Актуальные проблемы экономики и управления на предприятиях машиностр.-1

.pdf

СЕКЦИЯ I

ЭКОНОМИЧЕСКИЕ ПРОБЛЕМЫ ПРЕДПРИЯТИЙ НЕФТЕГАЗОВОЙ ПРОМЫШЛЕННОСТИ

O.V. Kezhapkina

Penza State University, Russian Federation

PROBLEMS AND PROSPECTS OF INVESTMENT DECISION-MAKING PROCESS IN THE PRACTICE OF DOMESTIC ENTERPRISES

The article deals with the problem of making investment decisions in modern industrial enterprises in Russia, taking into account the existing market situation and internal problems. The author emphasizes the subjective nature of the existing model of investment decision-making, comes to the conclusion that the formation of a universal objective model that can compile information at different levels and neutralize the subjective factors of the decision making process is very important for nation companies

Keywords: decision-making process, investment, management system.

During the development and implementation of an investment project its leaders face the task of making competent investment decisions, taking into account complex of various aspects: the investment policy of the company, market conjuncture, economic outlook, sustainability of the project, the social aspect. Investment decision making is one of the main types of administrative work and means making a choice of a range of alternatives, action aimed at the solution of effective implementation of an investment project.

Investment decision making is influenced by many factors, the main ones are: the time factor, relationship between decisions, managers personal assessment, information limitations, uncertainties and risks, possible negative consequences, decision making environment, behavioral limitations [2]. Investment decision making cannot be considered in isolation from the organization as a whole, as they have a significant impact on many functions of the company, and the company, in turn, has an impact on decisions.

11

In most cases, the company does not have comprehensive information about the state of affairs in the future, which prevents the adoption of an objective and informed decision. To correct this problem manager need to enable additional financial resources, more time, however, due to the fact that a person is able to assimilate information only in limited quantities, providing a decision maker with detailed information does not always provide qualitative effect when making investment decisions. In addition, the person in charge often faces the question whether the cost of the search for a more detailed information expended on it additional funds. Behavioral factors, namely the negative (or positive) attitude to anything, personal biases and barriers of perception – are common problems in the field of qualitative decision making. One of the most important of all the factors listed above can be called a time factor. The more distant the time of receipt of cash flow from investment decisions, the less valuable will be the result. One of the main reasons for this is the loss of investment opportunities.

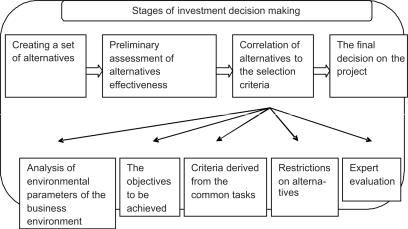

In general, the process of making an investment decision can be represented as follows (Figure).

Fig. Structure of the stages of investment decision making

Each stage of investment decision making contains a number of objective and subjective problems that must be solved to make effective decisions.

Model of investment decision making consists of a set of alternative solutions for investment projects and business environment factors that influ-

12

ence end up on the final decision. The use of mathematical models is very important in making investment decisions. One of the most significant advantages is that models allow making predictions and establishing rules in the process of investment decision making. The essence of modeling is an abstraction, and the advantages and disadvantages of building models are associated with the fact that all models are a simplification of reality, in varying degrees, reflecting only those factors that are relevant to the decision.

After building a model, you need to specify initial data. There can be various parameters that characterize the state of the environment, as well as forward-limiting variables depending on the enterprise management system. The final stage of investment decision making process is the choice of alternatives to ensure maximum results, in accordance with the decision.

All steps in the process of investment decision making are interrelated. In reality, there are no clear boundaries, where one stage ends and the other begins. For example, the original definition of the problem may change dramatically in next stages of analysis. The gradual clarification and refinement of the problem may be the most significant result of the whole process of investment decision research. Uncertainty is one of the important factors involved in the process of making an investment decision. It is necessary to conduct a qualitative analysis of this factor because it has a significant effect on the calculations of future projects efficiency.

Making investment and many others decisions is the area of human activity, not a mechanical process. This fact is not considered by traditional theory of investment. From a theoretical point of view, almost always it refers to the image of a person who is economically feasible and focused on maximum profit, has perfect knowledge of finance and devoid of emotion effects. The concept of rationality is related to the theory of investment. Rationality supposes that a person determines the goals, able to identify ways to achieve them, anticipate the possible results of using these routes.

In reality, managers, who make decisions, are guided not only by the goals of the enterprise, but also their personal motives, experience, intuition. This is a behavioral factor. Decision-makers have their own goals, which may include a maximum own reward, achieving a certain position of power or official position [1]. Significant impact on managers behavior has the political situation, as evidenced by the massive curtailment of economic activities in the Russian Federation foreign companies, including large transnational corporations, not only because of the crisis situation in the

13

local market, but the crisis mood of decision-makers who are not receiving positive signals from the market and the state institutions.

Rather complex issues that arise when adopting a competent investment decision is a combination of authority and responsibility. Manager is responsible for the investment decision on the one hand, on the other hand, it must have the appropriate controls for the ability to influence these results. In practice several problems grows of this dilemma.

The first problem is that the project in the organization goes through a hierarchy of management at different levels that attract different groups of people. The more people involved in the project, the less impact each participant has. It become more difficult to assess the contribution of each project participant and objective promotion of employees gets virtually impossible.

Implementation of any action on the stage of post-investment monitoring is a second problem. Project leader, exercising proper control over the project implementation may not achieve the expected results. This problem leads to a decrease in investment decisions and staff evaluating.

The third problem is related to the policy pursued by the organization. Political changes in the organization can lead to a situation where investment decisions cannot be taken into account at all. In this case, the person responsible for the investment decisions cannot or does not wish to influence the political situation in the company, with the result that the final investment decision is consistent with the mood of the responsible expert, but weakly correlated to the market conditions and long-term strategy of the company.

On the basis of these problems, it is clear that the relationship between the authority and responsibility is uncertain. It is difficult to estimate the contribution of people who participate in the process of making an investment decision. Due to the lack of complete means of influencing investment decisions, motivational behavior of the team head changes that may occur discrepancy between objectives and goals of the company.

As a rule, during the analysis of investment opportunities CEOs have a tendency to overly optimistic and do not account fully emerging risks and financial consequences of adverse developments [3]. Because of this, the management often authorizes investment projects in such a way that only allows meeting the minimum requirements for return on investment, but does not provide the best possible financial results. The adoption of such not enough ambitious indicators of the project does not create sufficient incentives for further optimization of the design decisions and the implementation.

14

Optimization of the business case and the economic model is carried out before the final investment decision (in the preparation of a feasibility study or in the basic design) and is characterized by the greatest potential to increase the economic attractiveness of the project. This is due to the fact that in the later stages opportunities for optimization will be severely limited by already done decision-making and project work. The goal of optimizing the business case and the economic model is to comprehensively assess the risks of the project, to analyze its sensitivity to various factors payback and decide on the main market and technical aspects. This activity brings the best results if the process of making key decisions on the project involves active participation on the part of management or a specially created for that working group focused on maximizing project economic attractiveness and not to a project approval at any cost with a view to the further implementation.

Let’s consider some of the common mistakes that lead to a significant reduction of the economic attractiveness of an investment project:

♦usage patterns of past technical developments without considering why it was decided that any decision. With the continued development of technologies and management practices, if automatically to base decisions within the last project without considering their causes and conditions that can make serious errors (for example, the construction of a standard set of necessary facilities in place of a thorough analysis of the existing configuration and finding opportunities to use existing modernized plants);

♦unrealistic (or overly optimistic) assumptions on the basic parameters (for example, in the oil and gas fields of geology and mining, on operating work parameters of basic settings, the quality and the parameters of the main raw material);

♦lack of clear definition of the necessary flexibility (for example, ignored the possibility of switching the installation to produce more attractive products or work on another form of raw materials). Also often overlooked opportunities to reduce their own costs through the development of partnerships with other companies to balance capacity and loading;

♦insufficient study of the main indicators of project costs (use of high-level counterparts without a detailed benchmarking and gathering all available factual information);

♦lack of a comprehensive assessment of project risks and the likelihood of their realization.

Companies often rely on optimal technology and configuration of the

production design institutes and / or technology experts, without delving

15

into the analysis of the simulation parameters and calculations. As the result there may be missed interesting perspectives, requiring a comprehensive assessment of the design parameters and risks. For example, the design institute cannot provide separation of fractions that maximize the value of the following value-added production, considering the project as a separate entity and not taking into account synergies with existing production. In addition, the assumptions may prove overly optimistic.

In addition to choosing the best technological solutions targeted optimization of a business case includes a comprehensive review of all of its parameters, as well as the development and evaluation of alternatives that can help to increase the attractiveness of the project.

♦Demand, prices and profitability assumptions: how in the calculation of these parameters are taken into account history and the cyclical development of the industry over the past 5/10/20 years, and the factors of further development of the industry? Not whether these calculations are based only on the dynamics of the last two or three years, considered whether possible changes in market dynamics?

♦Volume optimization and configuration of new capacity. Balancing the capacity of key installations of the main and auxiliary equipment with the features of modernization and efficiency of current systems can lead to significant savings in capital costs.

♦Conduct a comprehensive benchmarking (comparative evaluation) on the basic parameters, including the cost of the basic settings and parameters of their work (performance, yield, etc.) of the operating costs.

♦Involving technical expertise to the design and analysis of the active configuration options (technological solutions) of the basic facilities and schemes of the field development. For example, how can we be sure that we have reviewed all the features and advanced technologies (and not only those that are known to one design institute)?

♦Analysis of other significant assumptions: the role of government and the regulatory regime, the need for additional investments in non-core infrastructure due to its congestion, financing scheme, etc.

Purposeful conducting of investment decision making optimization

program allows us to derive a new level of skills in the management of large investment projects. On the one hand, it allows you to reach a specific economic benefit for those projects where such work is started, and on the other hand, provides the basis for the formation of a team of specialists who possess fundamentally new approaches to the management of investment pro-

16

jects. These skills and the application of advanced approaches – the most important source of competitive advantage for Russian companies operating in capital-intensive industries. The effect of investment program optimization and skills development with excess pays effort and money spent on the implementation of such programs.

References

1.Modernization of the economy based on technological innovation / A.N. Asaul, B.M. Karpov, V.B. Perevyazkina, M.K. Starovoytov. – St. Petersburg: ANO IPEV, 2008. – 606 p.

2.Larichev O.I. Theory and methods of decision-making, as well as the Chronicle of events in a magical land: Textbook. – M.: Logos, 2000. – 296 p.

3.Simulation modeling in decision-making in the management of oil refinery / N.V. Lisitsyn, V.V. Sotnikov, A.V. Gurko, B.V. Startcev // Refining and Petrochemicals. Scientific and technological developments and best practices. – 2003. – No. 1. – Р. 11–17.

Об авторе

Кежапкина Ольга Владимировна – соискатель Пензенского госу-

дарственного университета, Россия, e-mail: freshlookinscience@mail.ru.

17

Д.О. Абдумаликова

Филиал Российского государственного университета нефти и газа им. И.М. Губкина, г. Ташкент, Республика Узбекистан

МОДЕРНИЗАЦИЯ И ПРОБЛЕМЫ ОБНОВЛЕНИЯ ОСНОВНЫХ ФОНДОВ НЕФТЕГАЗОВОЙ ОТРАСЛИ

Основой успешного и динамичного развития нефтегазовой отрасли является постоянное переоснащение производства и наиболее полное использование передовой техники и технологии. Однако на данный момент отрасль испытывает серьезные трудности в модернизации. С одной стороны, высокая степень обводненности нефтяных месторождений, с другой стороны – высокие затраты на извлечение оставшейся части углеводородов не дают возможности внедрять новые современные технологии для увеличения коэффициента извлечения нефти из пластов. Необходимо создавать амортизационные фонды, открывая в банках дополнительный аккумулированный счет.

Ключевые слова: модернизация, обновление, передовая техника и технология, коэффициент выбытия, коэффициент годности, амортизационные фонды, аккумулированный счет.

D.O. Abdumalikova

Branch of Gubkin Russian State University of Oil and Gas,

Tashkent, Republic of Uzbekistan

MODERNIZATION AND UPGRADE ISSUES FIXED

ASSETS OIL AND GAS INDUSTRY

The basis of a successful and dynamic development of the oil and gas industry – permanent re-production, the fullest use of advanced equipment and technology. However, the industry is currently experiencing serious difficulties in upgrading. On the one hand, the high water cut oil fields, and on the other hand, the high costs of extraction of the remaining portion of the hydrocarbons do not allow to introduce new advanced technologies to increase oil recovery from the reservoir. It is therefore necessary to create a sinking fund to open in banks accumulated an additional expense.

Keywords: modernization, renovation, advanced equipment and technology, retirement rate, the coefficient of life, depreciation funds, accumulated through.

Нефтегазовая промышленность – одна из крупнейших отраслей экономики Узбекистана, которая обеспечивает треть доходов государ-

18

ственного бюджета. На сегодняшний день экономика Республики Узбекистан напрямую зависит от состояния нефтегазового комплекса страны, так как в структуре экспорта энергоносители и нефтепродукты занимают наибольшую долю (рис. 1).

Рис. 1. Структура экспорта Республики Узбекистан за 2012 г.

Одним из приоритетных направлений развития экономики Республики Узбекистан является нефтегазовая отрасль. Основа успешного и динамичного развития этой отрасли – постоянное переоснащение производства, наиболее полное использование передовой техники и технологий. В отрасли создан значительный научно-технический потенциал, в течение 2008–2011 годов при выполнении планов внедрения (использования) новой техники, передовой технологии, механизации и автоматизации производственных процессов использовали 414 научно-технических решений на сумму 132 млрд 243 млн 61 тыс. сумов. От внедрения 48 изобретений на сумму 19 306 млрд сумов и от использования 598 рационализаторских предложений получен экономический эффект 84,41 млрд сумов. За этот период дополнительно добыто19 500,3 млнм3 природногогаза, 116,79 тыс. тнефти, 680,35 тыс. т газовогоконденсата, 46,33 тыс. т пропан-бутановой фракции.

В 2012 году в отрасли реализовано 71 мероприятие по внедрению новой техники с экономическим эффектом на сумму 25 млрд сумов. В результате реализации 5 проектов выпущено 119,5 т продукции и 26 видов изделий на сумму 4402,2 млн сумов, обеспечено импортозамещение химических реагентов, техники и технологии на сумму 2933,4 тыс. долл. с экономией ресурсов около 81,67 млн сумов1.

1 Закиров А.А. Экономика нефтяной и газовой отрасли Узбекистана / Национальнаяхолдинговаякомпания«Узбектнефтегаз». Ташкент: EXTREMUM-PRESS, 2013. 432 с.

19

Однако на данный момент отрасль испытывает серьезные трудности в модернизации. С одной стороны, высокая степень обводненности нефтяных месторождений, а с другой стороны – высокие затраты на извлечение оставшейся части углеводородов не дают возможности внедрять новые современные технологии для увеличения коэффициента извлечения нефти из пластов (коэффициент извлечения углеводородов сейчас в отрасли не превышает 0,3)1. Следствием этого является низкий показатель добычи нефти, который в 2012 году по сравнению с 2011 уменьшился на 12 % (рис. 2).

Рис. 2. Добыча нефти в Узбекистане (2001–2012 годы). BP Statistical Review of World Energy, June 2013

В таких условиях нефтегазовая отрасль страны нуждается в дополнительных инвестициях для поднятия технологического уровня добычи на новую ступень.

Известно, что увеличения производительности труда, улучшения качества продукции, а следовательно, увеличения доходности предприятия можно добиться путем модернизации производства, обновления основных фондов, приобретения новейших технологий.

Основными направлениями научно-технического прогресса в нефтянойотраслиявляются:

–увеличение скорости бурения и сокращение сроков строительства скважин на основе совершенствования и внедрения новых типов породоразрушающих инструментов и промывочной жидкости;

–внедрение и распространение горизонтального и радиального бурения, а также врезка боковых аварийных скважин для более полного извлечения из месторождений потенциальных запасов углеводородов;

–дальнейшее углубление переработки нефти и природного газа

сцелью производства новых видов моторного топлива и максималь-

1 Узбекский журнал нефти и газа / Спец. выпуск. 2013. Январь.

20