- •ABBREVIATIONS AND ACRONYMS

- •INTRODUCTION

- •1. The evolution of money laundering and AML/CFT measures

- •1.1. A brief history of money laundering

- •1.2. The first stage of ML evolution: Al Capone tax evasion charges

- •1.3. The subsequent stages of ML evolution: better hiding techniques

- •1.4. The appearance of “money laundering” expression in the legal context

- •1.5. Further development of the international AML/CFT standards

- •2. An overview of money laundering and AML regime goals

- •2.1. Basic concept of money laundering

- •2.2. Predicate offences: the scope and methods of AML/CFT description

- •2.3. Definition of money laundering in the narrow sense

- •2.4. Definition of money laundering in the broad sense

- •2.5. Anti-money laundering measures of combating organized crime

- •2.6. The process of money laundering and modeling of its phases

- •3. Applying a risk-based approach to a model AML/CFT regime

- •3.1. Key institutions of a national AML/CFT regime

- •3.2. Methodology bases of a risk-based approach and national AML/CFT coordination

- •3.3. Financial institutions: definition for AML/CFT purposes through activities and operations related to managing clients’ assets

- •3.4. Definition of financial institutions for AML/CFT purposes through activities and operations other then managing clients’ assets

- •3.5. AML/CFT definition of designated non-financial businesses and professions

- •3.6. AML/CFT risk-assessment obligations and decisions for countries

- •4. Legal requirements for a national AML/CFT regime

- •4.1. An extension of liability for money laundering to the predicate offence perpetrator: the adverse implications for the economy

- •4.2. Dual criminality for money laundering offences committed internationally

- •4.3. “State of mind” connected with a money laundering offence

- •4.4. Confiscation and provisional measures related to AML/CFT

- •4.5. Non-conviction based confiscation and corporate liability for money laundering

- •5. Explanations of terrorism and the financing of terrorism

- •5.1. Social and economic origins of terrorism

- •5.2. Basic concept of terrorist financing

- •5.3. Legal definition of terrorism and terrorist financing

- •5.4. Characteristics of the terrorist financing offence and legal capacity to prosecute persons that finance terrorism

- •5.5. Targeted financial sanctions related to terrorism, terrorist financing and proliferation

- •6. Institutional bases of the international AML/CFT framework

- •6.1. The United Nations bodies of the international AML/CFT framework

- •6.2. The United Nations organizations of the international AML/CFT framework

- •6.3. Main functions of the Financial Action Taskforce

- •6.4. The Financial Action Task Force associate members and observers

- •6.5. The Egmont Group of financial intelligence units and international AML/CFT standard setters in banking, securities and insurance sectors

- •6.6. The Wolfsberg Group of banks and its AML/CFT documents

- •7. Customer due diligence measures undertaken by financial institutions

- •7.1. General requirements for AML/CFT programs of financial institutions and groups of financial institutions

- •7.2. Methodology approach to customer due diligence

- •7.3. Additional features of customer due diligence

- •7.4. Customer due diligence measures for legal persons and their arrangements

- •7.5. Actions of financial institutions in case of inability to comply with customer due diligence requirements

- •7.6. AML/CFT-related record-keeping requirements for financial institutions

- •8. Risk-based approach pursued by financial institutions in customer due diligence

- •8.1. Reliance on customer due diligence information received from third parties

- •8.2. Potentially higher-risk situations for enhanced customer due diligence measures

- •8.3. Lower-risk situations for simplified customer due diligence measures

- •8.4. Enhanced customer due diligence measures

- •8.5. Simplified customer due diligence measures

- •9. Additional AML/CFT measures for specific activities of financial institutions

- •9.1. AML/CFT requirements for cross-border correspondent banking relationships

- •9.2. Definition of wire transfers and activities of involved parties

- •9.3. The scope of applying AML/CFT measures to wire transfers

- •9.4. AML/CFT measures of information gathering related to wire transfers

- •9.6. AML/CFT obligations for persons that provide money or value transfer services

- •10. Additional AML/CFT measures for specific customers, entities and professions

- •10.1. Definition of politically exposed persons and the scope of applying AML/CFT measures

- •10.2. Additional AML/CFT measures for politically exposed persons

- •10.3. AML/CFT requirements for financial institutions with foreign operations

- •10.4. Customer due diligence and record-keeping requirements for designated non-financial businesses and professions

- •10.5. Other AML/CFT requirements for designated non-financial businesses and professions

- •11. Competent authorities of a national AML/CFT system

- •11.1. General requirements for government agencies with an AML/CFT function

- •11.2. Approaches to AML/CFT-related regulation and supervision

- •11.3. Financial intelligence unit and its core functions

- •11.4. AML/CFT responsibilities of law enforcement and investigative authorities

- •11.5. Detecting and countering activities of cash couriers for the AML/CFT purposes

- •12. Additional requirements for a national AML/CFT regime and issues of international cooperation

- •12.1. Transparency and beneficial ownership of legal persons and their arrangements

- •12.2. Prevention of using non-profit organizations for the purpose of terrorist financing

- •12.3. General principles of AML/CFT mutual legal assistance

- •12.4. Mutual legal assistance: freezing and confiscation of assets related to money laundering and terrorist financing

- •12.5. Extradition in relation to money laundering and terrorist financing

- •12.6. International exchange of information between government agencies with an AML/CFT function

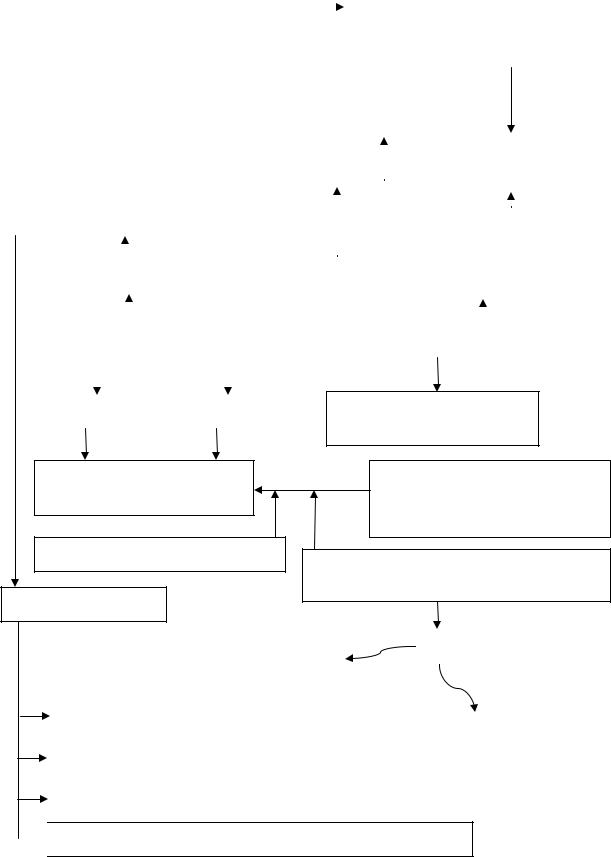

7.3. Additional features of customer due diligence

Reviews of existing records |

|

|

It must be ensured that docu- |

|

|

||

|

|

|

ments, data and information col- |

|

|

|

|

|

|

|

lected are kept up-to-date |

|

|

|

|

|

|

|

|

Existing customers as of the date the |

|

|

|

||||||||||||

|

|

|

|

CDD requirements are brought into force |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At appropriate times – |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Should apply to all new customers |

|

||||||||||||||

|

|

|

|

|

|

|

|

ongoing CDD |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Should be determined using an RBA |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

Should apply to existing cus- |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

tomers on the basis of materiali- |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

The extend of the CDD measures |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

ty and risk |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer due diligence (CDD) features, R. 10 |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before |

|

During |

|

|

|

The course of establishing a business relationship

Risks are effectively managed

Risk variables

Conducing transactions for occasional customers

It may be permitted to complete the verification as soon as practically possible

When it is essential not to interrupt the normal conduct of business

|

|

|

|

E.g |

|

|

|

Non face-to-face business |

|

|

|||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||

The purpose of an account or relationship |

|

|

|

|||

Securities transactions |

||||||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

which are required to |

||

The level of assets to be deposited |

|

|||||

|

be performed very rap- |

|||||

|

|

|

|

|||

|

|

|

|

|||

The size of transactions undertaken |

|

|

idly |

|||

|

|

|

|

|

|

|

The regularity or duration of the business relationship

The regularity or duration of the business relationship

59

7.4. Customer due diligence measures for legal persons and their arrangements

It should be required to understand the following in relation to customers that are legal persons or legal arrangements, R. 10, IN, (C)

The nature of business |

|

Ownership structure |

|

Control structure |

|

|

|

|

|

(a) Identify the customer E.g. a certificate of incorporation, a cerand verify its identity tificate of good standing, a partnership

agreement, a deed of trust

(i) Name, legal form and proof of existence

(i) Name, legal form and proof of existence

(ii) The powers that regulate  and bind the legal person

and bind the legal person

(iii) The names of senior managers

(iii) The names of senior managers

(iv) The address of registered office

(iv) The address of registered office

(b) Identify the beneficial owners of the customer and take reasonable measures to verify their identity

E.g. memorandum and articles of association of a company

E.g. directors, trustee(s)

If different, a principal place of business

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(i) For legal persons |

|

|

If no one is identified, then |

|

|

|||||||

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(i.i) Natural persons who ultimately have |

|

|

|

|

There is no need to |

|||||

|

|

|

|

|

|

a controlling ownership interest in the le- |

|

|

|

|

identify any share- |

|||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

gal person |

|

|

|

|

|

|

|

holder or beneficial |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

owner of a company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

(i.ii) Natural persons exercising control of |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

listed on a stock ex- |

|||||||

|

|

|

|

|

|

the legal person through other means (e.g. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

change and subject |

||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

owns more than 25% of the company) |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

to disclosure re- |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

quirements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

(i.iii) The senior |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

managing official |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

The settlor, the trustee(s), the protector, the |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(ii) For legal arrangements |

|

|

|

beneficiaries and others (persons in similar |

|||||||||||

|

(trusts and other types) |

|

|

|

positions) who have effective control |

|||||||||||

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|||

7.5. Actions of financial institutions in case of inability to comply with customer due diligence requirements

If it is not possible for a financial institution to comply with the CDD requirements

A business relation must not be commenced

A business relation must not be commenced

Transactions must not be performed

Transactions must not be performed

An account must not be opened

An account must not be opened

The existing business relationship must be terminated

The existing business relationship must be terminated

Tipping-off: it is prohibited to disclose the fact that an STR or other related information was filed with the FIU, R. 21, (b)

|

|

|

|

|

|

|

|

|

There is a risk of unin- |

|

|

|

|

tentional tipping-off |

|

|

|

|

|

|

|

|

|

when performing the |

An STR needs to be send to the FIU |

|

CDD process |

||

|

|

|

|

|

|

|

|

|

|

Financial institutions and their em- |

The institution may |

|

choose not to perform |

||

ployees should be protected from |

||

further CDD process and |

||

any liability when they report their |

||

file an STR with data |

||

suspicions to the FIU, R. 21, (a) |

||

available, R. 10, IN, (A) |

||

|

||

If they report their suspicions in good |

If there are reasonable grounds |

|

faith, even if they do not know precise- |

to suspect that funds are pro- |

|

ly what the underlying activity was |

ceeds of criminal activity or are |

|

(they do not know whether activity was |

related to terrorist financing, R. |

|

criminal) |

20 |

|

61 |

|

7.6. AML/CFT-related record-keeping requirements for financial institutions

After the business rela- |

|

|

|

After the date of the occa- |

tion is ended |

|

|

|

sional transaction |

|

|

|

||

|

|

|

|

|

Record-keeping, R. 11

Must be kept for at least five years

Information obtained |

|

|

|

Account files and |

|

|

Records on |

||||

through the CDD |

|

|

business corre- |

||

|

transactions |

|

|||

measures |

|

|

spondence |

||

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

E.g. copies of official identification documents

The information should be available to domestic competent authorities

The records must be sufficient to permit reconstruction of individual transactions

The results of any analysis undertaken

E.g. inquiries to establish the background and purpose of complex, unusual large transactions

The records must be sufficient to provide evidence for prosecution of criminal activity

62