- •About the author

- •Brief Contents

- •Contents

- •Preface

- •This Book’s Approach

- •What’s New in the Seventh Edition?

- •The Arrangement of Topics

- •Part One, Introduction

- •Part Two, Classical Theory: The Economy in the Long Run

- •Part Three, Growth Theory: The Economy in the Very Long Run

- •Part Four, Business Cycle Theory: The Economy in the Short Run

- •Part Five, Macroeconomic Policy Debates

- •Part Six, More on the Microeconomics Behind Macroeconomics

- •Epilogue

- •Alternative Routes Through the Text

- •Learning Tools

- •Case Studies

- •FYI Boxes

- •Graphs

- •Mathematical Notes

- •Chapter Summaries

- •Key Concepts

- •Questions for Review

- •Problems and Applications

- •Chapter Appendices

- •Glossary

- •Translations

- •Acknowledgments

- •Supplements and Media

- •For Instructors

- •Instructor’s Resources

- •Solutions Manual

- •Test Bank

- •PowerPoint Slides

- •For Students

- •Student Guide and Workbook

- •Online Offerings

- •EconPortal, Available Spring 2010

- •eBook

- •WebCT

- •BlackBoard

- •Additional Offerings

- •i-clicker

- •The Wall Street Journal Edition

- •Financial Times Edition

- •Dismal Scientist

- •1-1: What Macroeconomists Study

- •1-2: How Economists Think

- •Theory as Model Building

- •The Use of Multiple Models

- •Prices: Flexible Versus Sticky

- •Microeconomic Thinking and Macroeconomic Models

- •1-3: How This Book Proceeds

- •Income, Expenditure, and the Circular Flow

- •Rules for Computing GDP

- •Real GDP Versus Nominal GDP

- •The GDP Deflator

- •Chain-Weighted Measures of Real GDP

- •The Components of Expenditure

- •Other Measures of Income

- •Seasonal Adjustment

- •The Price of a Basket of Goods

- •The CPI Versus the GDP Deflator

- •The Household Survey

- •The Establishment Survey

- •The Factors of Production

- •The Production Function

- •The Supply of Goods and Services

- •3-2: How Is National Income Distributed to the Factors of Production?

- •Factor Prices

- •The Decisions Facing the Competitive Firm

- •The Firm’s Demand for Factors

- •The Division of National Income

- •The Cobb–Douglas Production Function

- •Consumption

- •Investment

- •Government Purchases

- •Changes in Saving: The Effects of Fiscal Policy

- •Changes in Investment Demand

- •3-5: Conclusion

- •4-1: What Is Money?

- •The Functions of Money

- •The Types of Money

- •The Development of Fiat Money

- •How the Quantity of Money Is Controlled

- •How the Quantity of Money Is Measured

- •4-2: The Quantity Theory of Money

- •Transactions and the Quantity Equation

- •From Transactions to Income

- •The Assumption of Constant Velocity

- •Money, Prices, and Inflation

- •4-4: Inflation and Interest Rates

- •Two Interest Rates: Real and Nominal

- •The Fisher Effect

- •Two Real Interest Rates: Ex Ante and Ex Post

- •The Cost of Holding Money

- •Future Money and Current Prices

- •4-6: The Social Costs of Inflation

- •The Layman’s View and the Classical Response

- •The Costs of Expected Inflation

- •The Costs of Unexpected Inflation

- •One Benefit of Inflation

- •4-7: Hyperinflation

- •The Costs of Hyperinflation

- •The Causes of Hyperinflation

- •4-8: Conclusion: The Classical Dichotomy

- •The Role of Net Exports

- •International Capital Flows and the Trade Balance

- •International Flows of Goods and Capital: An Example

- •Capital Mobility and the World Interest Rate

- •Why Assume a Small Open Economy?

- •The Model

- •How Policies Influence the Trade Balance

- •Evaluating Economic Policy

- •Nominal and Real Exchange Rates

- •The Real Exchange Rate and the Trade Balance

- •The Determinants of the Real Exchange Rate

- •How Policies Influence the Real Exchange Rate

- •The Effects of Trade Policies

- •The Special Case of Purchasing-Power Parity

- •Net Capital Outflow

- •The Model

- •Policies in the Large Open Economy

- •Conclusion

- •Causes of Frictional Unemployment

- •Public Policy and Frictional Unemployment

- •Minimum-Wage Laws

- •Unions and Collective Bargaining

- •Efficiency Wages

- •The Duration of Unemployment

- •Trends in Unemployment

- •Transitions Into and Out of the Labor Force

- •6-5: Labor-Market Experience: Europe

- •The Rise in European Unemployment

- •Unemployment Variation Within Europe

- •The Rise of European Leisure

- •6-6: Conclusion

- •7-1: The Accumulation of Capital

- •The Supply and Demand for Goods

- •Growth in the Capital Stock and the Steady State

- •Approaching the Steady State: A Numerical Example

- •How Saving Affects Growth

- •7-2: The Golden Rule Level of Capital

- •Comparing Steady States

- •The Transition to the Golden Rule Steady State

- •7-3: Population Growth

- •The Steady State With Population Growth

- •The Effects of Population Growth

- •Alternative Perspectives on Population Growth

- •7-4: Conclusion

- •The Efficiency of Labor

- •The Steady State With Technological Progress

- •The Effects of Technological Progress

- •Balanced Growth

- •Convergence

- •Factor Accumulation Versus Production Efficiency

- •8-3: Policies to Promote Growth

- •Evaluating the Rate of Saving

- •Changing the Rate of Saving

- •Allocating the Economy’s Investment

- •Establishing the Right Institutions

- •Encouraging Technological Progress

- •The Basic Model

- •A Two-Sector Model

- •The Microeconomics of Research and Development

- •The Process of Creative Destruction

- •8-5: Conclusion

- •Increases in the Factors of Production

- •Technological Progress

- •The Sources of Growth in the United States

- •The Solow Residual in the Short Run

- •9-1: The Facts About the Business Cycle

- •GDP and Its Components

- •Unemployment and Okun’s Law

- •Leading Economic Indicators

- •9-2: Time Horizons in Macroeconomics

- •How the Short Run and Long Run Differ

- •9-3: Aggregate Demand

- •The Quantity Equation as Aggregate Demand

- •Why the Aggregate Demand Curve Slopes Downward

- •Shifts in the Aggregate Demand Curve

- •9-4: Aggregate Supply

- •The Long Run: The Vertical Aggregate Supply Curve

- •From the Short Run to the Long Run

- •9-5: Stabilization Policy

- •Shocks to Aggregate Demand

- •Shocks to Aggregate Supply

- •10-1: The Goods Market and the IS Curve

- •The Keynesian Cross

- •The Interest Rate, Investment, and the IS Curve

- •How Fiscal Policy Shifts the IS Curve

- •10-2: The Money Market and the LM Curve

- •The Theory of Liquidity Preference

- •Income, Money Demand, and the LM Curve

- •How Monetary Policy Shifts the LM Curve

- •Shocks in the IS–LM Model

- •From the IS–LM Model to the Aggregate Demand Curve

- •The IS–LM Model in the Short Run and Long Run

- •11-3: The Great Depression

- •The Spending Hypothesis: Shocks to the IS Curve

- •The Money Hypothesis: A Shock to the LM Curve

- •Could the Depression Happen Again?

- •11-4: Conclusion

- •12-1: The Mundell–Fleming Model

- •The Goods Market and the IS* Curve

- •The Money Market and the LM* Curve

- •Putting the Pieces Together

- •Fiscal Policy

- •Monetary Policy

- •Trade Policy

- •How a Fixed-Exchange-Rate System Works

- •Fiscal Policy

- •Monetary Policy

- •Trade Policy

- •Policy in the Mundell–Fleming Model: A Summary

- •12-4: Interest Rate Differentials

- •Country Risk and Exchange-Rate Expectations

- •Differentials in the Mundell–Fleming Model

- •Pros and Cons of Different Exchange-Rate Systems

- •The Impossible Trinity

- •12-6: From the Short Run to the Long Run: The Mundell–Fleming Model With a Changing Price Level

- •12-7: A Concluding Reminder

- •Fiscal Policy

- •Monetary Policy

- •A Rule of Thumb

- •The Sticky-Price Model

- •Implications

- •Adaptive Expectations and Inflation Inertia

- •Two Causes of Rising and Falling Inflation

- •Disinflation and the Sacrifice Ratio

- •13-3: Conclusion

- •14-1: Elements of the Model

- •Output: The Demand for Goods and Services

- •The Real Interest Rate: The Fisher Equation

- •Inflation: The Phillips Curve

- •Expected Inflation: Adaptive Expectations

- •The Nominal Interest Rate: The Monetary-Policy Rule

- •14-2: Solving the Model

- •The Long-Run Equilibrium

- •The Dynamic Aggregate Supply Curve

- •The Dynamic Aggregate Demand Curve

- •The Short-Run Equilibrium

- •14-3: Using the Model

- •Long-Run Growth

- •A Shock to Aggregate Supply

- •A Shock to Aggregate Demand

- •A Shift in Monetary Policy

- •The Taylor Principle

- •14-5: Conclusion: Toward DSGE Models

- •15-1: Should Policy Be Active or Passive?

- •Lags in the Implementation and Effects of Policies

- •The Difficult Job of Economic Forecasting

- •Ignorance, Expectations, and the Lucas Critique

- •The Historical Record

- •Distrust of Policymakers and the Political Process

- •The Time Inconsistency of Discretionary Policy

- •Rules for Monetary Policy

- •16-1: The Size of the Government Debt

- •16-2: Problems in Measurement

- •Measurement Problem 1: Inflation

- •Measurement Problem 2: Capital Assets

- •Measurement Problem 3: Uncounted Liabilities

- •Measurement Problem 4: The Business Cycle

- •Summing Up

- •The Basic Logic of Ricardian Equivalence

- •Consumers and Future Taxes

- •Making a Choice

- •16-5: Other Perspectives on Government Debt

- •Balanced Budgets Versus Optimal Fiscal Policy

- •Fiscal Effects on Monetary Policy

- •Debt and the Political Process

- •International Dimensions

- •16-6: Conclusion

- •Keynes’s Conjectures

- •The Early Empirical Successes

- •The Intertemporal Budget Constraint

- •Consumer Preferences

- •Optimization

- •How Changes in Income Affect Consumption

- •Constraints on Borrowing

- •The Hypothesis

- •Implications

- •The Hypothesis

- •Implications

- •The Hypothesis

- •Implications

- •17-7: Conclusion

- •18-1: Business Fixed Investment

- •The Rental Price of Capital

- •The Cost of Capital

- •The Determinants of Investment

- •Taxes and Investment

- •The Stock Market and Tobin’s q

- •Financing Constraints

- •Banking Crises and Credit Crunches

- •18-2: Residential Investment

- •The Stock Equilibrium and the Flow Supply

- •Changes in Housing Demand

- •18-3: Inventory Investment

- •Reasons for Holding Inventories

- •18-4: Conclusion

- •19-1: Money Supply

- •100-Percent-Reserve Banking

- •Fractional-Reserve Banking

- •A Model of the Money Supply

- •The Three Instruments of Monetary Policy

- •Bank Capital, Leverage, and Capital Requirements

- •19-2: Money Demand

- •Portfolio Theories of Money Demand

- •Transactions Theories of Money Demand

- •The Baumol–Tobin Model of Cash Management

- •19-3 Conclusion

- •Lesson 2: In the short run, aggregate demand influences the amount of goods and services that a country produces.

- •Question 1: How should policymakers try to promote growth in the economy’s natural level of output?

- •Question 2: Should policymakers try to stabilize the economy?

- •Question 3: How costly is inflation, and how costly is reducing inflation?

- •Question 4: How big a problem are government budget deficits?

- •Conclusion

- •Glossary

- •Index

C H A P T E R 1 4 A Dynamic Model of Aggregate Demand and Aggregate Supply | 423

aggregate supply curve in that period, which in turn affects output and inflation in period t + 1, which then affects expected inflation in period t + 2, and so on.

These linkages of economic outcomes across time periods will become clear as we work through a series of examples.

14-3 Using the Model

Let’s now use the dynamic AD –AS model to analyze how the economy

responds to changes in the exogenous variables. The four exogenous variables in |

|||

|

|

− |

|

the model are the natural level of output Yt, the supply shock ut, the demand |

|||

shock |

et |

, and the central bank’s inflation target |

p t |

|

*. To keep things simple, we will |

||

assume that the economy always begins in long-run equilibrium and is then subject to a change in one of the exogenous variables. We also assume that the other exogenous variables are held constant.

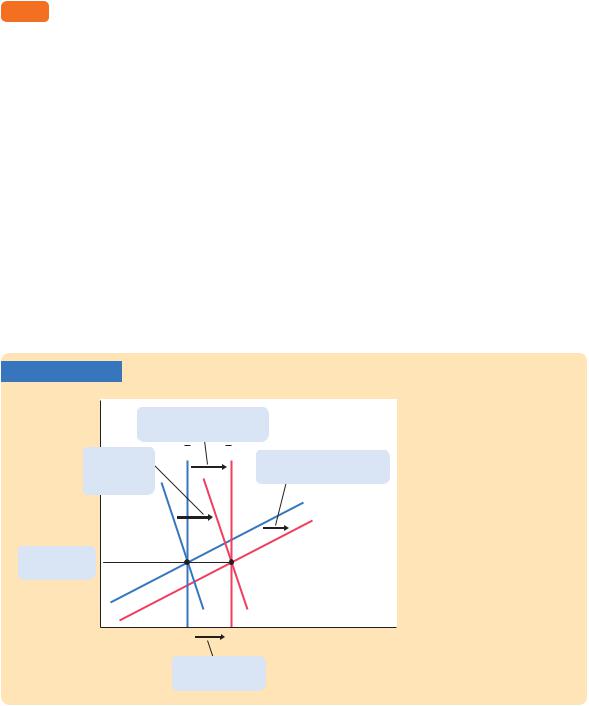

Long-Run Growth

−

The economy’s natural level of output Yt changes over time because of pop-

ulation growth, capital accumulation, and technological progress, as discussed

−

in Chapters 7 and 8. Figure 14-5 illustrates the effect of an increase in Yt. Because this variable affects both the dynamic aggregate demand curve and

the dynamic aggregate supply curve, both curves shift. In fact, they both shift

−

to the right by exactly the amount that Yt has increased.

FIGURE 14-5

Inflation, p

1. When the natural

level of output increases, . . .

3. . . . as does |

Yt |

Yt + 1 |

2. . . . the dynamic AS |

|

the dynamic |

|

|

|

|

|

|

|

curve shifts to the right, . . . . |

|

AD curve, . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

DASt |

|

|

|

|

DASt + 1 |

5. . . . and |

A |

B |

|

|

stable inflation. |

|

|

|

|

|

|

DADt |

DADt + 1 |

|

|

Yt |

|

Yt + 1 |

Income, output, Y |

|

4. . . . leading to |

|

||

|

growth in ouput . . . |

|

||

An Increase in the Natural Level of Output If−the natural level of output Yt increases, both the dynamic aggregate demand curve and the dynamic aggregate supply curve shift to the right by the same amount. Output Yt increases, but inflation pt remains the same.

424 | P A R T I V Business Cycle Theory: The Economy in the Short Run

The shifts in these curves move the economy’s equilibrium in the figure from

point A to point B. Output Y |

increases by exactly as much as the natural level |

|

− |

t |

|

Yt |

. Inflation is unchanged. |

|

The story behind these conclusions is as follows: When the natural level of output increases, the economy can produce a larger quantity of goods and services. This is represented by the rightward shift in the dynamic aggregate supply curve. At the same time, the increase in the natural level of output makes people richer. Other things equal, they want to buy more goods and services. This is represented by the rightward shift in the dynamic aggregate demand curve. The simultaneous shifts in supply and demand increase the economy’s output without putting either upward or downward pressure on inflation. In this way, the economy can experience long-run growth and a stable inflation rate.

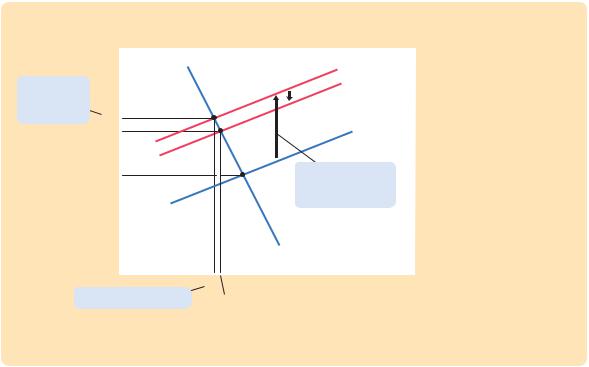

A Shock to Aggregate Supply

Consider now a shock to aggregate supply. In particular, suppose that ut rises to 1 percent for one period and subsequently returns to zero. This shock to the Phillips curve might occur, for example, because an international oil cartel pushes up prices or because new union agreements raise wages and, thereby, the costs of production.

In general, the supply shock |

ut |

− |

|

captures any event that influences inflation beyond |

expected inflation Et −1pt and current economic activity, as measured by Yt − Yt. Figure 14-6 shows the result. In period t, when the shock occurs, the dynam-

ic aggregate supply curve shifts upward from DASt −1 to DASt. To be precise, the

FIGURE 14-6 |

|

|

|

|

|

|

|

|||

|

Inflation, p |

|

|

|

|

|

|

|

DASt |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yall |

||||

|

|

|

|

|

|

DASt + 1 |

||||

2. . . . causing |

|

|

|

|

|

|

|

|||

inflation to |

|

|

B |

|

|

|

|

|

||

rise . . . |

pt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DASt – 1 |

||

|

pt + 1 |

|

|

|

C |

|

||||

|

pt – 1 |

|

|

|

A |

|

|

1. An adverse supply |

||

|

|

|

|

|

|

|

shock shifts the DAS |

|||

|

|

|

|

|

|

|

|

|

|

curve upward, . . . |

|

|

|

|

|

|

|

|

|

|

DADall |

|

|

|

|

|

|

|

|

|

||

|

3. . . . and output to fall. |

Yt |

Yt – 1 |

Income, output, Y |

||||||

|

|

Yt + 1 |

|

|||||||

A Supply Shock A supply shock in period t shifts the dynamic aggregate supply curve upward from DASt −1 to DASt. The dynamic aggregate demand curve is unchanged. The economy’s short-run equilibrium moves from point A to point B. Inflation rises and output falls. In the subsequent period (t + 1), the dynamic aggregate supply curve shifts to DASt +1 and the economy moves to point C. The supply shock has returned to its normal value of zero, but inflation expectations remain high. As a result, the economy returns only gradually to its initial equilibrium, point A.

C H A P T E R 1 4 A Dynamic Model of Aggregate Demand and Aggregate Supply | 425

curve shifts upward by exactly the size of the shock, which we assumed to be 1 percentage point. Because the supply shock ut is not a variable in the dynamic aggregate demand equation, the DAD curve is unchanged. Therefore, the economy moves along the dynamic aggregate demand curve from point A to point B. As the figure illustrates, the supply shock in period t causes inflation to rise to pt and output to fall to Yt.

These effects work in part through the reaction of monetary policy to the shock. When the supply shock causes inflation to rise, the central bank responds by following its policy rule and raising nominal and real interest rates. The higher real interest rate reduces the quantity of goods and services demanded, which depresses output below its natural level. (This series of events is represented by the movement along the DAD curve from point A to point B.) The lower level of output dampens the inflationary pressure to some degree, so inflation rises somewhat less than the initial shock.

FYI

The Numerical Calibration and Simulation

The text presents some numerical simulations of the dynamic AD–AS model. When interpreting these results, it is easiest to think of each period as representing one year. We examine the impact of the change in the year of the shock (period t) and over the subsequent 12 years.

The simulations use these parameter values:

− =

Yt 100.

p* = 2.0.

t

a = 1.0. r = 2.0. f = 0.25.

vp = 0.5. vY = 0.5.

Here is how to interpret these numbers. The nat-

−

ural level of output Y is 100; as a result of choos-

t − −

ing this convenient number, fluctuations in Yt Yt can be viewed as percentage deviations of output from its natural level. The central bank’s inflation

target p* is 2 percent. The parameter a = 1.0

t

implies that a 1-percentage-point increase in the real interest rate reduces output demand by 1, which is 1 percent of its natural level. The econo-

my’s natural rate of interest r is 2 percent. The Phillips curve parameter f = 0.25 implies that when output is 1 percent above its natural level, inflation rises by 0.25 percentage point. The parameters for the monetary policy rule vp = 0.5 and vY = 0.5 are those suggested by John Taylor and are reasonable approximations of the behavior of the Federal Reserve.

In all cases, the simulations assume a change of 1 percentage point in the exogenous variable of interest. Larger shocks would have qualitatively similar effects, but the magnitudes would be proportionately greater. For example, a shock of 3 percentage points would affect all the variables in the same way as a shock of 1 percentage point, but the movements would be three times as large as in the simulation shown.

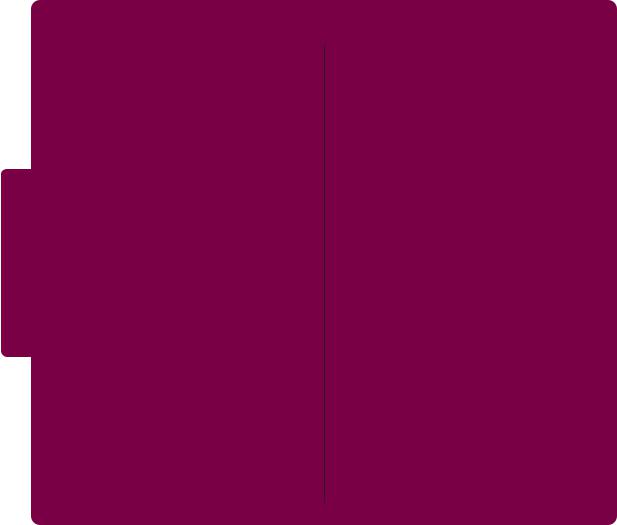

The graphs of the time paths of the variables after a shock (shown in Figures 14-7, 14-9, and 14-11) are called impulse response functions. The word “impulse” refers to the shock, and “response function” refers to how the endogenous variables respond to the shock over time. These simulated impulse response functions are one way to illustrate how the model works. They show how the endogenous variables move when a shock hits the economy, how these variables adjust in subsequent periods, and how they are correlated with one another over time.

426 | P A R T I V Business Cycle Theory: The Economy in the Short Run

In the periods after the shock occurs, expected inflation is higher because expectations depend on past inflation. In period t + 1, for instance, the economy is at point C. Even though the shock variable ut returns to its normal value of zero, the dynamic aggregate supply curve does not immediately return to its initial position. Instead, it slowly shifts back downward toward its initial position DASt −1 as a lower level of economic activity reduces inflation and thereby expectations of future inflation. Throughout this process, output remains below its natural level.

Figure 14-7 shows the time paths of the key variables in the model in response to the shock. (These simulations are based on realistic parameter values: see the

FIGURE 14-7

(a) Supply Shock

vt |

2.0 |

|

|

|

1.5 |

|

|

|

1.0 |

|

|

|

0.5 |

|

|

|

0.0 |

|

|

|

–0.5 |

|

|

|

–1.0 |

|

|

|

–1.5 |

|

|

|

–2.0 |

t |

t + 2 t + 4 t + 6 t + 8 t + 10 t + 12 |

|

t – 2 |

||

|

|

|

Time |

The Dynamic Response to a Supply Shock This figure shows the responses of the key variables over time to a onetime supply shock.

|

|

|

|

|

|

|

(b) Output |

|

|

|

|

|

|

|

(d) Inflation |

||||||||||||||||||||||

Yt 101.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

pt 3.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

100.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

99.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

99.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

t – 2 t t + 2 t + 4 t + 6 t + 8 t + 10 t + 12 |

|

t – 2 t t + 2 t + 4 t + 6 t + 8 t + 10 t + 12 |

||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time |

||||||

|

|

|

|

|

(c) Real Interest Rate |

|

|

|

|

(e) Nominal Interest Rate |

|||||||||||||||||||||||||||

rt 3.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

it 6.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t – 2 t t + 2 t + 4 t + 6 t + 8 t + 10 t + 12 |

|

t – 2 t t + 2 t + 4 t + 6 t + 8 t + 10 t + 12 |

||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||

Time |

Time |