- •Contents

- •Revisions to our forecasts, TPs and ratings

- •Investment stance

- •Capital cycle favours rising returns

- •Comfortable balance sheets and supportive dividend potential

- •Value relative to other stocks

- •Yield potential through the cycle

- •Mid-cycle cash generation offers supportive yields

- •Where to hide if you are bearish

- •What to buy if you are bullish

- •Limited lives weighing down IRR

- •Yields should compensate for limited lives

- •Positive earnings momentum continues to support share prices

- •Commodity price revisions

- •Commodity section

- •Commodity section

- •Preference for base metals over steelmaking materials

- •Earnings revisions

- •Risks and catalysts

- •Peer comp charts

- •Commodity price and exchange rate forecasts

- •Important publications

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Sasol

- •Disclosures appendix

vk.com/id446425943

What to buy if you are bullish

The miners are cheap if incentive pricing prevails

Renaissance Capital

1 April 2019

Metals & Mining

Management teams’ focus on balance-sheet preservation and capital efficiency could result in under-investment in the sector, leading to production declines. Under-investment could therefore underpin a longer-term commodity price recovery, in our view.

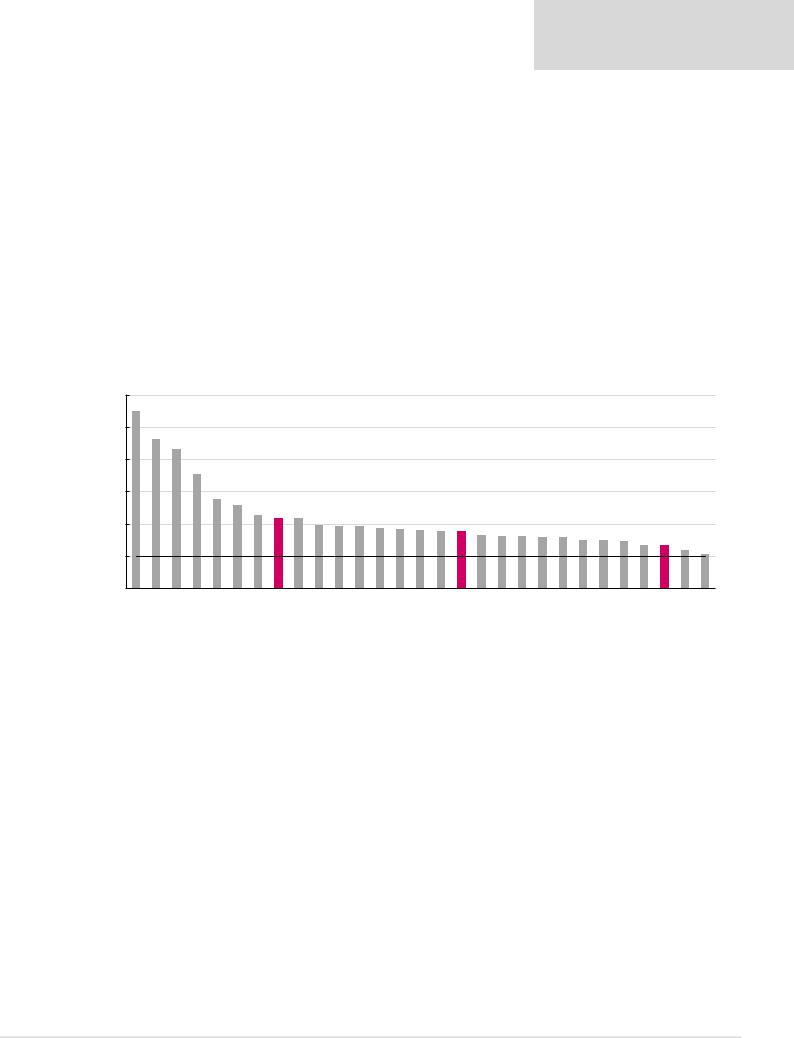

Our peak commodity price assumptions are based on incentive prices, where we assume that the average producer will achieve a 10% IRR on the average greenfield project.

All miners generate WACC-beating returns at our peak prices. We have not incorporated growth capex in this analysis, which would likely be incentivised at our peak commodity prices, resulting in lower cash flow yields and potentially being value-destructive.

Some iron ore producers’ spot FCF yields have already exceeded the estimated FCF yields using incentive prices. While we believe high iron ore prices may be sustained over the medium term given the major supply disruptions in Brazil, we forecast declining iron ore margins in the longer term.

Some miners’ spot FCF yields have already exceed our ‘peak’ levels

Figure 43: CY21E FCF yields calculated using our peak commodity price assumptions

|

60% |

55%+ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50% |

|

46% |

43% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

40% |

|

|

|

35% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

30% |

|

|

|

|

28% |

26% |

23% |

22% |

22% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

20% |

19% |

19% |

19% |

18% |

18% |

18% |

18% |

16% |

16% |

16% |

16% |

16% |

15% |

15% |

14% |

14% |

13% |

12% |

11% |

||||||

|

|

|

|

|

||||||||||||||||||||||||||

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Required rate of return, 10% |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

Rusal |

Lonmin |

Sibanye |

Harmony |

Alrosa |

Gold Fields |

AngloGold |

Gold* |

Vale |

Impala |

ARM |

South32 |

Sasol |

Glencore |

Anglo |

Norilsk |

Diversified* |

Exxaro |

Polymetal |

Polyus |

Assore |

Northam |

Rio Tinto |

Fortescue |

RBPlats |

BHP |

Platinum* |

Kumba |

Amplats |

|

|

|||||||||||||||||||||||||||||

*Industry average.

Note: Priced as at market close on 26 March 2019.

Source: Thomson Reuters, Renaissance Capital estimates

24