- •Will 2019 be another difficult year for EM?

- •When will EM equities begin a decent rally; what support is required?

- •Is there a case for local-currency debt over hard-currency debt?

- •Positives to rely on; developments to be warned of

- •Key messages

- •Signposts and triggers for change

- •Pictures that tell the story

- •Overview of EM asset calls

- •EM growth challenges return

- •Late cycle is not kind to EM, but no blow-ups this time

- •Equities: Cheapening as expected, amid tighter liquidity

- •Box 1: What do asset, product and labour markets tell us about the stage of the economic cycle?

- •Box 1: What do asset, product and labour markets tell us about the stage of the economic cycle? (continued)

- •Chinese equities better placed than many in EM

- •Currencies: Better total returns

- •Box 2: How far are we from capitulation in EM equities?

- •Box 3: How can investors overcome EM's weakest link – currencies?

- •Top trades for 2019

- •1. Long China A-shares vs EM ex China, Long USDCNY

- •2. Long MSCI EM Value vs MSCI EM Growth

- •3. Long 10y Indian government bonds vs MSCI India

- •5. Long G3 currencies vs KRW

- •6. Long CZK vs ZAR

- •7. Long 10y Russia OFZ, long RUBCAD

- •8. Long NTN-F 2025, Long BRLCOP

- •9. Receive 2Y Mexico TIIE rates

- •China (too) makes difficult choices now

- •Box 4: Can a more globally accepted CNY help fund a potential deficit in China?

- •Box 5: How sensitive are global assets to a weaker CNY?

- •Box 5: How sensitive are global assets to a weaker CNY? (Continued)

- •Equities: Probing what is cheap and why

- •The 'where and how' of EM being cheap – taking a lens to EM multiples

- •The consensus and reality on earnings

- •Our bottom-up numbers agree with the top-down

- •Understanding the size, sector and country reads

- •Box 6: Can Indian equities find their groove?

- •Can the consumption story recover?

- •Temporary liquidity squeeze or credit shock?

- •Box 6: Can Indian equities find their groove? (continued)

- •Have valuations adjusted enough for a re-examination?

- •Growth or Value?

- •Leading indicators suggest Growth heavyweights, consumer and tech, will remain under pressure for now

- •Box 7: Semiconductors: Where next for the fading 'Memory Supernova'?

- •A different size and nature of stimulus from China

- •Currencies: A shift in pressure points

- •That unravelled fast

- •Box 8: What reforms can we expect from Brazil?

- •Box 9: What is the collateral damage from China's inclusion in global indices?

- •A narrowing growth gap against DM still, but for different reasons

- •Can external balances, carry and valuation help EMFX withstand the relative growth challenges?

- •Box 10: Why is EM growth not benefitting from stronger US growth?

- •We find few currencies to be cheap enough to withstand further pressure.

- •The CNY will remain a source of volatility

- •Main risks to our views

- •Local rates: Buffered by term premia & real rates

- •Another challenging year ahead, but past worst

- •Has value been re-built?

- •Which markets are rich, and which are cheap?

- •Which local rates are sensitive to FX and credit?

- •Box 11: Which EM debt market is most vulnerable to slower portfolio flows?

- •Box 12: What will ECB and BoJ normalisation mean for EM assets?

- •Box 12: What will ECB and BoJ normalisation mean for EM assets? (continued)

- •Monetary policy expectations: what’s mispriced?

- •Curve shapes – where’s the alpha?

- •Box 13: Where is term premium in EM local currency debt?

- •Putting everything together

- •Credit: Help from more realistic risk premia

- •No large step adjustment due in EM credit

- •A modest widening amid weak growth is the base case

- •CNY volatility will mean greater pressure on EM corporates

- •Box 15: Will onshore defaults continue in China?

- •Political calendar

- •Performance of 2018 top trades

- •UBS FX & macroeconomic forecasts

- •Valuation Method and Risk Statement

vk.com/id446425943

Equities: Probing what is cheap and why

Global Macro Strategy 19 November 2018 |

41 |

vk.com/id446425943

Briefing

•There are spells of time when EM is cheap enough and the international context is changing in a manner that EM becomes a passive buy and hold. This is not such a time.

•The sectors in which EM's long-term strength lies – consumer, IT, health care and financials – are all seeing earnings downgrades. We expect these downgrades to end at some point in Q2 next year, when EM's sequential growth should bottom. Our EM Cycle Index helps to identify this turning point more precisely.

•As a style, we prefer Growth over Value in EM for the long haul, but in the coming months expect strong earnings downgrades in the Growth sectors, and therefore go into 2019 long Value vs Growth.

•China's stimulus is likely to be more modest and of a different nature from previous downturns. Although China will stabilise its own economy, the EPS pass-through to the rest of EM is likely to be much more limited.

•By country, we recommend being overweight China, Indonesia and Brazil; we are less enthusiastic about India, Malaysia and South Africa.

•The pressure on EM may not increase sharply, but it should sustain. We expect a total return of 7–8% on MSCI EM next year – significantly better than in 2018 – but not sufficient to undo its post-2017 losses.

Figure 82: Annualised total return vs volatility since 2011

14 |

|

Total return (%, |

|

|

|

|

|

|

|

|

|

|

|

annualised, since |

|

|

|

|

|

MSCI US |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

12 |

|

2011) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MSCI World |

|

|

|

||

8 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US HY |

|

|

|

|

|

MSCI Japan |

|

|

||

6 |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

EMBI GD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

UST |

US IG |

|

|

|

|

|

MSCI Europe |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MSCI EM |

|

|

||

0 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

GBI-EM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

2 |

4 |

6 |

8 |

10 |

12 |

14 |

16 |

18 |

20 |

||

Volatility (%, annualised, since 2011)

Source: Bloomberg, MSCI, Datastream, UBS

Note: The calculations are based on daily data.

EM's reputation as an asset did not improve in 2018. The narrative of superior returns for higher risk is being challenged (Figure 82) in a world in which the premium of EM growth over that of DM has shrunk close to the lowest levels in 20 years. GDP growth does not equate to equity returns, but earnings growth is not coming through consistently either. EM earnings have been treading water in the post-crisis era since late-2010, compared with a 40%+ EPS expansion in DM, which implies a healthy 5% CAGR. Therefore this is an asset class for a strong active manager; one has to pick the right style, the right sector and, most importantly, the right stocks. There are spells of time, typically when very strong China growth and a dovish Fed coincide, through which a 'buy and hold' ETF strategy works very well in EM. However, 2019 is not lining up to be one of them.

With a subpar overall risk-return profile, EM has become a stockpicker's market

Global Macro Strategy 19 November 2018 |

42 |

vk.com/id446425943

The 'where and how' of EM being cheap – taking a lens to EM multiples

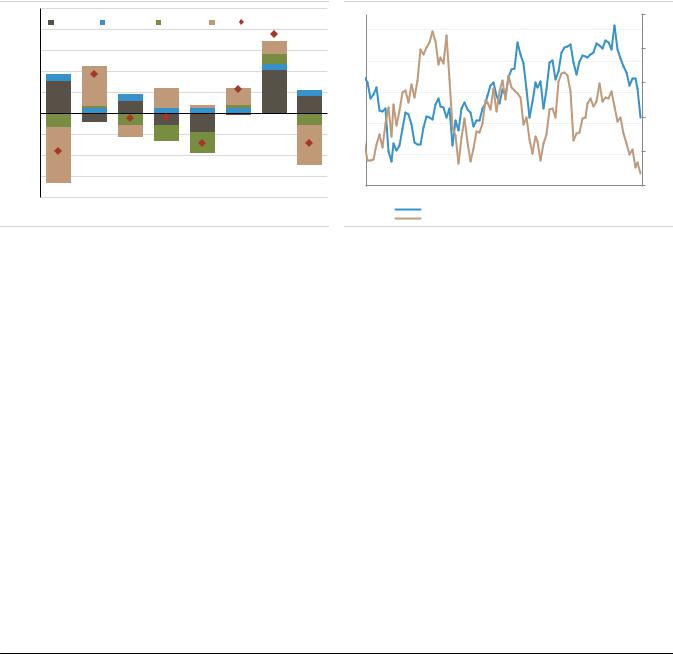

The de-rating of multiples has made, by far, the largest negative contribution to EM total return this year (Figure 83). The MSCI EM 12-month forward P/E ratio fell from over 13x in January to 10-11x times in recent weeks, below its long-term average. EM's valuation discount to DM has widened further, with relative P/BV falling to the bottom decile of its long-term distribution (Figure 85).

It is notable, however, that this de-rating has been in line with what would have been expected in the context of the rise in local currency bond yields and credit spreads (Figure 84). We do not see any additional risk premium being priced on future earnings volatility or trade tariffs. In other words, the higher EM cost of equity – experienced when bond and credit prices fall – has pulled EM valuations lower. Valuations cheaper than historical averages do not in themselves imply an imminent re-rating. It is important to establish what fundamentally drives valuations in EM, and where exactly EM's cheapness lies.

EM valuation de-rating has been in line with rising bond yields and spreads; we see limited scope for re-rating next year

Figure 83: EM yearly total returns in USD terms |

Figure 84: EM equity valuations vs cost of capital |

50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.0 |

|

Earnings |

|

Dividends |

Currency |

P/E |

Total return (USD) |

|

|

|

|

|

|

|

|||

40% |

|

13 |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

30% |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

3.5 |

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

4.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0% |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

4.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-20% |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

5.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

-30% |

|

|

|

|

|

|

|

|

|

|

|

|

Correlation: -0.62 |

|

||

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

5.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

-40% |

|

|

|

|

|

|

|

|

11 |

12 |

13 |

14 |

15 |

16 |

17 |

18 |

|

11 |

12 |

13 |

14 |

15 |

16 |

17 |

YTD |

|

|

MSCI EM: 12m fwd P/E |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

10y UST+10y CDS (RHS, inverted, MSCI-weighted) |

|||||

Source: MSCI, Datastream, UBS |

|

|

|

|

|

Source: IBES, MSCI, Datastream, UBS |

|

|

|

|

||||||

It is largely EM Value sectors, such as materials, energy, financials and utilities that are cheap relative to DM (Figure 86). Growth-overweight sectors – consumer discretionary, consumer staples and health care – still screen as expensive relative to DM. As we show later in this section, it does not help that these expensive Growth sectors, are precisely the ones that are facing larger earnings downgrades.

EM Value sectors cheapened relative to DM, but Growthoverweight sectors still look expensive

Global Macro Strategy 19 November 2018 |

43 |

vk.com/id446425943

Figure 85: MSCI EM forward P/E and trailing P/BV premium over MSCI World (DM)

Figure 86: Percentile of 12m fwd P/E relative to MSCI World (since 2002) vs proportion of Value stocks in sector

20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100% |

12m fwd P/E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current |

90% |

relative to |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DM |

HTC |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

EM/DM P/E |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(percentile |

|

|

TEL |

|

|||||

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

premium at |

80% |

CST |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

since 2002) |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33th |

70% |

|

|

CDS |

|

|

|

|

|

-10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

percentile |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-20% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40% |

|

|

|

|

ENE |

UTL |

|

-40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current |

30% |

|

ITS |

EM |

|

MAT |

FIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EM/DM P/BV |

|

|

IND |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

|

|

|

|

|

|||||

-50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

premium at |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8th |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10% |

|

|

|

REL |

|

|

|

||

-60% |

|

|

|

|

|

|

|

|

|

|

|

|

|

percentile |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

||||

02 |

03 |

04 |

05 |

06 |

07 |

08 |

09 |

10 |

11 |

12 |

13 |

14 |

15 |

16 |

17 |

18 |

0% |

20% |

40% |

60% |

80% |

100% |

||

|

|

EM/DM P/E premium |

|

|

|

|

Average |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Proportion of Value stocks in sector |

|

|

|||||||||||

|

|

EM/DM P/BV premium |

|

|

|

|

Average |

|

|

|

|

|

|

|

||||||||||

Source: IBES, MSCI, Datastream, UBS |

|

|

|

|

|

|

|

|

|

Source: IBES, MSCI, Datastream, UBS |

|

|

|

|

||||||||||

In this report, we introduce a regression model for the MSCI EM 12-month forward P/E ratio (Figure 87). There are three explanatory variables in this model:

9m change in long-term MSCI EM EPS growth forecast.

12m change in macro balance sheet risk score (see pages 12–15 in our quarterly EM Navigator report published on 30 June 2017).

EM CDS spread – an MSCI-EM weighted average of the CDS spreads for major EM economies.

Our base-case scenario in Figure 87 assumes an MSCI EM valuation re-rating to 11x on 12-month forward P/E in 2019 from 10.5x currently. Our optimistic scenario assumes a bigger re-rating to 12.3x, which is in line with its 2017 average. The pessimistic scenario points to P/E valuations of approximately 10x, which is marginally below current levels (Figure 88).

A new top-down model for MSCI EM 12-month forward P/E

Our base case assumes re-rating to 11x on a 12-month forward P/E basis from just over 10x now

Figure 87: MSCI EM 12m forward P/E: Base case, upside and downside scenarios

2018E |

2019E |

Downside |

Base Case |

Upside |

9m change in long-term MSCI |

-5.0 |

-5.0 |

|

-1.5 |

|

2.0 |

|

|

EM EPS growth forecast |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

12m change in MBS risk score |

0.1 |

0.2 |

|

|

0.1 |

|

-0.1 |

|

|

|

|

|

|

|

|

|

|

EM CDS spread |

147.9 |

200.0 |

|

160.0 |

|

125.0 |

|

|

12m forward P/E |

10.6 |

10.0 |

11.0 |

12.3 |

Source: Bloomberg, Haver, IBES, MSCI, Datastream, UBS |

|

|

||

Figure 88: Actual, fitted and residual of our forward P/E model

13.5 |

|

2.0 |

13.0 |

|

1.5 |

12.5 |

|

1.0 |

|

|

|

12.0 |

|

0.5 |

|

|

|

11.5 |

|

0.0 |

11.0 |

|

|

|

|

|

10.5 |

|

-0.5 |

|

|

|

10.0 |

|

-1.0 |

|

|

|

9.5 |

|

-1.5 |

9.0 |

|

-2.0 |

Jan-12 Jan-13 Jan-14 Jan-15 |

Jan-16 Jan-17 Jan-18 |

|

Residual (RHS) |

Actual |

Fitted |

Source: Bloomberg, Haver, IBES, MSCI, Datastream, UBS

Global Macro Strategy 19 November 2018 |

44 |