- •brief contents

- •contents

- •preface

- •acknowledgments

- •about this book

- •What’s new in the second edition

- •Who should read this book

- •Roadmap

- •Advice for data miners

- •Code examples

- •Code conventions

- •Author Online

- •About the author

- •about the cover illustration

- •1 Introduction to R

- •1.2 Obtaining and installing R

- •1.3 Working with R

- •1.3.1 Getting started

- •1.3.2 Getting help

- •1.3.3 The workspace

- •1.3.4 Input and output

- •1.4 Packages

- •1.4.1 What are packages?

- •1.4.2 Installing a package

- •1.4.3 Loading a package

- •1.4.4 Learning about a package

- •1.5 Batch processing

- •1.6 Using output as input: reusing results

- •1.7 Working with large datasets

- •1.8 Working through an example

- •1.9 Summary

- •2 Creating a dataset

- •2.1 Understanding datasets

- •2.2 Data structures

- •2.2.1 Vectors

- •2.2.2 Matrices

- •2.2.3 Arrays

- •2.2.4 Data frames

- •2.2.5 Factors

- •2.2.6 Lists

- •2.3 Data input

- •2.3.1 Entering data from the keyboard

- •2.3.2 Importing data from a delimited text file

- •2.3.3 Importing data from Excel

- •2.3.4 Importing data from XML

- •2.3.5 Importing data from the web

- •2.3.6 Importing data from SPSS

- •2.3.7 Importing data from SAS

- •2.3.8 Importing data from Stata

- •2.3.9 Importing data from NetCDF

- •2.3.10 Importing data from HDF5

- •2.3.11 Accessing database management systems (DBMSs)

- •2.3.12 Importing data via Stat/Transfer

- •2.4 Annotating datasets

- •2.4.1 Variable labels

- •2.4.2 Value labels

- •2.5 Useful functions for working with data objects

- •2.6 Summary

- •3 Getting started with graphs

- •3.1 Working with graphs

- •3.2 A simple example

- •3.3 Graphical parameters

- •3.3.1 Symbols and lines

- •3.3.2 Colors

- •3.3.3 Text characteristics

- •3.3.4 Graph and margin dimensions

- •3.4 Adding text, customized axes, and legends

- •3.4.1 Titles

- •3.4.2 Axes

- •3.4.3 Reference lines

- •3.4.4 Legend

- •3.4.5 Text annotations

- •3.4.6 Math annotations

- •3.5 Combining graphs

- •3.5.1 Creating a figure arrangement with fine control

- •3.6 Summary

- •4 Basic data management

- •4.1 A working example

- •4.2 Creating new variables

- •4.3 Recoding variables

- •4.4 Renaming variables

- •4.5 Missing values

- •4.5.1 Recoding values to missing

- •4.5.2 Excluding missing values from analyses

- •4.6 Date values

- •4.6.1 Converting dates to character variables

- •4.6.2 Going further

- •4.7 Type conversions

- •4.8 Sorting data

- •4.9 Merging datasets

- •4.9.1 Adding columns to a data frame

- •4.9.2 Adding rows to a data frame

- •4.10 Subsetting datasets

- •4.10.1 Selecting (keeping) variables

- •4.10.2 Excluding (dropping) variables

- •4.10.3 Selecting observations

- •4.10.4 The subset() function

- •4.10.5 Random samples

- •4.11 Using SQL statements to manipulate data frames

- •4.12 Summary

- •5 Advanced data management

- •5.2 Numerical and character functions

- •5.2.1 Mathematical functions

- •5.2.2 Statistical functions

- •5.2.3 Probability functions

- •5.2.4 Character functions

- •5.2.5 Other useful functions

- •5.2.6 Applying functions to matrices and data frames

- •5.3 A solution for the data-management challenge

- •5.4 Control flow

- •5.4.1 Repetition and looping

- •5.4.2 Conditional execution

- •5.5 User-written functions

- •5.6 Aggregation and reshaping

- •5.6.1 Transpose

- •5.6.2 Aggregating data

- •5.6.3 The reshape2 package

- •5.7 Summary

- •6 Basic graphs

- •6.1 Bar plots

- •6.1.1 Simple bar plots

- •6.1.2 Stacked and grouped bar plots

- •6.1.3 Mean bar plots

- •6.1.4 Tweaking bar plots

- •6.1.5 Spinograms

- •6.2 Pie charts

- •6.3 Histograms

- •6.4 Kernel density plots

- •6.5 Box plots

- •6.5.1 Using parallel box plots to compare groups

- •6.5.2 Violin plots

- •6.6 Dot plots

- •6.7 Summary

- •7 Basic statistics

- •7.1 Descriptive statistics

- •7.1.1 A menagerie of methods

- •7.1.2 Even more methods

- •7.1.3 Descriptive statistics by group

- •7.1.4 Additional methods by group

- •7.1.5 Visualizing results

- •7.2 Frequency and contingency tables

- •7.2.1 Generating frequency tables

- •7.2.2 Tests of independence

- •7.2.3 Measures of association

- •7.2.4 Visualizing results

- •7.3 Correlations

- •7.3.1 Types of correlations

- •7.3.2 Testing correlations for significance

- •7.3.3 Visualizing correlations

- •7.4 T-tests

- •7.4.3 When there are more than two groups

- •7.5 Nonparametric tests of group differences

- •7.5.1 Comparing two groups

- •7.5.2 Comparing more than two groups

- •7.6 Visualizing group differences

- •7.7 Summary

- •8 Regression

- •8.1 The many faces of regression

- •8.1.1 Scenarios for using OLS regression

- •8.1.2 What you need to know

- •8.2 OLS regression

- •8.2.1 Fitting regression models with lm()

- •8.2.2 Simple linear regression

- •8.2.3 Polynomial regression

- •8.2.4 Multiple linear regression

- •8.2.5 Multiple linear regression with interactions

- •8.3 Regression diagnostics

- •8.3.1 A typical approach

- •8.3.2 An enhanced approach

- •8.3.3 Global validation of linear model assumption

- •8.3.4 Multicollinearity

- •8.4 Unusual observations

- •8.4.1 Outliers

- •8.4.3 Influential observations

- •8.5 Corrective measures

- •8.5.1 Deleting observations

- •8.5.2 Transforming variables

- •8.5.3 Adding or deleting variables

- •8.5.4 Trying a different approach

- •8.6 Selecting the “best” regression model

- •8.6.1 Comparing models

- •8.6.2 Variable selection

- •8.7 Taking the analysis further

- •8.7.1 Cross-validation

- •8.7.2 Relative importance

- •8.8 Summary

- •9 Analysis of variance

- •9.1 A crash course on terminology

- •9.2 Fitting ANOVA models

- •9.2.1 The aov() function

- •9.2.2 The order of formula terms

- •9.3.1 Multiple comparisons

- •9.3.2 Assessing test assumptions

- •9.4 One-way ANCOVA

- •9.4.1 Assessing test assumptions

- •9.4.2 Visualizing the results

- •9.6 Repeated measures ANOVA

- •9.7 Multivariate analysis of variance (MANOVA)

- •9.7.1 Assessing test assumptions

- •9.7.2 Robust MANOVA

- •9.8 ANOVA as regression

- •9.9 Summary

- •10 Power analysis

- •10.1 A quick review of hypothesis testing

- •10.2 Implementing power analysis with the pwr package

- •10.2.1 t-tests

- •10.2.2 ANOVA

- •10.2.3 Correlations

- •10.2.4 Linear models

- •10.2.5 Tests of proportions

- •10.2.7 Choosing an appropriate effect size in novel situations

- •10.3 Creating power analysis plots

- •10.4 Other packages

- •10.5 Summary

- •11 Intermediate graphs

- •11.1 Scatter plots

- •11.1.3 3D scatter plots

- •11.1.4 Spinning 3D scatter plots

- •11.1.5 Bubble plots

- •11.2 Line charts

- •11.3 Corrgrams

- •11.4 Mosaic plots

- •11.5 Summary

- •12 Resampling statistics and bootstrapping

- •12.1 Permutation tests

- •12.2 Permutation tests with the coin package

- •12.2.2 Independence in contingency tables

- •12.2.3 Independence between numeric variables

- •12.2.5 Going further

- •12.3 Permutation tests with the lmPerm package

- •12.3.1 Simple and polynomial regression

- •12.3.2 Multiple regression

- •12.4 Additional comments on permutation tests

- •12.5 Bootstrapping

- •12.6 Bootstrapping with the boot package

- •12.6.1 Bootstrapping a single statistic

- •12.6.2 Bootstrapping several statistics

- •12.7 Summary

- •13 Generalized linear models

- •13.1 Generalized linear models and the glm() function

- •13.1.1 The glm() function

- •13.1.2 Supporting functions

- •13.1.3 Model fit and regression diagnostics

- •13.2 Logistic regression

- •13.2.1 Interpreting the model parameters

- •13.2.2 Assessing the impact of predictors on the probability of an outcome

- •13.2.3 Overdispersion

- •13.2.4 Extensions

- •13.3 Poisson regression

- •13.3.1 Interpreting the model parameters

- •13.3.2 Overdispersion

- •13.3.3 Extensions

- •13.4 Summary

- •14 Principal components and factor analysis

- •14.1 Principal components and factor analysis in R

- •14.2 Principal components

- •14.2.1 Selecting the number of components to extract

- •14.2.2 Extracting principal components

- •14.2.3 Rotating principal components

- •14.2.4 Obtaining principal components scores

- •14.3 Exploratory factor analysis

- •14.3.1 Deciding how many common factors to extract

- •14.3.2 Extracting common factors

- •14.3.3 Rotating factors

- •14.3.4 Factor scores

- •14.4 Other latent variable models

- •14.5 Summary

- •15 Time series

- •15.1 Creating a time-series object in R

- •15.2 Smoothing and seasonal decomposition

- •15.2.1 Smoothing with simple moving averages

- •15.2.2 Seasonal decomposition

- •15.3 Exponential forecasting models

- •15.3.1 Simple exponential smoothing

- •15.3.3 The ets() function and automated forecasting

- •15.4 ARIMA forecasting models

- •15.4.1 Prerequisite concepts

- •15.4.2 ARMA and ARIMA models

- •15.4.3 Automated ARIMA forecasting

- •15.5 Going further

- •15.6 Summary

- •16 Cluster analysis

- •16.1 Common steps in cluster analysis

- •16.2 Calculating distances

- •16.3 Hierarchical cluster analysis

- •16.4 Partitioning cluster analysis

- •16.4.2 Partitioning around medoids

- •16.5 Avoiding nonexistent clusters

- •16.6 Summary

- •17 Classification

- •17.1 Preparing the data

- •17.2 Logistic regression

- •17.3 Decision trees

- •17.3.1 Classical decision trees

- •17.3.2 Conditional inference trees

- •17.4 Random forests

- •17.5 Support vector machines

- •17.5.1 Tuning an SVM

- •17.6 Choosing a best predictive solution

- •17.7 Using the rattle package for data mining

- •17.8 Summary

- •18 Advanced methods for missing data

- •18.1 Steps in dealing with missing data

- •18.2 Identifying missing values

- •18.3 Exploring missing-values patterns

- •18.3.1 Tabulating missing values

- •18.3.2 Exploring missing data visually

- •18.3.3 Using correlations to explore missing values

- •18.4 Understanding the sources and impact of missing data

- •18.5 Rational approaches for dealing with incomplete data

- •18.6 Complete-case analysis (listwise deletion)

- •18.7 Multiple imputation

- •18.8 Other approaches to missing data

- •18.8.1 Pairwise deletion

- •18.8.2 Simple (nonstochastic) imputation

- •18.9 Summary

- •19 Advanced graphics with ggplot2

- •19.1 The four graphics systems in R

- •19.2 An introduction to the ggplot2 package

- •19.3 Specifying the plot type with geoms

- •19.4 Grouping

- •19.5 Faceting

- •19.6 Adding smoothed lines

- •19.7 Modifying the appearance of ggplot2 graphs

- •19.7.1 Axes

- •19.7.2 Legends

- •19.7.3 Scales

- •19.7.4 Themes

- •19.7.5 Multiple graphs per page

- •19.8 Saving graphs

- •19.9 Summary

- •20 Advanced programming

- •20.1 A review of the language

- •20.1.1 Data types

- •20.1.2 Control structures

- •20.1.3 Creating functions

- •20.2 Working with environments

- •20.3 Object-oriented programming

- •20.3.1 Generic functions

- •20.3.2 Limitations of the S3 model

- •20.4 Writing efficient code

- •20.5 Debugging

- •20.5.1 Common sources of errors

- •20.5.2 Debugging tools

- •20.5.3 Session options that support debugging

- •20.6 Going further

- •20.7 Summary

- •21 Creating a package

- •21.1 Nonparametric analysis and the npar package

- •21.1.1 Comparing groups with the npar package

- •21.2 Developing the package

- •21.2.1 Computing the statistics

- •21.2.2 Printing the results

- •21.2.3 Summarizing the results

- •21.2.4 Plotting the results

- •21.2.5 Adding sample data to the package

- •21.3 Creating the package documentation

- •21.4 Building the package

- •21.5 Going further

- •21.6 Summary

- •22 Creating dynamic reports

- •22.1 A template approach to reports

- •22.2 Creating dynamic reports with R and Markdown

- •22.3 Creating dynamic reports with R and LaTeX

- •22.4 Creating dynamic reports with R and Open Document

- •22.5 Creating dynamic reports with R and Microsoft Word

- •22.6 Summary

- •afterword Into the rabbit hole

- •appendix A Graphical user interfaces

- •appendix B Customizing the startup environment

- •appendix C Exporting data from R

- •Delimited text file

- •Excel spreadsheet

- •Statistical applications

- •appendix D Matrix algebra in R

- •appendix E Packages used in this book

- •appendix F Working with large datasets

- •F.1 Efficient programming

- •F.2 Storing data outside of RAM

- •F.3 Analytic packages for out-of-memory data

- •F.4 Comprehensive solutions for working with enormous datasets

- •appendix G Updating an R installation

- •G.1 Automated installation (Windows only)

- •G.2 Manual installation (Windows and Mac OS X)

- •G.3 Updating an R installation (Linux)

- •references

- •index

- •Symbols

- •Numerics

- •23.1 The lattice package

- •23.2 Conditioning variables

- •23.3 Panel functions

- •23.4 Grouping variables

- •23.5 Graphic parameters

- •23.6 Customizing plot strips

- •23.7 Page arrangement

- •23.8 Going further

352 |

CHAPTER 15 Time series |

The month plot (top figure) displays the subseries for each month (all January values connected, all February values connected, and so on), along with the average of each subseries. From this graph, it appears that the trend is increasing for each month in a roughly uniform way. Additionally, the greatest number of passengers occurs in July and August. The season plot (lower figure) displays the subseries by year. Again you see a similar pattern, with increases in passengers each year, and the same seasonal pattern.

Note that although you’ve described the time series, you haven’t predicted any future values. In the next section, we’ll consider the use of exponential models for forecasting beyond the available data.

15.3 Exponential forecasting models

Exponential models are some of the most popular approaches to forecasting the future values of a time series. They’re simpler than many other types of models, but they can yield good short-term predictions in a wide range of applications. They differ from each other in the components of the time series that are modeled. A simple exponential model (also called a single exponential model) fits a time series that has a constant level and an irregular component at time i but has neither a trend nor a seasonal component. A double exponential model (also called a Holt exponential smoothing) fits a time series with both a level and a trend. Finally, a triple exponential model (also called a Holt-Winters exponential smoothing) fits a time series with level, trend, and seasonal components.

Exponential models can be fit with either the HoltWinters() function in the base installation or the ets() function that comes with the forecast package. The ets() function has more options and is generally more powerful. We’ll focus on the ets() function in this section.

The format of the ets() function is

ets(ts, model="ZZZ")

where ts is a time series and the model is specified by three letters. The first letter denotes the error type, the second letter denotes the trend type, and the third letter denotes the seasonal type. Allowable letters are A for additive, M for multiplicative, N for none, and Z for automatically selected. Examples of common models are given in table 15.3.

Table 15.3 Functions for fitting simple, double, and triple exponential forecasting models

Type |

Parameters fit |

Functions |

|

|

|

simple |

level |

ets(ts, model="ANN") |

|

|

ses(ts) |

double |

level, slope |

ets(ts, model="AAN") |

|

|

holt(ts) |

triple |

level, slope, seasonal |

ets(ts, model="AAA") |

|

|

hw(ts) |

|

|

|

Exponential forecasting models |

353 |

The ses(), holt(), and hw() functions are convenience wrappers to the ets() function with prespecified defaults.

First we’ll look at the most basic exponential model: simple exponential smoothing. Be sure to install the forecast package (install.packages("forecast")) before proceeding.

15.3.1Simple exponential smoothing

Simple exponential smoothing uses a weighted average of existing time-series values to make a short-term prediction of future values. The weights are chosen so that observations have an exponentially decreasing impact on the average as you go back in time.

The simple exponential smoothing model assumes that an observation in the time series can be described by

Yt = level + irregulart

The prediction at time Yt+1 (called the 1-step ahead forecast) is written as

Yt+1 = c0Yt + c1Yt−1 + c2Yt−2 + c2Yt−2 + ...

where ci = α(1−α)i, i = 0, 1, 2, ... and 0 ≤α≤1. The ci weights sum to one, and the 1-step ahead forecast can be seen to be a weighted average of the current value and all past values of the time series. The alpha (α) parameter controls the rate of decay for the weights. The closer alpha is to 1, the more weight is given to recent observations. The closer alpha is to 0, the more weight is given to past observations. The actual value of alpha is usually chosen by computer in order to optimize a fit criterion. A common fit criterion is the sum of squared errors between the actual and predicted values. An example will help clarify these ideas.

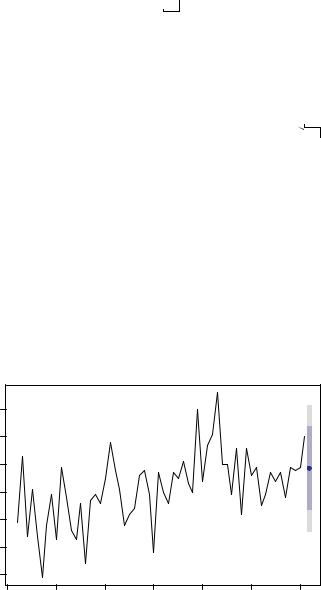

The nhtemp time series contains the mean annual temperature in degrees Fahrenheit in New Haven, Connecticut, from 1912 to 1971. A plot of the time series can be seen as the line in figure 15.8.

There is no obvious trend, and the yearly data lack a seasonal component, so the simple exponential model is a reasonable place to start. The code for making a 1-step ahead forecast using the ses() function is given next.

Listing 15.4 Simple exponential smoothing

> library(forecast)

> |

fit |

<- ets(nhtemp, model="ANN") |

|

|

|

||||

> |

fit |

|

b Fits the model |

|

ETS(A,N,N)

Call:

ets(y = nhtemp, model = "ANN")

Smoothing parameters: alpha = 0.182

Initial states: l = 50.2759

354 |

CHAPTER 15 Time series |

sigma: 1.126

AIC AICc BIC

263.9 264.1 268.1

c 1-step ahead forecast

> forecast(fit, 1)

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95 1972 51.87 50.43 53.31 49.66 54.08

> plot(forecast(fit, 1), xlab="Year", ylab=expression(paste("Temperature (", degree*F,")",)), main="New Haven Annual Mean Temperature")

> accuracy(fit)

ME |

RMSE |

MAE |

MPE |

MAPE |

MASE |

d Prints accuracy measures |

Training set 0.146 |

1.126 |

0.8951 |

0.2419 |

1.749 |

0.9228 |

|

The ets(mode="ANN") statement fits the simple exponential model to the nhtemp time series b. The A indicates that the errors are additive, and the NN indicates that there is no trend and no seasonal component. The relatively low value of alpha (0.18) indicates that distant as well as recent observations are being considered in the forecast. This value is automatically chosen to maximize the fit of the model to the given dataset.

The forecast() function is used to predict the time series k steps into the future. The format is forecast(fit, k). The 1-step ahead forecast for this series is 51.9°F with a 95% confidence interval (49.7°F to 54.1°F) c. The time series, the forecasted value, and the 80% and 95% confidence intervals are plotted in figure 15.8 d.

New Haven Annual Mean Temperature

|

54 |

|

|

|

|

|

|

|

53 |

|

|

|

|

|

|

Temperature (°F) |

50 51 52 |

|

|

|

|

|

|

|

49 |

|

|

|

|

|

|

|

48 |

|

|

|

|

|

|

|

1910 |

1920 |

1930 |

1940 |

1950 |

1960 |

1970 |

|

|

|

|

Year |

|

|

|

Figure 15.8 Average yearly temperatures in New Haven, Connecticut; and a 1-step ahead prediction from a simple exponential forecast using the ets() function

Exponential forecasting models |

355 |

The forecast package also provides an accuracy() function that displays the most popular predictive accuracy measures for time-series forecasts d. A description of each is given in table 15.4. The et represent the error or irregular component of each observation (Yt− Yi ).

Table 15.4 Predictive accuracy measures

Measure |

Abbreviation |

Definition |

|

|

|

Mean error |

ME |

mean( et ) |

Root mean squared error |

RMSE |

sqrt( mean( e2t ) ) |

Mean absolute error |

MAE |

mean( | et | ) |

Mean percentage error |

MPE |

mean( 100 * et / Yt ) |

Mean absolute percentage error |

MAPE |

mean( | 100 * et / Yt | ) |

Mean absolute scaled error |

MASE |

mean( | qt | ) where |

|

|

qt = et / ( 1/(T-1) * sum( | yt – yt-1| ) ), T is the number |

|

|

of observations, and the sum goes from t=2 to t=T |

|

|

|

The mean error and mean percentage error may not be that useful, because positive and negative errors can cancel out. The RMSE gives the square root of the mean square error, which in this case is 1.13°F. The mean absolute percentage error reports the error as a percentage of the time-series values. It’s unit-less and can be used to compare prediction accuracy across time series. But it assumes a measurement scale with a true zero point (for example, number of passengers per day). Because the Fahrenheit scale has no true zero, you can’t use it here. The mean absolute scaled error is the most recent accuracy measure and is used to compare the forecast accuracy across time series on different scales. There is no one best measure of predictive accuracy. The RMSE is certainly the best known and often cited.

Simple exponential smoothing assumes the absence of trend or seasonal components. The next section considers exponential models that can accommodate both.

15.3.2Holt and Holt-Winters exponential smoothing

The Holt exponential smoothing approach can fit a time series that has an overall level and a trend (slope). The model for an observation at time t is

Yt = level + slope*t + irregulart

An alpha smoothing parameter controls the exponential decay for the level, and a beta smoothing parameter controls the exponential decay for the slope. Again, each parameter ranges from 0 to 1, with larger values giving more weight to recent observations.

The Holt-Winters exponential smoothing approach can be used to fit a time series that has an overall level, a trend, and a seasonal component. Here, the model is

Yt = level + slope*t + st + irregulart

356 |

CHAPTER 15 Time series |

where st represents the seasonal influence at time t. In addition to alpha and beta parameters, a gamma smoothing parameter controls the exponential decay of the seasonal component. Like the others, it ranges from 0 to 1, and larger values give more weight to recent observations in calculating the seasonal effect.

In section 15.2, you decomposed a time series describing the monthly totals (in log thousands) of international airline passengers into additive trend, seasonal, and irregular components. Let’s use an exponential model to predict future travel. Again, you’ll use log values so that an additive model fits the data. The code in the following listing applies the Holt-Winters exponential smoothing approach to predicting the next five values of the AirPassengers time series.

Listing 15.5 Exponential smoothing with level, slope, and seasonal components

>library(forecast)

>fit <- ets(log(AirPassengers), model="AAA")

>fit

ETS(A,A,A)

Call:

ets(y = log(AirPassengers), model = "AAA")

Smoothing |

parameters: |

|

|

|

|

|

|||

alpha |

= |

0.8528 |

b Smoothing parameters |

|

beta |

= |

4e-04 |

|

|

gamma |

= |

0.0121 |

|

|

Initial |

states: |

|

|

|

l = 4.8362 b = 0.0097

s=-0.1137 -0.2251 -0.0756 0.0623 0.2079 0.2222 0.1235 -0.009 0 0.0203 -0.1203 -0.0925

sigma: 0.0367

AIC AICc BIC -204.1 -199.8 -156.5

>accuracy(fit)

|

|

ME |

RMSE |

MAE |

MPE |

MAPE |

MASE |

||

Training |

set -0.0003695 |

0.03672 0.02835 -0.007882 0.5206 0.07532 |

|||||||

> pred <- forecast(fit, |

5) |

|

|

|

|

|

|

||

> pred |

|

|

|

|

|

|

|

||

Point Forecast |

Lo 80 |

Hi 80 |

Lo 95 |

Hi 95 |

c Future forecasts |

||||

|

|

|

|

|

|||||

Jan |

1961 |

6.101 |

6.054 |

6.148 |

6.029 |

6.173 |

|

|

|

Feb |

1961 |

6.084 |

6.022 |

6.146 |

5.989 |

6.179 |

|

|

|

Mar |

1961 |

6.233 |

6.159 |

6.307 |

6.120 |

6.346 |

|

|

|

Apr |

1961 |

6.222 |

6.138 |

6.306 |

6.093 |

6.350 |

|

|

|

May |

1961 |

6.225 |

6.131 |

6.318 |

6.082 |

6.367 |

|

|

|

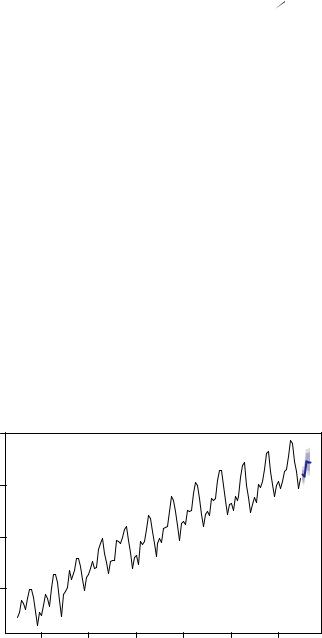

> plot(pred, main="Forecast for Air Travel", ylab="Log(AirPassengers)", xlab="Time")

Exponential forecasting models |

|

|

357 |

> pred$mean <- exp(pred$mean) |

|

d |

Makes forecasts in |

|

|||

> pred$lower <- exp(pred$lower) |

|

||

> pred$upper <- exp(pred$upper) |

|

|

the original scale |

|

|

|

|

> p <- cbind(pred$mean, pred$lower, pred$upper) |

|

|

|

> dimnames(p)[[2]] <- c("mean", "Lo 80", "Lo 95", "Hi 80", "Hi 95") |

|||

> p |

|

|

|

mean Lo 80 Lo 95 Hi 80 Hi 95 Jan 1961 446.3 425.8 415.3 467.8 479.6 Feb 1961 438.8 412.5 399.2 466.8 482.3 Mar 1961 509.2 473.0 454.9 548.2 570.0 Apr 1961 503.6 463.0 442.9 547.7 572.6 May 1961 505.0 460.1 437.9 554.3 582.3

The smoothing parameters for the level (.82), trend (.0004), and seasonal components (.012) are given in b. The low value for the trend (.0004) doesn’t mean there is no slope; it indicates that the slope estimated from early observations didn’t need to be updated.

The forecast() function produces forecasts for the next five months c and is plotted in figure 15.9. Because the predictions are on a log scale, exponentiation is used to get the predictions in the original metric: numbers (in thousands) of passengers d. The matrix pred$mean contains the point forecasts, and the matrices pred$lower and pred$upper contain the 80% and 95% lower and upper confidence limits, respectively. The exp() function is used to return the predictions to the original scale, and cbind() creates a single table. Thus the model predicts 509,200 passengers in March, with a 95% confidence band ranging from 454,900 to 570,000.

Forecast for Air Travel

|

6.5 |

|

|

|

|

|

Log(AirPassengers) |

5.5 6.0 |

|

|

|

|

|

|

5.0 |

|

|

|

|

|

|

1950 |

1952 |

1954 |

1956 |

1958 |

1960 |

|

|

|

|

Time |

|

|

Figure 15.9 Five-year forecast of log(number of international airline passengers in thousands) based on a Holt-Winters exponential smoothing model. Data are from the AirPassengers time series.