- •Table of contents

- •Abbreviations and Acronyms

- •Executive summary

- •Introduction

- •Institutional arrangements for tax administration

- •Key points

- •Introduction

- •The revenue body as an institution

- •The extent of revenue body autonomy

- •Scope of responsibilities of the revenue body

- •Special governance arrangements

- •Special institutional arrangements for dealing with taxpayers’ complaints

- •Bibliography

- •The organisation of revenue bodies

- •Getting organised to collect taxes

- •Office networks for tax administration

- •Large taxpayer operations

- •Managing the tax affairs of high net worth individuals taxpayers

- •Bibliography

- •Selected aspects of strategic management

- •Key points and observations

- •Managing for improved performance

- •Reporting revenue body performance

- •Summary observations

- •Managing and improving taxpayers’ compliance

- •Bibliography

- •Human resource management and tax administration

- •Key points

- •Aspects of HRM Strategy

- •Changes in policy in aspects of HRM within revenue bodies

- •Staff metrics: Staff numbers and attrition, age profiles and qualifications

- •Resources of national revenue bodies

- •Key points and observations

- •The resources of national revenue bodies

- •Impacts of recent Government decisions on revenue bodies’ budgets

- •Overall tax administration expenditure

- •Measures of relative costs of administration

- •International comparisons of administrative expenditure and staffing

- •Bibliography

- •Operational performance of revenue bodies

- •Key points and observations

- •Tax revenue collections

- •Refunds of taxes

- •Taxpayer service delivery

- •Are you being served? Revenue bodies’ use of service delivery standards

- •Tax verification activities

- •Tax disputes

- •Tax debts and their collection

- •Bibliography

- •The use of electronic services in tax administration

- •Key points

- •Provision and use of modern electronic services

- •Bibliography

- •Tax administration and tax intermediaries

- •Introduction

- •The population and work volumes of tax intermediaries

- •Regulation of tax intermediaries

- •The services and support provided to tax intermediaries

- •Bibliography

- •Legislated administrative frameworks for tax administration

- •Key findings and observations

- •Introduction

- •Taxpayers’ rights and charters

- •Access to tax rulings

- •Taxpayer registration

- •Collection and assessment of taxes

- •Administrative review

- •Enforced collection of unpaid taxes

- •Information and access powers

- •Tax offences (including policies for voluntary disclosures)

- •Bibliography

9. LEGISLATED ADMINISTRATIVE FRAMEWORKS FOR TAX ADMINISTRATION – 281

all personnel of the authority and commences with a statement of values and approaches that underpin its philosophy of service delivery. These are stated as:

Polite service of high quality

The appropriate service environmentConvenient opening hours

Special attention to the disabled, old people, people in poor health and pregnant women

Permanent control and improvement of serviceThe right to be heard

High quality and speed of services providedConfidentiality and safety of information

Unbiased, thorough and fair settlement of complaints, conflicts and other issues within the remit of the STI

The STI conveys the expectation that the due performance of its duties as reflected in the legislation of the Republic of Lithuania, compliance with the general standards of ethics and the good offices to each other will help to ensure better quality of taxpayer service.

Access to tax rulings

In line with taxpayers’ rights to be informed, assisted and provided with certainty, it has become a matter of practice for revenue bodies to provide services in the form of advice on how they will interpret the laws they administer. This section provides an overview of the regimes operated by revenue bodies that provide rulings on important aspects of tax law (that are made public) and allow taxpayers to seek advanced rulings in respect of certain transactions being considered by them or already undertaken.

A public ruling is a published statement of how a revenue body will interpret provisions of the tax law in particular situations. They are generally published to clarify the application of the law, especially in situations where large numbers of taxpayers may be impacted by particular provisions of the law and/or where a particular provision has been found to be causing confusion and/or uncertainty – in other words, a taxation issue or question of public importance. Typically, a public ruling is binding on the revenue body if the ruling applies to the taxpayer and the taxpayer relies on the ruling.

A private ruling relates to a specific request from a taxpayer (or their advisor) seeking clarification of how the law would be applied by the revenue body in relation to a particular proposed or completed transaction/s. The objective of private ruling systems is to provide additional support and early certainty to taxpayers on the tax consequences of certain, often complex or high-risk transactions.

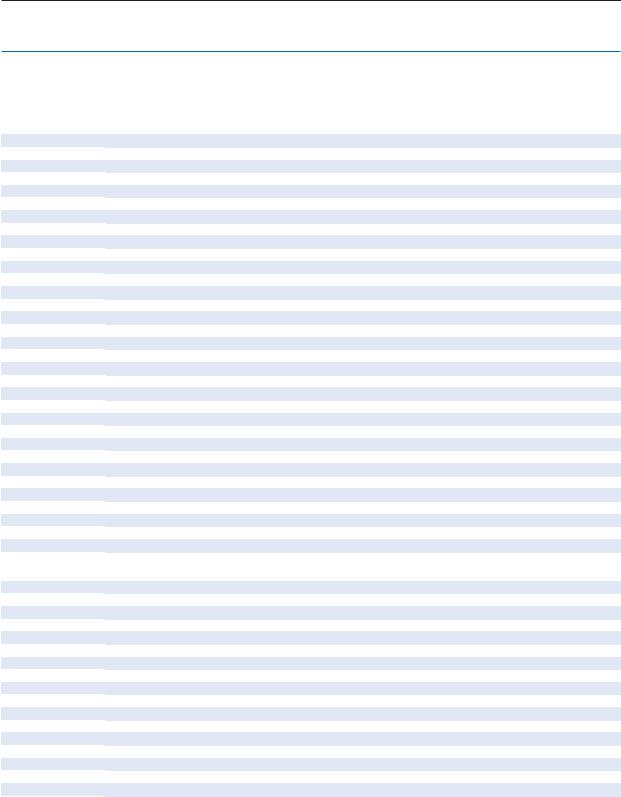

Table 9.1 identifies key features of the systems in place for obtaining public and private tax rulings. The key observations are as follows:

With one exception (i.e. Estonia) all revenue bodies reported the operation of a public rulings system; most revenue bodies (44 of 50) reported that such rulings are generally binding on them;

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

282 – 9. LEGISLATED ADMINISTRATIVE FRAMEWORKS FOR TAX ADMINISTRATION

Table 9.1. Taxpayers’ rights and selected features of the revenue rulings system

|

|

Taxpayers’ rights |

Public rulings |

|

Private rulings |

|

|||

|

|

Rights are |

Rights are |

|

|

|

|

|

|

|

|

formally |

formally defined |

|

Rulings are |

|

Rulings are |

Time limits |

Fees are |

|

|

defined in tax law |

in administrative |

Rulings are |

binding on |

Rulings |

binding on |

exist for |

imposed for |

Country |

or other statutes |

documents |

issued |

revenue body are issued revenue body giving rulings |

giving rulings |

||||

oecd Countries |

|

|

|

|

|

|

|

|

|

Australia |

9 |

9 |

9 |

9 |

9 |

9 |

9/1 |

x |

|

Austria |

9 |

9 |

9 |

9 |

9 |

9/1 |

9 |

x/1 |

|

Belgium |

9 |

9 |

9 |

9 |

9 |

9 |

9/1 |

x |

|

Canada |

9/1 |

9 |

9 |

x |

9 |

9 |

9/2 |

9 |

|

Chile |

9/1 |

9 |

9 |

9 |

9/2 |

9 |

x |

x |

|

Czech Rep. |

9 |

x |

9 |

9 |

9 |

9 |

9 |

x |

|

Denmark |

9 |

9 |

9 |

9 |

9 |

9 |

9 |

9 |

|

Estonia |

9 |

x |

x |

n.a. |

9 |

9 |

9 |

9 |

|

Finland |

9 |

9 |

9 |

9 |

9 |

9 |

9 |

9 |

|

France |

9 |

9 |

9 |

9 |

9 |

9 |

9 |

x |

|

Germany |

9 |

x |

9 |

9 |

9 |

9/1 |

9 |

9 |

|

Greece |

9 |

9 |

9 |

9 |

x |

n.a. |

n.a. |

n.a. |

|

Hungary |

9 |

9 |

9 |

9 |

9 |

9 |

9/1 |

x |

|

Iceland |

9 |

x |

9 |

9 |

9 |

9/1 |

9 |

9 |

|

Ireland |

x |

9/1 |

9 |

9 |

9 |

9 |

9 |

x |

|

Israel |

9 |

9 |

9 |

9 |

9 |

9 |

9 |

9 |

|

Italy |

9 |

9 |

9 |

9 |

9 |

9 |

9 |

x |

|

Japan |

9 |

x |

9 |

9 |

9 |

x |

x |

x |

|

Korea |

9 |

9 |

9 |

x |

9 |

9 |

9 |

x |

|

Luxembourg |

9 |

9/1 |

9 |

9 |

9/1 |

9/1 |

x/1 |

x/1 |

|

Mexico |

9 |

9 |

9 |

9 |

9 |

9/1 |

9 |

x |

|

Netherlands |

9 |

9 |

9 |

9 |

9 |

9 |

x |

x |

|

New Zealand |

x |

9 |

9 |

x |

9 |

9 |

9 |

9 |

|

Norway |

9 |

9 |

9 |

x |

9 |

9 |

9/1 |

9 |

|

Poland |

9 |

x |

9 |

9 |

9 |

9 |

9 |

9 |

|

Portugal |

9 |

9 |

9 |

9 |

9 |

9 |

9/1 |

9/2 |

|

Slovak Rep. |

9 |

x |

9 |

9 |

9 |

9/1 |

x/2 |

9 |

|

Slovenia/1 |

9 |

9 |

9 |

9 |

9 |

9 |

9/1 |

x/1 |

|

Spain |

9 |

9 |

9 |

9 |

9 |

9 |

9 |

x |

|

Sweden |

9 |

9 |

9 |

9 |

x |

n.a. |

n.a. |

n.a. |

|

Switzerland |

9 |

x |

9 |

9 |

9 |

9 |

x |

x |

|

Turkey |

x |

9 |

9 |

9 |

9 |

9 |

x |

x |

|

United Kingdom |

9 |

9 |

9 |

9 |

9 |

9 |

9 |

x |

|

United States |

9 |

9 |

9 |

9 |

9 |

9 |

x |

9 |

|

Non-OECD Countries |

|

|

|

|

|

|

|

|

|

Argentina |

x |

x/1 |

9 |

9 |

9 |

9/2 |

9/3 |

x |

|

Brazil |

9 |

9 |

9 |

9 |

9 |

x |

9 |

x |

|

Bulgaria |

9 |

9 |

9 |

9 |

9 |

x |

9 |

x |

|

China |

9 |

9 |

9 |

9 |

9 |

9 |

x |

x |

|

Colombia |

x |

9 |

9 |

9 |

x |

n.a. |

n.a. |

n.a. |

|

Cyprus |

9 |

9 |

9 |

9 |

9 |

9 |

9/1 |

x |

|

Hong Kong, China |

9 |

9 |

9 |

x |

9 |

9 |

9 |

9 |

|

India |

9 |

9 |

9 |

9 |

x |

n.a. |

n.a. |

n.a. |

|

Indonesia |

9 |

9 |

9 |

9 |

9 |

9 |

x |

x |

|

Latvia |

9 |

9 |

9 |

n.a. |

9 |

9 |

9 |

x |

|

Lithuania |

9 |

9 |

9 |

9 |

9 |

9 |

9/1 |

x |

|

Malaysia |

9 |

9 |

9 |

9 |

9 |

9 |

9/1 |

x |

|

Malta |

9 |

9 |

9 |

9 |

9 |

x |

x |

x |

|

Romania |

9 |

9 |

9 |

9 |

9 |

9 |

9/1 |

9 |

|

Russia |

9 |

x |

9 |

9 |

x |

n.a. |

n.a. |

n.a. |

|

Saudi Arabia |

9 |

9 |

9 |

9 |

9 |

9 |

x |

x |

|

Singapore |

9 |

9 |

9/1 |

9 |

9/1 |

9 |

9/2 |

9/2 |

|

South Africa |

x |

9 |

9 |

9 |

9 |

9 |

9/1 |

9 |

|

For notes indicated by “/ (number)”, see Notes to Tables section at the end of the chapter, p. 338. Sources: IBFD and CIS survey responses.

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

9. LEGISLATED ADMINISTRATIVE FRAMEWORKS FOR TAX ADMINISTRATION – 283

Most revenue bodies (46 of 52) reported the operation of a private rulings service, with virtually all of them indicating that rulings are generally binding on the revenue body; in Sweden, there is a council independent of the revenue body that provides advance private rulings that, in some cases, are subject to a charge (but there are no time limits);

The vast majority of revenue bodies providing a private rulings service reported the existence of time limits (either imposed under the law or applied administratively) for making such rulings; data provided by some revenue bodies indicate that these time limits vary widely (from 28 days to 90 days); 18 of these bodies also reported the practice of imposing a fee for the provision of a ruling.

While not addressed in this survey previous OECD studies have noted that rulings regimes are potentially costly to administer and vulnerable where taxpayers use them to secure “comfort” or “insurance” rulings. This may explain why many countries have chosen to impose a fee for private rulings, a practice that based on past observations appears to be growing.

Taxpayer registration

Comprehensive systems of taxpayer registration and numbering are a critical feature of the tax administration arrangements in most countries, supporting most tax administration processes and underpinning all return filing, collection and assessment activities.

For some revenue bodies, registration involves the maintenance of basic taxpayer identifying information (e.g. for individuals, full name and address, date of birth, and for businesses, full name, business and postal addresses) using a citizen or business identification number that is used generally across government and which, for tax administration purposes, permits the routine identification of taxpayers for a range of administrative functions (e.g. issue of notices, detection of non-filers and follow-up enforcement actions). For others, the registration system involves the operation of a system of unique taxpayer identification numbers (TINs) which similarly facilitates general administration of the tax laws. Regardless of whether the identification and numbering of taxpayers is based on a citizen number or a unique TIN, many revenue bodies also use the number to match information reports received from third parties with tax records to detect instances of potential non-compliance, to exchange information between government agencies (where permitted under the law), and for numerous other applications. Information pertaining to registered taxpayer populations in surveyed countries and the use of taxpayer identification numbers is set out in Tables 9.2 to 9.4. Significantly:

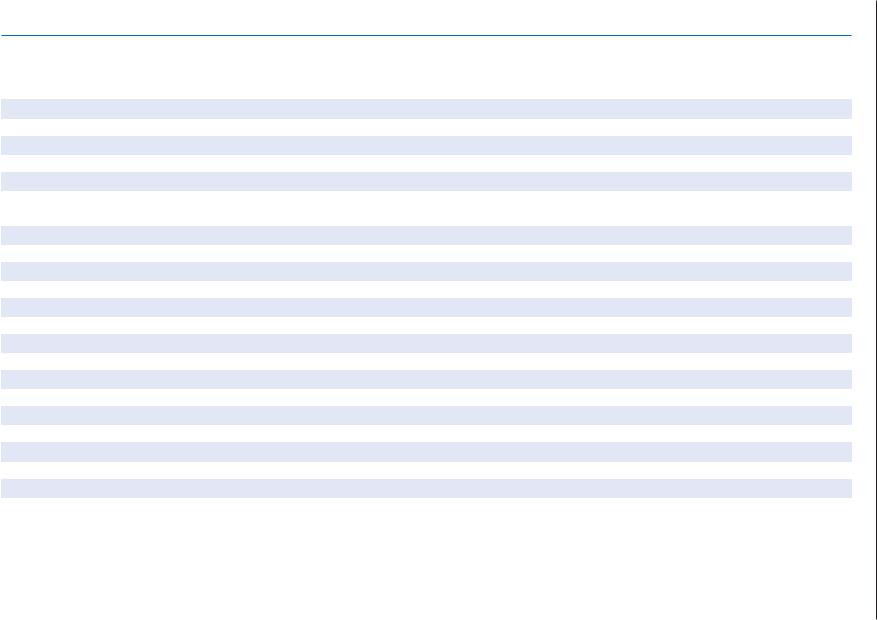

Around two-thirds (32) of surveyed revenue bodies utilise a unique taxpayer identifier (or some other high integrity number (e.g. a citizen identification number) for personal taxation purposes; in general these numbering systems are all numeric, do not incorporate taxpayer specific information, and incorporate a check digit for point-of-entry validation purposes. Similar arrangements apply for CIT and VAT, with unique identification and numbering systems used by 40 revenue bodies (for CIT) and 37 revenue bodies (for VAT) respectively.

In several countries the number used is not unique to the revenue body. For example in Chile, Denmark, Korea, Malta, Norway and Romania the citizen identification number is also used for PIT purposes. In Canada and the USA, an individual’s social security number is used for personal tax purposes. In Finland an individual’s social security number is used for personal tax and individual VAT, a business registration number is used for corporate tax and VAT.

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

284 – 9. LEGISLATED ADMINISTRATIVE FRAMEWORKS FOR TAX ADMINISTRATION

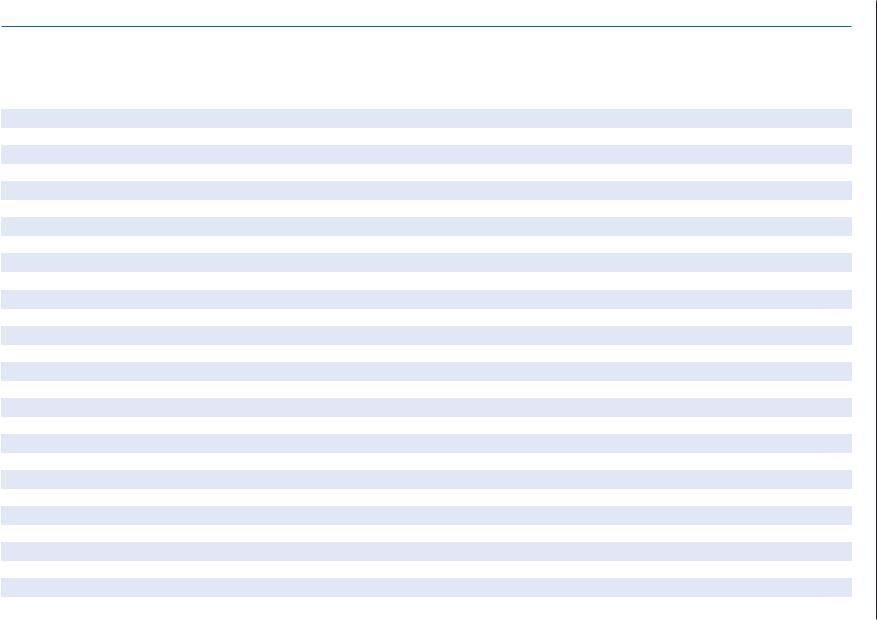

Table 9.2. Comparison of registered taxpayer populations (2011)

|

Populations (millions) |

Number of registered taxpayers (millions) |

Relative indicators |

||||

|

|

|

Personal |

Corporate |

|

Registered PIT |

Registered PIT |

|

|

|

income tax |

income tax |

Value added tax |

payers/labour |

payers/citizen |

Country |

Citizens |

Labour force |

(PIT) |

(CIT) |

(VAT) |

force (%)/1 |

population (%) |

OECD countries |

|

|

|

|

|

|

|

Australia/1 |

22.34 |

12.11 |

19.05 |

1.67 |

2.67 |

157.3 |

85.3 |

Austria |

8.39 |

4.32 |

6.67 |

0.14 |

0.80 |

154.2 |

79.5 |

Belgium/2 |

10.44 |

4.99 |

6.9 |

0.47 |

0.78 |

138.2 |

66.1 |

Canada/2 |

34.11 |

18.70 |

30.0 |

2.86 |

3.25 |

160.4 |

88.0 |

Chile/2 |

17.2 |

8.10 |

8.37 |

0.8 |

0.78 |

103.3 |

48.5 |

Czech Rep. |

10.52 |

5.24 |

2.82 |

0.48 |

0.53 |

53.8 |

26.8 |

Denmark |

5.54 |

3.00 |

4.7 |

0.24 |

0.45 |

156.6 |

84.8 |

Estonia |

1.34 |

0.70 |

0.63 |

0.18 |

0.69 |

90.6 |

47.0 |

Finland |

5.36 |

2.67 |

5.3 |

0.38 |

0.31 |

198.3 |

98.8 |

France |

65.63 |

28.40 |

37 |

1.7 |

4.8 |

130.3 |

56.4 |

Germany/2 |

81.31 |

43.60 |

26.49 |

1.16 |

5.69 |

60.8 |

32.6 |

Greece/2 |

10.77 |

4.97 |

8.2 |

0.27 |

1.1 |

165.0 |

76.2 |

Hungary |

10.00 |

4.26 |

3.7 |

0.59 |

0.62 |

86.8 |

37.0 |

Iceland |

0.32 |

0.18 |

0.26 |

0.05 |

0.03 |

144.4 |

81.8 |

Ireland |

4.47 |

2.12 |

3.2 |

0.16 |

0.26 |

151.3 |

71.6 |

Israel |

7.62 |

3.50 |

1.48 |

0.21 |

0.49 |

42.3 |

19.4 |

Italy |

61.26 |

25.07 |

41.5 |

1.1 |

5.1 |

165.5 |

67.7 |

Japan/2 |

127.37 |

65.45 |

22 |

3 |

3 |

33.6 |

17.3 |

Korea/2 |

50.52 |

25.10 |

19.89 |

0.56 |

5.02 |

79.2 |

39.4 |

Luxembourg |

0.51 |

0.24 |

0.2 |

0.08 |

0.06 |

84.0 |

39.3 |

Mexico/2 |

108.40 |

48.86 |

31.9 |

1.1 |

5.1 |

65.3 |

29.4 |

Netherlands/2 |

16.73 |

8.92 |

8.4 |

0.8 |

1.6 |

94.2 |

50.2 |

New Zealand/2 |

4.37 |

2.37 |

3.62 |

0.47 |

0.63 |

152.7 |

82.8 |

Norway |

4.89 |

2.63 |

4.4 |

0.24 |

0.34 |

167.4 |

90.0 |

Poland |

38.19 |

17.85 |

17.44 |

0.41 |

2.39 |

97.7 |

45.7 |

Portugal |

10.78 |

5.51 |

7.0 |

0.4 |

1.4 |

127.0 |

64.9 |

Slovak Rep. |

5.43 |

2.72 |

0.98 |

0.28 |

0.22 |

36.0 |

18.0 |

Slovenia |

2.00 |

1.02 |

1.01 |

0.1 |

0.1 |

99.1 |

50.6 |

Spain/2 |

46.07 |

23.10 |

19.3 |

2.36 |

3.23 |

83.5 |

41.9 |

Sweden |

9.38 |

5.02 |

7.5 |

0.5 |

1.0 |

150.0 |

80.0 |

Switzerland |

7.82 |

4.65 |

4.6 |

0.3 |

0.35 |

98.9 |

58.8 |

Turkey |

72.70 |

27.23 |

1.7 |

0.66 |

2.3 |

6.2 |

2.3 |

United Kingdom |

61.35 |

31.74 |

30.3 |

0.93 |

1.91 |

94.8 |

49.1 |

United States/2 |

309.05 |

153.62 |

270.3 |

21.2 |

n.a. |

176.0 |

87.5 |

Non-OECD countries |

|

|

|

|

|

|

|

Argentina |

42.19 |

16.8 |

--------- 1.22 ------- |

0.93 |

7.28 |

2.89 |

|

Brazil |

199.32 |

104.7 |

188 |

14 |

n.a. |

179.56 |

94.32 |

Bulgaria |

7.04 |

2.5 |

1.06 |

0.54 |

0.21 |

43.00 |

15.06 |

China |

1.343 |

795.5 |

n.a. |

n.a. |

n.a. |

n.a |

n.a |

Colombia |

45.24 |

22.5 |

4.5 |

0.3 |

0.37 |

20.04 |

9.95 |

Cyprus |

0.84 |

0.43 |

0.33 |

0.2 |

0.08 |

79.69 |

29.00 |

Hong Kong, China |

7.15 |

3.7 |

3 |

0.8 |

n.a. |

81.02 |

41.94 |

India |

1.205 |

487.6 |

31.03 |

0.49 |

n.a. |

6.36 |

2.57 |

Indonesia |

248.65 |

117.4 |

20.17 |

1.92 |

0.8 |

17.18 |

8.11 |

Latvia/2 |

2.19 |

1.2 |

0.86 |

0.08 |

0.09 |

73.57 |

39.24 |

Lithuania |

3.53 |

1.6 |

1.46 |

0.1 |

0.08 |

89.90 |

41.41 |

Malaysia |

29.18 |

0.0 |

7.2 |

0.7 |

n.a. |

60.45 |

24.67 |

Malta/2 |

0.41 |

0.2 |

0.27 |

0.04 |

0.05 |

158.36 |

65.88 |

Romania |

21.85 |

9.3 |

0.46 |

0.77 |

0.57 |

4.97 |

2.11 |

Russia/2 |

142.52 |

75.4 |

138.6 |

5.1/1 |

n.a. |

183.80 |

97.25 |

Saudi Arabia/2 |

26.53 |

7.6 |

0.4 |

0.03 |

n.a. |

5.24 |

1.51 |

Singapore/2 |

5.35 |

3.3 |

1.73 |

0.15 |

0.08 |

52.91 |

32.32 |

South Africa |

48.81 |

17.7 |

13.77 |

2.04 |

0.65 |

77.97 |

28.21 |

For notes indicated by “/ (number)”, see Notes to Tables section at the end of the chapter, p. 339.

Sources: Country and labour force populations (latest years available) from OECD Statistical database, EU statistics, or CIA World Factbook; other data from country survey responses.

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

9. LEGISLATED ADMINISTRATIVE FRAMEWORKS FOR TAX ADMINISTRATION – 285

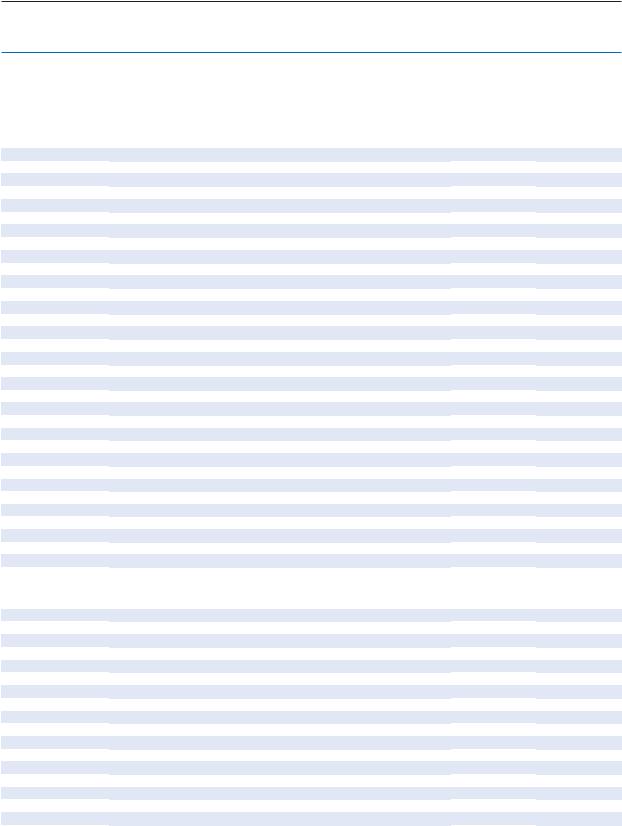

Unique taxpayer identifiers are widely used for information reporting and data matching with information reports covering wages, pensions, government benefits, interest, dividends, contract income, and/or asset sales and purchases reported to revenue bodies for verification purposes (see Table 9.3).

Using country labour force data as a benchmark, the proportion of personal taxpayers who are registered with the revenue body varies substantially across surveyed revenue bodies; for over one third of revenue bodies (18), the proportion was less than 80%, while for 15 revenue bodies the proportion exceeded 150%; these data indicate that across surveyed revenue bodies, the workloads associated with registering and numbering taxpayers also vary enormously.

Revenue bodies with relatively low rates of registration (i.e. less than 60%) were Argentina, Bulgaria, Colombia, Czech Rep., Israel, India, Indonesia, Japan, Romania, Saudi Arabia, Slovak Rep., and Turkey); leaving aside Saudi Arabia which has its own unique tax arrangements, all of these revenue bodies administer cumulative withholding regimes for their employee taxpayers, freeing them from the requirement to file annual tax returns.

Revenue bodies with relatively high rates of personal taxpayer registration (i.e. over 150% of their respective labour forces or over 80% of their respective citizen populations) such as Australia, Canada, Denmark, Finland, New Zealand, Norway, Sweden and the USA typically have some other unique features attaching to their systems of personal tax administration (e.g. extensive third party reporting regimes, end-year matching and reconciliation processes, pre-filled tax returns and extensive electronic return filing, and responsibilities for the payment of certain government welfare/benefits or other government programmes that concern the citizen population).

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

2013 OECD © – ECONOMIES EMERGING AND ADVANCED OTHER AND OECD ON INFORMATION COMPARATIVE 2013: ADMINISTRATION TAX

Table 9.3. System of taxpayer identifiers for revenue administration

|

|

Personal income tax (PIT) |

|

|

Corporate income tax (CIT) |

|

|

Value added tax (VAT) |

|

||||||

|

Unique |

Num. (N) or |

No. of |

Check |

Taxpayer |

Unique |

Num. or |

No. of |

Check |

Taxpayer |

Unique |

Num. or |

No. of |

Check |

Taxpayer |

|

Alpha-numeric |

||||||||||||||

Country |

TIN |

(AN) |

digits |

digit |

specifics |

TIN |

Alpha-n. |

digits |

digit |

specifics |

TIN |

alpha-n. |

digits |

digit |

specifics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OECD countries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australia/1 |

9 |

N |

9 |

9 |

x |

9 |

N |

8 |

9 |

x |

9 |

N |

11 |

9 |

x |

Austria |

9 |

N |

9 |

9 |

x |

9 |

N |

9 |

9 |

x |

9 |

AN |

11 |

9 |

x |

Belgium |

9 |

N |

11 |

9 |

9/1 |

9 |

N |

10 |

9 |

x |

9 |

AN |

12 |

9 |

x |

Canada/1 |

x/1 |

N |

9 |

9 |

x |

9 |

AN |

15 |

9 |

x |

9 |

AN |

15 |

9 |

x |

Chile/1 |

x/1 |

N |

8 |

9 |

x |

9 |

N |

8 |

9 |

x |

9 |

N |

8 |

9 |

x |

Czech Rep. |

9 |

AN |

12/1 |

9 |

x |

9 |

AN |

12/1 |

9 |

x |

9 |

AN |

12/1 |

9 |

x |

Denmark/1 |

x/1 |

N |

10 |

9 |

9 |

9 |

N |

8 |

9 |

x |

9 |

N |

8 |

9 |

x |

Estonia |

x/1 |

N |

11 |

9 |

9 |

x/1 |

N |

8 |

9 |

x |

9 |

AN |

11 |

x |

x |

Finland/1 |

x |

AN |

10 |

9 |

9 |

x |

N |

8 |

9 |

9 |

x |

N |

8 |

9 |

9 |

France/1 |

x/1 |

N |

13 |

x |

x |

9 |

N |

9 |

x |

x |

9 |

AN |

13 |

x |

x |

Germany |

9 |

N |

11 |

9 |

x |

9 |

N |

11 |

9 |

x |

9 |

N |

11 |

9 |

x |

Greece/1 |

9/1 |

N |

9 |

x |

x |

9 |

N |

9 |

x |

x |

9 |

N |

9 |

x |

x |

Hungary/1 |

9 |

N |

10 |

9 |

9 |

9 |

N |

11 |

9 |

9 |

9 |

N |

11 |

9 |

9 |

Iceland/1 |

x/1 |

N |

10 |

9 |

9 |

x/1 |

N |

10 |

9 |

x |

9 |

N |

6 |

x |

x |

Ireland/1 |

9 |

AN |

8 |

9 |

x |

9 |

AN |

8 |

9 |

x |

9 |

AN |

8 |

9 |

x |

Israel |

x |

N |

9 |

9 |

9 |

x |

N |

9 |

9 |

9 |

x |

N |

9 |

9 |

9 |

Italy/1 |

9 |

AN |

16 |

9 |

9 |

9 |

N |

11 |

9 |

x |

9 |

N |

11 |

9 |

x |

Japan |

x |

- |

- |

- |

- |

x |

- |

- |

- |

- |

x |

- |

- |

- |

- |

Korea/1 |

x |

N |

13 |

9 |

9 |

9 |

N |

10 |

9 |

9 |

9 |

N |

10 |

9 |

9 |

Luxembourg/1 |

x |

N |

11 |

9 |

9 |

x |

N |

11 |

9 |

9 |

x |

AN |

10 |

9 |

x |

Mexico/1 |

9 |

AN |

13 |

9 |

9 |

9 |

AN |

12 |

9 |

9 |

9 |

AN |

12/13 |

9 |

x |

Netherlands/1 |

x |

N |

9 |

9 |

x |

9 |

N |

9 |

9 |

x |

9/1 |

N |

9 |

9 |

x |

New Zealand/1 |

9 |

N |

9 |

9 |

x |

9 |

N |

9 |

9 |

x |

9 |

N |

9 |

9 |

x |

Norway/1 |

x |

N |

11 |

9 |

9 |

x |

N |

9 |

9 |

9 |

x |

AN |

9 |

9 |

x |

Poland |

9 |

N |

10 11 |

9 |

x/1 |

9 |

N |

10 |

9 |

x |

9 |

N |

10 |

9 |

x |

Portugal |

9 |

N |

9 |

9 |

x |

9 |

N |

9 |

9 |

x |

9 |

N |

9 |

9 |

x |

Slovak Rep./1 |

9 |

N |

10 |

9 |

x |

9 |

N |

10 |

9 |

x |

9 |

N |

10 |

9 |

x |

Slovenia |

9 |

N |

8 |

9 |

x |

9 |

N |

8 |

9 |

x |

9 |

AN/1 |

10 |

9 |

x |

ADMINISTRATION TAX FOR FRAMEWORKS ADMINISTRATIVE LEGISLATED .9 – 286

2013 OECD © – ECONOMIES EMERGING AND ADVANCED OTHER AND OECD ON INFORMATION COMPARATIVE 2013: ADMINISTRATION TAX

Table 9.3. System of taxpayer identifiers for revenue administration (continued)

|

|

|

Personal income tax (PIT) |

|

|

Corporate income tax (CIT) |

|

|

Value added tax (VAT) |

|

||||||

|

|

Unique |

Num. (N) or |

No. of |

Check |

Taxpayer |

Unique |

Num. or |

No. of |

Check |

Taxpayer |

Unique |

Num. or |

No. of |

Check |

Taxpayer |

|

|

Alpha-numeric |

||||||||||||||

Country |

TIN |

(AN) |

digits |

digit |

specifics |

TIN |

Alpha-n. |

digits |

digit |

specifics |

TIN |

alpha-n. |

digits |

digit |

specifics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spain/1 |

x |

AN |

9 |

9 |

x |

x |

AN |

9 |

9 |

x |

x |

AN |

9 |

9 |

x |

|

Sweden/1 |

x |

N |

12 |

9 |

9 |

x |

N |

12 |

9 |

9 |

x |

N |

12 |

9 |

9 |

|

Switzerland/1 |

x |

N |

Vary |

x |

x |

x |

N |

Vary |

x |

x |

9 |

N |

9 |

x |

x |

|

Turkey/1 |

9 |

N |

11 |

9 |

x |

9 |

N |

10 |

9 |

x |

9 |

N |

10/11 |

9 |

x |

|

United Kingdom/1 |

9 |

N |

10 |

9 |

x |

9 |

N |

10 |

9 |

x |

9 |

N |

9 |

9 |

x |

|

United States |

x/1 |

N |

9 |

x |

x |

9 |

N |

9 |

x |

x |

- |

- |

- |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-OECD countries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Argentina |

9 |

N |

11 |

9 |

9 |

9 |

N |

11 |

9 |

9 |

9 |

N |

11 |

9 |

9 |

|

Brazil |

9 |

N |

11 |

9 |

x |

9 |

N |

14 |

9 |

x |

- |

- |

- |

- |

- |

|

Bulgaria |

9 |

N |

10 |

9 |

9 |

9 |

N |

9 |

9 |

x |

9 |

AN |

11(12) |

9 |

x |

|

China |

x |

AN |

18 |

9 |

9 |

x |

AN |

15 |

9 |

x |

x |

AN |

15 |

9 |

x |

|

Colombia |

9 |

AN |

9 |

9 |

x |

9 |

AN |

9 |

9 |

x |

9 |

AN |

9 |

9 |

x |

|

Cyprus |

9 |

AN |

9 |

9 |

9 |

9 |

AN |

9 |

9 |

9 |

9 |

AN |

9 |

9 |

9 |

|

Hong Kong, China |

9 |

AN |

7 |

9 |

x |

9 |

N |

Up to 8 |

9 |

x |

- |

- |

- |

- |

- |

|

India |

9 |

AN |

10 |

x |

9 |

9 |

AN |

10 |

x |

9 |

- |

- |

- |

- |

- |

|

Indonesia |

9 |

N |

15 |

9 |

x |

9 |

N |

15 |

9 |

x |

9 |

N |

15 |

9 |

x |

|

Latvia |

x |

N |

11 |

9 |

9 |

x |

N |

11 |

9 |

x |

x |

AN |

11 |

9 |

x/1 |

|

Lithuania |

9 |

N |

9- 11 |

9 |

9 |

9 |

N |

9-10 |

9 |

x |

9 |

AN |

9 or 12 |

9 |

x |

|

Malaysia |

9 |

AN |

11 |

9 |

x |

9 |

AN |

10 |

9 |

x |

- |

- |

- |

- |

- |

|

Malta |

x |

AN |

Vary |

x |

9 |

9 |

N |

9 |

9 |

9 |

9 |

N |

8 |

x |

x |

|

Romania |

9 |

N |

13 |

9 |

9 |

9 |

N |

2-12 |

9 |

x |

9 |

AN |

2-12 |

9 |

x |

|

Russia |

9 |

N |

10, 12 |

9 |

x |

9 |

N |

12 |

9 |

x |

9 |

N |

10, 12 |

9 |

x |

|

Saudi Arabia |

9 |

N |

10 |

9 |

x |

9 |

N |

10 |

9 |

x |

- |

- |

- |

- |

- |

|

Singapore |

x/1 |

AN |

9 |

9 |

x |

x/1 |

AN |

10 |

9 |

x |

x/1 |

AN |

9 (10) |

9 |

x |

|

South Africa |

9 |

N |

10 |

9 |

x |

9 |

N |

10 |

9 |

x |

9 |

N |

10 |

9 |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For notes indicated by “/ (number)”, see Notes to Tables section at the end of the chapter, p. 340.

TIN: Taxpayer Identification Number, AN: Alpha-Number, N: Number

Source: Information Series compiled by CFA, Working Party 8 and CIS survey responses.

287 – ADMINISTRATION TAX FOR FRAMEWORKS ADMINISTRATIVE LEGISLATED .9

288 – 9. LEGISLATED ADMINISTRATIVE FRAMEWORKS FOR TAX ADMINISTRATION

Table 9.4. Use of taxpayer identifiers for information reporting and matching

|

Use of taxpayer identifiers (or some other number) for information reporting and matching |

|||||

|

|

Government |

|

|

Government |

Prescribed |

|

|

agencies: |

|

|

agencies: |

contractors: |

|

|

pensions and |

Financial institutions: |

Companies: |

asset sales and |

payments to |

Country |

Employers: wages |

benefits |

interest |

dividends |

purchases |

sub-contractors |

OECD countries |

|

|

|

|

|

|

Australia |

9 |

9 |

9 |

9 |

x |

x |

Austria |

9 |

9 |

x |

x |

x |

x |

Belgium |

9 |

9 |

9 |

x |

x |

x |

Canada |

9 |

9 |

9 |

9 |

some |

9 |

Chile |

9 |

9 |

9 |

9 |

x |

x |

Czech Rep. |

9 |

9 |

9 |

9 |

9 |

9 |

Denmark |

9 |

9 |

9 |

9 |

9 |

x |

Estonia |

9 |

9 |

9 |

9 |

9 |

x |

Finland |

9 |

9 |

9 |

9 |

9 |

9 |

France |

x |

x |

x |

x |

x |

9 |

Germany/1 |

9 |

9/1 |

x |

x |

x |

x |

Greece |

9 |

9 |

9 |

9 |

9 |

9 |

Hungary |

9 |

9 |

9 |

9 |

9 |

9 |

Iceland |

9 |

9 |

9 |

9 |

9 |

9 |

Ireland/1 |

9 |

9 |

9/1 |

x |

x |

9 |

Israel |

9 |

9 |

9 |

9 |

x |

x |

Italy |

9 |

9 |

9 |

9 |

9 |

9 |

Japan |

x |

x |

x |

x |

x |

x |

Korea |

9 |

9 |

9 |

9 |

9 |

9 |

Luxembourg |

9 |

9 |

x |

9 |

9 |

9 |

Mexico |

9 |

9 |

9 |

9 |

x |

9 |

Netherlands |

9 |

9 |

9 |

9 |

9 |

9 |

New Zealand |

9 |

9 |

9 |

9 |

x |

9 |

Norway |

9 |

9 |

9 |

9 |

9 |

9 |

Poland |

9 |

9 |

9 |

9 |

9 |

9 |

Portugal/1 |

9 |

9 |

9 |

9 |

9 |

9 |

Slovak Rep. |

x |

x |

x |

x |

x |

x |

Slovenia |

9 |

9 |

9 |

9 |

x |

x |

Spain |

9 |

9 |

9 |

9 |

9 |

9 |

Sweden/1 |

9 |

9 |

9 |

9 |

9 |

x |

Switzerland |

9 |

x |

x |

x |

x |

x |

Turkey |

x |

x |

x |

x |

x |

x |

United Kingdom |

9 |

9 |

9 |

x |

9 |

9 |

United States |

9 |

9 |

9 |

9 |

x |

9 |

Non-OECD countries |

|

|

|

|

|

|

Argentina |

9 |

9 |

9 |

9 |

9 |

9 |

Brazil |

9 |

9 |

9 |

9 |

9 |

9 |

Bulgaria |

9 |

9 |

9 |

9 |

9 |

9 |

China |

9 |

9 |

9 |

9 |

9 |

9 |

Colombia |

9 |

9 |

9 |

9 |

9 |

9 |

Cyprus/1 |

9 |

9/2 |

x |

9 |

9 |

x |

Hong Kong, China |

9 |

9 |

n.a. |

n.a. |

n.a. |

n.a. |

India |

9 |

9 |

9 |

9 |

9 |

9 |

Indonesia |

9 |

x |

x |

x |

9 |

9 |

Latvia |

9 |

9 |

9 |

9 |

n.a. |

n.a. |

Lithuania |

9 |

9 |

9 |

9 |

9 |

9 |

Malaysia |

9 |

9 |

x |

x |

x |

x |

Malta |

9 |

9 |

9 |

9 |

9 |

9 |

Romania |

9 |

9 |

9 |

9 |

9 |

x |

Russia |

9 |

9 |

9 |

9/1 |

9 |

x |

Saudi Arabia |

x |

x |

x |

x |

x |

x |

Singapore |

9/1 |

9/1 |

x |

x/1 |

x/2 |

9/2 |

South Africa |

9 |

9 |

9 |

9/1 |

9 |

x |

For notes indicated by “/ (number)”, see Notes to Tables section at the end of the chapter, p. 341. Source: CIS survey responses.

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013