- •1. Market

- •2. Exchange

- •3. Commitment

- •4. Trade

- •5. Profit ant. Loss

- •6. Price

- •7. List

- •Market place

- •Vocabulary notes

- •Vocabulary notes

- •Vocabulary notes

- •Vocabulary notes

- •Vocabulary notes

- •Vocabulary notes

- •Vocabulary notes

- •Vocabulary notes

- •Vocabulary notes

- •Vocabulary notes

- •Vocabulary notes

- •Vocabulary notes

- •1. Exchange

- •4. Trade /

- •Vocabulary notes

- •Vocabulary notes

Vocabulary notes

1. average

stock market average — индекс курсов акций

Dow Jones Industrial Average — индекс Доу-Джонса для

акций промышленных компаний

Dow Jones Transportation Average — индекс Доу-Джонса

для акций транспортных компаний

Dow Jones Utility Average-—индекс Доу-Джонса для акций

коммунальных компаний

composite average — составной индекс Доу-Джонса

bond average — индекс Доу-Джонса для корпоративных

облигаций

weekly average — еженедельно публикуемый курс акций

2. index

pi. indices, indexes

share price index — индекс курсов акций

stock exchange index — индекс фондовой биржи

Standard & Poor's "500" Stock Index — индекс Стандарт энд Пур

NYSE Composite Index—составной индекс Нью-Йоркской фондовой биржи index option — индексный опцион

index future — индексный фьючерс

3. ratio

price-earnings ratio (Р-Е ratio; PER)—отношение рыночной цены акции компании к ее чистой прибыли

syn. the multiple

4. yield

yield of bonds — процентный доход по облигациям

flat yield— текущий доход по ценным бумагам"

redemption yield—доход по ценной бумаге при ее погашении

5. net change — нетто-изменеиие курса ценной бумаги

6. price

bid—цена покупателя (bid price)

asked—цена продавца (asked price)

high — наивысший курс (highest price)

low — наименьший курс (lowest price)

close — цена последней сделки в конце рабочего дня (closing price)

syn. last (last price)

Answer the following comprehension questions based on the text:

1. What is the market average? What do you come to know about its history? How can you characterize daily changes in the averages?

2. What information do the newspaper financial pages provide?

3. Why is the Price-Earnings Ratio a key figure in judging the value of a stock? What are the possible fluctuations of the multiple?

4. What other stock tables do the newspaper financial pages carry?

STOCK MARKET AVERAGES READING THE NEWSPAPER QUOTATIONS

The financial pages of the newspaper are a mystery to many people. But dramatic movements in the stock market often make the front page. In newspaper headlines, TV news summaries, and elsewhere, almost everyone has been exposed to the stock market averages.

In a brokerage firm office, it's common to hear the question, 'How's the market?" and the answer, "Up five dollars," or "Down a dollar." With 1.500 common stocks listed on the NYSE, there has to be some easy way to express the price trend of i he day. Market averages are a way of summarizing that information.

Despite all competition, the popularity crown still goes to an average that has some of the qualities of an antique — the Dow Jones Industrial Average, an average of 30 prominent stocks dating back to i he 1890s. This average is named for Charles Dow — one of the earliest stock market theorists, and a founder of Dow Jones & Company, a leading financial news service and publisher of the Wall Street Journal.

In the days before computers, an average of 30 stocks was perhaps as much as anyone could calculate on a practical basis at intervals throughout the day. Now, the Standard & Poor's 500 Stock Index (500 leading stocks) and the New York Stock Exchange Composite Index (all stocks on the NYSE) provide a much more accurate picture of the total market. The professionals are likely to focus their attention on these "broad" market indexes, But old habits die slowly, and when someone calls out, "How's the market?" and someone else answers, "Up five dollars," or "Up five" — it's still the Dow Jones Industrial Average (the "Dow" for short) that they're talking about.

The importance of daily changes in the averages will be clear you view them in percentage terms. When the market is not changing rapidly, the normal daily change is less than 1/2 of 1%. A change of 1/2% is still moderate; 1% is large but not extraordinary: 2% is dramatic. From the market averages, it's a short step to the thousands of detailed listings of stock prices and related data that you'll find in the daily newspaper financial tables. These tables include complete reports on the previous day's trading on the New York Stock Exchange and other leading exchanges. They can also give you a surprising amount of extra information.

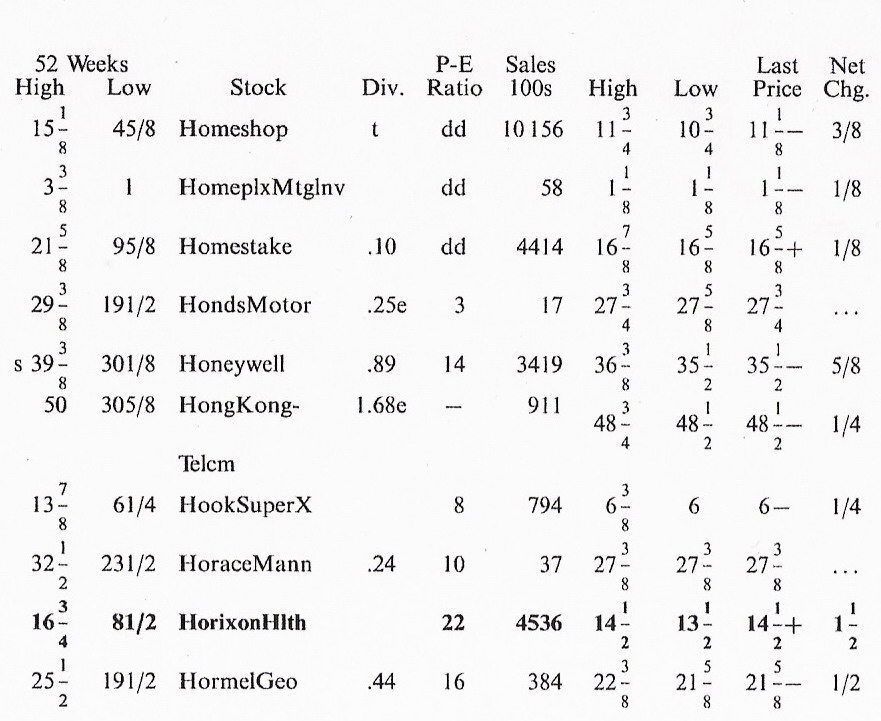

Some newspapers provide more extensive tables, some less. Since l lie Wall Street Journal is available world wide, we'll use it as a source of convenient examples. You'll find a prominent page headed "New York Stock Exchange Composite Transactions”. This table covers the lay's trading for all stocks listed on the NYSE. "Composite" means i hat it also includes trades in those same stocks on certain other changes (Pacific, Midwest, etc.) where the stocks are "dually listed". Here are some sample entries:

Some of the abbreviated company names in the listings can be a considerable puzzle, but you will get used to them.

While some of the columns contain longer-term information about the stocks and the companies, we'll look first at the columns that actually report on the day's trading. Near the center of the table you will see a column headed "Sales 100s". Stock trading generally takes place in units of 100 shares and is tabulated that way; the figures mean, for example, that 90,900 shares of Consolidated Edison,

1,192,400 shares of General Electric, and 1,571,300 shares of Mobil

traded on January 8. (Моbil actually was the 12th "most active'1 stock on the NYSE that day, meaning that it ranked 12th in number of shares traded.)

The next three columns show the highest price for the day, the lowest, and the last or "closing" price, The "Net Chg." (net change) column to the far right shows how. the closing price differed from the previous day's close — in this case, January 7.

Prices are traditionally .calibrated in eighths of a dollar. In case you aren't familiar with the equivalents, they are:

Con Edison traded on January 8 at a high of $49.375 per share and a low of $48.875; it closed at $49.25, which was a gain of $0.25 from the day before. General Electric closed down $1.00 per share at $90.00, but it earned a "u" notation by trading during the day at $91.375, which was a new high price for the stock during the most recent 52 weeks (a new low price would have been denoted by a "d").

The two columns to the far left show the high and low prices recorded in the latest 52 weeks, not including the latest day. (Note that the high for General Electric is shown as 91, not 91.) You will note that while neither Con Edison nor Mobil reached a new, high on January 8, each was near the top of its "price range*''for the latest 52 weeks. (Individual stock price charts, which are published by several financial services, would show the price history of each stock in detail.).

The other three columns in the table give you information of use in making judgments, about stocks as investments. Just to the right of the name, the “Div.“ (dividend) column shows the current annual dividend rate on the stock— or, if there's no clear regular rate, then the actual dividend total to the latest 12 months. The dividend rates shown here are $2.68 annually for Con Edison, $2.52 for GE, and $2.20 for Mobil. (Most companies that pay regular dividends pay them quarterly: it's actually $0.67 quarterly for Con Edison; etc.) The "Yld." (Yield) column relates the annual dividend to the latest stock price. In the case of Con Edison, for example, $2.68 (annual dividend) /$49.25 (stock price) = 5.4%, which represents the current yield on the stock.

The Price-Earnings Ratio

Finally, we have the "P-E ratio", or price-earnings ratio, which represents a key figure in judging the value of a stock. The price-earnings ratio — also referred to as the "price-earnings multiple", or sometimes simply as the "multiple" — is the ratio of the price of a stock to the earnings per share behind the stock.

This concept is important. In simplest terms (and without taking possible complicating factors into account), "earnings per share" of a company are calculated by taking the company's net profits for the year, and dividing by the number of shares outstanding. The result is, in a very real sense, what each share earned in the business for the year—not to be confused with the dividends that the company may or may not have paid out. The board of directors of the company may decide to plow the earnings Back into the business, or to pay them out to shareholders as dividends, or (more likely) a combination of both; but in any case, it is the earnings that are usually considered as the key measure of the company's success and the value of the

stock.

'The price-earnings ratio tells you a great deal about how investors view a stock. Investors will bid a stock price up to a higher multiple if a company's earnings are expected to grow rapidly in the future.' The multiple may look too high in relation to current earnings, but not in relation to expected future earnings. On the other hand, if a company's future looks uninteresting, and earnings are not expected to grow substantially, the market price will decline to a point where the multiple is low.

Multiples also change with the broad cycles of the stock market, as investors become willing to pay more or less for certain values and potentials. Between 1966 and 1972, a period of enthusiasm and speculation, the average multiple was usuajly 15 or higher. In the late 1970s, when investors were generally cautious and skeptical, the average multiple was below 10. However, note that these figures refei to average multiples — whatever the average multiple is at any given time, the multiples on individual stocks will range widely above and' below it.

Now we can return to the table on page 94. The P-E ratio for each] stock is based on the latest price of the stock and on earnings for the latest reported 12 months. The multiples, as you can see, were 12 for Con Edison, 17 for GE, and 10 for Mobil. In January 1987, the average multiple for all stocks was very roughly around 15. Con] Edison is viewed by investors as a relatively good-quality utility company, but one that by the nature of its business cannot grow much more rapidly that the economy as a whole. GE, on the other hand, is generally given a premium rating as a company that is expected to outpace the economy.

••• You can't buy a stock on the P-E ratio alone, but the ratio tells you much that is useful. For stocks where no P-E ratio is shown, it J often means that the company showed a loss for the latest 12 months, and that no P-E ratio can be calculated. Somewhere near the main NYSE table, you'll find a few small tables that also relate to the day's NYSE-Composite trading. There's the table showing the 15 stocks that traded the greatest number of shares for the day (the_ "most active" list); a table of the stocks that showed the greatest percentage of gains or declines (low-priced stocks generally predominate here); and one showing stocks that made new price highs or lows relative to the latest 52 weeks.

You'll find a large table of "American Stock Exchange Composite Transactions", which does for stocks listed on the AMEX just what the NYSE-Composite table does for NYSE-listed stocks. There are smaller tables covering the Pacific Stock Exchange, Boston Exchange, and other regional exchanges.

The tables showing over-the-counter stock trading are generally divided into two or three sections. For the major over-the-counter stocks covered by the NASDAQ quotation and reporting system, actual sales for the day are reported and tabulated just as for stocks on the NYSE and AMEX. For less active over-the-counter stocks, the paper lists only "bid" and "asked" prices, as reported by dealers to the NASD.

It is worth becoming familiar with the daily table of prices of U.S. Treasury and agency securities. The Treasury issues are shown not only in terms of price, but in terms of the yield represented by the currenl

Brice. This is the simplest way to get a bird's-eye view of the current [merest rate situation — you can see at a glance the current rates on long-term Treasury bonds, intermediate-term notes, and short-term hills.

Elsewhere in the paper you will also find a large table showing prices of corporate bonds traded on the NYSE, and a small table of

Led tax-exempt bonds (traded OTC). But unless you have a spe-• ii interest in any of these issues, the table of Treasury prices is the best way to follow the bond market.

There are other tables listed. These are generally for more experi-inced investors and those interested in taking higher risks. For txample, there are tables showing the trading on several different lumges in listed options — primarily options to buy or sell common •locks (call options and put options). There are futures prices — Commodity futures and also interest rate futures, foreign currency I mures, and stock index futures. There are also options relating to и 11 crest rates and options relating to the stock index futures.

VOCABULARY PRACTICE

■ Ex. I. Look at the words in the box, all of which are from this unit. Match the words with the correct definition from the list below.

S & P's Composite Index, low, bid, asked, average, yield, NYSE Composite Index, close

1. The highest price a prospective buyer is prepared to pay at P particular time for a trading unit of a given security.

2. Market value-weighted index which relates all NYSE stocks to nn aggregate market value as of December 31, 1965, adjusted for capitalization changes.

3. The price of the final trade of a security at the end of и trading day.

4. Percentage rate of return paid on a common or preferred stock in dividends; rate of return on a bond.

5. The lowest price acceptable to a prospective seller of a given

security.

6. Market value-weighted index showing the change in the aggregate market value of 500 stocks relative to the base period 1941-43.

7. Bottom price paid for a security over the past year or since i rading in the security began.

8. Appropriately weighted and adjusted arithmetic mean of selected securities designed to represent market behaviour generally or important segments of the market.

■ Ex. II. Look through this excerpt and then fill the spaces with words from the box. Translate the text into Russian.

To understand the Major Market Index, it is necessary to be acquainted with ... (1), though now most professionals are likely to focus on ... (2) or ... (3) as measures of the broad market. But ... (4) retains much of its fascination and popularity.

The Dow isn't ... (5). But the Major Market Index has been constructed to move like the Dow. It is... (6), 15 of which are also in the Dow.

Like the Dow, the Major Market Index is not ... (7), but ... (8), meaning that the market price of each of the 20 stocks is taken into the calculation without adjustment.

a market-weighted average, the NYSE Composite, made up of 20 leading stocks, index option, the S & P 500, a price-weighted average, asked, the Dow Jones Industrial Average (2), traded on options and futures exchanges

■ Ex. III. Study the following newspaper quotations. What stock do you consider to be safe (risky) investment? Bear out your statement.

EXPLANATORY NOTES

The following explanations apply to New York and American exchange listed issues and the National Association of Securities Dealers Automated Quotations system's over-the-counter securities.

Boldfaced quotations highlight those issues whose price changed by 5% or more if their previous closing price was $2 or higher,

FOOTNOTES: ▲— New 52-week high. ▼—new 52-week low. a-Extra dividend or extras in additions to the regular dividend, b-Indicates annual rate of the cash dividend and that a stock dividend was paid. c-Liquidating dividend. cc-P/E ratio is 100 or more. dd-Loss in the most recent four quarters. e-Indicates a dividend was declared or paid in the preceding 12 months, but that there isn't a regular dividend rate. f-Annual rate, increased on latest declaration. g-Indicates the dividend and earnings are expressed in Canadian money. The stock trades in U.S. dollars. No yield or P/E ratio is shown. gg-Special sales condition; no regular way trading. i-Indicates amount declared or paid after a stock dividend or split. i-Indicates dividend was paid this year, and that at the last dividend meeting a dividend was omitted or deferred. k-Indicates dividend declared or paid this year on cumulative issues with dividends in arrears. m-Annual rate, reduced on latest declaration. n-Newly issued in the past 52 weeks. The high-low range begins with the start of trading and doesn't cover the entire period. p-Initial dividend. pf-Preferred. pp-Holder owes installment(s) of purchase price. pr-Preference. r-Indicates a cash dividend declared or paid in the preceding 12 months, plus a stock dividend. rt-Rights. s-Stock split or stock dividend amounting to 10% or more in the past 52 weeks. The high-low price is adjusted from the old stock. Dividend calculations begin with the date the split was paid or the stock dividend occurred. t-Paid in stock in the preceding 12 months, estimated cash value on ex-dividend or ex-distribution date except for some NASDAQ listings where payment is in stock. un-Units. v-Trading halted on primary market. vi-In bankruptcy or receivership or being reorganized under the Bankruptcy Code, or securities assumed by such companies. wd-When distributed. wi-When issued. wt-Warrants. ww-With warrants. x-Ex-dividend, ex-rights or without warrants. z-Sales in full, not in hundreds.

■ Ex. IV. A) Familiarize yourself with the following text. Be ready to answer some questions based on the text making use of the suggested helpful phrases (Part A).

Облигации обладают свойством обратимости, то есть с ними могут осуществляться операции по купле-продаже. Некоторые облигации обращаются на бирже, однако большинство сделок осуществляется на внебиржевом рынке. Торговля облигациями, как правило, менее интенсивная, чем операции с акциями.

Как и акции, облигации имеют номинальную стоимость (которая является фиксированной) и рыночную цену (которая меняется). Поскольку номинал, как предполагается, составляет для любой облигации 1000 долларов США (исключения бывают в редких случаях), котировка облигаций осуществляется в процентах от номинала: например, если облигация (1000 долларов США) продается «97», это значит, что ее цена составляет 97 процентов от номинала, то есть 970 долларов США. Облигации могут продаваться по цене выше номинала—с надбавкой, или ниже номинала — со скидкой. Рыночная цена облигаций обычно зависит от их надежности (финансовой стабильности корпорации-эмитента) и от ставки процента. В первом случае очевидно, что, чем ниже надежность облигации, тем ниже ее рыночная стоимость. Во втором случае связь заключается в том, что с ростом ставки процента рыночная стоимость облигаций, выпущенных под более низкий по сравнению с текущей ставкой процент, снижается. При этом чем больше времени до погашения | облигации в случае повышения ставки процента, тем ниже падает рыночная стоимость облигации, выпущенной под более низкий процент.

Важной характеристикой облигации как финансового инструмента является ее доходность. Доход по облигации может быть номинальным (по купонной ставке) и текущим (последний основан на текущей цене облигации).

Большинство облигаций корпораций имеют «рейтинг». Он устанавливается независимыми фирмами. Наиболее распространенными являются рейтинги компаний «Стэндард энд Пурз» и «Мудиз».

Облигации, имеющие более высокий рейтинг, называются облигациями «инвестиционного класса». Те облигации, которые имеют более низкий рейтинг, считаются спекулятивными (в том числе так называемые бросовые облигации*. Чем ниже рейтинг, тем выше риск неплатежа. В последнее время все чаще используются уточнения к рейтингу (« + » и «—» — по системе «Стэндард и Пурз» и «I» по системе «Мудиз»). В целом чем выше рейтинг облигаций, тем ниже доход по ним.

Следует отметить, что в современной практике различия между акциями и облигациями корпораций постепенно все больше стираются. С одной стороны, происходит узаконение выпуска «не голосующих» акций, с другой — появились «голосующие» облигации. Стиранию этих различий способствует также эмиссия конвертируемых облигаций и выпуск так называемых гибридных фондовых бумаг.** Сближение акций и облигаций в определенной мере отражает тенденцию сближения (сращивания) промышленного и банковского капитала.

_____________________

* junk bonds

** hybrid securities

В) Act as an interpreter for Parts A and B.

Part B

1. Тема нашего разговора сегодня —котировка и рейтинг облигаций, а начнем мы с цены облигаций. Существуют различия в определении цены

облигаций и акций? Как осуществляется котировка облигаций?

2. От каких факторов зависит рыночная цена облигаций? Каким образом она может колебаться под воздействием этих факторов?

3. Не могли бы Вы прокомментировать наиболее распространенные рейтинги облигаций?

4. Существует мнение, что в современной практике различия между акциями и облигациями корпораций все больше стираются. Чем, по Вашему мнению, это объясняется? В каких формах это происходит?

Part A

I'd like to begin by saying ...

It's important to make a distinction between ...

By way of an example ...

To put. that in another way ..

More specifically ...

So much for A, let's look at В

So we can see that ...

As I see that …

/ am sorry if my English is a little difficult to understand.

■ Ex. V. Do it in English making use of the active:

Для того чтобы составить представление о положении компании, необходимо, конечно, достаточно внимательно следить за колебаниями курса ее ценных бумаг и другими показателями в течение длительного времени. Но не менее важно сравнивать ее показатели с показателями других компаний и динамикой рынка ценных бумаг в целом. Для этого газеты ежедневно публикуют не только индивидуальные цены акций, облигаций и проч., но и агрегированные и средние показатели по отдельным биржевым рынкам, отраслям и т. д.

Самым популярным измерителем рынка ценных бумаг в целом является в США индекс Доу-Джонса. Впервые рассчитал его В 1884 году Чарльз Доу.

Сегодня индекс Доу-Джойса — это уже не один показатель, а четыре. Самый популярный — индекс Доу-Джонса для промышленных предприятий — учитывает акции 30 ведущих компаний обрабатывающей промышленности и торговли страны. Кроме того, рассчитывается индекс Доу-Джонса для 20 транспортных компаний, отдельный для 15 компаний коммунальной сферы и, наконец, суммарный индекс для 65 предприятий, включаемых в первые три группы. Список этих компаний ежедневно публикует «Уолл-стрит джорнэл».

Своей популярностью индекс Доу-Джонса во многом обязан той рекламе, которая дается ему в печати и по телевидению. Даже на биржах он рассчитывается и официально объявляется каждые полчаса. Но в последнее время в его адрес стало высказываться все больше критики. Это и охват только узкого круга крупнейших компаний, и недостаточная математическая точность.

В 1957 году у компании «Доу-Джонс» появился конкурент. Крупнейшая в США фирма по исследованию рынка ценных бумаг «Стэндард энд Пур'с» начала расчет индекса цен акций 500 компаний. Индекс «Стэндард энд Пур'с» более репрезентативен, хотя бы потому, что охватывает большее число корпораций: 400 промышленных, 20 транспортных, 40 предприятий сферы коммунального обслуживания и 40 финансовых компаний. Рассчитываются самостоятельные индексы и для этих групп отраслей. Более того, с самого начала методика расчета «Стэндард энд Пур'с» была более продуманной, чем Доу-Джонса. Цены акций взвешиваются по количествам выпуска.1 Но, как утверждают специалисты, важнейшее практическое преимущество индекса 500 «Стэндард энд Пур'с» состоит в том, что его числовое значение во много раз меньше. Скажем, когда Доу-Джонс равен 2965,56, «Стэндард энд Пур'с» — лишь 377,75. Поэтому колебания рынка, измеренные по последнему показателю, не так пугают инвесторов. Например, мрачный газетный заголовок «Индекс Доу-Джонса упал на 25 пунктов» впечатляет куда сильнее, нежели осознание того факта, что реально цены акций в среднем упали лишь на 2%. Любопытно, что невзирая на все различия, оба показателя достаточно четко и синхронно фиксируют подъемы и спады. Исключение составляют те редкие случаи, когда цены акций неустойчиво колеблются в течение дня.

DISCUSSION

1.How can you account for the numerous tables the newspaper financial pages carry? Do they display a tendency to multiply?

2.Do you think the absence of a developed system of indexes poses problems for the securities market in this country?

3.What do you happen to know about stock index options and futures? In what way have they transformed the speculative scene?

Individual Task

Unit 6

Part B

Text II

derivatives, investment, Single European Market, futures, option, trading, liquidity, arrival, stamp duty