- •Contents at a glance

- •Contents

- •Introduction

- •Who this book is for

- •Assumptions about you

- •Organization of this book

- •Conventions

- •About the companion content

- •Acknowledgments

- •Errata and book support

- •We want to hear from you

- •Stay in touch

- •Chapter 1. Introduction to data modeling

- •Working with a single table

- •Introducing the data model

- •Introducing star schemas

- •Understanding the importance of naming objects

- •Conclusions

- •Chapter 2. Using header/detail tables

- •Introducing header/detail

- •Aggregating values from the header

- •Flattening header/detail

- •Conclusions

- •Chapter 3. Using multiple fact tables

- •Using denormalized fact tables

- •Filtering across dimensions

- •Understanding model ambiguity

- •Using orders and invoices

- •Calculating the total invoiced for the customer

- •Calculating the number of invoices that include the given order of the given customer

- •Calculating the amount of the order, if invoiced

- •Conclusions

- •Chapter 4. Working with date and time

- •Creating a date dimension

- •Understanding automatic time dimensions

- •Automatic time grouping in Excel

- •Automatic time grouping in Power BI Desktop

- •Using multiple date dimensions

- •Handling date and time

- •Time-intelligence calculations

- •Handling fiscal calendars

- •Computing with working days

- •Working days in a single country or region

- •Working with multiple countries or regions

- •Handling special periods of the year

- •Using non-overlapping periods

- •Periods relative to today

- •Using overlapping periods

- •Working with weekly calendars

- •Conclusions

- •Chapter 5. Tracking historical attributes

- •Introducing slowly changing dimensions

- •Using slowly changing dimensions

- •Loading slowly changing dimensions

- •Fixing granularity in the dimension

- •Fixing granularity in the fact table

- •Rapidly changing dimensions

- •Choosing the right modeling technique

- •Conclusions

- •Chapter 6. Using snapshots

- •Using data that you cannot aggregate over time

- •Aggregating snapshots

- •Understanding derived snapshots

- •Understanding the transition matrix

- •Conclusions

- •Chapter 7. Analyzing date and time intervals

- •Introduction to temporal data

- •Aggregating with simple intervals

- •Intervals crossing dates

- •Modeling working shifts and time shifting

- •Analyzing active events

- •Mixing different durations

- •Conclusions

- •Chapter 8. Many-to-many relationships

- •Introducing many-to-many relationships

- •Understanding the bidirectional pattern

- •Understanding non-additivity

- •Cascading many-to-many

- •Temporal many-to-many

- •Reallocating factors and percentages

- •Materializing many-to-many

- •Using the fact tables as a bridge

- •Performance considerations

- •Conclusions

- •Chapter 9. Working with different granularity

- •Introduction to granularity

- •Relationships at different granularity

- •Analyzing budget data

- •Using DAX code to move filters

- •Filtering through relationships

- •Hiding values at the wrong granularity

- •Allocating values at a higher granularity

- •Conclusions

- •Chapter 10. Segmentation data models

- •Computing multiple-column relationships

- •Computing static segmentation

- •Using dynamic segmentation

- •Understanding the power of calculated columns: ABC analysis

- •Conclusions

- •Chapter 11. Working with multiple currencies

- •Understanding different scenarios

- •Multiple source currencies, single reporting currency

- •Single source currency, multiple reporting currencies

- •Multiple source currencies, multiple reporting currencies

- •Conclusions

- •Appendix A. Data modeling 101

- •Tables

- •Data types

- •Relationships

- •Filtering and cross-filtering

- •Different types of models

- •Star schema

- •Snowflake schema

- •Models with bridge tables

- •Measures and additivity

- •Additive measures

- •Non-additive measures

- •Semi-additive measures

- •Index

- •Code Snippets

plenty of them). Moreover, because the calculated table is computed at data refresh time and stored in the model, the overall performance will be much better.

In this case, we simplified the code not by changing the model structure; the last model is identical to the previous one. Instead, we changed the content of the table, which forced the relationship to be at the correct granularity.

Multiple source currencies, multiple reporting currencies

If your model stores orders in multiple currencies and you want to be able to report in any currency, then you face the most complex scenario. In reality, however, it is not much more complex than the one with multiple reporting currencies. This is because, as you might expect, complexity comes from the need to perform a currency conversion at query time by using measures and precomputed tables. Moreover, in the case of multiple currencies on both sides (storage and reporting), the exchange rate table needs to contain many more rows (one row for each pair of currencies for every day), or you will need to compute the exchange rate in a dynamic way.

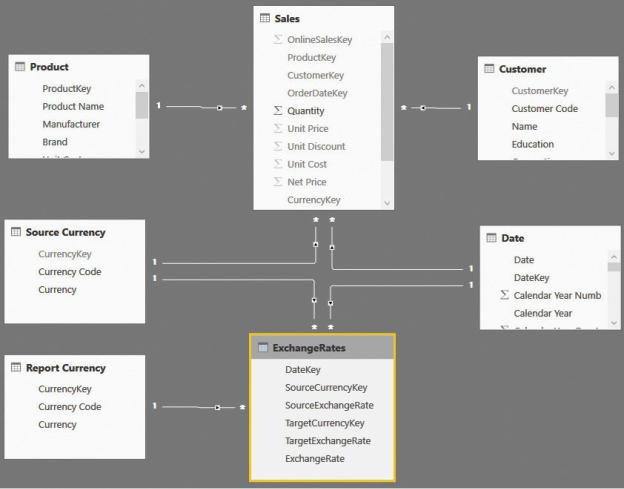

Let us start by looking at the data model shown in Figure 11-10.

FIGURE 11-10 The data model includes multiple source and target currencies.

Note the following things about this model:

There are two currency tables: Source Currency and Report Currency. Source Currency is used to slice the currency that records the sales, whereas Report Currency is used to slice the currency used in the report.

There are two currency tables: Source Currency and Report Currency. Source Currency is used to slice the currency that records the sales, whereas Report Currency is used to slice the currency used in the report.

The ExchangeRates table now contains both the source and the target currency because it lets you convert any currency into any other currency. It is worth noting that the ExchangeRates table can be computed (through DAX code) from the original table that converted every currency to USD.

The ExchangeRates table now contains both the source and the target currency because it lets you convert any currency into any other currency. It is worth noting that the ExchangeRates table can be computed (through DAX code) from the original table that converted every currency to USD.

The following code generates the ExchangeRates table:

Click here to view code image

ExchangeRates = SELECTCOLUMNS (

GENERATE (

ExchangeRateFull,

VAR SourceCurrencyKey = ExchangeRateFull VAR SourceDateKey = ExchangeRateFull[Dat VAR SourceAverageRate = ExchangeRateFull RETURN

SELECTCOLUMNS ( CALCULATETABLE (

ExchangeRateFull, ExchangeRateFull[DateKey] = ALL ( ExchangeRateFull )

),

"TargetCurrencyKey", ExchangeRat

"TargetExchangeRate", ExchangeRa

)

),

"DateKey", ExchangeRateFull[DateKey], "SourceCurrencyKey", ExchangeRateFull[Curren "SourceExchangeRate", ExchangeRateFull[Avera "TargetCurrencyKey", [TargetCurrencyKey], "TargetExchangeRate", [TargetExchangeRate], "ExchangeRate", ExchangeRateFull[AverageRate

)

This basically performs a cross-join of the ExchangeRateFull table with itself. First, it gathers the exchange rate to USD of both currencies, on the same date. Then it multiplies the exchange rates to obtain the correct exchange rate of any currency with any other one.

This table is much larger than the original one (we grew from 25,166 rows in ExchangeRateFull to 624,133 rows in the final table), but it lets us create relationships in an easy way. The code can be written even without the creation of this table, but it is utterly complicated.

When it comes to writing the code that computes the amount sold, you basically mix the two previous scenarios into a single one. You must slice sales by date and currency to obtain a set of sales that share the same exchange rate. Then you need to search, in a dynamic way, for the current exchange rate, taking into account the selected report currency, as in the following expression:

Click here to view code image

Sales Amount Converted =

IF (

HASONEVALUE ( 'Report Currency'[Currency] ), SUMX (

SUMMARIZE ( Sales, 'Date'[Date], 'Source Cur [Sales Amount] * CALCULATE ( VALUES ( Exchan

)

)

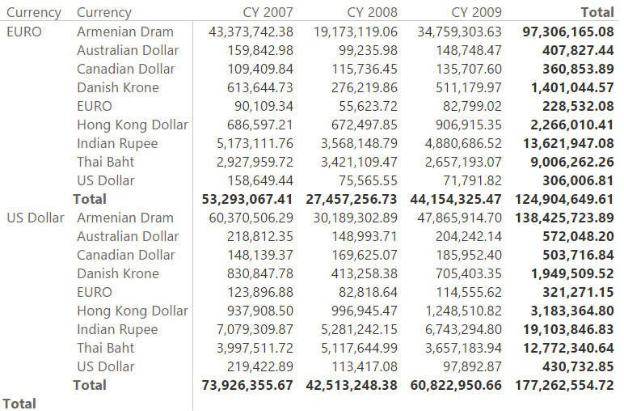

Using this model, you can, for example, report orders in different currencies in both EUR and USD with a currency conversion on the fly. In the report shown in Figure 11-11, for example, currency conversion happens at the date of the order.

FIGURE 11-11 The values are converted in EUR and USD from the original currency.

Conclusions

Currency conversion requires models of increasing complexity depending on the requirements. The following main points were made in this chapter:

You can achieve simple conversion from multiple currencies to a single currency (or a very small number of different currencies) through simple

You can achieve simple conversion from multiple currencies to a single currency (or a very small number of different currencies) through simple

calculated columns.

Converting to multiple reporting currencies requires a bit more complex DAX code and some adjustments on the data model because you can no longer leverage a calculated column. The conversion needs to happen in a more dynamic way.

Converting to multiple reporting currencies requires a bit more complex DAX code and some adjustments on the data model because you can no longer leverage a calculated column. The conversion needs to happen in a more dynamic way.

The dynamic conversion code can be made simpler by ensuring that the exchange rate table contains all the needed dates, which you can achieve by using a simple calculated table.

The dynamic conversion code can be made simpler by ensuring that the exchange rate table contains all the needed dates, which you can achieve by using a simple calculated table.

The most complex scenario is when you have multiple source currencies and multiple reporting currencies. In that case, you need to mix the previous techniques and create two currency tables: one for the source currency and another for the reporting currency.

The most complex scenario is when you have multiple source currencies and multiple reporting currencies. In that case, you need to mix the previous techniques and create two currency tables: one for the source currency and another for the reporting currency.