- •Table of contents

- •Abbreviations and Acronyms

- •Executive summary

- •Introduction

- •Institutional arrangements for tax administration

- •Key points

- •Introduction

- •The revenue body as an institution

- •The extent of revenue body autonomy

- •Scope of responsibilities of the revenue body

- •Special governance arrangements

- •Special institutional arrangements for dealing with taxpayers’ complaints

- •Bibliography

- •The organisation of revenue bodies

- •Getting organised to collect taxes

- •Office networks for tax administration

- •Large taxpayer operations

- •Managing the tax affairs of high net worth individuals taxpayers

- •Bibliography

- •Selected aspects of strategic management

- •Key points and observations

- •Managing for improved performance

- •Reporting revenue body performance

- •Summary observations

- •Managing and improving taxpayers’ compliance

- •Bibliography

- •Human resource management and tax administration

- •Key points

- •Aspects of HRM Strategy

- •Changes in policy in aspects of HRM within revenue bodies

- •Staff metrics: Staff numbers and attrition, age profiles and qualifications

- •Resources of national revenue bodies

- •Key points and observations

- •The resources of national revenue bodies

- •Impacts of recent Government decisions on revenue bodies’ budgets

- •Overall tax administration expenditure

- •Measures of relative costs of administration

- •International comparisons of administrative expenditure and staffing

- •Bibliography

- •Operational performance of revenue bodies

- •Key points and observations

- •Tax revenue collections

- •Refunds of taxes

- •Taxpayer service delivery

- •Are you being served? Revenue bodies’ use of service delivery standards

- •Tax verification activities

- •Tax disputes

- •Tax debts and their collection

- •Bibliography

- •The use of electronic services in tax administration

- •Key points

- •Provision and use of modern electronic services

- •Bibliography

- •Tax administration and tax intermediaries

- •Introduction

- •The population and work volumes of tax intermediaries

- •Regulation of tax intermediaries

- •The services and support provided to tax intermediaries

- •Bibliography

- •Legislated administrative frameworks for tax administration

- •Key findings and observations

- •Introduction

- •Taxpayers’ rights and charters

- •Access to tax rulings

- •Taxpayer registration

- •Collection and assessment of taxes

- •Administrative review

- •Enforced collection of unpaid taxes

- •Information and access powers

- •Tax offences (including policies for voluntary disclosures)

- •Bibliography

84 – 2. THE ORGANISATION OF REVENUE BODIES

Examples of large scale office network rationalisation programs

Over recent years, a number of revenue bodies have responded to the need for greater efficiency and effectiveness by rationalising their office networks. A number of examples are described in Box 2.4.

Box 2.4. Examples of large scale office network rationalisation programs

Austria: Since 2004, the office network of the Directorate General for Taxes and Customs has been reshaped to achieve increased efficiency. From a network previously comprised of 7 regional directorates and 81 tax offices, the new network implemented from mid-2004 now sees five regional management areas, 41 tax offices, and one Large Trader Audit Division).

Bulgaria: In 2004 and 2005, centralisation of the maintenance of national taxes was accomplished and since then the collection of local taxes and fees is done by municipalities. This required the transfer of some 1 300 employees (about 14% of 9 000 employees) from NRA to the municipalities, and enabled a substantial reduction in the number of structures situated in the district centres (under the NRA) from 340 in 2003 to 29 in 2006.

Denmark: In 2005, the central and municipal tax administration bodies merged thereby creating a country-wide unified tax administration dealing with all aspects of tax, contributions to the unemployment and sickness leave fund, real estate valuations, VAT, customs and tax collection. As a result of the merger, a major restructuring of the office network was undertaken. There are now 30 regional tax offices altogether (comprising just under 80% of total revenue body staffing), a considerable reduction from the 275 separate offices when each municipality had its own local tax office.

Greece: By the end of 2012, the Ministry of Finance plans to reduce the number of local tax offices to one (1) for each Prefecture, with the exception of the Prefectures of Attica, Salonica and island areas. This could entail up to 200 office closures. Since 2010, already 49 local tax offices have been merged, and 6 Regional Audit Centers and 4 Inspectorates have been abolished.

Norway: There is an office rationalisation programme underway with the network expected to be cut by over 50% by early 2013 compared to the number existing at the beginning of 2011 (i.e. 225)

Portugal: Officials reported that there is a target of 20% for reducing the size of its local office network, which currently numbers over 340 offices.

Romania: Reform efforts currently being planned include attention being given to the scale of Romania’s current network of local offices. Currently, NAFA’s structure includes 42 regional offices and 221 local offices. Steps will be taken to consolidate to eight regional directorates by mid-2013 and 47 local tax offices by the beginning of 2015.

Sources: Revenue body annual reports, survey responses, and IMF reports (referenced elsewhere in CIS).

Large taxpayer operations

As mentioned earlier in this chapter, the vast majority of revenue bodies surveyed have established special dedicated units – hereafter referred to as Large Taxpayer Units (LTUs)-to manage some/all aspects of the tax affairs of their largest taxpayers.3 Further background on this development and its rationale follow.

The common characteristics of large taxpayers

Large taxpayers are very different from other categories of taxpayers and present certain significant risks to effective tax administration. Many revenue bodies have recognised that managing these risks requires strategies and approaches appropriate to the

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

2. THE ORGANISATION OF REVENUE BODIES – 85

unique characteristics and compliance behaviour of these taxpayers. Key characteristics of the large business segment identified from previous OECD work include:

Concentration of revenue – a small number of large taxpayers have a critical role in revenue collection, paying and withholding taxes. The concentration of tax revenue results from the size of these taxpayers and the range of taxes they are responsible for, including their role as withholding agents for large numbers of employees.

Complexity of their business and tax dealings – several countries describe large taxpayers as complex for a variety of reasons, including: 1) multiple operating entities and/or diverse business interests; 2) high volume of transactions in day-to- day business activities; 3) large number of employees; 4) many have international dealings, often involving cross-border transactions with related parties; 5) operate in an industry that presents unique tax issues (e.g. banking and insurance); 6) many are widely spread in geographical terms; 6) deal with complicated issues involving complex tax law and accounting principles; and 7) the use of complex financing and tax planning arrangements.

From the revenue bodies’ perspective, major tax compliance risks – for revenue bodies, many of these large taxpayers present major tax compliance risks due to various factors including: 1) significant offshore activities; 2) policies and strategies to minimise tax liabilities; 3) large portion of tax assessments result from audit activity of large taxpayers; and 4) growing/significant differences between financial accounting profits and the profits computed for tax purposes.

Use of professional/dedicated tax advice – many large businesses engage professional advisors to handle their tax planning etc., while others maintain their own in-house tax advisors.

Status – generally, most large businesses are publicly-listed corporate companies, and also include multinational companies and some private groups.

Given these sorts of considerations, many revenue bodies have established dedicated LTUs, supported by highly skilled and expert staff to manage all/most aspects of the tax affairs of their largest taxpayers. Across surveyed revenue bodies, these organisational units are likely to have different names and the scope and nature of their activities may vary but most have been established to improve the revenue body’s capability to manage and improve the compliance of this important segment of taxpayers.

Criteria used by revenue bodies to identify large businesses

The criteria applied for identifying “large businesses” vary from country to country, having regard to local factors and conditions, and internal revenue body management decisions as to where the boundary between “large” and “non-large” taxpayers should be drawn. While the definition of “large” differs from one revenue body to another, most have established clear and specific criteria for identifying large taxpayers – see Table 2.5. As will be evident from Table 2.5, the criteria commonly used to define taxpayers as “large business” or to place them under the responsibility of the large business unit (regardless of the size of the taxpayer) include: 1) size of turnover or gross sales; 2) size of assets; 3) the aggregate amount of tax paid per annum across all taxes; 4) businesses operating in certain business sectors (e.g. banking, insurance and oil); 5) businesses with significant international business activities and/or which are foreign-controlled; and 6) number of employees.

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

86 – 2. THE ORGANISATION OF REVENUE BODIES

As will also be evident from Table 2.5, many revenue bodies place emphasis on management of corporate groups and related affiliates to ensure that a “whole of taxpayer” focus is brought to the tasks of identifying and treating compliance risks. In addition, some revenue bodies (e.g. Ireland and South Africa) have placed responsibility for the administration of “high net-worth” individuals (HNWIs) under the control of their LTU, recognising that many of the taxpayers concerned have direct links with the large corporate taxpayers also under its control.

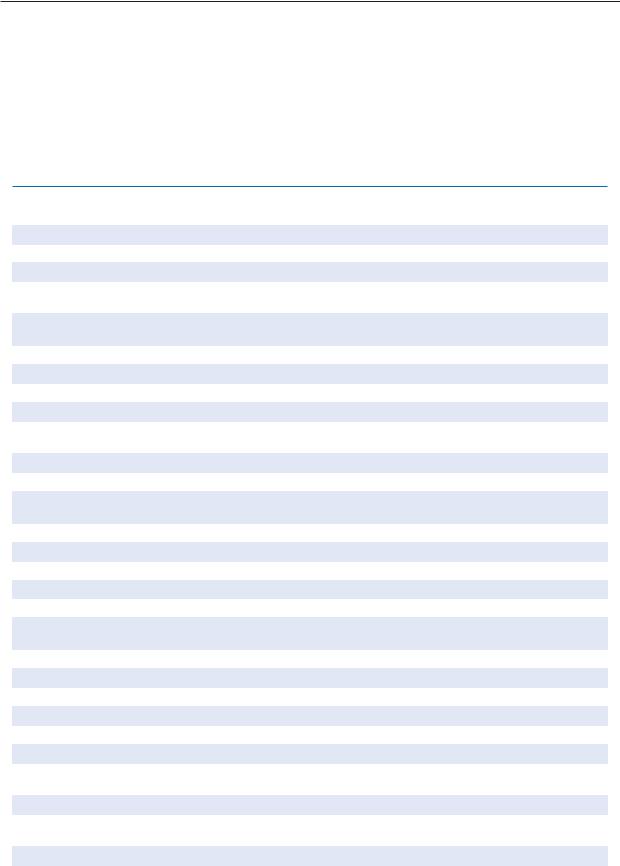

Table 2.5. Large taxpayer operations: Criteria, taxpayer numbers and staff (2011)

Countries |

Criteria applied to identify large corporate taxpayers |

No. of entities |

Staff (FTEs) |

OECD countries |

|

|

|

Australia |

Turnover over AUD 250 m |

32 000/2 |

1 310 |

Austria |

Turnover over EUR 9.68 m |

6 619 |

509 |

Belgium |

Multiple criteria – balance of account, turnover, number of employees |

/1 |

65/1 |

Canada |

Income tax: Gross revenue over CAD 250 m/1; |

25 748/2 |

510 |

|

Indirect taxes (GST/HST): Gross revenue over CAD 100 m/1 |

13 000 |

170 |

Chile |

Turnover equal to or higher than 90 000 UTA during each of prior 3 years or |

1 534 |

188 |

|

other criteria also applicable./1 |

|

|

Czech Rep. |

Multiple criteria – turnover over CZK 2 bn, banks, insurance, group members |

n.a./1 |

n.a./1 |

Denmark |

Groups with total turnover over DKK 3 billion; companies with over 250 staff |

2 000 |

225 |

Finland |

Turnover exceeds EUR 50 m/1 |

4 000 |

139 |

France |

Turnover over EUR 400 m (exclusive of VAT or assets) and related companies/1 |

36 396 |

304 |

Germany/1 |

Trading companies: turnover over EUR 6.9 m or profit over EUR 265 000 and |

194 000 |

n.a. |

|

industry related criteria/1 |

|

|

Greece |

Turnover over EUR 30 m and banks and insurance/1 |

n.a. |

n.a |

Hungary |

Banks, insurance and others with tax capacity over HUF 3 250 m in 2012/1 |

651 |

235 |

Ireland |

Turnover exceeds EUR 162 m or tax payments over EUR 16 m and entity type/ |

12 638/2 |

201 |

|

industry/1 |

|

|

Italy |

Turnover exceeds EUR 100 m |

3 000 |

507 |

Japan |

Corporations with over Y 100 m in capital |

32 010 |

2 326 |

Korea |

Total income over WON 50 billion/1 |

5 185 |

/1 |

Mexico |

Gross income over 618 m pesos, financial institutions, and others/1 |

17 248 |

1 368 |

Netherlands |

Multiple: Tax paid, foreign subsidiaries, specific industries, complex/1 |

2 000 |

700 |

New Zealand |

Enterprises with turnover over NZD 100 m, or in specialist industries or subject |

15 600 |

177 |

|

to specialised tax laws |

|

|

Norway |

Sales/turnover over NOK 5 bn; other criteria may also apply/1 |

3 066 |

53 |

Portugal |

Turnover/1 |

1 425/1 |

142/1 |

Poland |

Multiple – annual revenue over PLN 5 m, banks, insurance etc/1 |

66 126 |

2 442 |

Slovak Rep./1 |

Turnover exceeds EUR 40 m, banks, branches of foreign banks, and insurance |

640 |

74 |

Slovenia |

Turnover exceeds EUR 50 m |

446 |

57 |

Spain |

Turnover over EUR 100 m, large groups, major banks and insurance/1 |

2 795 |

915/2 |

Sweden |

Groups with over 800 employees, companies with annual payroll over |

350 groups |

375 |

|

SEK 50 m, companies supervised by Swedish Financial Supervisory Authority |

15 000 |

|

Turkey |

Mix of criteria-turnover, taxes paid, assets, employees, and industry |

841 |

195 |

United Kingdom |

Large Business Service: Turnover over GDP 600 m, or assets over GDP 2 bn; Local |

778 groups |

3 457 (both |

|

Compliance Large and Complex: Turnover over GDP 30 m or over 250 employees |

9 600 groups |

services) |

United States |

All corporations and partnerships with assets over USDUS 10 m/1 |

244 623/2 |

6 414 |

|

|

|

|

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

2. THE ORGANISATION OF REVENUE BODIES – 87

Table 2.5. Large taxpayer operations: Criteria, taxpayer numbers and staff (2011) (continued)

Countries |

Criteria applied to identify large corporate taxpayers |

No. of entities |

Staff (FTEs) |

Non-OECD countries |

|

|

|

Argentina |

Mix of tax assessed, tax paid, annual sales, VAT debt, economic sector and |

907 |

497 |

|

number of employees |

|

|

Brazil |

Gross revenue and size of treasury, payroll and social security debt/1 |

12 600 |

n.a./1 |

Bulgaria |

Mix of turnover, taxes paid, tax refunds, and industry/1 |

1 569 |

166 |

China |

Combination of industry, turnover and ownership |

45/1 |

21/1 |

Colombia |

Largest taxpayers representing 60% of total taxes paid, no debts, and |

2 655/1 |

257 |

|

operating over 3 years |

|

|

Cyprus |

Tax revenue and size of business (VAT taxpayers only) |

200 |

11 |

India |

Mix of where return s are assessed, and levels of major taxes/1 |

172 |

165 |

Latvia |

Turnover, taxes paid and entity type/industry/1 |

1 314 |

129 |

Lithuania |

Turnover over LTL 50 m and number of employees exceeds 10, finance and |

523 |

66 |

|

insurance, holding companies etc |

|

|

Malaysia |

Specific sectors |

n.a. |

n.a |

Romania |

Tax paid, income, assets, specific expenditure, industry/1 |

3 000 |

465 |

Russia |

At Federal level: Total federal taxes exceed RUR 1 bn, total income received |

7 400 (2 300 |

n.a. |

|

exceeds RUR 20 bn, or total assets exceed RUR 20 bn/1 |

federal level) |

|

Saudi Arabia |

1) Significant industries/activities (e.g. oil, banks, etc), 2) equity of over |

1 920 |

76 |

|

SR 100 m; and 3) gross income over SR 100 m/1 |

|

|

Singapore |

1) Corporate income tax: Net tax assessed, turnover, complexity; 2) VAT/GST: |

1) 1 600 |

1) 50 |

|

Annual GST supplies over SGD 100 m |

2) 1 500 |

2) 25 |

South Africa |

Groups with turnover >ZAR 1 bn; groups engaged in mining and financial services |

700 groups |

400 |

|

with turnover>ZAR 250 m; entities part of MNE with turnover >ZAR 250 m/1 |

7 800 entities |

|

For notes indicated by “/ (number)”, see Notes to Tables section at the end of the chapter, p. 99. Source: CIS survey responses.

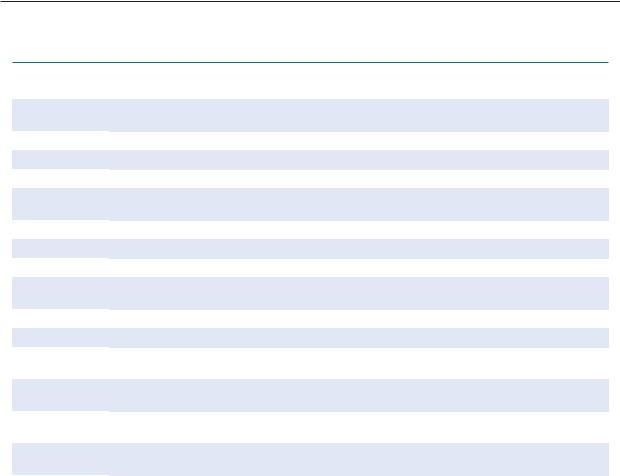

Common and/or important features of large taxpayer units

More detailed exploratory work undertaken by the FTA’s Task Group on large taxpayers has identified a number of other fairly common and/or important features of large taxpayer units (e.g. internal structure, range of taxes administered, and number of staff):

The LTU’s responsibilities tend to cover both direct and indirect taxes, enabling a “whole of taxpayer” focus to be given to administering these taxpayers’ tax affairs.

Business units typically provide both service and enforcement functions; reflecting this and the significant revenue and compliance risks they are responsible for, considerable resources are devoted to large taxpayer administration in many countries (e.g. Argentina, Australia, Austria, Canada, Italy, Japan, Mexico, Netherlands, Poland, South Africa, Spain, United Kingdom, and United States).

The use of an “account manager” approach – providing designated large businesses with a nominated contact point for interactions with the revenue body.

To optimise performance, considerable emphasis is given to the development of industry knowledge through the use of industry-based teams and experts for key sectors of each country’s economy. The information in Table 2.6, drawn from a

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013

88 – 2. THE ORGANISATION OF REVENUE BODIES

selection of countries, indicates two broad approaches in this respect: 1) teams for the key/major industries of a country’s economy (e.g. Australia and Netherlands); and 2) teams for each industry grouping (as established by individual revenue bodies (e.g. United Kingdom and United States).

In addition to tax and accounting skills, the inclusion of specialist teams/expertise for support in areas such as industry knowledge, economics, international tax issues and computer-based examination techniques.

Table 2.6. Selected Large Taxpayer Units (LTUs)

Country |

Organisation (including industry specialisation) |

Taxes |

|

|

|

Australia |

Under new management arrangements (effective 1 December 2010) there are |

Company tax |

|

discrete business units responsible for Internationals; Case Leadership; Risk and |

and petroleum |

|

Intelligence; Government Relations; and Industry based strategy. Broad industry |

resource rent tax |

|

based compliance strategies are developed around Manufacturing; Financial |

|

|

Services [for major banks (including regional banks), foreign and investment |

|

|

banks, insurance and superannuation]; Energy and Resources; Sales and Services. |

|

|

Local delivery units reporting to Assistant Commissioners are responsible for |

|

|

the delivery of the national strategies for the large market. Led by a Deputy |

|

|

Commissioner with responsibility for compliance with the Income Tax law for the |

|

|

large market. An additional Deputy Commissioner is assigned to provide focused |

|

|

senior leadership on complex case work. Staffing usage in 2011 was 1 310 FTEs |

|

Ireland |

The Division’s case base is handled in business units based on economic |

Company tax, |

|

sectors: 1) Construction, Property, Mining and Energy; 2) Alcohol, Tobacco and |

employment |

|

Multiples; 3) Financial Services (Banking); 4) Financial Services (Insurance and |

and social |

|

Investment Funds); 5) Financial Services (Pensions); 6) Betting, Food and Media; |

taxes, VAT, |

|

7) Healthcare and General Manufacturing; 8) Information, Communications |

Customs duties |

|

and Technology; 9) Motor, Oils and Transport 10) High Wealth Individuals; The |

and excises and |

|

Division also has specialist Anti-Avoidance Units, a Central Audit Unit including |

various other |

|

Computer E-Audit, a Customer Service/Processing Unit, and a Central Office. |

taxes |

|

LCD is responsible, with some exceptions, for all operational activities in respect |

|

|

of its case base. Staffing in the Division in 2011 was 219 FTE. |

|

Netherlands |

Specialist industry teams for 1) finance; 2) communications, technology, and |

Company tax, |

|

energy; and 3) natural resources/oil and gas. Because of the risks with these |

employment, |

|

taxpayers, the efforts of the nine offices are co-ordinated by two members of the |

social taxes and |

|

management teams of the tax offices in Amsterdam and Rotterdam together with |

VAT |

|

the Co-ordination Group on the treatment of very large organisations. Staffing |

|

|

usage in 2011 was 700 FTEs. |

|

United |

Compliance operations are organised into 17 industry-based sectors: Agriculture |

Company tax, |

Kingdom |

and Food, Alcohol and Tobacco, Automotive, Banking, Business Services, |

employment and |

|

Chemicals, Healthcare and Pharmaceuticals, Construction, General Retailing, |

social taxes and |

|

Insurance, Leisure and Media, Manufacturing, Oil and Gas, Public Bodies, Real |

VAT |

|

Estate, Telecommunications and Information Technology, Transport, and Utilities. |

|

|

Staffing usage in 2011 was 3 457 FTEs. |

|

United |

The LB&I Division is led by a Commissioner and two Deputy Commissioners |

Company tax, |

States |

(DC)-DC Operations (DCO) and DC International (DCI). The DCO oversees |

employment and |

|

the following departments: 1) Planning, Quality and Assurance; 2) Research |

social taxes and |

|

and Workload Identification; 3) Management and Finance; 4) Business Systems |

excise |

|

Planning, 5) five industry-based operations groups; and 6) a field specialist group. |

|

|

The industry-based groups are: 1) Financial services; 2) Heavy manufacturing and |

|

|

transportation; 3) Communications, media, and technology; 4) Natural resources |

|

|

and construction; and 5) Retailers, food, pharmaceuticals and healthcare. |

|

|

Field Specialists include Computer Audit Specialists, U.S. LB&I Employment |

|

|

Tax Specialists, Economists, Engineers, Financial Products and Transactions |

|

|

Specialists and International Examiners integrated in industry workforce. Staffing |

|

|

usage in 2011 was 6 414 FTEs. |

|

Source: Report of FTA task group examining aspects of large taxpayer operations and survey response data.

TAX ADMINISTRATION 2013: COMPARATIVE INFORMATION ON OECD AND OTHER ADVANCED AND EMERGING ECONOMIES – © OECD 2013