- •Методичні рекомендації до виконання завдань до практичних занять з курсу "іноземна мова за професійним спрямуванням"

- •Text 1. Bic's success in a throwaway world

- •Text 2. Zurich Municipal

- •Завдання до першого модуля до практичних занять № 4,5,6 на тему «Роздрібна торгівля».

- •Read and translate the text, be ready to speak on the topic:

- •Answer the questions:

- •Look at the following bar chart which shows reasons why people don’t like shopping:

- •Match the words in the box to the definitions in 1-8 below:

- •Reorder the following sentences 1-6 to describe the process in business English:

- •Find retail expressions in Ex.6 to match to the following general English expressions, as in the example:

- •Translate the following sentences into English:

- •Read and translate the following text, do all the exercises to it and be ready to retell:

- •Form compound adjectives matching the words from the columns with each other:

- •Translate the following sentences into English:

- •Завдання до першого модуля до практичних занять № 7,8,9 на тему «Міжнародна торгівля».

- •International trade

- •Read and translate the text, be ready to speak on the topic:

- •Answer the following questions:

- •Complete this text about free trade by completing sentences 1-6 with a-f below:

- •Answer the questions below:

- •Read the emails below. Which email is:

- •Make complete sentences by using one phrase from each column. Which sentences are used in: a request? a reminder? a refusal? an agreement? a final demand?

- •Which is the most polite form a) or b)?

- •Discussion. As the exporter, decide what methods of payment in 5 you would require from these customers:

- •Завдання до першого модуля до практичних занять № 10,11,12 на тему «Реклама та продукція компанії».

- •Read and translate the texts, be ready to speak on the topic. Do all the exercises to them: Text a

- •The Benefits of Advertising

- •The Price We Pay for Advertising.

- •Advertising Strategies

- •Make an advertisement of any company or product you like. Choose the audience it would be pointed at, use different techniques.

- •Завдання до першого модуля до практичних занять № 13,14,15 на тему «Ділові презентації».

- •Read and translate the text, be able to speak on the topic:

- •Introduction

- •Answer the following questions:

- •Study the following table that shows examples of language used at presentations:

- •Introduction

- •Speak on the topic.

- •Make your own presentation.

- •Завдання до другого модуля до практичних занять № 17,18,19 на тему «Фінанси».

- •Read and translate the texts, be able to speak on the topic: Text a

- •Answer the questions:

- •Make sure you understand the following:

- •Find English equivalents to the following:

- •Complete the sentences with the appropriate word from the box:

- •Choose the correct answer to make a sentence:

- •Answer the following questions:

- •The noun and the definition are matched. Choose the correct adjective to complete the word partners:

- •Read and take into account the following information for the topic:

- •Information for Managers

- •Information for Shareholders

- •Discuss the following questions:

- •Look at the pie chart which shows the average weekly expenditure of a British person:

- •Завдання до другого модуля до практичних занять № 20,21,22 на тему «Гроші».

- •Learn the new vocabulary to the topic:

- •Read and translate the text, be able to speak on the topic: Money and its functions

- •The Medium of Exchange

- •Other Functions of Money

- •Different Kinds of Money

- •Answer the questions:

- •Give Ukrainian equivalents:

- •Replace the words in italics by synonyms from the box:

- •Translate into English:

- •Name the following money (banknote or written form) and its country:

- •Make sure that you know what the following proverbs mean, explain how you understand them:

- •Завдання до другого модуля до практичних занять № 23,24,25,26 на тему «Банківська справа».

- •Read and translate the text, be able to speak on the topic:

- •Safeguarding and transfer of funds

- •Lending and loans

- •Answer the questions:

- •Choose from the words in the box to complete the sentences:

- •Read the following texts:

- •Insurance of goods

- •Answer the following questions:

- •Match the words with their corresponding definitions:

- •Match the words in italics from sentences a-e below to these definitions:

- •Think over the following questions:

- •Be ready to speak on the topic.

- •Завдання до другого модуля до практичних занять № 27,28,29 на тему «Податки та оподаткування».

- •Read and translate the text:

- •International Taxation

- •Answer the following questions:

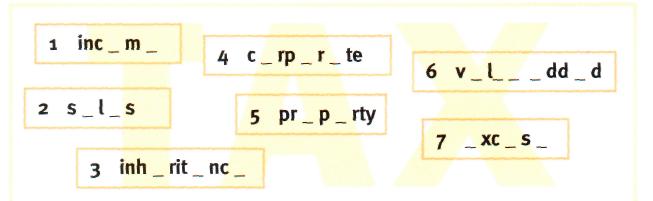

- •There are some types of tax in the boxes below, but some letters are missing. Can you complete the words?

- •Match these expressions with tax to their definitions:

- •Use the words from the box to complete the following conversation:

- •Read the text and ask all types of questions to the underlined sentences: Taxation planning

- •Can you think of any tax breaks which the government in your country has introduced recently?

- •Be ready to speak on the topic. Список літератури

- •Рецензія на "Методичну розробку завдань з англійської мови для підготовки до практичних занять бакалаврів IV курсу спеціальності ‘Фінанси’ ”

Answer the following questions:

What is taxation used for?

What is the commonest distinction of taxes classification?

What type of taxes does the tax on goods belong to?

Do employers compute, deduct and remit the tax to be paid on their employees' earnings?

What are the best known examples of indirect taxes?

What is the distinction between excise duties and sales taxes?

What can you say about VAT?

There are some types of tax in the boxes below, but some letters are missing. Can you complete the words?

Which taxes in the boxes above are you familiar with? Briefly explain each one.

What do foreign companies and individuals need to know about the taxation system in your country?

Match these expressions with tax to their definitions:

tax avoidance a someone who lives in another country for tax reasons

tax bracket b to introduce a new tax on something

tax evasion c to make the tax go up

tax exempt d when you don't have to pay tax on certain income

tax exile e to cancel a tax

to abolish tax f tells you what amount of tax to pay based on income

to impose tax g trying not to pay tax (legal)

to increase tax h trying not to pay tax (illegal)

Use words from the box to fill in the gap:

-

abolish • bracket • breaks • exempt • exile • increase • property • return

1 The government needs more money, so it is planning to taxes.

He earns a lot of money - he must be in the highest tax .

She lives there because she has to - she's a tax .

They are planning to the tax on large company cars, and replace it with a tax

on all company cars.

She is a student, so she is tax .

The government is planning to introduce new tax for IT companies.

Don't buy a house this year - the taxes are being abolished next March.

A tax is the same as a tax declaration - it's a list of income and tax deductible

expenditure for the tax authority.

Use the words from the box to complete the following conversation:

-

depends • so • clarify • mean • basically • exactly

Kathy Hi Javier. How's it going?

Javier It's not easy, all this English. We didn't do any of this on my course.

Kathy Can I help?

Javier Well, maybe you could __________ a couple of things. Let's see. Ah, here we are. Provision for income taxes. What does that__________?

Kathy OK. Provision means putting money aside so that we have something to pay with later. So provision for income taxes is talking about the current year's tax expense which will have to be paid in the future.

Javier Like provisional?

Kathy Not __________. Provisional just means temporary, you know, not final. Like a provisional budget. It's not the final version.

Javier I see. And what about deferred income tax balances. What does deferred mean?

Kathy ___________ put off to another day. The income has been recognized in the accounts, but the tax owing on that income will only be realized in the future. Javier OK. How does that affect associated companies?

Kathy Well, it __________. Associated companies and affiliates are a special case. Deferred taxes are not normally recognized on undistributed earnings, but only if the plan is to re-invest the profits.

Javier __________ if we don't invest the profits, we pay tax.

Kathy Exactly.