- •Will 2019 be another difficult year for EM?

- •When will EM equities begin a decent rally; what support is required?

- •Is there a case for local-currency debt over hard-currency debt?

- •Positives to rely on; developments to be warned of

- •Key messages

- •Signposts and triggers for change

- •Pictures that tell the story

- •Overview of EM asset calls

- •EM growth challenges return

- •Late cycle is not kind to EM, but no blow-ups this time

- •Equities: Cheapening as expected, amid tighter liquidity

- •Box 1: What do asset, product and labour markets tell us about the stage of the economic cycle?

- •Box 1: What do asset, product and labour markets tell us about the stage of the economic cycle? (continued)

- •Chinese equities better placed than many in EM

- •Currencies: Better total returns

- •Box 2: How far are we from capitulation in EM equities?

- •Box 3: How can investors overcome EM's weakest link – currencies?

- •Top trades for 2019

- •1. Long China A-shares vs EM ex China, Long USDCNY

- •2. Long MSCI EM Value vs MSCI EM Growth

- •3. Long 10y Indian government bonds vs MSCI India

- •5. Long G3 currencies vs KRW

- •6. Long CZK vs ZAR

- •7. Long 10y Russia OFZ, long RUBCAD

- •8. Long NTN-F 2025, Long BRLCOP

- •9. Receive 2Y Mexico TIIE rates

- •China (too) makes difficult choices now

- •Box 4: Can a more globally accepted CNY help fund a potential deficit in China?

- •Box 5: How sensitive are global assets to a weaker CNY?

- •Box 5: How sensitive are global assets to a weaker CNY? (Continued)

- •Equities: Probing what is cheap and why

- •The 'where and how' of EM being cheap – taking a lens to EM multiples

- •The consensus and reality on earnings

- •Our bottom-up numbers agree with the top-down

- •Understanding the size, sector and country reads

- •Box 6: Can Indian equities find their groove?

- •Can the consumption story recover?

- •Temporary liquidity squeeze or credit shock?

- •Box 6: Can Indian equities find their groove? (continued)

- •Have valuations adjusted enough for a re-examination?

- •Growth or Value?

- •Leading indicators suggest Growth heavyweights, consumer and tech, will remain under pressure for now

- •Box 7: Semiconductors: Where next for the fading 'Memory Supernova'?

- •A different size and nature of stimulus from China

- •Currencies: A shift in pressure points

- •That unravelled fast

- •Box 8: What reforms can we expect from Brazil?

- •Box 9: What is the collateral damage from China's inclusion in global indices?

- •A narrowing growth gap against DM still, but for different reasons

- •Can external balances, carry and valuation help EMFX withstand the relative growth challenges?

- •Box 10: Why is EM growth not benefitting from stronger US growth?

- •We find few currencies to be cheap enough to withstand further pressure.

- •The CNY will remain a source of volatility

- •Main risks to our views

- •Local rates: Buffered by term premia & real rates

- •Another challenging year ahead, but past worst

- •Has value been re-built?

- •Which markets are rich, and which are cheap?

- •Which local rates are sensitive to FX and credit?

- •Box 11: Which EM debt market is most vulnerable to slower portfolio flows?

- •Box 12: What will ECB and BoJ normalisation mean for EM assets?

- •Box 12: What will ECB and BoJ normalisation mean for EM assets? (continued)

- •Monetary policy expectations: what’s mispriced?

- •Curve shapes – where’s the alpha?

- •Box 13: Where is term premium in EM local currency debt?

- •Putting everything together

- •Credit: Help from more realistic risk premia

- •No large step adjustment due in EM credit

- •A modest widening amid weak growth is the base case

- •CNY volatility will mean greater pressure on EM corporates

- •Box 15: Will onshore defaults continue in China?

- •Political calendar

- •Performance of 2018 top trades

- •UBS FX & macroeconomic forecasts

- •Valuation Method and Risk Statement

vk.com/id446425943

Top trades for 2019

Global Macro Strategy 19 November 2018 |

22 |

vk.com/id446425943

1. Long China A-shares vs EM ex China, Long USDCNY

We expect the coming stimulus to infrastructure spending in China to have a larger impact on domestic equities than in the EM aggregate. From 2015 to 2017, credit to households remained easy, which helped real estate, while credit to local governments tightened, which hurt infrastructure growth. Government statements are consistent with the stimulus shifting to infrastructure. Special local government bonds issuance, easier LGFV financing, and reduced scrutiny of PPP projects should lift infrastructure FAI to 10% y/y in 2019. Currently the spread between AA and AAA-rated local bonds – a good proxy for financial conditions – is close to the highest since 2015, suggesting local businesses are still suffering from the previous tightening of shadow liquidity (Figure 44). China's exports have stalled sequentially over the past three months, and new export orders PMI prints do not look inspiring. Whether because of tariffs or because of the tech boom plateauing, if the external sector slows further, the possibility of further easing from China will rise.

In an adverse scenario, we expect China to 'lean against the wind'

Our calculations show that while EM EPS growth is even more sensitive to China housing than it is to US or European capex, its beta to China infrastructure FAI is not statistically significant (Figure 45). The coming China stimulus will bring less help, but should still offer some for China, less for the rest of EM. In this environment, we recommend being long China A-shares, which have bigger exposure to traditional sectors of the economy that should benefit more from higher infrastructure expenditure in the coming months. We are long China A- shares vs MSCI EM ex China index (Bloomberg ticker: MXCXBRV Index).

China infrastructure FAI unlikely to have a significant impact on overall MSCI EM EPS

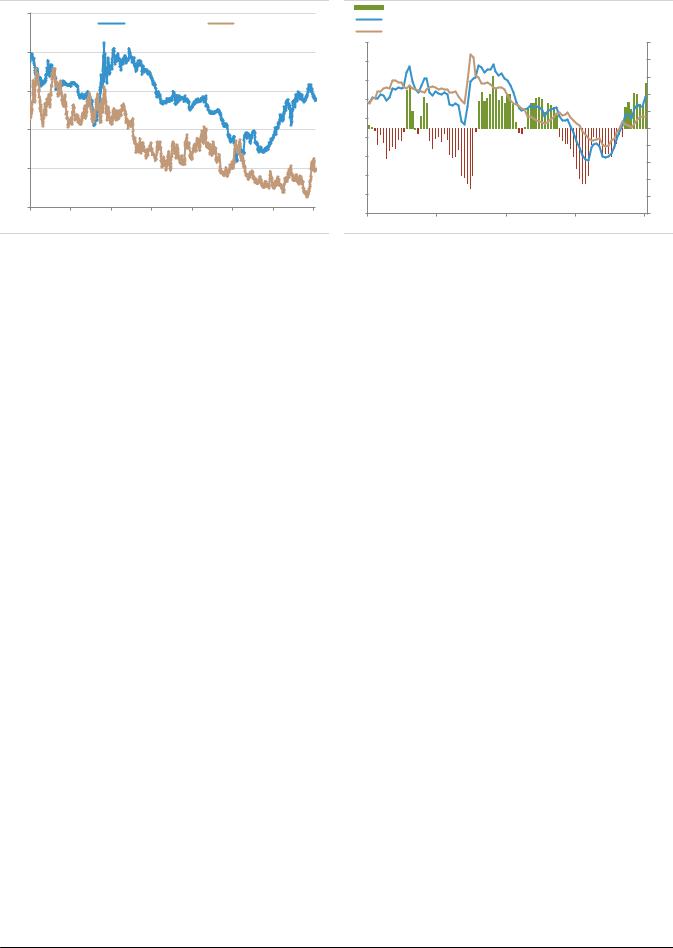

Figure 44: Liquidity conditions are tight; stimulus would be focused on infrastructure investment

Figure 45: EM EPS reaction to China's real estate investment is larger than to infrastructure

Average spread between 1y AA and AAA CNY bonds (bps)

180

TSF growth (% y/y, 3mma, rhs)

160

140

120

100

80

60

40

20

Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18

24% |

6 |

|

|

|

|

t-stat |

|

|

|||

|

|

|

|||

22% |

5 |

|

|

|

|

|

|

|

|||

|

|

|

|

||

20% |

4 |

|

|

|

|

|

|

|

|||

3 |

|

|

|

||

18% |

|

|

|

||

|

|

|

|||

2 |

|

|

|

||

16% |

|

|

|

||

|

|

|

|||

1 |

|

|

|

||

14% |

|

|

|

||

0 |

|

|

|

||

|

|

|

|||

12% |

-1 |

|

|

|

|

|

|

|

|||

10% |

-2 |

|

|

|

|

China Infra FAI German Factory |

US CAPEX |

China Real Estate |

|||

|

|||||

|

|

||||

|

|

Orders |

|

FAI |

Source: CEIC, UBS |

Source: Haver, Datastream, UBS. Note: t-statistics based on simple linear |

|

regressions of EM EPS growth on four different indicators of investment activity. |

2. Long MSCI EM Value vs MSCI EM Growth

EM Value outperformed EM Growth in 2018, but their relative index remains at the 12th percentile of its historical distribution since 1997 (Figure 46). In DM, this ratio is even more stretched, but the main arguments for being long EM Value vs EM Growth in 2019 is the difference in the sector composition of the two investment style indices.

EM equities' valuation discount to DM has widened further as the latter has been supported by the performance of the US market. But, it is largely EM Value sectors, such as materials, energy, financials and utilities that are cheap relative to DM. Growth-heavy sectors – consumer discretionary, consumer staples and healthcare –

Long-term underperformance and valuations should help to extend the recent EM Value rally

Growth-overweight sectors are expensive, and are seeing bigger earnings cuts vs Value sectors

Global Macro Strategy 19 November 2018 |

23 |

vk.com/id446425943

still screen as expensive relative to DM. Moreover, these are also the sectors that are seeing the largest earnings downgrades (Figure 47). As we show in the equity section of this report, the two biggest sectors within the MSCI EM Growth universe – IT and consumer discretionary – are likely to decline in 2019, in our view. The former is likely to remain under pressure in 2019 as our EM Tech Index points to continued downgrades, and UBS analysts are more pessimistic than consensus on the DRAM cycle. It is likely to be just as difficult for EM consumer sectors to outperform the market next year because consumer sentiment should see a further deterioration in an environment of slower real GDP growth.

Figure 46: MSCI EM and DM: Value/Growth relative indices

Figure 47: Percentile of current 12m fwd P/E relative to MSCI World (since 2002) vs 6m revisions in 12m fwd EPS

1.3 |

|

|

|

|

|

|

|

1.2 |

|

|

|

|

|

|

|

1.1 |

|

|

|

|

|

|

12th |

|

|

|

|

|

|

|

|

1.0 |

|

|

|

|

|

|

percentile |

|

|

|

|

|

|

|

|

0.9 |

|

|

|

|

|

|

|

0.8 |

|

|

|

|

3rd percentile |

||

|

|

|

|

|

|||

0.7 |

|

|

|

|

|

|

|

97 |

00 |

03 |

06 |

09 |

12 |

15 |

18 |

|

MSCI EM Value/Growth |

|

MSCI DM Value/Growth |

||||

25 |

6m change |

|

in 12m |

|

|

|

|

|

20 |

forward EPS |

ENE |

|

|

15Cheap and being upgraded

10

5 |

|

|

MAT |

|

|

|

|

|

|

REL |

EM |

|

|

|

|

|

|

0 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

IND |

FIN |

|

|

TEL |

|

|

|

|

|

|

|

|

|

|||

-5 |

|

|

ITS |

UTL |

CST |

|

HTC |

|

|

|

|

|

|

||||

-10 |

|

|

|

|

|

Expensive |

|

|

|

|

|

|

CDS and being |

||||

|

|

|

|

|

||||

-15 |

|

|

|

|

|

downgraded |

||

|

|

|

|

|

|

|

|

|

0% |

20% |

40% |

|

60% |

80% |

100% |

||

12m fPE relative to DM (percentile since 2002)

Source: MSCI, Datastream, UBS |

Source: IBES, MSCI, Datastream, UBS |

3. Long 10y Indian government bonds vs MSCI India

We expect India's growth to slow down in the second half of 2019. This deceleration will take a larger toll on equity valuations, while local bond markets are likely to benefit. We expect equity market total returns to depend on the external environment, domestic growth and the elections, but see returns as skewed towards 5–10% downside. For debt assets, we expect full-year returns of 9–10% (including c.25bp tightening in yields).

For the equity market, the spread between 10y G-Sec yields and earnings yields is high (Figure 48). Moreover, we do not see equity valuations as compelling because liquidity conditions are tighter and domestic retail flows into equity markets are slowing down, with risk from a reversal in these flows rising. For debt valuations, we expect annual inflation to average 4.6% in FY20, well within the RBI's target range, leading to a prolonged pause. This implies that in our valuation model we estimate 10y yields as currently 25bp too high as we see fair value at 7.25–7.50% (Figure 49). Market dynamics will also be supportive of local debt after the RBI's recent OMO purchases and potential slowdown in banks' credit growth (attributable to NBFC's liquidity squeeze), likely resulting in a modest pickup in their demand for G-Secs.

A deceleration in domestic growth will imply more de-rating for equities

Equity valuations have not adjusted enough to be attractive

We expect 25bp downside in G- Sec yields

Global Macro Strategy 19 November 2018 |

24 |

vk.com/id446425943

Figure 48: Yawning gap between bond and earnings yield

10% |

|

|

|

|

|

|

|

|

|

|

10-y Gsec |

|

Earnings yield |

|

|

9% |

|

|

|

|

|

|

|

8% |

|

|

|

|

|

|

|

7% |

|

|

|

|

|

|

|

6% |

|

|

|

|

|

|

|

5% |

|

|

|

|

|

|

|

Nov-11 |

Nov-12 |

Nov-13 |

Nov-14 |

Nov-15 |

Nov-16 |

Nov-17 |

Nov-18 |

Source: Bloomberg, Datastream, UBS

Figure 49: G-Secs are already pricing in a large risk-premia

Cheap (+)/Rich (-), RHS 10y (current)

Fair Value (dependant on CPI, IP, credit growth and short end rates)

9.5 |

|

|

|

1.0 |

9.0 |

|

|

|

0.8 |

8.5 |

|

|

|

0.6 |

|

|

|

|

|

8.0 |

|

|

|

0.4 |

|

|

|

|

|

7.5 |

|

|

|

0.2 |

|

|

|

0.0 |

|

7.0 |

|

|

|

|

|

|

|

-0.2 |

|

|

|

|

|

|

6.5 |

|

|

|

-0.4 |

|

|

|

|

|

6.0 |

|

|

|

-0.6 |

|

|

|

|

|

5.5 |

|

|

|

-0.8 |

5.0 |

|

|

|

-1.0 |

Sep-10 |

Sep-12 |

Sep-14 |

Sep-16 |

Sep-18 |

Source: Bloomberg, UBS |

|

|

|

|

4.Long MSCI Indonesia vs Malaysia & Thailand, FXhedged

We have been positioned long MSCI Indonesia (against India) since late June 2018. We recommend carrying this position into 2019 against the country's ASEAN peers: Malaysia and Thailand.

Banks are the largest sector in Indonesia (Figure 50), and have seen steady earnings downgrades. However, UBS Indonesia banks analysts, Joshua Tanja and Igor Putra, have pointed out that there is no pressure on banks' balance sheets this time. The sector is in a much better position than in 2013, as evidenced by the sanguine treatment of banks' bonds by credit investors. The composition of Malaysia's, and to a lesser extent, Thailand's, equity markets is arguably more defensive than that of Indonesia, and hence the former two countries' stocks tend to outperform the latter in a negative environment. However, the fact that the concern of the coming 12–24 months is economic growth, not so much the US Treasury market, helps Indonesia over the other two markets. Thailand's high weight in energy and materials has held it in better stead this year, but we do not expect further significant improvement in these sectors.

Like other equity markets in EM, Indonesia has seen a steady de-rating this year, and although it is still expensive, it is less so than Thailand, whose multiples relative to DM are the most elevated across EM in history (Figure 51), leaving little room for re-rating, according to our Thailand equity strategist, Ian Gisbourne. A changing growth context may expose these high valuations. Although we expect lower GDP growth in 2019 across all three countries, the y/y deceleration is the smallest for Indonesia (30bp, compared with 70bp for Malaysia and 1.3pp for Thailand), and its rate of 5% remains the strongest (a 1pp premium to the next best, Malaysia). The current-account deficit for Indonesia is a concern, as always, but with modestly weaker growth, we see this improving next year to a manageable 2.6% of GDP. Malaysia does not run twin deficits, but a higher fiscal deficit is a concern; in order to prevent public debt rising beyond 80% of GDP (including contingent liabilities), the government is having to make difficult decisions, which are negative for most sectors in the market, according to UBS Malaysia analyst, Chris Oh.

While political risk remains high in each of the three ASEAN countries, we believe it is smaller in Indonesia and most under-priced in Thailand. We keep this trade FX-

Global Macro Strategy 19 November 2018 |

25 |