- •Contents

- •Unit 1 Forms of Business Organization

- •Forms of Business Organization

- •International finance corporation (ifc)

- •Investment Guidelines

- •Ifc Products and Services

- •Unit 2 Sale of Goods

- •Contract No. 365/01-84

- •1. Subject of the contract

- •2. Delivery and acceptance

- •3. Quality

- •4. Price and payments

- •5. Claims

- •6. Force majeure

- •7. Arbitration

- •8. Other conditions:

- •9. The legal addresses of the parties:

- •Memorandum of understanding

- •Procedures

- •Unit 3 Exporting and Importing

- •Countertrade

- •Контракт №

- •1. Предмет контракта

- •2. Поставка и принятие

- •3. Качество

- •4. Цена и порядок оплаты

- •5. Претензии

- •6. Обстоятельства непреодолимой силы

- •7. Арбитраж

- •8. Дополнительные условия

- •9. Юридические адреса

- •Unit 4 Shipping Documents

- •Types of Bill of Lading

- •The Bill of Lading

- •Unit 5 Negotiable Instruments

- •Мероприятия, направленные на кредитное обеспечение согласно генеральному договору

- •1) Материальные средства (сырая нефть и/или переработанная продукция)

- •2.А.) Ожидаемые платежи

- •Страхование

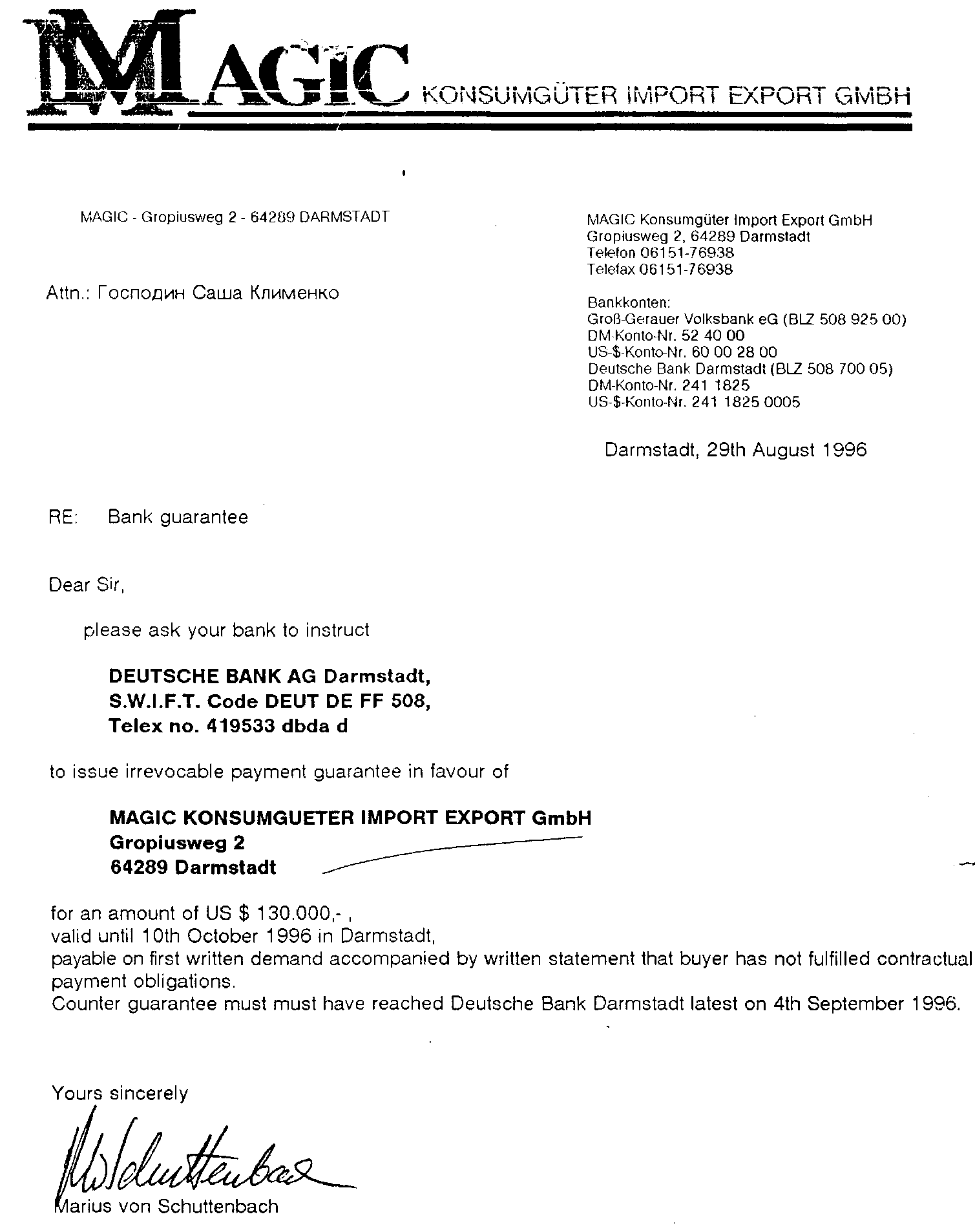

- •Банковская Гарантия

- •Promissory note

- •Letter of indemnity

- •Unit 6 Arbitration

- •Unit 7 Conditions of Sale for Overseas Markets

- •Режим наибольшего благоприятствования (mfn Treatment)

Unit 5 Negotiable Instruments

Useful Vocabulary

negotiable instruments оборотные документы,

передаваемые денежные документы

document embodying a right документ, предоставляющий право

negotiation передача (заказа); продажа (векселя)

assignment переуступка (права, имущества)

to pass title передать право на имущество

subject to any defenses … подлежащий всяческой защите

… travels freely он передается свободно

trade bill торговая тратта

inland sale продажа внутри страны

export sale экспортная продажа

clause пункт, статья (договора)

contract of sale договор купли-продажи

to draw a bill (on) выставлять вексель

promise to pay обещание оплатить

overseas buyer иностранный покупатель

within the agreed time в течение оговоренного периода времени

drawer трассант (лицо, выставившее тратту)

drawee трассат (лицо, на которое выставлена тратта)

acceptor акцептант

acceptance принятие, акцепт

discounting операция по дисконту

bill of exchange переводной вексель

draft тратта

unconditional order безусловный заказ

on demand по требованию

to the order of на заказ

payee получатель платежа, ремитент

payer, AmE payor плательщик по кредитным обязательствам

bearer владелец

to assent давать согласие

endorsee, AmE indorsee индоссат

endorser, AmE indorser индоссант

holder владелец

bona fide purchaser доброжелательный покупатель

holder in due course законный владелец

to obligate обязывать

three-cornered relationship трехстороннее взаимоотношение

borrowing заимствование

delivery поставка

transferor лицо, переуступающее свое право, индоссант

transferee получатель по трансферту, индоссатор

liability ответственность

to meet payment осуществить платеж

to become due наступать (о сроке платежа)

failure to pay неспособность оплатить

formally формально

notice of dishonor протест (нотариальный акт о неплатеже по векселю в срок или об отказе в его акцептировании)

certificate of dishonor свидетельство о протесте

prior endorser предыдущий индоссант

to propose предлагать

eventually постепенно

to adopt принимать (закон)

convention конвенция

promissory note простой вексель

orbit сфера

letter of indemnity гарантия от убытка

expire истекать (о сроке)

on presentation по предоставлению

cargo груз

herewith engage irrevocably настоящим обязуемся безоговорочно

harmless без ущерба

debtor должник, дебитор

fixed interest фиксированная ставка прибыли

repayment of credit возврат кредита

nominee получатель страховки по доверенности

stipulate указывать

commitment обязательство

letter of credit аккредитив

irrevocable documentary letter of credit безотзывный товарный аккредитив

validity срок действия

full set полный комплект

certificate of origin сертификат происхождения

packing and weight list упаковочный лист

certificate of quality сертификат качества

beneficiary бенефициар (получатель денег по аккредитиву)

to issue выдавать

covering shipment отгрузка товара со страховым обеспечением

a third party третья сторона

clarification разъяснение

repayment agreement соглашение о возврате кредита

letter of guarantee гарантийное письмо

draft bank guarantee банковская гарантия

to open an account with a bank открывать счет в банке

escrow account блокированный счет

to honour cheques, drafts, orders оплачивать чеки, тратты, письменные приказы об уплате денег

to act on the instruction действовать по указанию

to dispose of money and securities распоряжаться деньгами и ценными бумагами

authorized уполномочен

endorsement индоссамент (передаточная надпись)

purports to be signed должен быть подписан

Translate the following from English into Russian, focus on the underlined word combinations.

The negotiable instrument is essentially a document embodying a Right to the payment of money and may be transferred from person to person. This quality distinguishes negotiation from assignment. To assign a contract is to pass title to it, subject to any defenses connected with its origin. A negotiable instrument is not thus burdened". It travels freely on its own.

Negotiable instruments are used for the purpose of payment of credit, and as security. Sometimes one instrument may perform all three functions. A typical "trade bill" used in connection with an inland or export sale serves as an example of this: the seller, according to a clause of a contract of sale, may draw a bill on the buyer (that is, prepare a "promise to pay" that the buyer has to sign) or, in the case of an overseas buyer, on a bank acting for the buyer, payment to be made within the agreed time (such as 90 days after delivery). The buyer or his bank signs the bill as drawee and thereby becomes acceptor. On return of the instrument the seller may use this accepted bill to pay his own debts or may sell it to his bank (discounting). The buyer may also, although this is not typical for commercial transactions, draw a check on his own bank and send it to the seller.

The commonest and most complex form of negotiable instrument is the draft, or bill of exchange. It has been defined in England as an unconditional order in writing addressed by one person to another, signed by the person giving it (the drawer), and requiring the person to whom it is addressed (the drawee) to pay on demand or at a fixed or determinable future time a certain sum of money to, or to the order of, a specified person (the payee) or to bearer.

If the drawee assents to the order and accepts the bill, which is done by signing his name, or his name with the word "accepted" across the face of the paper, he is called an acceptor. The person to whom the bill is transferred by endorsement is called the endorsee.

Any person in possession of a bill, whether as payee, endorsee, or bearer, is termed a holder and, if he is a bona fide purchaser, a holder in due course.

The basic rule applying to drafts is that any signature appearing on a draft obligates the signer to pay the amount drawn. It is the characteristic feature of a draft that it is not limited to the three-cornered relationship among drawer, drawee, and the named or unnamed creditor.

Rather, the creditor may transfer it (for purposes of payment or borrowing) to a fourth party, and the latter may transfer it to a fifth, and so on, in a long chain. The means of accomplishing a transfer from one creditor to another is by endorsement or delivery. If an instrument is payable "to order," the signature of the transferor is required. The draft is then delivered to the new creditor. If the instrument is payable "to bearer", delivery alone suffices.

Endorsement transfers the right of the endorser to the new holder and also creates a liability of the endorser for payment of the amount of the draft if the drawee does not meet payment when the draft becomes due.

A failure to pay a draft must be more or less formally ascertained (in Continental Europe through a formal "certificate of dishonor"). Upon due notice of dishonor, the holder of the draft may claim payment from any endorser whose signature appears on the instrument, and he in turn may claim from prior endorsers, from the drawee, and from the drawer.

The necessity of unifying the legal rules relating to negotiable instruments used in international trade has long been felt. The principal rules in English law are laid down in the Bills of Exchange Act of 1882. This Act spread through the whole Commonwealth and also influenced the United States Negotiable Instruments Act proposed in 1896 and eventually adopted throughout the U.S. This latter act has since been replaced by article 3 of the Uniform Commercial Code (UCC).

On the Continent uniformity between the French and German approaches was first achieved at two conferences held at The Hague in 1910 and 1912 and finally by two Geneva conventions of 1930 and 1931 on uniform laws for drafts, promissory notes, and checks.

These latter agreements included some uniform provisions on conflicts of law. These have been adopted by most European countries and by many states in other parts of the world. Neither England nor the United States accepted these conventions, however, partly for fear of upsetting the uniformity already achieved in the Anglo-American orbit.

Translate the following either from Russian into English or from English into Russian.