МГИМО_Практикум по юридическому переводу

.pdf

to encumber the property trust administration

to encumber the property trust administration

trustee

to administer the property

to be held in the ownership of

acquisition and termination of the right of ownership

contribution

amalgamation

charitable foundation

to assign to something / somebody

5.Translate into English the following extract from the RF Civil Code:

ПРАВО МУНИЦИПАЛЬНОЙ СОБСТВЕННОСТИ

1.Имущество, принадлежащее на праве собственности городским и сельским поселениям, а также другим муниципальным образованием, является муниципальной собственностью.

2.От имени муниципального образования права собственника осуществляют органы местного самоуправле-

61

ния и лица, указанные в статье 125 настоящего Кодекса.

3.Имущество, находящееся в муниципальной собственности, закрепляется за муниципальными предприятиями и учреждениями во владение, пользование и распоряжение в соответствии с настоящим Кодексом.

4.Средства местного бюджета и иное муниципальное имущество, не закрепленное за муниципальными предприятиями и учреждениями, составляет муниципальную казну соответствующего городского, сельского поселения или другого муниципального образования.

LESSON 11

BANKRUPTCY

VOCABULARY

1. Read and remember the following:

BANKRUPTCY GLOSSARY

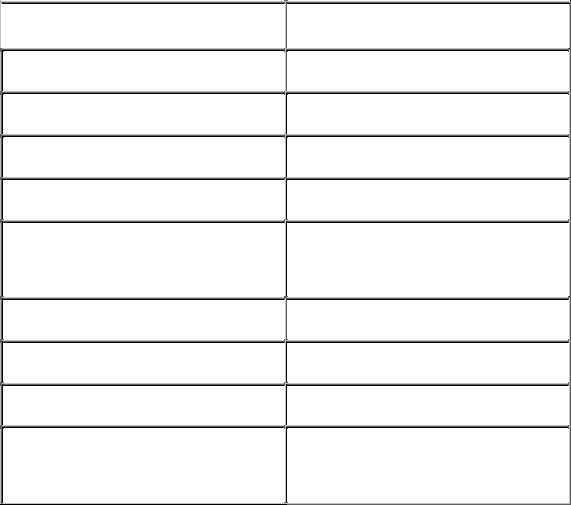

Russian Term |

English Term |

банкротство |

bankruptcy |

банкрот |

bankrupt |

постановление суда о |

bankruptcy order |

признании банкротства |

|

|

62 |

заявление о признании |

bankruptcy petition |

должника банкротом |

|

подать заявление |

to file a petition |

несостоятельность |

insolvency |

внешний управляющий |

external manager / administrator |

конкурсный управляю- |

trustee / receiver |

щий (управляющий кон- |

|

курсной массой) |

|

временный управляющий |

interim manager |

внешнее управление |

external management / |

|

administration |

осуществлять внешнее |

to exercise external management |

управление |

|

процедура банкротства |

bankruptcy proceeding |

признаки банкротства |

indicia of bankruptcy |

преднамеренное и фик- |

deliberate and fraudulent bank- |

тивное банкротство |

ruptcy |

наблюдение |

observation proceedings |

финансовое оздоровление |

financial rehabilitation |

конкурсное производство |

competitive proceedings |

мировое соглашение |

amicable agreement / settlement |

|

|

2. Learn the basic definition given below:

Bankruptcy is the state of a person who has been adjudged by a court to be insolvent. The court orders the compulsory administration of a bankrupt’s affairs so that his assets can be fairly distributed among his creditors. To declare a debtor to be a bankrupt a creditor or a debtor himself must make an applica-

63

tion (known as a bankruptcy petition) either to the High Court or to a country court. If a creditor petitions, he must show that the debtor owes him at least $750 and that the debtor appears unable to pay it. The debtor’s inability to pay can be shown ether by: (1) the creditor making a formal demand in a special statutory form, and the debtor failing to pay within three weeks; or (2) the creditor of a judgement debtor being unsuccessful in enforcing payment of a judgement debt through the courts. If the petition is accepted the court makes a bankruptcy order. Within three weeks of the bankruptcy order, the debtor must usually submit a statement of affairs, which the creditors may inspect. This may be followed by a public examination of the debtor. After the bankruptcy order, the bankrupt’s property is placed in the hands of the official receiver. The official receiver must either call a creditors’ meeting to appoint a trustee in bankruptcy to manage the bankrupt’s affairs or he becomes trustee himself. The trustee must be qualified insolvency practitioner. He takes possession of the bankrupt’s property and subject to certain rules, distributes it among the creditors.

A bankrupt is subject to certain disabilities. Bankruptcy is terminated when the court makes an order of discharge but a bankrupt who has not previously been bankrupt within the preceding 15 years is automatically discharged after three years.

3.Find the appropriate term for each definition:

a)“A court order that makes a debtor bankrupt. When the order is made, ownership of all the debtor’s property is transferred either to a court officer (служащий суда) known as the official receiver or to a trustee appointed by the creditors. It replaced both the former receiving order (судебный приказ о на-

64

значении управляющего конкурсной массой или об управлении имуществом банкрота) and adjudication order (судебное решение о признании банкротом) in bankruptcy proceedings”

(______________________)

b) “An application to the High Court or a country court for a bankruptcy order to be made against an insolvent debtor” (_____________________)

4.Read and translate the text. Pay attention to the highlighted words and word combinations:

RUSSIAN BANKRUPTCY LAW AND PRIVATIZATION

CRAIG A. HART

I.RUSSIAN BANKRUPTCY LAW AND THE PRIVATIZATION PROCESS IN RUSSIA

This Article examines whether Russia’s new bankruptcy law, which became effective retroactively on January 1, 1998 (the “Russian Bankruptcy Law”), is likely to advance or undo the privatization of Russian firms subject to bankruptcy administration. The analysis presented in this Article focuses on who gains control over debtor firms during bankruptcy and how the presence of a bankruptcy regime influences the decisionmaking of owners and managers.

Bankruptcy, in most jurisdictions, involves the State in the economic decision-making of private firms more intimately

65

than it normally would in a market economy. With respect to Russia, bankruptcy should not become a means through which the State regains control of private firms. The initial research for this Article examined whether the State could be eliminated altogether from the process of reorganizing or liquidating debtor enterprises. Concluding that eliminating the State from the bankruptcy process was not feasible under the economic and political conditions prevailing in Russia, the research turned to considering ways in which the State’s role could be appropriately limited to assisting in the development of corporate governance of debtor firms undergoing bankruptcy administration, so that these firms can compete more effectively in a market economy. The conclusion was that the appropriate role for the State is to support a bankruptcy framework in which interested parties select suitable agents to exercise governance. Whether the State is limited to helping place capable third parties in positions of corporate governance, or is permitted to provide corporate governance itself, is the basis upon which the Russian Bankruptcy Law is judged in this Article.

The Russian Bankruptcy Law is deemed to reverse or prevent the further progress of the privatization of debtor firms if, during the course of bankruptcy, the State regains control of formerly privatized enterprises, prevents the removal of ineffective management insiders, or rescues enterprises that would otherwise fail.

Russian Bankruptcy Law is judged to advance the goals of the Russian privatization program in cases in which judiciallysupervised bankruptcy provides a method for transferring ownership and control of insolvent State-owned and privatelyheld enterprises to private owners who will competitively manage these entities.

66

In order to determine whether ownership and management is placed with private owners who can operate firms on a competitive basis, the Article evaluates different possible ownership groups based on (1) technical ability to provide corporate governance, (2) incentive to pursue the goals of maximizing firm value and profits, and (3) influence over firm management in order to cause management to operate debtor firms in accordance with the goals of shareholders.

In assessing the Russian Bankruptcy Law, this Article concludes that the law may reverse the privatization of certain firms employing large numbers of people. If these firms become subject to bankruptcy administration, the Russian Bankruptcy Law permits the State to takeover the bankruptcy and to operate the debtor for a period of up to ten years, provided the State guarantees or pays the debts of the enterprise. Additionally, the Russian Bankruptcy Law permits the State to acquire ownership of any debtor by entering into an agreement with the debtor and its creditors. These provisions can reverse the privatization of bankrupt enterprises.

The Russian Bankruptcy Law appears to improve corporate governance in two respects. First, the Russian Bankruptcy Law appears likely to reduce the influence of insiders during bankruptcy. Second, it places creditors in a central role with respect to selecting and monitoring the external administrator, confirming the plan of external administration and approving major decisions affecting the debtor enterprise.

This Article recommends that the bankruptcy law in Russia would be best able to advance the goal of improving corporate governance if it promoted large private shareholders, particularly investment funds, commercial enterprises, and creditors into positions of ownership and control in respect of debtor

67

firms, and eliminated the State from economic decisions which are traditionally made by firm management in a market economy.

II. OVERVIEW OF THE CURRENT RUSSIAN BANKRUPTCY LAW

The Russian Bankruptcy Law was signed by President Yeltsin on January 8, 1998; its substantive provisions became effective retroactively on January 1, 1998. It is the third bankruptcy law adopted by the Russian Federation.

The Russian Bankruptcy Law governs the bankruptcy of natural and legal persons. It contains special provisions for large employers, called “town-forming” organizations, agricultural organizations, insurance organizations, professionals engaged in the securities business, individual farmers, individual entrepreneurs, credit organizations and citizens. Credit organizations are also the subject of separate legislation providing detailed guidelines for the bankruptcy of these entities. Certain government-owned enterprises that are operated pursuant to statute and are scheduled to be privatized by 1999 are excluded from the provisions of the Russian Bankruptcy Law.

This Article discusses bankruptcy proceedings with respect to the reorganization of enterprises, including town-forming enterprises. It does not address any of the other provisions governing specific types of entities or natural persons.

With respect to enterprises, the Russian Bankruptcy Law provides for three kinds of bankruptcy administration, during which the enterprise is to be declared solvent, restructured or liquidated. Prior to a formal declaration of bankruptcy, an enterprise is subject to “observation proceedings” for a period of

68

three months, which can be extended for an additional two months. During observation proceedings, the arbitration court collects information about the management and the financial status of the debtor in order to determine the appropriateness of formal bankruptcy administration. The arbitration court appoints an interim manager to monitor the debtor’s management, preserve the assets of the debtor, analyze the debtors financial status, ascertain whether there are indicia of deliberate or fraudulent bankruptcy, and to convene the first creditors’ meeting. During this period, the Russian Bankruptcy Law envisions that the debtor’s management will continue to operate the enterprise, although the arbitration court is empowered to remove the management for cause, such as for hindering the interim manager.

Following observation proceedings, the arbitration court, based on a decision of the creditors’ committee or the court’s own determination that the debtor can be restored to solvency, may declare the debtor subject to external administration, the method of reorganizing a debtor enterprise under the Russian Bankruptcy Law. At the commencement of external administration, the arbitration court appoints an external manager, selected by the creditors, who assumes the responsibilities of the debtor’s management, subject to supervision and control by the arbitration court and the creditors. The external manager is obligated to present a plan of external administration within one month after appointment.

Under the plan, the external manager must seek to restore the enterprise to solvency by selling assets, selling the enterprise, reaching agreement with the creditors to reschedule debts or otherwise satisfying their claims in full performance of the debtor’s obligations, including by means of the assumption of

69

debts by new entrant third parties, or such other methods as may be accepted by a majority of creditors present at the creditors’ meeting. The period of external management may last no more than twelve months, with a six month extension by the court, subject to a possible further extension by the arbitration court based on the petition of the creditors after their review of the external managers’ report at the end of the year and a half period of external administration.

If external management fails, or if the enterprise is deemed unsuitable for reorganization, the arbitration court may order the liquidation of the debtor’s assets under “competitive proceedings.” In such a case, the arbitration court appoints a competitive proceedings manager who temporarily manages the debtor, sells its assets, and makes distributions to creditors according to the priority scheme provided under the Russian Bankruptcy Law. Competitive proceedings last up to one year, with a possible extension of six months by the arbitration court.

During any of the proceedings described above, the debtor and its creditors may conclude an amicable agreement. The agreement must be approved by the creditors. Third parties may enter into an amicable agreement with the debtor and its creditors in order to acquire rights to, and assume obligations of, the debtor. The rights that third parties can acquire in a debtor enterprise include ownership of the debtor entity. Notably, there is no restriction against the State entering into an amicable agreement in order to gain ownership of a debtor. An amicable agreement is subject to the requirement that the claims of the creditors in the first and second order of priority must be satisfied.

The order of priority of creditors under the Russian Bankruptcy Law is as follows:

70