- •Contents

- •Revisions to our forecasts, TPs and ratings

- •Investment stance

- •Capital cycle favours rising returns

- •Comfortable balance sheets and supportive dividend potential

- •Value relative to other stocks

- •Yield potential through the cycle

- •Mid-cycle cash generation offers supportive yields

- •Where to hide if you are bearish

- •What to buy if you are bullish

- •Limited lives weighing down IRR

- •Yields should compensate for limited lives

- •Positive earnings momentum continues to support share prices

- •Commodity price revisions

- •Commodity section

- •Commodity section

- •Preference for base metals over steelmaking materials

- •Earnings revisions

- •Risks and catalysts

- •Peer comp charts

- •Commodity price and exchange rate forecasts

- •Important publications

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Sasol

- •Disclosures appendix

vk.com/id446425943

Peer comp charts

Renaissance Capital

1 April 2019

Metals & Mining

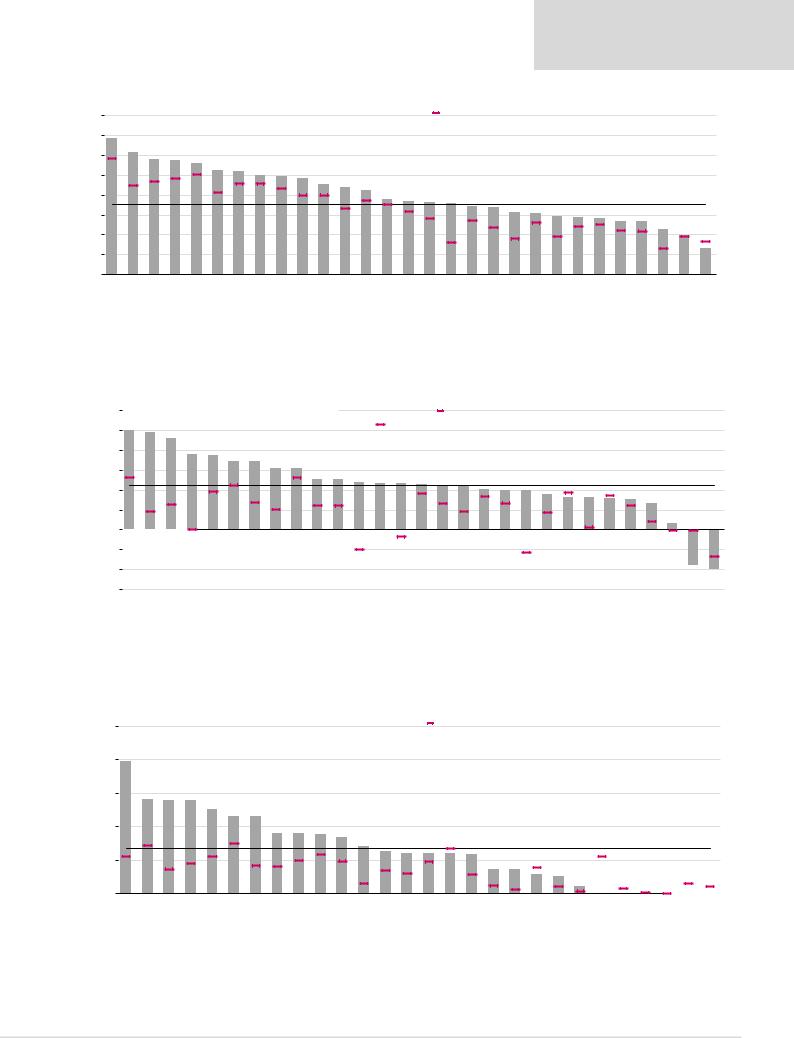

Figure 105: Companies ranked by CY19E EBITDA margins compared with their historical averages

80% |

|

69% |

62% |

58% |

|

||||

70% |

|

|||

|

|

|

|

|

60% |

|

|

|

|

50% |

|

|

|

|

40% |

|

|

|

|

30% |

|

|

|

|

20% |

|

|

|

|

10% |

|

|

|

|

0% |

|

Polyus |

Fortescue |

Norilsk |

|

||||

|

|

*Proportionately consolidated. **Excluding marketing business.

57% |

56% |

53% |

52% |

50% |

49% |

48% |

|

CY19E EBITDA margins |

|

|

LT average |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

46% |

44% |

42% |

38% |

37% |

36% |

36% |

34% |

34% |

31% |

31% |

29% |

29% |

28% |

27% |

27% |

23% |

20% |

13% |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sector average, 35% |

|||

BHP |

Kumba |

Vale |

Alrosa |

Gold Fields |

Polymetal |

Rio Tinto |

Assore* |

ARM* |

AngloGold |

Russian* |

Exxaro* |

Anglo |

Northam |

Others* |

Harmony |

Amplats |

South32 |

Impala |

Sibanye |

Glencore** |

Sasol |

RBPlats |

Lonmin |

Merafe |

Rusal |

||||

Source: Company data, Renaissance Capital estimates

Figure 106: Companies ranked by CY19E FCF yield compared with their historical averages |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CY19E FCF yield |

|

|

LT average |

|

|

|

|

|

|

||||||

25% |

|

25.0%+ |

24.6% |

22.8% |

18.9% |

18.6% |

17.2% |

17.1% |

15.5% |

15.4% |

12.8% |

12.8% |

11.9% |

11.8% |

11.8% |

11.4% |

11.2% |

10.9% |

10.2% |

10.0% |

9.8% |

8.9% |

8.2% |

8.2% |

8.0% |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-15% |

|

Fortescue |

Merafe |

ARM |

Impala |

Rusal |

Kumba |

Assore |

Exxaro |

Alrosa |

Anglo |

BHP |

Harmony |

South32 |

Sibanye |

Russian* |

Polyus |

Others* |

Rio Tinto |

Vale |

Northam |

Polymetal |

Glencore |

Gold Fields |

Norilsk |

||||||

|

|||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||

Sector average, 11.1% |

||

7.6% |

6.7% |

1.7% |

AngloGold |

Amplats |

Sasol |

RBPlats-8.9% |

Lonmin-10.0%+ |

Note: Priced at market close on 26 March 2019.

Source: Company data, Renaissance Capital estimates

Figure 107: Miners ranked by CY19E dividend yield compared with their historical averages

25.0% |

|

19.7% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

20.0% |

|

|

14.1% |

|

|

15.0% |

|

|

13.9% |

13.9% |

|

|

|

|

|

|

|

10.0% |

|

|

|

|

|

5.0% |

|

|

|

|

|

0.0% |

|

Fortescue |

Kumba |

Merafe |

Alrosa |

|

|||||

|

|

Note: Priced at market close on 26 March 2019.

12.6% |

11.6% |

11.5% |

9.0% |

9.0% |

|

|

CY19E Dividend yield |

|

|

LT average |

|

|

|

|

|

|

|

|

|

|

|

|

||||

8.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

8.4% |

7.0% |

6.3% |

6.0% |

5.9% |

5.9% |

5.8% |

3.7% |

3.7% |

2.9% |

2.6% |

1.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sector average, 6.8% |

|

||||

Exxaro |

Norilsk |

Assore |

ARM |

BHP |

Russian* |

|

|

|

|

Polymetal |

Polyus |

Others* |

Rusal |

Amplats |

Sasol |

Gold… |

AngloGold |

Vale |

Impala |

Northam |

|

|

|

|

||

Rio Tinto |

South32 |

Glencore |

Anglo |

RBPlats |

Sibanye |

Harmony |

||||||||||||||||||||

Source: Company data, Renaissance Capital estimates

60