- •Contents

- •Revisions to our forecasts, TPs and ratings

- •Investment stance

- •Capital cycle favours rising returns

- •Comfortable balance sheets and supportive dividend potential

- •Value relative to other stocks

- •Yield potential through the cycle

- •Mid-cycle cash generation offers supportive yields

- •Where to hide if you are bearish

- •What to buy if you are bullish

- •Limited lives weighing down IRR

- •Yields should compensate for limited lives

- •Positive earnings momentum continues to support share prices

- •Commodity price revisions

- •Commodity section

- •Commodity section

- •Preference for base metals over steelmaking materials

- •Earnings revisions

- •Risks and catalysts

- •Peer comp charts

- •Commodity price and exchange rate forecasts

- •Important publications

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Sasol

- •Disclosures appendix

vk.com/id446425943

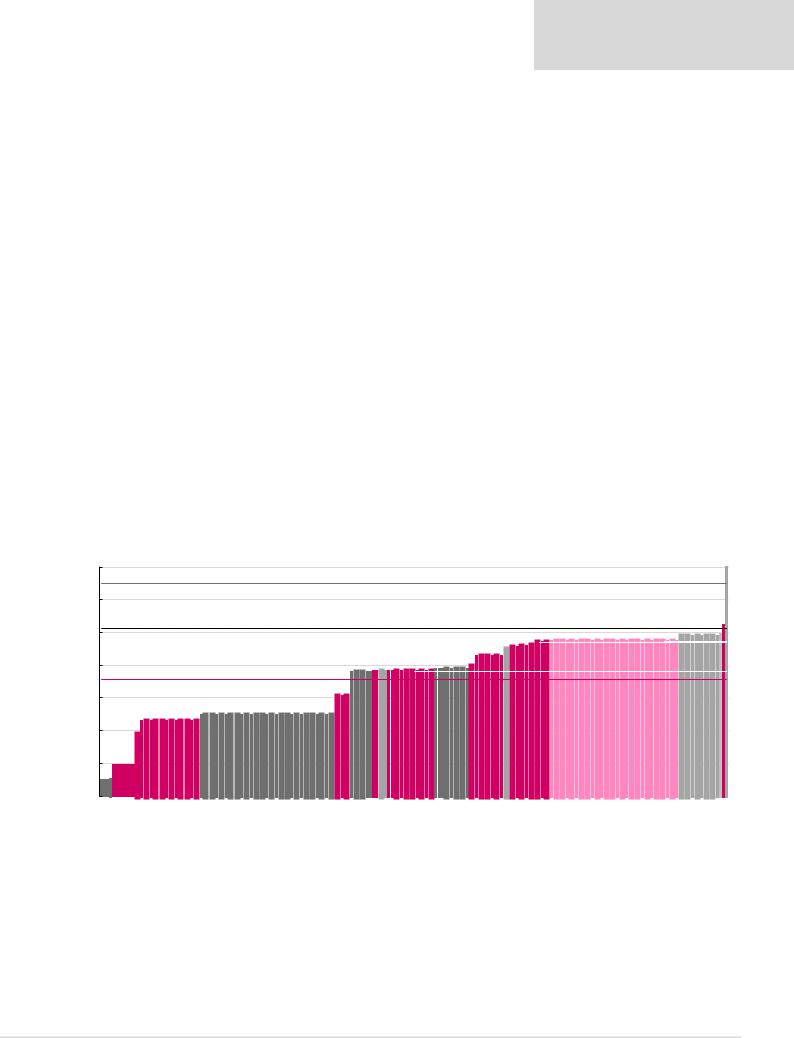

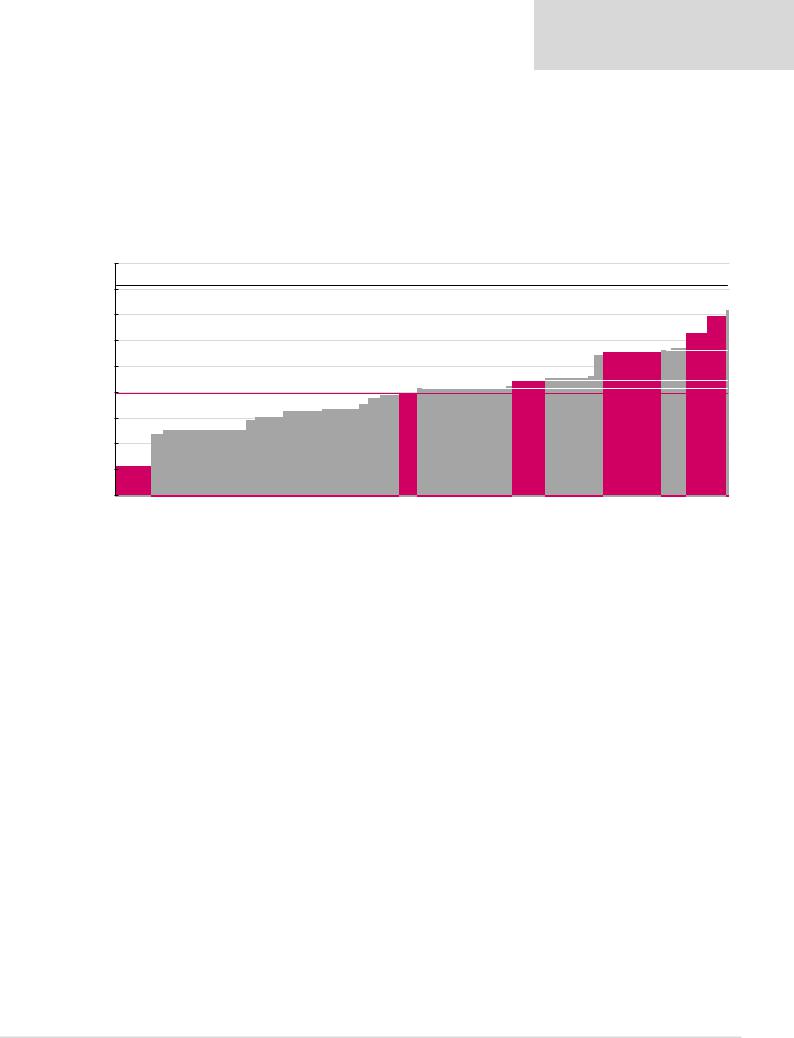

Preference for base metals over steelmaking materials

We forecast falling prices for coal, iron ore and manganese over the medium term, given that they are trading above the 90th percentile of cost curves.

We are constructive on base metals, some of which are trading well below the 90th percentile, rendering significant parts of the respective industries cash-burning.

Thematically, from a demand perspective, we also prefer base metals over steelmaking materials (iron ore, metallurgical coal and manganese).

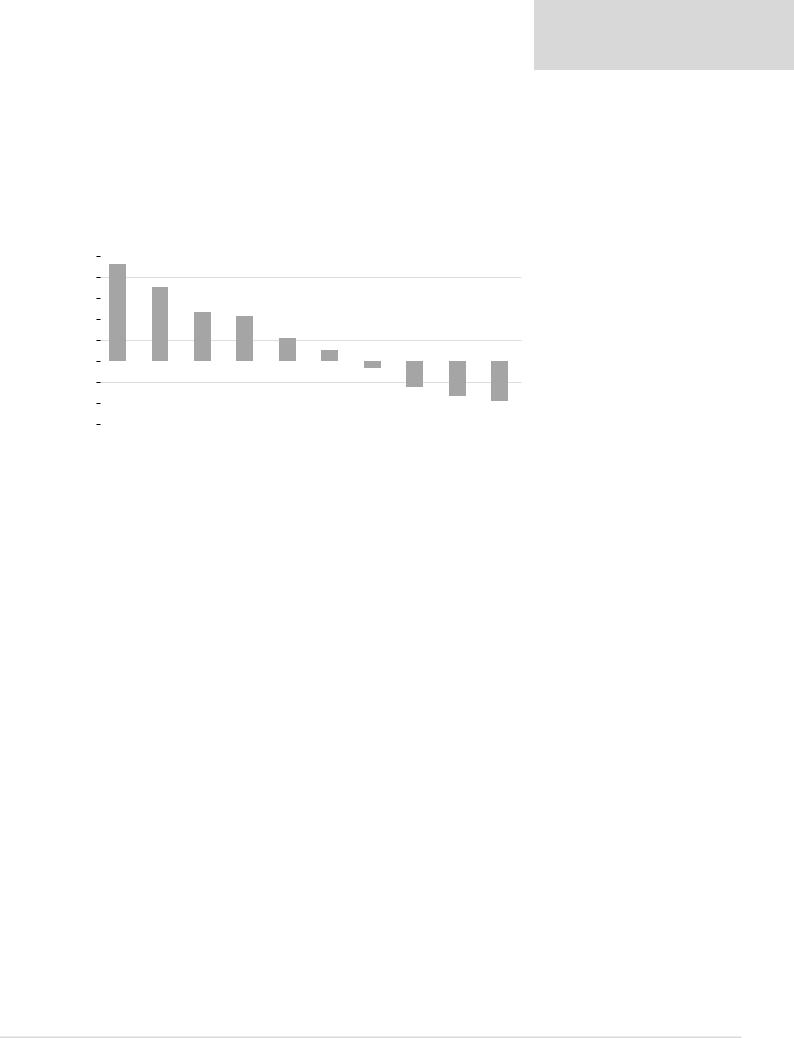

Figure 58: Spot commodity price premium (discount) to 90th percentile

50% |

46% |

|

|

|

% 90th percentile premium (discount) to spot price |

|

|

|

|||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

35% |

|

|

|

|

|

|

|

|

|

|

||

40% |

|

|

|

|

|

|

|

|

|

|

|

||

30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24% |

21% |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11% |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

10% |

|

|

|

|

|

|

|

5% |

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-3% |

|

|

|

||

-10% |

|

|

|

|

|

|

|

|

-12% |

|

|

||

-20% |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

-16% |

-19% |

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

-30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Met. Coal, $214/t |

Iron ore, $85/t |

Gold**, $1316/t |

PGM***, $1282/t |

Manganese ore, $6/t |

Copper, $6338/t |

Zinc*, $2920/t |

Nickel, $12995/t |

Aluminium, $1865/t |

Thermal coal, $74/t |

||||

|

|||||||||||||

*Used commodity/company data for 2017. **Used commodity data for 4Q18.

***PGM basket price calculated using 57% Pt, 36% Pd, 7% Rh. Note: Priced as at 26 March 2019.

Source: Bloomberg, Company data, Renaissance Capital estimates

Renaissance Capital

1 April 2019

Metals & Mining

Some commodities trading above cost support

Our long-term commodity price forecasts are supported by industry costs and we calculate these prices would result in poor industry average returns on new projects (below 9%), which we do not think would incentivise over-supply.

Management focus remains on cash-flow returns and perceived investment risk remains high for lenders.

We calculate incentive prices in the following charts as the commodity price required for a Incentive prices to achieve a 10% IRR project with industry average cash costs and industry average capital intensity to achieve

a 10% IRR.

34

vk.com/id446425943

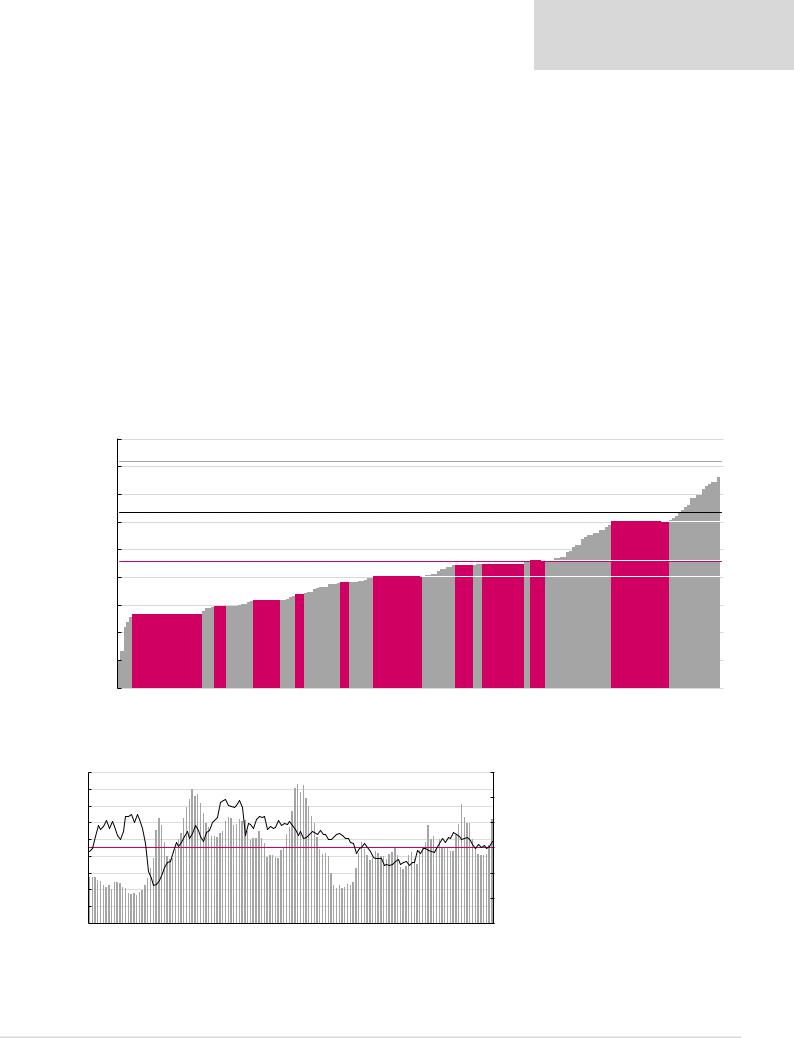

Metallurgical coal

We believe metallurgical coal spot prices of $214/t are unsustainable given our view that prices above $180/t incentivise new supply (10% IRR for average metallurgical coal projects). Lower steel prices could reduce demand for steelmaking materials or result in capacity cuts, which could weigh on metallurgical coal prices.

Renaissance Capital

1 April 2019

Metals & Mining

Lower steel margins could put pressure on steelmaking material prices

Metallurgical coal cost curve (631mnt)

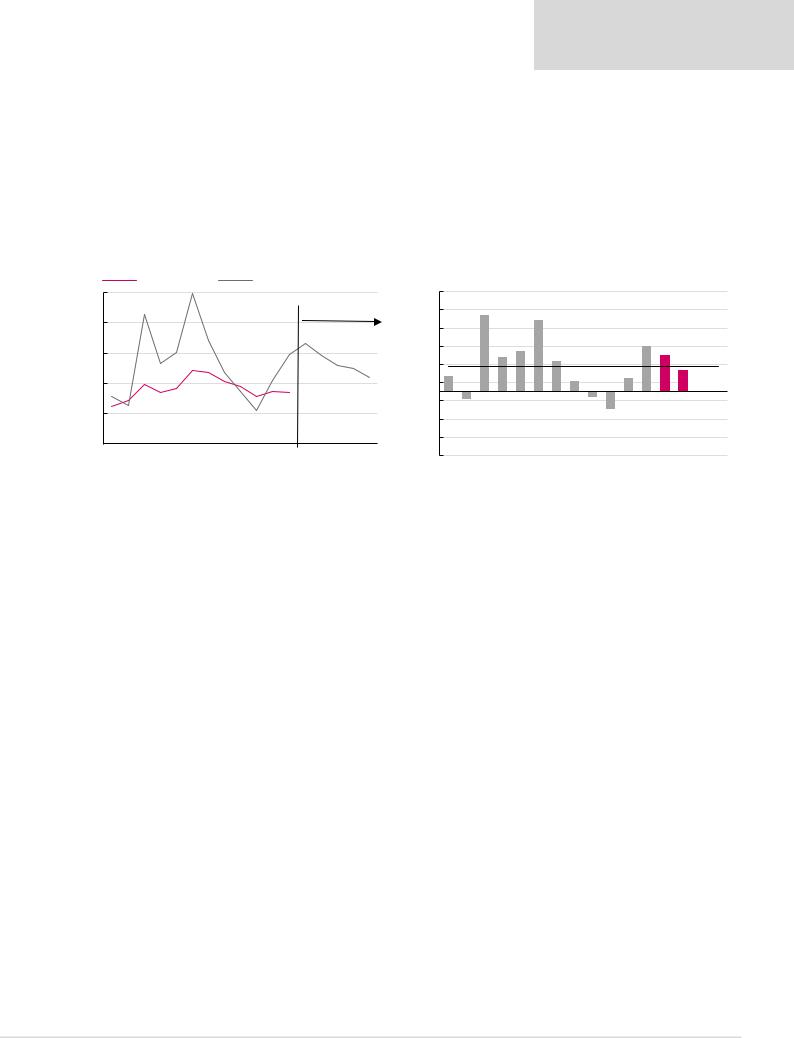

Figure 59: 2018E metallurgical coal cash costs plus sustaining capex, $/t

240

Spot price: $214/t*

200

Incentive price: $180/t

160 |

|

|

|

|

|

|

$/t |

|

|

|

|

|

|

120 |

Average cash cost: $118/t |

|

|

|

AngloAmerican, 125 |

|

|

|

|

Resources,Teck 115 |

Glencore, 123 |

||

80 |

Mechel,90 |

BHP,92 |

Evraz,106 |

|||

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

*Priced as at 26 March 2019. |

|

|

|

|

|

|

|

186 |

|

Vale, |

|

173 |

90th percentile: $147/t |

Severstal, |

|

|

70th percentile: $125/t |

|

50th percentile: $117/t |

|

South32, 143 |

|

Source: Bloomberg, CRU, Renaissance Capital estimates (in pink)

We believe spot metallurgical coal prices make the entire industry cash-flow positive. We see no risk of capacity cuts.

Figure 60: Percentage of metallurgical coal cost curve that is cash-burning over time

% Cash burning |

|

Hard coking coal - spot, $/t |

Average LT cash burn |

|

350 |

|

|

|

|

|

|

330 |

|

|

|

84.0% |

81.0% |

|

|

|

|

90% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

305 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

300 |

|

|

66.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

80% |

|

|

|

|

|

|

|

|

|

|

|

|

266 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

58.5% |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

55.5% |

|

|

|

70% |

||

250 |

|

|

|

|

|

|

|

|

51.0% |

|

|

|

214 |

60% |

|||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

200 |

|

|

|

|

|

|

|

|

34.5% 34.0% |

|

|

|

|

|

|

|

50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

150 |

|

|

|

|

|

|

|

|

29.0% |

|

|

|

|

|

188 |

40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

$/t |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

100 |

|

|

14.5% 14.5% 14.5% |

|

12.5% |

|

|

|

|

17.5% |

|

|

|

|

|

|

30% |

|

|

98 |

|

|

|

|

|

|

|

|

|

|

|

||||

|

5.5% 6.0% 6.0% 6.0% |

7.5% |

0.0% 0.0% 0.0% 0.0% 8.5% 8.5% 8.5% |

|

|

4.5% 2.0% 1.5% 8.5% 6.0% |

|

|

Average LT cash burn, 12.4% |

20% |

|||||||

50 |

1.5% 1.0% 1.5% 1.0% |

0.0% 0.0% 0.0% 0.5% 1.0% 1.0% |

4.5% |

|

81 |

4.5% |

0.0% 0.5% 0.5% 0.5% |

0.5% |

0.5% 1.0% 1.0% 0.0% 0.5% 0.5% |

10% |

|||||||

|

|

|

|||||||||||||||

|

|

|

|

||||||||||||||

0 |

Mar 06 Jun 06 Sep 06 Dec 06 Mar 07 Jun 07 Sep 07 Dec 07 Mar 08 Jun 08 Sep 08 Dec 08 Mar 09 Jun 09 Sep 09 Dec 09 Mar 10 Jun 10 Sep 10 Dec 10 Mar 11 Jun 11 Sep 11 Dec 11 Mar 12 Jun 12 Sep 12 Dec 12 Mar 13 Jun 13 Sep 13 Dec 13 Mar 14 Jun 14 Sep 14 Dec 14 Mar 15 Jun 15 Sep 15 Dec 15 Mar 16 Jun 16 Sep 16 Dec 16 Mar 17 Jun 17 Sep 17 Dec 17 Mar 18 Jun 18 Sep 18 Dec 18 Mar 19 Spot |

0% |

|||||||||||||||

|

|

||||||||||||||||

Source: Bloomberg, CRU, Renaissance Capital estimates

35

vk.com/id446425943

Renaissance Capital

1 April 2019

Metals & Mining

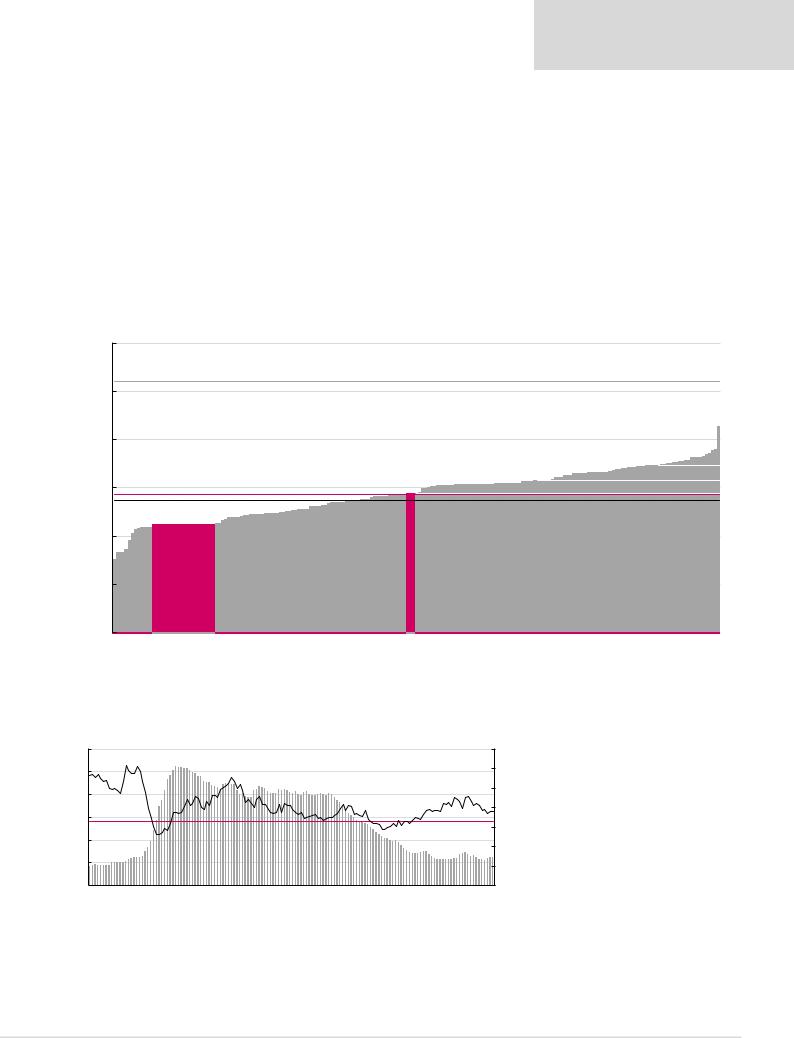

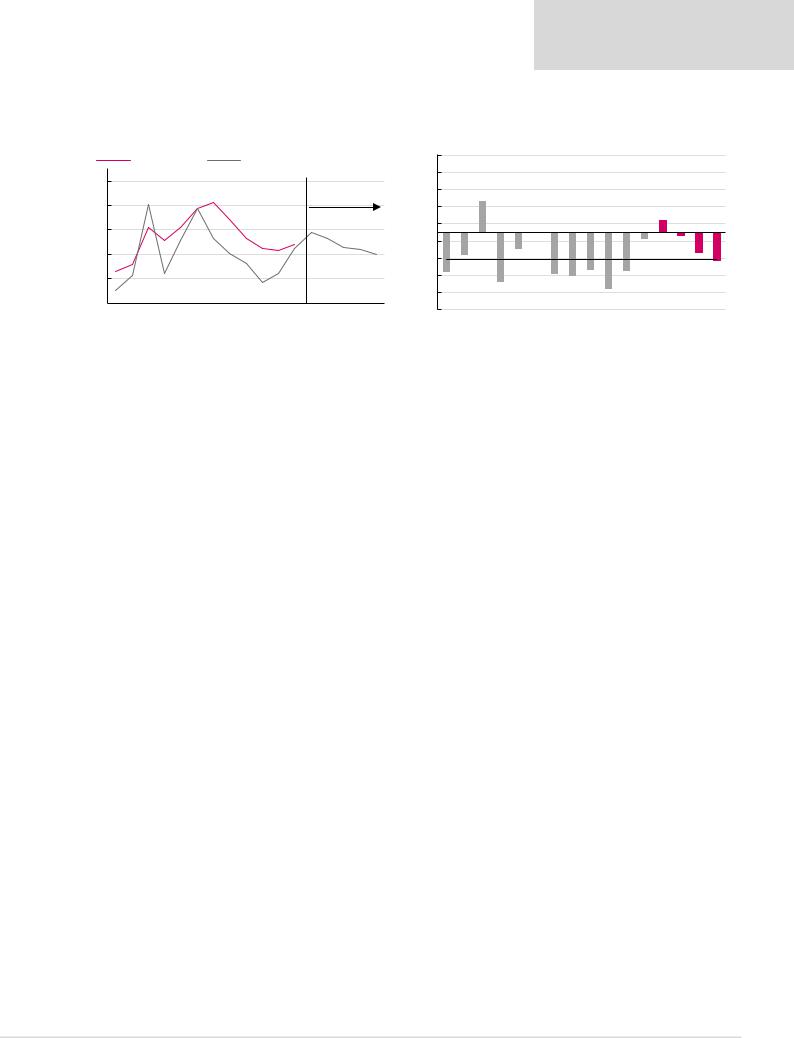

From a longer-term perspective, we are cautious on coking coal demand and prices:

1.Given our cautious outlook for Chinese steel demand growth; and

2.over the medium term, we expect Chinese steel production to shift from blast furnace to electric arc furnace, which would likely add pressure on coking coal demand and prices.

Our long-term metallurgical coal price forecast of $150/t is based on cost support of the 90th percentile of the cost curve.

Figure 61: Met coal price vs cash costs at the 90th percentile |

Figure 62: Met coal price premium (discount) to the 90th percentile |

|

Cash costs, $/t |

Met coal average price. $/t |

|

290 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

110% |

|

|

|

|

|

|

|

|

|

|

|

|

|

206 |

Forecasts |

|

90% |

||

240 |

101 |

112 |

138 |

125 |

132 |

162 |

158 |

143 |

135 |

118 |

126 |

188 |

187 |

170 |

165 |

150 |

70% |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

190 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30% |

140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

126 |

|

|

|

|

|

-10% |

90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-50% |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018E |

2019E |

2020E |

2021E |

LT (real) |

|

|

|

-70% |

|||||||||||||||||

|

|

|||||||||||||||||

|

|

84% |

|

|

79% |

|

|

|

|

17% |

|

|

38% |

44% |

|

34% |

11% |

Historical |

|

|

|

|

|

|

|

|

|

||

|

-9% |

|

|

|

|

|

|

-7% |

-20% |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

15% |

49% |

40% |

24% |

average, 28%

2016 |

2017 |

2018E |

2019E |

9% |

3% |

|

|

|

|

|

2020E |

2021E |

|

||

*Cash costs net of by-product credits plus sustaining capex.

Source: Bloomberg, Renaissance Capital estimates |

Source: Bloomberg, Renaissance Capital estimates |

36

vk.com/id446425943

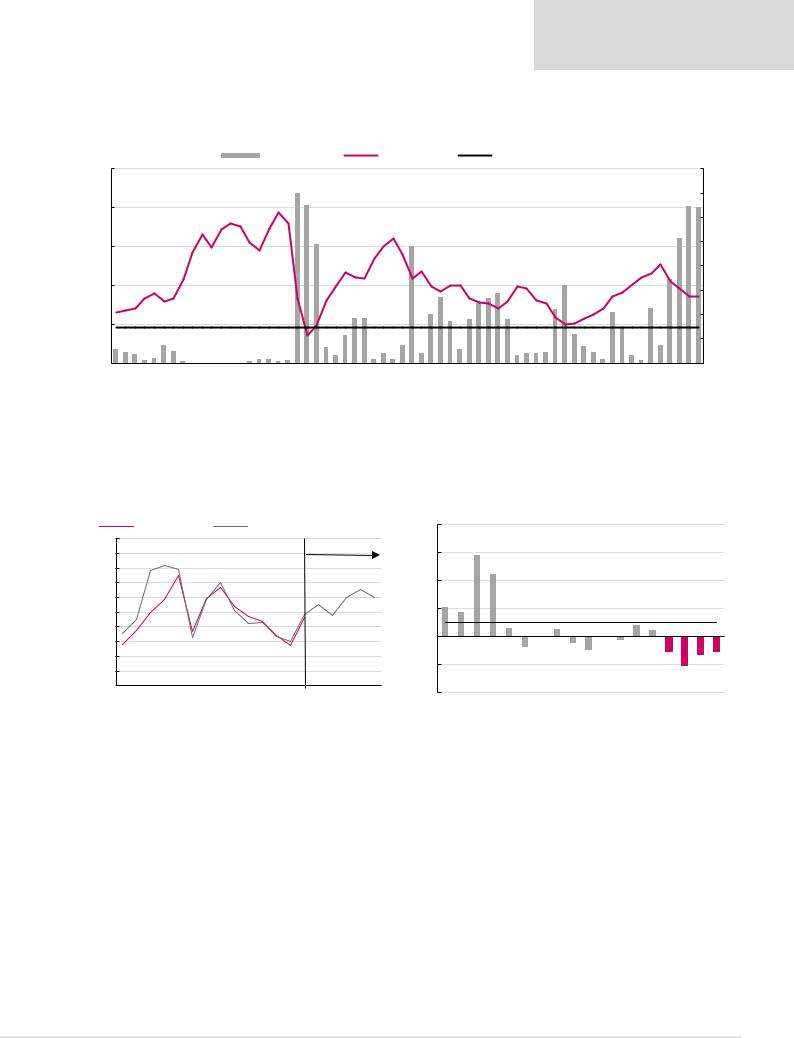

Iron ore

We believe a potential medium-term iron ore deficit following production disruptions in Brazil could support iron ore prices above cost support.

Following the Brumadinho dam rupture, Vale´s iron ore fines annualised production was impacted by the equivalent of about 92.8mn tpa (source: Vale):

1)40mn tpa from Feijão, Vargem Grande and Fábrica complexes, as a result of the following events: (i) on February 4th, 2019 (and again on February 20th, 2019), Vale disclosed its intention to advance the decommissioning process of all upstream dams; (ii) on February 18th, 2019, Brazil’s National Mining Agency (“ANM” – Agência Nacional de Mineração) published the new Resolution No 4 recommending higher dam safety parameters; (iii) on February 20th, 2019, Vale confirmed that Vargem Grande, Grupo and Forquilha I, II and III tailings dams safety parameters could be potentially lower than what the new resolution recommended; and (iv) on February 20th, 2019, ANM promoted inspections to the sites and determined the suspension of activities at the entire Vargem Grande Complex and Fábrica mine; as informed in the press release

“Clarification on the Vargem Grande, Grupo and Forquilha I, II and III dams”, dated March 1st, 2019.

2)30mn tpa from Brucutu mine, following the decision held by the Court of the Comarca of Santa Barbara.

3)12.8mn tpa from Timbopeba mine, following the decision held by the 2nd Civil Court of the Comarca of Ouro Preto, filed by the MPMG, as informed in the press release “Vale on the Timbopeba mine operations”, dated March 15th, 2019.

4)10mn tpa from Alegria mine, following Vale’s decision to temporarily suspend on a preventive basis the Alegria mine operation, as informed in the press release

“Vale informs on operation of the Alegria mine”, dated March 20th, 2019.

On 29 March Vale guided to 2019 iron ore sales of between 307 and 332mnt, a material reduction compared with our forecast of 401mnt in January 2019.

However, we forecast iron ore prices in the longer term.

1)Low-cost supply continues to grow as Vale, Samarco, BHP, Rio Tinto and Minas Rio ramp up.

2)Steel prices have fallen to levels that put pressure on steel company margins. This could lead to capacity curtailments and weigh on demand for steelmaking materials.

3)Chinese iron ore port inventories are still at highly elevated levels of around 38 days of consumption.

4)Steel demand growth could be lacklustre as the Chinese property market cools down and stimulus slows. A decline in Chinese steel intensity per capita to developed consumer economy levels such as the US poses a potential structural headwind over the longer term.

5)We see the potential for scrap substituting iron ore as China matures.

6)We forecast longer-term cost support around the 90th percentile at $65/t, and calculate incentive prices at $80/t.

Renaissance Capital

1 April 2019

Metals & Mining

37

vk.com/id446425943

Renaissance Capital

1 April 2019

Metals & Mining

Iron ore cost curve (1,720mnt)

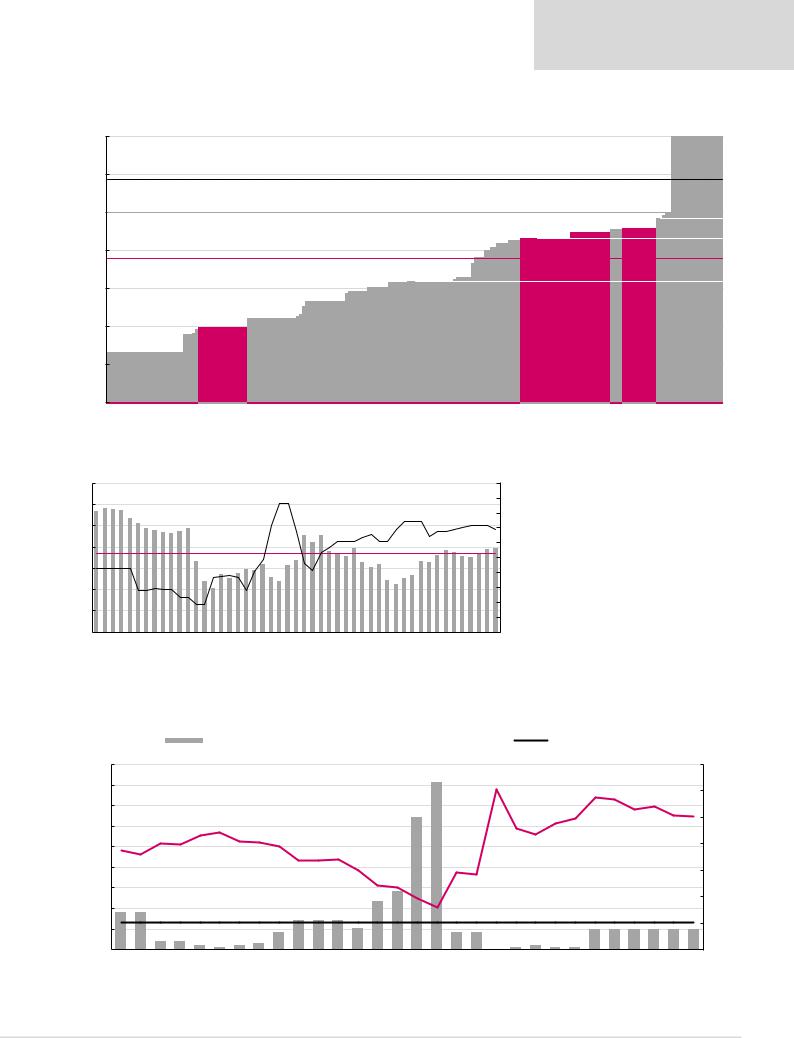

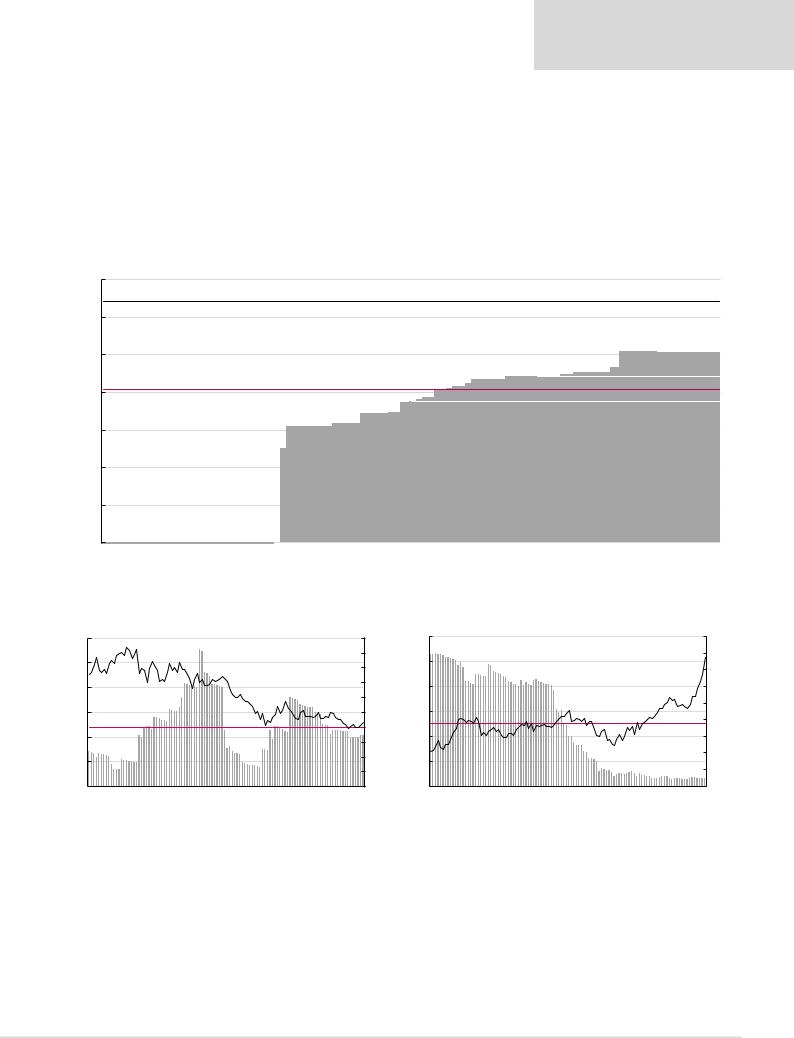

Figure 63: 2018E iron ore cash costs plus sustaining capex, $/t

100

90 |

Spot price: $85/t* |

|

80

Incentive price: $80/t

70

60

$/t

50

Average cash cost: $41/t

40 |

|

|

30 |

|

|

20 |

25 |

|

Vale, |

||

|

||

10 |

|

*Priced as at 26 March 2019.

90th percentile: $63/t

|

|

|

|

52 |

70th percentile: $47/t |

33Tinto,Rio |

34,Kumba |

35BHP, |

39Assmang, |

|

|

Fortescue, |

50th percentile: $35/t |

||||

|

|

|

|

|

Source: Bloomberg, CRU, Renaissance Capital estimates (in pink)

Figure 64: Iron ore Chinese port inventory days compared with the iron ore price (RHS) over time, $/t |

|

|

Chinese port inventories are still at |

||||

|

|

|

|

|

|

|

|

50 |

|

|

|

48 |

|

|

elevated levels, which supports our |

45 |

|

|

|

43 |

|

|

view of falling prices in the medium |

|

|

|

41 |

|

|

||

|

|

|

|

|

|

term |

|

|

|

|

|

|

|

39 |

|

40 |

|

|

|

|

|

|

|

|

|

36 |

36 |

|

|

|

|

|

|

34 |

|

|

|

||

35 |

|

|

34 |

|

|

|

|

Average Chinese stock days, 32 |

31 |

|

|

|

|

||

|

|

|

|

|

|||

30 |

29 |

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

25 |

|

|

|

|

|

|

|

20 |

17 |

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

07-Jan 07-Jun 07-Nov 08-Apr 08-Sep 09-Feb 09-Jul 09-Dec 10-May 10-Oct 11-Mar 11-Aug 12-Jan 12-Jun 12-Nov 13-Apr 13-Sep 14-Feb 14-Jul 14-Dec 15-May 15-Oct 16-Mar 16-Aug 17-Jan 17-Jun 17-Nov 18-Apr 18-Sep 19-Feb

Note: Calculated as Chinese inventory/Chinese iron ore demand*1.6*365.

Source: Bloomberg, Renaissance Capital

38

vk.com/id446425943

Renaissance Capital

1 April 2019

Metals & Mining

We calculate that only 3.5% of iron ore producers are cash-burning at current spot prices, which is not enough to provide cost support in a weakening demand environment, in our view.

Figure 65: Percentage of iron ore cost curve that is cash-burning over time

% Cash burning |

|

Iron ore fines (62% Fe, CIF China), $/t |

Average LT cash burn |

|

|

200 |

|

|

|

|

|

|

|

189 |

|

|

|

|

|

|

184 |

|

|

|

|

|

|

|

|

33.5% |

|

|

|

37.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40% |

|

|

32.5% |

|

|

|

|

|

|

|

32.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

180 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

35% |

||||

|

160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

136 |

|

|

|

|

26.0% |

24.0% |

|

|

|

|

|

|

|

|

|

|

|

|

30% |

|||||

|

140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20.0% |

21.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

120 |

18.5% |

|

|

19.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25% |

||||||||

|

|

|

|

|

|

|

16.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

$/t |

100 |

15.0% |

13.0% |

|

|

|

12.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

13.5% |

|

86 |

|

|

|

|

|

12.0% |

|

|

85 |

20% |

||||||||||||

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.0% |

|

|

|

|

|

11.5% |

|

|

|

15% |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.5% |

|

8.5% |

|

|

|

|

|||||||||||||||||||||

60 |

|

|

Average LT cash burn, 9.3% |

|

|

|

|

|

|

|

|

|

|

|

6.0% |

|

|

6.5% |

7.0% |

|

|

10% |

|||||||||||||||||||||||

40 |

61 |

|

5.0% |

|

|

|

4.0% |

|

|

|

|

|

|

|

3.5% 3.5% |

|

3.5% |

|

3.0% |

|

4.5% |

4.0% |

3.5% |

||||||||||||||||||||||

|

|

|

|

2.5% |

|

|

|

|

|

|

|

2.5% 2.5% |

|

|

|||||||||||||||||||||||||||||||

|

|

1.5% |

|

|

1.0% |

|

1.0% |

|

1.0% |

|

1.0% |

1.5% |

|

||||||||||||||||||||||||||||||||

20 |

|

|

0.0% 0.0% 0.0% |

0.5% |

0.5% |

0.5% 0.5% 0.5% 0.5% |

0.5% 0.5% |

5% |

|||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

-0 |

Mar 06 Jun 06 Sep 06 Dec 06 Mar 07 Jun 07 Sep 07 Dec 07 Mar 08 Jun 08 Sep 08 Dec 08 Mar 09 Jun 09 Sep 09 Dec 09 Mar 10 Jun 10 Sep 10 Dec 10 Mar 11 Jun 11 Sep 11 Dec 11 Mar 12 Jun 12 Sep 12 Dec 12 Mar 13 Jun 13 Sep 13 Dec 13 Mar 14 Jun 14 Sep 14 Dec 14 Mar 15 Jun 15 Sep 15 Dec 15 Mar 16 Jun 16 Sep 16 Dec 16 Mar 17 Jun 17 Sep 17 Dec 17 Mar 18 Jun 18 Sep 18 Dec 18 Mar 19 Spot |

0% |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

Source: Bloomberg, CRU, Renaissance Capital estimates

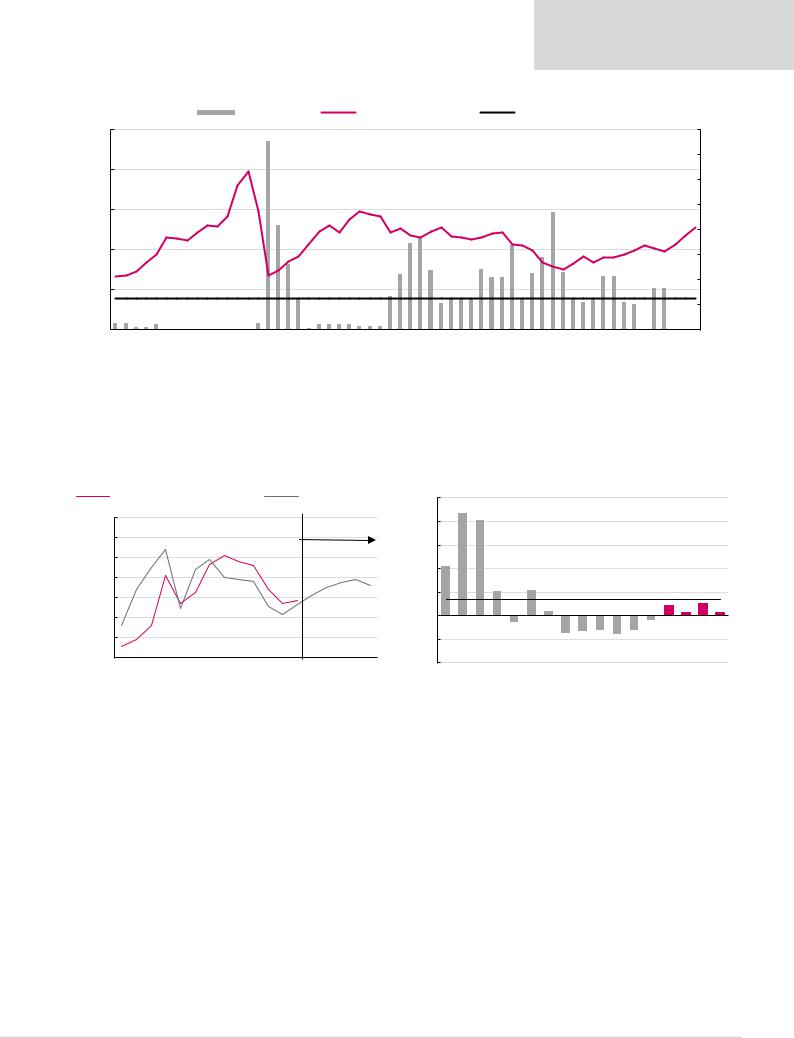

Our long-term iron ore price forecast of $65/t is 5% above the estimated 90th percentile of the cost curve, which reflects our view that some of Vale’s production may be replaced by higher cost supply.

Figure 66: Iron ore price vs cash costs* at the 90th percentile, $/t |

Figure 67: Iron ore price premium (discount) to the 90th percentile |

Cash costs, $/t |

Iron ore average price. $/t |

80% |

|

|

200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

180 |

|

|

|

|

175 |

|

|

|

|

|

|

|

|

|

60% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

140 |

91 |

100 |

77 |

98 |

108 |

111 |

95 |

70 |

70 |

Forecasts |

78 |

65 |

|

||

|

71 66 |

88 |

85 |

|

|||||||||||

120 |

|

|

|

|

101 |

|

|

|

|

|

|

|

|

|

20% |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

|

|

61 |

|

|

|

|

-20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

2007 |

2008 |

2009 |

2010 |

2011 2012 |

2013 |

2014 |

2015 |

2016 |

2017 2018E |

2019E |

2020E |

2021E |

LT (real) |

-40% |

|

|||||||||||||||

|

|

||||||||||||||

*Cash costs net of by-product credits plus sustaining capex. |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

Source: Bloomberg, Renaissance Capital estimates |

|

||||||

52% |

55% |

63% |

34% |

9% |

31% |

22% |

2% |

16% |

5% |

36% |

27% |

13% |

|

|

|

|

Historical average, 23% |

|

|

|

||

|

|

|

|

|

|

|

|

-21% |

-16% |

|

|

|

|

|

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018E |

2019E |

2020E |

2021E |

Source: Bloomberg, Renaissance Capital estimates

39

vk.com/id446425943

Manganese ore

Manganese ore cost curve (16.7mnt contained metal)

Figure 68: 2018E manganese lump cash costs plus sustaining capex, $/dmtu (44%, CIF China)

8.0

7.0Spot price: $6.88/dmtu*

|

6.0 |

Incentive price: $6/dmtu |

|

|

|

$/dmtu |

5.0 |

Average cash cost: $4.79/dmtu |

|

|

|

|

4.0 |

|

|

3.0 |

2.98 |

|

(AU), |

|

|

|

|

|

2.0 |

Samancor |

|

|

|

|

1.0 |

|

*Priced as at 26 March 2019. |

||

Renaissance Capital

1 April 2019

Metals & Mining

90th percentile: $5.83/dmtu 70th percentile: $5.31/dmtu

Assmang, 5.31 |

Vale, 5.47 |

Samancor (SA), 5.58 |

Source: Bloomberg, CRU, Renaissance Capital estimates (in pink)

Figure 69: Manganese – Chinese port inventory days (LHS) and manganese price, $/mtu (RHS)

70 |

|

|

|

|

|

|

|

|

|

8.65 |

|

|

|

|

|

|

|

|

|

|

|

10 |

|

58 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

||

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

7.40 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.88 |

8 |

||

|

|

|

|

48 |

|

|

|

|

|

|

45 |

|

|

6.55 |

|

|

|

|

|

|

||

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39 |

|||

40 |

|

Average exchange stock days, 37 |

|

|

|

|

|

|

|

|

|

|

38 |

|

|

6 |

||||||

|

|

|

|

|

33 |

|

|

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

10 |

|

|

|

|

|

|

|

2.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

1.83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

Jan-15 |

Mar-15 |

May-15 |

Jul-15 Sep-15 |

Nov-15 |

Jan-16 Mar-16 |

May-16 |

Jul-16 |

Sep-16 |

Nov-16 |

Jan-17 Mar-17 |

May-17 |

Jul-17 |

Sep-17 Nov-17 |

Jan-18 |

Mar-18 |

May-18 |

Jul-18 |

Sep-18 |

Nov-18 |

Jan-19 |

- |

|

|

|||||||||||||||||||||

Note: Calculated as Chinese port stocks/Chinese consumption*365.

Source: Bloomberg, CRU, Renaissance Capital

Manganese ore inventory days have reduced to long-term average levels

Figure 70: Percentage of manganese ore cost curve that is cash-burning over time

% Cash burning |

|

Manganese ore (44%, CIF China), $/mtu |

Average LT cash burn |

|

|

9.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

63.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

70% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.39 |

|

|

|

|

|

|

|

|

8.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

60% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

7.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.48 |

|

|

|

6.00 |

|

|

|

|

|

5.71 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$/mtu |

5.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

18.0% |

22.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

3.00 |

14.0% |

14.0% |

|

|

|

|

|

|

|

11.0% |

11.0% |

11.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

|||

|

|

|

|

|

|

|

|

8.0% |

|

|

|

|

|

|

|

|

|

7.5% |

7.5% |

7.5% |

7.5% |

7.5% |

7.5% |

|||||||||

2.00 |

3.0% |

3.0% |

|

|

|

2.5% |

6.5% |

|

|

6.5% |

6.5% |

|

|

|

|

|

|

|||||||||||||||

|

1.5% |

1.0% |

1.5% |

|

2.07 |

|

1.0% |

1.5% |

1.0% |

1.0% |

|

|||||||||||||||||||||

|

1.00 |

|

|

|

|

|

|

0.0% |

10% |

|||||||||||||||||||||||

|

Average LT cash burn, 10.1% |

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||||||

|

0.00 |

Mar 12 |

Jun 12 |

Sep 12 |

Dec 12 |

Mar 13 |

Jun 13 |

Sep 13 |

Dec 13 |

Mar 14 |

Jun 14 |

Sep 14 |

Dec 14 |

Mar 15 |

Jun 15 |

Sep 15 |

Dec 15 |

Mar 16 |

Jun 16 |

Sep 16 |

Dec 16 |

Mar 17 |

Jun 17 |

Sep 17 |

Dec 17 |

Mar 18 |

Jun 18 |

Sep 18 |

Dec 18 |

Mar 19 |

Spot |

0% |

|

|

|

||||||||||||||||||||||||||||||

Source: Bloomberg, CRU, Renaissance Capital estimates

40

vk.com/id446425943

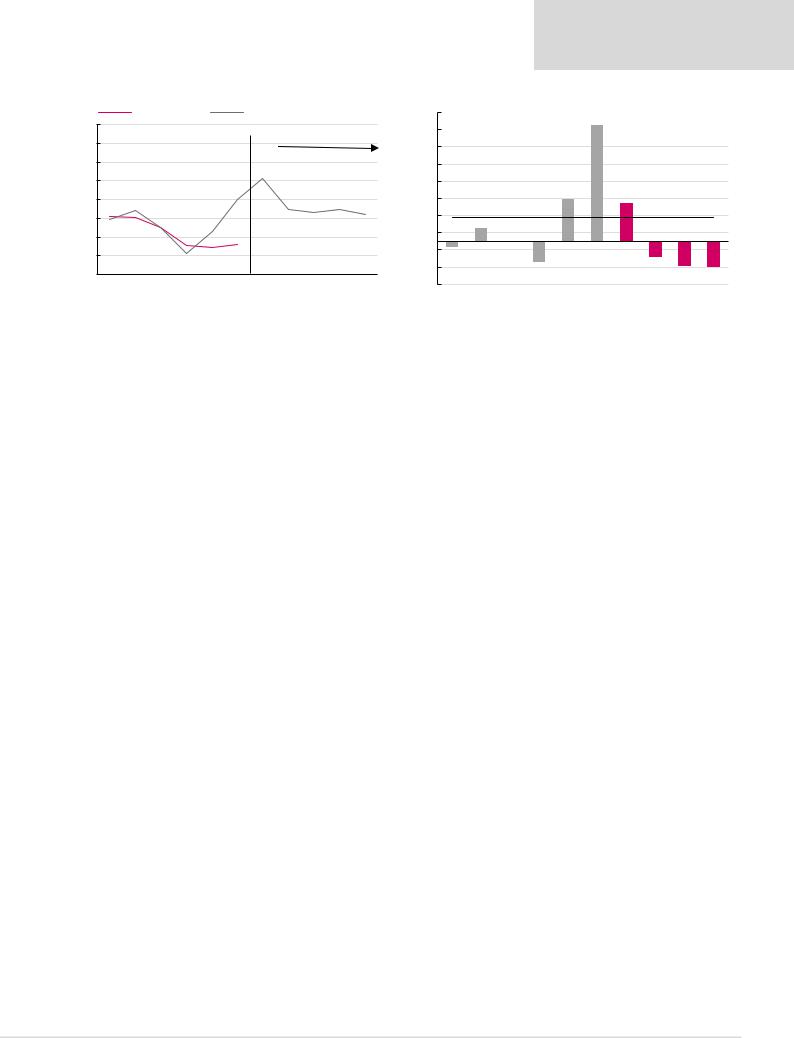

Figure 71: Manganese price vs cash costs* at the 90th percentile

Cash costs, $/t |

Manganese average price. $/t |

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

Forecasts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

7.1 |

|

|

|

|

|

7 |

|

|

|

|

|

6.0 |

|

5.5 |

|

5.5 |

|

$/t |

6 |

5.1 |

5.0 |

4.5 |

|

|

|

5.3 |

5.2 |

|||

5 |

|

|

|

|||||||||

|

|

|

|

3.6 |

3.5 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

3.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018E |

2019E |

2020E |

2021E |

LT (real) |

|

|

|||||||||||

Renaissance Capital

1 April 2019

Metals & Mining

Figure 72: Manganese price premium (discount) to the 90th percentile

75% |

68% |

|

|

65% |

|

|

55%

45%

35% |

|

|

|

24% |

|

22% |

|

|

|

|

|

|

|

|

|

|

|

|

|

25% |

|

|

|

|

|

|

|

|

|

15% |

8% |

0% |

|

|

|

Historical average, 14% |

|||

5% |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

-5% |

|

|

|

|

|

|

|

|

|

-15% |

|

|

2015-12% |

|

|

|

2019E -9% |

2020E-14% |

2021E-14% |

-25% |

|

|

|

|

|

||||

20123%- |

2013 |

2014 |

2016 |

2017 |

2018E |

||||

*Cash costs net of by-product credits plus sustaining capex.

Source: Bloomberg, Renaissance Capital estimates |

Source: Bloomberg, Renaissance Capital estimates |

41

vk.com/id446425943

Copper

Consumer growth in emerging markets is likely to support copper demand. Copper should also benefit from strong electric vehicle demand growth and a shift to renewable energy generation such as wind and solar. The multi-government-led Electric Vehicle Initiative has set a goal for 30% electric vehicle market share for passenger cars, light commercial vehicles, buses and trucks by 2030. According to Glencore this could increase copper demand by 4.1mnt by 2030, which implies 18% supply growth compared with 2017 production.

Vale estimates that the number of electric vehicles could grow by 12mn units per year from 1.8mn in 2018 to around 13.8mn by 2025. Using NCM811 chemistry this could consume 43 kg of nickel, 6 kg of cobalt, 5 kg of manganese and 11 kg of lithium per vehicle.

The supply side is also supportive for copper. Mining capex remains at very low levels and few base metal projects are being approved. Given continued grade declines at existing mines, incremental volume growth from new copper projects will probably not be enough to meet demand over the medium term. We calculate the incentive price to approve new projects at $8,200/t, which is well above spot.

Renaissance Capital

1 April 2019

Metals & Mining

Positive demand outlook driven by consumer growth, electric vehicles and alternative energy

Supportive supply side

Copper cost curve (22mnt)

Figure 73: 2018E copper cash costs plus sustaining capex, $/t

9,000

|

8,000 |

Incentive price: $8,200/t |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

7,000 |

Spot price: $6,338/t* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

90th percentile: $6,017/t |

||

|

6,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$/t |

5,000 |

Average cash cost: $4,590/t |

|

|

|

|

|

|

|

70th percentile: $4,603/t |

|

|

3,163Copper,Southern |

3,385Vale, |

3,804Resources,Teck |

4,029BHP, |

4,427American,Anglo |

4,484Glencore, |

4,603Tinto,Rio |

||||

|

4,000 |

2,669Freeport, |

2,936Norilsk, |

6,017Codelco, |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

3,000 |

|

|

|

|

|

|

|

|

|

|

|

2,000 |

|

|

|

|

|

|

|

|

|

|

|

1,000 |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

*Priced as at 26 March 2019. |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Source: Bloomberg, CRU, Renaissance Capital estimates (in pink) |

Figure 74: Copper exchange inventory days and price, $/t (RHS)

18 |

|

|

|

|

|

16 |

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

12,000 |

|

|

|

|

|

|

9,811 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

8,693 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,000 |

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

12 |

|

|

||

12 |

|

|

|

|

|

|

11 |

|

|

|

|

|

7,136 |

|

|

|

|

12 |

6,5568,000 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|||||

10 |

|

|

Average exchange stock days, 9 |

|

|

8 |

|

|

|

|

|

|

|

|

9 |

|

|

8 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,000 |

|||

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,000 |

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,000 |

|

2 |

|

|

|

3,042 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

Jan-07 |

Jun-07 |

Nov-07 |

Apr-08 Sep-08 Feb-09 |

Jul-09 |

Dec-09 May-10 |

Oct-10 Mar-11 |

Aug-11 |

Jan-12 |

Jun-12 |

Nov-12 |

Apr-13 Sep-13 |

Feb-14 |

Jul-14 Dec-14 |

May-15 |

Oct-15 |

Mar-16 |

Aug-16 |

Jan-17 Jun-17 |

Nov-17 |

Apr-18 |

Sep-18 |

Feb-19 |

0 |

|

|

|||||||||||||||||||||||

Note: Calculated as exchange inventory/global refined copper demand*365.

Source: Bloomberg, Renaissance Capital

Copper exchange inventories have fallen below the 10-year average

42

vk.com/id446425943

Renaissance Capital

1 April 2019

Metals & Mining

We estimate that around 7.5% of the copper industry is cash-burning at spot prices.

Figure 75: Percentage of copper cost curve that is cash-burning over time

|

|

|

|

|

|

|

|

|

|

|

|

% Cash burning |

|

|

|

|

Copper, $/t |

|

|

|

|

Average LT cash burn |

|

|

|

|

|

|

|

|

|

|

||||||||||

12,000 |

|

|

|

|

|

|

26.0% |

26.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30% |

10,000 |

|

|

|

|

|

|

|

|

|

|

|

9,646 |

|

|

|

|

|

|

|

|

|

|

|

|

|

23.0% |

|

|

|

|

|

|

|

|

|

|

|

25% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

8,448 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17.5% |

18.5% |

17.5% |

17.5% |

|

|

|

|

|

|

|

|

|

|

||

8,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,338 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6,000 |

|

|

|

|

|

|

|

|

11.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

10.0% 10.0% 10.0% |

|

|

|

|

11.0% |

10.0% |

4,678 |

10.0% |

|

|

|

|

|

|

|

|

|

15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.0% |

|

9.5% |

|

9.5% |

|

|

|

9.0% |

|

|

|

|

|||||||

4,000 |

|

|

|

|

|

|

|

|

6.5% |

|

|

|

|

|

|

5.5% |

|

|

|

|

|

7.5% |

8.5% |

|

|

8.5% |

6.5% |

|

|

8.5% 8.5% |

7.5% |

10% |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.0% 5.0% |

||||||||||||||

2,000 |

4.5% |

1.0% 1.0% |

1.5% 1.5% |

|

1.5% |

3,435 |

3.5% 3.5% |

4.0% |

3.5% |

1.0% |

|

1.0% 1.0% |

3.5% |

4.0% |

4.5% |

4.0% |

4.5% |

Average LT cash burn, 7.7% |

4.0% |

5% |

||||||||||||||||||||||

0.5% |

|

|

|

0.5% |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

0 |

Mar 07 |

Jun 07 Sep 07 |

Dec 07 |

Mar 08 |

Jun 08 |

Sep 08 |

Dec 08 |

Mar 09 |

Jun 09 |

Sep 09 |

Dec 09 Mar 10 |

Jun 10 |

Sep 10 |

Dec 10 |

Mar 11 |

Jun 11 Sep 11 |

Dec 11 |

Mar 12 |

Jun 12 |

Sep 12 |

Dec 12 |

Mar 13 |

Jun 13 Sep 13 Dec 13 |

Mar 14 |

Jun 14 |

Sep 14 |

Dec 14 |

Mar 15 |

Jun 15 Sep 15 |

Dec 15 Mar 16 |

Jun 16 |

Sep 16 Dec 16 |

Mar 17 |

Jun 17 |

Sep 17 |

Dec 17 |

Mar 18 Jun 18 |

Sep 18 |

Dec 18 |

Mar 19 |

Spot |

0% |

|

|

|||||||||||||||||||||||||||||||||||||||||

Source: Bloomberg, CRU, Renaissance Capital estimates

Our long-term copper price of $6,700/t is based on the 90th percentile of the copper cost curve.

Figure 76: Copper price vs cash costs* at the 90th percentile |

Figure 77: Copper price premium (discount) to the 90th percentile |

|

|

|

Cash costs, $/t |

|

|

|

Copper average price, $/t |

|

70% |

58% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

10,000 |

|

|

|

|

8,811 |

|

|

|

|

|

|

|

|

|

|

60% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,000 |

|

|

|

|

|

|

|

|

|

|

Forecasts |

|

|

|

|

|

|

|

39% |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

$/t |

|

4,515 |

5,440 |

4,701 |

5,792 |

6,323 |

7,060 |

7,009 |

6,254 |

5,958 |

5,200 |

6,1705,587 |

6,400 |

6,500 |

7,025 |

6,700 |

|

28% |

10% |

30% |

13% |

5% |

10% |

|

|

10% |

9% |

3% |

2% |

7% |

||

8,000 |

0% |

|

|

|

||||||||||||||||||||||||||||

|

7,000 |

|

|

|

|

|

|

|

|

|

|

6,532 |

|

|

|

|

30% |

|

|

|

|

|

|

Historical average, 17% |

|

|

|

|

||||

|

6,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-10% |

|

|

|

|

|

|

|

|

-7% |

-6% |

|

|

|

|

|

|

3,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 2018E |

2019E |

2020E |

2021E |

(real)LT |

|

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018E |

2019E |

2020E |

2021E |

|

|

|

-30% |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Cash costs net of by-product credits plus sustaining capex.

Source: Bloomberg, Renaissance Capital estimates |

Source: Bloomberg, Renaissance Capital estimates |

43

vk.com/id446425943

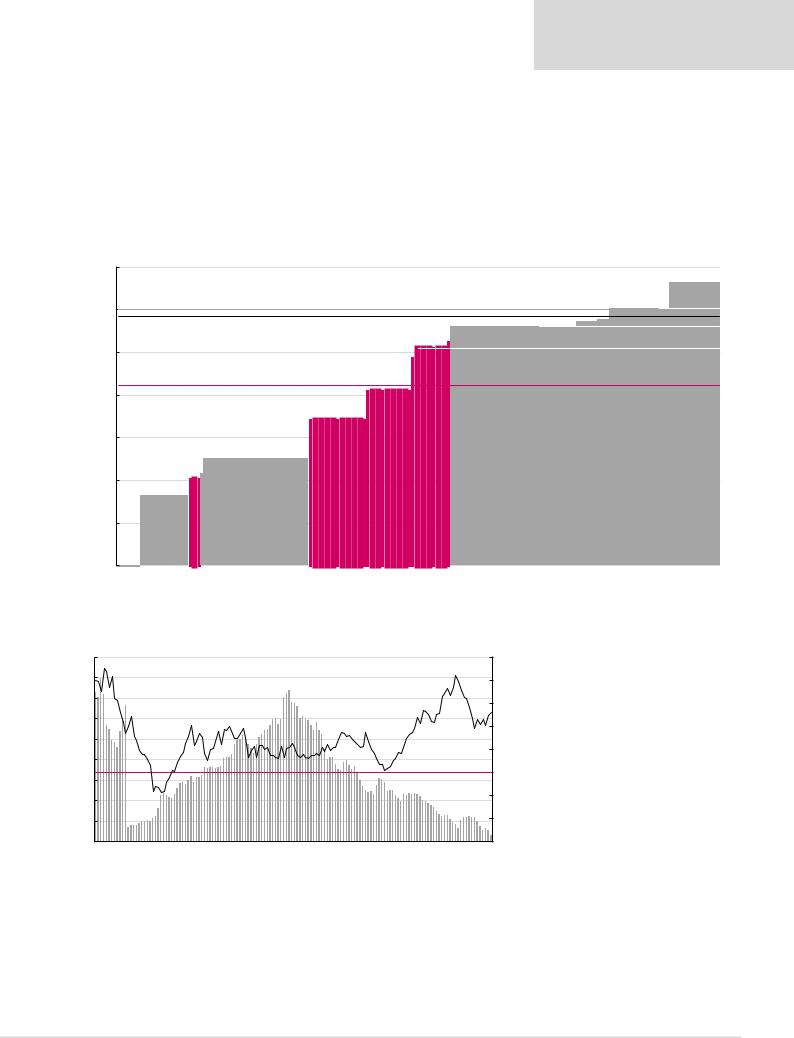

Aluminium

Consumer growth in emerging markets is likely to support aluminium demand.

We believe aluminium demand growth could remain strong as motor vehicle manufacturers continue to replace steel with lighter aluminium. Aluminium is also likely to continue benefiting from packaging growth (beverage cans, etc.). China’s environmental constraints and supply reform policies are likely to limit Chinese aluminium supply growth. We are not aware of major planned aluminium capacity from Western producers.

We calculate the incentive price to approve new projects at $3,100/t, which is significantly above spot.

Renaissance Capital

1 April 2019

Metals & Mining

Aluminium cost curve (67mnt supply)

Figure 78: 2018E aluminium cash costs plus sustaining capex, $/t

3,500

3,000 |

Incentive price: $3,100/t |

|

2,500

$/t |

2,000 |

Average cash cost: $1,932/t |

|

|

|

Spot price: $1,865/t* |

|

|

1,500 |

1,620 |

1,625 |

|

|

||

|

1,000 |

RioTinto, |

Rusal, |

|

|

|

|

|

500 |

|

|

*Priced as at 26 March 2019. |

|

||

South32, 1,935

90th percentile: $2,231/t 70th percentile: $2,072/t

50th percentile: $1,939/t

Source: Bloomberg, CRU, Renaissance Capital estimates (in pink)

Aluminium inventories have been declining since 2014 and are now at a supportive 13 days.

Figure 79: Aluminium exchange inventory days and price, $/t (RHS)

60 |

|

3,070 |

|

|

52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

2,256 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,8902,500 |

||||

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,670 |

|

|

|

|||

30 |

Average exchange stock days, 28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,000 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

1,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

20 |

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

14 |

11 |

12 |

1,000 |

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

Nov-07 Apr-08 |

|

Feb-09 |

Jul-09 Dec-09 |

May-10 Oct-10 Mar-11 |

|

|

|

|

Apr-13 |

|

Feb-14 |

Jul-14 |

|

May-15 |

Oct-15 |

Mar-16 Aug-16 |

|

|

Nov-17 Apr-18 |

|

Feb-19 |

0 |

Jan-07 |

Jun-07 |

Sep-08 |

Aug-11 |

Jan-12 |

Jun-12 |

Nov-12 |

Sep-13 |

Dec-14 |

Jan-17 |

Jun-17 |

Sep-18 |

|

||||||||||||

Note: Calculated as exchange inventory/global refined aluminium demand*365.

Source: Bloomberg, Renaissance Capital

Aluminium inventories have been declining, supporting a more favourable price outlook

44

vk.com/id446425943

Renaissance Capital

1 April 2019

Metals & Mining

We calculate that around 64% of the aluminium industry is cash-burning at current spot prices, which could trigger capacity cuts and support our constructive medium-term view.

Figure 80: Percentage of aluminium cost curve that is cash-burning over time

|

|

|

|

|

|

|

|

|

% Cash burning |

|

|

|

Aluminium, $/t |

|

|

|

|

Average LT cash burn |

|

|

|

|

|

|

|

||||||||||||

|

3,500 |

|

|

|

|

|

|

|

|

|

.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80% |

|

|

|

|

|

|

|

|

|

|

|

|

70 0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

64.5% 64.0% |

|

|

|

|

|

|

|

|

|

|

|

2,941 |

|

65. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

70% |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

3,000 |

|

|

|

|

|

|

|

|

|

|

49.0% |

|

|

|

|

|

48.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51.5% |

60% |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50% |

|||||

|

2,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,264 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32.0% |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28.5% |

|

|

|

|

|

|

|

|

|

40% |

|||

|

2,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,865 |

|

||||

$/t |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27.0% |

|

26.5% |

|

|

|

|

|

|

|

21.0% |

|

34.5% |

30% |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

1,500 |

|

|

|

|

|

|

Average LT cash burn, 14.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.0% |

|

|

20% |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

5.5% 4.5% |

|

|

7.5% |

|

1.5% 1.5% |

|

|

|

6.5% |

18.5% |

4.0% |

7.5% |

24.5% |

|

18.0% |

4.0% |

22.0% |

7.0% |

|

|

14.5% |

|

|

||||||||||||||

|

|

|

|

1.0% |

|

|

|

|

|

10% |