- •Contents

- •Revisions to our forecasts, TPs and ratings

- •Investment stance

- •Capital cycle favours rising returns

- •Comfortable balance sheets and supportive dividend potential

- •Value relative to other stocks

- •Yield potential through the cycle

- •Mid-cycle cash generation offers supportive yields

- •Where to hide if you are bearish

- •What to buy if you are bullish

- •Limited lives weighing down IRR

- •Yields should compensate for limited lives

- •Positive earnings momentum continues to support share prices

- •Commodity price revisions

- •Commodity section

- •Commodity section

- •Preference for base metals over steelmaking materials

- •Earnings revisions

- •Risks and catalysts

- •Peer comp charts

- •Commodity price and exchange rate forecasts

- •Important publications

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Sasol

- •Disclosures appendix

vk.com/id446425943

Rio Tinto – BUY

Renaissance Capital

1 April 2019

Metals & Mining

Figure 120: Rio Tinto, $mn (unless otherwise noted)

|

|

|

|

Rio Tinto |

RIO.LN |

Target price, GBP: |

50.0 |

Market capitalisation, $mn: |

96,223 |

Share price, GBP: |

43.1 |

Enterprise value, $mn: |

105,084 |

Potential 12-month return: |

24.2% |

Dec-YE |

2017 |

2018 |

2019E |

2020E |

2021E |

Income statement |

|

|

|

|

|

Revenue |

41,857 |

42,835 |

48,774 |

50,163 |

48,787 |

Underlying EBITDA |

18,580 |

18,136 |

23,545 |

22,514 |

21,149 |

Underlying EBIT |

13,558 |

13,471 |

18,756 |

17,632 |

16,396 |

EBIT |

14,474 |

18,200 |

18,552 |

17,393 |

16,132 |

Finance items |

-1,658 |

-33 |

-724 |

-641 |

-600 |

Taxation |

-3,965 |

-4,242 |

-5,494 |

-5,045 |

-4,644 |

Minority interest in profit |

-89 |

-287 |

-758 |

-714 |

-666 |

Net profit for the year |

8,762 |

13,638 |

11,575 |

10,993 |

10,221 |

Underlying earnings |

8,627 |

8,808 |

11,575 |

10,993 |

10,221 |

Underlying EPS, USc |

483 |

512 |

682 |

651 |

605 |

Thomson Reuters consensus EPS, USc |

|

|

568 |

498 |

482 |

DPS declared, USc |

290 |

550 |

477 |

456 |

424 |

Underlying EBIT |

10,488 |

10,075 |

16,300 |

14,495 |

12,593 |

Iron ore |

|||||

EBIT margin |

52% |

50% |

61% |

56% |

53% |

Copper |

297 |

1,276 |

1,325 |

1,466 |

1,820 |

EBIT margin |

4% |

15% |

15% |

15% |

17% |

Energy |

1,049 |

873 |

8 |

-2 |

-4 |

EBIT margin |

32% |

62% |

3% |

-7% |

-47% |

Aluminium |

2,224 |

1,973 |

1,698 |

2,219 |

2,596 |

EBIT margin |

20% |

16% |

14% |

16% |

18% |

Minerals |

489 |

413 |

452 |

574 |

598 |

EBIT margin |

18% |

15% |

15% |

17% |

17% |

Other operations |

-989 |

-1,139 |

-1,028 |

-1,120 |

-1,206 |

Underlying EBIT |

13,558 |

13,471 |

18,756 |

17,632 |

16,396 |

Income statement ratios |

|

|

|

|

|

EBITDA margin |

44% |

42% |

48% |

45% |

43% |

EBIT margin |

32% |

31% |

38% |

35% |

34% |

EPS growth |

70% |

6% |

33% |

-5% |

-7% |

Dividend payout ratio |

60% |

107% |

70% |

70% |

70% |

Input assumptions |

|

|

|

|

|

Iron ore fines (62%Fe, CIF China) $/t |

71 |

66 |

88 |

85 |

78 |

Copper, USc/lb |

280 |

296 |

290 |

295 |

319 |

Coking coal, $/t |

188 |

206 |

187 |

170 |

165 |

Aluminium, $/t |

1,968 |

2,110 |

1,950 |

2,200 |

2,307 |

$/AUD |

0.77 |

0.75 |

0.73 |

0.78 |

0.80 |

Required breakeven prices |

|

|

|

|

|

Iron ore, $/t |

33 |

32 |

35 |

38 |

37 |

Copper, USc/lb |

244 |

209 |

198 |

193 |

201 |

Aluminium, $/t |

1,430 |

1,620 |

1,553 |

1,691 |

1,740 |

Sales volumes (RIO's share) |

|

|

|

|

|

Iron ore, mnt |

282 |

291 |

301 |

302 |

302 |

Copper, kt |

455 |

624 |

585 |

639 |

652 |

Aluminium, kt |

3,552 |

3,459 |

3,438 |

3,476 |

3,476 |

Attributable Cu eq volumes, kt |

5,539 |

5,780 |

5,880 |

5,957 |

5,898 |

Volume growth |

-0.2% |

4.4% |

1.7% |

1.3% |

-1.0% |

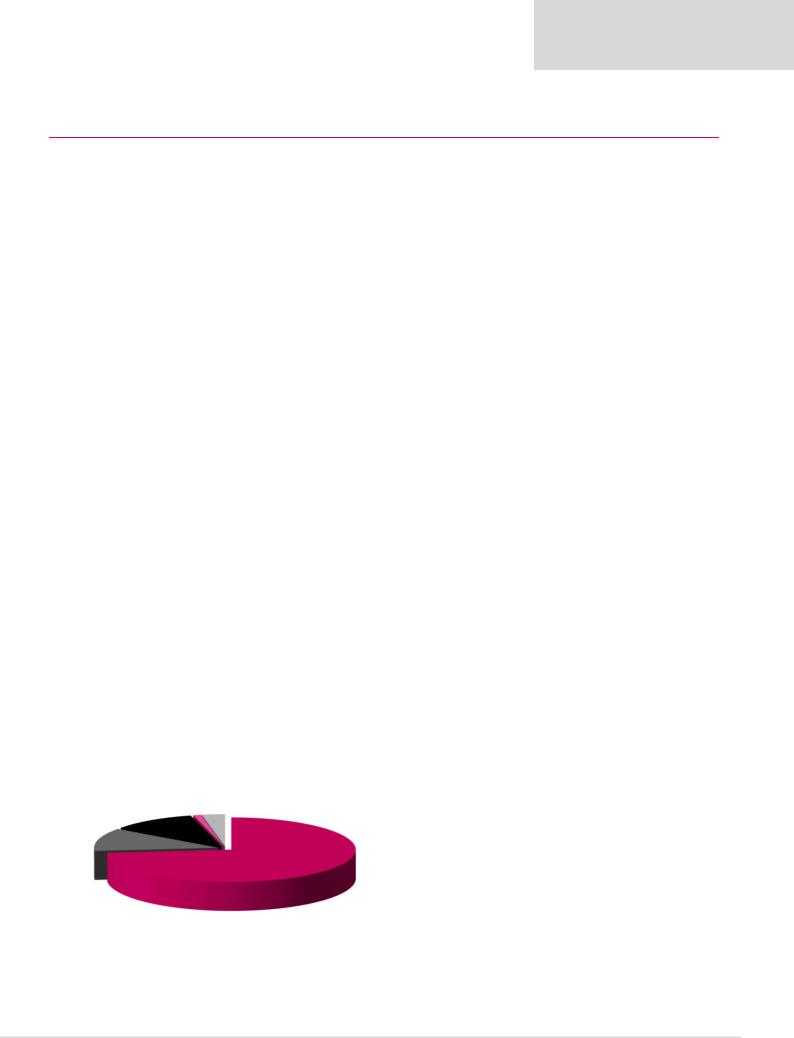

Contribution to FY19E attributable underlying EBITDA

Dec-YE |

|

|

2019E |

2020E |

2021E |

2017 |

2018 |

||||

Balance sheet |

|

|

|

|

|

Net operating assets |

55,023 |

49,464 |

51,518 |

52,768 |

55,247 |

Investments |

-63 |

103 |

103 |

103 |

103 |

Equity |

44,711 |

43,686 |

42,481 |

45,278 |

48,014 |

Minority interest |

6,404 |

6,137 |

6,289 |

6,431 |

6,565 |

Net debt |

3,845 |

-256 |

2,851 |

1,162 |

772 |

Balance sheet ratios |

|

|

|

|

|

Gearing (net debt/(net debt+equity)) |

7.9% |

-0.6% |

6.3% |

2.5% |

1.6% |

Net debt to EBITDA |

0.2x |

0.0x |

0.1x |

0.1x |

0.0x |

RoCE |

19.7% |

20.2% |

29.0% |

26.4% |

24.0% |

RoIC (after tax) |

17.6% |

12.4% |

19.5% |

18.8% |

15.7% |

RoE |

20.9% |

30.9% |

26.9% |

25.1% |

21.9% |

Cash flow statement |

|

|

|

|

|

Operating cash flow |

17,003 |

12,935 |

16,991 |

17,644 |

15,593 |

Capex |

-4,761 |

-5,344 |

-6,000 |

-6,500 |

-6,500 |

Other |

-443 |

7,474 |

-204 |

-239 |

-264 |

FCF |

11,799 |

15,065 |

10,787 |

10,905 |

8,829 |

Equity shareholders' cash |

12,075 |

14,843 |

9,673 |

9,885 |

7,876 |

Dividends and share buy backs |

-6,333 |

-10,742 |

-12,781 |

-8,196 |

-7,486 |

Surplus (deficit) cash |

5,742 |

4,101 |

-3,107 |

1,690 |

390 |

Cash flow ratios |

|

|

|

|

|

Working capital days |

8 |

8 |

10 |

8 |

8 |

Cash conversion |

1.4x |

1.7x |

0.8x |

0.9x |

0.8x |

FCF yield |

13.2% |

15.6% |

10.1% |

10.4% |

8.5% |

Equity shareholders' yield |

15.3% |

16.4% |

9.9% |

10.2% |

8.1% |

Capex/EBITDA |

25.6% |

29.5% |

25.5% |

28.9% |

30.7% |

Valuation |

|

|

|

|

|

SoTP DCF valuation and calculation of target price |

|

$mn |

GBP/sh |

||

Iron ore |

|

|

|

98,762 |

44.3 |

Energy |

|

|

|

37 |

0.0 |

Aluminium |

|

|

|

21,031 |

9.4 |

Copper |

|

|

|

15,502 |

6.9 |

Diamonds |

|

|

|

21 |

0.0 |

Minerals |

|

|

|

4,588 |

2.1 |

Exploration and other |

|

|

|

-17,189 |

-7.7 |

Total enterprise value |

|

|

|

122,753 |

55.0 |

Net debt as at 31 December 2018 |

|

|

|

256 |

0.1 |

Cash used in share buy-backs |

|

|

|

-1,700 |

-0.8 |

Other investments |

|

|

|

103 |

0.0 |

Minority interest |

|

|

|

-9,117 |

-4.1 |

Equity value as at 27/3/2019 |

|

|

|

112,295 |

50.3 |

Rounded to |

|

|

|

|

50.0 |

Share price on 26/3/2019 |

|

|

|

|

43.1 |

Expected share price return |

|

|

|

|

15.9% |

Plus: expected dividend yield |

|

|

|

|

8.3% |

Total implied one-year return |

|

|

|

|

24.2% |

Share price range, GBP: |

|

|

|

|

|

12-month high on 7/6/2018 |

43.5 |

12-month low on 11/9/2018 |

33.2 |

||

Price move since high |

-1.0% |

Price move since low |

|

30.0% |

|

|

Diamonds |

Minerals |

Calculation of discount rate |

|

|

|

|

|

|

Copper |

3% |

WACC |

9.2% |

Cost of debt |

|

|

4.5% |

||

1% |

|

|

|||||||

11% |

|

Risk-free rate |

4.0% |

Tax rate |

|

|

30% |

||

|

|

|

|

||||||

|

|

|

Equity risk premium |

5.0% After-tax cost of debt |

|

3.2% |

|||

|

|

|

Beta |

1.25 |

Debt weighting |

|

15% |

||

Aluminium |

|

|

Cost of equity |

10.3% |

Terminal growth rate |

|

3.5% |

||

12% |

|

|

Valuation ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec-YE |

2017 |

2018 |

|

2019E |

2020E |

2021E |

|

|

|

P/E multiple |

9.1x |

10.2x |

|

8.4x |

8.7x |

9.4x |

|

|

Iron ore |

Dividend yield |

6.6% |

10.6% |

|

8.4% |

8.0% |

7.4% |

|

|

EV/EBITDA |

4.8x |

5.3x |

|

4.5x |

4.6x |

4.9x |

|

|

|

73% |

P/B |

1.8x |

2.1x |

|

2.3x |

2.1x |

2.0x |

|

|

|

NAV per share, $ |

24.9 |

25.2 |

|

24.9 |

26.6 |

28.2 |

|

|

|

NAV per share, GBP |

19.3 |

18.8 |

|

19.0 |

20.1 |

21.3 |

Source: Bloomberg, Thomson Reuters, Company data, Renaissance Capital estimates

74