- •3. Read the text and do the exercises.

- •The entire oil industry is often divided into three major sectors: upstream, midstream and downstream.

- •Downstream (oil industry)

- •Upstream (oil industry)

- •Midstream (oil industry)

- •The Seven Sisters of the petroleum industry is a term coined by an Italian entrepreneur, Enrico Mattei, that refers to seven oil companies that dominated mid-20th century oil production, refinement, and distribution.

- •ROYAL DUTCH SHELL

- •Founded: 1907

- •Products: oil, natural gas, petrochemicals

- •Products: natural gas, petroleum

- •Headquarters: the Netherlands, principal offices in Houston, Paris and the Hague

- •Pronunciation of the name

- •12. Translate into English.

- •12. http://www.fourmilab.ch/gravitation/foobar/

- •15. http://www.fe.doe.gov/education/energylessons/oil/oil2.html

- •Exploration Methods

- •Elements of a petroleum prospect

- •Terms used in petroleum evaluation

- •Drill Stem Tests

- •A. Electric, Radioactivity and Acoustic (Sonic) Logging

- •2. ______ _______ invades the rock surrounding the wellbore, affects the logging of the hole and must be accounted for.

- •3. ______ _______ measure formation radioactivity.

- •Acidizing

- •2. Pay attention to the underlined stress in the following words.

- •Completion

- •Production

- •Abandonment

- •3. Pay attention to the underlined stress in the following words.

- •4. Read the following text and do the exercises.

- •2. Pay attention to the underlined stress in the following words.

- •5. Fill in the gaps with the most suitable words or terms from the text.

- •6. Match the two parts of the sentences.

- •Terms and Vocabulary

- •People

- •9. Read the text “Drilling Rig” and fill in the missing words from the box. There is one extra word.

- •Drilling Rig

- •Drilling Rig Classification

- •4. Read the text “Hoisting system components” and do the exercises.

- •16. Read the text “PIPE (MATERIAL)” and fill in the missing information. The first sentence is done for you.

- •2. Pay attention to the stress in the following words. □ shows the position of stress.

- •2. Pay attention to the stress in the following words. □ shows the position of stress.

- •2. Pay attention to the underlined stress in the following words.

- •6. Fill in the gaps with the correct term.

- •Example: 7. relies upon

- •7. Scan through the following short definitions and do the after – task exercises.

- •Corrosion types

- •Crack characteristics can vary greatly depending on the cause of the crack, the materials being cracked, and the environment causing the cracking. The following photos show examples of crack profiles.

- •Applied coatings

- •15. Match the questions about “Cathodic protection” on the left with the answers on the right.

- •STEEL TANKS WITH FIXED ROOFS

- •STEEL TANKS WITH FLOATING ROOF

- •METHODS OF ERECTION OF CYLINDRICAL STEEL TANKS

- •APPENDIX 5

- •Dictionary of Pipeliner's Terms (SLANGS)

- •A. подаваемый ток

- •1. weakening

- •B. коррозионный элемент

- •2. rust

- •C. выходное напряжение

- •3. discoloration

- •D. интенсивность

- •4. impressed current

- •E. (удельная) проводимость

- •5. direct current

- •F. ослабление

- •6. corrosion cell

- •G. обезвоживание

- •7. output voltage

- •H. постоянный ток

- •8. severity

- •9. water removal

- •10. conductivity

- •K. толщина стенки

- •11. operating pressure

- •12. yield strength

- •L. ухудшения характеристик

- •M. рабочее давление

- •13. allowance

- •N. предел текучести

- •14. wall thickness

- •O. допуск

- •fracture

- •трещина

- •gradient

- •угол наклона, склон

- •circuitous

- •окольный, обходной

- •Reynolds number

- •число Рейнольда

- •interplay

- •взаимодействие

- •facet

- •сторона

- •aquifer

- •водоносный слой

- •porous media

- •пористая среда

- •pertinent

- •имеющий отношение

- •civil engineering

- •гражданское строительство

- •soil science

- •почвоведение

- •fluid mechanics

- •механика жидкости

- •inertia

- •инерция

- •Laplace equation

- •уравнение Лапласа

- •simulate

- •имитировать

- •heat conduction

- •теплопроводность

- •heat transfer

- •теплообмен

- •uncoupled processes

- •несвязанные процессы

- •soil moisture

- •влажность почвогрунта

- •viscous

- •вязкий

- •viscosity

- •вязкость ( жидкости, газа )

- •diffusion

- •диффузия

- •steady flow

- •transient flow

- •неустановившийся поток

- •15. deterioration

- •UNIT 1

- •Introduction to Economics and management

- •UNIT 2

- •Finance

- •UNIT 3

- •STOCK

- •UNIT 4

- •THE ECONOMY OF PETROLEUM INDUSTRY

- •UNIT 5

- •Taxation and audit

- •UNIT 6

- •Production and Costs

- •UNIT 7

- •BUSINESS PLAN

- •UNIT 8

- •International Business Etiquette AND ETHICS

- •References

- •3. Read the text “Hydrogeology: Key Terms and Concepts”, do the exercises

- •Hydrogeology

- •7. What are the subjects of the following sciences?

- •12. Fill in the chart with the necessary information from the text.

- •13. Pay attention to the pronunciation of the following terms.

- •14. Read the following short texts and fulfill the after-reading exercises. Pay attention to the diagrams and underlined words.

- •Ground Water Aquifer

- •Confined or Artesian Aquifer

- •Drawdown – the vertical drop of the water level in a well caused by ground water pumping; also, the difference between the water level before pumping and the water level during pumping.

- •Make your own sentences with two of the expressions.

- •UNIT 4

- •THE GREENHOUSE EFFECT

- •Compose your own sentences with two of the expressions.

- •5. Translate from Russian into English.

- •10. Answer the following questions.

- •1. What are the functions of atmosphere?

- •1. The phenomenon known as El Niňo

- •A) is confined to the Pacific Ocean.

- •D) caused the disappearance of the dinosaurs.

- •2. It was named after

- •3. It is caused by

- •A) the wind changing direction.

- •D) occurs every four or five years.

- •5. The effect of El Niňo

- •Make your own sentences with two of the expressions.

UNIT 3

STOCK

Lead-in

Fill in the spidergram with the words associated with Stock Market (use your active vocabulary from Unit 2).

Stock

Market

Discuss the following questions.

1.What do you know about stock market?

2.What are the most famous stock markets?

3.Do you have any stock or bond, or security?

4.What can you say about the situation at the world’s stock markets nowadays?

5.What are the most profitable stocks?

|

Terms and Vocabulary |

primary |

первичный |

secondary |

вторичный |

previous |

предварительный |

to negotiate |

вести переговоры |

underwriter |

поручитель |

intermediary |

посредник |

membership |

членство |

|

509 |

“Big Board” |

“Большое табло” |

approximately |

приблизительно |

to list |

здесь: регистрировать на бирже |

pretax |

до обложения налогом |

tangible |

реальный (осязаемый) |

to qualify |

квалифицировать(ся), законно претендовать |

over-the-counter market |

рынок без посредников |

to be located |

находиться, располагаться |

screen |

экран |

up to date |

в курсе |

option |

опцион |

Exercise 1. Read and learn the pronunciation.

[i:] intermediary, predetermined [a:] grant

[o:] floor

[əu] negotiate, located

[ə] approximately, predetermined [ju:] execute

[ai] primary

[æ] pretax, tangible [ai] underwriter

Exercise 2. Pay attention to the stress in the following words.

′primary |

under′writer |

pre′tax |

|

prede′termined |

|

|

|

negoti′ate |

′tangible |

a′ccommodate |

′implement |

Exercise 3. Read the text, do the exercises.

SECURITIES MARKETS

Securities are bought and sold at two types of securities markets: primary markets, which issue new securities, and secondary markets, where previously issued securities are bought and sold. If a company wants to sell a new issue of stock or bonds it usually negotiates with an investment bank, or

510

underwriter, who sells the securities for it. The underwriter buys the securities from the corporation and resells then to individual investors through the secondary market.

Organized security exchanges have developed to make the buying and selling of securities easier. The securities exchanges consist of the individual investors, brokers, and intermediaries who deal in the purchase and sale of securities. Security exchanges do not buy or sell securities; they simply provide the location and services for the brokers who buy and sell.

Stock transactions are handled by a stockbroker. A stockbroker buys and sells securities for clients. Stockbrokers act on the clients' orders. Stockbrokers receive a fee and are associated with a brokerage house. To trade on the exchange, a "seat" must be purchased. A seat is a membership. The members represent stockbrokers. When a stockbroker calls in an order to sell, the member representing that broker looks for a buyer at the price requested. When a broker calls in an order to buy, the exchange member looks for a buyer at the price offered.

The largest and best known exchange in the USA is the New York Stock Exchange (NYSE) also called the "Big Board". There are 1,300 seats on the NYSE and approximately 2,000 stocks and 3,400 bonds are traded daily. In order to be listed on the NYSE, a firm has to meet the following requirements:

1.Pretax earnings of at least $2.5 million in the previous year.

2.Tangible assets of at least $16 million.

3.At least 1 million shares of stock publicly held, and others.

The second largest stock exchange in the USA is the American Stock Exchange (AMEX). It is located in Manhattan and has about 500 full members and 400 associate members. AMEX operates in much the same way as NYSE, but smaller companies may qualify for listing. There are also regional stock exchanges that serve regional markets.

The over the counter market (OTC) sells and buys unlisted securities outside of the organized securities exchanges. About 5,000 brokers of OTC are scattered all over the country. They trade unlisted stocks and bonds by phone and keep in contact with each other.

The prices of the securities are established by supply and demand. Electronic screens in the offices of the brokerage firms display OTC

511

transactions, so brokers continually keep customers up to date on the latest prices.

Options are traded on the major stock exchanges, but also on a special market for options, the Chicago Bond Options Exchange (СВОЕ).

America's Financial Markets / The Economist, 2000. November 24.

Exercise 4. Answer the following questions.

1.Where are securities bought and sold?

2.What is the difference between primary markets and secondary markets?

3.Who does a company negotiate with if it wants to issue stock?

4.What does an underwriter usually do?

5.What is the main purpose of security exchanges?

6.Who are the participants of security exchanges?

7.Do the exchanges buy or sell securities?

8.Who are stock transactions handled by?

9.What do stockbrokers receive from clients?

10.What is the first thing you do to become a broker?

11.What does the member do when a stockbroker calls in an order to sell?

12.What is the largest stock exchange in the USA?

13.How many seats are there on the "Big Board"?

14.What requirements does a firm have to meet in order to be on the NYSE?

15.What are the major differences between the NYSE and AMEX?

16.What is OTC and how many brokers participate in it?

17.Where are options bought and sold in the USA?

Exercise 5. Substitute the words in the statement with the given synonyms.

Statement: Exchanges are simply auctions where investors get together to bid for stocks and bonds.

Example: Exchanges are simply places where investors get together to bid for stocks and bonds.

security markets |

gather |

trade |

securities |

just |

businessmen |

Exercise 6. Transform the sentences according to the model.

512

Model: Security exchanges provide the location for the brokers.

The location for the brokers is provided by security exchanges.

1.Securities markets buy and sell securities.

2.The company issues new stock through an underwriter.

3.The exchanges trade listed corporation securities only.

4.Several underwriters form an underwriting syndicate.

5.The underwriter buys securities from the corporations.

6.The individual used to sell stocks over the counter originally.

7.The National Association of Security Dealers developed the computerized communications system NASDAQ (National Association of Securities Dealers Automated Quotations) in the early 1970s.

8.NASDAQ ties the OTC market together in one vast electronic stock market.

9.The individuals trade the majority of stocks in a true bid auction.

Exercise 7. Read and act out the dialogue.

John Simpson is talking to his friend, Martin Walker, about his progress in business

J:Well, you know Martin, these new developments in computer systems are fantastic.

M: I bet they are. You seem to be glowing with delight.

J:Sure I am. It took me a lot of time to call the broker whenever I wanted to sell or to buy stock.

M: You have done away with the broker, haven't you?

J:Not really. I've got a computer now and. I can get the latest prices of all stocks in my portfolio from a database.

M: And how about the broker. Did you dismiss him?

J: Why should I? I just hooked my computer up to a telephone and send my instructions to the broker's computer.

M: How do you benefit from all of this?

J:Well, first of all, you save a minute or two on transactions. Moreover my broker has already offered a discount for computer orders.

M: The costs in processing these orders are comparatively low, aren't they?

J: Right! And even at lower costs it is good for the broker too. M: But how much is it to use the computerized system?

513

J:Not really much. Just about $10 for the first hour each month and $20 per additional hour.

M: And is the system reliable? As far as I can remember the 1987 crash was caused to a great extent by the flaws in the use of computers.

J:I've read a lot about it. About 4 million shares were involved in transaction on the day of the crash and there was some problem with

software which made a mess of most transactions. But I believe computer systems have improved since then.

M: I hope so, and wish you luck with it!

Words and expressions

to glow with delight – светиться от радости to do away with – избавиться от чего–либо database – банк данных

to dismiss – увольнять

to hook (v) – зацеплять; соединять crash (n) – крах, катастрофа

to a great extent – в большой степени flaw (n) – ошибка, промах; изъян

to make a mess (of something) – все испортить to bet – биться об заклад

Exercise 8. Make up dialogues of your own.

1.You employ a broker to commit business transactions for you.

2.Your firm doesn't meet either NYSE or AMEX requirements so you come into contact with one of the OTC brokers to discuss the possibilities of cooperation.

3.Your computer is out of order. Contact your broker and discuss the situation.

Exercise 9. Transform the following sentences according to the model.

Model: – We can do it.

–It can be done.

1.They must introduce telecommunication on the OTC market.

2.We can't trade unlisted securities.

3.We should buy and sell unlisted stocks and bonds by phone.

4.I have to pay special attention to the major security markets of the

514

world.

5.They ought to close trading at the Tokyo exchange.

6.We must replace face to face buying and selling of securities by telecommunication.

7.We must watch the foreign exchange closely.

8.We should keep customers up to date on the latest prices.

9.We have to look through the NASDAQ national market quotations in the daily stock sections of national newspapers.

10.I should have my stock listed on regional and national exchanges.

Exercise 10. Translate into English.

1. Ценные бумаги продаются на первичных и вторичных рынках ценных бумаг. 2. Если компания хочет выпустить новые акции, она проводит переговоры с инвестиционным банком или поручителем. 3. Поручитель покупает ценные бумаги компании и перепродает их на вторичном рынке индивидуальным инвесторам. 4. Фондовые биржи делают процесс продажи и покупки ценных бумаг проще. 5. Фондовая биржа состоит из инвесторов, брокеров и посредников, которые занимаются покупкой и продажей ценных бумаг. 6. Операции с ценными бумагами проводятся биржевыми брокерами. 7. Биржевые брокеры получают вознаграждение. 8. Биржевые брокеры действуют по поручению клиентов. 9. Чтобы вести дела на бирже, брокер должен купить место. 10. Члены биржи представляют биржевых брокеров. 11. Крупнейшая и наиболее известная биржа в США – Нью-йоркская фондовая биржа ("Большое табло"). 12. Чтобы быть зарегистрированной на бирже, компания должна соответствовать ряду требований. 13. Американская фондовая биржа имеет около 500 полных членов и около 400 ассоциированных членов. 14. Рынок без посредников торгует незарегистрированными ценными бумагами. 15. Цены на ценные бумаги устанавливаются спросом и предложением. 16. Опционы продаются на главных фондовых биржах, а также на Бирже опционов в Чикаго.

515

Exercise 11. Read the text, do the tasks.

TRADING STOCKS

Trading stock begins with an investor placing an order that is informing the stockbroker as to what stock and how much he wants the broker to buy or sell. An order to buy or sell stock at the best possible price at the present time is called a market order. The broker conveys the order to an exchange member on the trading floor, who attempts to get a better price for the buyer by offering a little less. For example, the broker might offer 47 1/8 ($47.12.5) for the stock with a current price of 47 1/4 and see if someone will sell at this price. If the investor were selling, the broker would attempt to get a slightly higher price by offer say, 47 3/8.

The final sale will then be electronically relayed to the broker who placed the order. The investor might also place a limit order which specifies the highest or lowest price at which the broker may buy or sell. If the investor can't be accommodated immediately, the broker places the order in a sales book and then tries again in order of priority. If an investor wants to keep the order on the books he can issue an open order which instructs the broker to leave the order on the books until it is executed or canceled.

Sometimes the investor might give a discretionary order which allows the broker to exercise judgment in making money. The investor leaves it up to the broker to decide when and at what price to buy or sell.

An odd lot is any number of shares less than 100. One hundred shares comprises a round lot. Brokers usually trade shares in lots, odd lots being combined with a series of other small orders to form a round lot. A purchase of 10,000 shares is sometimes called a block sale. In addition to the price of the stock, the investor pays the broker a commission for buying or selling the securities.

Sometimes investors pay less than the full amount when they buy stock. This is called margin trading. The FRS determines the minimum margin required. In recent years the stock margin has been approximately 50 percent. Fearing that the investor might sell the stock and abscond with the funds, the broker keeps stock certificates of margin accounts at the brokerage as collateral. If the stocks were to plummet, the broker would call the investor and request that he put up more money or have the stock sold.

516

Active buyers of stock are called bulls. They believe that the prices of stocks are going to rise. During the mid 1980s, the US witnessed a very long bull market. At the 1987 crash even bulls became bears. A bear is an investor who makes a profit when the prices are going to fall. Selling short is a high risk strategy which bears use in order to do that. They sell borrowed stock in the hope of later buying it on the open market at a lower price.

Options are contracts that allow an investor to either buy or sell a security at a predetermined price within a certain time. Depending on the investor's expectations, he may buy a put option or a call option. A put option grants the owner the right to sell a security. Believing that the price of certain shares will drop over some period of time an investor might buy an option and benefit from selling the shares at the option price to the person who sold the options. A call option grants its owner the right to buy a certain amount of stock at a predetermined price within a fixed period of time.

(America's Financial Markets / The Economist, 2000. November 24)

|

Words and expressions |

to place |

размещать |

to convey |

передавать (сообщение, информацию) |

floor |

пол, площадка |

to attempt |

пытаться |

current |

текущая, существующая |

slightly |

немного, слегка |

to relay |

передавать, сообщать |

to accommodate |

здесь: оказывать услугу |

to execute |

выполнять |

priority |

приоритет, первенство |

order of priority |

в порядке очереди |

to cancel |

отозвать; отменить |

discretionary |

представленный на усмотрение, дискреционный |

judgment |

суждение, оценка, суд |

odd |

неполный, нечетный |

round |

круглый, полный |

commission |

комиссионный |

|

517 |

to fear |

опасаться, бояться |

to abscond |

сбежать с деньгами |

to plummet |

здесь: резко падать в цене |

bull |

бык |

bear |

медведь |

short |

короткий, кратковременный |

to sell short |

продать на срок без покрытия |

predetermined |

заранее установленный |

put option |

опцион продавца |

call option |

опцион покупателя |

to grant |

гарантировать |

to drop |

падать |

Exercise 12. Answer the following questions.

1.How does the trading of stocks begin?

2.What is a market order?

3.Who does the broker convey the market order to?

4.What is a limit order?

5.What is an open order?

6.What is a discretionary order?

7.What is an odd lot and how does it differ from a round lot?

8.What is a block sale?

9.What is margin trading and how is the margin trading regulated?

10.What does a broker do to protect his interests in case the stock falls down in price?

11.What is a bull market?

12.What is a bear market?

13.What is the selling short procedure?

14.What is a put option?

15.What is a call option?

Exercise 13. Change the following sentences according to the example.

Example: If an investor wants to keep the order on the books, she can issue an open order.

If an investor wanted to keep the order on the books, she could issue an open order.

518

1.If the investor wants to sell or buy at the current price, he can issue a market order.

2.If someone sells at the offered price, the broker will settle the transaction.

3.If the investor specifies the highest price at which the broker may buy, the broker will commit to the deal.

4.If the investor pays the ten percent commission, the broker will work harder.

5.If the investor absconds with the funds, the broker will go bankrupt.

Exercise 14. Translate into English.

1. Торговые операции с фондами начинаются с передачи приказаброкеру продавать или покупать ценные бумаги. 2. Брокер передает приказ о покупке (продаже) члену биржи, который пытается найти лучшую цену для покупателя. 3. Сведения об окончательной продаже передаются брокеру, передавшему приказ. 4. Инвестор передает брокеру приказ, ограниченный условиями высшей цены, по которой брокер может купить акции. 5. Иногда инвестор дает брокеру дискреционный приказ, который позволяет брокеру показать свое умение делать деньги на бирже.

6.Федеральная резервная система определяет минимальную маржу.

7.Опасаясь бегства инвестора с деньгами, брокер хранит акционерные сертификаты. 8. Активные покупатели акций называются "быками", активные продавцы – "медведями". 9. Опцион продавца гарантирует право продать ценные бумаги по заранее установленной стоимости в течение определенного срока.

519

Exercise 15. Listen to the text and complete the notes.

Other names: (1)………… (2)…………

Main trading centres: (3)………… (4)………… (5)…………

Most traded currencies: (6)………... (7)………… (8)…………

Amount traded daily: (9)…………

Trading hours: (10)…………

Main traders: (11)………… (12)………… (13)…………

(14)………...

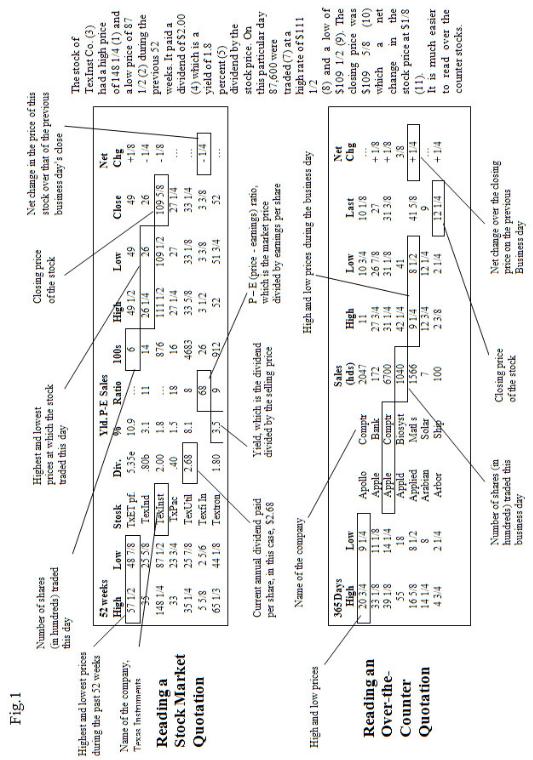

Exercise 16. Study Fig.1 and make a report about Stock Market and Over- the-Counter Quotations.

520

521

521

Exercise 17. Read the text, do the exercises.

HOW TO MAKE MONEY IN THE STOCK MARKET

Investors buy stock for one simple reason: to make money. The surest way to earn money from investing is to create as diverse a portfolio as possible and hang on to it for a long time. To succeed at making money investors need good sources of information.

Much information is supplied by stockbrokers. They study market reports and get information on the forecasted financial performance of companies. Brokers usually recommend opportunities or provide special services such as newsletters. For this brokers charge additional fees.

Sometimes investors prefer to avoid high brokerage fees. They implement their own investment strategy. Serious investors subscribe to investment newsletters and carefully study the stock market. Best investors become an expert in a particular industry.

A simpler investment strategy is to choose some reliable blue chip stocks and stick to them. This strategy is safe and can earn money over the long run. Investors should avoid making common mistakes which are: 1) failure to diversify, 2) paying too much for a stock which would not go up, 3) not knowing when to sell a stock going down, 4) paying too much attention to rumors and tips.

There are also several techniques of predicting the stock prices. Most investors begin with fundamental analysis, which is the process of comparing a company's current financial position and future prospects with those of other firms in the same or different industries. Some investors usually called "chartists" try to identify a specific stock's behavior charting it over time and then predicting its future price movement. Other investors believe that prices are random. The random walk theory is based on the assumption that future stock prices are independent of past stock prices. They choose stocks at random. A group of investors has adopted an unusual approach, contrarianism, which holds that the market will move in the direction opposite to that predicted by the general public. In other words, these investors do the opposite of what the general public does.

(V. Milovidov «English for Financial Management Experts»)

522

|

Words and expressions |

to hang on to something |

держаться (за что-либо) |

to succeed |

иметь успех |

opportunity |

шанс, возможность |

to implement |

приводить в исполнение |

to subscribe to |

подписываться на... |

to stick to something |

придерживаться чего-либо |

over the long run |

здесь: на протяжении долгого времени |

rumor |

слух, сплетня |

tip |

совет |

to predict |

предсказывать |

to chart |

изображать в виде графика |

behavior |

поведение |

random |

случайный, беспорядочный |

at random |

наугад |

contrarianism |

от contrary - противоположный |

Exercise 18. Answer the following questions.

1.What reason do investors buy stock for?

2.What is the surest way to make money in the stock market?

3.What do investors need in order to succeed at making money?

4.Who supplies information about the market?

5.Where do the stockbrokers obtain information from?

6.What do stockbrokers charge for information?

7.What do investors do if they want to avoid brokerage fees?

8.What is the serious investors' approach to studying the market?

9.What is the simplest investment strategy?

10.What are common mistakes usually made by investors?

11.What is the fundamental market analysis?

12.How do the "chartists" predict stock's behavior?

13.What is a "random walk theory"?

14.What is contrarianism based upon theoretically?

523

Exercise 19. Read the dialogue.

Lorna McCourt, a stockbroker, is consulting with Brian Lowman, an investor in IBM

B: Suppose, the stocks go down by 5 points. How much will I lose? L: As far as I know, you have about $75,000 invested in IBM and that

would be about a $20,000 loss. But that won't happen over the long run, I hope. IBM is going up steadily.

B: But anyway, what would you recommend to make a safer portfolio?

L:Diversify and study the market. Here I have some of the latest reports. You take them and study most thoroughly. You will easily see the

direction most companies head to if you do it rather regularly. B: And could you possibly do it for me?

L: I am a so called discount broker, you know, and I do not usually do that kind of a job. But if...

B: Well, I see, that means some additional payment?

L:Right. Brokers usually get an additional 20 percent for information about the market.

B: That'll suit me. That'll help me to avoid mistakes.

L:That'll be of some help, sure. But you've got to be aware that even the best brokers sometimes perform below average and do not pick a winner every time.

B:You have to run risks if you want to stay in the business, haven't you?

Exercise 20. Make up dialogues of your own.

You consult a broker about possible mistakes in the investment policy in order to avoid them. Choose between major techniques of predicting stock market activity.

Exercise 21. Translate into English.

1. Наиболее надежный способ зарабатывать деньги на фондовомрынке – создать диверсификационный портфель акций. 2. Чтобы преуспеть в бизнесе, инвесторы должны иметь хорошие источники информации. 3. Биржевые брокеры изучают биржевые отчеты и предоставляют инвесторам бюллетени о состоянии капиталов компаний. 4. Брокеры устанавливают дополнительный гонорар за информационное обслуживание. 5. Если инвесторы хотят избежать уплаты высоких

524

брокерских гонораров, они полагаются на собственную финансовую политику. 6. Многие инвесторы становятся экспертами в конкретных отраслях. 7. Простейшая инвестиционная стратегия состоит в выборе надежных "голубых фишек". 8. Главные ошибки инвесторов состоят в неспособности к диверсификации, придании слишком большого значения советам и слухам, в незнании, когда следует продать акции, теряющие в цене. 9. Серьезные инвесторы полагаются на фундаментальный анализ рынка. 10. Они сравнивают текущее финансовое состояние разных компаний в разных отраслях промышленности. 11. "Чартисты" пытаются установить поведениеакций. 12. Другие инвесторы выбирают акции наугад.

525