Global corporate finance - Kim

.pdf

392 INTERNATIONAL WORKING CAPITAL MANAGEMENT

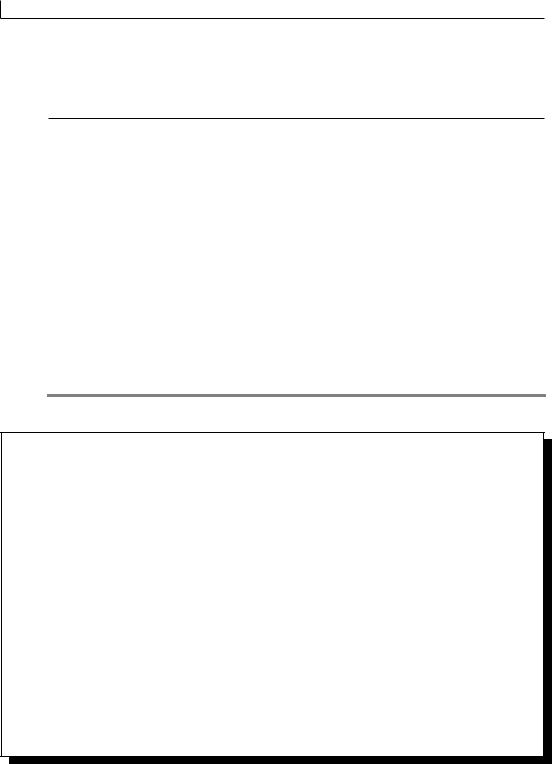

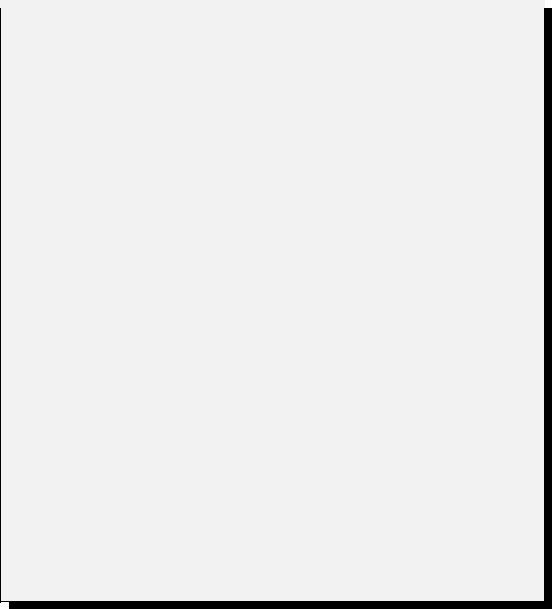

the price elasticity of demand for the merchandise is extremely high, the local market may not bear the higher price. Nevertheless, a certain level of price increase is required to prevent a deterioration of converted earnings.

Table 15.8 The effect of pricing on profits

|

|

(1) Maintain old price |

|

|

(2) Adjust price |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Korean |

|

US |

|

|

Korean |

|

US |

|||

|

|

|

|

|

|

|||||||

Exchange rate |

|

currency |

dollars |

|

|

currency |

dollars |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

W1,000 (now) sold for |

|

W15,000 |

$15 |

|

|

W30,000 |

$30 |

|||||

W500 (old) cost |

10,000 |

|

20 |

|

|

10,000 |

20 |

|||||

Profit |

W 5,000 |

-$ 5 |

|

|

|

W20,000 |

$10 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Another important question is whether a subsidiary should continue to import that type of merchandise. If local sales prices can be raised to cover the current higher dollar import prices, imports should continue. If not, imports could cease. Although the decision not to import merchandise does not cause any transaction loss, it may result in idle production and an eventual operating loss due to the surrender of that particular foreign market. If possible, MNCs should price their inventory goods in such a way that sales revenues include the sum of the increase in replacement cost of the inventory sold, the loss in real value of the monetary profit expected, and increased income taxes.

SUMMARY

Techniques of international working capital management are essentially similar to those employed domestically, but additional variables are involved. In domestic operations, all transactions are subject to the same rules of movement, accumulation, and reinvestment, but these rules vary when these transactions occur across national boundaries. These additional variables include political, tax, foreign exchange, and other economic constraints.

This chapter has discussed cash, accounts receivable, and inventory management. Cash management can be centralized or decentralized on a company level. Although decentralization is popular among subsidiary managers, it does not permit the MNCs to use its most liquid asset on a widespread basis. Multinational accounts receivable are created by two separate types of transactions: sales to independent customers and intracompany sales. Management of accounts receivable from independent customers involves the denomination of currency to be used for payments and the terms of payment. Intracompany sales differ from sales to independent customers, in that little concern is given to credit standing and the timing of the payments may depend upon a company’s desire to allocate resources rather than normal payment schedules. The overall efficiency of inventory management is extremely important for two reasons. First, inventories represent a significant segment of total assets for most MNCs. Second, they are the least liquid of current assets and thus errors in inventory management are not quickly remedied.

PROBLEMS 393

Questions

1What are the economic constraints of current asset management for multinational companies? Why do multinational companies face such constraints?

2Why are various arbitrage opportunities available to multinational companies in their working capital management?

3What techniques are available to a company with operating subsidiaries in many countries to optimize on cash and marketable securities?

4What are the advantages of leads and lags over direct loans?

5List the two major functions of international cash management.

6Why is the problem of floats in international operations more serious than in domestic operations?

7Explain the three types of portfolio management available to international cash managers.

8Why should a firm invest in a portfolio of foreign currencies instead of just a single foreign currency?

9Standard advice given to exporters is to invoice in their own currency or a strong currency. Critically analyze this recommendation.

10Under what conditions should companies maintain overstocked inventory accounts?

11Explain the importance of current asset management.

12Why is the literature on international working capital management rather limited?

Problems

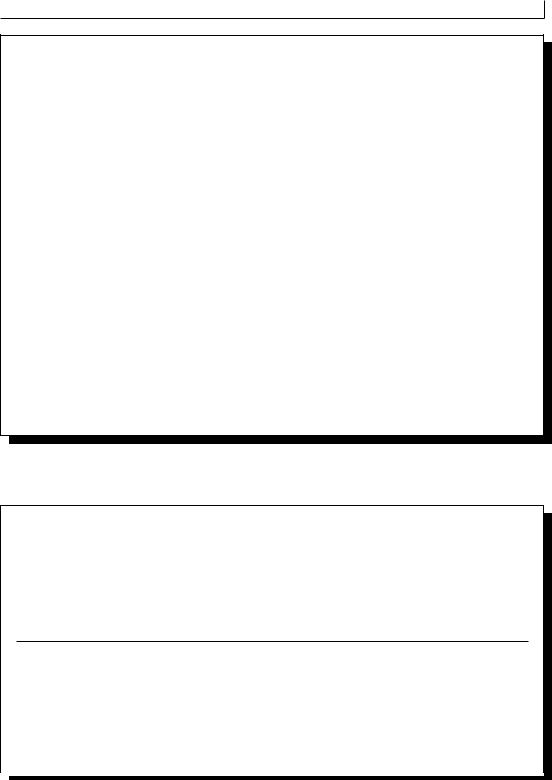

1Assume that the netting center uses a matrix of payables and receivables to determine the net payer or creditor position of each subsidiary at the date of clearing. The following table shows an example of such a matrix:

|

|

|

|

|

|

|

|

Paying subsidiary |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Receiving subsidiary |

|

USA |

|

Japan |

Germany |

Canada |

Total receipts |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USA |

|

– |

$ |

800 |

$ 700 |

$400 |

|

$1,900 |

|

|

|

|||||||

|

|

|

Japan |

$600 |

|

|

– |

400 |

|

200 |

|

1,200 |

|

|

|

|

|||||

|

|

|

Germany |

200 |

|

|

0 |

|

|

– |

300 |

|

500 |

|

|

|

|||||

|

|

|

Canada |

|

100 |

|

|

200 |

|

|

500 |

|

|

– |

|

|

800 |

|

|

|

|

|

|

|

Total payments |

$900 |

$1,000 |

$1,600 |

$900 |

|

$4,400 |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

394INTERNATIONAL WORKING CAPITAL MANAGEMENT

(a)Prepare a multilateral netting schedule, such as table 15.3.

(b)Determine the amount of total payments to be reduced by netting.

(c)Determine the percentage reduction in total payments by netting.

2A multinational company has a subsidiary in country A that produces auto parts and sells them to another subsidiary in country B, where the production process is completed. Country A has a tax rate of 50 percent, while country B has a tax rate of 20 percent. The income statements of these two subsidiaries are shown in the following table:

Pro forma income statements for two subsidiaries

|

High tax A |

Low tax B |

Combined A + B |

||||||

High transfer price |

|

|

|

|

|

|

|

|

|

Sales price |

$4,000 |

|

$7,000 |

|

$7,000 |

|

|||

Cost of goods sold |

|

2,200 |

|

|

4,000 |

|

|

2,200 |

|

Gross profit |

$1,800 |

|

$3,000 |

|

$4,800 |

|

|||

Operating expense |

|

800 |

|

|

1,000 |

|

|

1,800 |

|

Earnings before taxes |

$1,000 |

|

$2,000 |

|

$3,000 |

|

|||

Taxes (50%/20%) |

|

500 |

|

|

400 |

|

|

900 |

|

Net income |

$ 500 |

|

$1,600 |

|

$2,100 |

|

|||

|

|

|

|

|

|

|

|

|

|

Assume that the multinational company reduces its transfer price from $4,000 to $3,200. Determine the tax effect of this low transfer price on the company’s consolidated net income.

3The foreign subsidiary of a US parent company earns $1,000 before any taxes. The parent company wants to receive $400 before US taxes. The local tax rate is 50 percent and the US tax rate is 30 percent. The US company is considering two options: option X: $400 in cash dividends and option Y: $160 in cash dividends plus $240 in royalty fees for a total of $400 in cash. Which option should the company select to maximize its consolidated income?

4A US company has $10,000 in cash available for 45 days. It can earn 1 percent on a 45day investment in the USA. Alternatively, if it converts the dollars to Swiss francs, it can earn 1.5 percent on a Swiss deposit for 45 days. The spot rate of the Swiss franc is $0.50. The spot rate 45 days from now is expected to be $0.40. Should this company invest its cash in the USA or in Switzerland?

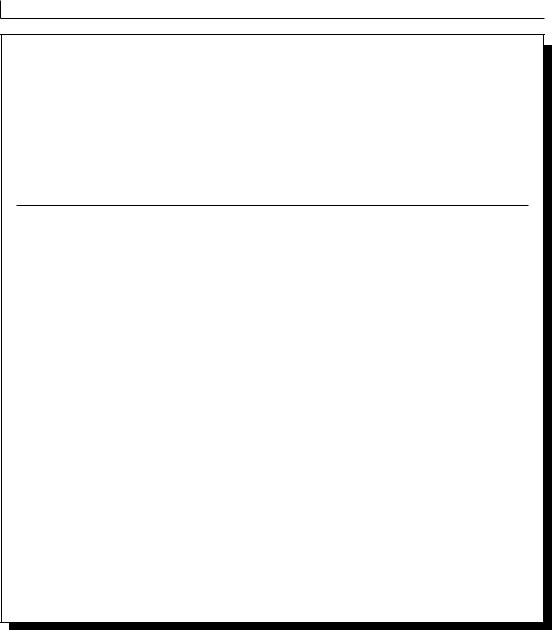

396 INTERNATIONAL WORKING CAPITAL MANAGEMENT

|

|

|

|

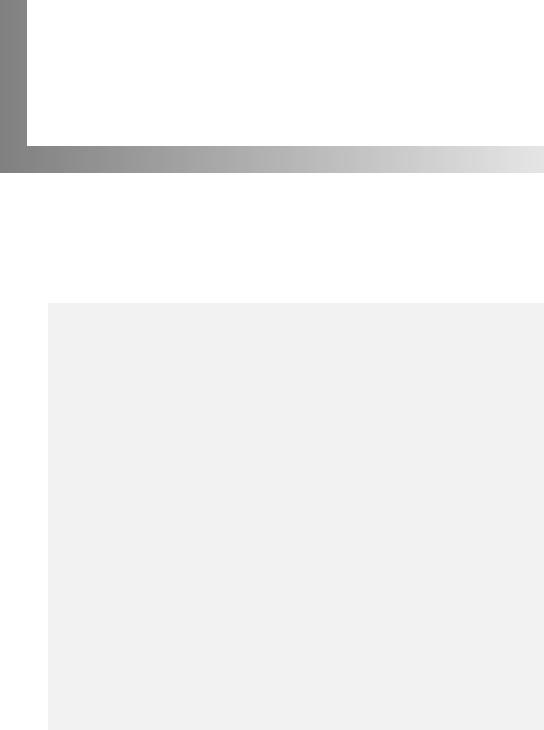

Return on equity |

42.2% |

Net income ($ millions) |

$544 |

38.9%

$299

14.7%

|

$150 |

7.1% |

$65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1996 |

1997 |

1998 |

|

1999 |

|

|

|

1996 |

1997 |

1998 |

1999 |

|||||||||||||||||

|

|

|

|

|

|

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

|

|

|||||

|

|

|

|

|

|

Sales and revenues ($ millions) |

$8,647 |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

$7,885 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

$5,754 |

$6,371 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1996 |

1997 |

1998 |

1999 |

Year

Figure 15.2 The recent financial performance of Navistar International

Source: www.navistar.com; accessed July 7, 2000.

ing at that time in local currencies. The clearing center converts all amounts into dollar terms at the current spot exchange rate and sends information to those subsidiaries with net payables on how much they owe and to whom. These paying subsidiaries are responsible for informing the net receivers of funds and for obtaining and delivering the foreign exchange. Settlement is on the 25th day of the month and the funds are purchased 2 days in advance, so that they are received on the designated day. Any difference between the exchange rate used by the Swiss center on the 15th and the rate prevailing for settlement on the 25th gives rise to foreign-exchange gains or losses, and these are attributed to the subsidiary.

Navistar used this original clearing system for intracompany transactions and did not use the system for its transactions with independent companies. After a decade with this system, the company introduced a scheme for foreign-exchange settlements for payments to outside companies. There are two different dates, the 10th and 25th, on which all foreign exchange is purchased by and transferred from the Swiss center. The payment needs are sent electronically to the center from the subsidiary more than 2 days before the settlement date. Then the center nets the amounts of each currency in order to make the minimum number of foreign-

|

CASE PROBLEM 15 |

397 |

|

|

|

|

|

|

|

|

|

|

|

|

|

exchange transactions. The subsidiary, which owes the foreign exchange, settles with the clearing center by the appropriate settlement date. This netting system can cut the total number of transactions with outsider companies in half.

The use of interdivisional leading and lagging makes the cash management system even more flexible. If a subsidiary is a net payer, it may delay or drag payment for up to 2 months while compensating the net receiver at the prevailing interest rate. Net receivers of funds may, at their discretion, make funds available to other subsidiaries at an appropriate interest rate. In this way, the Swiss clearing center serves to bring different subsidiaries together so that they can reduce outside borrowing. The netting with leading and lagging has allowed the company to eliminate intracompany floats and reduce the number of transactions by 80 percent.

Case Questions

1Why did Navistar choose Switzerland as its clearing center for the company’s netting system?

2What are the direct cost savings of Navistar’s netting system?

3What are the benefits derived from Navistar’s netting system in addition to the direct cost savings discussed in question 2?

4Assume that Navistar hired you as a consultant for its working capital management. How would you advise the company when it faces the following conditions: absence of forward markets, high transaction costs, high political risk, liquidity needs by subsidiaries, and high taxes.

5Major international banks provide a variety of working capital and cash management services for multinational companies. Use the website of the Bank of America, www.bankamerica.com/, and the website of the Bank of Montreal, www.bmo.com/, to assess their multinational cash management services.

Sources: Navistar International Annual Report, various issues; M. D. Levi, International Finance, New York: McGraw-Hill, 1996, pp. 427–8; and J. P. Miller, “Navistar Gains Spotlight Amid Volvo’s Rumored Interest,”

The Wall Street Journal, Mar. 10, 1999, p. B4.

CHAPTER 16

International Portfolio

Investment

Opening Case 16: LG Group Shows how Korea Inc.

Might Restructure

Amid a spate of corporate scandals that questioned the durability of South Korea’s reforms for the post-Asian financial crisis era, the LG Group has completed a transformation which could prove to be a test case for one of the country’s biggest challenges – restructuring big business. LG is the country’s second-largest chaebol, or family-owned conglomerate, with assets of $49.5 billion and businesses ranging from electronics to financial services. The company dismantled its complex web of crossshareholdings and reorganized most of its affiliates under a holding company, the LG Corp. “The greatest corporate action in Korea so far is LG Group’s restructuring to a holding company,” stated Wonki Lee, the head of equity research at Merrill Lynch in Seoul.

Chaebols prospered by forming intricate financial and business ties among group companies – profiting together and often bailing each other out during economic distress. In the process, they took Korea’s economy from postwar devastation to the world’s 12th-largest. Nevertheless, the Asian financial crisis of 1997–8 exposed chaebol mismanagement and corruption. Since then, they have struggled to solve these problems and polish a tarnished image so that they could compete more effectively on a global stage. The LG Group began its reincarnation by improving its financial profile. LG merged 15 companies into other affiliates, shed five noncore businesses, listed 20 more, attracted foreign investors, and placed 34 of its 51 affiliates under the LG Corp. umbrella.

The restructuring also clarified how much of the group was controlled by the founding Koo and Huh families, whose current patriarchs are Koo Bon Moo and Huh Chang

OPENING CASE 16 |

399 |

|

|

Soo. Together, they once controlled the entire conglomerate through small holdings in various affiliates. Through sales, equity swaps, and other deals, those stakes have been consolidated in their 59 percent LG Corp. stake. The holding company – whose earnings come solely from dividends and LG brand usage fees – sets group strategy, oversees unit management, and promotes the LG brand globally. The holding company aligns its interests with those of affiliate shareholders in terms of business strategy, financial status, and cash flows. Previously, the founders exercised unchallenged control over the entire conglomerate; now, the holding company has legal legitimacy and must act in a rational, accountable way, thus permitting unit independence.

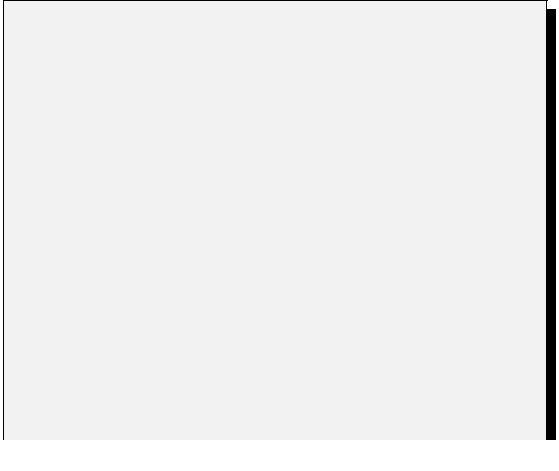

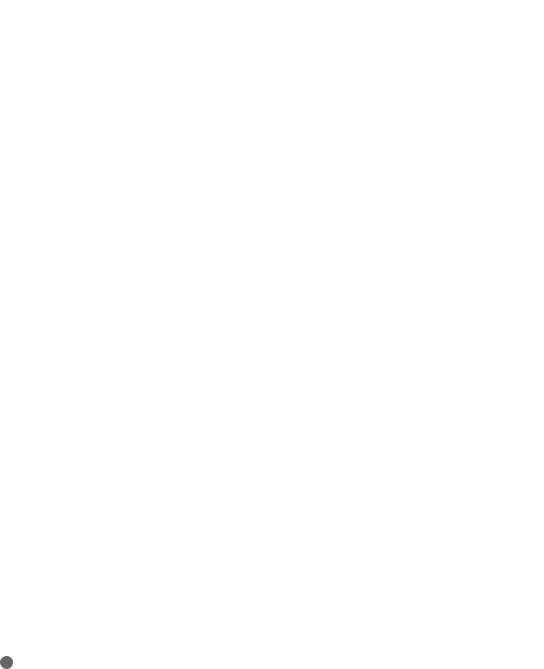

The major purpose of this new structure is to increase corporate governance and transparency. The increased transparency is usually rewarded by the markets, with “good disclosure” stocks trading at higher valuation than those of their peers. Although it is difficult to isolate the effect of corporate openness on an overall share price, compelling circumstantial evidence shows that the more information a company releases, the better. Apparently, investors seem to believe that LG’s transformation has improved corporate governance and created transparency at what was once an impenetrable tangle of interlocking companies. As shown in figure 16.1, LG affiliate shares have soared since LG launched its structure in March 2003.

To increase competitiveness and management efficiency by focusing on core businesses, the Board of LG Corp. voted to divide the company into LG Group and GS

All for One, and One for All

The shares of LG Corp. affiliates have risen sharply since the March 1, 2003, announcement of the chaebol's holding-company structure.

|

COMPANY |

INCREASE IN SHARE PRICE THROUGH SEPT. 5 |

|

|||||||

LG Life Sciences |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

142% |

||

|

LG Micron |

|

|

|

|

|

|

|

+99% |

|

|

|

|

|

|

|

|

||||

|

LG International |

|

|

|

|

|

|

+54% |

|

|

|

|

|

|

|

|

|

|

|||

|

LG Electronics |

|

|

|

|

|

+49% |

|

|

|

|

|

|

|

|

|

|

|

|||

LG Engineering & |

|

|

|

|

+44% |

|

|

|||

|

|

|

|

|

|

|||||

|

Construction |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

LG Cable |

|

|

|

|

+43% |

|

|

||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

TOTAL MARKET CAP |

33.4% |

|

|

|

|

|

|

|

|||||

|

LG Chem |

|

|

+30% |

|

|

OF ALL LG COMPANIES |

|||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

SINCE MARCH 1 |

|

|

Source: LG Corp.

Figure 16.1 All for one, and one for all

Source: The Wall Street Journal, Sept. 8, 2003, p. A10.

400 INTERNATIONAL PORTFOLIO INVESTMENT

Holdings on April 13, 2004. Company shareholders approved the plan at a special meeting on May 28, thereby establishing GS Holdings as a new company. LG Group took manufacturing units, while GS Holdings took logistics and service units. GS Holdings started its business with Huh Chang Soo as its first Chairman on July 1, 2004.

Sources: K. Song, “LG Group Shows how Korea Inc. Might Restructure,” The Wall Street Journal, Sept. 12, 2003, p. A10; and W. H. Lee and S. H. Park, “LG Plans Split to Establish 2 Holding Firms,” JoongAng Daily, Apr. 14, 2004, p. 3.

In 1990, two American finance professors – Harry Markowitz (1959) and William Sharpe (1964)

– received the Nobel Prize in economic science because of their contribution to portfolio theory. A highly respectable mean-variance model developed by Markowitz and Sharpe employs two basic measures: an index of expected return (mean) and an index of risk (variance or standard deviation). The expected value for a portfolio of securities is simply the sum of the individual returns for the securities that make up the portfolio. The standard deviation as a measure of risk for the portfolio is not easily measured. In many business situations, risks of individual securities tend to offset each other. Thus, with successful diversification, the investor may select a portfolio having less risk than the sum of the risks of individual securities.

There was a time when investment opportunities stopped at national borders. However, today we assume a unified and integrated world capital market when analyzing international finance and macroeconomics. Indeed, recent national policy discussions rely on this premise stimulated by global integration of capital markets. Thus, many countries have internationalized their capital markets since 1980. National capital markets have changed to an integrated global capital market, often followed by widespread international multiple listings of securities. An economic revolution is taking place in many parts of the world as countries deregulate financial markets.

Diversification among risky securities in a particular country reduces risk. Yet this potential is rather limited, because most companies usually earn more during booms and less during recessions, which suggests that international portfolio diversification reduces additional risk. In fact, gains from such diversification have become so commonplace in recent years that additional empirical studies are not needed to confirm the benefits of international diversification. Still, this chapter describes key diversification terminology, the gains from international diversification, and methods of international diversification.

16.1 Key Terminology

In the real world, no company or individual invests everything in a single asset. Accordingly, it is useful to consider the risk and return of a particular asset in conjunction with its counterparts in existing assets or new investment opportunities. Portfolio theory deals with selecting investment projects that minimize risk for a given rate of return or that maximize the rate of return for a given degree of risk.

KEY TERMINOLOGY |

401 |

|

|

16.1.1Risk analysis: standard deviation

Two conflicts from investment in assets are that: (1) very few financial variables are known with certainty and (2) investors are basically risk averters. Risk is variability in the return generated by investment in an asset. For example, investors buy common stock in the hope of receiving growing dividends and an appreciating stock price. However, neither the dividend stream nor price appreciation is certain or guaranteed. Thus, investors evaluate risk before they invest in common stock.

Risk may be measured by the dispersion of alternative returns around the average return. Standard deviation, being a measure of dispersion, fits nicely as a technique for measuring risk. To determine the standard deviation of, say, monthly returns for an asset, we may use the following formula:

s =

Â(R - R )2

n -1

–

where s is the standard deviation; R is the monthly returns; and R is the average monthly return. To illustrate, assume that the monthly returns of a common stock are 0.40, 0.50, and 0.60 for 3 months. The average monthly return is 0.50, and the standard deviation is 0.10.

Standard deviation is an absolute measure of dispersion. If returns are expressed in dollars, the standard deviation shows the amount of risk per dollar of average return. A relative measure of dispersion is the coefficient of variation, which is the standard deviation divided by the average return. In general, the coefficient of variation measures risk better than the standard deviation for assets whose returns are stated in dollars. Standard deviation should be used to measure risk only for those assets whose returns are stated as percentages.

16.1.2The capital asset pricing model

The capital asset pricing model (CAPM) assumes that the total risk of a security consists of systematic (undiversifiable) risk and unsystematic (diversifiable) risk. Systematic risk reflects overall market risk – risk that is common to all securities. Common causes of systematic risk include changes in the overall economy, tax reform by Congress, and change in national energy supply. Because it is common to all stocks, systematic risk cannot be eliminated by diversification.

Unsystematic risk is unique to a particular company. Some causes of unsystematic risk include wildcat strikes affecting only that company, new competitors producing essentially the same product, and technological breakthroughs making an existing product obsolete. Because it is unique to a particular stock, unsystematic risk can be eliminated by diversification.

Within an international context, systematic risk relates to such global events as worldwide recessions, world wars, and changes in world energy supply. Unsystematic risk relates to such national events as expropriation, currency controls, inflation, and exchange rate changes.

If a market is in equilibrium, the expected rate of return on an individual security (j) is stated as follows: