- •Contents

- •Unit I. Customs control

- •Text a. Customs control

- •I. Read the following article and give synonyms for the words and phrases in bold.

- •II. Translate the following phrases into English. Make up sentences with them describing customs control areas.

- •IV. Using the vocabulary complete the sentences giving extensive information.

- •Text b. Customs laboratories

- •I. Read the article and give English equivalents for the words and phrases in brackets.

- •Text c. Principles of customs control

- •I. Read the article and give Russian equivalents for the words and phrases in bold.

- •II. Using the vocabulary give the gist of Text b and Text c. Text d. Forms and order of customs control measures

- •I. Read the article and give Russian equivalents for the words and phrases in bold.

- •Verification of Documents and Information

- •Verbal Inquiry

- •Verification of Special Marking or Other Identification of Goods

- •Verification of Authenticity of Information Following Release of Goods and/or Means of transport for Free Circulation

- •II. Find 11 words from the text in the table and translate them.

- •III. Match the words with their definitions. Make up sentences with them.

- •IV. Define if the following statements are true or false.

- •I. Read the article and give Russian equivalents for the words and phrases in bold.

- •3. How pcc works

- •4. Eligible Processes:

- •Operation of the procedure

- •Text f. Regulations for the federal customs service

- •Read the article and compare the authorities of the fcs of Russia with those of Belarus.

- •Is responsible for:

- •Unit II. Customs tariffs

- •Text a. Tariffs and their types

- •I. Read the following article and give Russian equivalents for the words and phrases in bold.

- •II. Using the dictionary of synonyms find the synonyms for the following words.

- •III. Match the words in column a with the appropriate words in column b.

- •IV. Complete the following sentences using the required information and the vocabulary from the article above.

- •Read the article and translate and find synonyms for the words and phrases in bold.

- •II. Give the summary of the article. Text c. Tariff quotas

- •Read the article and explain the words and phrases in bold.

- •II. Using the vocabulary speak on tariff quotas. Find some additional information on them. Text d. Tariff regulations

- •I. Choose the words to complete the article. It may be necessary to change the form of the given words.

- •Translate the following words and phrases and give definitions to them.

- •Using the vocabulary give the summary of the article.

- •Text e. Tariff regulations of foreign trade in the republic of belarus

- •Read the article and be ready to discuss it.

- •Answer the following questions.

- •Read the article and translate the words and phrases in bold.

- •Industrial suspensions

- •Complete the sentences using the required information from the above article.

- •Text g. Tariff databases

- •I. Read the articles and render them in Russian.

- •Unit III. Customs duties

- •Text a. Customs duty

- •I. Read the article and give Russian equivalents for the words and phrases in bold.

- •Import vat

- •Import vat rate

- •Text b. Import duty

- •Text c. Duties

- •Read the article and give Russian equivalents for the words and phrases in bold.

- •Imported or used in specified circumstances include:

- •Import duty relief

- •Import reliefs on previously exported goods

- •II. Using the vocabulary give the gist of the article. Then render it in Russian. Text f. Types of duty relief

- •I. Choose the words to complete the article. It may be necessary to change the form of the given words.

- •Part I. Inward processing relief (ipr)

- •Part II. Outward processing regime

- •Part III. Temporary admission relief (ta)

- •Read the article and be ready to discuss it.

- •II. Give the Russian equivalents for the following phrases.

- •III. Explain the following words and expressions and find synonyms for them.

- •IV. Complete the following sentences using the required information from the article.

- •V. Using the vocabulary and the information from the article make up a story “a true story of an eternal debtor”. Text h. Duty-free exemption

- •Read the article and give its main ideas in Russian.

- •II. Find some information about the duty-free exemption in Belarus. Compare it with that of the usa. What could our customs systems borrow from the custom system of the usa and vice versa?

- •Unit IV. Export procedure and export finance

- •Text a. Export procedures

- •I. Read the article and find the synonyms for the words and phrases in bold.

- •II. In the article above find the English equivalents for the following words and phrases. Then make up sentences with them explaining export procedure.

- •III. Answer the following questions.

- •Text b. Export declarations

- •Read the article and find Russian equivalents for the words and phrases in bold.

- •With the vocabulary from the article give the gist of it. Text c. Export control laws

- •I. Read the article and translate the words in bold.

- •II. Fill in the missing words.

- •III. Using the vocabulary make up a detective story with a disastrous end.

- •IV. Complete the following sentences using the required information from the article.

- •Text d. Import, export and tariff eu regulations

- •Read the article and render it in Russian.

- •Text e. Export permit

- •I. Choose the words from the group below to complete the article. It may be necessary to change the form of the given words.

- •Read the article and be ready to discuss it.

- •Give the Russian equivalents for the following phrases.

- •Using the vocabulary give the gist of the article.

- •Make up a dialogue between a customs officer and a businessman discussing the export of goods, their identification and valuation.

- •Unit V. Import procedures and import finance

- •Text a. Guidelines on imports

- •I. Read the following article and give synonyms for the words and phrases in bold.

- •Import Requirements

- •How Customs Determines Value of Imported Goods

- •Transaction Value Method

- •Transaction Value of Identical Goods Method

- •Transaction Value of Similar Goods Method

- •Deductive Value of Imported Goods Method

- •Clearance Procedures

- •Import Procedures

- •1. Import Procedures

- •II. Translate the following phrases into Russian. Make up sentences with them describing import procedures and requirements.

- •Match the words with their definitions.

- •IV. Answer the questions.

- •Give the summary of the above article. Text b. Methods of payment in import

- •I. Read the article and give English equivalents for the words and phrases in brackets.

- •Text c. Trade, volume, early payment and cash discounts

- •I. Read the articles and render them in Russian.

- •II. What is a Customs Bond?

- •Read the article and be ready to discuss it.

- •Import through Sea

- •Translate the words and phrases into English.

- •III. Using the vocabulary and the information talk about import duties.

- •Read the article and be ready to discuss it.

- •Match the words in column a with their translation in column b.

- •III. Using the vocabulary complete the sentences giving extensive information.

- •IV. With your partner discuss what other risks can take place in import activities. Text f. Commercial cash entry processing system

- •Read the article and render it in Russian.

- •In groups prepare “Brain Ring” game. Appoint the host, participants; get ready with the questions on import in customs.

- •Unit VI. Types of customs payment

- •Text a. International trade payment

- •II. Find Russian equivalents for the following words. Using them give the essence of each type of international payment.

- •I. Read the text and translate all the marked words and phrases.

- •Standby Letter of Credit

- •II. Find 14 words from the text in the table and translate them.

- •III. Match the words in column a with the appropriate words in column b.

- •IV. Complete the following sentences using the required information and the vocabulary from the article above.

- •Text c. A letter of credit

- •I. Read the text and translate all the marked words and phrases.

- •II. Answer the questions:

- •Using the vocabulary give the main points of the article. Text d. Risks in lc situations

- •I. Read the article and give the summary of it.

- •II. So what are the major risks in lc payment? Find additional information on each type of risk and present it to the group mates.

- •II. Translate the word combinations. Choose 3 expressions that you like most of all and give their definitions to the group. The group will guess the combinations you are explaining.

- •II. Define if the statements are true or false.

- •IV. Using the vocabulary give the main points of the article. Text f. Customs card

- •I. Choose the words from the group below to complete the article. It may be necessary to change the form of the given words.

- •I. Read the article and write out all the economic terms.

- •Types of Customs Bonds

- •II. Give the gist of the article and then render it in Russian.

- •Unit VII. International trade contracts – incoterms

- •Text a. International commercial terms

- •Read the following article and give Russian equivalents for the words and phrases in bold.

- •Text b. Free alongside ship and free on board

- •I. Read the article and give English equivalents for the words and phrases in brackets.

- •I. Read the articles and give English equivalents for the words and phrases in brackets.

- •Carriage paid to and carriage and insurance paid to

- •Delivered at frontier, delivered ex-ship and delivered ex-quay

- •Delivered duty unpaid and delivered duty paid

- •II. Using the vocabulary complete the sentences giving extensive information.

- •III. Using the vocabulary and the information from the articles act out a dialogue between the buyer and the seller. Text d. Incoterms and vat

- •Choose the words to complete the article. It may be necessary to change the form of the given words.

- •Import vat

- •Text e. About incoterms

- •I. Read the article and be ready to discuss it.

- •Translate the following words and phrases and give definitions to them.

- •III. Give the summary of the article. Text f. Incoterms and trade

- •Read the article and render it in Russian.

- •Import documentation

- •Unit VIII. Customs union

- •Text a. Customs union: what is it?

- •Text b. The customs union among russia, belorussia and kazakhstan

- •Indirect taxation of foreign activity performed by countries of the Customs Union

- •II. Translate and then explain the meaning of the following words and phrases from the article above.

- •I. Read this scientific essay and find the synonyms for the words and phrases in bold.

- •Match the words in column a with the appropriate words in column b.

- •III. Make a list of positive and negative welfare effects of customs union creation as viewed by the author of the article. Which of them do you agree with?

- •IV. Render the article in Russian. Text d. Benefits of a customs union

- •I. Choose the words to complete the article. It may be necessary to change the form of the given words.

- •II. Using the vocabulary give the gist of the article above. What other benefits of a customs union can you think of? text e. Russia, belarus and kazakhstan

- •Read the following article and be ready to discuss it.

- •Translate the following words and phrases into Russian.

- •III. Complete the following sentences using the required information and the vocabulary from the article above.

- •Unit IX. Electronic customs

- •Text a. The present customs landscape in europe

- •I. Read the article and explain the words and phrases in bold.

- •International drivers towards Customs transformation

- •II. Give synonyms for the words in bold.

- •III. Match the words in column a with the appropriate words in column b.

- •IV. Use the collocations in the assignment above and make short but extensive slogans advertising e-Customs.

- •V. Are the following statements true or false? Provide the necessary information for them.

- •VI. Act out a dialogue between the ibm specialist and a Customs officer on the topic of e-Customs. Use the vocabulary and information from the article. Text b. Customs automation system

- •I. Read the text and translate all the marked words and phrases.

- •1. Key Application Areas

- •II. Match the synonyms.

- •III. Explain the meaning of the following terms.

- •IV. Complete the following sentences using the required information and the vocabulary from the article above.

- •Unit X. Customs brokerage

- •Text a. Customs brokerage

- •III. Match the English and Russian words and phrases. Then using them act out a short dialogue on customs clearance.

- •IV. Complete the following sentences using the required information from the article.

- •Text b. Customs broker

- •I. Choose the words from the group below to complete the article. It may be necessary to change the form of the given words.

- •How Customs Brokerage Makes Importing Easier

- •Unit XI. Customs of the 21st century

- •Text a.

- •I. Read the article and give Russian equivalents for the words and phrases in bold.

- •21St century customs: a new dynamic role

- •III. Using the vocabulary complete the sentences giving extensive information.

- •I. Read the following article and give synonyms for the words and phrases in bold.

- •Text c. United states: customs in the 21st century

- •II. Using the dictionary of synonyms find the synonyms for the following words.

- •III. Find 9 words from the text in the table and translate them.

- •IV. Define if the following statements are true or false.

- •Text d. A customs blueprint for the 21st century

- •I. Read the article and give English equivalents for the words and phrases in brackets.

- •1. Introduction

- •2.Questions and Answers :

- •II. Using the vocabulary make up a conversation between a wco officer and a businessman on a Customs blueprint for the 21st century.

- •For discussion

- •Unit I.

- •Import controls - prohibitions, restrictions and licences

- •Export controls

- •Vat on exports and other export taxes

- •Classification of goods

- •The importance of classifying your goods

- •Unit II. Taking On China

- •China Restarts Rare Earth Shipments to Japan

- •What Development Round?

- •Tricky Tariff Customs Tax Bills

- •Unit III. Duty Free Tax Exemptions on Returned Goods

- •7 Rules for Customs Duty Savings for Items on Return to Canada

- •Tariff Duty Refunds

- •How to Reduce Customs Tariff Duties and Taxes

- •Unit IV. Export Procedures

- •Export Boom Helps Farms, but Not American Factories

- •Unit V. What Determines a Car Shipping Rate?

- •Solar Panel Tariff May Further Strain u.S.-China Trade

- •The Price of Gold and the Gold Customs

- •Unit VI. Zambia: zra to launch e-Customs payment system

- •Payment of an annuity to a non-resident

- •Unit VII. Do the unidroit Principles of International Commercial Contracts form a new lex mercatoria?

- •Unit VIII. New customs declaration rules for Customs Union corporations in 2011

- •Let’s Stick Together: Pros and Cons of the Tripartite Customs Union in the cis

- •Customs union creates new rules, new problems

- •Zambia: comesa making progress towards Customs Union launch

- •Unit IX. An Airport Program That Makes Traveling (Gasp!) Easier

- •E.U., Kiev and Moscow Search for Friendly Ties

- •Russia and 2 Neighbors Form Economic Union

- •Unit X. The New Computerised Transit System (ncts)

- •Sap Introduces New Stand-Alone Application to Help Companies Rapidly Comply With European eCustoms Procedures

- •Unit X. Customs Broker

- •Translating articles

- •Таможня

- •Таможенная политика

- •Таможенно-тарифное регулирование

- •Таможенное декларирование

- •Таможенные тарифы

- •Таможня и экспорт

- •Доводы «за» национальный протекционизм

- •Таможенные платежи

- •Таможенные пошлины (I)

- •Таможенные пошлины (II)

- •Ставки таможенных пошлин

- •Виды таможенных пошлин

- •2. По способу взимания:

- •Влияние таможенных пошлин на торговлю

- •Импорт прижали

- •Союз, да не тот

- •Электронная таможня

- •Электронная таможня в беларуси

- •Концепция проекта "электронная таможня" на 2011-2015 гг. В беларуси

- •Преимущества электронного декларирования

- •Таможенный брокер

- •Российская таможня в условиях построения информационного общества

International drivers towards Customs transformation

In addition to pressures towards e-Customs from inside individual European member states, there are also pressures from the EU itself. The European Commission has guidance in the form of Customs Blueprints. These guidelines are based on European best practices against which national Customs administrators can measure their own operational capacity. They aim to harmonise Customs regulations and procedures among EU member states and their trading partners by offering assistance in reconciling a country’s existing situation with blueprint standards and thus providing a basis for Customs reform.

More importantly, the European Union has also published the “Multi-Annual Strategic Plan” (MASP) which represents the EU’s programme for the creation of a simple and paperless environment for customs and trade. This programme incorporates a number of different initiatives including modernisation of customs legislation and IT solutions.

Excise Movement and Control System (EMCS)

A specific example of EMCS can be found in implementations by IBM and IBM Business Partner INTRASOFT International. EMCS is a computerised system for monitoring movements of excise goods (e.g., alcoholic beverages, tobacco products and energy products) between EU member states under duty suspension. The system will replace paper documentation that has accompanied these movements. Member states are developing their own national EMCS applications, and these systems will be linked to all other member states through a common domain, maintained by the European Commission.

The EMCS asset enables tax and customs administrations to process excise declarations electronically and to achieve optimal excise control for exchanging data on excise declarations among member states (country of dispatch, country of destination, country of transit). The platform takes advantage of open standards and service-oriented architecture. It is modular, separates business logic from services implementation, and comes with a GUI that can be individually customised, distributed and integrated with existing applications. In addition, by reusing the solution, a client can benefit by knowing how to build and integrate a National Excise Application (NEA) that meets the EU requirements but is also flexible enough for specific national functionality. Present IBM and INTRASOFT EMCS implementations meet exactly the specifications and requirements requested by the EC.

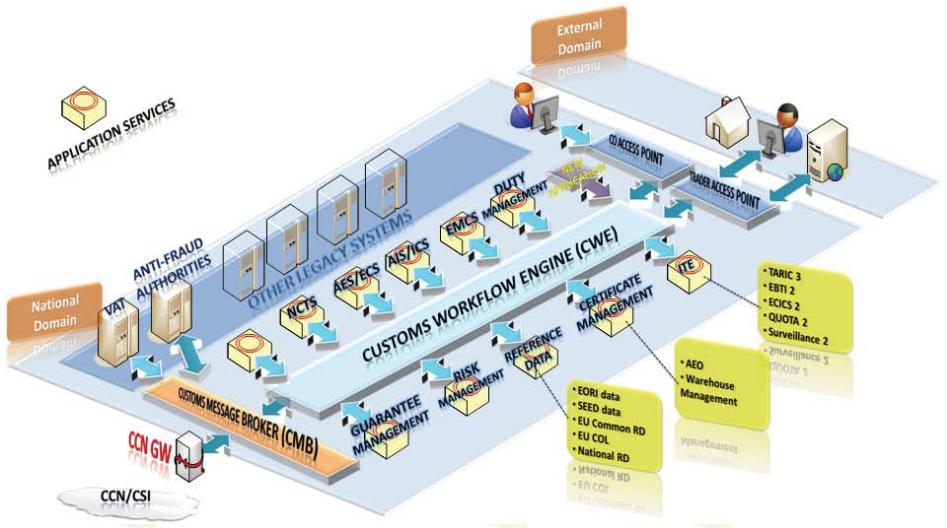

Projection of an e-Customs implementation for a typical EU member state

Examples of other e-Customs offerings

In addition to EMCS and DMS, IBM and IBM Business Partners have been and are collaborating on the following e-Customs assets:

Customs Messaging Gateway, an integrated solution featuring a secure, multi-channel communications and data transformation gateway leveraging IBM hardware, software and services;

Customs Message Broker, messaging service through which current legacy systems or newly developed applications can satisfy the information exchange and interoperability requirements between EU member state administrations and DG TAXUD.