- •BUSINESSES IN THE BOOK

- •Preface

- •Brief Contents

- •CONTENTS

- •Why Study Strategy?

- •Why Economics?

- •The Need for Principles

- •So What’s the Problem?

- •Firms or Markets?

- •A Framework for Strategy

- •Boundaries of the Firm

- •Market and Competitive Analysis

- •Positioning and Dynamics

- •Internal Organization

- •The Book

- •Endnotes

- •Costs

- •Cost Functions

- •Total Cost Functions

- •Fixed and Variable Costs

- •Average and Marginal Cost Functions

- •The Importance of the Time Period: Long-Run versus Short-Run Cost Functions

- •Sunk versus Avoidable Costs

- •Economic Costs and Profitability

- •Economic versus Accounting Costs

- •Economic Profit versus Accounting Profit

- •Demand and Revenues

- •Demand Curve

- •The Price Elasticity of Demand

- •Brand-Level versus Industry-Level Elasticities

- •Total Revenue and Marginal Revenue Functions

- •Theory of the Firm: Pricing and Output Decisions

- •Perfect Competition

- •Game Theory

- •Games in Matrix Form and the Concept of Nash Equilibrium

- •Game Trees and Subgame Perfection

- •Chapter Summary

- •Questions

- •Endnotes

- •Doing Business in 1840

- •Transportation

- •Communications

- •Finance

- •Production Technology

- •Government

- •Doing Business in 1910

- •Business Conditions in 1910: A “Modern” Infrastructure

- •Production Technology

- •Transportation

- •Communications

- •Finance

- •Government

- •Doing Business Today

- •Modern Infrastructure

- •Transportation

- •Communications

- •Finance

- •Production Technology

- •Government

- •Infrastructure in Emerging Markets

- •Three Different Worlds: Consistent Principles, Changing Conditions, and Adaptive Strategies

- •Chapter Summary

- •Questions

- •Endnotes

- •Definitions

- •Definition of Economies of Scale

- •Definition of Economies of Scope

- •Economies of Scale Due to Spreading of Product-Specific Fixed Costs

- •Economies of Scale Due to Trade-offs among Alternative Technologies

- •“The Division of Labor Is Limited by the Extent of the Market”

- •Special Sources of Economies of Scale and Scope

- •Density

- •Purchasing

- •Advertising

- •Costs of Sending Messages per Potential Consumer

- •Advertising Reach and Umbrella Branding

- •Research and Development

- •Physical Properties of Production

- •Inventories

- •Complementarities and Strategic Fit

- •Sources of Diseconomies of Scale

- •Labor Costs and Firm Size

- •Spreading Specialized Resources Too Thin

- •Bureaucracy

- •Economies of Scale: A Summary

- •The Learning Curve

- •The Concept of the Learning Curve

- •Expanding Output to Obtain a Cost Advantage

- •Learning and Organization

- •The Learning Curve versus Economies of Scale

- •Diversification

- •Why Do Firms Diversify?

- •Efficiency-Based Reasons for Diversification

- •Scope Economies

- •Internal Capital Markets

- •Problematic Justifications for Diversification

- •Diversifying Shareholders’ Portfolios

- •Identifying Undervalued Firms

- •Reasons Not to Diversify

- •Managerial Reasons for Diversification

- •Benefits to Managers from Acquisitions

- •Problems of Corporate Governance

- •The Market for Corporate Control and Recent Changes in Corporate Governance

- •Performance of Diversified Firms

- •Chapter Summary

- •Questions

- •Endnotes

- •Make versus Buy

- •Upstream, Downstream

- •Defining Boundaries

- •Some Make-or-Buy Fallacies

- •Avoiding Peak Prices

- •Tying Up Channels: Vertical Foreclosure

- •Reasons to “Buy”

- •Exploiting Scale and Learning Economies

- •Bureaucracy Effects: Avoiding Agency and Influence Costs

- •Agency Costs

- •Influence Costs

- •Organizational Design

- •Reasons to “Make”

- •The Economic Foundations of Contracts

- •Complete versus Incomplete Contracting

- •Bounded Rationality

- •Difficulties Specifying or Measuring Performance

- •Asymmetric Information

- •The Role of Contract Law

- •Coordination of Production Flows through the Vertical Chain

- •Leakage of Private Information

- •Transactions Costs

- •Relationship-Specific Assets

- •Forms of Asset Specificity

- •The Fundamental Transformation

- •Rents and Quasi-Rents

- •The Holdup Problem

- •Holdup and Ex Post Cooperation

- •The Holdup Problem and Transactions Costs

- •Contract Negotiation and Renegotiation

- •Investments to Improve Ex Post Bargaining Positions

- •Distrust

- •Reduced Investment

- •Recap: From Relationship-Specific Assets to Transactions Costs

- •Chapter Summary

- •Questions

- •Endnotes

- •What Does It Mean to Be “Integrated?”

- •The Property Rights Theory of the Firm

- •Alternative Forms of Organizing Transactions

- •Governance

- •Delegation

- •Recapping PRT

- •Path Dependence

- •Making the Integration Decision

- •Technical Efficiency versus Agency Efficiency

- •The Technical Efficiency/Agency Efficiency Trade-off

- •Real-World Evidence

- •Double Marginalization: A Final Integration Consideration

- •Alternatives to Vertical Integration

- •Tapered Integration: Make and Buy

- •Franchising

- •Strategic Alliances and Joint Ventures

- •Implicit Contracts and Long-Term Relationships

- •Business Groups

- •Keiretsu

- •Chaebol

- •Business Groups in Emerging Markets

- •Chapter Summary

- •Questions

- •Endnotes

- •Competitor Identification and Market Definition

- •The Basics of Competitor Identification

- •Example 5.1 The SSNIP in Action: Defining Hospital Markets

- •Putting Competitor Identification into Practice

- •Empirical Approaches to Competitor Identification

- •Geographic Competitor Identification

- •Measuring Market Structure

- •Market Structure and Competition

- •Perfect Competition

- •Many Sellers

- •Homogeneous Products

- •Excess Capacity

- •Monopoly

- •Monopolistic Competition

- •Demand for Differentiated Goods

- •Entry into Monopolistically Competitive Markets

- •Oligopoly

- •Cournot Quantity Competition

- •The Revenue Destruction Effect

- •Cournot’s Model in Practice

- •Bertrand Price Competition

- •Why Are Cournot and Bertrand Different?

- •Evidence on Market Structure and Performance

- •Price and Concentration

- •Chapter Summary

- •Questions

- •Endnotes

- •6: Entry and Exit

- •Some Facts about Entry and Exit

- •Entry and Exit Decisions: Basic Concepts

- •Barriers to Entry

- •Bain’s Typology of Entry Conditions

- •Analyzing Entry Conditions: The Asymmetry Requirement

- •Structural Entry Barriers

- •Control of Essential Resources

- •Economies of Scale and Scope

- •Marketing Advantages of Incumbency

- •Barriers to Exit

- •Entry-Deterring Strategies

- •Limit Pricing

- •Is Strategic Limit Pricing Rational?

- •Predatory Pricing

- •The Chain-Store Paradox

- •Rescuing Limit Pricing and Predation: The Importance of Uncertainty and Reputation

- •Wars of Attrition

- •Predation and Capacity Expansion

- •Strategic Bundling

- •“Judo Economics”

- •Evidence on Entry-Deterring Behavior

- •Contestable Markets

- •An Entry Deterrence Checklist

- •Entering a New Market

- •Preemptive Entry and Rent Seeking Behavior

- •Chapter Summary

- •Questions

- •Endnotes

- •Microdynamics

- •Strategic Commitment

- •Strategic Substitutes and Strategic Complements

- •The Strategic Effect of Commitments

- •Tough and Soft Commitments

- •A Taxonomy of Commitment Strategies

- •The Informational Benefits of Flexibility

- •Real Options

- •Competitive Discipline

- •Dynamic Pricing Rivalry and Tit-for-Tat Pricing

- •Why Is Tit-for-Tat So Compelling?

- •Coordinating on the Right Price

- •Impediments to Coordination

- •The Misread Problem

- •Lumpiness of Orders

- •Information about the Sales Transaction

- •Volatility of Demand Conditions

- •Facilitating Practices

- •Price Leadership

- •Advance Announcement of Price Changes

- •Most Favored Customer Clauses

- •Uniform Delivered Prices

- •Where Does Market Structure Come From?

- •Sutton’s Endogenous Sunk Costs

- •Innovation and Market Evolution

- •Learning and Industry Dynamics

- •Chapter Summary

- •Questions

- •Endnotes

- •8: Industry Analysis

- •Performing a Five-Forces Analysis

- •Internal Rivalry

- •Entry

- •Substitutes and Complements

- •Supplier Power and Buyer Power

- •Strategies for Coping with the Five Forces

- •Coopetition and the Value Net

- •Applying the Five Forces: Some Industry Analyses

- •Chicago Hospital Markets Then and Now

- •Market Definition

- •Internal Rivalry

- •Entry

- •Substitutes and Complements

- •Supplier Power

- •Buyer Power

- •Commercial Airframe Manufacturing

- •Market Definition

- •Internal Rivalry

- •Barriers to Entry

- •Substitutes and Complements

- •Supplier Power

- •Buyer Power

- •Professional Sports

- •Market Definition

- •Internal Rivalry

- •Entry

- •Substitutes and Complements

- •Supplier Power

- •Buyer Power

- •Conclusion

- •Professional Search Firms

- •Market Definition

- •Internal Rivalry

- •Entry

- •Substitutes and Complements

- •Supplier Power

- •Buyer Power

- •Conclusion

- •Chapter Summary

- •Questions

- •Endnotes

- •Competitive Advantage Defined

- •Maximum Willingness-to-Pay and Consumer Surplus

- •From Maximum Willingness-to-Pay to Consumer Surplus

- •Value-Created

- •Value Creation and “Win–Win” Business Opportunities

- •Value Creation and Competitive Advantage

- •Analyzing Value Creation

- •Value Creation and the Value Chain

- •Value Creation, Resources, and Capabilities

- •Generic Strategies

- •The Strategic Logic of Cost Leadership

- •The Strategic Logic of Benefit Leadership

- •Extracting Profits from Cost and Benefit Advantage

- •Comparing Cost and Benefit Advantages

- •“Stuck in the Middle”

- •Diagnosing Cost and Benefit Drivers

- •Cost Drivers

- •Cost Drivers Related to Firm Size, Scope, and Cumulative Experience

- •Cost Drivers Independent of Firm Size, Scope, or Cumulative Experience

- •Cost Drivers Related to Organization of the Transactions

- •Benefit Drivers

- •Methods for Estimating and Characterizing Costs and Perceived Benefits

- •Estimating Costs

- •Estimating Benefits

- •Strategic Positioning: Broad Coverage versus Focus Strategies

- •Segmenting an Industry

- •Broad Coverage Strategies

- •Focus Strategies

- •Chapter Summary

- •Questions

- •Endnotes

- •The “Shopping Problem”

- •Unraveling

- •Alternatives to Disclosure

- •Nonprofit Firms

- •Report Cards

- •Multitasking: Teaching to the Test

- •What to Measure

- •Risk Adjustment

- •Presenting Report Card Results

- •Gaming Report Cards

- •The Certifier Market

- •Certification Bias

- •Matchmaking

- •When Sellers Search for Buyers

- •Chapter Summary

- •Questions

- •Endnotes

- •Market Structure and Threats to Sustainability

- •Threats to Sustainability in Competitive and Monopolistically Competitive Markets

- •Threats to Sustainability under All Market Structures

- •Evidence: The Persistence of Profitability

- •The Resource-Based Theory of the Firm

- •Imperfect Mobility and Cospecialization

- •Isolating Mechanisms

- •Impediments to Imitation

- •Legal Restrictions

- •Superior Access to Inputs or Customers

- •The Winner’s Curse

- •Market Size and Scale Economies

- •Intangible Barriers to Imitation

- •Causal Ambiguity

- •Dependence on Historical Circumstances

- •Social Complexity

- •Early-Mover Advantages

- •Learning Curve

- •Reputation and Buyer Uncertainty

- •Buyer Switching Costs

- •Network Effects

- •Networks and Standards

- •Competing “For the Market” versus “In the Market”

- •Knocking off a Dominant Standard

- •Early-Mover Disadvantages

- •Imperfect Imitability and Industry Equilibrium

- •Creating Advantage and Creative Destruction

- •Disruptive Technologies

- •The Productivity Effect

- •The Sunk Cost Effect

- •The Replacement Effect

- •The Efficiency Effect

- •Disruption versus the Resource-Based Theory of the Firm

- •Innovation and the Market for Ideas

- •The Environment

- •Factor Conditions

- •Demand Conditions

- •Related Supplier or Support Industries

- •Strategy, Structure, and Rivalry

- •Chapter Summary

- •Questions

- •Endnotes

- •The Principal–Agent Relationship

- •Combating Agency Problems

- •Performance-Based Incentives

- •Problems with Performance-Based Incentives

- •Preferences over Risky Outcomes

- •Risk Sharing

- •Risk and Incentives

- •Selecting Performance Measures: Managing Trade-offs between Costs

- •Do Pay-for-Performance Incentives Work?

- •Implicit Incentive Contracts

- •Subjective Performance Evaluation

- •Promotion Tournaments

- •Efficiency Wages and the Threat of Termination

- •Incentives in Teams

- •Chapter Summary

- •Questions

- •Endnotes

- •13: Strategy and Structure

- •An Introduction to Structure

- •Individuals, Teams, and Hierarchies

- •Complex Hierarchy

- •Departmentalization

- •Coordination and Control

- •Approaches to Coordination

- •Types of Organizational Structures

- •Functional Structure (U-form)

- •Multidivisional Structure (M-form)

- •Matrix Structure

- •Matrix or Division? A Model of Optimal Structure

- •Network Structure

- •Why Are There So Few Structural Types?

- •Structure—Environment Coherence

- •Technology and Task Interdependence

- •Efficient Information Processing

- •Structure Follows Strategy

- •Strategy, Structure, and the Multinational Firm

- •Chapter Summary

- •Questions

- •Endnotes

- •The Social Context of Firm Behavior

- •Internal Context

- •Power

- •The Sources of Power

- •Structural Views of Power

- •Do Successful Organizations Need Powerful Managers?

- •The Decision to Allocate Formal Power to Individuals

- •Culture

- •Culture Complements Formal Controls

- •Culture Facilitates Cooperation and Reduces Bargaining Costs

- •Culture, Inertia, and Performance

- •A Word of Caution about Culture

- •External Context, Institutions, and Strategies

- •Institutions and Regulation

- •Interfirm Resource Dependence Relationships

- •Industry Logics: Beliefs, Values, and Behavioral Norms

- •Chapter Summary

- •Questions

- •Endnotes

- •Glossary

- •Name Index

- •Subject Index

The Learning Curve • 81

firm-specific learning, but must usually rely on their judgment to determine if learning is firm or task-specific.

The Learning Curve versus Economies of Scale

Economies of learning differ from economies of scale. Economies of scale refer to the ability to perform an activity at a lower unit cost when it is performed on a larger scale at a particular point in time. Learning economies refer to reductions in unit costs due to accumulating experience over time and can be independent of current scale of the activity. Economies of scale may be substantial even when learning economies are minimal. This is likely to be the case in simple capitalintensive activities, such as two-piece aluminum can manufacturing. Similarly, learning economies may be substantial even when economies of scale are minimal. This is likely to be the case in complex labor-intensive activities, such as the practice of antitrust law.

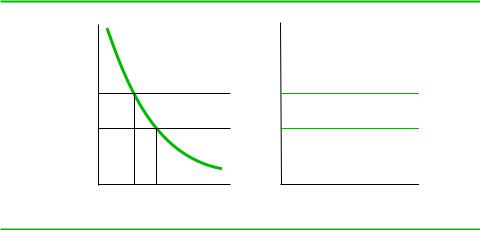

Figure 2.8 illustrates how one can have learning economies without economies of scale. The left side of the figure shows a typical learning curve, with average costs declining with cumulative experience. The right side shows two average cost curves, for different experience levels. Both average cost curves are perfectly flat, indicating that there are no economies of scale. Suppose that the firm under consideration enters a given year of production with cumulative experience of Q1. According to the learning curve, this gives it an average cost level of AC1. This remains constant regardless of current output because of constant returns to scale. Entering the next year of production, the firm has cumulative output of Q2. Its experiences in the previous year enable the firm to revamp its production techniques. In thus moving down the learning curve, it can enjoy an average cost level of AC2 in the next year of production.

FIGURE 2.8

Learning Economies When Scale Economies Are Absent

$ Per unit

AC1

AC2

Learning Curve

$ Per unit

Average Cost Curve

AC1

AC2

Q1 Q2 |

Output per year |

Cumulative output |

|

It is not necessary to have economies of scale to realize learning economies. The production process depicted here shows constant returns to scale, as evidenced by the flat average cost curves, which show output within a given year. The level of average cost falls with cumulative experience across several years, however, as shown by the learning curve.

82 • Chapter 2 • The Horizontal Boundaries of the Firm

Managers who do not correctly distinguish between economies of scale and learning may draw incorrect inferences about the benefits of size in a market. For example, if a large firm has lower unit costs because of economies of scale, then any cutbacks in production volume will raise unit costs. If the lower unit costs are the result of learning, the firm may be able to cut current volume without necessarily

EXAMPLE 2.4 THE PHARMACEUTICAL MERGER WAVE

Beginning in the 1990s, pharmaceutical companies faced an unprecedented strategic challenge. The growth of managed care in the United States and the tightening of government health care budgets in other nations forced manufacturers to lower prices on many drugs. Traditional research pipelines began to dry up, while the advent of biotechnology promised new avenues for drug discovery coupled with new sources of competition. In response to these pressures, the pharmaceutical industry underwent a remarkable wave of consolidation, with the total value of merger and acquisition activity exceeding $500 billion. As a result, the combined market shares of the 10 largest firms has grown from 20 percent to more than 50 percent. Using almost any yardstick, we can view Glaxo’s 2000 acquisition of SmithKline Beecham and Pfizer’s 2003 acquisition of Pharmacia as among the largest in business history.

Industry analysts point out three potential rationales for consolidation. One cynical view is that executives at struggling pharmaceutical companies are buying the research pipelines of more successful rivals merely to save their jobs. Another potential rationale is to make more efficient use of sales personnel. Many pharmaceutical firms spend more money on sales than they do on R&D. Although pharmaceutical “direct to consumer” advertising has received a lot of attention lately, drug makers spend much more money on traditional advertising in medical journals and especially on “detailing.” Detailing is when sales personnel visit doctors and hospitals to describe the benefits of new drugs and share data on efficacy and side effects. Detailers spend most of their time on the road, creating an obvious opportunity for scale economies. A detailer who can offer several cardiovascular drugs to a cardiologist will have a much

higher ratio of selling time to traveling time. Why have two detailers from two companies visiting the same cardiologist when one will do?

Perhaps the most common explanation offered for the merger wave is to exploit economies of scale in R&D. As we discuss in the accompanying text, there are conflicting theories as to whether bigger firms will be more innovative or will innovate at lower cost. The theoretical considerations apply especially well in pharmaceutical R&D, and those in the industry who bank on achieving greater research effectiveness through scale economies in R&D may not have solid footing.

Two recent studies examine some of these potential scale economies.13 Danzon, Epstein, and Nicholson found that acquirers tended to have older drug portfolios, lending some support to the cynical explanation for acquisitions. In contrast, targets had average-to-possibly- slightly younger portfolios. Combined sales after the merger seem to be slightly below premerger sales levels, which may reflect the weak portfolios of the acquirers. Addressing scale economies, they find that two years after a merger, the number of employees has fallen by about 6 percent. This finding is consistent with economies of scale in sales. Carmine Ornaghi examined R&D productivity, as measured by R&D spending and by the number of patents, finding that merged companies kept R&D spending flat and generated fewer patents after merging, while similar companies that remained independent increased R&D spending and generated about the same number of patents over the time period. Taken together, these findings suggest that mergers among pharmaceutical firms may have led to lower sales costs but almost surely did not generate increased research productivity.