- •Contents

- •Revisions to our forecasts, TPs and ratings

- •Investment stance

- •Capital cycle favours rising returns

- •Comfortable balance sheets and supportive dividend potential

- •Value relative to other stocks

- •Yield potential through the cycle

- •Mid-cycle cash generation offers supportive yields

- •Where to hide if you are bearish

- •What to buy if you are bullish

- •Limited lives weighing down IRR

- •Yields should compensate for limited lives

- •Positive earnings momentum continues to support share prices

- •Commodity price revisions

- •Commodity section

- •Commodity section

- •Preference for base metals over steelmaking materials

- •Earnings revisions

- •Risks and catalysts

- •Peer comp charts

- •Commodity price and exchange rate forecasts

- •Important publications

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Sasol

- •Disclosures appendix

vk.com/id446425943

Anglo American Platinum – HOLD

Renaissance Capital

1 April 2019

Metals & Mining

Figure 130: Anglo American Platinum, ZARmn (unless otherwise noted)

|

|

|

|

Anglo American Platinum |

AMSJ.J |

Target price, ZAR: |

780 |

Market capitalisation, ZARmn: |

215,866 |

Last price, ZAR: |

795 |

Enterprise value, ZARmn: |

212,840 |

Potential 12-month return: |

2.0% |

Dec-YE |

|

2017 |

2018 |

2019E |

2020E |

2021E |

Income statement |

|

|

|

|

|

|

Revenue |

|

65,671 |

74,582 |

101,921 |

112,129 |

94,596 |

EBITDA |

|

11,985 |

14,503 |

32,201 |

38,440 |

35,879 |

EBIT |

|

8,273 |

10,842 |

27,299 |

33,522 |

30,696 |

Net interest |

|

-951 |

458 |

33 |

451 |

956 |

Taxation |

|

-1,616 |

-2,666 |

-7,653 |

-9,513 |

-8,863 |

Equity accounted income |

|

-380 |

-40 |

0 |

0 |

0 |

Attributable profit |

|

1,944 |

6,817 |

19,518 |

24,203 |

22,482 |

Headline earnings |

|

3,886 |

7,588 |

19,518 |

24,203 |

22,482 |

HEPS, ZAc |

|

1,482 |

2,893 |

7,264 |

9,007 |

8,367 |

Thomson Reuters consensus HEPS, ZAc |

|

|

3,792 |

4,100 |

5,118 |

|

DPS declared, ZAc |

|

349 |

751 |

2,905 |

3,603 |

3,347 |

Breakdown of EBITDA |

|

7,700 |

8,249 |

16,211 |

18,195 |

17,887 |

Mogalakwena |

|

|||||

EBITDA margin |

|

48% |

46% |

61% |

63% |

61% |

Amandelbult |

|

1,173 |

2,031 |

6,621 |

8,825 |

8,913 |

EBITDA margin |

|

10% |

15% |

34% |

42% |

41% |

Unki |

|

823 |

835 |

1,601 |

1,808 |

1,724 |

EBITDA margin |

|

33% |

29% |

41% |

46% |

44% |

Mototolo |

|

267 |

591 |

1,826 |

2,277 |

2,048 |

EBITDA margin |

|

22% |

29% |

47% |

51% |

47% |

Modikwa |

|

361 |

566 |

1,535 |

1,735 |

1,534 |

EBITDA margin |

|

20% |

26% |

45% |

49% |

44% |

Kroondal |

|

646 |

1,052 |

2,506 |

2,888 |

2,607 |

EBITDA margin |

|

20% |

27% |

46% |

51% |

47% |

Third party |

|

2,309 |

2,884 |

3,842 |

4,411 |

2,756 |

EBITDA margin |

|

9% |

10% |

10% |

10% |

11% |

Other |

|

-648 |

-653 |

565 |

1,189 |

1,017 |

EBITDA |

|

11,985 |

14,503 |

32,201 |

38,440 |

35,879 |

Income statement ratios |

|

|

|

|

|

|

EBITDA margin |

|

18% |

19% |

32% |

34% |

38% |

EBIT margin |

|

18% |

19% |

32% |

34% |

38% |

HEPS growth |

|

108% |

95% |

151% |

24% |

-7% |

Dividend payout ratio |

|

47% |

29% |

40% |

40% |

40% |

Input assumptions |

|

|

|

|

|

|

Platinum, $/oz |

|

950 |

880 |

843 |

900 |

966 |

Palladium, $/oz |

|

871 |

1,030 |

1,558 |

1,700 |

1,576 |

Rhodium, $/oz |

|

1,108 |

2,218 |

3,135 |

4,250 |

3,825 |

USD/ZAR |

|

13.31 |

13.24 |

14.28 |

14.40 |

14.49 |

Sales volumes, koz |

|

|

|

|

|

|

Mined platinum |

|

1,417 |

1,303 |

1,508 |

1,404 |

1,434 |

Third party platinum |

|

1,082 |

1,120 |

1,215 |

1,228 |

728 |

Total platinum sales |

|

2,505 |

2,424 |

2,723 |

2,632 |

2,162 |

Volume growth |

|

3.7% |

-3.2% |

12.3% |

-3.3% |

-17.8% |

3PGM breakeven price, $/oz |

|

|

|

|

|

|

Mogalakwena breakeven |

|

502 |

623 |

470 |

502 |

510 |

Amandelbult breakeven |

|

866 |

869 |

801 |

758 |

749 |

Unki breakeven |

|

598 |

692 |

671 |

695 |

697 |

Mototolo breakeven |

|

703 |

637 |

591 |

594 |

645 |

Modikwa breakeven |

|

754 |

729 |

629 |

617 |

683 |

Kroondal breakeven |

|

809 |

824 |

728 |

736 |

784 |

Group (mined production) breakeven |

742 |

773 |

688 |

675 |

684 |

|

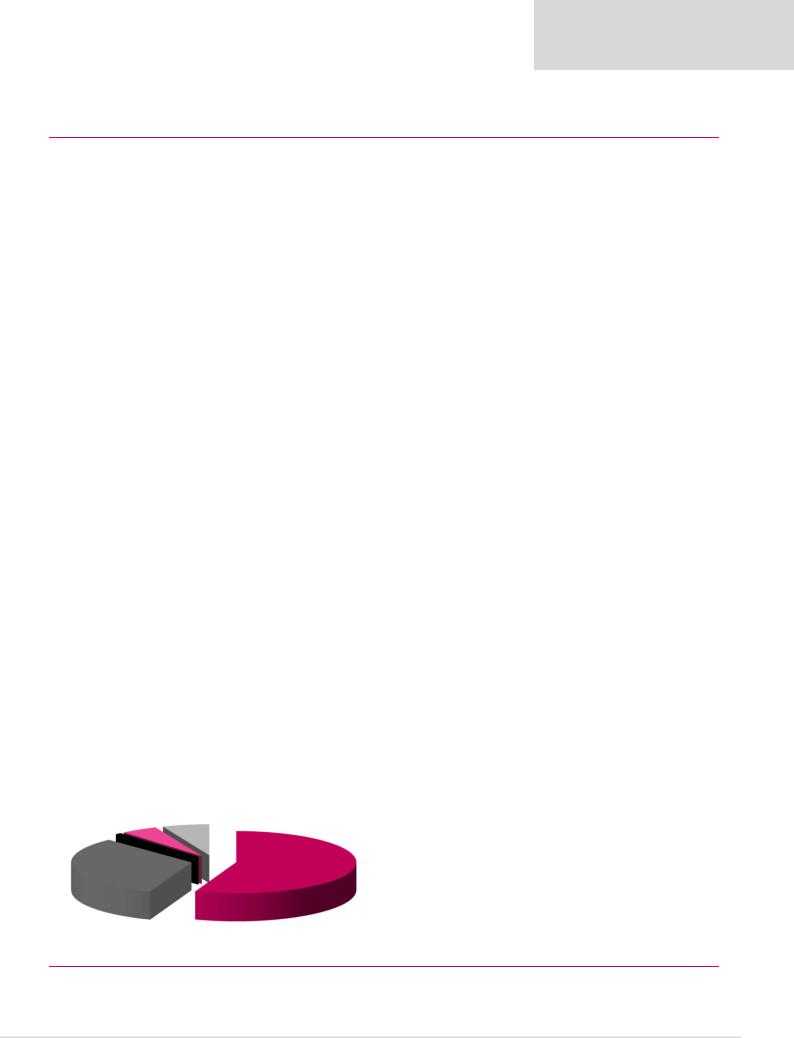

Contribution to FY19E underlying EBITDA |

|

|

|

|

||

|

Third party |

|

|

Amandelbult |

|

|

Kroondal |

11% |

|

|

|

||

|

|

19% |

|

|

||

7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mototolo

5%

Modikwa |

Mogalakwena |

|

48% |

||

5% |

||

|

||

Unki |

|

|

5% |

|

Dec-YE |

|

2017 |

2018 |

|

2019E |

2020E |

2021E |

Balance sheet |

|

|

|

|

|

|

|

Net operating assets |

|

40,109 |

41,101 |

|

47,199 |

51,214 |

50,514 |

Investments |

|

2,725 |

2,984 |

|

2,984 |

3,001 |

3,016 |

Equity |

|

41,527 |

47,111 |

|

61,838 |

77,176 |

90,258 |

Minority interest |

|

-526 |

231 |

|

231 |

231 |

231 |

Net debt |

|

1,833 |

-3,257 |

|

-11,886 |

-23,192 |

-36,959 |

Balance sheet ratios |

|

|

|

|

|

|

|

Gearing (net debt/(net debt+equity)) |

|

4.2% |

-7.4% |

|

-23.8% |

-43.0% |

-69.3% |

Net debt to EBITDA |

|

0.2x |

-0.2x |

|

-0.4x |

-0.6x |

-1.0x |

RoCE |

|

16.6% |

22.4% |

|

51.7% |

57.3% |

50.5% |

RoIC (after tax) |

|

11.9% |

19.1% |

|

38.8% |

42.3% |

37.5% |

RoE |

|

9.5% |

17.1% |

|

35.8% |

34.8% |

26.9% |

Cash flow statement |

|

|

|

|

|

|

|

Operating cash flow |

|

8,267 |

14,197 |

|

22,584 |

28,268 |

31,480 |

Capex (net of disposals) |

|

-4,744 |

-6,718 |

|

-8,766 |

-8,858 |

-9,310 |

Other |

|

3,060 |

-1,119 |

|

-200 |

754 |

679 |

FCF |

|

6,583 |

6,360 |

|

13,618 |

20,164 |

22,849 |

Equity shareholders' cash |

|

5,486 |

7,012 |

|

13,420 |

20,170 |

23,167 |

Dividends and share buy backs |

|

0 |

-1,922 |

|

-4,791 |

-8,865 |

-9,399 |

Movement in net debt |

|

5,486 |

5,090 |

|

8,629 |

11,305 |

13,768 |

Cash flow ratios |

|

|

|

|

|

|

|

Working capital turnover, days |

|

52 |

39 |

|

38 |

40 |

33 |

FCF yield |

|

7.3% |

6.2% |

|

6.8% |

10.6% |

13.0% |

Equity shareholders' yield |

|

6.2% |

6.6% |

|

6.3% |

9.5% |

10.9% |

Capex/EBITDA |

|

39.6% |

46.3% |

|

27.2% |

23.0% |

25.9% |

Cash conversion |

|

1.4x |

0.9x |

|

0.7x |

0.8x |

1.0x |

Valuation |

|

|

|

|

|

|

|

SoTP DCF fair value and calculation of target price |

|

|

|

ZARmn |

ZAR/sh |

||

Amandelbult operations |

|

|

|

|

39,120 |

146 |

|

Mogalakwena mine |

|

|

|

|

131,192 |

489 |

|

Twickenham mine |

|

|

|

|

-206 |

-1 |

|

Unki mine |

|

|

|

|

11,181 |

42 |

|

Modikwa |

|

|

|

|

9,021 |

34 |

|

Mototolo |

|

|

|

|

9,993 |

37 |

|

Kroondal |

|

|

|

|

4,665 |

17 |

|

Third party sales |

|

|

|

|

14,279 |

53 |

|

Other |

|

|

|

|

-15,059 |

-56 |

|

Enterprise value |

|

|

|

|

204,185 |

762 |

|

Investments as at 31 December 2018 |

|

|

|

|

2,984 |

11 |

|

Net debt as at 31 December 2018 |

|

|

|

|

3,257 |

12 |

|

Cash used in share buy-backs during 2019E |

|

|

|

|

0 |

0 |

|

Equity value |

|

|

|

|

210,426 |

785 |

|

Rounded to |

|

|

|

|

|

780 |

|

Current share price on 26/3/2019 |

|

|

|

|

|

795.0 |

|

Expected share price return |

|

|

|

|

|

-1.9% |

|

Plus: expected dividend yield |

|

|

|

|

|

3.9% |

|

Total implied one-year return |

|

|

|

|

|

2.0% |

|

Share price range, ZAR: |

|

|

|

|

|

|

|

12-month high |

842 |

12-month low |

|

299 |

|||

Price move since high |

-5.6% |

Price move since low |

|

166.1% |

|||

Calculation of WACC |

|

|

|

|

|

|

|

WACC |

11.4% |

Cost of debt |

|

|

10.0% |

||

Risk-free rate |

9.0% |

Tax rate |

|

|

28% |

||

Equity risk premium |

4.0% |

After-tax cost of debt |

|

7.2% |

|||

Beta |

1.30 |

Debt weighting |

|

40% |

|||

Cost of equity |

14.2% |

Terminal growth rate |

|

6.0% |

|||

Valuation ratios |

|

|

|

|

|

|

|

Dec-YE |

|

2017 |

2018 |

|

2019E |

2020E |

2021E |

P/E multiple |

|

22.4x |

13.7x |

|

10.9x |

8.8x |

9.5x |

Dividend yield |

|

1.1% |

1.9% |

|

3.7% |

4.5% |

4.2% |

EV/EBITDA |

|

7.5x |

7.1x |

|

6.3x |

4.9x |

4.9x |

P/B |

|

2.1x |

2.3x |

|

3.4x |

2.8x |

2.4x |

NAV per share, ZAR |

|

155 |

176 |

|

231 |

288 |

337 |

Source: Bloomberg, Thomson Reuters, Renaissance Capital estimates

84

vk.com/id446425943

Impala Platinum – BUY

Renaissance Capital

1 April 2019

Metals & Mining

Figure 131: Impala Platinum, ZARmn (unless otherwise noted)

|

|

|

|

Impala Platinum |

IMPJ.J |

Target price, ZAR: |

83 |

Market capitalisation, ZARmn: |

52,668 |

Last price, ZAR: |

65 |

Enterprise value, ZARmn: |

61,695 |

Potential 12-month return: |

28.1% |

Jun-YE |

|

|

2017 |

2018 |

2019E |

2020E |

2021E |

Income statement |

|

|

|

|

|

|

|

Revenue |

|

|

40,540 |

39,587 |

54,180 |

66,474 |

64,069 |

Underlying EBITDA |

|

|

3,622 |

5,884 |

14,262 |

21,430 |

21,311 |

Underlying EBIT |

|

|

-474 |

1,684 |

10,430 |

17,702 |

17,998 |

Net interest |

|

|

-400 |

-701 |

-579 |

-13 |

879 |

Taxation |

|

|

2,461 |

2,042 |

-2,678 |

-4,953 |

-5,285 |

Minority interest in profit |

|

122 |

-114 |

-446 |

-770 |

-788 |

|

Attributable profit |

|

|

-7,976 |

-10,907 |

6,334 |

11,966 |

12,803 |

Headline earnings |

|

|

-983 |

-1,228 |

6,256 |

11,966 |

12,803 |

HEPS, ZAc |

|

|

-137 |

-171 |

871 |

1,665 |

1,782 |

Thomson Reuters consensus HEPS, ZAc |

|

|

|

271 |

355 |

596 |

|

DPS declared, ZAc |

|

|

0 |

0 |

0 |

0 |

0 |

Underlying EBIT |

|

|

-1,760 |

-1,083 |

5,159 |

9,200 |

9,166 |

Rustenburg lease |

|

|

|||||

EBIT margin |

|

|

-6% |

-4% |

15% |

21% |

23% |

Zimplats |

|

|

1,169 |

1,911 |

3,342 |

4,952 |

5,204 |

EBIT margin |

|

|

17% |

26% |

36% |

43% |

44% |

Marula |

|

|

-627 |

-6 |

589 |

1,186 |

1,148 |

EBIT margin |

|

|

-39% |

0% |

18% |

30% |

28% |

Mimosa |

|

|

2 |

320 |

430 |

805 |

872 |

EBIT margin |

|

|

0% |

16% |

19% |

28% |

29% |

Two Rivers |

|

|

460 |

419 |

689 |

1,285 |

1,320 |

EBIT margin |

|

|

24% |

23% |

33% |

45% |

44% |

Other |

|

|

282 |

123 |

221 |

274 |

288 |

EBIT |

|

|

-474 |

1,684 |

10,430 |

17,702 |

17,998 |

Income statement ratios |

|

|

|

|

|

|

|

EBITDA margin |

|

|

9% |

15% |

26% |

32% |

33% |

EBIT margin |

|

|

-1% |

4% |

19% |

27% |

28% |

HEPS growth |

|

|

-1242% |

-25% |

609% |

91% |

7% |

Dividend payout ratio |

|

|

0% |

0% |

0% |

0% |

0% |

Input assumptions |

|

|

|

|

|

|

|

Platinum, $/oz |

|

|

988 |

940 |

827 |

875 |

920 |

Palladium, $/oz |

|

|

738 |

977 |

1,272 |

1,663 |

1,663 |

Rhodium, $/oz |

|

|

821 |

1,634 |

2,651 |

3,833 |

4,122 |

USD/ZAR |

|

|

13.60 |

12.85 |

14.18 |

14.40 |

14.41 |

Production volumes, koz |

|

|

|

|

|

|

|

Mined platinum |

|

|

1,121 |

1,048 |

1,193 |

1,144 |

1,004 |

Third party platinum |

|

|

244 |

241 |

180 |

180 |

180 |

Joint venture platinum |

|

|

165 |

180 |

143 |

149 |

149 |

Gross refined platinum |

|

1,530 |

1,468 |

1,516 |

1,473 |

1,333 |

|

Volume growth |

|

|

6.4% |

-4.0% |

3.3% |

-2.8% |

-9.5% |

3PGM breakeven price, $/oz |

|

|

|

|

|

|

|

Rustenburg lease breakeven |

|

1,071 |

1,182 |

966 |

1,002 |

957 |

|

Zimplats breakeven |

|

|

653 |

783 |

664 |

755 |

775 |

Marula breakeven |

|

|

1,201 |

970 |

879 |

977 |

1,030 |

Mimosa breakeven |

|

|

888 |

896 |

945 |

958 |

970 |

Two Rivers breakeven |

|

|

677 |

797 |

769 |

743 |

772 |

Group (mined production) breakeven |

|

895 |

958 |

806 |

812 |

778 |

|

Contribution to FY19E proportionately consolidated underlying EBITDA |

|

||||||

|

Two Rivers |

|

|

|

|

||

Mimosa |

6% |

|

|

Rustenburg Lease |

|||

IRS |

5% |

|

|

|

|

||

|

|

|

|

|

56% |

|

|

1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zimplats

32%

Jun-YE |

|

|

|

|

2019E |

2020E |

2021E |

|

2017 |

2018 |

|

||||

Balance sheet |

|

|

|

|

|

|

|

Net operating assets |

|

51,832 |

45,983 |

|

46,686 |

46,876 |

48,603 |

Investments |

|

-929 |

257 |

|

74 |

75 |

77 |

Equity |

|

46,807 |

37,213 |

|

44,155 |

56,121 |

68,924 |

Minority interest |

|

2,425 |

2,380 |

|

2,487 |

2,487 |

2,487 |

Net debt (including finance leases) |

|

1,671 |

6,647 |

|

118 |

-11,657 |

-22,731 |

Balance sheet ratios |

|

|

|

|

|

|

|

Gearing (net debt/(net debt+equity)) |

|

3.4% |

15.2% |

|

0.3% |

-26.2% |

-49.2% |

Net debt to EBITDA |

|

0.5x |

1.1x |

|

0.0x |

-0.5x |

-1.1x |

RoCE |

|

-0.8% |

3.2% |

|

21.3% |

35.4% |

35.3% |

RoIC (after tax) |

|

-8.5% |

-7.6% |

|

17.8% |

25.6% |

25.5% |

RoE |

|

-1.9% |

-2.9% |

|

15.4% |

23.9% |

20.5% |

Cash flow statement |

|

|

|

|

|

|

|

Operating cash flow |

|

-1,247 |

-1,256 |

|

12,647 |

17,049 |

15,094 |

Capex (net of disposals) |

|

-3,798 |

-5,106 |

|

-4,862 |

-4,492 |

-3,863 |

Other |

|

3,856 |

3,236 |

|

-684 |

0 |

0 |

FCF |

|

-1,189 |

-3,126 |

|

7,101 |

12,556 |

11,231 |

Equity shareholders' cash |

|

846 |

-4,976 |

|

6,529 |

11,775 |

11,074 |

Dividends and share buy backs |

|

0 |

0 |

|

0 |

0 |

0 |

Movement in net debt |

|

846 |

-4,976 |

|

6,529 |

11,775 |

11,074 |

Cash flow ratios |

|

|

|

|

|

|

|

Working capital turnover, days |

|

58 |

73 |

|

53 |

40 |

48 |

FCF yield |

|

-2.9% |

-10.0% |

|

14.4% |

33.6% |

42.7% |

Equity shareholders' yield |

|

2.3% |

-22.3% |

|

14.0% |

25.3% |

23.8% |

Capex/EBITDA |

|

104.9% |

86.8% |

|

34.1% |

21.0% |

18.1% |

Cash conversion |

|

-0.9x |

4.1x |

|

1.0x |

1.0x |

0.9x |

Valuation |

|

|

|

|

|

|

|

SoTP DCF fair value and calculation of target price |

|

|

|

ZARmn |

ZAR/sh |

||

Rustenburg lease |

|

|

|

|

36,671 |

51.0 |

|

Zimplats (effective interest = 87%) |

|

|

|

|

22,424 |

31.2 |

|

Marula (effective interest = 73%) |

|

|

|

|

1,903 |

2.6 |

|

Afplats (effective interest = 74%) |

|

|

|

|

0 |

0.0 |

|

IRS (third party only) |

|

|

|

|

367 |

0.5 |

|

Mimosa (effective interest = 50%) |

|

|

|

|

2,750 |

3.8 |

|

Two Rivers (effective interest = 46%) |

|

|

|

|

6,245 |

8.7 |

|

Chrome operations |

|

|

|

|

393 |

0.5 |

|

Enterprise value |

|

|

|

|

70,752 |

98.5 |

|

Investments as at 30 June 2018 |

|

|

|

|

257 |

0.4 |

|

Net debt as at 30 June 2018 |

|

|

|

|

-6,647 |

-9.2 |

|

Cash used in share buy-backs during 2019E |

|

|

|

|

0 |

0.0 |

|

Convertible bond dilution based on current share price |

|

|

|

-3,497 |

-4.9 |

||

Anticipated indigenization discount of Zimplats and Mimosa |

|

-1,284 |

-1.8 |

||||

Equity value |

|

|

|

|

59,582 |

82.9 |

|

Rounded to |

|

|

|

|

|

83.0 |

|

Current share price on 26/3/2019 |

|

|

|

|

|

64.8 |

|

Expected share price return |

|

|

|

|

|

28.1% |

|

Plus: expected dividend yield |

|

|

|

|

|

0.0% |

|

Total implied one-year return |

|

|

|

|

|

28.1% |

|

Share price range, ZAR: |

|

|

|

|

|

|

|

12-month high |

69 |

12-month low |

|

16 |

|||

Price move since high |

-6.6% |

Price move since low |

|

315.1% |

|||

Calculation of WACC |

|

|

|

|

|

|

|

WACC |

14.8% |

Cost of debt |

|

|

10.0% |

||

Risk-free rate |

9.0% |

Tax rate |

|

|

28% |

||

Equity risk premium |

5.5% |

After-tax cost of debt |

|

7.2% |

|||

Beta |

1.30 |

Debt weighting |

|

15% |

|||

Cost of equity |

16.2% |

Terminal growth rate |

|

0.0% |

|||

Valuation ratios |

|

|

|

|

|

|

|

Jun-YE |

|

2017 |

2018 |

|

2019E |

2020E |

2021E |

P/E multiple |

|

-36.6x |

-18.2x |

|

7.4x |

3.9x |

3.6x |

Dividend yield |

|

0.0% |

0.0% |

|

0.0% |

0.0% |

0.0% |

EV/EBITDA |

|

11.3x |

5.3x |

|

3.4x |

1.7x |

1.2x |

P/B |

|

0.8x |

0.6x |

|

1.1x |

0.8x |

0.7x |

NAV per share, ZAR |

|

64 |

52 |

|

61 |

78 |

96 |

Source: Bloomberg, Thomson Reuters, Renaissance Capital estimates

85