400 |

|

|

|

INVESTMENT PHILOSOPHIES |

|

15.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

10.00% |

|

|

|

|

|

|

|

|

|

|

|

|

Excess Return |

5.00% |

|

|

|

|

|

|

|

|

|

|

|

|

0.00% |

0 |

5 |

10 |

15 |

20 |

25 |

30 |

35 |

40 |

45 |

50 |

55 |

Cumulative |

Day–60 –55 –50 –45 –40 –35 –30 –25 –20 –15 –10 –5 |

–5.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

–10.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

–15.00% |

|

|

|

|

|

|

|

|

|

|

|

|

Days around Earnings Announcement

|

|

|

Most Positive |

UE9 |

|

UE8 |

UE7 |

|

|

|

|

|

|

UE6 |

UE5 |

|

UE4 |

UE3 |

|

|

|

|

|

|

UE2 |

Most Negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

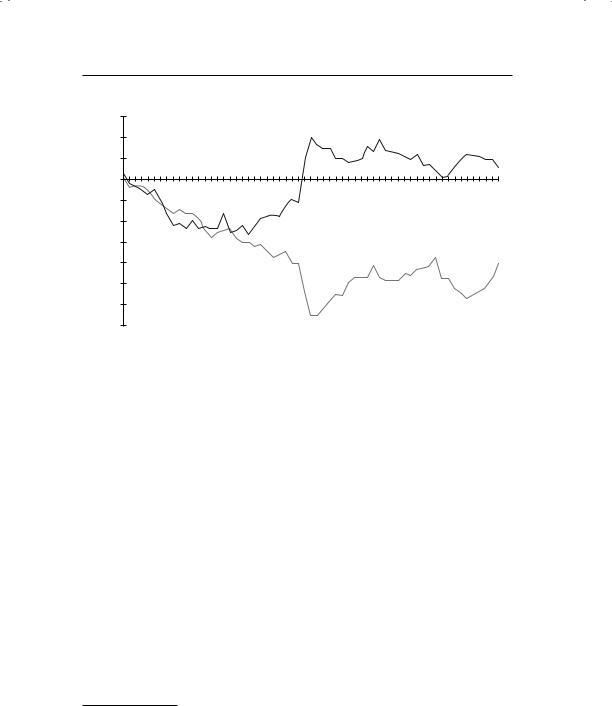

F I G U R E 1 0 . 1 0 Market Reaction to Unexpected Quarterly Earnings Surprises: U.S. Companies from 1988 to 2002

Source: D. C. Nichols and J. M. Wahlen, “How Do Accounting Numbers Relate to Stock Returns: A Review of Classic Accounting Research with Updated Numbers,”

Accounting Horizons 18 (2004): 263–286.

The evidence contained in this graph is consistent with the evidence in most earnings announcement studies.

The earnings announcement clearly conveys valuable information to fi- nancial markets; there are positive excess returns (cumulative abnormal

“Post-Earnings Announcement Drift: Delayed Price Response or Risk Premium?” Journal of Accounting Research 27 (1989): 1–48.) This graph is developed from an update of that study by Nichols and Wahlen (2004). (D. C. Nichols and J. M. Wahlen, “How Do Accounting Numbers Relate to Stock Returns: A Review of Classic Accounting Research with Updated Numbers,” Accounting Horizons 18 (2004): 263–286.)

Information Pays: Trading on News |

401 |

returns) around positive surprises (actual earnings expected earnings) and negative excess returns around negative surprises (actual earnings expected earnings).

There is some evidence of a price drift in the days immediately prior to the earnings announcement, which is consistent with the nature of the announcement; that is, prices tend to go up on the days before positive announcements and down on the days before negative announcements. This can be viewed as evidence of either insider trading, information leaking out to the market, or getting the announcement date wrong.33

There is some evidence of a price drift in the days following an earnings announcement. This can be seen by isolating only the postannouncement effect of earnings reports in Figure 10.11.

Thus, a positive (or negative) report evokes a positive (or negative) market reaction on the announcement date, and there are positive excess returns in the days and weeks following the earnings announcement.

The price changes around earnings reports are also accompanied by a jump in trading volume in the days immediately before and after earnings reports.

The studies just quoted looked at all earnings announcements, but there is research that indicates that the returns associated with earnings surprises are more pronounced with some types of stocks than with others. For instance:

A study of value and growth stocks found that the returns in the three days around earnings announcements were much more positive for value stocks (defined as low-P/E and low-PBV stocks) than for growth stocks across all earnings announcements—positive as well as negative. This suggests that you are much more likely to get a positive surprise with a value stock than with a growth stock, indicating perhaps that markets tend to be overly optimistic in their expectations of earnings for growth companies.

Earnings announcements made by smaller firms seem to have a larger impact on stock prices on the announcement date, and prices are more likely to drift after the announcement.

33The Wall Street Journal or Compustat are often used as information sources to extract announcement dates for earnings. For some firms, news of the announcement may actually cross the newswire the day before the Wall Street Journal announcement, leading to a misidentification of the report date and the drift in returns the day before the announcement.

402 |

|

|

|

|

|

|

|

INVESTMENT PHILOSOPHIES |

4.00% |

|

|

|

|

|

|

|

|

|

|

|

|

3.00% |

|

|

|

|

|

|

|

|

|

|

|

|

2.00% |

|

|

|

|

|

|

|

|

|

|

|

|

1.00% |

|

|

|

|

|

|

|

|

|

|

|

|

0.00% |

|

|

|

|

|

|

|

|

|

|

|

|

Day |

0 |

5 |

10 |

15 |

20 |

25 |

30 |

35 |

40 |

45 |

50 |

55 |

–1.00% |

|

|

|

|

|

|

|

|

|

|

|

|

–2.00% |

|

|

|

|

|

|

|

|

|

|

|

|

–3.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Most Positive |

|

UE9 |

|

|

|

UE8 |

|

|

UE7 |

|

UE6 |

|

|

|

UE5 |

|

|

|

UE4 |

|

|

UE3 |

|

UE2 |

|

|

|

Most Negative |

|

|

|

|

|

F I G U R E 1 0 . 1 1 Postannouncement Drift after Unexpected Quarterly Earnings Surprises: U.S. Companies from 1988 to 2002

Source: D. C. Nichols and J. M. Wahlen, “How Do Accounting Numbers Relate to Stock Returns: A Review of Classic Accounting Research with Updated Numbers,”

Accounting Horizons 18 (2004): 263–286.

As with analyst reports, there seems to be evidence that the market reaction to earnings reports is a function of not only the earnings number reported but also the accompanying management commentary.34

There is some evidence that the market reaction to earnings reports is greater at firms with high institutional ownership, with one rationale being offered that institutional investors tend to be more short term in their focus and thus more likely to respond to quarterly earnings reports.

In summary, the fact that stock prices go up when earnings are better than expected and go down when they are worse than expected is not

34E. A. Demers and C. Vega, “Soft Information in Earnings Announcements: News or Noise?” (SSRN Working Paper, 2008).

Information Pays: Trading on News |

403 |

0.08 |

Tuesday |

Wednesday |

Monday |

0.06 |

|

Thursday |

|

|

0.04 |

|

Friday |

|

|

0.02 |

|

|

0 |

|

|

–0.02 |

|

% Change in |

|

Earnings |

–0.04 |

|

% Change in |

|

Dividends |

|

|

–0.06 |

|

|

F I G U R E 1 0 . 1 2 |

Earnings and Dividend Reports by Day of the Week |

Source: A. Damodaran, “The Weekend Effect in Information Releases: A Study of Earnings and Dividend Announcements,” Review of Financial Studies 2 (1989): 607–623.

unexpected. It is the drift in the days after the announcements that is surprising, since it suggests that investors can trade after announcements and generate profits.

E a r n i n g s D e l a y s , I n d u s t r y E f f e c t s , a n d P r i c e R e a c t i o n The management of a firm has some discretion on the timing of earnings reports, and there is some evidence that the timing affects expected returns. A study of earnings reports, classified by the day of the week that the earnings are reported, reveals that earnings and dividend reports on Fridays are much more likely to contain negative information than announcements on any other day of the week.35 This is shown in Figure 10.12.

Announcements made on Friday are more likely to contain bad news— earnings drops and dividend cuts—than announcements on any other day of the week, and a significant number of these announcements come out after close of trading on Friday. This may provide an interesting link to the weekend effect described in Chapter 7.

35A. Damodaran, “The Weekend Effect in Information Releases: A Study of Earnings and Dividend Announcements,” Review of Financial Studies 2 (1989): 607– 623.

|

404 |

|

|

INVESTMENT PHILOSOPHIES |

|

0.006 |

|

|

|

|

|

|

Earnings Announcement |

Early > 6 Days |

|

|

|

|

|

|

|

Date |

|

|

Return |

–30 |

0 |

+30 |

|

Cumulative Abnormal |

|

|

|

|

|

–0.014 |

|

|

Delayed > 6 Days |

|

|

|

|

F I G U R E 1 0 . 1 3 Cumulated Abnormal Returns around Earnings Reports: Day 0 Is Earnings Announcement Date

Source: A. E. Chambers and S. H. Penman, “Timeliness of Reporting and the Stock Price Reaction to Earnings Announcement,” Journal of Accounting Research 22: 21–47.

There is also some evidence, as seen in Figure 10.13, that earnings announcements that are delayed, relative to the expected announcement date,36 are much more likely to contain bad news than earnings announcements that are early or on time.

Earnings announcements that are more than six days late relative to the expected announcement date are much more likely to contain bad news and evoke negative market reactions than earnings announcements that are on time or early. It may be worth the while of investors who build their investment strategies around earnings announcements to keep track of expected earnings announcement dates.

Finally, investors do learn about earnings prospects for a company from earnings announcements made by other companies in the sector. Thus, the announcement by an automobile company of higher earnings will lead investors to reassess (and increase) expectations of earnings at other automobile companies that are yet to report earnings. As a consequence, the price

36Firms in the United States tend to be consistent about the date each year that they reveal their quarterly earnings. The delay is computed relative to this expected date. See A. E. Chambers and S. H. Penman, “Timeliness of Reporting and the Stock Price Reaction to Earnings Announcement,” Journal of Accounting Research 22: 21–47.

Information Pays: Trading on News |

405 |

100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Favorable |

|

Unfavorable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

90% |

|

|

|

Completed |

80% |

|

|

|

70% |

|

|

|

|

|

|

|

of Adjustment |

60% |

|

|

|

50% |

|

|

|

40% |

|

|

|

Proportion |

30% |

|

|

|

20% |

|

|

|

|

10% |

|

|

|

|

0% |

|

|

|

|

0 |

1 |

2 |

3 |

Time (in hours after earnings report)

F I G U R E 1 0 . 1 4 Price Adjustment by Hour after Earnings Report

Source: Catherine S. Woodruff and A. J. Senchack Jr., “Intradaily Price-Volume Adjustments of NYSE Stocks to Unexpected Earnings,” Journal of Finance 43, no. 2 (1988): 467–491.

impact of earnings surprises will be higher for companies that announce earlier in the cycle than for later announcers.

I n t r a d a y P r i c e R e a c t i o n Studies have examined the speed with which prices react to earnings announcements within the day of the announcement. There, the evidence is mixed. Woodruff and Senchack examined price adjustment by transaction after favorable earnings reports (surprise 20 percent) and unfavorable earnings reports (surprise –20 percent), and reported the proportion of the eventual adjustment that had occurred by the hour after the earnings report for each category (in Figure 10.14).37

As Figure 10.14 illustrates, approximately 91 percent of the eventual adjustment occurs within three hours of the report for the most positive

37Catherine S. Woodruff and A. J. Senchack Jr., “Intradaily Price-Volume Adjustments of NYSE Stocks to Unexpected Earnings,” Journal of Finance 43, no. 2 (1988): 467–491.

406 |

INVESTMENT PHILOSOPHIES |

earnings surprises, while only 76 percent of the eventual adjustment occurs during the same period for the most negative earnings announcements. This would seem to indicate that markets are much more efficient about assessing good news than bad news. If nothing else, this also illustrates the importance of trading promptly after an earnings announcement. Investors who wait to read about the announcement the next day or even later in the day will find that the bulk of the adjustment has occurred by the time that they trade.

E a r n i n g s Q u a l i t y a n d M a r k e t R e a c t i o n The strategy of investing on earnings surprises has come under some pressure because firms have learned to play the earnings game. In the past two decades, concerns have been raised by some about the phenomenon of earnings management at companies, and whether it has led to deterioration in the informativeness of earnings reports. While there is evidence that companies manage earnings more, manifested in the higher frequency with which firms are able to beat earnings estimates from analysts, earnings reports still seem to evoke strong price responses. In fact, at least according to some studies, the market responses to earnings reports have increased over time.38 One reason is that markets have learned that companies manage earnings, so they adjust expectations accordingly. Thus, to evoke a positive response, markets have to report earnings that exceed so-called whispered earnings and that are higher than the consensus analyst estimate by a margin, with the margin depending on the company’s history. Another reason is that increased disclosure requirements have increased the information contained in earnings reports and thus the price response.

As firms play the earnings game, the quality of earnings has also diverged across companies. A firm that beats earnings estimates because it has more efficient operations should be viewed more favorably than one that beats estimates because it changed the way it values inventory. Does the market distinguish appropriately between the two? The evidence indicates that it does not, at least on the date of the announcement, but that it eventually corrects for poor quality earnings. In a study of this phenomenon, Chan, Chan, Jegadeesh, and Lakonishok examined firms that reported high accruals (i.e., a measure of cash earnings and argued that firms that report high earnings without a matching increase in cash flows have poorer quality

38W. D. Collins, O. Li, and H. Xie, “What Drives the Increased Informativeness of Earnings Announcements over Time?” Review of Accounting Studies 14 (2009): 1–30.

Information Pays: Trading on News |

407 |

earnings.39 When they tracked a portfolio composed of these firms, they discovered that the high-accrual year was usually the turning point in the fortunes of this firm, with subsequent years bringing declining earnings and negative stock returns.

C a n Y o u M a k e M o n e y o f f E a r n i n g s A n n o u n c e m e n t s ? Financial markets get much of their firm-specific information from earnings announcements, and there are collectively thousands of earnings announcements each year. There are some portfolio managers whose investment strategies are based primarily or largely on trading on or after these announcements. There are three strategies that can be built around earnings announcements:

1.The first strategy is to buy immediately on the announcement and hope to make money intraday on the slow price adjustment (shown in Figure 10.14). This is a very short-term, high-turnover strategy and will generally make sense only if you can track information in real time, trade instantly, and control your transaction costs.

2.The second strategy is to buy stocks that report large positive earnings surprises, hoping to benefit from the drift. The returns can be augmented by selling short on stocks that report negative earnings surprises, hoping again as these stocks continue to drift down. This is a slightly more long-term strategy with holding periods measured in weeks rather than hours, but there is potential for excess returns, even after transaction costs. How would you refine this strategy to harvest higher returns? You could draw on the empirical evidence and concentrate only on earnings announcements made by smaller, less liquid companies where the drift is more pronounced. In addition, you can try to direct your money toward companies with higher-quality earnings surprises by avoiding firms with large accruals (i.e., firms that report increasing earnings and decreasing cash flows).

3.Your potential for large returns is greatest if you can forecast which firms are most likely to report large positive earnings surprises, and invest in those firms prior to their earnings announcements. Impossible, without insider information, you say! Not quite, if you remember that price and volume drift up before the actual announcement and that firms that report their earnings later than expected are more likely to report bad news. Even if you are right only 55 percent of the time, you should be able to post high excess returns.

39K. Chan, L. K. C. Chan, N. Jegadeesh, and J. Lakonishok, “Earnings Quality and Stock Returns,” Journal of Business 79 (2006): 1041–1082.

408 |

INVESTMENT PHILOSOPHIES |

B U Y O N T H E R U M O R , S E L L O N T H E N E W S

Wall Street adages should always be taken with a grain of salt, but they usually do have a kernel of truth to them. This particular one on rumor and news has particular relevance when we look at how prices run up before the news announcement and how little is left on the table after the announcement. An investor who has access to high-quality gossip (if that is not an oxymoron) may be able to buy stocks before good news comes out and sell before bad news. But high-quality gossip is difficult to come by, especially on Wall Street, where a dozen false news stories circulate for every true one.

A c q u i s i t i o n s

The investment announcements that usually have the most effect on value and stock prices are acquisition announcements, simply because acquisitions are large relative to other investments. In this section, we begin with an analysis of how the announcement of an acquisition affects the market price of the target and acquiring firm on the day of the acquisition, follow up by looking at the postacquisition performance (operating and stock price) of the acquiring firm, and conclude with the question of whether there is anything in this process that can be exploited by an investor for gain.

T h e A c q u i s i t i o n D a t e The big price movements associated with acquisitions occur around the date the acquisition is announced and not when it is actually consummated. While much of the attention in acquisitions is focused on the target firms, we will argue that what happens to the acquiring firm is just as interesting, if not more so.

The Announcement Effect: Targets and Bidders The evidence indicates that the stockholders of target firms are the clear winners in takeovers— they earn significant excess returns40 not only around the announcement of the acquisitions, but also in the weeks leading up to it. Jensen and Ruback reviewed 13 studies that look at returns around takeover announcements and reported an average excess return of 30 percent to target stockholders in

40The excess returns around takeover announcements to target firms are so large that using different risk and return models seems to have no effect on the overall conclusions.

Information Pays: Trading on News |

409 |

Cumulative Abnormal Return

25.00%

20.00%

15.00%

10.00%

5.00%

0.00%

–5.00%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Target |

|

|

|

|

Bidder |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Very slight drift in stock price |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

after announcement. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The stock price drifts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

up before the news |

|

|

|

|

The acquisition is announced |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

hits the market. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

at this point in time. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

–20 |

–19 |

–18 |

–17 |

–15 |

–16 |

–14 |

–13 |

–12 |

–11 |

–10 |

–9 |

–8 |

–7 |

–6 |

–5 |

–4 |

–3 |

–2 |

–1 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

15 |

16 |

17 |

18 |

19 |

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F I G U R E 1 0 . 1 5 Acquisition Announcement: Cumulative Excess Returns—Target and Acquirer

successful tender offers and 20 percent to target stockholders in successful mergers.41 Jarrell, Brickley, and Netter examined the results of 663 tender offers made between 1962 and 1985 and noted that premiums averaged 19 percent in the 1960s, 35 percent in the 1970s, and 30 percent between 1980 and 1985.42 The price behavior of a typical target firm in an acquisition is illustrated in Figure 10.15, from one of the studies, which summarizes the target firm stock price in the 10 days before, the day of, and the 10 days after an acquisition announcement.43

Note that about half the premium associated with the acquisition is already incorporated in the target’s stock price by the time the acquisition is announced. This suggests that information about acquisitions is leaked to some investors, who trade on that information. On the acquisition date, there is a decided jump in the stock price, but the drift afterward is mild.

If we categorize acquisitions based on how the acquiring firm pays for them, we find that the stock prices of target firms tend to do much better on the announcement of cash-based acquisitions (where the acquirer uses only

41M. C. Jensen and R. S. Ruback, “The Market for Corporate Control,” Journal of Financial Economics 11 (1983): 5–50.

42G. A. Jarrell, J. A. Brickley, and J. M. Netter, “The Market for Corporate Control: The Empirical Evidence since 1980,” Journal of Economic Perspectives 2 (1988): 49–68.

43Dennis, D. D. and J. J. McConnell, “Corporate Mergers and Security Returns,”

Journal of Financial Economics 16 (1986): 143–188.