- •Contents

- •Revisions to our forecasts, TPs and ratings

- •Investment stance

- •Capital cycle favours rising returns

- •Comfortable balance sheets and supportive dividend potential

- •Value relative to other stocks

- •Yield potential through the cycle

- •Mid-cycle cash generation offers supportive yields

- •Where to hide if you are bearish

- •What to buy if you are bullish

- •Limited lives weighing down IRR

- •Yields should compensate for limited lives

- •Positive earnings momentum continues to support share prices

- •Commodity price revisions

- •Commodity section

- •Commodity section

- •Preference for base metals over steelmaking materials

- •Earnings revisions

- •Risks and catalysts

- •Peer comp charts

- •Commodity price and exchange rate forecasts

- •Important publications

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Sasol

- •Disclosures appendix

vk.com/id446425943

Investment stance

Renaissance Capital

1 April 2019

Metals & Mining

We have a neutral outlook on the metals & mining sector following strong share-price recoveries since 2016’s lows. While the mining sector still screens cheaply on near-term valuation multiples, we believe margin forecasts are approaching optimistic levels in some cases, which may not be sustainable over the long term.

Sector capex has been cut to a level that could result in supply deficits over the medium term. This could support favourable commodity prices and sector returns. We believe management teams continue to focus on value-creation through productivity, costcontainment and capital efficiency rather than volume growth, which is often valuedestructive. However, we see a risk that a cyclical slowdown in commodity demand could result in falling commodity prices.

Sector capex has been cut to a level that could result in supply deficits

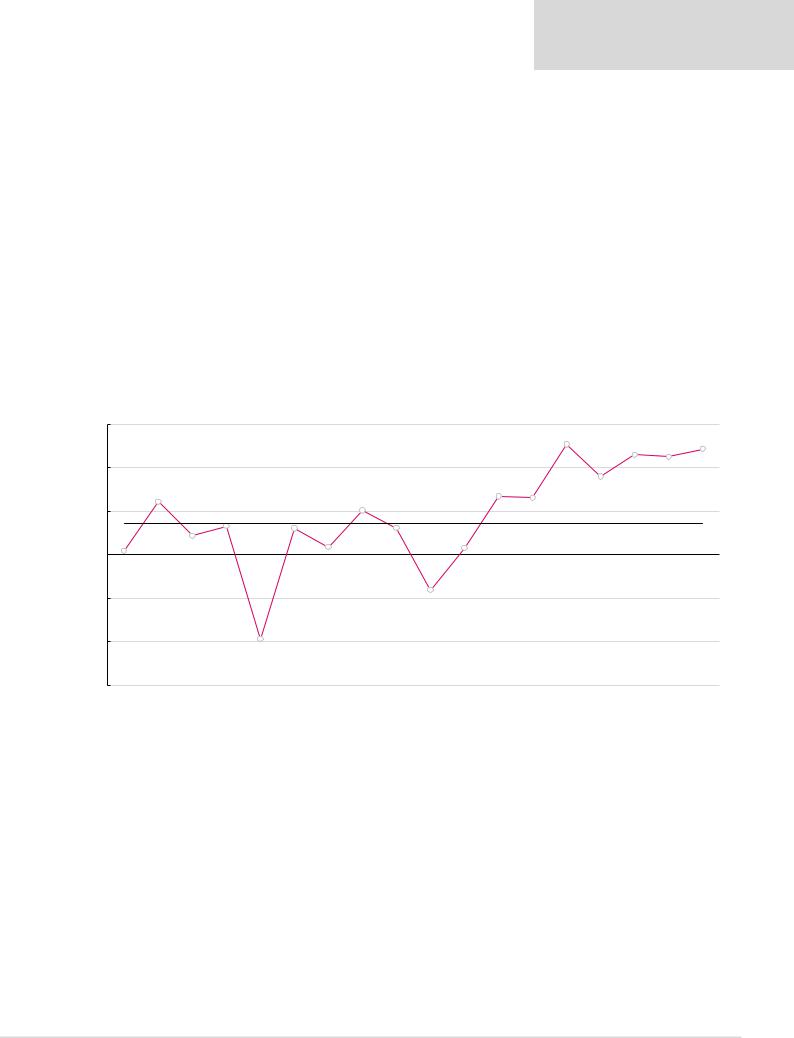

Attractive spot FCF yields

We calculate that the sector generated higher FCF yields over the past three years than anything achieved in the previous decade. Spot FCF is still at attractive levels, in our view, compared with the previous decade.

Figure 2: Market cap-weighted FCF yield*, % per calendar year ($ terms)

15% |

|

|

|

|

|

|

|

|

|

|

|

|

13% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12% |

|

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11% |

12% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6% |

|

|

|

|

|

|

|

|

|

7% |

|

|

9% |

|

|

|

|

|

|

|

|

|

5% |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5% |

|

|

3% |

|

3% |

|

|

3% |

|

|

|

7% |

|

Average, 2003-18, 3.6% |

|

||

0% |

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1% |

|

|

|

1% |

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-5% |

|

|

|

|

|

|

|

|

-4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

-15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019E |

|

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Spot |

|

Note: Priced at market close on 26 March 2019.

*FCF yield is determined using equity shareholders' cash flow.

Source: Company data, Thomson Reuters Datastream, Renaissance Capital estimates

4

vk.com/id446425943

Renaissance Capital

1 April 2019

Metals & Mining

But margin outlook is approaching optimistic levels

We forecast near-term margins exceeding the average over the past 16 years, which included the commodity super-cycle. Our long-term margin forecasts are now only slightly below the average over the past 16 years.

Figure 3: EBITDA per copper equivalent unit (2019 real) for diversified miners under coverage, $/t

7,000

6,000

5,000

4,000

$/t

3,000

2,000

1,000

0

|

|

|

|

|

|

|

|

6,209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,744 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,691 |

|

|

|

|

2,905 |

|

|

|

Average 2003-18, 3,353 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,320 |

|

|

|

|

|

|

|

|

|

|

|

1,889 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019E |

2020E |

2021E |

2022E |

2023E |

2024E |

|

Source: Company data, Renaissance Capital estimates

Since January 2016 we have increased our long-term margin forecasts (beyond 2023) for the mining sector by 77% on the back of the industry’s supply discipline, recovering commodity prices and a more optimistic demand outlook.

Figure 4: Increase in long-term EBITDA per copper equivalent tonne margin forecasts since January 2016

3,500

|

3,000 |

2,905 |

|

|

|

||

|

2,500 |

|

|

|

|

||

|

2,000 |

|

|

$/t |

1,645 |

||

|

|||

|

|

||

|

1,500 |

|

|

|

|

1,000

500

0

January 2016 |

Current |

Source: Renaissance Capital estimates

Our long-term margin forecasts have increased over 70% since 2016

5

vk.com/id446425943

Renaissance Capital

1 April 2019

Metals & Mining

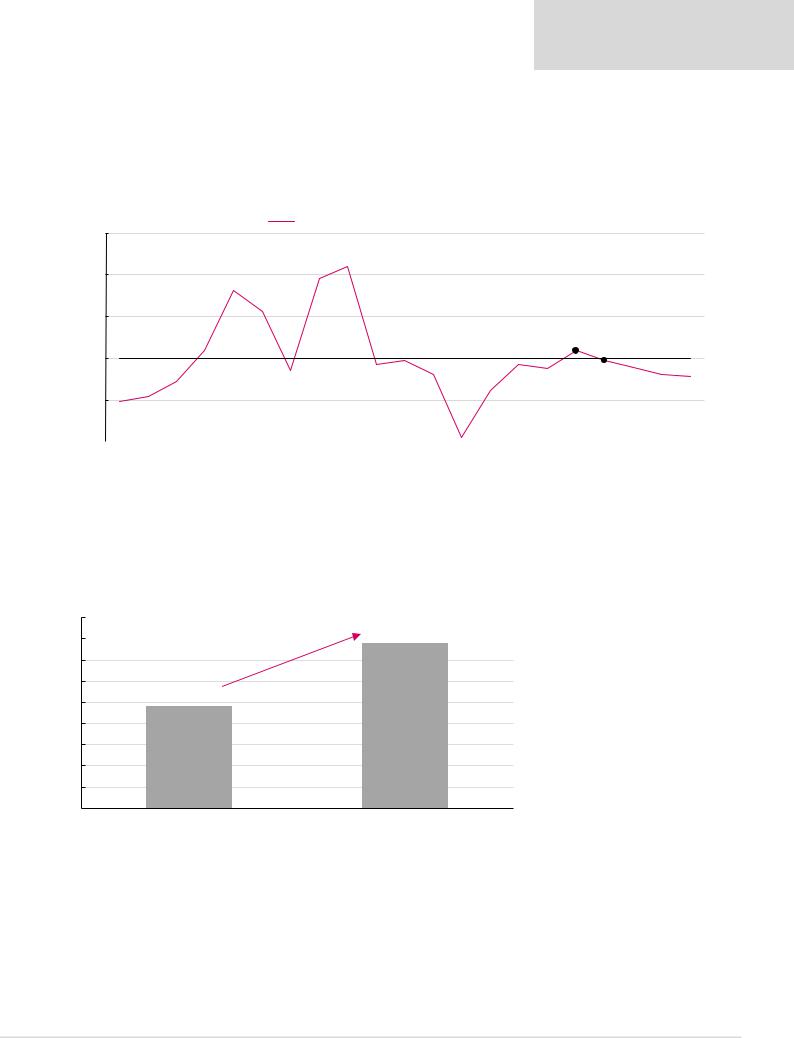

And our return forecasts are approaching levels which could incentivise new supply…

While our long-term commodity price and return forecasts are below super-cycle averages, we believe low cost producers may be incentivised to add new supply when industry average returns are around 8%.

Figure 5: Return on incremental capital (RoIC), based on assets at estimated replacement cost |

|

|

|

|

|

RoIC, based on assets at estimated replacement cost |

|

|

|

25% |

|

|

|

|

|

21.0% |

|

|

|

20% |

18.1% |

|

|

|

|

|

|

|

|

15% |

|

|

|

|

|

Estimated incentive return, 10% |

10.9% |

|

|

|

|

|

|

|

10% |

|

|

|

|

|

8.5% |

8.8% |

9.7% |

7.8% |

|

|

|

||

|

|

|

|

|

5% |

4.9% |

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

0.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019E |

2020E |

2021E |

2022E |

2023E |

|

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

||||||

Note: Chart includes Alrosa, Anglo American, ARM, Assore, BHP, Exxaro, Fortescue, Glencore, Kumba, Norilsk, Rio Tinto, South32 and Vale.

Source: Company data, Renaissance Capital estimates

Since January 2016 our long-term average sector return forecasts have increased from 4.8% to 7.8%. This was driven by an increase in our long-term commodity price and margin forecasts as discussed.

Figure 6: Increase in long-term returns at replacement cost forecasts since January 2016 |

Our long-term return forecasts have |

||

|

|

||

9% |

|

increased over 60% since 2016 |

|

7.8% |

|||

8% |

|

||

|

|

||

7%

6%

4.8%

5%

4%

3%

2%

1%

0%

January 2016 |

Current |

Source: Renaissance Capital estimates

6

vk.com/id446425943

Renaissance Capital

1 April 2019

Metals & Mining

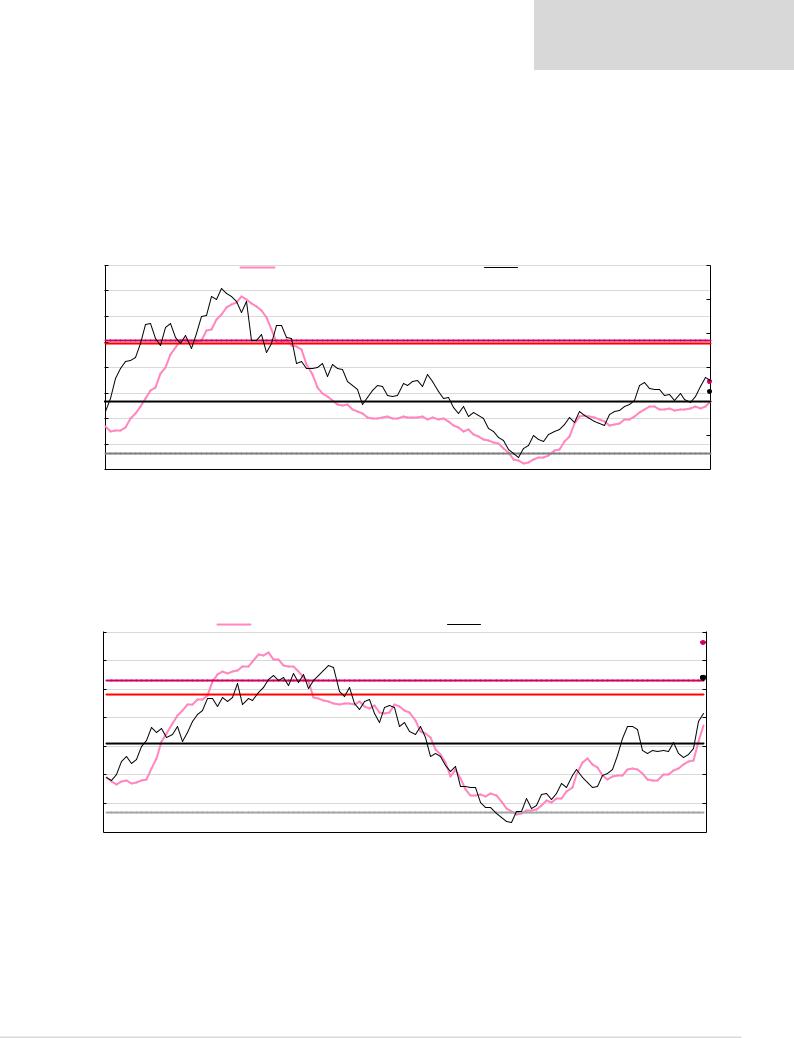

Positive earnings momentum, but earnings now above our mid-cycle estimate

Positive earnings momentum

Earnings momentum remains positive and we calculate further upside risk to consensus earnings forecasts if spot commodity prices prevail. In chart below we calculate ‘mid-cycle EPS’ using our long-term commodity price forecasts, which are around the 90th percentile of cost curves. We calculate ‘peak EPS using incentive prices’ using commodity prices which will result in a 10% IRR on greenfield projects with industry average cash costs and capital intensity.

Figure 7: Anglo American – consensus earnings momentum vs share price |

|

|

|

|

|

|

|||||

|

8 |

|

|

Forward 12M EPS |

|

|

Share price, $ (RHS) |

|

60 |

||

|

7 |

|

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

2011 reported peak EPS, 5.06 |

|

|

|

|

|

|

|

40 |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$/share |

|

Peak EPS using incentive prices, |

4.96 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

12M forward spot EPS est., 3.44 |

|

||

|

3 |

Mid cycle EPS, 2.67 |

|

|

|

|

|

|

12M forward RenCap EPS est., 3.05 |

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

10 |

|

2015 reported trough EPS, 0.64 |

|

|

|

|

|

|

|

|

||

|

0 |

|

|

|

|

|

|

|

|

|

0 |

|

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

Source: Company data, Thomson Reuters Datastream, Bloomberg, Renaissance Capital

Kumba’s estimated spot EPS of ZAR66.20 implies what we view as a cheap P/E multiple of only 6.1x. However, spot earnings are well above previously reported peak levels during the super-cycle and may not be sustained over the long term.

Figure 8: Kumba Iron Ore – consensus earnings momentum vs share price

|

70 |

|

|

Forward 12M EPS |

|

|

|

Share price, ZAR (RHS) |

700 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

12M forward spot EPS est., 66.20 |

|

|

60 |

|

|

|

|

|

|

|

|

600 |

|

|

2011 reported peak EPS, 53.13 |

|

|

|

|

12M forward RenCap EPS est., 53.97 |

|||

|

50 |

|

|

|

|

|

|

|

|

500 |

ZAR/share |

|

|

|

|

|

|

Peak EPS using incentive prices, |

48.25 |

||

40 |

|

|

|

|

|

|

|

|

400 |

|

|

Mid-cycle EPS, 31.14 |

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

300 |

|

|

|

|

|

|

|

|

|

|

||

|

20 |

|

|

|

|

|

|

|

|

200 |

|

10 |

2006 reported trough EPS, 6.77 |

|

|

|

|

|

|

100 |

|

|

0 |

|

|

|

|

|

|

|

|

0 |

|

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Company data, Thomson Reuters Datastream, Bloomberg, Renaissance Capital

7

vk.com/id446425943

Renaissance Capital

1 April 2019

Metals & Mining

Diversified miners seem almost fairly valued considering midcycle earnings generation potential

Anglo American’s (as a proxy for diversified miners) P/E multiple based on mid-cycle |

|

Anglo on 1.7x P/E in 2016 |

||||||||

earnings of $2.67/share is 10.3x, which is slightly below its long-term average of 11.3x. In |

|

|

|

|||||||

January 2016 Anglo American traded at only 1.7x its normalised earnings. |

|

|

|

|

|

|||||

Figure 9: Anglo American – P/E multiple using mid-cycle EPS |

|

|

|

|

|

|

|

|||

30x |

|

|

|

|

|

|

|

|

|

|

25x |

|

22.6x |

|

|

|

|

|

|

|

|

20x |

|

|

|

|

|

|

|

|

|

|

15x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10year average, 11.3x |

|

|

10.3x |

|

|

|

|

|

|

|

|

|

|

|

10x |

|

|

|

|

|

|

|

|

|

|

5x |

|

|

|

|

|

|

|

|

|

|

0x |

|

|

|

|

|

|

1.7x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mar 09 |

Mar 10 |

Mar 11 |

Mar 12 |

Mar 13 |

Mar 14 |

Mar 15 |

Mar 16 |

Mar 17 |

Mar 18 |

Mar 19 |

Source: Thomson Reuters DataStream, Renaissance Capital

BHP’s P/E multiple based on mid-cycle earnings of $2.00/share is 12.5x, which is also below its long-term average of 13.2x.

Figure 10: BHP – P/E multiple using mid-cycle EPS

25x |

|

|

|

|

|

|

23.1x |

|

|

|

|

|

|

|

|

|

|

|

|

21.5x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20x |

|

|

|

|

|

|

|

|

|

|

18.5x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.5x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10year average, 13.2x |

|

|

|

|

|

|

||

10x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5x |

|

|

|

|

|

|

|

|

|

|

|

5.4x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mar-04 |

Mar-05 |

Mar-06 |

Mar-07 |

Mar-08 |

Mar-09 |

Mar-10 |

Mar-11 |

Mar-12 |

Mar-13 |

Mar-14 |

Mar-15 |

Mar-16 |

Mar-17 |

Mar-18 |

Mar-19 |

Source: Thomson Reuters DataStream, Renaissance Capital

8

vk.com/id446425943

Renaissance Capital

1 April 2019

Metals & Mining

Kumba’s P/E multiple based on its mid-cycle earnings of ZAR31.14/share is 14.4x, which looks expensive to us considering its relatively shorter remaining mine life of around 20 years. However, surprisingly it’s in line with its long-term average of 14.2x.

We believe the market may be willing to pay a premium for Kumba given its capital efficiency |

Market seems willing to pay a |

and high dividend payout ratio, which usually translates into supportive dividend yields. |

premium for Kumba |

Figure 11: Kumba Iron Ore – P/E multiple using mid-cycle EPS

30x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26.1x |

|

|

|

|

|

|

|

|

|

|

|

|

|

25x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15x |

|

|

|

|

10year average, 14.2x |

|

|

|

|

|

|

|

|

|

|

|

|

14.4x |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0x |

|

|

|

|

|

|

|

|

|

|

|

|

|

1.6x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mar-09 |

Sep-09 |

Mar-10 |

Sep-10 |

Mar-11 |

Sep-11 |

Mar-12 |

Sep-12 |

Mar-13 |

Sep-13 |

Mar-14 |

Sep-14 |

Mar-15 |

Sep-15 |

Mar-16 |

Sep-16 |

Mar-17 |

Sep-17 |

Mar-18 |

Sep-18 |

Mar-19 |

Source: Thomson Reuters, Renaissance Capital estimates

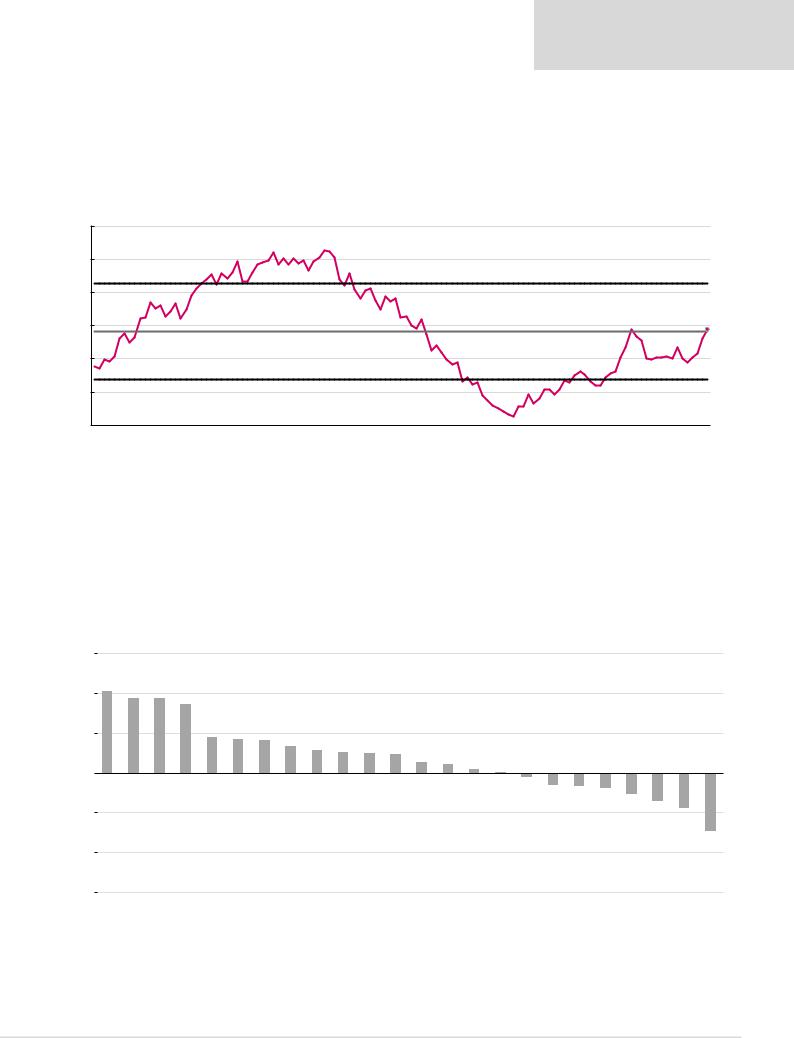

However, many miners still offer more upside if spot prices persist over the medium term

The graph below shows the potential share-price upside we calculate for mining companies relative to our NPV for the stocks if spot commodity prices hold for five years before reverting to our mid-cycle assumptions, which are lower in most cases.

Figure 12: % upside to stocks relative to our NPV if spot prices hold for five years and then revert to mid-cycle FCF generation

150% |

|

102% |

94% |

93% |

86% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

50% |

|

|

|

|

44% |

43% |

41% |

33% |

28% |

26% |

24% |

23% |

13% |

10% |

5% |

1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-5% |

-16% |

-17% |

-20% |

27%- |

36%- |

45%- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-150% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-73%

Fortescue |

Vale |

ARM |

Sibanye |

Exxaro |

Harmony |

Norilsk |

Kumba |

Assore |

Implats |

Gold Fields |

Glencore |

Anglo |

Rio Tinto |

Polymetal |

BHP |

Polyus |

Amplats |

South32 |

AngloGold |

Northam |

RBPlats |

Alrosa |

Lonmin |

Note: Priced as at market close on 26 March 2019

Source: Company data, Thomson Reuters, Renaissance Capital estimates

9