- •About the author

- •Brief Contents

- •Contents

- •Preface

- •This Book’s Approach

- •What’s New in the Seventh Edition?

- •The Arrangement of Topics

- •Part One, Introduction

- •Part Two, Classical Theory: The Economy in the Long Run

- •Part Three, Growth Theory: The Economy in the Very Long Run

- •Part Four, Business Cycle Theory: The Economy in the Short Run

- •Part Five, Macroeconomic Policy Debates

- •Part Six, More on the Microeconomics Behind Macroeconomics

- •Epilogue

- •Alternative Routes Through the Text

- •Learning Tools

- •Case Studies

- •FYI Boxes

- •Graphs

- •Mathematical Notes

- •Chapter Summaries

- •Key Concepts

- •Questions for Review

- •Problems and Applications

- •Chapter Appendices

- •Glossary

- •Translations

- •Acknowledgments

- •Supplements and Media

- •For Instructors

- •Instructor’s Resources

- •Solutions Manual

- •Test Bank

- •PowerPoint Slides

- •For Students

- •Student Guide and Workbook

- •Online Offerings

- •EconPortal, Available Spring 2010

- •eBook

- •WebCT

- •BlackBoard

- •Additional Offerings

- •i-clicker

- •The Wall Street Journal Edition

- •Financial Times Edition

- •Dismal Scientist

- •1-1: What Macroeconomists Study

- •1-2: How Economists Think

- •Theory as Model Building

- •The Use of Multiple Models

- •Prices: Flexible Versus Sticky

- •Microeconomic Thinking and Macroeconomic Models

- •1-3: How This Book Proceeds

- •Income, Expenditure, and the Circular Flow

- •Rules for Computing GDP

- •Real GDP Versus Nominal GDP

- •The GDP Deflator

- •Chain-Weighted Measures of Real GDP

- •The Components of Expenditure

- •Other Measures of Income

- •Seasonal Adjustment

- •The Price of a Basket of Goods

- •The CPI Versus the GDP Deflator

- •The Household Survey

- •The Establishment Survey

- •The Factors of Production

- •The Production Function

- •The Supply of Goods and Services

- •3-2: How Is National Income Distributed to the Factors of Production?

- •Factor Prices

- •The Decisions Facing the Competitive Firm

- •The Firm’s Demand for Factors

- •The Division of National Income

- •The Cobb–Douglas Production Function

- •Consumption

- •Investment

- •Government Purchases

- •Changes in Saving: The Effects of Fiscal Policy

- •Changes in Investment Demand

- •3-5: Conclusion

- •4-1: What Is Money?

- •The Functions of Money

- •The Types of Money

- •The Development of Fiat Money

- •How the Quantity of Money Is Controlled

- •How the Quantity of Money Is Measured

- •4-2: The Quantity Theory of Money

- •Transactions and the Quantity Equation

- •From Transactions to Income

- •The Assumption of Constant Velocity

- •Money, Prices, and Inflation

- •4-4: Inflation and Interest Rates

- •Two Interest Rates: Real and Nominal

- •The Fisher Effect

- •Two Real Interest Rates: Ex Ante and Ex Post

- •The Cost of Holding Money

- •Future Money and Current Prices

- •4-6: The Social Costs of Inflation

- •The Layman’s View and the Classical Response

- •The Costs of Expected Inflation

- •The Costs of Unexpected Inflation

- •One Benefit of Inflation

- •4-7: Hyperinflation

- •The Costs of Hyperinflation

- •The Causes of Hyperinflation

- •4-8: Conclusion: The Classical Dichotomy

- •The Role of Net Exports

- •International Capital Flows and the Trade Balance

- •International Flows of Goods and Capital: An Example

- •Capital Mobility and the World Interest Rate

- •Why Assume a Small Open Economy?

- •The Model

- •How Policies Influence the Trade Balance

- •Evaluating Economic Policy

- •Nominal and Real Exchange Rates

- •The Real Exchange Rate and the Trade Balance

- •The Determinants of the Real Exchange Rate

- •How Policies Influence the Real Exchange Rate

- •The Effects of Trade Policies

- •The Special Case of Purchasing-Power Parity

- •Net Capital Outflow

- •The Model

- •Policies in the Large Open Economy

- •Conclusion

- •Causes of Frictional Unemployment

- •Public Policy and Frictional Unemployment

- •Minimum-Wage Laws

- •Unions and Collective Bargaining

- •Efficiency Wages

- •The Duration of Unemployment

- •Trends in Unemployment

- •Transitions Into and Out of the Labor Force

- •6-5: Labor-Market Experience: Europe

- •The Rise in European Unemployment

- •Unemployment Variation Within Europe

- •The Rise of European Leisure

- •6-6: Conclusion

- •7-1: The Accumulation of Capital

- •The Supply and Demand for Goods

- •Growth in the Capital Stock and the Steady State

- •Approaching the Steady State: A Numerical Example

- •How Saving Affects Growth

- •7-2: The Golden Rule Level of Capital

- •Comparing Steady States

- •The Transition to the Golden Rule Steady State

- •7-3: Population Growth

- •The Steady State With Population Growth

- •The Effects of Population Growth

- •Alternative Perspectives on Population Growth

- •7-4: Conclusion

- •The Efficiency of Labor

- •The Steady State With Technological Progress

- •The Effects of Technological Progress

- •Balanced Growth

- •Convergence

- •Factor Accumulation Versus Production Efficiency

- •8-3: Policies to Promote Growth

- •Evaluating the Rate of Saving

- •Changing the Rate of Saving

- •Allocating the Economy’s Investment

- •Establishing the Right Institutions

- •Encouraging Technological Progress

- •The Basic Model

- •A Two-Sector Model

- •The Microeconomics of Research and Development

- •The Process of Creative Destruction

- •8-5: Conclusion

- •Increases in the Factors of Production

- •Technological Progress

- •The Sources of Growth in the United States

- •The Solow Residual in the Short Run

- •9-1: The Facts About the Business Cycle

- •GDP and Its Components

- •Unemployment and Okun’s Law

- •Leading Economic Indicators

- •9-2: Time Horizons in Macroeconomics

- •How the Short Run and Long Run Differ

- •9-3: Aggregate Demand

- •The Quantity Equation as Aggregate Demand

- •Why the Aggregate Demand Curve Slopes Downward

- •Shifts in the Aggregate Demand Curve

- •9-4: Aggregate Supply

- •The Long Run: The Vertical Aggregate Supply Curve

- •From the Short Run to the Long Run

- •9-5: Stabilization Policy

- •Shocks to Aggregate Demand

- •Shocks to Aggregate Supply

- •10-1: The Goods Market and the IS Curve

- •The Keynesian Cross

- •The Interest Rate, Investment, and the IS Curve

- •How Fiscal Policy Shifts the IS Curve

- •10-2: The Money Market and the LM Curve

- •The Theory of Liquidity Preference

- •Income, Money Demand, and the LM Curve

- •How Monetary Policy Shifts the LM Curve

- •Shocks in the IS–LM Model

- •From the IS–LM Model to the Aggregate Demand Curve

- •The IS–LM Model in the Short Run and Long Run

- •11-3: The Great Depression

- •The Spending Hypothesis: Shocks to the IS Curve

- •The Money Hypothesis: A Shock to the LM Curve

- •Could the Depression Happen Again?

- •11-4: Conclusion

- •12-1: The Mundell–Fleming Model

- •The Goods Market and the IS* Curve

- •The Money Market and the LM* Curve

- •Putting the Pieces Together

- •Fiscal Policy

- •Monetary Policy

- •Trade Policy

- •How a Fixed-Exchange-Rate System Works

- •Fiscal Policy

- •Monetary Policy

- •Trade Policy

- •Policy in the Mundell–Fleming Model: A Summary

- •12-4: Interest Rate Differentials

- •Country Risk and Exchange-Rate Expectations

- •Differentials in the Mundell–Fleming Model

- •Pros and Cons of Different Exchange-Rate Systems

- •The Impossible Trinity

- •12-6: From the Short Run to the Long Run: The Mundell–Fleming Model With a Changing Price Level

- •12-7: A Concluding Reminder

- •Fiscal Policy

- •Monetary Policy

- •A Rule of Thumb

- •The Sticky-Price Model

- •Implications

- •Adaptive Expectations and Inflation Inertia

- •Two Causes of Rising and Falling Inflation

- •Disinflation and the Sacrifice Ratio

- •13-3: Conclusion

- •14-1: Elements of the Model

- •Output: The Demand for Goods and Services

- •The Real Interest Rate: The Fisher Equation

- •Inflation: The Phillips Curve

- •Expected Inflation: Adaptive Expectations

- •The Nominal Interest Rate: The Monetary-Policy Rule

- •14-2: Solving the Model

- •The Long-Run Equilibrium

- •The Dynamic Aggregate Supply Curve

- •The Dynamic Aggregate Demand Curve

- •The Short-Run Equilibrium

- •14-3: Using the Model

- •Long-Run Growth

- •A Shock to Aggregate Supply

- •A Shock to Aggregate Demand

- •A Shift in Monetary Policy

- •The Taylor Principle

- •14-5: Conclusion: Toward DSGE Models

- •15-1: Should Policy Be Active or Passive?

- •Lags in the Implementation and Effects of Policies

- •The Difficult Job of Economic Forecasting

- •Ignorance, Expectations, and the Lucas Critique

- •The Historical Record

- •Distrust of Policymakers and the Political Process

- •The Time Inconsistency of Discretionary Policy

- •Rules for Monetary Policy

- •16-1: The Size of the Government Debt

- •16-2: Problems in Measurement

- •Measurement Problem 1: Inflation

- •Measurement Problem 2: Capital Assets

- •Measurement Problem 3: Uncounted Liabilities

- •Measurement Problem 4: The Business Cycle

- •Summing Up

- •The Basic Logic of Ricardian Equivalence

- •Consumers and Future Taxes

- •Making a Choice

- •16-5: Other Perspectives on Government Debt

- •Balanced Budgets Versus Optimal Fiscal Policy

- •Fiscal Effects on Monetary Policy

- •Debt and the Political Process

- •International Dimensions

- •16-6: Conclusion

- •Keynes’s Conjectures

- •The Early Empirical Successes

- •The Intertemporal Budget Constraint

- •Consumer Preferences

- •Optimization

- •How Changes in Income Affect Consumption

- •Constraints on Borrowing

- •The Hypothesis

- •Implications

- •The Hypothesis

- •Implications

- •The Hypothesis

- •Implications

- •17-7: Conclusion

- •18-1: Business Fixed Investment

- •The Rental Price of Capital

- •The Cost of Capital

- •The Determinants of Investment

- •Taxes and Investment

- •The Stock Market and Tobin’s q

- •Financing Constraints

- •Banking Crises and Credit Crunches

- •18-2: Residential Investment

- •The Stock Equilibrium and the Flow Supply

- •Changes in Housing Demand

- •18-3: Inventory Investment

- •Reasons for Holding Inventories

- •18-4: Conclusion

- •19-1: Money Supply

- •100-Percent-Reserve Banking

- •Fractional-Reserve Banking

- •A Model of the Money Supply

- •The Three Instruments of Monetary Policy

- •Bank Capital, Leverage, and Capital Requirements

- •19-2: Money Demand

- •Portfolio Theories of Money Demand

- •Transactions Theories of Money Demand

- •The Baumol–Tobin Model of Cash Management

- •19-3 Conclusion

- •Lesson 2: In the short run, aggregate demand influences the amount of goods and services that a country produces.

- •Question 1: How should policymakers try to promote growth in the economy’s natural level of output?

- •Question 2: Should policymakers try to stabilize the economy?

- •Question 3: How costly is inflation, and how costly is reducing inflation?

- •Question 4: How big a problem are government budget deficits?

- •Conclusion

- •Glossary

- •Index

414 | P A R T I V Business Cycle Theory: The Economy in the Short Run

The Nominal Interest Rate: The Monetary-Policy Rule

The last piece of the model is the equation for monetary policy. We assume that the central bank sets a target for the nominal interest rate it based on inflation and output using this rule:

|

− |

|

it = pt + r + vp(pt − p*t ) + vY (Yt − Yt ). |

In this equation, |

p t |

* is the central bank’s target for the inflation rate. (For most pur- |

poses, target inflation can be assumed to be constant, but we will keep a time subscript on this variable so we can examine later what happens when the central bank changes its target.) Two key policy parameters are vp and vY, which are both assumed to be greater than zero. They indicate how much the central bank allows the interest rate target to respond to fluctuations in inflation and output. The larger the value of vp, the more responsive the central bank is to the deviation of inflation from its target; the larger the value of vY, the more responsive the central bank is to the deviation of income from its natural level. Recall that r, the constant in this equation, is the natural rate of interest (the real interest rate at which, in the absence of any shock, the demand for goods and services equals the natural level of output). This equation tells us how the central bank uses monetary policy to respond to any situation it faces. That is, it tells us how the target for the nominal interest rate chosen by the central bank responds to macroeconomic conditions.

To interpret this equation, it is best to focus not just on the nominal interest rate it but also on the real interest rate rt. Recall that the real interest rate, rather than the nominal interest rate, influences the demand for goods and services. So, although the central bank sets a target for the nominal interest rate it, the bank’s influence on the economy works through the real interest rate rt. By definition,

the real interest rate is rt = it − Etpt +1, but with our expectation equation Etpt +1 |

||||

= pt, we can also write the real interest rate as rt = it − pt. According to the equa- |

||||

− |

p |

t = |

p |

*t ) and output is at its |

tion for monetary policy, if inflation is at its target ( |

|

|

||

natural level (Yt = Yt), the last two terms in the equation are zero, and so the real

interest rate equals the natural rate of interest r. As inflation rises above its target |

|||

|

|

|

− |

(pt > p*t ) or output rises above its natural level (Yt > Yt), the real interest rate |

|||

rises. And as inflation falls below its target ( |

t < |

p |

*t ) or output falls below its nat- |

− |

p |

|

|

ural level (Yt < Yt), the real interest rate falls. |

|

|

|

At this point, one might naturally ask: what about the money supply? In previous chapters, such as Chapters 10 and 11, the money supply was typically taken to be the policy instrument of the central bank, and the interest rate adjusted to bring money supply and money demand into equilibrium. Here, we turn that logic on its head. The central bank is assumed to set a target for the nominal interest rate. It then adjusts the money supply to whatever level is necessary to ensure that the equilibrium interest rate (which balances money supply and demand) hits the target.

The main advantage of using the interest rate, rather than the money supply, as the policy instrument in the dynamic AD –AS model is that it is more realistic. Today, most central banks, including the Federal Reserve, set a short-term target for the nominal interest rate. Keep in mind, though, that

C H A P T E R 1 4 A Dynamic Model of Aggregate Demand and Aggregate Supply | 415

hitting that target requires adjustments in the money supply. For this model, we do not need to specify the equilibrium condition for the money market, but we should remember that it is lurking in the background. When a central bank decides to change the interest rate, it is also committing itself to adjust the money supply accordingly.

CASE STUDY

The Taylor Rule

If you wanted to set interest rates to achieve low, stable inflation while avoiding large fluctuations in output and employment, how would you do it? This is exactly the question that the governors of the Federal Reserve must ask themselves every day. The short-term policy instrument that the Fed now sets is the federal funds rate—the short-term interest rate at which banks make loans to one another. Whenever the Federal Open Market Committee meets, it chooses a target for the federal funds rate. The Fed’s bond traders are then told to conduct open-market operations to hit the desired target.

The hard part of the Fed’s job is choosing the target for the federal funds rate. Two general guidelines are clear. First, when inflation heats up, the federal funds rate should rise. An increase in the interest rate will mean a smaller money supply and, eventually, lower investment, lower output, higher unemployment, and reduced inflation. Second, when real economic activity slows—as reflected in real GDP or unemployment—the federal funds rate should fall. A decrease in the interest rate will mean a larger money supply and, eventually, higher investment, higher output, and lower unemployment. These two guidelines are represented by the monetary-policy equation in the dynamic AD –AS model.

The Fed needs to go beyond these general guidelines, however, and decide exactly how much to respond to changes in inflation and real economic activity. Stanford University economist John Taylor has proposed the following rule for the federal funds rate:1

Nominal Federal Funds Rate = Inflation + 2.0

+ 0.5 (Inflation − 2.0) + 0.5 (GDP gap).

The GDP gap is the percentage by which real GDP deviates from an estimate of its natural level. (For consistency with our dynamic AD –AS model, the GDP gap here is taken to be positive if GDP rises above its natural level and negative if it falls below it.)

According to the Taylor rule, the real federal funds rate—the nominal rate minus inflation—responds to inflation and the GDP gap. According to this rule,

1 John B. Taylor,“Discretion Versus Policy Rules in Practice,” Carnegie-Rochester Conference Series on Public Policy 39 (1993): 195–214.

416 | P A R T I V Business Cycle Theory: The Economy in the Short Run

the real federal funds rate equals 2 percent when inflation is 2 percent and GDP is at its natural level. The first constant of 2 percent in this equation can be interpreted as an estimate of the natural rate of interest r, and the second constant of 2 percent subtracted from inflation can be interpreted as the Fed’s inflation tar-

get p*. For each percentage point that inflation rises above 2 percent, the real

t

federal funds rate rises by 0.5 percent. For each percentage point that real GDP rises above its natural level, the real federal funds rate rises by 0.5 percent. If inflation falls below 2 percent or GDP moves below its natural level, the real federal funds rate falls accordingly.

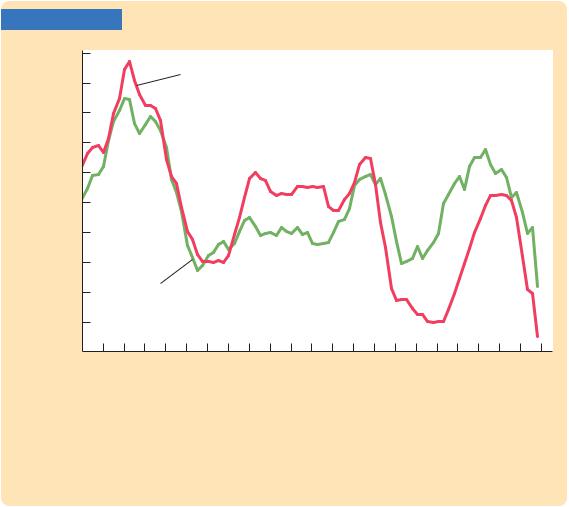

In addition to being simple and reasonable, the Taylor rule for monetary policy also resembles actual Fed behavior in recent years. Figure 14-1 shows the actual nominal federal funds rate and the target rate as determined by Taylor’s proposed rule. Notice how the two series tend to move together. John Taylor’s monetary rule may be more than an academic suggestion. To some degree, it may be the rule that the Federal Reserve governors have been subconsciously following. ■

FIGURE 14-1

Percent 10

Actual

9

8

7

6

5

4

3

2Taylor’s rule

1

1987 |

1989 |

1991 |

1993 |

1995 |

1997 |

1999 |

2001 |

2003 |

2005 |

2007 |

2009 |

|

|

|

|

|

|

|

|

|

|

|

Year |

The Federal Funds Rate: Actual and Suggested This figure shows the federal funds rate set by the Federal Reserve and the target rate that John Taylor’s rule for monetary policy would recommend. Notice that the two series move closely together.

Source: Federal Reserve Board, U.S. Department of Commerce, U.S. Department of Labor, and author’s calculations. To implement the Taylor rule, the inflation rate is measured as the percentage change in the GDP deflator over the previous four quarters, and the GDP gap is measured as negative two times the deviation of the unemployment rate from its natural rate (as shown in Figure 6-1).