- •Contents

- •Revisions to our forecasts, TPs and ratings

- •Investment stance

- •Capital cycle favours rising returns

- •Comfortable balance sheets and supportive dividend potential

- •Value relative to other stocks

- •Yield potential through the cycle

- •Mid-cycle cash generation offers supportive yields

- •Where to hide if you are bearish

- •What to buy if you are bullish

- •Limited lives weighing down IRR

- •Yields should compensate for limited lives

- •Positive earnings momentum continues to support share prices

- •Commodity price revisions

- •Commodity section

- •Commodity section

- •Preference for base metals over steelmaking materials

- •Earnings revisions

- •Risks and catalysts

- •Peer comp charts

- •Commodity price and exchange rate forecasts

- •Important publications

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Sasol

- •Disclosures appendix

vk.com/id446425943

Comfortable balance sheets and supportive dividend potential

Net debt reduced to comfortable levels

Renaissance Capital

1 April 2019

Metals & Mining

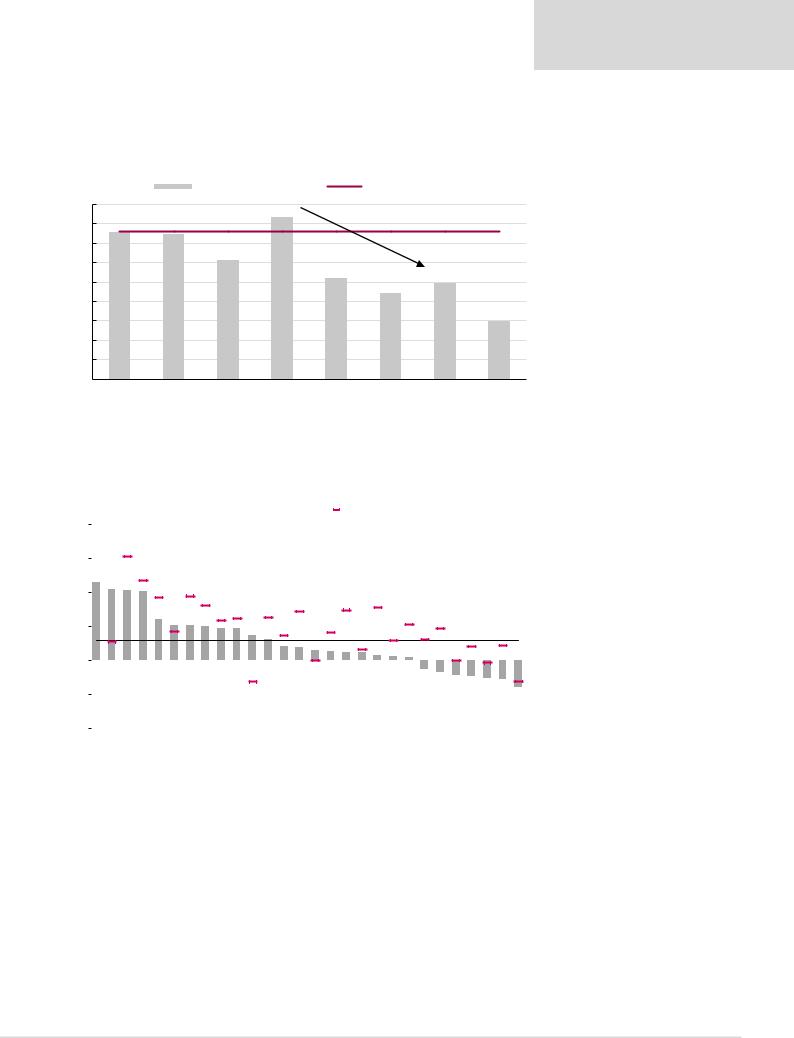

Mining companies have significantly deleveraged their balance sheets since 2015, and we believe comfortable balance sheets position them better for a cyclical downturn.

Figure 17: Mining sector net debt/EBITDA over time (2012-2019E)

|

|

|

Average net debt to EBITDA |

|

LT average (2003-2018) |

|

||

1.8x |

|

|

|

1.7x |

|

|

|

|

1.6x |

1.5x |

1.5x |

|

|

|

LT average (2003-2018), 1.5x |

||

1.4x |

|

|

1.2x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.2x |

|

|

|

|

1.0x |

|

1.0x |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

0.9x |

|

|

1.0x |

|

|

|

|

|

|

|

|

0.8x |

|

|

|

|

|

|

|

0.6x |

|

|

|

|

|

|

|

|

|

0.6x |

|

|

|

|

|

|

|

|

0.4x |

|

|

|

|

|

|

|

|

0.2x |

|

|

|

|

|

|

|

|

0.0x |

|

|

|

|

|

|

|

|

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019E |

Source: Company data, Renaissance Capital

Net debt/EBITDA now at comfortable levels

CY19E net debt/EBITDA ranked

Figure 18: Companies ranked by CY19E net debt/EBITDA compared with their historical averages |

|

|

|

|

||||||||||||||||||||||||||||||

4x |

|

|

|

|

|

|

|

|

CY19E Net debt/EBITDA |

|

|

LT average |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.3x |

2.1x |

2.1x |

2.0x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

2x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.2x |

1.0x |

1.0x |

1.0x |

0.9x |

0.9x |

0.7x |

0.6x |

0.4x |

0.4x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1x |

|

|

|

0.3x |

0.3x |

0.2x |

0.2x |

0.2x |

0.1x |

0.1x |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sector average, 0.6x |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

0x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.3x- |

0.4x- |

0.4x- |

0.5x- |

0.5x- |

0.6x- |

|

||||

-1x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.8x+- |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

-2x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rusal* |

Sasol |

Glencore |

Northam Polymetal |

Norilsk |

Russian* |

Sibanye |

Gold Fields |

Polyus |

RBPlats |

AngloGold |

Others* |

Alrosa |

Harmony |

BHP |

Fortescue |

Exxaro* |

Vale |

Rio Tinto |

Anglo Impala |

Amplats |

South32 |

ARM* |

Kumba |

Merafe |

Assore* |

|||||||||

|

||||||||||||||||||||||||||||||||||

Noted: Net debt/EDITDA ratio has been limited to 5x. We do not subtract Glencore’s readily marketable inventory from net debt.

*Net debt/EBITDA plus equity-accounted income.

Source: Company data, Renaissance Capital estimates

Sector average net debt/EBITDA of 0.6x

12

vk.com/id446425943

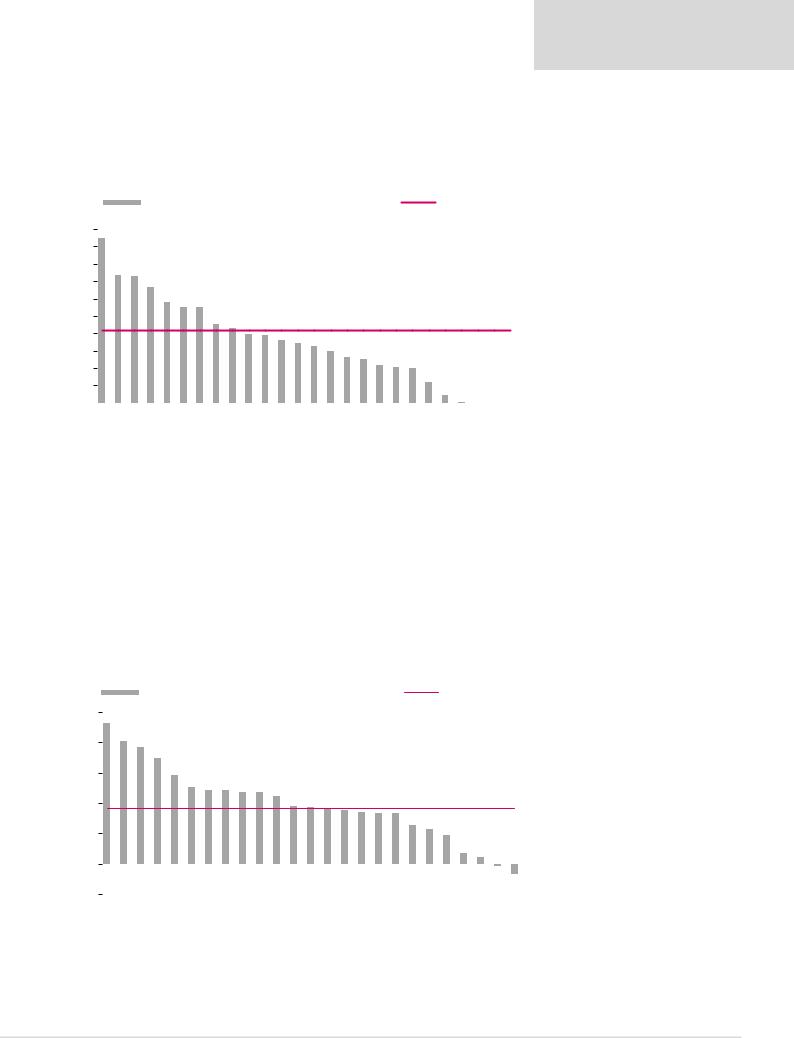

Attractive dividend yields over the next three years…

We forecast average dividend yields of 8.4% over the next three years, with potential upside risk to our forecasts if the current strategy of capital discipline and returning cash to shareholders prevails over the short-to-medium term.

Figure 19: Average dividend yield over next three years (2019-2021E)

|

19.0% |

|

Average dividend yield over next 3 years (2019E-2021E) |

|

|

|

|

Sector Average |

|

|||||||||||||||||

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

18% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14.8% |

14.6% |

13.4% |

11.6% |

11.1% |

11.0% |

9.0% |

8.7% |

7.9% |

7.9% |

7.2% |

6.9% |

6.5% |

5.9% |

5.3% |

5.1% |

4.4% |

4.1% |

4.0% |

2.4% |

0.9% |

0.1% |

0.0% |

0.0% |

0.0% |

||

16% |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

14% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

12% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sector Average, 8.4% |

|

|

|||||||

8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Merafe Fortescue |

Alrosa |

Norilsk |

Kumba |

Assore |

Exxaro |

ARM |

BHP |

Rio Tinto |

South32 |

Glencore |

Anglo |

Polyus |

Polymetal |

Sibanye |

Vale |

Impala |

Amplats |

Sasol |

Gold Fields |

AngloGold |

Harmony |

Lonmin |

Northam |

RBPlats |

||

|

||||||||||||||||||||||||||

Note: Priced as at market close on 26 March 2019.

Source: Company data, Renaissance Capital estimates

Renaissance Capital

1 April 2019

Metals & Mining

We forecast a potential average sector dividend yield of c. 8.4%

…with significant further excess cash available after dividends

We define excess cash as the amount in excess of net debt/EBITDA of 1.5x.

We calculate average cumulative excess cash available for dividends at 37% of market cap over the next three years, despite attractive dividends paid over the period. While we do not have any conviction about the sector’s capital discipline over the medium term, we believe the sector could re-rate over the short term as the market gains visibility on the sector’s yield potential.

Figure 20: Potential average excess cash* as a percentage of market cap over the next three years

|

93% |

Average excess cash over next 3 years (2019E-2021E), % |

|

|

|

|

Sector average |

|

||||||||||||||

100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

81% |

77% |

70% |

59% |

50% |

48% |

48% |

47% |

47% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60% |

45% |

38% |

38% |

36% |

35% |

34% |

33% |

33% |

25% |

23% |

19% |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sector average, 37% |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7% |

4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-1% |

7% |

|

-20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

Impala Harmony |

ARM* |

Merafe |

Sibanye |

Assore* |

Fortescue |

Kumba |

RBPlats |

Vale |

Anglo |

South32 |

AngloGold |

Amplats |

Exxaro* |

Gold Fields |

Norilsk |

Rio Tinto |

BHP |

Alrosa |

Polyus Polymetal |

Northam Sasol |

Glencore |

Note: Priced as at market close on 26 March 2019.

*Average excess cash over a three-year period (CY19-21E) at target debt gearing levels (net debt/EBITDA of 1.5x).

Source: Company data, Thomson Reuters, Renaissance Capital estimates

We forecast potential cumulative excess cash after dividends of 37% of the sector’s market cap over the next three years

13