- •Донецький національний університет економіки і торгівлі імені Михайла Туган-Барановського

- •Economics Today

- •Content

- •Texts for Individual Reading

- •Передмова

- •Unit 1. What does economics study?

- •Vocabulary.

- •What does economics study?

- •Money price human wants scarcity

- •What does economics study?

- •Pronouns

- •Unit 2. Different Economic systems.

- •Vocabulary.

- •Different economic systems

- •Outstanding economists.

- •Unit 3. Economics as a social science.

- •Vocabulary.

- •Try to explain the above mentioned economic notions as you understand them, by your own words.

- •Economics as a social science.

- •Economics as a social science

- •Outstanding economists

- •Unit 4. Economics as a policy.

- •Vocabulary.

- •Economics as policy.

- •Economics and policy

- •Outstanding economists.

- •Unit 5. Main economic concepts.

- •Vocabulary.

- •Main economic concepts.

- •Outstanding economists.

- •2. Define:

- •Unit 6. Market, Supply and Demand.

- •Vocabulary.

- •Market, supply and demand

- •What money can’t buy

- •Outstanding economists.

- •Unit 7. Prices and their formation.

- •Vocabulary.

- •Price and its formation.

- •Past Tenses

- •When prices draw us.

- •Outstanding Economists.

- •2. Value:

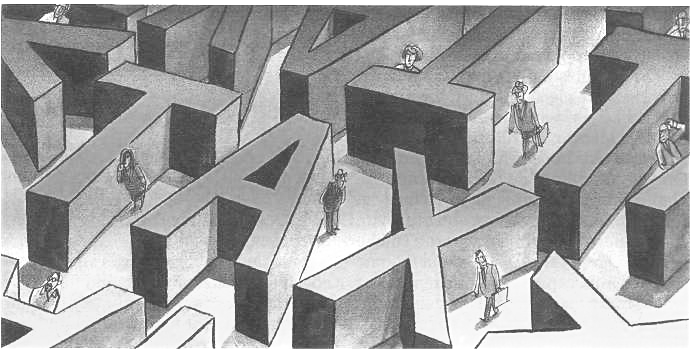

- •Unit 8. Taxes and Taxation.

- •Vocabulary.

- •Taxes and taxation

- •Past Tenses Past Perfect Simple

- •Past Perfect Continuous

- •Will Germany Start Tax Reform?

- •Crackdown on “alcohol disorder zones”

- •Outstanding economists.

- •Sources of government revenue

- •Public spending

- •Unit 9. Business organization.

- •Vocabulary.

- •Forms of business ownership in the u.S.A.

- •The Formal Organization.

- •Up and Down of People Express

- •Burr’s Business

- •3. Necessity:

- •Unit 10.

- •Forms of business small business

- •I. Can you stick with it?

- •How to make business plan.

- •The Passive Voice

- •Unit 11. Franchising.

- •Vocabulary.

- •Franchising.

- •Evaluate your franchise opportunities.

- •Mc’Donald’s : burger and fries a la français.

- •Invest:

- •5. Tax:

- •Unit 12.

- •International Trade.

- •International trade.

- •How to avoid business blunders abroad.

- •Vocabulary to Text 2.

- •Advertising.

- •Vocabulary:

- •Answer the questions:

- •Economic theories.

- •Vocabulary:

- •Answer the questions:

- •Main economic concepts.

- •Vocabulary:

- •Answer the questions:

- •Management.

- •Vocabulary:

- •Answer the questions:

- •Marketing.

- •Vocabulary:

- •Answer the questions:

- •Types of economic systems.

- •Vocabulary:

- •Vocabulary:

- •Practical Tasks:

- •Text 2. Classical Theories.

- •Vocabulary:

- •Practical Tasks:

- •Text 3. The Meaning of Management.

- •Vocabulary:

- •Practical Tasks:

- •What is you understanding of management?

- •Vocabulary:

- •Practical Tasks:

- •Text 5. Management Activities.

- •Vocabulary:

- •Practical Tasks:

- •Text 6. Classical Theories.

- •Vocabulary:

- •Practical Tasks:

- •Text 7. Fayol's Principles of Management.

- •Vocabulary:

- •Practical Tasks:

- •Text 8. F.W.Taylor and Scientific Management.

- •Vocabulary:

- •Practical Tasks:

- •Text 9. The Principles of Scientific Management.

- •Vocabulary:

- •Practical Tasks:

- •Text 10. Scientific Management after Taylor.

- •Vocabulary:

- •Practical Tasks:

- •Text 1. Comments on the Scientific Management School.

- •Text 2. L.F.Urwick.

- •Text 3. E.F.L.Brech.

- •Text 4. Max Weber and the Idea of Bureaucracy.

- •Text 5. Bureaucracy.

- •Text 6. Bureaucracy after Weber.

- •Questions for Discussions to texts 1-6.

- •Nobel prize winners.

- •1975: Nobel Prizes.

- •Money in our everyday life quotations. Attitudes to money.

- •Giving away money.

- •Money and everyday life.

- •Money and the family.

- •Money at work.

- •Money madness.

- •Possessions.

- •The economic model.

- •The psychology of money.

- •The very rich.

- •Young people, socialisation and money.

- •Poetry.

- •I have some fe a rainy day underneath me bed,

- •Is dis culture yours, cause it is not mine

- •It could do good but it does more bad

- •The coin speaks.

- •The hardship of accounting.

- •The millionaire.

- •Keys unit 1.

- •Comprehension check.

- •Unit 2.

- •Comprehension check.

- •Unit 3.

- •Comprehension check.

- •Unit 4.

- •Comprehension check.

- •Unit 5.

- •Comprehension check.

- •Unit 6.

- •Comprehension check.

- •Unit 7.

- •Train and check yourself

- •Unit 8.

- •Unit 9.

- •Comprehension check.

- •Fill in the chart

- •Unit 10.

- •Unit 11.

- •Comprehension check.

- •Unit 12.

- •Keys to the texts for individual reading

- •Economics Today

Past Tenses Past Perfect Simple

had + Participle II

Action referring to an earlier past:

He got the loan but unfortunately the court had declared him a bankrupt.

They started discussing their budget as soon as the Chief Executive had arrived.

He was excited because he had never taken part in such representative meetings.

Action referring to unfulfilled hopes and wishes with verbs expect, hope, mean, suppose, think, want:

I had hoped to return the loan in time, but I didn’t manage to do it.

Past Perfect Continuous

Had been + Participle I (Ving)

Action in progress throughout a period:

They looked very tired because they had been making a very important order days and nights.

Read text II about the attempts of German politicians to change tax system in the country.

Will Germany Start Tax Reform?

Paul Kirchhof, a lawyer at Heidelberg University tried to persuade Germany that the country's tax system needs radical reform. He suggested the country would do away with most tax exemptions and cut the top marginal income-tax rate to 25%.

Angela Merkel said that she did not expect tax reform this year.

That

Germany badly needs tax reform has been recognised for years. What is

new is the attention being paid to simplicity, which is popular with

voters. Hardly a day passes without a politician demanding that tax

returns be made no larger than a "beer mat", or quoting the

claim that Germany produces over two-thirds of the world's academic

tax literature.

Germany

is hardly the only country to suffer from fiscal complexity. But

marginal and average tax rates are high, especially for companies.

That matters, as it makes the country a less attractive place in

which to invest. Other countries have responded to a similar lack of

competitiveness by lowering marginal tax rates and scrapping tax

breaks, broadening the tax base and simplifying the system. But

Germany has managed only incremental reforms. These have left a

patchwork that, says the German council of economic experts, "is

fast losing any semblance of being a structured, rational system".

Germany

is hardly the only country to suffer from fiscal complexity. But

marginal and average tax rates are high, especially for companies.

That matters, as it makes the country a less attractive place in

which to invest. Other countries have responded to a similar lack of

competitiveness by lowering marginal tax rates and scrapping tax

breaks, broadening the tax base and simplifying the system. But

Germany has managed only incremental reforms. These have left a

patchwork that, says the German council of economic experts, "is

fast losing any semblance of being a structured, rational system".

One often cited explanation for this is Germany's federal system, which gives the opposition a de facto veto over tax changes. Less well known is the role of the country's Constitutional Court, says Steffen Ganghof, a researcher at the Max Planck Institute for the Study of Societies in Cologne, in a forthcoming book. The court often has the last say in tax policy. It is widely assumed that it would strike down any law openly breaking with one tradition of German taxation: those corporate- and income-tax rates must be about the same. Combined with the Gewerbesteuer, a court-protected local trade tax, this has meant that politicians are limited in their ability to respond to tax competition without losing revenue.

The CDU*, adds Mr.Ganghof, has often proposed bolder tax reforms than other right-wing parties. One recent plan drawn up by Friedrich Merz, a CDU parliamentary leader, would have put Germany ahead of other countries in simplicity. It suggests three tax rates: 12%, 24% and 36%, for incomes above €8,000, €16,000 and €40,000 respectively. Such radicalism does not make for easy compromises. Despite scrapping many tax breaks, Mr.Merz's plan would cut revenues by €24 billion in the first year – which the government cannot afford. Anyway, the governing Social Democrats (SPD) dislike low tax rates, because they want progressive taxes to balance high social-security contributions, which tax lower incomes proportionately more than higher ones.

More surprisingly, the Christian Social Union, or CSU, the CDU’s sister party in Bavaria, has qualms of its own. It recognises that the CDU's tax ideas do not square with its health-care plans, which would make social-security contributions more regressive. The CSU has come up with a rather less ambitious proposal, which gets rid of some tax breaks and lowers the top rate only from 45% to 39%. So what way will the government choose? One option would be to copy Scandinavian countries by bringing in a "dual income tax" that treats labour and capital income differently. While wages can still be taxed progressively, this allows a flat rate for dividends, capital gains and rents. That would mean taxing capital and labour differently, according to how mobile each is. The CDU could, at least partially, test its flat tax; the SPD and CSU would keep their progressive income tax. But this would not be legal, says Mr.Kirchhof, who once sat on the Constitutional Court.

“The Economist”

*CDU – Christian Democratic Union.

|

COMPREHENSION CHECK |

|

Exercise 1. Match the definitions with the words from the text.

|

1. competitiveness |

a. increasing |

|

2. incremental |

b. to make smth. die or become so bad that it can exist no longer |

|

3. semblance |

c. refusal from cutting the tax rate |

|

4. right-wing parties |

d. reduction of the tax rate |

|

5. strike down |

е. a thick piece of card that you use for putting your drink on esp. in a bar |

|

6. exemption |

f. if one idea, opinion, explanation is in conformity with another, they both seem good or reasonable |

|

7. beer mat |

g. difficult nature of smth. which may be hard to understand, to do, to deal with |

|

8. oft-sited |

h. the most conservative parties |

|

9. tax break |

i. thoughts that what you are doing might be bad or wrong |

|

10. marginal tax rate |

j. the ability to compete in markets for goods and services |

|

11. patch work |

k. the situation in which smth. only appears in a small amount |

|

12. complexity |

l. permission to ignore smth. such as a rule, obligation, payment |

|

13. academic tax literature |

m. mostly referred to |

|

14. tax return |

n. smth. in great disorder, chaos |

|

15. scrapping tax breaks |

o. manuals and books devoted to tax problems |

|

16. to square with |

p. additional tax paid on each unit in the revenue increased |

|

17. qualms |

q. a report by a taxpayer to the tax authorities of his or her income |

Exercise 2. Read the text again and complete the following sentences:

Germany badly needs tax reform because … .

Marginal and average tax rates are very high for … .

Other countries attract foreign investments by … .

Now German system of taxation is far from … .

The complexity of German tax system is explained … .

The main opponent of breaking a tradition of German taxation is … .

The main traditional law in tax system says that … .

Friedrich Mezz suggests 12%, 24% and 36%tax rates for … .

That tax system if introduced … .

People with less incomes pay tax … .

Duel income tax … .

Exercise 3. Insert the proper word.