Lectures_1-2_monopoly

.pdf

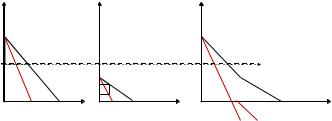

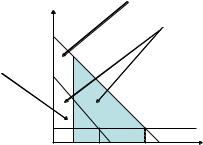

3rd degree price discrimination: welfare

IDoes 3rd degree price discrimination improve welfare as compared to non-discriminating monopoly?

I of monopolist? of consumers? total?

I Monopolist

Iyes (revealed preference argument)

I Consumers

Ilow-elasticity markets prefer uniform price,

Ihigh-elasticity markets prefer discrimination (see picture above)

IIs it always true?

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

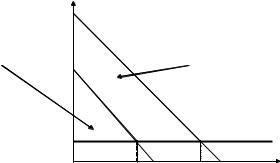

|||||||||

p1 Large demand p2 |

|

|

|

Small demand |

|

|

p |

|

Total demand |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

D1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D1+D2 |

|

|

||||||||||||||||||||||||||||

p1_ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

mon |

|

|

|

|

|

|

|

|

|

|

p2_mon |

|

D2 |

p |

1+2_ |

mon |

|

|

|

|

|

|

|

|

|

|

MC |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

q1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

q2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

MR1+2 |

|

q1+ q2 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

MR1 |

|

MR2 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

31

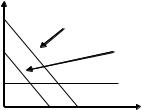

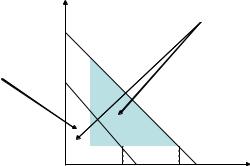

3rd degree price discrimination: welfare (cont.)

IDoes 3rd degree price discrimination improve total welfare as compared to non-discriminating monopoly?

Inecessary condition: 3rd degree price discrimination increases welfare only if increases output

IE.g. allows to serve a market that would not be served under uniform price

I You will have a problem like this for 2 goods and linear demand

IDoes 3rd degree price discrimination improve welfare as compared to perfect competition?

INO!

32

2nd degree price discrimination

I Nonlinear pricing: price per unit depends on number of units

I E.g. two-part tari¤s: …xed payment + price per unit: F + Vq

I Plan A: High F and low V vs.

I Plan B: Low (or trivial) F and high V

I Self-selection of consumers: those who expect high usage will prefer Plan A

I Example: cellular tari¤s, books - hardcover vs paperback, etc.

IOr fully non-linear tari¤: monopolist o¤ers di¤erent bundles of (quantity, fee)

IExample: quantity discounts

IAlso di¤erent prices for di¤erent quality (bundles (quality, fee))

33

2nd degree price discrimination: fully non-linear prices

I Simple example:

I Two types of consumers

I“high” demand

I“low” demand

I |

Monopoly o¤ers two contracts: x |

H |

, R |

and x |

L |

, R |

L |

|

|

H |

|

|

|||

|

I Ri is the total payment (Ri = pi xi ) |

|

|

|

|

||

I |

Need to make sure that the “high” type does not pretend to |

||||||

|

be “low” and take xL, RL |

|

|

|

|

|

|

p

DH

DL

MC

x

34

Reference point: perfect discrimination

IAssume that the monopolist knows exactly who is who

IPerfect price discrimination

Iboth types get to consume e¢ cient levels but monopoly expropriates all surplus

RL

RH

MC

xL* |

xH* |

35

Fully non-linear tari¤ (cont.)

I Types are not observed

I The above does not work

IHigh type pretends to be low type (businessmen buy economy class tickets)

I What to do?

ILeave "informational rent" to the high type

IThat is, do not take all of his surplus in his contract - leave enough for him not to switch

High type’s surplus if chooses xL* and pays RL

RL

MC

xL* |

xH* |

36 |

Fully non-linear tari¤ (cont.)

I Is the solution above optimal?

INo

IMonopoly wants to charge higher prices to high type

IBut needs to make the low type’s contract su¢ ciently unattractive to high type by reducing xL

IEnsure incentive compatibility

I high type chooses the contract which is intended for her

High type’s surplus if chooses xL* and pays RL = surplus if chooses xH* and pays RH

RH

RL

MC

xL |

xL* |

xH* |

37

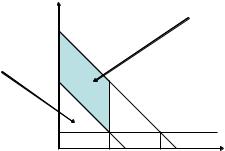

Optimal fully non-linear tari¤

|

|

|

|

|

Profits from |

|

|

|

|

|

|

serving high type |

|

Profits from |

C |

|

|

|||

serving low type |

|

|

|

When decreasing xL: earn more |

||

|

|

|||||

|

|

|

|

|

on high type but less on low |

|

|

|

|

|

|

type |

|

|

|

|

|

B |

|

|

|

|

|

|

|

MC |

FOC.: |

|

|

|

|

A |

CB/BA=share of low |

|

|

|

|

|

|

||

|

|

|

|

|

|

type/share of high type |

|

xL |

xL* |

xH* |

|

||

38

Fully non-linear prices (summary)

I Quantity

IHigh type receives e¢ cient quantity

ILow type’s quantity is below e¢ cient level

IDistortion is the greater, the larger the weight of high type

I Consumer surplus

IMonopoly fully expropriates consumer surplus from low type

IBut has to leave some surplus (“informational rent”) to the high type

39

Common misconceptions and comments

I Monopoly provides a good without substitutes

I Demand is elastic

I If demand were inelastic monopoly would set an in…nite price I Changes in the markets of substitutes can a¤ect monopoly’s

price – and even bring it down to AC (then monopoly is “natural”)

I Natural monopoly is a characteristic of an industry?

INo, it depends on both structure of costs and size of the market (demand)

IWhat is a natural monopoly in one country, may be a competitive sector in the other country (or in another time period)

IMobile telecommunications in Russia:

I1990s: natural monopoly within each standard

I2000s: competition within GSM

40