- •Contents

- •Revisions to our forecasts, TPs and ratings

- •Investment stance

- •Capital cycle favours rising returns

- •Comfortable balance sheets and supportive dividend potential

- •Value relative to other stocks

- •Yield potential through the cycle

- •Mid-cycle cash generation offers supportive yields

- •Where to hide if you are bearish

- •What to buy if you are bullish

- •Limited lives weighing down IRR

- •Yields should compensate for limited lives

- •Positive earnings momentum continues to support share prices

- •Commodity price revisions

- •Commodity section

- •Commodity section

- •Preference for base metals over steelmaking materials

- •Earnings revisions

- •Risks and catalysts

- •Peer comp charts

- •Commodity price and exchange rate forecasts

- •Important publications

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Sasol

- •Disclosures appendix

vk.com/id446425943

Assore – HOLD

Renaissance Capital

1 April 2019

Metals & Mining

Figure 113: Assore, ZARmn (unless otherwise noted)

|

|

|

|

Assore |

ASRJ.J |

Target price, ZAR: |

350 |

Market capitalisation, ZARmn: |

50,770 |

Last price, ZAR: |

361 |

Enterprise value, ZARmn: |

44,004 |

Potential 12-month return: |

7.0% |

Jun-YE |

2017 |

2018 |

2019E |

2020E |

2021E |

Income statement |

|

|

|

|

|

Revenue |

5,945 |

6,306 |

6,135 |

6,365 |

6,597 |

Underlying EBITDA |

2,250 |

1,840 |

1,938 |

2,117 |

2,107 |

Underlying EBIT |

2,120 |

1,683 |

1,789 |

1,940 |

1,915 |

Investment and other income |

372 |

649 |

691 |

833 |

1,053 |

Interest paid |

-20 |

-19 |

-43 |

-2 |

0 |

Taxation |

-583 |

-646 |

-696 |

-776 |

-831 |

Equity income |

3,249 |

3,508 |

5,068 |

4,848 |

3,663 |

Minority interest in profit |

-117 |

-56 |

-16 |

0 |

0 |

Net profit for the year |

5,021 |

5,119 |

6,791 |

6,843 |

5,801 |

Headline earnings |

5,209 |

5,109 |

6,793 |

6,843 |

5,801 |

HEPS, ZAc |

5,410 |

4,953 |

6,585 |

6,634 |

5,624 |

Thomson Reuters consensus EPS, ZAc |

4,478 |

4,205 |

6,036 |

4,863 |

4,141 |

EPS incl estimated BEE dilution, ZAc |

5,522 |

5,569 |

4,721 |

||

DPS declared, ZAc |

1,400 |

2,200 |

2,940 |

3,930 |

3,740 |

Underlying EBIT |

1,200 |

704 |

573 |

698 |

745 |

Other mining and trading business |

|||||

EBIT margin |

20% |

11% |

9% |

11% |

11% |

Commissions on sales and technical fees |

920 |

979 |

1,216 |

1,242 |

1,170 |

Total consolidated |

2,120 |

1,683 |

1,789 |

1,940 |

1,915 |

Equity accounted: Assmang |

2,881 |

2,115 |

4,474 |

4,967 |

3,437 |

Iron ore |

|||||

EBIT margin |

36% |

29% |

44% |

45% |

36% |

Manganese |

1,681 |

2,553 |

2,443 |

1,838 |

1,737 |

EBIT margin |

33% |

40% |

34% |

27% |

25% |

Chrome |

-5 |

-29 |

-5 |

0 |

0 |

Underlying EBIT* |

6,677 |

6,322 |

8,700 |

8,745 |

7,089 |

Income statement ratios |

|

|

|

|

|

EBITDA margin * |

41% |

37% |

42% |

42% |

36% |

EBIT margin * |

35% |

31% |

37% |

36% |

30% |

HEPS growth |

220% |

-8% |

33% |

1% |

-15% |

Dividend payout ratio |

38% |

60% |

60% |

80% |

90% |

Input assumptions |

|

|

|

|

|

Iron ore spot (CIF China), $/t |

69 |

67 |

75 |

88 |

83 |

Manganese ore (44%, CIF China), $/mtu |

5.72 |

6.79 |

6.45 |

5.24 |

5.41 |

Ferro Manganese - CIF, $/t |

1,166 |

1,341 |

1,147 |

1,100 |

1,135 |

Chrome ore, $/t |

278 |

207 |

184 |

192 |

202 |

ZAR/$ |

13.60 |

12.85 |

14.18 |

14.40 |

14.41 |

Required breakeven price |

|

|

|

|

|

Iron ore, $/t |

42 |

42 |

32 |

47 |

50 |

Manganese ore, $/mtu |

4.37 |

5.21 |

4.87 |

4.43 |

4.60 |

Chrome ore, $/t |

209 |

151 |

154 |

157 |

165 |

Assmang sales volumes (100%) |

17.3 |

17.9 |

17.5 |

17.4 |

17.4 |

Iron ore, mnt |

|||||

Manganese ore, mnt |

3.0 |

3.2 |

3.3 |

3.5 |

3.7 |

Manganese alloys, kt |

303 |

378 |

384 |

440 |

440 |

Chrome ore, kt |

1,279 |

1,557 |

1,507 |

1,500 |

1,500 |

Attributable Cu eq volumes, kt |

204 |

214 |

210 |

219 |

222 |

Volume growth |

5.7% |

4.5% |

-1.4% |

4.0% |

1.5% |

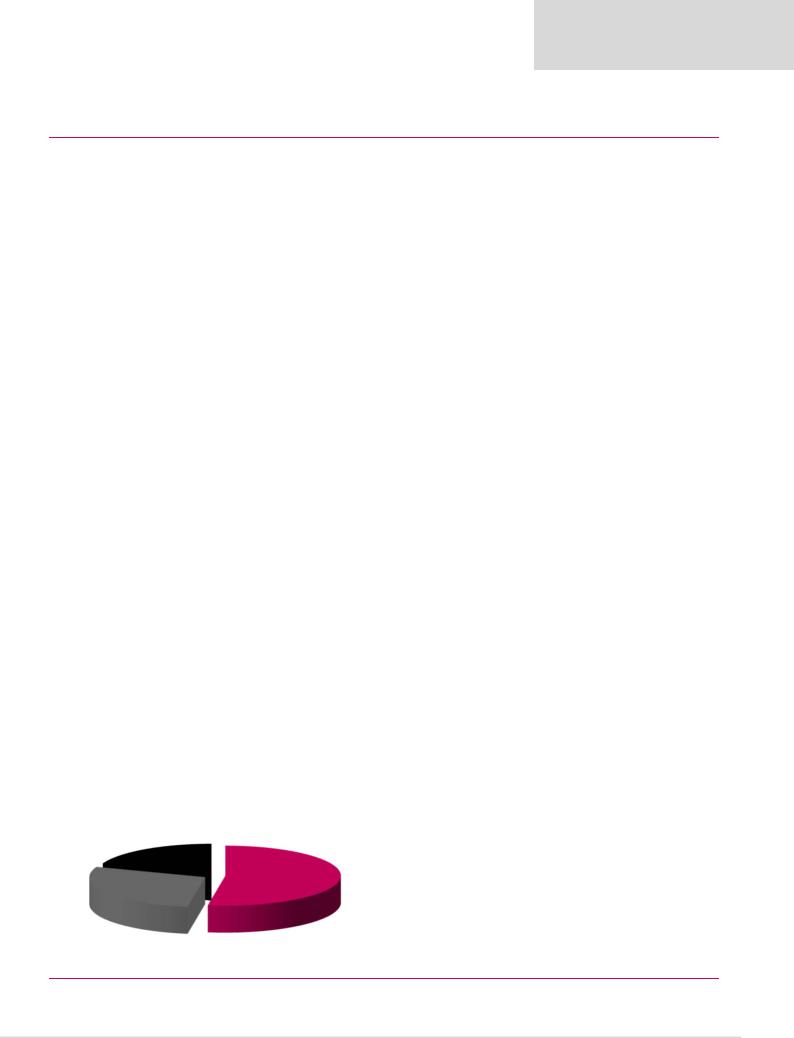

Contribution to FY19E attributable underlying EBITDA

Other mining, trading and

shipping activities

20% Iron ore

52%

Manganese

28%

Jun-YE |

|

|

|

2019E |

2020E |

2021E |

2017 |

2018 |

|

||||

Balance sheet |

|

|

|

|

|

|

Net operating assets |

17,547 |

17,915 |

|

20,148 |

20,320 |

20,404 |

Investments |

253 |

270 |

|

208 |

208 |

208 |

Equity |

22,872 |

26,091 |

|

30,324 |

31,473 |

32,131 |

Minority interest |

-24 |

-41 |

|

-62 |

-62 |

-62 |

Net (cash) debt |

-5,047 |

-7,865 |

|

-9,906 |

-10,883 |

-11,457 |

Balance sheet ratios |

|

|

|

|

|

|

Gearing* |

-28.3% |

-43.2% |

|

-48.5% |

-52.9% |

-55.4% |

Net debt to EBITDA plus equity income |

-0.9x |

-1.5x |

|

-1.4x |

-1.6x |

-2.0x |

RoCE |

39.5% |

35.0% |

|

44.8% |

42.3% |

34.0% |

RoIC (after tax) |

30.8% |

27.3% |

|

34.9% |

33.0% |

26.5% |

RoE (ex. cash) |

28.6% |

25.6% |

|

32.1% |

29.4% |

23.0% |

*net debt/(net debt+equity) |

|

|

|

|

|

|

Cash flow statement |

|

|

|

|

|

|

Operating cash flow |

4,917 |

4,739 |

|

4,522 |

6,437 |

5,334 |

Capex |

-127 |

-367 |

|

-453 |

-364 |

-375 |

Other cash flows |

-1,435 |

-19 |

|

40 |

0 |

0 |

FCF |

3,356 |

4,354 |

|

4,109 |

6,072 |

4,959 |

Equity shareholders' cash |

3,473 |

4,718 |

|

4,599 |

6,671 |

5,717 |

Dividends and share buy-backs |

-1,095 |

-1,900 |

|

-2,559 |

-5,694 |

-5,143 |

Movement in net debt |

2,378 |

2,818 |

|

2,040 |

977 |

575 |

Cash flow ratios |

|

|

|

|

|

|

Working capital days |

30 |

12 |

|

21 |

21 |

17 |

Capex/EBITDA * |

19.8% |

25.6% |

|

23.2% |

20.2% |

21.4% |

FCF yield |

20.2% |

19.4% |

|

14.4% |

22.0% |

18.3% |

Equity shareholders' yield |

16.0% |

15.5% |

|

11.9% |

17.3% |

14.8% |

Cash conversion |

0.7x |

0.9x |

|

0.7x |

1.0x |

1.0x |

Valuation |

|

|

|

|

|

|

SoTP DCF fair value |

|

|

|

|

ZARmn |

ZAR/sh |

Assmang |

|

|

|

|

24,221 |

173 |

Marketing fee |

|

|

|

|

6,229 |

45 |

Other mining and trading |

|

|

|

|

2,756 |

20 |

Other |

|

|

|

|

39 |

0 |

Enterprise value |

|

|

|

|

33,245 |

238 |

Other Investments |

|

|

|

|

270 |

2 |

Net cash (debt) as at 30 June 2018 |

|

|

|

|

7,865 |

56 |

Dividends retained against BEE vendor loans |

|

|

|

3,500 |

25 |

|

DCF fair value for equity |

|

|

|

|

44,880 |

321 |

Plus: equity shareholders' cash/share |

|

|

|

|

|

60 |

Less: DPS |

|

|

|

|

|

-36 |

Rounded to |

|

|

|

|

|

350 |

Share price on 26/3/2019 |

|

|

|

|

|

361 |

Expected share price return |

|

|

|

|

|

-3.1% |

Plus: expected dividend yield |

|

|

|

|

|

10.1% |

Total implied one-year return |

|

|

|

|

|

7.0% |

Share price range, ZAR: |

|

|

|

|

|

|

12-month high on 25/9/2018 |

381 |

12-month low on 20/7/2018 |

252 |

|||

Price move since high |

-1.9% |

Price move since low |

|

48.1% |

||

Calculation of discount rate |

|

|

|

|

|

|

WACC |

15.1% |

Cost of debt |

|

|

9.5% |

|

Risk-free rate |

9.0% |

Tax rate |

|

|

28% |

|

Equity risk premium |

5.0% |

After-tax cost of debt |

|

6.8% |

||

Beta |

1.30 |

Debt weighting |

|

5.0% |

||

Cost of equity |

15.5% |

Terminal growth rate |

|

4.0% |

||

Valuation ratios |

|

|

|

|

|

|

Jun-YE |

2017 |

2018 |

|

2019E |

2020E |

2021E |

P/E multiple |

4.7x |

7.0x |

|

6.8x |

6.7x |

7.9x |

Dividend yield |

6.7% |

7.5% |

|

7.9% |

10.5% |

10.0% |

Average enterprise value, ZARmn |

24,246 |

33,217 |

|

42,245 |

41,268 |

40,694 |

EV/(EBITDA + equity income) |

4.4x |

6.2x |

|

6.0x |

5.9x |

7.1x |

P/B |

1.3x |

1.6x |

|

1.7x |

1.7x |

1.6x |

NAV per share, ZAR |

164 |

187 |

|

217 |

225 |

230 |

Net cash (debt) per share, ZAR |

36 |

56 |

|

71 |

78 |

82 |

* Proportionately consolidated

Source: Bloomberg, Thomson Reuters, Company data, Renaissance Capital estimates

67

vk.com/id446425943

BHP – HOLD

Renaissance Capital

1 April 2019

Metals & Mining

Figure 114: BHP, $mn (unless otherwise noted) |

|

|

|

BHP |

BILJ.J |

Target price, ZAR: |

340 |

Market capitalisation, $mn: |

122,607 |

Share price, ZAR: |

340 |

Enterprise value, $mn: |

146,463 |

Potential 12-month return: |

9.1% |

Jun-YE |

2017 |

2018 |

2019E |

2020E |

2021E |

Income statement |

|

|

|

|

|

Revenue |

38,285 |

43,650 |

45,289 |

48,643 |

47,705 |

Underlying EBITDA |

20,296 |

23,183 |

24,740 |

26,976 |

25,097 |

Underlying EBIT |

12,283 |

16,429 |

18,158 |

20,153 |

18,219 |

Net interest |

-1,431 |

-1,245 |

-1,060 |

-973 |

-948 |

Taxation |

-4,100 |

-7,007 |

-5,697 |

-6,384 |

-5,796 |

Minority interest in profit |

-332 |

-1,118 |

-936 |

-1,078 |

-1,139 |

Attributable profit |

5,890 |

3,705 |

10,082 |

11,718 |

10,336 |

Underlying attributable profit |

6,732 |

8,933 |

10,050 |

11,718 |

10,336 |

Underlying EPS, USc |

127 |

168 |

195 |

232 |

205 |

Thomson Reuters consensus EPS, USc |

|

|

197 |

196 |

171 |

DPS declared, USc |

83 |

118 |

257 |

209 |

205 |

Underlying EBIT |

-777 |

0 |

0 |

0 |

0 |

Petroleum - US onshore |

|||||

EBIT margin |

-36% |

0% |

- |

- |

- |

Petroleum - Conventional |

1,349 |

1,549 |

2,162 |

1,587 |

1,512 |

EBIT margin |

29% |

35% |

38% |

31% |

30% |

Copper |

1,985 |

4,330 |

2,759 |

3,871 |

4,273 |

EBIT margin |

27% |

37% |

27% |

32% |

33% |

Iron ore |

7,174 |

7,194 |

9,462 |

12,089 |

10,335 |

EBIT margin |

49% |

49% |

55% |

60% |

55% |

Coal |

3,050 |

3,683 |

4,001 |

2,848 |

2,341 |

EBIT margin |

40% |

41% |

42% |

34% |

28% |

Other |

-498 |

-327 |

-225 |

-242 |

-243 |

Underlying EBIT |

12,283 |

16,429 |

18,158 |

20,153 |

18,219 |

Income statement ratios |

|

|

|

|

|

EBITDA margin |

55% |

55% |

56% |

57% |

55% |

EBIT margin |

32% |

38% |

40% |

41% |

38% |

EPS growth |

455% |

33% |

16% |

19% |

-12% |

Dividend payout ratio |

66% |

70% |

132% |

90% |

100% |

Input assumptions |

|

|

|

|

|

Brent crude oil, $/bbl |

51 |

64 |

68 |

63 |

61 |

Iron ore fines (62%Fe, CIF China), $/t |

69 |

67 |

75 |

88 |

83 |

Copper, USc/lb |

245 |

306 |

282 |

295 |

306 |

Hard coking coal, $/t |

190 |

200 |

204 |

170 |

167 |

$/AUD |

0.75 |

0.78 |

0.72 |

0.76 |

0.80 |

Oil breakeven price - conventional, $/boe |

29 |

33 |

35 |

40 |

44 |

Copper breakeven price, $/t |

3,752 |

4,001 |

3,943 |

3,914 |

3,974 |

Iron ore breakeven price, $/t |

34 |

34 |

37 |

44 |

44 |

Coking coal breakeven price, $/t |

81 |

92 |

91 |

95 |

104 |

Sales volumes (BHP's share) |

|

|

|

|

|

Petroleum products, MMboe* |

209 |

193 |

120 |

116 |

116 |

Iron ore, mnt |

231 |

237 |

244 |

251 |

251 |

Iron ore - WAIO (100% basis), mnt |

268 |

275 |

279 |

290 |

290 |

Copper - Escondida (100% basis), kt |

767 |

1,209 |

1,146 |

1,200 |

1,200 |

Other copper, kt |

550 |

543 |

531 |

600 |

644 |

Metallurgical coal, mnt |

38 |

41 |

44 |

45 |

45 |

Export thermal coal, mnt |

28 |

28 |

28 |

29 |

29 |

Attributable Cu eq volumes, kt |

5,878 |

6,191 |

5,877 |

6,066 |

6,128 |

Volume growth |

-6.8% |

5.3% |

-5.1% |

3.2% |

1.0% |

Contribution to FY19E underlying EBITDA

|

Conventional |

Coal |

petroleum |

19% |

16% |

|

Copper |

|

20% |

Iron ore |

|

45% |

|

Jun-YE |

|

|

|

2019E |

2020E |

2021E |

2017 |

2018 |

|

||||

Balance sheet |

|

|

|

|

|

|

Net operating assets |

79,194 |

71,636 |

|

62,131 |

63,271 |

64,265 |

Investments |

-147 |

-32 |

|

39 |

39 |

39 |

Equity |

57,258 |

55,592 |

|

48,965 |

49,980 |

50,190 |

Minority interest |

5,468 |

5,078 |

|

4,778 |

4,994 |

5,222 |

Net debt |

16,321 |

10,934 |

|

8,426 |

8,336 |

8,892 |

Balance sheet ratios |

|

|

|

|

|

|

Gearing* |

22.2% |

16.4% |

|

14.7% |

14.3% |

15.1% |

Net debt to EBITDA |

0.8x |

0.5x |

|

0.3x |

0.3x |

0.4x |

RoCE |

13.5% |

19.4% |

|

23.6% |

27.6% |

24.4% |

RoIC |

10.8% |

14.4% |

|

15.8% |

18.3% |

16.4% |

RoE |

12.1% |

15.8% |

|

19.2% |

23.7% |

20.6% |

Cash flow statement |

|

|

|

|

|

|

Operating cash flow |

17,837 |

19,610 |

|

18,696 |

20,034 |

19,081 |

Capex (net of disposals) |

-4,252 |

-4,979 |

|

-8,000 |

-8,000 |

-8,252 |

Other |

-841 |

1,159 |

|

10,296 |

0 |

0 |

FCF |

12,744 |

15,790 |

|

20,992 |

12,034 |

10,829 |

Equity shareholders' cash |

12,659 |

10,607 |

|

19,139 |

10,793 |

9,569 |

Dividends and share buy backs |

-2,878 |

-5,220 |

|

-16,631 |

-10,703 |

-10,126 |

Excess cash |

9,781 |

5,387 |

|

2,508 |

91 |

-557 |

Cash flow ratios |

|

|

|

|

|

|

Working capital days** |

28 |

20 |

|

20 |

20 |

20 |

Capex/EBITDA |

21% |

21% |

|

32% |

30% |

33% |

FCF yield |

12.3% |

13.0% |

|

15.8% |

9.1% |

8.1% |

Equity shareholders' yield |

15.5% |

10.0% |

|

16.0% |

9.0% |

8.0% |

Cash conversion |

1.9x |

1.2x |

|

1.9x |

0.9x |

0.9x |

Valuation |

|

|

|

|

|

|

SoTP valuation and calculation of target price |

|

|

|

$mn |

ZAR/sh |

|

US onshore petroleum at estimated sales value |

|

|

|

0 |

0 |

|

Conventional petroleum |

|

|

|

|

7,641 |

21 |

Copper |

|

|

|

|

25,396 |

70 |

Iron ore |

|

|

|

|

79,802 |

221 |

Coal |

|

|

|

|

19,757 |

55 |

Other |

|

|

|

|

4,956 |

14 |

Enterprise value as at 27/3/2019 |

|

|

|

|

137,553 |

381 |

Net debt, investments and buy-backs |

|

|

|

|

-16,186 |

-45 |

Equity value as at 27/3/2019 |

|

|

|

|

121,367 |

336 |

Plus: One year forward FCF/share |

|

|

|

|

|

36 |

Less: DPS |

|

|

|

|

|

-31 |

TP, rounded to |

|

|

|

|

|

340 |

Share price on 26/3/2019 |

|

|

|

|

|

340 |

Expected share price return |

|

|

|

|

|

0.0% |

Plus: expected dividend yield |

|

|

|

|

|

9.0% |

Total implied one-year return |

|

|

|

|

|

9.1% |

Share price range, ZAR: |

|

|

|

|

|

|

12-month high |

345 |

12-month low |

|

215 |

||

Price move since high |

-1.6% |

Price move since low |

|

58.1% |

||

Calculation of discount rate |

|

|

|

|

|

|

WACC |

9.4% |

Cost of debt |

|

|

4.5% |

|

Risk-free rate |

4.0% |

Tax rate |

|

|

30% |

|

Equity risk premium |

5.0% |

After-tax cost of debt |

|

3.2% |

||

Beta |

1.30 |

Debt weighting |

|

15.0% |

||

Cost of equity |

10.5% |

Terminal growth rate |

|

3.0% |

||

Valuation ratios |

|

|

|

|

|

|

Jun-YE |

2017 |

2018 |

|

2019E |

2020E |

2021E |

P/E multiple |

12.1x |

11.8x |

|

12.1x |

10.2x |

11.5x |

Dividend yield |

5.4% |

5.9% |

|

10.9% |

8.8% |

8.7% |

EV/EBITDA |

5.1x |

5.2x |

|

5.4x |

4.9x |

5.3x |

P/B |

1.4x |

1.9x |

|

2.4x |

2.4x |

2.4x |

NAV per share, $ |

10.8 |

10.4 |

|

9.7 |

9.9 |

9.9 |

NAV per share, ZAR |

146 |

134 |

|

137 |

142 |

143 |

*Net debt/(net debt+equity)

**Working capital/revenue*365

Source: Bloomberg, Thomson Reuters, Company data, Renaissance Capital estimates

68