- •Contents

- •Revisions to our forecasts, TPs and ratings

- •Investment stance

- •Capital cycle favours rising returns

- •Comfortable balance sheets and supportive dividend potential

- •Value relative to other stocks

- •Yield potential through the cycle

- •Mid-cycle cash generation offers supportive yields

- •Where to hide if you are bearish

- •What to buy if you are bullish

- •Limited lives weighing down IRR

- •Yields should compensate for limited lives

- •Positive earnings momentum continues to support share prices

- •Commodity price revisions

- •Commodity section

- •Commodity section

- •Preference for base metals over steelmaking materials

- •Earnings revisions

- •Risks and catalysts

- •Peer comp charts

- •Commodity price and exchange rate forecasts

- •Important publications

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Sasol

- •Disclosures appendix

vk.com/id446425943

Norilsk Nickel – BUY

Renaissance Capital

1 April 2019

Metals & Mining

Figure 119: Norilsk Nickel, $mn (unless otherwise noted)

|

|

|

|

NorNickel |

GMKN.MM |

Target price, $: |

31.0 |

Market capitalisation, $mn: |

35,374 |

Share price, $: |

22.4 |

Enterprise value, $mn: |

42,675 |

Potential 12-month return: |

50.4% |

Dec-YE |

2017 |

2018 |

2019E |

2020E |

2021E |

Income statement |

|

|

|

|

|

Revenue |

9,146 |

11,670 |

13,277 |

14,634 |

14,602 |

EBITDA |

3,995 |

6,231 |

7,678 |

8,626 |

8,443 |

EBIT |

3,123 |

5,416 |

6,933 |

7,801 |

7,533 |

Net interest |

-458 |

-485 |

-363 |

-394 |

-457 |

Taxation |

-721 |

-843 |

-1,577 |

-1,778 |

-1,698 |

Minority interest in profit |

6 |

26 |

-67 |

-124 |

-156 |

Net profit for the year |

2,129 |

3,085 |

4,927 |

5,505 |

5,221 |

Underlying earnings |

2,129 |

3,085 |

4,927 |

5,505 |

5,221 |

Underlying EPS, $ |

1.35 |

1.95 |

3.11 |

3.48 |

3.30 |

Thomson Reuters consensus EPS, $ |

|

|

2.73 |

2.84 |

2.66 |

DPS declared, $ |

1.17 |

2.11 |

2.60 |

3.12 |

3.28 |

Thomson Reuters consensus DPS, $ |

|

####### |

2.31 |

2.67 |

2.73 |

EBIT by division |

|

|

|

|

|

|

|

|

|

|

|

Russia (GMK & KGMK) |

4,217 |

6,098 |

7,601 |

8,354 |

7,993 |

EBIT margin |

58% |

65% |

72% |

74% |

72% |

NN Harjavalta |

36 |

47 |

154 |

227 |

237 |

EBIT margin |

4% |

5% |

14% |

18% |

18% |

Other metallurgical |

-140 |

71 |

168 |

311 |

391 |

EBIT margin |

-99% |

62% |

37% |

46% |

47% |

Other non-metallurgical |

-6 |

22 |

6 |

7 |

7 |

EBIT margin |

-1% |

2% |

1% |

1% |

1% |

Other |

-757 |

-772 |

-996 |

-1,098 |

-1,095 |

Income statement ratios |

|

|

|

|

|

EBITDA margin |

44% |

53% |

58% |

59% |

58% |

EBIT margin |

34% |

46% |

52% |

53% |

52% |

EPS growth |

-17% |

45% |

60% |

12% |

-5% |

Dividend payout ratio |

87% |

108% |

83% |

90% |

99% |

Dividend as % of EBITDA |

46% |

54% |

54% |

57% |

61% |

Input assumptions |

|

|

|

|

|

Nickel, $/t |

10,404 |

13,130 |

12,762 |

14,805 |

15,728 |

Copper, $/t |

6,170 |

6,532 |

6,400 |

6,500 |

7,025 |

Palladium, $/oz |

871 |

1,030 |

1,558 |

1,700 |

1,576 |

Platinum, $/oz |

950 |

880 |

843 |

900 |

966 |

RUB/$ |

58 |

63 |

67 |

69 |

68 |

Unit costs per nickel eq tonne, $ |

8,399 |

7,873 |

7,971 |

8,454 |

8,779 |

Sustaining capex per nickel eq tonne, $ |

1,221 |

931 |

2,420 |

2,320 |

2,594 |

Production volumes* |

217 |

219 |

223 |

223 |

222 |

Nickel, kt |

|||||

Copper, kt |

401 |

474 |

481 |

494 |

470 |

Palladium, koz |

2,780 |

2,728 |

2,780 |

2,780 |

2,780 |

Platinum, koz |

670 |

653 |

668 |

668 |

668 |

Attributable Cu eq volumes, kt |

1,412 |

1,478 |

1,506 |

1,519 |

1,492 |

Volume growth |

2% |

5% |

2% |

1% |

-2% |

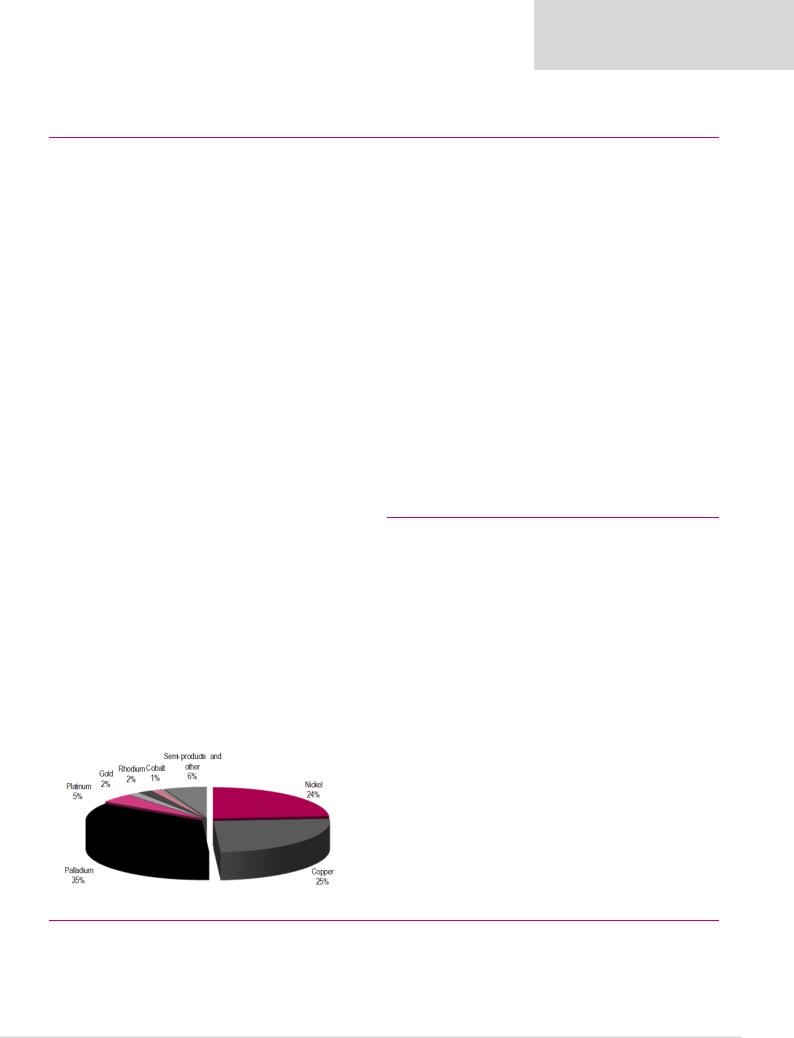

Contribution to 2019E revenue per commodity

Dec-YE |

|

|

|

2019E |

2020E |

2021E |

2017 |

2018 |

|

||||

Balance sheet |

|

|

|

|

|

|

Net operating assets |

13,581 |

11,062 |

|

12,914 |

14,588 |

16,189 |

Financial instruments |

267 |

222 |

|

222 |

222 |

222 |

Equity |

4,333 |

3,229 |

|

4,042 |

4,607 |

4,638 |

Minority interest |

331 |

250 |

|

317 |

441 |

598 |

Net debt |

8,201 |

7,051 |

|

7,973 |

8,908 |

10,270 |

Balance sheet ratios |

|

|

|

|

|

|

Gearing (net debt/(net debt+equity)) |

65.4% |

68.6% |

|

66.4% |

65.9% |

68.9% |

Net debt to EBITDA |

2.1x |

1.1x |

|

1.0x |

1.0x |

1.2x |

RoCE |

28.1% |

44.4% |

|

57.8% |

56.7% |

49.0% |

RoIC (after tax) |

21.5% |

35.2% |

|

44.5% |

43.6% |

37.7% |

RoE |

45.7% |

81.6% |

|

135.5% |

127.3% |

113.0% |

Cash flow statement |

|

|

|

|

|

|

Operating cash flow |

1,339 |

6,417 |

|

5,781 |

6,721 |

6,694 |

Capex |

-2,002 |

-1,553 |

|

-2,300 |

-2,400 |

-2,500 |

Other FCF |

431 |

-35 |

|

0 |

0 |

0 |

FCF |

-232 |

4,829 |

|

3,481 |

4,321 |

4,194 |

Equity shareholders' cash |

-667 |

4,486 |

|

3,191 |

4,005 |

3,828 |

Dividends and share buy backs |

-3,004 |

-3,336 |

|

-4,114 |

-4,940 |

-5,190 |

Surplus (deficit) cash |

-3,671 |

1,150 |

|

-922 |

-935 |

-1,362 |

Cash flow ratios |

|

|

|

|

|

|

Working capital days |

96 |

35 |

|

39 |

37 |

38 |

Cash Conversion |

-0.3x |

1.5x |

|

0.6x |

0.7x |

0.7x |

FCF yield |

-0.7% |

13.5% |

|

8.0% |

9.6% |

9.0% |

Equity shareholders' yield |

-2.6% |

15.7% |

|

9.0% |

11.3% |

10.8% |

Capex/EBITDA |

50.1% |

24.9% |

|

30.0% |

27.8% |

29.6% |

Valuation |

|

|

|

|

|

|

SoTP DCF valuation and calculation of target price |

|

$mn |

$/sh |

|||

Russia (GMK & KGMK) |

|

|

|

|

60,807 |

38.4 |

Finland |

|

|

|

|

2,262 |

1.4 |

Other metallurgical |

|

|

|

|

4,191 |

2.6 |

Other non-metallurgical |

|

|

|

|

-90 |

-0.1 |

Other |

|

|

|

|

-11,557 |

-7.3 |

Total enterprise value |

|

|

|

|

55,613 |

35.1 |

Net debt as at 31 December 2018 |

|

|

|

|

-7,051 |

-4.5 |

Cash used in share buy-backs |

|

|

|

|

- |

- |

Other investments |

|

|

|

|

222 |

0.1 |

Minority interest |

|

|

|

|

-250 |

-0.2 |

Equity value as at 27/3/2019 |

|

|

|

|

48,534 |

30.7 |

Rounded to |

|

|

|

|

|

31.0 |

Share price on 26/3/2019 |

|

|

|

|

|

22.4 |

Expected share price return |

|

|

|

|

|

38.3% |

Plus: expected dividend yield |

|

|

|

|

|

12.1% |

Total implied one-year return |

|

|

|

|

|

50.4% |

Share price range, $: |

|

|

|

|

|

|

12-month high on 19/3/2019 |

22.8 |

12-month low on 10/4/2018 |

14.6 |

|||

Price move since high |

-1.8% Price move since low |

|

53.9% |

|||

Calculation of discount rate |

|

|

|

|

|

|

WACC |

9.4% |

Cost of debt |

|

|

5.0% |

|

Risk-free rate |

4.0% |

Tax rate |

|

|

24% |

|

Equity risk premium |

6.0% After-tax cost of debt |

|

3.8% |

|||

Beta |

1.30 |

Debt weighting |

|

30% |

||

Cost of equity |

11.8% |

Terminal growth rate |

|

2.5% |

||

Valuation ratios |

|

|

|

|

|

|

Dec-YE |

2017 |

2018 |

|

2019E |

2020E |

2021E |

P/E multiple |

12.0x |

9.3x |

|

7.2x |

6.4x |

6.8x |

Dividend yield |

7.2% |

11.7% |

|

11.6% |

13.9% |

14.6% |

EV/EBITDA |

8.6x |

5.8x |

|

5.7x |

5.2x |

5.5x |

P/B |

5.9x |

8.8x |

|

8.8x |

7.7x |

7.6x |

NAV per share, $ |

2.7 |

2.0 |

|

2.6 |

2.9 |

2.9 |

* From Russian own feed

Source: Bloomberg, Thomson Reuters, Company data, Renaissance Capital estimates

73