- •Table of contents

- •Abbreviations and Acronyms

- •Executive summary

- •Introduction

- •Institutional arrangements for tax administration

- •Key points

- •Introduction

- •The revenue body as an institution

- •The extent of revenue body autonomy

- •Scope of responsibilities of the revenue body

- •Special governance arrangements

- •Special institutional arrangements for dealing with taxpayers’ complaints

- •Bibliography

- •The organisation of revenue bodies

- •Getting organised to collect taxes

- •Office networks for tax administration

- •Large taxpayer operations

- •Managing the tax affairs of high net worth individuals taxpayers

- •Bibliography

- •Selected aspects of strategic management

- •Key points and observations

- •Managing for improved performance

- •Reporting revenue body performance

- •Summary observations

- •Managing and improving taxpayers’ compliance

- •Bibliography

- •Human resource management and tax administration

- •Key points

- •Aspects of HRM Strategy

- •Changes in policy in aspects of HRM within revenue bodies

- •Staff metrics: Staff numbers and attrition, age profiles and qualifications

- •Resources of national revenue bodies

- •Key points and observations

- •The resources of national revenue bodies

- •Impacts of recent Government decisions on revenue bodies’ budgets

- •Overall tax administration expenditure

- •Measures of relative costs of administration

- •International comparisons of administrative expenditure and staffing

- •Bibliography

- •Operational performance of revenue bodies

- •Key points and observations

- •Tax revenue collections

- •Refunds of taxes

- •Taxpayer service delivery

- •Are you being served? Revenue bodies’ use of service delivery standards

- •Tax verification activities

- •Tax disputes

- •Tax debts and their collection

- •Bibliography

- •The use of electronic services in tax administration

- •Key points

- •Provision and use of modern electronic services

- •Bibliography

- •Tax administration and tax intermediaries

- •Introduction

- •The population and work volumes of tax intermediaries

- •Regulation of tax intermediaries

- •The services and support provided to tax intermediaries

- •Bibliography

- •Legislated administrative frameworks for tax administration

- •Key findings and observations

- •Introduction

- •Taxpayers’ rights and charters

- •Access to tax rulings

- •Taxpayer registration

- •Collection and assessment of taxes

- •Administrative review

- •Enforced collection of unpaid taxes

- •Information and access powers

- •Tax offences (including policies for voluntary disclosures)

- •Bibliography

46 – 1. INSTITUTIONAL ARRANGEMENTS FOR TAX ADMINISTRATION

Features of |

TIGTA consists mainly of auditors and investigators focused on the duties and |

operations |

responsibilities of an Inspector General organisation on matters relating to the IRS. TIGTA |

|

is organisationally placed within the Department of the Treasury, but is independent |

|

of the Department and all other Treasury offices, including the Treasury Office of the |

|

Inspector General (OIG). TIGTA’s focus is devoted entirely to tax administration, while |

|

Treasury OIG is responsible for overseeing other Treasury bureaus. TIGTA’s audit and |

|

investigative activities are designed to: 1) promote economy, efficiency, and effectiveness |

|

in administering the Nation’s tax system; 2) detect and deter fraud and abuse in IRS |

|

programs and operations; 3) protect IRS against external attempts to corrupt or threaten its |

|

employees; 4) review and make recommendations about existing and proposed legislation |

|

and regulations related to IRS and TIGTA programs and operations; 5) prevent fraud, |

|

abuse, and deficiencies in IRS programs and operations; and 6) inform the Secretary of the |

|

Treasury and Congress of problems and progress made to resolve them. |

Examples of |

There Are Billions of Dollars in Undetected Tax Refund Fraud Resulting From Identity Theft. |

studies in 2012 |

Substantial Changes Are Needed to the Individual Taxpayer Identification Number Program |

|

to Detect Fraudulent Applications. |

Source: Treasury Inspector General for Tax Administration’s website.

In addition to the Treasury Inspector in the United States, there is also the Office of Taxpayer Advocate which is responsible for both individual complaints received from taxpayers as well as reporting on systemic issues that arise with the operation of the tax system. More is said on this Office in the following section.

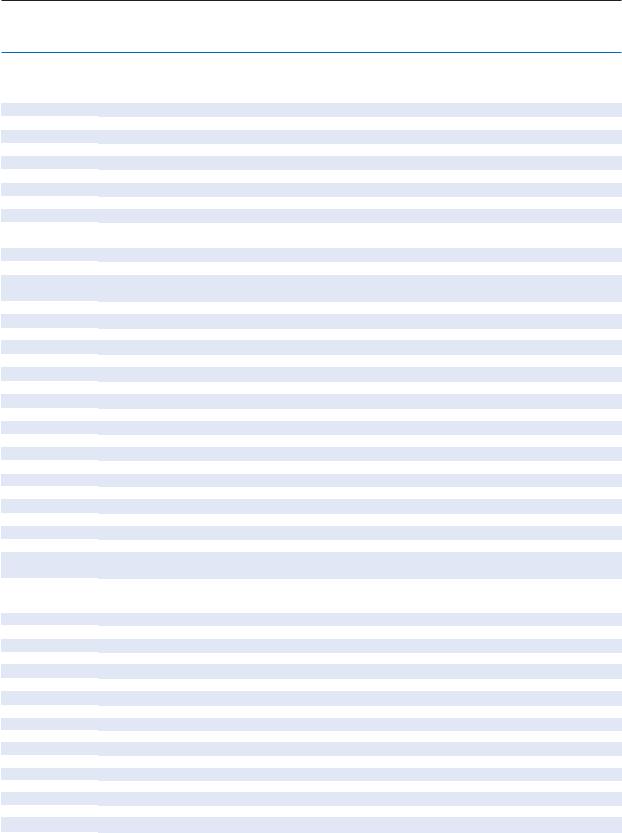

Special institutional arrangements for dealing with taxpayers’ complaints

Governments in many countries have established special bodies (e.g. an Ombudsman’s Office) to handle individual complaints concerning government agencies (including revenue bodies) in their dealings with citizens and business. In some countries, an agency dedicated to dealing only with tax-related complaints from citizens and business arising from actions/ inactions of the revenue body has been established (e.g. an Office of Tax Ombudsman). The primary purpose of these sorts of arrangements is to ensure that citizens and businesses have an opportunity to raise matters where they believe they have been treated harshly or unfairly and to have these matters handled independently of the agency to which the matter relates.

For this series, revenue bodies were asked to identify: 1) whether such a body has been created; 2) if so, whether its operations are based on a specific legal framework and set of powers; 3) whether it is autonomous from the revenue body; and 4) whether it is empowered to report on systemic issues (in addition to dealing with individual complaints of citizens and businesses). In addition, some research was undertaken to identify the nature of the specific arrangements in place in selected countries.

A summary of survey responses is set out in Table 1.7 and the key points are as follows:

Revenue bodies reported a broad mix of arrangements entailing a special body for handling taxpayers’ complaints:

-Eighteen bodies reported that taxpayers’ complaints are dealt with, along with non-tax complaints, by an Office of Ombudsman (or the equivalent);

-Ten bodies reported that a dedicated body exists for dealing solely with tax-related complaints (often described as a “Tax Ombudsman” or “Taxpayers Advocate”); and

-Five bodies reported that there was an internal part of their agency for dealing independently with taxpayers’ complaints (whose existence and operations were based on a specific legal framework).

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

1. INSTITUTIONAL ARRANGEMENTS FOR TAX ADMINISTRATION – 47

Table 1.7. Special body for dealing with taxpayers’ complaints

|

Special |

Specific legal |

Autonomous from |

Reports on |

|

|

Countries |

body exists |

frame-work |

revenue body |

systemic issues |

Name of body (ies) |

|

OECD countries |

|

|

|

|

|

|

Australia |

9 |

9 |

9 |

9 |

Ombudsman and Inspector General of Taxation |

|

Austria |

9 |

9 |

9 |

9 |

Tax Ombudsservice |

|

Belgium |

9 |

9 |

9 |

9 |

Tax Mediator |

|

Canada |

9 |

9 |

9 |

9 |

Office of Taxpayers’ Ombudsman |

|

Chile |

x |

- |

- |

- |

Public Defender of Rights – Ombudsman |

|

Czech Rep. |

9 |

9 |

9 |

x |

||

Denmark |

9 |

9 |

x |

9 |

Citizen Ambassador/1 |

|

Estonia |

x |

- |

- |

- |

- |

|

Finland |

9 |

9 |

9 |

9 |

Parliamentary Ombudsman |

|

France |

9 |

9 |

9 |

x |

Mediator of the Republic, Mediator of MOF/1, Provincial |

|

Mediator |

||||||

Germany |

x |

- |

- |

- |

||

Ombudsman/General Inspector of Public Administration |

||||||

Greece |

9 |

9 |

9 |

9 |

||

Hungary |

9 |

9 |

9 |

9 |

Commissioner for Fundamental Rights; National Authority |

|

for Data Protection and Freedom of Information/1 |

||||||

|

|

|

|

|

||

Iceland |

9 |

9 |

9 |

9 |

Althing (Parliamentary) Ombudsman |

|

Ireland |

9 |

9 |

9 |

9 |

Office of the Ombudsman |

|

Israel |

x/1 |

x |

x |

x |

Tax Ombudsman (“Garante del Contribuente”) |

|

Italy |

9 |

9 |

9 |

x |

||

Japan |

9 |

9 |

x |

9 |

Taxpayer Support |

|

Korea |

9 |

9 |

x |

9 |

Taxpayer Advocate |

|

Luxembourg |

9 |

9 |

9 |

9 |

Ombudsman |

|

Mexico |

9 |

9 |

9 |

9 |

Prodecon (Taxpayers Attorneys Office) |

|

Netherlands |

9 |

9 |

9 |

9 |

National Ombudsman |

|

New Zealand |

x |

- |

- |

- |

- |

|

Norway |

9 |

9 |

9 |

9 |

Ombudsman |

|

Poland |

x |

- |

- |

- |

Ombudsman |

|

Portugal |

9 |

9 |

9 |

9 |

||

Slovak Rep. |

x |

- |

- |

- |

|

|

Slovenia |

- |

- |

- |

- |

Taxpayers’ Counsel/1 |

|

Spain |

9 |

9 |

x |

9 |

||

Sweden |

x |

- |

- |

- |

|

|

Switzerland |

x |

- |

- |

- |

- |

|

Turkey |

x/1 |

- |

- |

- |

Adjudicators Office/Parliamentary Health and Service |

|

United Kingdom |

9/1 |

9 |

9 |

9 |

||

Ombudsman |

||||||

|

|

|

|

|

||

United States |

9 |

9 |

9 |

9 |

Taxpayer Advocate Service |

|

Non-OECD countries |

|

|

|

|

||

Argentina |

9 |

9 |

x |

9 |

Public Ombudsman |

|

Brazil |

9 |

x |

9 |

9 |

||

Bulgaria |

9 |

9 |

9 |

9 |

National Ombudsman |

|

China |

? |

? |

? |

? |

Taxpayers’ Advocate/1 |

|

Colombia |

9 |

9 |

9 |

9 |

||

Cyprus |

9/1 |

9 |

9 |

9 |

Ombudsman (DT, VAT),/2 |

|

Hong Kong, China |

9/1 |

9 |

9 |

9 |

Office of Ombudsman |

|

India |

9 |

9 |

9 |

9 |

Ombudsman |

|

Latvia |

x |

- |

- |

- |

- |

|

Lithuania |

x |

x |

x |

x |

|

|

Malaysia |

9 |

9 |

9 |

9 |

Office of the Ombudsman |

|

Malta |

9 |

9 |

9 |

9 |

||

Romania |

x |

x |

x |

x |

|

|

Russia |

x |

- |

- |

- |

|

|

Saudi Arabia |

x |

- |

- |

- |

|

|

Singapore |

x |

- |

- |

- |

Tax Ombud/Public Protector |

|

South Africa |

9/1 |

9 |

9 |

9 |

||

For notes indicated by “/ (number)”, see Notes to Tables section at the end of the chapter, p. 55.

Source: CIS survey responses.

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

48 – 1. INSTITUTIONAL ARRANGEMENTS FOR TAX ADMINISTRATION

With few exceptions, all of these bodies are empowered to report on systemic issues identified from the complaints they are required to help resolve.

A brief outline of the features of a number of these bodies is set out hereunder:

|

Canada: Taxpayers’ Ombudsman |

|

|

|

|

Background |

The Office of Taxpayers’ Ombudsman (TO) was established in early 2007, coinciding with |

|

|

the establishment of the Taxpayer’s Bill of Rights. |

|

Role |

The TO is generally responsible for ensuring that the CRA respects the service rights |

|

|

contained in the Taxpayers’ Bill of Rights 9 and specifically to: 1) conduct impartial and |

|

|

independent reviews of service-related complaints about the Canada Revenue Agency |

|

|

(CRA); 2) facilitate taxpayer access to assistance within the CRA; 3) identify and review |

|

|

systemic and emerging service-related issues within the CRA that have a negative impact |

|

|

on taxpayers; and 4) provide advice to the Minister of National Revenue about service |

|

|

related matters in the CRA. |

|

Features of |

The TO may review any service provided by the CRA at its own initiative. In so doing, the |

|

operations |

TO can identify systemic and emerging service-related issues within the CRA that have a |

|

|

negative impact on taxpayers, and make recommendations to the CRA to improve service |

|

|

delivery. The TO operates independently and at arm’s length from the management of the |

|

|

CRA and reports directly to the Minister of National Revenue. |

|

Recent reports |

Acting on ATIP, which examines the service issues related to the Canada Revenue Agency’s |

|

on systemic |

(CRA) processing of Access to Information and Privacy (ATIP) requests. |

|

issues |

|

|

Earning Credits, which looks at the CRA’s policies and procedures for determining |

||

|

||

|

students’ eligibility for tuition tax credits, against the background of complaints that claims |

|

|

were being denied unfairly. |

|

Website |

www.oto-boc.gc.ca/menu-eng.html |

Source: Ombudsman’s website.

|

Colombia’s Taxpayers’ Advocate |

|

|

Background |

The Office of Taxpayer Advocate (defensoria del contribuyente) was created in 2002. |

|

|

Roles |

Make recommendations to the General Directorate of the DIAN to ensure adequate, fair |

|

and timely provision of service tax. |

|

To follow up, at the request of taxpayers and customs users to control processes, to ensure |

|

compliance with due process. |

|

Participate, if deemed appropriate, as an observer in meetings where corrections are |

|

promoted declarations by taxpayers and users, and to ensure that once produced the |

|

respective correction, they are respected by DIAN officials. |

|

Ensure that the performances of the different units of the DIAN are met within the |

|

framework of the constitutional principles of fairness and transparency governing the |

|

exercise of the prosecutor. |

|

Participate in meetings of the Joint National Committee tax and customs administration, |

|

and submit to it a quarterly report on the development of their activities. |

|

Channeling the parent’s concerns about taxpayers and users adequate gaps in service |

|

provision by the DIAN, make such investigations as are the case, make recommendations |

|

to overcome them and to inform the authorities and units concerned its findings, with in |

|

order to apply the corrective and / or sanctions may be applicable. |

Website |

www.dian.gov.co/content/defensoria/index.htm (Spanish only) |

|

|

Source: Taxpayer Advocate’s website.

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

|

|

1. INSTITUTIONAL ARRANGEMENTS FOR TAX ADMINISTRATION – 49 |

|

|

|

United Kingdom: Adjudicator’s Office |

|

|

|

|

|

|

Background |

The Adjudicator’s Office (AO) was originally established in 1993 to investigate complaints |

|

|

|

made concerning the former Inland Revenue Department. |

|

|

Role |

The AO investigates and helps to resolve complaints from individuals and businesses that |

|

|

|

remain unhappy about the way their affairs have been handled by: 1) HMRC, including |

|

|

|

the Tax Credit Office and the Valuation Office Agency (VOA; 2) the Insolvency Service; |

|

|

|

and 3) the Public Guardianship Office. It looks to add value to the complaints handling |

|

|

|

of the organisations by aiming to be widely seen and used by the departments and the |

|

|

|

communities served, as a trusted provider of assurance and, where appropriate, redress, and |

|

|

|

as an informed advocate for service improvement. |

|

|

Features of |

The AO’s remit and service standards are set out in “service level agreements” with the |

|

|

operations |

Commissioners of HMRC. However, it functions independently and an annual report |

|

|

|

of its operations is produced. In practice, it deals with complaints concerning mistakes, |

|

|

|

unreasonable delays, poor or misleading advice, inappropriate staff behaviour, and the use |

|

|

|

of discretion. However, it cannot deal with matters of government or departmental policy, |

|

|

|

matters which can be considered on appeal by independent tribunals, disputes with the |

|

|

|

VOA about property valuations, issues that the courts have already considered, or could |

|

|

|

have considered, complaints that have been, or are being, investigated by the Parliamentary |

|

|

|

Ombudsman; and complaints about HMRC’s or the VOA’s, handling of requests under both |

|

|

|

the Freedom of Information Act 2000 and the Data Protection Act 1998, which should be |

|

|

|

considered by the Information Commissioner. |

|

|

Publications |

In addition to an annual report, the office has assembled a set of case studies which |

|

|

|

illustrate the work it does and to demonstrate how complaints are resolved, e.g. |

|

|

|

Case study 1: Recovery of an overpayment where the parties have separated |

|

|

|

Case study 2: Overpayments of Tax Credits |

|

|

|

Case study 3: Main responsibility for qualifying child |

|

|

Website |

See www.adjudicatorsoffice.gov.uk/ |

|

|

|

|

|

Source: Adjudicator’s Office website

|

United States: Taxpayer’s Advocate |

|

|

Background |

The Taxpayer Advocate Service (TAS) was established by the Taxpayer Bill of Rights 2 |

|

legislation in 1996, replacing the Office of the Taxpayer Ombudsman. |

Role |

The TAS is an independent organisation located within the IRS whose employees assist |

|

taxpayers who are experiencing economic hardship, who are seeking help in resolving tax |

|

problems that have not been resolved through normal channels, or who believe that an IRS |

|

system or procedure is not working as it should. The National Taxpayer Advocate heads |

|

the programme and each state and campus has at least one local Taxpayer Advocate who is |

|

independent of the local IRS office and reports directly to the National Taxpayer Advocate. |

|

The goals of the TAS are to protect individual and business taxpayers’ rights and to reduce |

|

taxpayer burden. |

Features of |

The Taxpayer Advocate independently represents taxpayers’ interests and concerns within |

operations |

the IRS. This is accomplished in two ways: 1) Ensuring that taxpayer problems which |

|

have not been resolved through normal channels, are handled promptly and fairly; and |

|

2) Identifying issues that increase burden or create problems for taxpayers-bringing |

|

those issues to the attention of IRS management and making legislative proposals where |

|

necessary. In Taxpayer Bill of Rights 2, Congress established the Office of the Taxpayer |

|

Advocate and also described its functions: 1) To assist taxpayers in resolving problems |

|

with the Internal Revenue Service; 2) To identify areas in which taxpayers have problems |

|

in dealings with the Internal Revenue Service; 3) To the extent possible, propose changes |

|

in the administrative practices of the IRS to mitigate those identified problems; and 4) To |

|

identify potential legislative changes which may be appropriate to mitigate such problems. |

|

The TAS provides two reports annually to Congress-one setting out its objectives for a |

|

fiscal year, the other on its achievements in the fiscal year. |

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

50 – 1. INSTITUTIONAL ARRANGEMENTS FOR TAX ADMINISTRATION

Examples |

An analysis of the IRS examination strategy: Suggestions to maximise compliance, |

of studies in |

improve credibility, and respect taxpayer rights. |

2010-11 |

Analyzing Pay-as-you-earn Systems as a path for Simplification of the U.S. tax system |

|

|

Website |

See www.irs.gov/advocate/ |

Source: Taxpayer Advocate’s website.

In their survey response, South Africa’s revenue body reported that its Government had recently taken steps to pass laws leading to the creation of an “Office of Tax Ombud”. Brief details of this reform are set out in Box 1.5.

Box 1.5. South Africa moves to establish Office of Tax Ombud

The Tax Administration Bill, 2011, which was passed by Parliament in 2011 and promulgated into law in 2012 makes provision for the appointment of an independent Tax Ombud by the Minister of Finance. The Tax Ombud may review complaints and, if necessary, resolve them through mediation or conciliation. The Tax Ombud may also identify and review systemic and emerging issues related to service matters, the application of the Tax Administration Act or procedural or administrative provisions of a tax Act that impact negatively on taxpayers. The Tax Ombud will report directly to the Minister and must submit an annual report to the Minister dealing with at least the ten most serious issues encountered by taxpayers, as well as the identified emerging and systemic issues. The report may also contain recommendations for administrative action to resolve issues encountered by taxpayers. The Minister must table this report in the National Assembly in Parliament.

Source: SARS CIS survey response.

Notes

1.The fiscal blueprints, originally developed in 1999 and updated in 2007, are described as a set of practical guidelines laying down clear criteria based on EU best practice, against which a tax or fiscal administration is able to measure its own operational capacity. The blueprints are regarded as having broad international application: http://ec.europa.eu/taxation_customs/ resources/documents/common/publications/info_docs/taxation/fiscal_blueprint_en.pdf

2.The main “exceptions” are seen in Germany, Italy and Switzerland.

3.In Germany, responsibility for tax administration is largely devolved to regional (i.e. Lander) administrations while a relatively small central body exercises a high level co-ordination role. Customs operations are administered separately (and centrally) while the collection of SSC is also carried out by separate social security agencies.

4.In the case of Italy, responsibility for tax administration is spread across a number of separate

bodies: 1) Agenzia delle Entrate (AE) is primarily responsible for tax administration; 2) Agenzia delle Dogane (Customs Agency) is responsible for administering excise duties, VAT on imports and customs duties; and 3) the Agenzia del Territorio (Territorial Agency) is responsible for cadastre, property registers and property valuations. In addition, some tax administration functions are not dealt with by the AE directly but provided by other agencies. Tax fraud work is carried out by a separate tax police body (the Guardia di Finanza), the enforced collection of tax and social contribution debts is carried out by a government-owned body (i.e. Equitalia s.p.a.) and information processing activities are carried out by a separate private body (i.e. Sogei s.p.a.).

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

1.INSTITUTIONAL ARRANGEMENTS FOR TAX ADMINISTRATION – 51

5.In Switzerland, responsibility for the administration of personal income tax and corporate income/profits tax is undertaken by sub-national “cantons” which number 26 across Switzerland, on behalf of the federal government. The VAT is administered centrally by the Federal Tax Administration–VAT.

6.The term “unified semi-autonomous body” is also intended to encompass the model elsewhere described as the “revenue authority” model seen in some developing countries (e.g. Kenya, Peru, South Africa, and Zambia).

7.Malta’s Minister of Finance foreshadowed the creation of a unified tax and customs body in his 2010 Budget statement and laws enacted in late-2011 provide for the creation of a position of Commissioner of Revenue who will lead a new body responsible for tax and customs administration. (Further detail is set out in Chapter 2.)

8.This number includes three countries that have announced plans to integrate tax and SSC collection (i.e. the Czech and Slovak Republics) or have the issue under review (i.e. Japan)

9.The dominant role of such contributions in most of these countries stems directly from the application of the so-called Bismarck model which remains the foundation of the social security system in much of Europe today. The model sees government-provided social security as a special form of insurance, with both benefits and contributions tied to workers’ wages. In some countries, the contributions are channelled through separate funds which are kept apart from the central government budget. By contrast, notably in some Scandinavian and English-speaking OECD countries, a substantial part of public spending on social benefits tends to be financed directly out of government general tax revenues although, even in countries following the Bismarck model, social security funds may also show a persistent deficit requiring subsidies from general taxation.

10.A review of Australia’s tax system completed in early 2010 also recommended the establishment of a board to advise the Commissioner of Taxation on the general organisation and management of the Australian Taxation Office. The board would not be a decision-making body and would have no role in interpreting the tax laws or examining individual taxpayer issues. The Government would appoint members to the board. The Government announced in July 2010 that it would proceed with the introduction of an advisory board but no final announcements concerning implementation have as yet been made.

11.An Advisory Board for the South Africa Revenue Service (SARS), created in 1997 with the establishment of SARS as a semi-autonomous revenue authority, was dissolved in 2002. In its place, a new governance framework was introduced that makes provision for the establishment of specialist committees to advise the Commissioner and Minister on any matter concerning the management of SARS’s resources.

12.See Chapter 8 for further details on this.

Notes to Tables

Table 1.1. Institutional arrangements for tax administration

/1. Argentina: There is an Advisory Council with representatives of state-owned institutions. Belgium: The Federal Public Service Finances is now comprised of six general administrations: 1) taxation; 2) collection and recovery of taxes; 3) serious tax fraud; 4) customs and excise; 5) patrimonial documentation; and 6) treasury; Brazil: The Secretariat of Federal Revenue – RFB is a body that reports to the Ministry of Finance. Due to constitutional federal regime, there are 3 independent levels of Tax Administration; Federal level: The Secretariat of Federal Revenue of Brazil – RFB; Regional level: 27 Member States’ Tax Administrations; Local level: more than 5 000 Tax Administrations. Cities and towns have Tax Administrations. Most small

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

52 – 1. INSTITUTIONAL ARRANGEMENTS FOR TAX ADMINISTRATION

villages do not, although they receive revenue transfers from Federal and State levels. Canada: CRA also administers subnational taxes (PIT, CIT and VAT) for most of Canada’s ten provinces and three territories; Chile: Revenue body (Servicio de Impuestos Internos, SII) is responsible for tax compliance procedures, audit and enforcement of internal taxes; Custom duties are administered by “Servicio Nacional de Aduanas, SDA” and the collection of taxes is the responsibility of Tesorería General de la República (Treasury); China: Separate body with minister; Cyprus, Luxembourg, Malta: There are separate directorates for Direct Taxes, Indirect Taxes, and/or Customs and Excise; Denmark: As of March 2010, the Danish Tax Administration has merged with the Danish Ministry of Taxation to form a single unified and autonomous tax administration with a corporate structure, headed by a single (internal) board chaired by the Permanent Secretary of the Ministry of Taxation; this integrated Danish revenue body is now officially referred to as the “Danish Ministry of Taxation”(Skatteministeriet); Finland: Excise and motor vehicle taxes administered by separate state bodies. Germany: Major taxes are administered separately by 16 State (Länder) MOFs, and subject to co-ordination and supervision by the Federal MOF; additionally, a Federal Central Tax Office, subordinated to the Federal MOF, performs certain central functions; Greece: From 2007 there is the possibility for the revenue body to assess, collect and recover SSC with 10% commission. This possibility is not in force yet, but it is predicted to be in force within the next semester for a part of the non-collected SSC; Italy: Italian Tax administration functions are carried out by a number of separate government and partly governmentowned bodies due to a reorganisation of the Public Administration (Legislative Decree 30 July 1999, n. 300) The purpose of this reform was to separate the political guidelines (given by the Ministry of Economy and Finance which maintains control over policy orientation) from the managerial and operational charge (Agencies): 1) Revenue Agency (Agenzia Entrate), with the task of managing the direct taxes, VAT and other tax revenues; 2) Financial Police (Guardia di Finanza GDF) is responsible for dealing with tax fraud, financial crime, smuggling, money laundering, international illegal drug trafficking, customs and borders checks, counterfeiting; 3) Customs Agency (Agenzia Dogane) excise and VAT on imports; 4) Land Registry Agency (Agenzia del Territorio) with functions relating to cadastre, cartographic Services, conservation real estate registry; 5)The State Property Agency (Agenzia del demanio) has the task of administering the State Property; and 6) Equitalia Spa is the public company (51% Revenue Agency and 49% “National Social Security Institute – INPS) entrusted with the task of tax debt collection. Korea: Comprehensive Real Estate Holding Tax introduced in 2005, assess bracket of real property tax as national tax. Malaysia: There are two semi-autonomous bodies, each with a board comprised of external officials – the Inland Revenue Board (for direct taxes) and Customs and Excise Department (which also administers a sales tax); Poland: With common head, Secretary of State; Russia: Federal Tax Service administers three property taxes: land tax (paid by individuals and organisations); individual property tax (immovable property); corporate property (movable and immovable property). Saudi Arabia: Saudi Arabian DZIT also administers “zakat”, a tax-like duty on commercial activities of Saudi persons. No taxes on wages and salaries (employment), but other activities by individuals (such as professional and trading activities) are taxable. Slovak Republic: There are plans for integration, with the effect from 2014. South Africa: Collects unemployment insurance fund contributions on behalf of Department of Labour; Sweden: Swedish Tax Agency with the Advisory Council; Switzerland: Direct taxes are administered at the sub-national level (by cantons); Turkey: Tax administration operations are conducted by a semi-autonomous authority known as the Presidency of Revenue Administration which provides all mainstream tax administration functions; it is supported in carrying out its mandate by the Tax Inspection Board which carries out audits of the taxpayers.

/2. Brazil: There is no national VAT, but two other taxes: One imposed by each Federal Member-State, the “Imposto sobre a Circulação de Mercadorias e Serviços” (ICMS) and another imposed by each municipality, the “Imposto sobre Serviços” (ISS); Canada: Employment Insurance and Canada Pension Plan contributions are collected for other departments that administer these national programmes. Chile: Self-employed persons are liable to pay contributions for retirement pension and occupational accident and sickness insurance as from 2012 (they can choose not to pay between 2012 and 2014, but it will be compulsory starting 2015). Health contributions may be voluntarily paid as from 2012, but it will be compulsory from 2018. Yearly, during the Income Tax Operation period, the SII will be in charge of assessing, based on the previous years’ annual taxable income of the self-employed persons, the mandatory contributions to pension they have to pay, deducting the voluntary monthly contributions they could have made in the past year. On the same annual taxable income, the SII will determine the compulsory occupational accident and sickness insurance, deducting the previous monthly payments too (the same assessment will be made with the health contributions). The assessed amounts will be deducted from the taxpayer’s withholding of monthly receipts or provisory payments, and the family allowances (if applicable), and reported to the Treasury in order to be transferred to the Pension Funds and Insurance companies, as appropriate; also, in the event that the refunds withheld by the SII are not enough to pay the assessed contributions, the debt will be informed. China: Varies from province to province; Estonia: Heavy goods vehicle tax; Germany: Revenue bodies determine property values for real property tax collected by municipalities; the motor vehicle tax will be administered by the

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

1. INSTITUTIONAL ARRANGEMENTS FOR TAX ADMINISTRATION – 53

Länder tax administrations by means of the official delegation of powers to them until 30 June 2014; Iceland: Wealth tax was re-introduced in 2010 for net wealth 2009, 2010 and 2011; Korea: Comprehensive Real Estate Holding Tax introduced in 2005, assess upper bracket of real property tax as national tax; Saudi Arabia: PIT is limited to professional personal taxpayers like individual accounting firm, individual physician and individual legal firms; Spain: Revenue body collaborates only in some aspects; wealth tax was abolished in 2008; excise duty on certain means of transport;

/3. Belgium: Motor Vehicle Tax is not administered for the Flemish Region as from 2012. Chile: However the revenue body (SII) establishes the tax base for the application of fees for motor vehicles.

Table 1.2. Delegated authority of national revenue bodies

/1. Separate references for countries with multiple revenue bodies.

/2. Australia: Not for penalties imposed by a court; Belgium: Tax rulings are made by the Service for advance decisions in tax matters which is an autonomous body within the Federal Public Service Finances. Brazil: Depends on legal authorisation; Cyprus: Only penalty for compromise of offence. France: Recruitment by competitive examination; Germany: Generally 16 States MOF can decide on the internal structure. Most important decisions on levels and mix staff are made by State and Federal Parliaments as part of the budget. Each of 17 MOF can hire within the limitations provided by its budget and can influence recruitment criteria, but dismissing staff is virtually impossible under German civil service law. Most of 16 States and Federal MOF maintain own IT operations; Latvia: The revenue body may set additional requirements for selection/ hire of new staff, e.g. specific tests, however, one must comply with requirements of the Civil Service Law which provides for basic requirements as to how civil servant staff positions are filled up. Lithuania: STI designs internal structure, but it must be approved by Minister of Finance Luxembourg: Only penalties. Data relate to direct tax and VAT directorates; Malta: Only with regards to penalties. Mexico: It is necessary to obtain authorisation from (Secretaría de la Función Pública) regarding the organisational structure and from the Ministry of Finance and Public Credit concerning the budget. Saudi Arabia: Some of these powers are under the direct authority of Ministry of Finance to which DZIT reports; Spain: Tax rulings are mainly made by the DG for Taxation, within the MOF. United Kingdom: Public Service Agreement targets have to be agreed with Ministers.

/3. Belgium: Remittance of interest and penalties for tax offences are under the jurisdiction of Minister, however, for excises this remittance is executed by the regional directors of excises; Mexico: Appointments for 6 of the 11 high level positions must be designated by the President and ratified by the Senate; Spain: The recruitment is made by competitive examination. Recruitment and dismissal of staff should be done under the General Spanish Civil Service Law. Dismissal is extremely rare.

Table 1.5. Social security contributions: Assistance provided by revenue bodies not having primary collection responsibility

/1. Austria: Joint audits involving tax and SSC agency officials; Chile: Starting 2013, the SII will be responsible for assessing the self-employeds’ liabilities for pension contributions, and from 2018, for health contributions. Italy: There is a useful exchange of information and tools between revenue body and National Social Security Institute (INPS); available web services enable INPS to access tax register information system to verify taxpayers’ data with cross reference verifications; Korea: NTS notifies individuals income data to the National Health Insurance Corporation; Luxembourg: Direct Taxes Department only; Poland: An integrated approach to tax and SSC collection is being examined in the context of MOF’s plans for e-services; Singapore: IRAS assists Central Provident Fund by transmitting income information of self-employed taxpayers to aid in computation of the contribution amount payable. Slovak Republic: Date of implementation is tentative, subject to completion of legal formalities after Parliamentary election. Spain: The “Plan for the Prevention and Correction of Tax, Labour and Social Security Fraud” (approved March 2010) widens and improves collaboration between the Tax Agency and the Social Security Administration and is based on three instruments: the shared use of information, the design of joint inspections and more coordinated actions in the recovery of taxes and SSC.

/2. Chile: The SII collaborates with: the Social Security Institute (IPS), providing information relevant to determine the entitlement to pensions under the “pension solidaria” system; and the National Health Fund (FONASA), by providing information on the income of those paying contributions to FONASA to ensure that the benefits granted correspond to their level of income, among others.

Table 1.6. Selected non-tax roles of revenue bodies

/1. Australia: Three categories: 1) From 1 July, 2010, the Australian Taxation Office is responsible for administering excise equivalent goods (EEGs) imported into Australia and stored in a warehouse licensed;

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

54 – 1. INSTITUTIONAL ARRANGEMENTS FOR TAX ADMINISTRATION

2) Some aspects of social welfare and student loan schemes; and 3) Fuel rebate and grants scheme, Australian Business Register, Superannuation systems; Austria: Financial Police – Regulatory policy tasks (in particular labour market tasks as well as controls to ensure compliance with the Gambling Act); Argentina: The Revenue Body of Argentina has also the tax examination and collection function of the Social Security Contributions and their subsequent distribution to the security and health systems in charge of their administration. Belgium: Specific general administration of customs; Bulgaria: Statistical functions; collects some non-tax revenues for the central government budget (e.g. traffic control fines); Canada: Only collects past due amounts. Chile: Self-employed persons are liable to pay contributions for retirement pension and occupational accident and sickness insurance as of 2012 (they can choose not to pay between 2012 and 2014 provided they comply with an administrative procedure before the SII, but it will be compulsory starting 2015). Payment of health contributions will be compulsory from 2018. Yearly, during the annual Income Tax Operation period, the SII will be in charge of assessing, based on a percentage of the previous years’ annual taxable income of the self-employed persons, the mandatory contributions to pension and occupational accident and sickness insurance they have to pay, deducting the voluntary monthly contributions they could have made in the past year. Over the same annual taxable income, the SII will determine the compulsory occupational accident and sickness insurance, deducting the previous monthly payments too (the same assessment will be made with the health contributions). The assessed amounts will be deducted from the monthly receipts withheld to the taxpayer, provisory payments and the family allowance (if applicable), and reported to the Treasury in order to be transferred to the Pension Funds and Insurance companies, as appropriate; also, in the event that the refunds due are not enough to pay the assessed contributions, the debt will be informed. Cyprus: For purpose of ascertaining taxable income or capital; Czech Rep.: Supervises lotteries and gambling games; Denmark: Agricultural export refund; France: The French General Directorate of Public Finances (DGFIP) created in April 2008 is responsible for tax administration and for the management of public finances; Germany: Premiums for owner-occupied homes, investment allowances, measures designed to promote saving, church tax; Greece: Treasury and budget, chemical state laboratory, public property and national legacies; Hungary: NTCA is responsible for the collection of member fee for pension funds, supervises gambling games; Iceland: Maintains companies register, and supervises accounting rules; Japan: Administers liquor industry; Korea: NTS only administers loaners repayment of loans; Latvia: Accounting, evaluation, realisation and destruction of property under the state jurisdiction. Providing for granting the status of Public Benefit Organisation. Acceptance of Public Officials’ Declarations; Lithuania: Includes takeover, accounting, safekeeping, realisation, return and write-off of property under the state jurisdiction including forfeited, derelict, inherited property of the state, material evidences, treasures and findings and, since 2012, acceptance of Public Officials’ declarations on public and private interests. Luxembourg: Direct taxes Department; Malaysia: Assists collect higher education loans on behalf of National Higher Education Fund; Mexico: The Revenue Body also controls businesses providing money exchange and money transfer services; Netherlands: The Tax and Customs Administration manages rent benefit, health care benefit, childcare benefit and supplementary child benefit; New Zealand: Administers “KiwiSaver”, a voluntary savings scheme started in July 2007, which promotes savings by low to medium income earners and has various incentives such as employer and member tax credits. The funds are invested by commercial fund managers; Romania: Applies in Romania some sets of international sanctions, like freezing assets, sanctions established by the UN Security Council or the EU Council of Ministers; Russia: Tax authorities perform other functions: a) the support of bankruptcy procedures, b) registration and maintenance of register of economic entities, c) licensing of certain activities; d) control and oversight of lotteries (including the target use of lottery proceeds; e) control and oversight the compliance of legislation by gambling organisers, including the inspection of safety equipment; f) control and supervision of cash registers; and g) control and supervision of currency legislation. Saudi Arabia: DZIT collects both Zakat and Tax; however, Zakat amounts are directed to welfare and distributed to recipients through Social Security Department. Singapore: Regulatory authority for property appraisers; Slovenia: Collection of certain nontax obligations; Spain: Deduction for working mothers; Sweden: The revenue body administers the public marriage register which was previously administered by the local courts since 2011. United Kingdom: Customs policy responsibilities; collection and provision of data to the Office for National Statistics for the production of overseas trade statistics and generation of UK Balance of Payments, administration of law in relation to the Proceeds of Crime Act 2002.

/2. Belgium: Cooperates with/gives relevant information to the public service managing welfare benefits, child support, student loans, etc., other non-tax functions include counter-terrorism activities at ports and at airports. Canada: Conducted only for support to income tax programmes. Luxembourg: Indirect taxes only.

/3. Canada: Administer national charities programme, collect debts on behalf of other departments, distributes federal and provincial payments for social programmes; Luxembourg: AED is in charge of the administration of the state property (drawing up contracts, collection of rents etc).

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013