- •«Хабаровская государственная академия экономики и права»

- •Phrases

- •DIALOGUE

- •PREAMBLE

- •CONTRACT №1

- •CONTRACT №2

- •SUBJECT OF THE CONTRACT

- •CONTRACT №1

- •EXERCISES

- •PRICE AND TOTAL VALUE OF THE CONTRACT

- •VOCABULARY

- •PHRASES

- •DIALOGUE

- •EXERCISES

- •DIALOGUE

- •TERMS OF PAYMENT

- •VOCABULARY

- •PHRASES

- •DIALOGUE

- •EXERCISES

- •1. Find English equivalents for the following.

- •3.1. Платёж будет осуществляться в долларах США.

- •PHRASES

- •DIALOGUE

- •EXERCISES

- •VOCABULARY

- •EXERCISES

- •GUARANTEE

- •VOCABULARY

- •PHRASES

- •DIALOGUE

- •EXERCISES

- •6. Гарантии

- •6. Гарантии

- •CLAIMS AND SANCTIONS

- •VOCABULARY

- •PHRASES

- •DIALOGUE

- •EXERCISES

- •7. Санкции

- •DIALOGUE

- •FORCE MAJEURE

- •VOCABULARY

- •PHRASES

- •DIALOGUE

- •DIALOGUE

- •ARBITRATION

- •VOCABULARY

- •PHRASES

- •EXERCISES

- •1. Find English equivalents for the following.

- •9. Арбитраж

- •OTHER CONDITIONS

- •CONTRACT № 1

- •BUSINESS GAME “MAKING A CONTRACT”

- •The Rapid Bottles

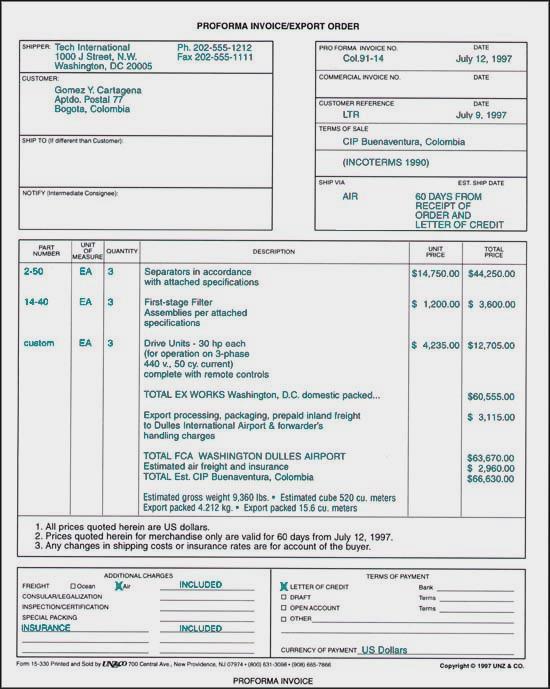

- •Methods of Payment in International Trade

- •Cash-in-Advance

- •Letters of Credit

- •Documentary Collections

- •Open Account

- •CONTENTS

- •Sources

102

METHODS OF PAYMENT IN INTERNATIONAL TRADE

To succeed in today’s global marketplace and win sales against foreign competitors, exporters must offer their customers attractive sales terms supported by appropriate payment methods. Because getting paid in full and on time is the ultimate goal for each export sale, an appropriate payment method must be chosen carefully to minimize the payment risk while also accommodating the needs of the buyer. There are four primary methods of payment for international transactions. During or before contract negotiations, you should consider which method is mutually desirable for both you and your customer.

Cash-in-Advance

With cash-in-advance payment terms, the exporter can avoid credit risk because payment is received before the ownership of the goods is transferred. Wire transfers and credit cards are the most commonly used cash-in-advance options available to exporters. However, requiring payment in advance is the least attractive option for the buyer, because it creates cash-flow problems. Foreign buyers are also concerned that the goods may not be sent if payment is made in advance. Thus, exporters who insist on this payment method as their sole manner of doing business may lose to competitors who offer more attractive payment terms.

Letters of Credit

Letters of credit (LCs) are one of the most secure instruments available to international traders. An LC is a commitment by a bank on behalf of the buyer that payment will be made to the exporter, provided that the terms and conditions stated in the LC have been met, as verified through the presentation of all required documents. The buyer pays his or her bank to render this service. An LC is useful when reliable credit information about a foreign buyer is difficult to obtain, but the exporter is satisfied with the creditworthiness of the buyer’s foreign bank. An LC also protects the buyer because no payment obligation arises until the goods have been shipped or delivered as promised.

Documentary Collections

A documentary collection (D/C) is a transaction whereby the exporter entrusts the collection of a payment to the remitting bank (exporter’s bank), which sends documents to a collecting bank (importer’s bank), along with instructions for payment.

Funds are received from the importer and remitted to the exporter through the banks involved in the collection in exchange for those documents. D/Cs involve using a draft that requires the importer to pay the face amount either at sight (document against payment) or on a specified date (document against acceptance). The draft gives instructions that specify the documents required for the transfer of title to the goods. Although banks do act as facilitators for their clients, D/Cs offer no verification process and limited recourse in the event of non-payment. Drafts are generally less expensive than LCs.

103

Open Account

An open account transaction is a sale where the goods are shipped and delivered before payment is due, which is usually in 30 to 90 days. Obviously, this option is the most advantageous option to the importer in terms of cash flow and cost, but it is consequently the highest risk option for an exporter. Because of intense competition in export markets, foreign buyers often press exporters for open account terms since the extension of credit by the seller to the buyer is more common abroad. Therefore, exporters who are reluctant to extend credit may lose a sale to their competitors. However, the exporter can offer competitive open account terms while substantially mitigating the risk of non-payment by using of one or more of the appropriate trade finance techniques, such as export credit insurance.

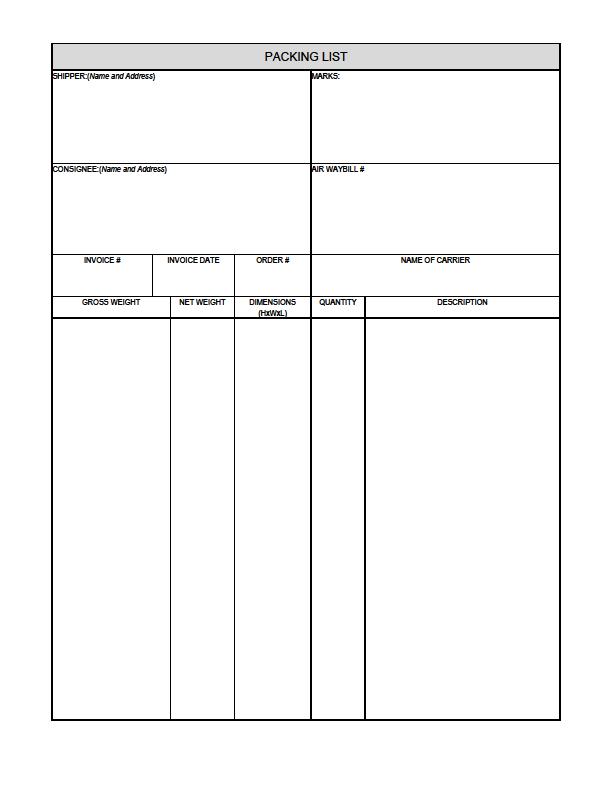

EXPORT DOCUMENTS

There are different types of documents used in international trade (import and export). Most international trade transactions require certain transport documents, administrative documents, commercial documents and insurance documents. There are a great variety of documents that may need to be produced to complete export/import transactions; some estimates indicate over 200 different documents are used in international trade. However, in most export transactions, only a few certain documents are used (invoice, packing list and transport document.).

Documents fulfill the following functions:

Proof of contract. Documents such as transport documents (bill of lading), insurance documents, etc. Evidence of the existence of contracts of sale and conditions stipulated there.

Title to the goods. Certain transport documents represent title to the goods, that is, they give the right to collect the goods from the carrier (just as a bank draft gives you the right to collect funds against the drawer).

Information. Certain documents provide information on the price for the goods (invoice), the contents of package units (packing list), etc.

Customs. The customs of the country of destination require documents that evidence the origin of the goods, etc. in order to establish whether the goods are importable to the country and in order to charge appropriate taxes and duties.

Proof of compliance. Certain documents serve as proof that the conditions stipulated in the contract of sale are complied with, such as date of shipment (transport documents), the origin of the goods (certificate of origin), etc.

The following documents are commonly used in exporting, but which of them are necessary in a particular transaction depends on the product being shipped as well as the requirements of the governments of the importing and exporting countries.

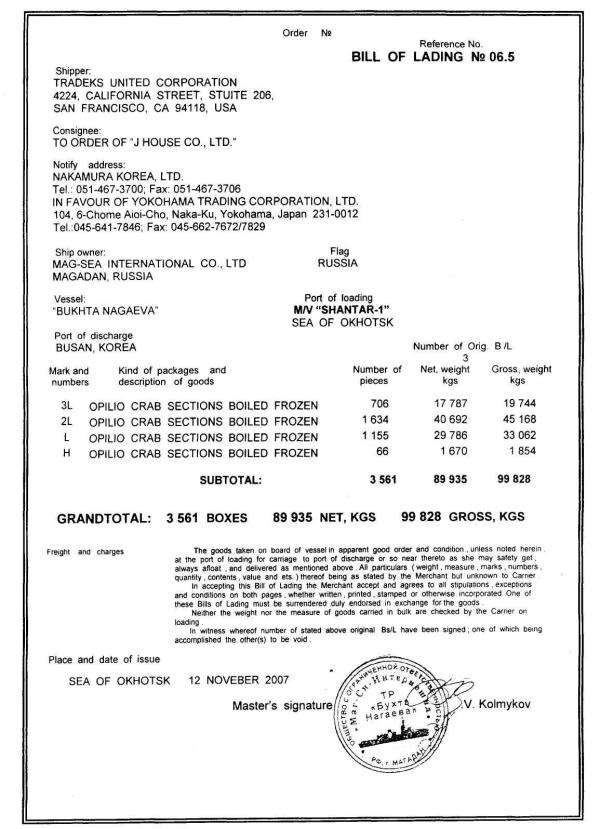

* Bill of Lading. A contract between the owner of the goods and the carrier (as with domestic shipments). For vessels, there are two types: a straight bill of lading, which is non-negotiable, and a negotiable or shipper’s order bill of lading, which can be bought,

104

sold, or traded while the goods are in transit. The customer usually needs an original bill of lading as proof of ownership to take possession of the goods. A bill of lading is a type of document that is used to acknowledge the receipt of a shipment of goods. A transportation company or carrier issues this document to a shipper. In addition to acknowledging the receipt of goods, a bill of lading indicates the particular vessel on which the goods have been placed, their intended destination, and the terms for transporting the shipment to its final destination.

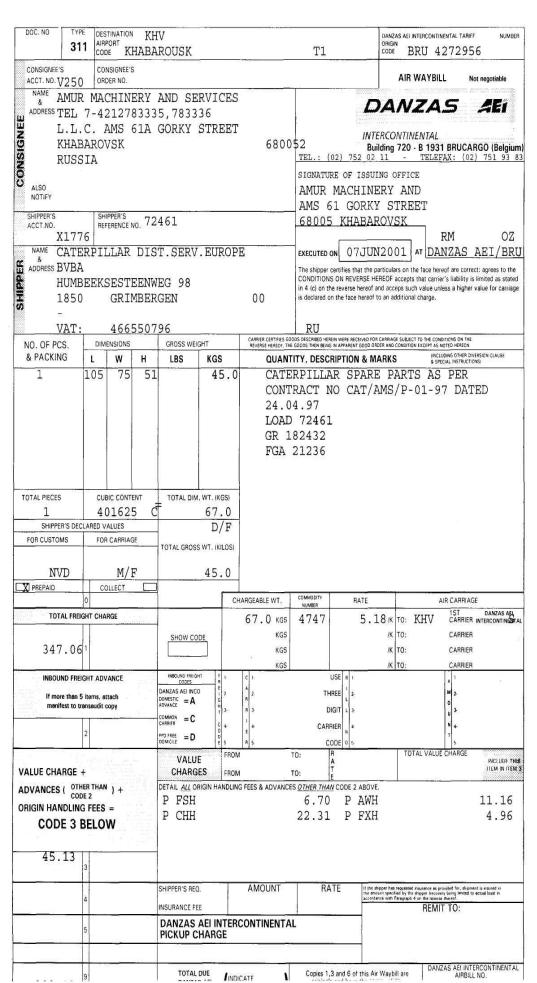

* Waybill is sometimes referred to as a bill of lading. Such a document is commonly used in the shipping industry. Its primary purpose is to provide information about a shipment. In may also act as a receipt for the payment or rendering of shipping services. Such documents are commonly used for shipments by road, boat, or air. When a person plans to ship something, she will generally need a waybill. This is usually made available by the shipper as a paper form or it may be made available online as an electronic form. In most instances, it will be filled out by the shipper.

Inland, ocean, through, and air waybill are the names given to bills of lading. An inland bill of lading is a document that establishes an agreement between a shipper and a transportation company for the transportation of goods. It is used to lay out the terms for transporting items overland to the exporter's international transportation company. An ocean bill of lading is a document that provides terms between an exporter and international carrier for the shipment of goods to a foreign location overseas.

A through bill of lading is a contract that covers the specific terms agreed to by a shipper and carrier. This document covers the domestic and international transportation of export merchandise. It provides the details of the agreed upon transportation between specific locations for a set monetary amount.

* Air (or Ocean) Waybill. Issued by an airline (or ocean shipper) when goods are received for transport; the waybill travels with the cargo. It is similar to a bill of lading, but cannot serve as a document of title.

An air waybill is a bill of lading that establishes terms of flights for the transportation of goods both domestically and internationally. This document also serves as a receipt for the shipper, proving the carrier's acceptance of the shipper's goods and agreement to carry those goods to a specific airport.

Essentially, an air waybill is a type of through bill of lading. This is because air waybills may cover both international and domestic transportation of goods. By contrast, ocean shipments require both inland and ocean bills of lading. Inland bills of lading are necessary for the domestic transportation of goods and ocean bills of lading are necessary for the international carriage of goods. Therefore, through bills of lading may not be used for ocean shipments.

* Shipper’s Export Declaration. Available from the U.S. Government Printing

Office and commercial outlets.

105

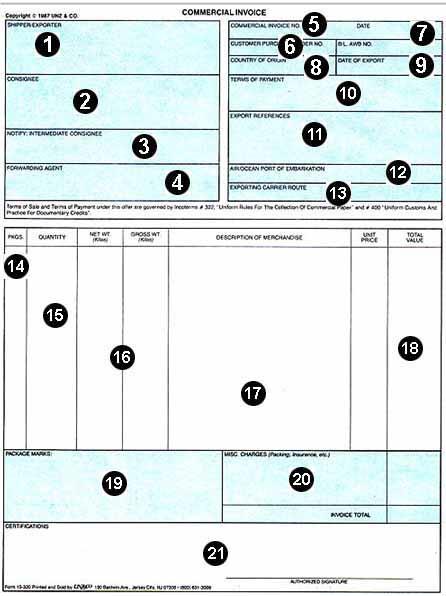

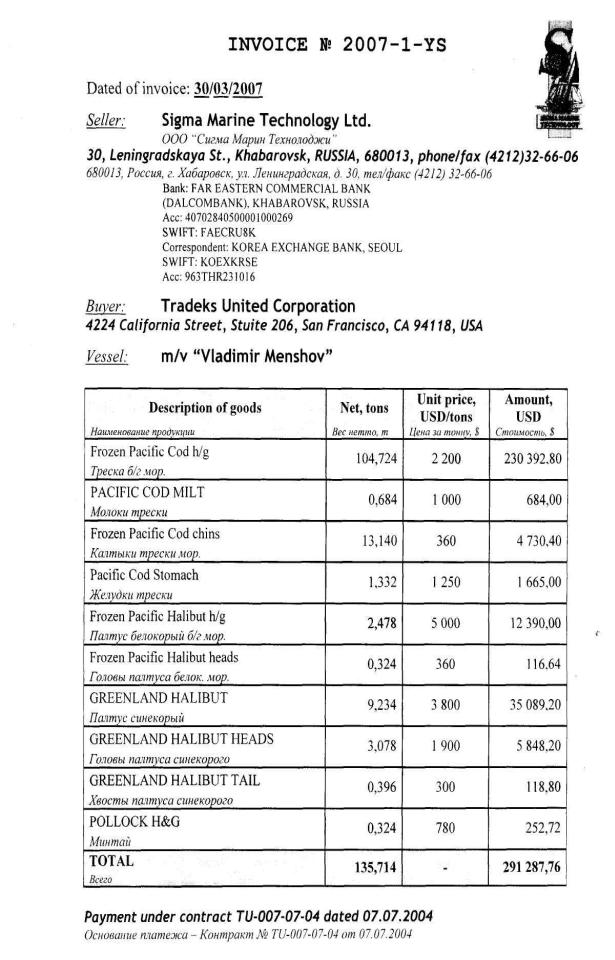

*Commercial Invoice. A bill for the goods from the seller to the buyer. These invoices are often used by governments to determine the true value of goods when assessing customs duties. Governments that use the commercial invoice to control imports will often specify its form, content, number of copies, language to be used, and other requirements.

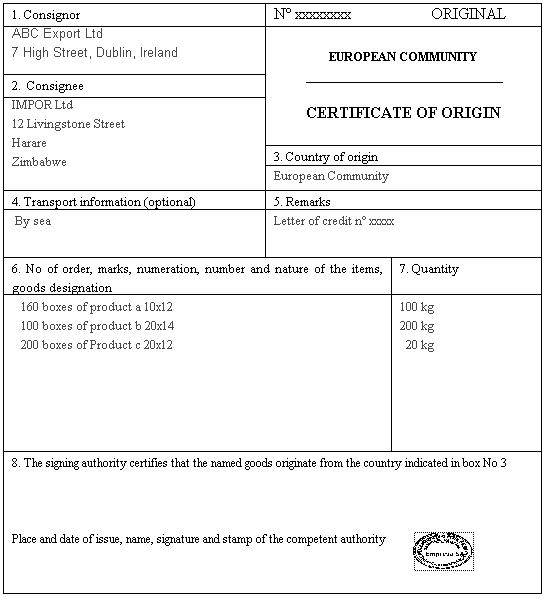

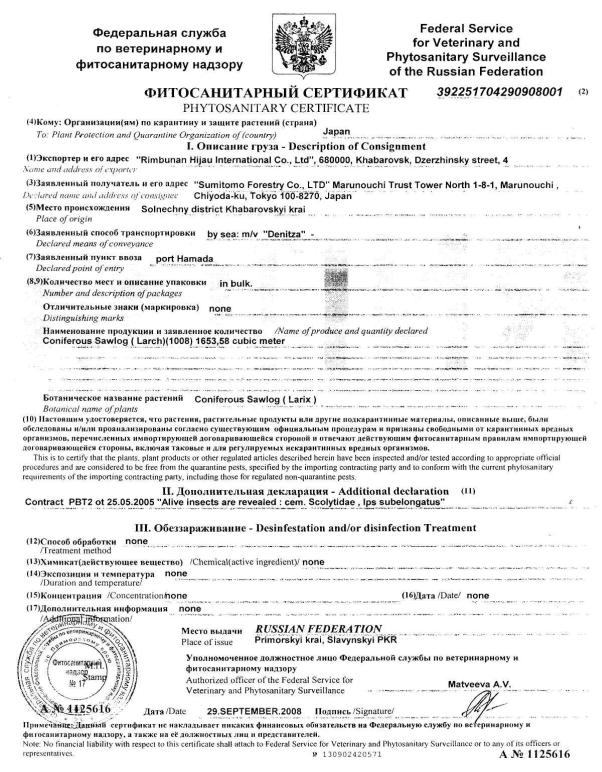

*Certificate of Origin. Required by some countries. In many cases, a statement of origin printed on company letterhead will suffice. Special certificates are needed for countries with which the U.S. has special trade agreements, such as Mexico, Canada, and Israel. For example, a NAFTA Certificate of Origin is needed for shipments to Mexico and Canada.

*CE Mark. Designates goods that have met the requirements to be marketed throughout the European Union (EU). Once a manufacturer has earned a CE mark for its product, it may affix the mark to the product, and then the product may be marketed throughout the EU without having to undergo further procedures in each EU member country.

*Insurance Certificate. Assures the consignee that insurance will cover the loss of or damage to the cargo during transit. This certificate can be obtained from the freight forwarder.

*Export Packing List. Itemizes the material in each individual package and indicates the type of package, such as a box, crate, drum, or carton. Both commercial stationers and freight forwarders carry packing list forms.

*Import License. Must be obtained by the importer. Including a copy with the rest of your export documentation, however, can sometimes prevent problems with customs in the destination country.

*Consular Invoice. Required in some countries. It describes the shipment of goods and shows information such as the consignor, consignee, and value of the shipment.

Forms may be obtained from the destination country’s embassy or consulate in the U.S.

*Inspection Certification. Required by some purchasers and countries to attest to the specifications of the goods shipped. Inspection is usually performed by a third party, often an independent testing organization.

*Dock Receipt and Warehouse Receipt. Used to transfer accountability when the export item is moved by the domestic carrier to the port of embarkation and left with the shipping line for export.

*Destination Control Statement. Appears on the invoice and waybill to notify the carrier and all foreign parties that the item can be exported only to certain destinations.

*Export License. Required by the U.S. government for dual use exports (commercial items that could have military applications) or exports to embargoed countries. Most export transactions do not require specific approval from the U.S. Government. Before shipping your product, make sure you understand the concept of dual use and how U.S. export regulations may affect your business.

106

SPECIMENS OF DOCUMENTS

The purpose of the documents of origin is to show where the goods originated. Therefore, they play an important role in order to establish the taxes and duties to be paid on the goods at the customs. One must find out what type of document exactly is required at the customs in order to be able to benefit from possible reduced tariffs.

107

108

1. EXPORTER – The name and address of the principal party responsible for effecting export from the United States. The exporter as named on the Export License.

2.CONSIGNEE – The name and address of the person/company to whom the goods are shipped for the designated end use, or the party so designated on the Export License.

3.INTERMEDIATE CONSIGNEE – The name and address of the party who effects the delivery of the merchandise to the ultimate consignee, or the party so named on the Export License.

4.FORWARDING AGENT – The name and address of the duly authorized forwarder acting as agent for the exporter.

5.COMMERCIAL INVOICE NO. – Commercial Invoice number assigned by the exporter.

6.CUSTOMER PURCHASE ORDER NO. – Overseas customer's reference of order number.

7.B/L, AWB NO. – Bill of Lading, or Air Waybill number, if known.

109

8.COUNTRY OF ORIGIN – Country of origin of shipment.

9.DATE OF EXPORT – Actual date of export of merchandise.

10.TERMS OF PAYMENT – Describe the terms, conditions, and currency of settlement as agreed upon by the vendor and purchaser per the Pro Forma Invoice, customer Purchase Order, and/or Letter of Credit.

11.EXPORT REFERENCES – May be used to record other useful information, e.g. - other reference numbers, special handling requirements, routing requirements, etc.

12.AIR/OCEAN PORT OF EMBARKATION – Ocean port/pier, or airport to be used for embarkation of merchandise.

13.EXPORTING CARRIER/ROUTE – Record airline carrier/flight number or vessel name/shipping line to be used for the shipment of merchandise.

14.PACKAGES – Record number of packages, cartons, or containers per description line.

15.QUANTITY – Record total number of units per description line.

16.NET WEIGHT/GROSS WEIGHT – Record total net weight and total gross weight (includes weight of container) in kilograms per description line.

17.DESCRIPTION OF MERCHANDISE – Provide a full description of items shipped, the type of container (carton, box, pack, etc.), the gross weight per container, and the quantity and unit of measure of the merchandise.

18.UNIT PRICE/TOTAL VALUE – Record the unit price of the merchandise per the unit of measure, compute the extended total value of the line.

19.PACKAGE MARKS – Record in this Field, as well as on each package, the package number (e.g. - 1 of 7, 3 of 7, etc.), shippers company name, country of origin (e.g. - made in USA), destination port of entry, package weight in kilograms, package size (length x width x height), and shipper's control number (e.g. - C/I number; optional).

20.MISC. CHARGES – Record any miscellaneous charges which are to be paid for by the customer - export transportation, insurance, export packaging, inland freight to pier, etc.

21.CERTIFICATIONS – Any certifications or declarations required of the shipper regarding any information recorded on the commercial invoice.

110

111

112

113

114

115