- •Contents

- •Revisions to our forecasts, TPs and ratings

- •Investment stance

- •Capital cycle favours rising returns

- •Comfortable balance sheets and supportive dividend potential

- •Value relative to other stocks

- •Yield potential through the cycle

- •Mid-cycle cash generation offers supportive yields

- •Where to hide if you are bearish

- •What to buy if you are bullish

- •Limited lives weighing down IRR

- •Yields should compensate for limited lives

- •Positive earnings momentum continues to support share prices

- •Commodity price revisions

- •Commodity section

- •Commodity section

- •Preference for base metals over steelmaking materials

- •Earnings revisions

- •Risks and catalysts

- •Peer comp charts

- •Commodity price and exchange rate forecasts

- •Important publications

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Sasol

- •Disclosures appendix

vk.com/id446425943

Vale – HOLD

Renaissance Capital

1 April 2019

Metals & Mining

Figure 123: Vale, $mn (unless otherwise noted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vale |

|

|

|

|

VALE.N |

|

|

|

|

|

Target price, $: |

|

|

15.5 |

|||

Market capitalisation, $mn: |

|

|

|

|

67,191 |

|

|

|

|

|

Last price, $: |

|

|

13.0 |

|||

Enterprise value, $mn: |

|

|

|

|

87,488 |

|

|

|

|

|

Potential 12-month return: |

|

19.0% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec-YE |

|

|

|

2016 |

2017 |

2018E |

2019E |

2020E |

Dec-YE |

2016 |

2017 |

|

2018E |

2019E |

2020E |

||

Income statement |

|

|

|

|

|

|

|

|

|

Balance sheet |

|

|

|

|

|

|

|

Revenue |

|

|

|

29,334 |

35,713 |

37,008 |

42,080 |

43,839 |

|

Net operating assets |

66,066 |

62,915 |

|

53,048 |

56,227 |

57,988 |

|

Adjusted EBITDA |

|

|

|

12,181 |

15,337 |

17,022 |

22,132 |

20,544 |

|

Investments |

18 |

18 |

|

6 |

6 |

7 |

|

Adjusted EBIT |

|

|

|

8,267 |

10,873 |

13,498 |

18,683 |

16,823 |

|

Equity |

39,042 |

43,458 |

|

43,341 |

52,017 |

59,578 |

|

Net interest |

|

|

|

1,966 |

-3,019 |

-6,019 |

-2,117 |

-1,748 |

|

Minority interest |

1,982 |

1,314 |

|

860 |

868 |

876 |

|

Taxation |

|

|

|

-2,781 |

-830 |

-1,469 |

-3,224 |

-2,811 |

|

Net debt (target: $10bn) |

25,060 |

18,161 |

|

8,853 |

3,348 |

-2,459 |

|

Minority interest in profit |

|

|

|

6 |

-14 |

-1 |

-40 |

-40 |

|

|

|

|

|

|

|

|

|

Net profit for the year |

|

|

|

5,277 |

6,935 |

5,669 |

8,676 |

7,560 |

|

Balance sheet ratios |

|

|

|

|

|

|

|

Underlying earnings |

|

|

|

4,968 |

7,188 |

7,993 |

12,326 |

11,210 |

|

Gearing * |

31.4% |

22.4% |

|

11.1% |

4.4% |

-2.9% |

|

Underlying EPS, $ |

|

|

|

0.96 |

1.39 |

1.54 |

2.39 |

2.17 |

|

Net debt to EBITDA |

2.1x |

1.2x |

|

0.5x |

0.2x |

-0.1x |

|

|

|

|

|

RoCE |

13.1% |

16.4% |

|

22.0% |

32.2% |

27.8% |

|||||||

Thomson Reuters consensus EPS, $ |

|

|

|

1.28 |

2.03 |

1.63 |

|

RoIC (after tax) |

12.6% |

19.8% |

|

15.4% |

22.1% |

19.3% |

|||

DPS declared, $ |

|

|

|

0.27 |

0.28 |

0.40 |

0.00 |

0.00 |

|

RoE |

13.7% |

17.4% |

|

18.4% |

25.9% |

20.1% |

|

Adjusted EBIT |

|

|

|

|

|

|

|

|

|

Cash flow statement |

|

|

|

|

|

|

|

Ferrous Minerals |

|

|

|

8,747 |

11,497 |

13,133 |

18,121 |

15,426 |

|

Operating cash flow |

10,030 |

16,819 |

|

12,802 |

16,398 |

15,985 |

|

EBIT margin |

|

|

|

43% |

46% |

46% |

55% |

47% |

|

Capex less disposals |

-5,480 |

-4,154 |

|

-2,353 |

-5,623 |

-5,185 |

|

Coal |

|

|

|

-244 |

-25 |

-5 |

88 |

168 |

|

Other cash flows |

-987 |

-1,825 |

|

3,001 |

-3,650 |

-3,650 |

|

EBIT margin |

|

|

|

-29% |

-2% |

0% |

5% |

7% |

|

FCF |

3,563 |

10,840 |

|

13,450 |

7,125 |

7,150 |

|

Base metals |

|

|

|

36 |

501 |

1,012 |

962 |

1,733 |

|

Equity shareholders' cash |

702 |

8,574 |

|

12,462 |

5,505 |

5,807 |

|

EBIT margin |

|

|

|

1% |

7% |

15% |

14% |

22% |

|

Dividends and share buy-backs |

-500 |

-1,675 |

|

-3,155 |

0 |

0 |

|

Fertiliser nutrients |

|

|

|

-138 |

-885 |

-109 |

0 |

0 |

|

Excess cash |

202 |

6,899 |

|

9,308 |

5,505 |

5,807 |

|

EBIT margin |

|

|

|

-7% |

-51% |

-122% |

n/a |

n/a |

Cash flow ratios |

|

|

|

|

|

|

||

Others and logistics |

|

|

|

-134 |

-215 |

-534 |

-488 |

-505 |

|

|

|

|

|

|

|

||

EBIT margin |

|

|

|

-84% |

-54% |

-168% |

-127% |

-126% |

|

Working capital days |

0 |

7 |

|

10 |

11 |

9 |

|

Adjusted EBIT - Group production |

|

8,267 |

10,873 |

13,498 |

18,683 |

16,823 |

|

Capex/EBITDA |

45.0% |

27.1% |

|

13.8% |

25.4% |

25.2% |

|||

Income statement ratios |

|

|

|

|

|

|

|

|

|

FCF yield |

6.6% |

15.4% |

|

16.8% |

10.0% |

10.9% |

|

|

|

|

|

|

|

|

|

|

Equity shareholders' yield |

2.6% |

16.9% |

|

17.7% |

8.2% |

8.6% |

||

EBITDA margin |

|

|

|

41.5% |

42.9% |

46.0% |

52.6% |

46.9% |

|

Cash conversion |

0.1x |

1.2x |

|

1.6x |

0.4x |

0.5x |

|

EBIT margin |

|

|

|

28.2% |

30.4% |

36.5% |

44.4% |

38.4% |

|

Valuation |

|

|

|

|

|

|

|

EPS growth |

|

|

|

393% |

44% |

11% |

55% |

-9% |

|

|

|

|

|

|

|

||

Dividend payout ratio |

|

|

|

29% |

20% |

26% |

0% |

0% |

|

SoTP valuation and calculation of target price |

|

|

|

$mn |

$ |

||

Input assumptions |

|

|

|

|

|

|

|

|

|

Ferrous minerals |

|

|

|

|

95,704 |

18.5 |

|

|

|

|

|

|

|

|

|

|

Coal |

|

|

|

|

1,004 |

0.2 |

||

Iron ore fines (62%Fe,CIF China), $/t |

|

58 |

71 |

66 |

88 |

85 |

|

Base metals |

|

|

|

|

9,756 |

1.9 |

|||

Brazil to China freight charge, $/t |

|

|

9 |

15 |

18 |

17 |

22 |

|

Fertiliser nutrients |

|

|

|

|

1,575 |

0.3 |

||

Nickel, $/t |

|

|

|

9,599 |

10,404 |

13,130 |

12,762 |

14,805 |

|

Others and logistics |

|

|

|

|

-7,497 |

-1.5 |

|

Copper, $/t |

|

|

|

4,867 |

6,170 |

6,532 |

6,400 |

6,500 |

|

Total enterprise value |

|

|

|

|

100,541 |

19.5 |

|

Thermal coal, $/t |

|

|

|

64 |

85 |

98 |

85 |

84 |

|

Net debt as at latest year end |

|

|

|

|

-18,161 |

-3.5 |

|

Hard coking coal, $/t |

|

|

|

144 |

188 |

206 |

187 |

170 |

|

Cash used in share buy-backs |

|

|

|

|

-497 |

-0.1 |

|

$/BRL |

|

|

|

3.49 |

3.19 |

3.65 |

3.68 |

3.47 |

|

Other investments |

|

|

|

|

18 |

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

Minority interest (DCF value) |

|

|

|

|

-2,136 |

-0.4 |

Required breakeven price |

|

|

|

|

|

|

|

|

|

Equity value as at 27/3/2019 |

|

|

|

|

79,765 |

15.5 |

|

Iron ore, $/t |

|

|

|

27 |

32 |

25 |

23 |

35 |

|

Rounded to |

|

|

|

|

|

15.5 |

|

Metallurgical coal, $/t |

|

|

|

192 |

152 |

186 |

172 |

151 |

|

Share price on 26/3/2019 |

|

|

|

|

|

13.0 |

|

Nickel, $/t |

|

|

|

8,184 |

9,159 |

8,961 |

9,094 |

8,965 |

|

Expected share price return |

|

|

|

|

|

19.0% |

|

Copper, $/t |

|

|

|

2,898 |

2,345 |

3,385 |

3,449 |

3,027 |

|

Plus: expected dividend yield |

|

|

|

|

|

0.0% |

|

Sales volumes |

|

|

|

|

|

|

|

|

|

Total implied one-year return |

|

|

|

|

|

19.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Iron ore, mnt |

|

|

|

293 |

289 |

309 |

269 |

290 |

|

Share price range, $: |

|

|

|

|

|

|

|

Iron pellets, mnt |

|

|

|

48 |

52 |

57 |

51 |

57 |

|

12-month high on 3/10/2018 |

16.13 |

12-month low on 8/2/2019 |

10.89 |

||||

Nickel, kt |

|

|

|

311 |

294 |

236 |

248 |

264 |

|

Price move since high |

-19.3% |

Price move since low |

|

19.6% |

|||

Copper, kt |

|

|

|

430 |

424 |

385 |

430 |

440 |

|

|

|

|

|

|

|

|

|

Attributable Cu eq volumes, kt |

|

|

5,406 |

5,383 |

5,152 |

4,835 |

5,254 |

|

Calculation of WACC |

|

|

|

|

|

|

||

Volume growth |

|

|

|

3.1% |

-0.4% |

-4.3% |

-6.2% |

8.7% |

|

WACC |

13.5% |

Cost of debt |

|

|

7.0% |

||

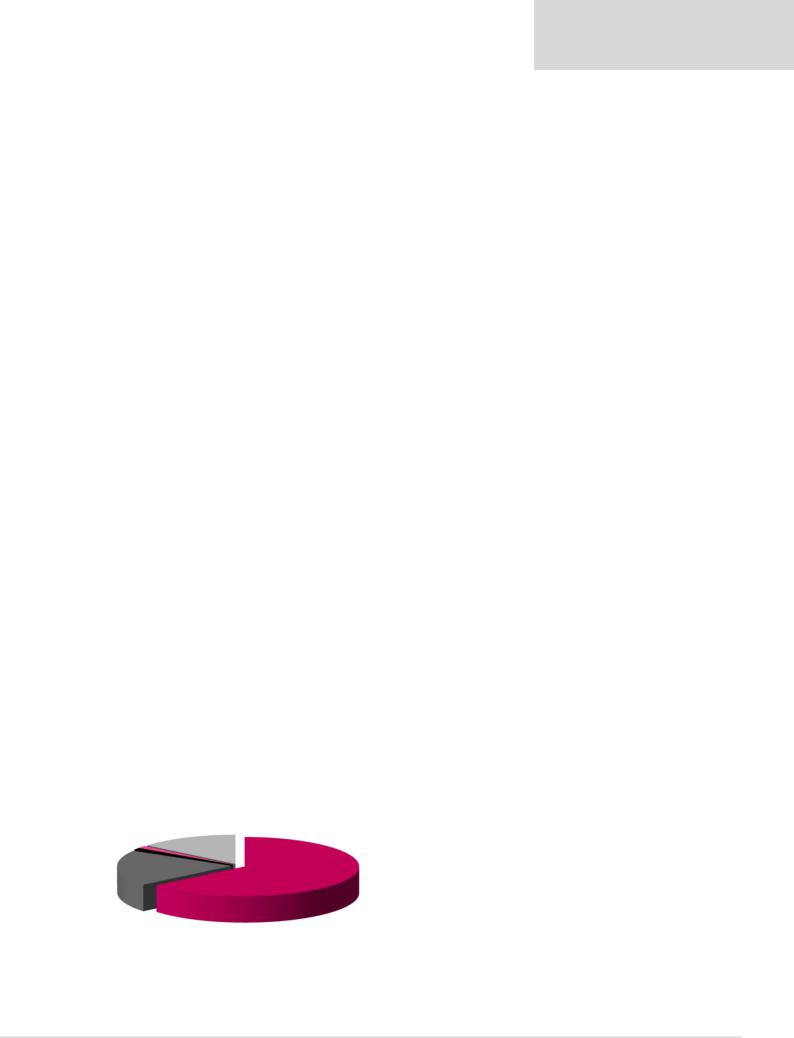

Contribution to FY18E Adjusted EBITDA |

|

|

|

|

|

|

Risk-free rate |

4.0% |

Tax rate |

|

|

30% |

|||||

|

|

|

|

|

|

Equity risk premium |

8.0% |

After-tax cost of debt |

|

4.9% |

|||||||

|

|

Base metals |

|

|

|

|

|

|

Beta |

1.30 |

Debt weighting |

|

10% |

||||

|

Coal |

|

|

|

|

|

|

Cost of equity |

14.4% |

Terminal growth rate |

|

2.0% |

|||||

|

|

14% |

|

|

|

|

|

|

|

|

|||||||

|

1% |

|

|

|

|

|

|

|

|

|

Valuation ratios |

|

|

|

|

|

|

|

Manganese |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1% |

|

|

|

|

|

|

|

|

|

Dec-YE |

2016 |

2017 |

|

2018E |

2019E |

2020E |

|

|

|

|

|

|

|

|

|

|

|

P/E multiple |

5.3x |

7.1x |

|

8.9x |

5.5x |

6.0x |

|

|

|

|

|

|

|

|

|

|

|

Dividend yield |

5.3% |

2.9% |

|

2.9% |

0.0% |

0.0% |

|

|

|

|

|

|

|

|

|

|

|

EV/EBITDA |

4.4x |

4.6x |

|

4.7x |

3.2x |

3.2x |

|

Pellets |

|

|

|

|

|

|

|

|

|

P/B |

0.7x |

1.2x |

|

1.6x |

1.3x |

1.1x |

|

|

|

|

|

|

|

|

|

|

NAV per share, $ |

7.6 |

8.4 |

|

8.4 |

10.1 |

11.5 |

|

|

20% |

|

|

|

|

|

|

Iron ore |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

64% |

|

|

Dividend policy: Minimum payment of 30% of EBITDA less sustaining capex. |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Gearing defined as net debt/(net debt +equity)

Source: Bloomberg, Thomson Reuters, Company data, Renaissance Capital estimates

77

vk.com/id446425943

AngloGold Ashanti – SELL

Renaissance Capital

1 April 2019

Metals & Mining

Figure 124: AngloGold Ashanti, $mn (unless otherwise noted)

|

|

|

|

AngloGold Ashanti |

ANGJ.J |

Target price, ZAR: |

115 |

Market capitalisation, $mn: |

5,940 |

Share price, ZAR: |

205 |

Enterprise value, $mn: |

7,692 |

Potential 12-month return: |

-43.0% |

Dec-YE |

|

2017 |

2018 |

|

2019E |

2020E |

2021E |

Income statement |

|

|

|

|

|

|

|

Revenue |

|

4,809 |

4,386 |

|

4,741 |

5,018 |

4,874 |

Adjusted EBITDA |

1,757 |

1,669 |

|

2,010 |

1,971 |

1,791 |

|

Adjusted EBIT |

797 |

874 |

|

1,174 |

1,075 |

902 |

|

Other items |

|

-696 |

-443 |

|

-290 |

-259 |

-259 |

Net interest |

|

-163 |

-179 |

|

-103 |

-62 |

-35 |

Taxation |

|

-84 |

-137 |

|

-234 |

-226 |

-182 |

Minority interest in profit |

-20 |

-17 |

|

-21 |

-22 |

-19 |

|

Net profit for the year |

-164 |

98 |

|

526 |

507 |

406 |

|

Headline earnings |

27 |

220 |

|

526 |

507 |

406 |

|

Headline EPS, USc |

6 |

53 |

|

126 |

122 |

98 |

|

Thomson Reuters consensus HEPS, USc |

|

|

|

101 |

111 |

111 |

|

DPS declared, USc |

5 |

7 |

|

15 |

12 |

11 |

|

Adjusted EBIT |

-3 |

21 |

|

116 |

98 |

71 |

|

South Africa |

|

|

|||||

EBIT margin |

0% |

3% |

|

20% |

17% |

12% |

|

Continental Africa |

386 |

380 |

|

569 |

580 |

533 |

|

EBIT margin |

20% |

19% |

|

25% |

23% |

22% |

|

Australasia |

|

159 |

160 |

|

269 |

233 |

187 |

EBIT margin |

22% |

21% |

|

29% |

25% |

21% |

|

Americas |

|

253 |

310 |

|

232 |

178 |

125 |

EBIT margin |

23% |

30% |

|

24% |

18% |

12% |

|

Other |

|

2 |

3 |

|

-12 |

-14 |

-14 |

Adjusted EBIT |

797 |

874 |

|

1,174 |

1,075 |

902 |

|

Income statement ratios |

|

|

|

|

|

|

|

EBITDA margin |

37% |

38% |

|

42% |

39% |

37% |

|

EBIT margin |

17% |

20% |

|

25% |

21% |

18% |

|

HEPS Growth |

-78% |

783% |

|

138% |

-4% |

-20% |

|

Dividend payout ratio |

86% |

13% |

|

12% |

10% |

12% |

|

Input assumptions |

|

|

|

|

|

|

|

Gold, $/oz |

|

1,258 |

1,269 |

|

1,350 |

1,337 |

1,311 |

ZAR/$ |

|

13.31 |

13.24 |

|

14.28 |

14.40 |

14.49 |

$/AUD |

|

1.30 |

1.34 |

|

1.37 |

1.28 |

1.25 |

$/BRL |

|

3.19 |

3.65 |

|

3.68 |

3.47 |

3.42 |

$/ARS |

|

16.56 |

28.09 |

|

36.04 |

35.79 |

36.33 |

Gold production volumes, koz |

|

|

|

|

|

|

|

South Africa |

lumes |

902 |

487 |

|

460 |

460 |

460 |

Continental Africa lumes |

1,453 |

1,512 |

|

1,610 |

1,808 |

1,772 |

|

Australasia |

lumes |

560 |

625 |

|

680 |

688 |

688 |

Americas |

lumes |

840 |

776 |

|

695 |

728 |

728 |

Total lumes |

3,755 |

3,400 |

|

3,445 |

3,684 |

3,648 |

|

Volume growth |

3.5% |

-9.5% |

|

1.3% |

6.9% |

-1.0% |

|

Calculated breakeven price, $/oz |

|

|

|

|

|

|

|

South Africa breakeven |

1,261 |

1,210 |

|

1,084 |

1,111 |

1,146 |

|

Continental Africa breakeven |

929 |

893 |

|

884 |

908 |

908 |

|

Australasia breakeven |

1,021 |

1,016 |

|

891 |

949 |

994 |

|

Americas breakeven |

927 |

863 |

|

1,011 |

1,081 |

1,127 |

|

Group breakeven |

1,083 |

1,028 |

|

1,016 |

1,042 |

1,066 |

|

Contribution to FY19E underlying EBITDA |

|

|

|

|

|

||

|

|

Corporate and |

|

South Africa |

|

|

|

|

Americas |

other |

|

|

|

||

|

-2% |

|

9% |

|

|

||

|

21% |

|

|

|

|

|

|

Australasia

22%

Continental Africa

48%

Dec-YE |

|

2017 |

2018 |

|

2019E |

2020E |

2021E |

Balance sheet |

|

|

|

|

|

|

|

Net operating assets |

|

5,506 |

5,029 |

|

5,101 |

4,958 |

4,775 |

Investments, net of rehab provision |

|

-801 |

-680 |

|

-680 |

-680 |

-680 |

Equity |

|

2,663 |

2,652 |

|

3,149 |

3,594 |

3,951 |

Minority interest |

|

41 |

42 |

|

42 |

42 |

42 |

Net debt |

|

2,001 |

1,655 |

|

1,231 |

642 |

102 |

Balance sheet ratios |

|

|

|

|

|

|

|

Gearing (net debt/(net debt+equity)) |

|

42.9% |

38.4% |

|

28.1% |

15.2% |

2.5% |

Net debt to EBITDA |

|

1.1x |

1.0x |

|

0.6x |

0.3x |

0.1x |

RoCE |

|

13.3% |

15.3% |

|

21.4% |

19.7% |

17.1% |

RoIC (after tax) |

|

-3.6% |

3.2% |

|

11.5% |

10.3% |

8.2% |

RoE |

|

1.0% |

8.3% |

|

18.1% |

15.0% |

10.8% |

Cash flow statement |

|

|

|

|

|

|

|

Operating cash flow |

|

1,432 |

1,378 |

|

1,796 |

1,742 |

1,580 |

Capex (net of disposals) |

|

-952 |

-722 |

|

-959 |

-769 |

-688 |

Other cash flows |

|

-472 |

-43 |

|

-290 |

-259 |

-259 |

Free cash flow |

|

8 |

614 |

|

547 |

715 |

633 |

Equity shareholders' cash |

|

-44 |

367 |

|

454 |

650 |

589 |

Dividends and share buy-backs |

|

-41 |

-21 |

|

-29 |

-62 |

-49 |

Surplus (deficit) cash |

|

-85 |

346 |

|

424 |

588 |

540 |

Cash flow ratios |

|

|

|

|

|

|

|

Working capital turnover, days |

|

29 |

34 |

|

29 |

25 |

26 |

FCF yield |

|

0.1% |

11.0% |

|

7.6% |

10.8% |

10.4% |

Equity shareholders' yield |

|

-1.0% |

9.4% |

|

7.6% |

10.9% |

9.9% |

Capex/EBITDA |

|

54.2% |

43.3% |

|

47.7% |

39.0% |

38.4% |

Cash conversion |

|

-1.6x |

1.7x |

|

0.9x |

1.3x |

1.5x |

Valuation |

|

|

|

|

|

|

|

SoTP DCF fair value and calculation of TP |

|

|

|

|

$mn |

ZAR/sh |

|

South Africa |

|

|

|

|

1,174 |

40.6 |

|

Continental Africa |

|

|

|

|

4,694 |

162.3 |

|

Australasia |

|

|

|

|

1,232 |

42.6 |

|

Americas |

|

|

|

|

994 |

34.4 |

|

Corporate and other |

|

|

|

|

-2,342 |

-81.0 |

|

Operating value |

|

|

|

|

5,751 |

198.9 |

|

Financial instruments and rehab provision as at 31 December 2018 |

|

-680 |

-23.5 |

||||

Enterprise value |

|

|

|

|

5,071 |

175.4 |

|

Net debt as at 31 December 2018 |

|

|

|

|

-1,655 |

-57.2 |

|

Minority interest |

|

|

|

|

-97 |

-3.4 |

|

Cash used in share buy-backs during 2019E |

|

|

|

|

0 |

0.0 |

|

Equity value |

|

|

|

|

3,319 |

114.8 |

|

Rounded to |

|

|

|

|

|

115.0 |

|

Share price on 26/3/2019 |

|

|

|

|

|

205.3 |

|

Expected share price return |

|

|

|

|

|

-44.0% |

|

Plus: expected dividend yield |

|

|

|

|

|

1.0% |

|

Total implied one-year return |

|

|

|

|

|

-43.0% |

|

Share price range, ZAR: |

|

|

|

|

|

|

|

12-month high on 20-2-2019 |

223 |

12-month low on 23-5-2018 |

100 |

||||

Price move since high |

-7.9% |

Price move since low |

|

104.9% |

|||

Calculation of WACC |

|

|

|

|

|

|

|

WACC |

7.4% |

Cost of debt |

|

|

5.0% |

||

Risk-free rate |

4.0% |

Tax rate |

|

|

30% |

||

Equity risk premium |

5.0% After-tax cost of debt |

|

1.1% |

||||

Beta |

1.00 |

Debt weighting |

|

30% |

|||

Cost of equity |

9.0% |

Terminal growth rate |

|

2.0% |

|||

Valuation ratios |

|

|

|

|

|

|

|

Dec-YE |

|

2017 |

2018 |

|

2019E |

2020E |

2021E |

P/E multiple |

|

177.4x |

17.6x |

|

11.3x |

11.7x |

14.6x |

Dividend yield |

|

0.5% |

0.7% |

|

1.0% |

0.8% |

0.8% |

EV/EBITDA |

|

3.7x |

3.3x |

|

3.6x |

3.4x |

3.4x |

P/B |

|

1.7x |

1.5x |

|

1.9x |

1.7x |

1.5x |

NAV per share, $ |

|

6.4 |

6.4 |

|

7.6 |

8.6 |

9.5 |

NAV per share, ZAR |

|

85 |

84 |

|

108 |

124 |

138 |

Source: Bloomberg, Thomson Reuters, Renaissance Capital estimates

78