Sales Transaction

- •Volatility of Demand Conditions

- •Facilitating Practices

- •Price Leadership

- •Advance Announcement of Price Changes

- •Most Favored Customer Clauses

- •Uniform Delivered Prices

- •Where Does Market Structure Come From?

- •Sutton’s Endogenous Sunk Costs

- •Innovation and Market Evolution

- •Learning and Industry Dynamics

- •Chapter Summary

- •Questions

- •Endnotes

- •8: Industry Analysis

- •Performing a Five-Forces Analysis

- •Internal Rivalry

- •Entry

- •Substitutes and Complements

- •Supplier Power and Buyer Power

- •Strategies for Coping with the Five Forces

- •Coopetition and the Value Net

- •Applying the Five Forces: Some Industry Analyses

- •Chicago Hospital Markets Then and Now

- •Market Definition

- •Internal Rivalry

- •Entry

- •Substitutes and Complements

- •Supplier Power

- •Buyer Power

- •Commercial Airframe Manufacturing

- •Market Definition

- •Internal Rivalry

- •Barriers to Entry

- •Substitutes and Complements

- •Supplier Power

- •Buyer Power

- •Professional Sports

- •Market Definition

- •Internal Rivalry

- •Entry

- •Substitutes and Complements

- •Supplier Power

- •Buyer Power

- •Conclusion

- •Professional Search Firms

- •Market Definition

- •Internal Rivalry

- •Entry

- •Substitutes and Complements

- •Supplier Power

- •Buyer Power

- •Conclusion

- •Chapter Summary

- •Questions

- •Endnotes

- •Competitive Advantage Defined

- •Maximum Willingness-to-Pay and Consumer Surplus

- •From Maximum Willingness-to-Pay to Consumer Surplus

- •Value-Created

- •Value Creation and “Win–Win” Business Opportunities

- •Value Creation and Competitive Advantage

- •Analyzing Value Creation

- •Value Creation and the Value Chain

- •Value Creation, Resources, and Capabilities

- •Generic Strategies

- •The Strategic Logic of Cost Leadership

- •The Strategic Logic of Benefit Leadership

- •Extracting Profits from Cost and Benefit Advantage

- •Comparing Cost and Benefit Advantages

- •“Stuck in the Middle”

- •Diagnosing Cost and Benefit Drivers

- •Cost Drivers

- •Cost Drivers Related to Firm Size, Scope, and Cumulative Experience

- •Cost Drivers Independent of Firm Size, Scope, or Cumulative Experience

- •Cost Drivers Related to Organization of the Transactions

- •Benefit Drivers

- •Methods for Estimating and Characterizing Costs and Perceived Benefits

- •Estimating Costs

- •Estimating Benefits

- •Strategic Positioning: Broad Coverage versus Focus Strategies

- •Segmenting an Industry

- •Broad Coverage Strategies

- •Focus Strategies

- •Chapter Summary

- •Questions

- •Endnotes

- •The “Shopping Problem”

- •Unraveling

- •Alternatives to Disclosure

- •Nonprofit Firms

- •Report Cards

- •Multitasking: Teaching to the Test

- •What to Measure

- •Risk Adjustment

- •Presenting Report Card Results

- •Gaming Report Cards

- •The Certifier Market

- •Certification Bias

- •Matchmaking

- •When Sellers Search for Buyers

- •Chapter Summary

- •Questions

- •Endnotes

- •Market Structure and Threats to Sustainability

- •Threats to Sustainability in Competitive and Monopolistically Competitive Markets

- •Threats to Sustainability under All Market Structures

- •Evidence: The Persistence of Profitability

- •The Resource-Based Theory of the Firm

- •Imperfect Mobility and Cospecialization

- •Isolating Mechanisms

- •Impediments to Imitation

- •Legal Restrictions

- •Superior Access to Inputs or Customers

- •The Winner’s Curse

- •Market Size and Scale Economies

- •Intangible Barriers to Imitation

- •Causal Ambiguity

- •Dependence on Historical Circumstances

- •Social Complexity

- •Early-Mover Advantages

- •Learning Curve

- •Reputation and Buyer Uncertainty

- •Buyer Switching Costs

- •Network Effects

- •Networks and Standards

- •Competing “For the Market” versus “In the Market”

- •Knocking off a Dominant Standard

- •Early-Mover Disadvantages

- •Imperfect Imitability and Industry Equilibrium

- •Creating Advantage and Creative Destruction

- •Disruptive Technologies

- •The Productivity Effect

- •The Sunk Cost Effect

- •The Replacement Effect

- •The Efficiency Effect

- •Disruption versus the Resource-Based Theory of the Firm

- •Innovation and the Market for Ideas

- •The Environment

- •Factor Conditions

- •Demand Conditions

- •Related Supplier or Support Industries

- •Strategy, Structure, and Rivalry

- •Chapter Summary

- •Questions

- •Endnotes

- •The Principal–Agent Relationship

- •Combating Agency Problems

- •Performance-Based Incentives

- •Problems with Performance-Based Incentives

- •Preferences over Risky Outcomes

- •Risk Sharing

- •Risk and Incentives

- •Selecting Performance Measures: Managing Trade-offs between Costs

- •Do Pay-for-Performance Incentives Work?

- •Implicit Incentive Contracts

- •Subjective Performance Evaluation

- •Promotion Tournaments

- •Efficiency Wages and the Threat of Termination

- •Incentives in Teams

- •Chapter Summary

- •Questions

- •Endnotes

- •13: Strategy and Structure

- •An Introduction to Structure

- •Individuals, Teams, and Hierarchies

- •Complex Hierarchy

- •Departmentalization

- •Coordination and Control

- •Approaches to Coordination

- •Types of Organizational Structures

- •Functional Structure (U-form)

- •Multidivisional Structure (M-form)

- •Matrix Structure

- •Matrix or Division? A Model of Optimal Structure

- •Network Structure

- •Why Are There So Few Structural Types?

- •Structure—Environment Coherence

- •Technology and Task Interdependence

- •Efficient Information Processing

- •Structure Follows Strategy

- •Strategy, Structure, and the Multinational Firm

- •Chapter Summary

- •Questions

- •Endnotes

- •The Social Context of Firm Behavior

- •Internal Context

- •Power

- •The Sources of Power

- •Structural Views of Power

- •Do Successful Organizations Need Powerful Managers?

- •The Decision to Allocate Formal Power to Individuals

- •Culture

- •Culture Complements Formal Controls

- •Culture Facilitates Cooperation and Reduces Bargaining Costs

- •Culture, Inertia, and Performance

- •A Word of Caution about Culture

- •External Context, Institutions, and Strategies

- •Institutions and Regulation

- •Interfirm Resource Dependence Relationships

- •Industry Logics: Beliefs, Values, and Behavioral Norms

- •Chapter Summary

- •Questions

- •Endnotes

- •Glossary

- •Name Index

- •Subject Index

Demand and Revenues • 21

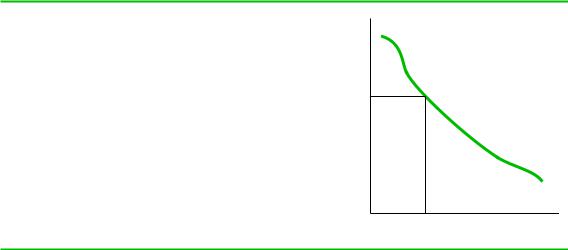

FIGURE P.7

Demand Curve

The demand curve shows the quantity of a product that consumers will purchase at different prices. For example, at price P9 consumers purchase Q9 units of the product. We would expect an inverse relationship between quantity and price, so this curve is downward sloping.

P′

Price

Q′

Q Quantity

The law of demand may not hold if high prices confer prestige or enhance a product’s image, or when consumers cannot objectively assess the potential performance of a product and use price to infer quality. Both prestige and signaling effects could result in demand curves that slope upward for some range of prices. Even so, personal experience and countless studies from economics and marketing confirm that the law of demand applies to most products.

As Figure P.7 shows, the demand curve is typically drawn with price on the vertical axis and quantity on the horizontal axis. This may seem strange because we think that price determines the quantity demanded, not the other way around. However, this representation emphasizes a useful alternative interpretation for a demand curve. Not only does the demand curve tell us the quantity consumers will purchase at any given price, it also tells us the highest possible price that the market will bear for a given quantity or supply of output. Thus, in Figure P.7, if the firm sets a target of selling output level Q9 (which might be what it can produce by running at full capacity), the demand curve tells us that the highest price the firm can charge is P9.

The Price Elasticity of Demand

Look at a firm that is considering a price increase. The firm understands that according to the law of demand, the increase in price will result in the loss of some sales. This may be acceptable if the loss in sales is not “too large.” If sales do not suffer much, the firm may actually increase its sales revenue when it raises its price. If sales drop substantially, however, sales revenues may decline, and the firm could be worse off.

Figure P.8 illustrates the implications of the firm’s pricing decision when its demand curve has one of two alternative shapes, DA and DB. Suppose the firm is currently charging P0 and selling Q0, and is considering an increase in price to P1. If the firm’s demand curve is DA, the price increase would cause only a small drop in sales. In this case, the quantity demanded is not very sensitive to price. We would suspect that the increase in price would increase sales revenue because the price increase swamps the quantity decrease. By contrast, if the firm’s demand curve is DB, the increase in price

22 • Economics Primer: Basic Principles

FIGURE P.8

Price Sensitivity and the Shape of the Demand Curve

When the demand curve is DA, a change in price from P0 to P1 has only a small effect on the quantity demanded. However, when the demand curve is DB, the same change in price results in a large drop in quantity demanded. When DA is the demand

curve, we would conjecture that the increase in price would increase sales revenues, but when DB is the demand curve, the price increase would reduce sales revenues.

Price

P1 P0

DB

DA

Q0

Q Quantity

would cause a large drop in sales. Here, the quantity demanded is very sensitive to price. We would expect that the price increase would decrease sales revenues.

As this analysis shows, the shape of the demand curve can strongly affect the success of the firm’s pricing strategy. The concept of the price elasticity of demand summarizes this effect by measuring the sensitivity of quantity demanded to price. The price elasticity of demand, commonly denoted by , is the percentage change in quantity brought about by a 1 percent change in price. Letting subscript “0” represent the initial situation and “1” represent the situation after the price changes, the formula for elasticity is

5 2 DQyQ0

DPyP0

where DP 5 P1 2 P0 is the change in price, and DQ 5 Q1 2 Q0 is the resulting change in quantity.8 To illustrate this formula, suppose price is initially $5, and the corresponding quantity demanded is 1,000 units. If the price rises to $5.75, though, the quantity demanded would fall to 800 units. Then

|

800 2 1000 |

|

|

|

|||

5 2 |

1000 |

|

|

5 |

20.20 |

5 1.33 |

|

|

5.75 2 |

5 |

|

0.15 |

|||

|

5 |

|

|

|

|

|

|

Thus over the range of prices between $5.00 and $5.75, quantity demanded falls at a rate of 1.33 percent for every 1 percent increase in price. The price elasticity might be less than 1 or greater than 1.

•If is less than 1, we say that demand is inelastic, which is the situation along demand curve DA for the price change being considered.

•If is greater than 1, we say that demand is elastic, which is the situation along demand curve DB for the price change being considered.

Demand and Revenues • 23

Given an estimate of the price elasticity of demand, a manager could calculate the expected percentage change in quantity demanded resulting from a given change in price by multiplying the percentage change in price by the estimated elasticity. To illustrate, suppose management believed 5 0.75. If it contemplated a 3 percent increase in price, then it should expect a 3 3 0.75 5 2.25 percent drop in the quantity demanded as a result of the price increase.9

Price elasticities can be estimated using statistical techniques, and economists and marketers have estimated price elasticities for many products. But in most practical situations, managers will not have the benefit of a precise numerical estimate of elasticity based on statistical techniques. Consequently, the manager must rely on his or her knowledge of the product and the nature of the market to estimate price sensitivity. Among the factors that tend to make demand for the firm’s product more sensitive to price are the following:

•The product has few unique features that differentiate it from rival products, and buyers are aware of the prices and features of rival products. Airline service is a good example of a product that is hard to differentiate and where consumers can easily inform themselves of the range of prices that exist in a particular market.

•Buyers’ expenditures on the product are a large fraction of their total expenditures. In this case, the savings from finding a comparable item at a lower price are large, so consumers tend to shop more than when making small purchases. Refrigerators and washing machines are products whose demand is fairly price sensitive because consumers are motivated to shop around before purchasing.

•The product is an input that buyers use to produce a final good whose demand is itself sensitive to price. In this case, if buyers tried to pass through to their customers even small changes in the price of the input, demand for the finished good could decrease dramatically. The input buyers will thus be very sensitive to price. For example, a personal computer manufacturer’s demand for components and materials is likely to be highly price elastic because consumer demand for personal computers is highly price elastic.

Among the factors that tend to make demand less sensitive to price are the following:

•Comparisons among substitute products are difficult. This could be because the product is complex and has many performance dimensions; because consumers have little or no experience with substitute products and thus would face a risk if they purchased them; or because comparison shopping is costly. Items sold door-to- door, such as Avon cosmetics, have traditionally been price inelastic because, at the time of sale, most consumers lack good information about the prices of alternatives.

•Because of tax deductions or insurance, buyers pay only a fraction of the full price of the product. Health care is an excellent example.

•A buyer would incur significant costs if it switched to a substitute product. Switching costs could arise if the use of a product requires specialized training or expertise that is not fully transferable across different varieties of the product. For example, to the extent that a consumer develops expertise in using a particular word processing package that is incompatible with available alternatives, switching costs will be high, and price sensitivity for upgrades will be low.