- •Contents

- •Revisions to our forecasts, TPs and ratings

- •Investment stance

- •Capital cycle favours rising returns

- •Comfortable balance sheets and supportive dividend potential

- •Value relative to other stocks

- •Yield potential through the cycle

- •Mid-cycle cash generation offers supportive yields

- •Where to hide if you are bearish

- •What to buy if you are bullish

- •Limited lives weighing down IRR

- •Yields should compensate for limited lives

- •Positive earnings momentum continues to support share prices

- •Commodity price revisions

- •Commodity section

- •Commodity section

- •Preference for base metals over steelmaking materials

- •Earnings revisions

- •Risks and catalysts

- •Peer comp charts

- •Commodity price and exchange rate forecasts

- •Important publications

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Sasol

- •Disclosures appendix

vk.com/id446425943

Rusal – BUY

Renaissance Capital

1 April 2019

Metals & Mining

Figure 121: Rusal, $mn (unless otherwise noted) |

|

|

|

Rusal |

0486.HK |

Target price, HKD: |

6.6 |

Market capitalisation, $mn: |

6,854 |

Share price, HKD: |

3.5 |

Enterprise value, $mn: |

14,296 |

Potential 12-month return: |

90.4% |

Dec-YE |

2017 |

2018 |

2019E |

2020E |

2021E |

Income statement |

|

|

|

|

|

Revenue |

9,969 |

10,280 |

10,239 |

10,834 |

11,522 |

Underlying EBITDA |

2,120 |

2,163 |

1,376 |

2,031 |

2,056 |

Underlying EBIT |

1,607 |

1,638 |

852 |

1,456 |

1,481 |

EBIT |

1,523 |

1,481 |

852 |

1,456 |

1,481 |

Net interest |

-855 |

-483 |

-538 |

-452 |

-357 |

Equity accounted income |

620 |

955 |

1,370 |

1,531 |

1,453 |

Taxation |

-66 |

-255 |

-53 |

-171 |

-191 |

Other |

0 |

0 |

0 |

0 |

0 |

Net profit for the year |

1,222 |

1,698 |

1,631 |

2,364 |

2,386 |

Underlying earnings |

1,222 |

1,698 |

1,631 |

2,364 |

2,386 |

Underlying EPS, USc |

8.04 |

11.18 |

10.73 |

15.56 |

15.70 |

Thomson Reuters consensus EPS, USc |

|

|

10.88 |

11.94 |

13.46 |

DPS declared, USc |

1.97 |

0.00 |

1.66 |

2.22 |

2.83 |

Income statement ratios |

|

0.389525 |

|

|

|

|

|

|

|

|

|

EBITDA margin |

21% |

21% |

13% |

19% |

18% |

EBIT margin |

15% |

14% |

8% |

13% |

13% |

EPS growth |

4% |

39% |

-4% |

45% |

1% |

Dividend payout ratio |

24% |

0% |

15% |

14% |

18% |

Input assumptions |

|

|

|

|

|

Aluminium, $/t |

1,968 |

2,110 |

1,950 |

2,200 |

2,307 |

Alumina, $/t |

376 |

480 |

390 |

418 |

388 |

RUB/$ |

58 |

63 |

67 |

69 |

68 |

Estimated aluminium breakeven price, $/t |

1,588 |

1,626 |

1,720 |

1,792 |

1,903 |

Production volumes, kt |

|

|

|

|

|

Aluminium |

|

|

|

|

|

Russia Aluminium |

3,584 |

3,621 |

3,616 |

3,621 |

3,716 |

Other |

144 |

127 |

136 |

136 |

136 |

Total |

3,728 |

3,754 |

3,752 |

3,757 |

3,852 |

Alumina |

|

|

|

|

|

Ireland |

1,938 |

1,875 |

1,872 |

1,872 |

1,872 |

Jamaica |

582 |

501 |

520 |

520 |

520 |

Ukraine |

1,675 |

1,715 |

1,756 |

1,756 |

1,756 |

Russia |

2,821 |

2,762 |

2,620 |

2,620 |

2,620 |

Australia (JV) |

755 |

739 |

744 |

744 |

744 |

Total |

7,772 |

7,774 |

7,892 |

7,992 |

7,992 |

Bauxite |

|

|

|

|

|

Jamaica |

1,954 |

1,792 |

1,920 |

1,920 |

1,920 |

Russia |

5,524 |

5,650 |

5,056 |

5,056 |

5,056 |

Guinea |

3,123 |

4,129 |

5,680 |

6,980 |

6,980 |

Guyana |

1,044 |

1,395 |

1,380 |

1,380 |

1,380 |

Total |

11,646 |

13,847 |

16,736 |

18,336 |

18,336 |

Nepheline |

4,333 |

4,293 |

3,268 |

3,268 |

3,268 |

Aluminium foil and packaging |

101 |

89 |

76 |

76 |

76 |

Sales volumes |

|

|

|

|

|

Aluminium, kt |

3,955 |

3,671 |

4,012 |

3,757 |

3,852 |

Value added products, % of total |

47% |

45% |

46% |

50% |

52% |

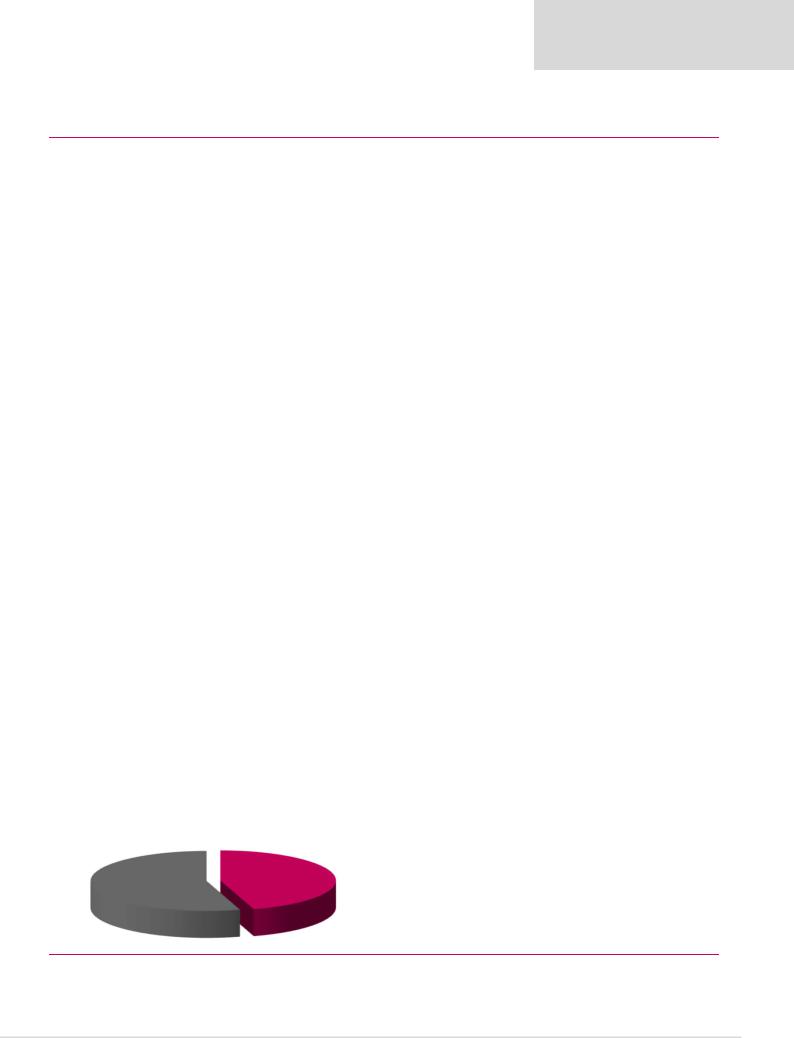

Contribution to enterprise value of $20bn

Norilsk Nickel |

Aluminium |

|

55% |

||

45% |

||

|

Dec-YE |

|

|

|

2019E |

2020E |

2021E |

2017 |

2018 |

|

||||

Balance sheet |

|

|

|

|

|

|

Net operating assets |

12,139 |

12,640 |

|

12,370 |

12,560 |

12,805 |

Financial instruments |

-50 |

11 |

|

11 |

11 |

11 |

Equity |

4,441 |

5,209 |

|

6,588 |

8,615 |

10,570 |

Minority interest |

0 |

0 |

|

0 |

0 |

0 |

Net debt |

7,648 |

7,442 |

|

5,793 |

3,956 |

2,246 |

Balance sheet ratios |

|

|

|

|

|

|

Gearing (net debt/(net debt+equity)) |

63.3% |

58.8% |

|

46.8% |

31.5% |

17.5% |

Net debt/(EBITDA+dividends from associat |

2.6x |

2.4x |

|

2.3x |

1.2x |

0.6x |

RoCE |

12.6% |

12.4% |

|

6.4% |

10.9% |

10.9% |

RoIC (after tax) |

10.3% |

9.1% |

|

5.5% |

9.3% |

9.2% |

RoE |

32.9% |

35.2% |

|

27.6% |

31.1% |

24.9% |

Cash flow statement |

|

|

|

|

|

|

Operating cash flow |

2,561 |

1,462 |

|

3,208 |

3,409 |

3,144 |

Capex |

-842 |

-834 |

|

-850 |

-850 |

-700 |

Other FCF |

-3 |

49 |

|

0 |

0 |

0 |

FCF |

1,717 |

678 |

|

2,358 |

2,559 |

2,444 |

Equity shareholders' cash |

1,072 |

206 |

|

1,901 |

2,175 |

2,141 |

Dividends and share buy backs |

-299 |

0 |

|

-252 |

-337 |

-430 |

Surplus (deficit) cash |

773 |

206 |

|

1,649 |

1,838 |

1,710 |

Cash flow ratios |

|

|

|

|

|

|

Working capital days |

64 |

104 |

|

76 |

64 |

64 |

Cash conversion |

0.9x |

0.1x |

|

1.2x |

0.9x |

0.9x |

FCF yield |

10.4% |

5.1% |

|

18.6% |

23.7% |

26.9% |

Equity shareholders' yield |

12.2% |

3.6% |

|

27.7% |

31.7% |

31.2% |

Capex/(EBITDA+Norilsk dividends) |

28.8% |

27.1% |

|

33.7% |

25.0% |

20.0% |

Valuation |

|

|

|

|

|

|

SoTP DCF valuation and calculation of target price |

|

$mn |

HKD/sh |

|||

Aluminium |

|

|

|

|

9,195 |

4.8 |

Norilsk Nickel |

|

|

|

|

11,084 |

5.7 |

Total enterprise value |

|

|

|

|

20,279 |

10.5 |

Net debt as at 31 December 2018 |

|

|

|

|

-7,442 |

-3.8 |

Cash used in share buy-backs |

|

|

|

|

0 |

0.0 |

Other investments |

|

|

|

|

11 |

0.0 |

Minority interest |

|

|

|

|

0 |

0.0 |

Equity value as at 27/3/2019 |

|

|

|

|

12,848 |

6.6 |

TP |

|

|

|

|

|

6.6 |

Share price on 26/3/2019 |

|

|

|

|

|

3.5 |

Expected share price return |

|

|

|

|

|

86.4% |

Plus: expected dividend yield |

|

|

|

|

|

4.0% |

Total implied one-year return |

|

|

|

|

|

90.4% |

Share price range, HKD: |

|

|

|

|

|

|

12-month high on 27/3/2018 |

4.8 |

12-month low on 17/4/2018 |

1.3 |

|||

Price move since high |

-26.9% Price move since low |

|

170.2% |

|||

Calculation of discount rate |

|

|

|

|

|

|

WACC |

12.5% |

Cost of debt |

|

|

6.0% |

|

Risk-free rate |

4.0% |

Tax rate |

|

|

15% |

|

Equity risk premium |

8.0% After-tax cost of debt |

|

5.1% |

|||

Beta |

1.30 |

Debt weighting |

|

20% |

||

Cost of equity |

14.4% |

Terminal growth rate |

|

2.0% |

||

Valuation ratios |

|

|

|

|

|

|

Dec-YE |

2017 |

2018 |

|

2019E |

2020E |

2021E |

P/E multiple |

7.2x |

3.4x |

|

4.2x |

2.9x |

2.9x |

Dividend yield |

3.4% |

0.0% |

|

3.7% |

4.9% |

6.3% |

EV/(EBITDA+Equity income) |

6.0x |

4.2x |

|

4.6x |

3.0x |

2.6x |

P/B |

2.0x |

1.1x |

|

1.0x |

0.8x |

0.6x |

NAV per share, USc |

29.2 |

34.3 |

|

43.4 |

56.7 |

69.6 |

NAV per share, HKD |

2.3 |

2.7 |

|

3.4 |

4.5 |

5.5 |

Source: Bloomberg, Thomson Reuters, Company data, Renaissance Capital estimates

75

vk.com/id446425943

South32 – HOLD

Renaissance Capital

1 April 2019

Metals & Mining

Figure 122: South32, $mn (unless otherwise noted)

|

|

|

|

South32 (Pro forma historic financials) |

S32J.J |

Target price, ZAR: |

40.0 |

Market capitalisation, $mn: |

13,214 |

Share price, ZAR: |

38.1 |

Enterprise value, $mn: |

10,927 |

Potential 12-month return: |

11.6% |

Jun-YE |

|

|

2017 |

2018 |

2019E |

2020E |

2021E |

Income statement |

|

|

|

|

|

|

|

Revenue |

|

|

6,950 |

7,549 |

7,772 |

7,895 |

8,238 |

Underlying EBITDA |

|

|

2,411 |

2,516 |

2,559 |

2,378 |

2,521 |

Underlying EBIT |

|

|

1,648 |

1,774 |

1,771 |

1,559 |

1,698 |

Net interest |

|

|

-171 |

-100 |

-97 |

-91 |

-72 |

Taxation |

|

|

-393 |

-287 |

-411 |

-356 |

-414 |

Minority interest in profit |

|

|

0 |

0 |

0 |

0 |

0 |

Attributable profit |

|

|

1,231 |

1,332 |

1,246 |

1,112 |

1,212 |

Underlying earnings |

|

|

1,146 |

1,327 |

1,253 |

1,112 |

1,212 |

Underlying EPS, USc |

|

|

21.6 |

25.7 |

24.8 |

22.2 |

24.2 |

Thomson Reuters consensus, USc |

|

|

|

25.7 |

25.6 |

25.7 |

|

DPS declared, USc |

|

|

10.0 |

13.5 |

16.6 |

17.8 |

19.4 |

Underlying EBIT |

|

|

520 |

870 |

868 |

941 |

1,003 |

Aluminium |

|

|

|||||

EBIT margin |

|

|

16% |

21% |

20% |

21% |

22% |

Manganese |

|

|

577 |

837 |

786 |

470 |

409 |

EBIT margin |

|

|

46% |

52% |

48% |

33% |

29% |

Nickel |

|

|

-16 |

120 |

30 |

55 |

101 |

EBIT margin |

|

|

-4% |

21% |

6% |

11% |

18% |

Cannington |

|

|

308 |

183 |

107 |

164 |

201 |

EBIT margin |

|

|

40% |

31% |

22% |

29% |

33% |

Energy Coal South Africa |

|

|

212 |

276 |

78 |

114 |

149 |

EBIT margin |

|

|

19% |

20% |

6% |

9% |

11% |

Illawarra Metallurgical Coal |

|

|

358 |

-62 |

304 |

122 |

121 |

EBIT margin |

|

|

32% |

-9% |

27% |

11% |

11% |

Other |

|

|

-311 |

-450 |

-401 |

-306 |

-287 |

Underlying EBIT |

|

|

1,648 |

1,774 |

1,771 |

1,559 |

1,698 |

Income statement ratios |

|

|

|

|

|

|

|

EBITDA margin |

|

|

35% |

33% |

33% |

30% |

31% |

EBIT margin |

|

|

24% |

23% |

23% |

20% |

21% |

EPS growth |

|

|

731% |

19% |

-4% |

-10% |

9% |

Dividend payout ratio |

|

|

46% |

53% |

67% |

80% |

80% |

Input assumptions |

|

|

|

|

|

|

|

Aluminium, $/t |

|

|

1,772 |

2,133 |

1,945 |

2,080 |

2,277 |

Manganese ore (44%, CIF China), $/mtu |

|

5.72 |

6.79 |

6.45 |

5.24 |

5.41 |

|

Silver, $/oz |

|

|

18 |

17 |

16 |

18 |

18 |

Hard coking coal, $/t |

|

|

190 |

200 |

204 |

170 |

167 |

$/AUD |

|

|

0.75 |

0.78 |

0.72 |

0.76 |

0.80 |

Required breakeven price |

|

|

|

|

|

|

|

Aluminium, $/t |

|

|

1,389 |

1,747 |

1,861 |

1,774 |

1,824 |

Manganese ore, $/dmtu |

|

|

2.36 |

2.96 |

3.15 |

3.11 |

3.31 |

Silver, $/oz |

|

|

-2.34 |

1.90 |

5.90 |

1.12 |

-0.23 |

Metallurgical coal, $/t |

|

|

117 |

206 |

129 |

136 |

133 |

Sales volumes (South32's share) |

|

|

|

|

|

|

|

Aluminium, kt |

|

|

986 |

985 |

983 |

988 |

988 |

Silver, mn oz |

|

|

16.3 |

12.0 |

12.0 |

10.9 |

11.5 |

Metallurgical coal, mnt |

|

|

6.0 |

2.9 |

5.1 |

5.8 |

6.0 |

Manganese ore, mnt |

|

|

5.1 |

5.4 |

5.3 |

5.4 |

5.4 |

Attributable Cu eq volumes, kt |

|

1,227 |

1,166 |

1,195 |

1,219 |

1,222 |

|

Volume growth |

|

|

-6.6% |

-5.0% |

2.5% |

2.0% |

0.3% |

|

|

|

|

|

|

||

Contribution to FY19E underlying EBITDA |

|

|

|

|

|

||

|

Illawarra |

|

|

|

|

|

|

Metallurgical Coal |

|

|

|

Aluminium |

|

||

Cannington |

17% |

|

|

|

|

39% |

|

6% |

|

|

|

|

|

|

|

Energy Coal South

Africa

5%

Nickel

4%

Manganese

29%

Jun-YE |

|

|

|

|

|

|

|

|

2017 |

2018 |

|

2019E |

2020E |

2021E |

|

Balance sheet |

|

|

|

|

|

|

|

Net operating assets |

|

8,027 |

7,977 |

|

9,580 |

9,507 |

9,507 |

Rehab provision net of investments |

|

568 |

691 |

|

394 |

402 |

410 |

Equity |

|

10,236 |

10,710 |

|

10,965 |

11,157 |

11,428 |

Minority interest |

|

-1 |

-1 |

|

-1 |

-1 |

-1 |

Net debt (cash) |

|

-1,640 |

-2,041 |

|

-990 |

-1,247 |

-1,510 |

Balance sheet ratios |

|

|

|

|

|

|

|

Gearing (net debt/(net debt+equity)) |

|

-19.1% |

-23.5% |

|

-9.9% |

-12.6% |

-15.2% |

Net debt to EBITDA |

|

-0.7x |

-0.8x |

|

-0.4x |

-0.5x |

-0.6x |

RoCE |

|

15.7% |

17.3% |

|

16.1% |

13.3% |

14.5% |

RoIC (after tax) |

|

15.1% |

15.5% |

|

11.7% |

10.1% |

10.9% |

RoE |

|

12.5% |

12.7% |

|

11.5% |

10.1% |

10.7% |

Cash flow statement |

|

|

|

|

|

|

|

Operating cash flow |

|

2,350 |

2,015 |

|

2,145 |

2,042 |

2,075 |

Capex (net of disposals) |

|

-316 |

-430 |

|

-667 |

-643 |

-813 |

Other cash flow |

|

162 |

-29 |

|

-1,805 |

-150 |

0 |

FCF |

|

2,196 |

1,556 |

|

-327 |

1,249 |

1,262 |

Equity shareholders' cash |

|

1,783 |

1,363 |

|

-97 |

1,177 |

1,204 |

Dividends and share buy backs |

|

-455 |

-962 |

|

-953 |

-920 |

-940 |

Excess cash |

|

1,328 |

401 |

|

-1,051 |

257 |

263 |

Cash flow ratios |

|

|

|

|

|

|

|

Working capital days |

|

38 |

46 |

|

41 |

39 |

38 |

Capex/EBITDA |

|

15.1% |

21.2% |

|

32.0% |

30.7% |

35.7% |

FCF yield |

|

26.4% |

13.7% |

|

-2.7% |

10.4% |

10.8% |

Equity shareholders' yield |

|

17.9% |

10.2% |

|

-0.7% |

8.9% |

9.1% |

Cash conversion |

|

1.6x |

1.0x |

|

-0.1x |

1.1x |

1.0x |

Capital returns/market cap |

|

4.6% |

7.2% |

|

7.2% |

7.0% |

7.1% |

Valuation |

|

|

|

|

|

|

|

Calculation of TP |

|

|

|

|

$mn |

ZAR/sh |

|

Aluminium |

|

|

|

|

7,142 |

20.6 |

|

Manganese |

|

|

|

|

1,833 |

5.3 |

|

Nickel |

|

|

|

|

673 |

1.9 |

|

Cannington |

|

|

|

|

927 |

2.7 |

|

Hermosa |

|

|

|

|

1,867 |

5.4 |

|

Energy Coal South Africa |

|

|

|

|

621 |

1.8 |

|

Illawarra Metallurgical Coal |

|

|

|

|

868 |

2.5 |

|

Corporate and other |

|

|

|

|

-2,610 |

-7.5 |

|

Enterprise value as at 27-3-2019 |

|

|

|

|

11,321 |

32.6 |

|

Investments as at 30 June 2018 |

|

|

|

|

691 |

2.0 |

|

Cash used in share buy-backs during 2019E |

|

|

|

|

-294 |

-0.8 |

|

Net cash (debt) as at 30 June 2018 |

|

|

|

|

2,041 |

5.9 |

|

Equity value as at 2-9-2016 |

|

|

|

|

13,759 |

39.6 |

|

Rounded to |

|

|

|

|

|

40.0 |

|

Share price on 26/3/2019 |

|

|

|

|

|

38.1 |

|

Expected share price return |

|

|

|

|

|

5.1% |

|

Plus: expected dividend yield |

|

|

|

|

|

6.4% |

|

Total implied one-year return |

|

|

|

|

|

11.6% |

|

Share price range, ZAR: |

|

|

|

|

|

|

|

12-month high on 4/10/2018 |

45 |

12-month low on 28/3/2018 |

29 |

||||

Price move since high |

-14.6% Price move since low |

|

32.6% |

||||

Calculation of discount rate |

|

|

|

|

|

|

|

WACC |

10.1% |

Cost of debt |

|

|

4.0% |

||

Risk-free rate |

4.0% |

Tax rate |

|

|

30% |

||

Equity risk premium |

5.0% After-tax cost of debt |

|

2.8% |

||||

Beta |

1.30 |

Debt weighting |

|

5% |

|||

Cost of equity |

10.5% |

Terminal growth rate |

|

2.0% |

|||

Valuation ratios |

|

|

|

|

|

|

|

Jun-YE |

|

2017 |

2018 |

|

2019E |

2020E |

2021E |

P/E multiple |

|

8.8x |

10.2x |

|

10.7x |

11.9x |

10.9x |

Dividend yield |

|

5.2% |

5.2% |

|

6.3% |

6.7% |

7.3% |

Capital returns/market cap |

|

4.6% |

7.2% |

|

7.2% |

7.0% |

7.1% |

EV/EBITDA |

|

3.4x |

4.5x |

|

4.8x |

5.0x |

4.6x |

P/B |

|

1.0x |

1.3x |

|

1.2x |

1.2x |

1.2x |

NAV per share, $ |

|

2.0 |

2.1 |

|

2.2 |

2.2 |

2.3 |

NAV per share, ZAR |

|

27 |

27 |

|

31 |

32 |

33 |

Source: Bloomberg, Thomson Reuters, Company data, Renaissance Capital estimates

76