- •About the author

- •Brief Contents

- •Contents

- •Preface

- •This Book’s Approach

- •What’s New in the Seventh Edition?

- •The Arrangement of Topics

- •Part One, Introduction

- •Part Two, Classical Theory: The Economy in the Long Run

- •Part Three, Growth Theory: The Economy in the Very Long Run

- •Part Four, Business Cycle Theory: The Economy in the Short Run

- •Part Five, Macroeconomic Policy Debates

- •Part Six, More on the Microeconomics Behind Macroeconomics

- •Epilogue

- •Alternative Routes Through the Text

- •Learning Tools

- •Case Studies

- •FYI Boxes

- •Graphs

- •Mathematical Notes

- •Chapter Summaries

- •Key Concepts

- •Questions for Review

- •Problems and Applications

- •Chapter Appendices

- •Glossary

- •Translations

- •Acknowledgments

- •Supplements and Media

- •For Instructors

- •Instructor’s Resources

- •Solutions Manual

- •Test Bank

- •PowerPoint Slides

- •For Students

- •Student Guide and Workbook

- •Online Offerings

- •EconPortal, Available Spring 2010

- •eBook

- •WebCT

- •BlackBoard

- •Additional Offerings

- •i-clicker

- •The Wall Street Journal Edition

- •Financial Times Edition

- •Dismal Scientist

- •1-1: What Macroeconomists Study

- •1-2: How Economists Think

- •Theory as Model Building

- •The Use of Multiple Models

- •Prices: Flexible Versus Sticky

- •Microeconomic Thinking and Macroeconomic Models

- •1-3: How This Book Proceeds

- •Income, Expenditure, and the Circular Flow

- •Rules for Computing GDP

- •Real GDP Versus Nominal GDP

- •The GDP Deflator

- •Chain-Weighted Measures of Real GDP

- •The Components of Expenditure

- •Other Measures of Income

- •Seasonal Adjustment

- •The Price of a Basket of Goods

- •The CPI Versus the GDP Deflator

- •The Household Survey

- •The Establishment Survey

- •The Factors of Production

- •The Production Function

- •The Supply of Goods and Services

- •3-2: How Is National Income Distributed to the Factors of Production?

- •Factor Prices

- •The Decisions Facing the Competitive Firm

- •The Firm’s Demand for Factors

- •The Division of National Income

- •The Cobb–Douglas Production Function

- •Consumption

- •Investment

- •Government Purchases

- •Changes in Saving: The Effects of Fiscal Policy

- •Changes in Investment Demand

- •3-5: Conclusion

- •4-1: What Is Money?

- •The Functions of Money

- •The Types of Money

- •The Development of Fiat Money

- •How the Quantity of Money Is Controlled

- •How the Quantity of Money Is Measured

- •4-2: The Quantity Theory of Money

- •Transactions and the Quantity Equation

- •From Transactions to Income

- •The Assumption of Constant Velocity

- •Money, Prices, and Inflation

- •4-4: Inflation and Interest Rates

- •Two Interest Rates: Real and Nominal

- •The Fisher Effect

- •Two Real Interest Rates: Ex Ante and Ex Post

- •The Cost of Holding Money

- •Future Money and Current Prices

- •4-6: The Social Costs of Inflation

- •The Layman’s View and the Classical Response

- •The Costs of Expected Inflation

- •The Costs of Unexpected Inflation

- •One Benefit of Inflation

- •4-7: Hyperinflation

- •The Costs of Hyperinflation

- •The Causes of Hyperinflation

- •4-8: Conclusion: The Classical Dichotomy

- •The Role of Net Exports

- •International Capital Flows and the Trade Balance

- •International Flows of Goods and Capital: An Example

- •Capital Mobility and the World Interest Rate

- •Why Assume a Small Open Economy?

- •The Model

- •How Policies Influence the Trade Balance

- •Evaluating Economic Policy

- •Nominal and Real Exchange Rates

- •The Real Exchange Rate and the Trade Balance

- •The Determinants of the Real Exchange Rate

- •How Policies Influence the Real Exchange Rate

- •The Effects of Trade Policies

- •The Special Case of Purchasing-Power Parity

- •Net Capital Outflow

- •The Model

- •Policies in the Large Open Economy

- •Conclusion

- •Causes of Frictional Unemployment

- •Public Policy and Frictional Unemployment

- •Minimum-Wage Laws

- •Unions and Collective Bargaining

- •Efficiency Wages

- •The Duration of Unemployment

- •Trends in Unemployment

- •Transitions Into and Out of the Labor Force

- •6-5: Labor-Market Experience: Europe

- •The Rise in European Unemployment

- •Unemployment Variation Within Europe

- •The Rise of European Leisure

- •6-6: Conclusion

- •7-1: The Accumulation of Capital

- •The Supply and Demand for Goods

- •Growth in the Capital Stock and the Steady State

- •Approaching the Steady State: A Numerical Example

- •How Saving Affects Growth

- •7-2: The Golden Rule Level of Capital

- •Comparing Steady States

- •The Transition to the Golden Rule Steady State

- •7-3: Population Growth

- •The Steady State With Population Growth

- •The Effects of Population Growth

- •Alternative Perspectives on Population Growth

- •7-4: Conclusion

- •The Efficiency of Labor

- •The Steady State With Technological Progress

- •The Effects of Technological Progress

- •Balanced Growth

- •Convergence

- •Factor Accumulation Versus Production Efficiency

- •8-3: Policies to Promote Growth

- •Evaluating the Rate of Saving

- •Changing the Rate of Saving

- •Allocating the Economy’s Investment

- •Establishing the Right Institutions

- •Encouraging Technological Progress

- •The Basic Model

- •A Two-Sector Model

- •The Microeconomics of Research and Development

- •The Process of Creative Destruction

- •8-5: Conclusion

- •Increases in the Factors of Production

- •Technological Progress

- •The Sources of Growth in the United States

- •The Solow Residual in the Short Run

- •9-1: The Facts About the Business Cycle

- •GDP and Its Components

- •Unemployment and Okun’s Law

- •Leading Economic Indicators

- •9-2: Time Horizons in Macroeconomics

- •How the Short Run and Long Run Differ

- •9-3: Aggregate Demand

- •The Quantity Equation as Aggregate Demand

- •Why the Aggregate Demand Curve Slopes Downward

- •Shifts in the Aggregate Demand Curve

- •9-4: Aggregate Supply

- •The Long Run: The Vertical Aggregate Supply Curve

- •From the Short Run to the Long Run

- •9-5: Stabilization Policy

- •Shocks to Aggregate Demand

- •Shocks to Aggregate Supply

- •10-1: The Goods Market and the IS Curve

- •The Keynesian Cross

- •The Interest Rate, Investment, and the IS Curve

- •How Fiscal Policy Shifts the IS Curve

- •10-2: The Money Market and the LM Curve

- •The Theory of Liquidity Preference

- •Income, Money Demand, and the LM Curve

- •How Monetary Policy Shifts the LM Curve

- •Shocks in the IS–LM Model

- •From the IS–LM Model to the Aggregate Demand Curve

- •The IS–LM Model in the Short Run and Long Run

- •11-3: The Great Depression

- •The Spending Hypothesis: Shocks to the IS Curve

- •The Money Hypothesis: A Shock to the LM Curve

- •Could the Depression Happen Again?

- •11-4: Conclusion

- •12-1: The Mundell–Fleming Model

- •The Goods Market and the IS* Curve

- •The Money Market and the LM* Curve

- •Putting the Pieces Together

- •Fiscal Policy

- •Monetary Policy

- •Trade Policy

- •How a Fixed-Exchange-Rate System Works

- •Fiscal Policy

- •Monetary Policy

- •Trade Policy

- •Policy in the Mundell–Fleming Model: A Summary

- •12-4: Interest Rate Differentials

- •Country Risk and Exchange-Rate Expectations

- •Differentials in the Mundell–Fleming Model

- •Pros and Cons of Different Exchange-Rate Systems

- •The Impossible Trinity

- •12-6: From the Short Run to the Long Run: The Mundell–Fleming Model With a Changing Price Level

- •12-7: A Concluding Reminder

- •Fiscal Policy

- •Monetary Policy

- •A Rule of Thumb

- •The Sticky-Price Model

- •Implications

- •Adaptive Expectations and Inflation Inertia

- •Two Causes of Rising and Falling Inflation

- •Disinflation and the Sacrifice Ratio

- •13-3: Conclusion

- •14-1: Elements of the Model

- •Output: The Demand for Goods and Services

- •The Real Interest Rate: The Fisher Equation

- •Inflation: The Phillips Curve

- •Expected Inflation: Adaptive Expectations

- •The Nominal Interest Rate: The Monetary-Policy Rule

- •14-2: Solving the Model

- •The Long-Run Equilibrium

- •The Dynamic Aggregate Supply Curve

- •The Dynamic Aggregate Demand Curve

- •The Short-Run Equilibrium

- •14-3: Using the Model

- •Long-Run Growth

- •A Shock to Aggregate Supply

- •A Shock to Aggregate Demand

- •A Shift in Monetary Policy

- •The Taylor Principle

- •14-5: Conclusion: Toward DSGE Models

- •15-1: Should Policy Be Active or Passive?

- •Lags in the Implementation and Effects of Policies

- •The Difficult Job of Economic Forecasting

- •Ignorance, Expectations, and the Lucas Critique

- •The Historical Record

- •Distrust of Policymakers and the Political Process

- •The Time Inconsistency of Discretionary Policy

- •Rules for Monetary Policy

- •16-1: The Size of the Government Debt

- •16-2: Problems in Measurement

- •Measurement Problem 1: Inflation

- •Measurement Problem 2: Capital Assets

- •Measurement Problem 3: Uncounted Liabilities

- •Measurement Problem 4: The Business Cycle

- •Summing Up

- •The Basic Logic of Ricardian Equivalence

- •Consumers and Future Taxes

- •Making a Choice

- •16-5: Other Perspectives on Government Debt

- •Balanced Budgets Versus Optimal Fiscal Policy

- •Fiscal Effects on Monetary Policy

- •Debt and the Political Process

- •International Dimensions

- •16-6: Conclusion

- •Keynes’s Conjectures

- •The Early Empirical Successes

- •The Intertemporal Budget Constraint

- •Consumer Preferences

- •Optimization

- •How Changes in Income Affect Consumption

- •Constraints on Borrowing

- •The Hypothesis

- •Implications

- •The Hypothesis

- •Implications

- •The Hypothesis

- •Implications

- •17-7: Conclusion

- •18-1: Business Fixed Investment

- •The Rental Price of Capital

- •The Cost of Capital

- •The Determinants of Investment

- •Taxes and Investment

- •The Stock Market and Tobin’s q

- •Financing Constraints

- •Banking Crises and Credit Crunches

- •18-2: Residential Investment

- •The Stock Equilibrium and the Flow Supply

- •Changes in Housing Demand

- •18-3: Inventory Investment

- •Reasons for Holding Inventories

- •18-4: Conclusion

- •19-1: Money Supply

- •100-Percent-Reserve Banking

- •Fractional-Reserve Banking

- •A Model of the Money Supply

- •The Three Instruments of Monetary Policy

- •Bank Capital, Leverage, and Capital Requirements

- •19-2: Money Demand

- •Portfolio Theories of Money Demand

- •Transactions Theories of Money Demand

- •The Baumol–Tobin Model of Cash Management

- •19-3 Conclusion

- •Lesson 2: In the short run, aggregate demand influences the amount of goods and services that a country produces.

- •Question 1: How should policymakers try to promote growth in the economy’s natural level of output?

- •Question 2: Should policymakers try to stabilize the economy?

- •Question 3: How costly is inflation, and how costly is reducing inflation?

- •Question 4: How big a problem are government budget deficits?

- •Conclusion

- •Glossary

- •Index

180 | P A R T I I Classical Theory: The Economy in the Long Run

TA B L E 6-3

Alternative Measures of Labor Underutilization

Variable |

Description |

Rate |

U-1 |

Persons unemployed 15 weeks or longer, as a percent of the civilian labor |

2.6% |

|

force (includes only very long-term unemployed) |

|

U-2 |

Job losers and persons who have completed temporary jobs, as a percent of |

3.9 |

|

the civilian labor force (excludes job leavers) |

|

U-3 |

Total unemployed, as a percent of the civilian labor force (official |

6.7 |

|

unemployment rate) |

|

U-4 |

Total unemployed, plus discouraged workers, as a percent of the civilian |

7.0 |

|

labor force plus discouraged workers |

|

U-5 |

Total unemployed plus all marginally attached workers, as a percent of the |

7.8 |

|

civilian labor force plus all marginally attached workers |

|

U-6 |

Total unemployed, plus all marginally attached workers, plus total employed |

12.5 |

|

part time for economic reasons, as a percent of the civilian labor force plus |

|

|

all marginally attached workers |

|

Note: Marginally attached workers are persons who currently are neither working nor looking for work but indicate that they want and are available for a job and have looked for work sometime in the recent past. Discouraged workers, a subset of the marginally attached, have given a job-market-related reason for not currently looking for a job. Persons employed part time for economic reasons are those who want and are available for full-time work but have had to settle for a part-time schedule. Source: U.S. Department of Labor. Data are for November 2008.

Because of these and many other issues that complicate the interpretation of the unemployment data, the Bureau of Labor Statistics calculates several measures of labor underutilization. Table 6-3 gives the definitions and their values as of November 2008. The measures range from 2.6 to 12.5 percent, depending on the characteristics one uses to classify a worker as not fully employed.

6-5 Labor-Market Experience: Europe

Although our discussion has focused largely on the United States, many fascinating and sometimes puzzling phenomena become apparent when economists compare the experiences of Americans in the labor market with those of Europeans.

The Rise in European Unemployment

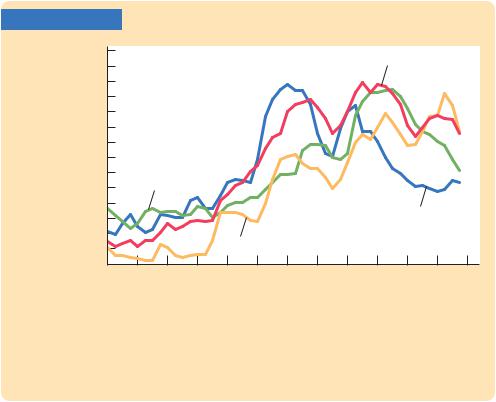

Figure 6-4 shows the rate of unemployment from 1960 to 2007 in the four largest European countries—France, Germany, Italy, and the United Kingdom. As you can see, the rate of unemployment in these countries has risen substantially. For France and Germany, the change is particularly pronounced: unemployment averaged about 2 percent in the 1960s and about 10 percent in recent years.

|

|

C H A P T E R |

6 Unemployment | 181 |

FIGURE 6-4 |

|

|

|

Percent |

14 |

France |

|

Unemployed |

|

|

|

|

|

|

|

|

12 |

|

|

|

10 |

|

|

|

8 |

|

|

|

6 |

Italy |

|

|

|

|

|

|

4 |

United |

|

|

|

|

|

|

2 |

Kingdom |

|

|

Germany |

|

|

|

|

|

|

|

0 |

|

|

|

1960 1964 1968 1972 1976 1980 1984 1988 1992 1996 2000 2004 2008 |

||

|

|

|

Year |

Unemployment in Europe This figure shows the unemployment rate in the four largest nations in Europe. The figure shows that the European unemployment rate has risen substantially over time, especially in France and Germany.

Source: Bureau of Labor Statistics.

What is the cause of rising European unemployment? No one knows for sure, but there is a leading theory. Many economists believe that the problem can be traced to the interaction between a long-standing policy and a more recent shock. The long-standing policy is generous benefits for unemployed workers. The recent shock is a technologically driven fall in the demand for unskilled workers relative to skilled workers.

There is no question that most European countries have generous programs for those without jobs. These programs go by various names: social insurance, the welfare state, or simply “the dole.” Many countries allow the unemployed to collect benefits for years, rather than for only a short period of time as in the United States. In some sense, those living on the dole are really out of the labor force: given the employment opportunities available, taking a job is less attractive than remaining without work. Yet these people are often counted as unemployed in government statistics.

There is also no question that the demand for unskilled workers has fallen relative to the demand for skilled workers. This change in demand is probably due to changes in technology: computers, for example, increase the demand for workers who can use them and reduce the demand for those who cannot. In the United States, this change in demand has been reflected in wages rather than unemployment: over the past two decades, the wages of unskilled workers have fallen substantially relative to the wages of skilled workers. In Europe, however,

182 | P A R T I I Classical Theory: The Economy in the Long Run

the welfare state provides unskilled workers with an alternative to working for low wages. As the wages of unskilled workers fall, more workers view the dole as their best available option. The result is higher unemployment.

This diagnosis of high European unemployment does not suggest an easy remedy. Reducing the magnitude of government benefits for the unemployed would encourage workers to get off the dole and accept low-wage jobs. But it would also exacerbate economic inequality—the very problem that welfare-state policies were designed to address.9

Unemployment Variation Within Europe

Europe is not a single labor market but is, instead, a collection of national labor markets, separated not only by national borders but also by differences in culture and language. Because these countries differ in their labor-market policies and institutions, variation within Europe provides a useful perspective on the causes of unemployment. Many empirical studies have, therefore, focused on these international differences.

The first noteworthy fact is that the unemployment rate varies substantially from country to country. For example, in August 2008, when the unemployment rate was 6.1 percent in the United States, it was 2.4 percent in Switzerland and 11.3 percent in Spain. Although in recent years average unemployment has been higher in Europe than in the United States, about a third of Europeans have been living in nations with unemployment rates lower than the U.S. rate.

A second notable fact is that much of the variation in unemployment rates is attributable to the long-term unemployed. The unemployment rate can be separated into two pieces—the percentage of the labor force that has been unemployed for less than a year and the percentage of the labor force that has been unemployed for more than a year. The long-term unemployment rate exhibits more variability from country to country than does the short-term unemployment rate.

National unemployment rates are correlated with a variety of labor-market policies. Unemployment rates are higher in nations with more generous unemployment insurance, as measured by the replacement rate—the percentage of previous wages that is replaced when a worker loses a job. In addition, nations tend to have higher unemployment, especially higher long-term unemployment, if benefits can be collected for longer periods of time.

Although government spending on unemployment insurance seems to raise unemployment, spending on “active” labor-market policies appears to decrease it. These active labor-market policies include job training, assistance with job search, and subsidized employment. Spain, for instance, has historically had a high rate of unemployment, a fact that can be explained by the combination of generous payments to the unemployed with minimal assistance at helping them find new jobs.

9 For more discussion of these issues, see Paul Krugman, “Past and Prospective Causes of High Unemployment,” in Reducing Unemployment: Current Issues and Policy Options, Federal Reserve Bank of Kansas City, August 1994.

C H A P T E R 6 Unemployment | 183

The role of unions also varies from country to country, as we saw in Table 6-1. This fact also helps explain differences in labor-market outcomes. National unemployment rates are positively correlated with the percentage of the labor force whose wages are set by collective bargaining with unions. The adverse impact of unions on unemployment is smaller, however, in nations where there is substantial coordination among employers in bargaining with unions, perhaps because coordination may moderate the upward pressure on wages.

A word of warning: Correlation does not imply causation, so empirical results such as these should be interpreted with caution. But they do suggest that a nation’s unemployment rate, rather than being immutable, is instead a function of the choices a nation makes.10

CASE STUDY

The Secrets to Happiness

Why are some people more satisfied with their lives than others? This is a deep and difficult question, most often left to philosophers, psychologists, and selfhelp gurus. But part of the answer is macroeconomic. Recent research has shown that people are happier when they are living in a country with low inflation and low unemployment.

From 1975 to 1991, a survey called the Euro-Barometer Survey Series asked 264,710 people living in 12 European countries about their happiness and overall satisfaction with life. One question asked,“On the whole, are you very satisfied, fairly satisfied, not very satisfied, or not at all satisfied with the life you lead?” To see what determines happiness, the answers to this question were correlated with individual and macroeconomic variables. Other things equal, people are more satisfied with their lives if they are rich, educated, married, in school, self-employed, retired, female, or either young or old (as opposed to middle-aged). They are less satisfied if they are unemployed, divorced, or living with adolescent children. (Some of these correlations may reflect the effects, rather than causes, of happiness; for example, a happy person may find it easier than an unhappy one to keep a job and a spouse.)

Beyond these individual characteristics, the economy’s overall rates of unemployment and inflation also play a significant role in explaining reported happiness. An increase in the unemployment rate of 4 percentage points is large enough to move 11 percent of the population down from one life-satisfaction category to another. The overall unemployment rate reduces satisfaction even after controlling for an individual’s employment status. That is, the employed in a high-unemployment nation are less happy than their counterparts in a lowunemployment nation, perhaps because they are more worried about job loss or perhaps out of sympathy with their fellow citizens.

High inflation is also associated with lower life satisfaction, although the effect is not as large. A 1.7-percentage-point increase in inflation reduces happiness by

10 Stephen Nickell, “Unemployment and Labor Market Rigidities: Europe Versus North America,” Journal of Economic Perspectives 11 (September 1997): 55–74.