- •Contents

- •Foreword

- •Industry snapshot

- •Industry snapshot

- •Reserves

- •Oil output

- •Oil output

- •Gas output

- •Gas output

- •Refining

- •Refining

- •Upstream

- •Upstream

- •Oil output

- •Gas output

- •New wells

- •Well-stock management

- •Well productivity

- •Reserves

- •Reserves

- •Oil reserves

- •Gas reserves

- •Reserve replacement

- •Reserve replacement

- •Refining

- •Refining

- •Capacity, throughput, utilisation

- •Light products yield

- •Complexity

- •Complexity

- •Modernisation plans

- •Capex

- •Capex

- •Oil & gas sector capex

- •Crude exports

- •Crude exports

- •Crude exports by market, company and direction

- •Russian crude exports in the FSU context

- •Crude export proceeds

- •Refined products exports

- •Refined products exports

- •Analysis by product

- •Gas balance

- •Gas balance

- •Domestic sales

- •UGSS balance

- •Appendix I: Reserves classifications

- •Appendix I: Reserves classifications

- •Russian reserves definitions

- •Western reserves definitions

- •Appendix II: Pricing

- •Appendix II: Pricing

- •Monthly pricing trends

- •International crude oil pricing

- •Domestic crude oil pricing

- •Domestic product pricing

- •International gas pricing

- •Domestic gas pricing

- •Gas tariffs

- •Appendix III: Regulation and tax

- •Appendix III: Regulation and tax

- •Regulatory overview

- •Licensing

- •Environmental protection

- •Oil and product transportation

- •Transportation costs

- •Typical crude export route costs

- •Volume and price controls for gas

- •Tax regime

- •Mineral Extraction Tax (MET)

- •Crude-export duty

- •Excess profits tax

- •Specific taxes applied to natural gas

- •Taxation of offshore projects – special treatment

- •Appendix IV: Sanctions

- •Appendix IV: Sanctions

- •Summary

- •Appendix V: Who’s Who

- •Appendix V: Who’s Who

- •Key policymakers

- •Company heads

- •Disclosures appendix

vk.com/id446425943

Excess profits tax

Renaissance Capital

20 June 2019

Russian oil & gas

On 19 July 2018, Federal Law No. 199-FZ On amending parts one and two of the Tax Code of the Russian Federation was adopted providing for the introduction of the tax on additional income from production of hydrocarbons from 1 January 2019. Only a few months later, some of the initial parameters of this new tax regime were amended via Federal Law No. 424-FZ On amending part two of the Tax Code of the Russian Federation and certain fiscal legislative acts, dated 27 November 2018.

Otherwise known as ‘profit-based tax’ or ‘excess profit tax’ (EPT), this regime represents a pilot scheme for what we believe may be a very slow and gradual transition to profitsbased taxation in the Russian oil sector. Key above all is that this change is largely voluntary and will apply only to a selected group of oil fields (the criteria for which are summarised in Figure 133), mainly representing new greenfield opportunities in East and West Siberia, although the scheme could eventually be rolled out across a wider group of production fields if deemed successful.

While the introduction of profit-based taxation (as opposed to the legacy fiscal regime based on either revenue or production volumes) has been under discussion for eight years, its adoption has been slow because of concerns that the oil producers may be overstating costs and therefore understating profits and taxes, making it a difficult task for the government to administer such a tax regime. Instead, the Russian government kept introducing various exemptions to the legacy tax regime, summarised in Figure 134. We view the introduction of profit-based taxation as an attempt to unify these various exemptions under a single framework: for example, all future yet-to-be-discovered or yet- to-be sanctioned greenfield opportunities in both West and East Siberia should be developed under the EPT rules.

Figure 133: Oil fields that are subject to profit-based taxation

Geographic location |

Group |

Depletion rate as of 1 Jan 2017 |

Greenfields in East Siberia |

|

|

Republic of Sakha, Irkutsk Region, Yamal-Nenets Autonomous |

1 |

Not exceeding 5% |

District, Krasnoyarsk Region, Caspian Sea |

|

|

Republic of Sakha, Irkutsk Region, Yamal-Nenets Autonomous |

2 |

Irrespective of the depletion rate, all fields that are specified by |

District, Krasnoyarsk Region, Caspian Sea |

|

law |

|

|

|

Brownfields in West Siberia |

|

|

Khanty-Mansiysk Autonomous District, Yamal-Nenets Autonomous |

3 |

Between 20% to 80%, or 10% to 80% provided that the depletion |

District, Komi Republic, Tyumen Region |

|

rate was above 1% as of 1 Jan 2011. The list of fields is specified |

|

|

in the law |

|

|

|

Greenfields in West Siberia |

|

|

Khanty-Mansiysk Autonomous District, Yamal-Nenets Autonomous |

4 |

Below 5%. The list of fields is specified in the law |

District, Komi Republic, Tyumen Region |

|

|

Source: Russian government

EPT vs existing tax regimes

Key parameters of the EPT calculation include:

▪Excess profits tax that will be charged at the rate of 50% of the oil revenue, calculated as the difference between the estimated revenue and costs (losses)

▪Export duty will be charged at the same rate established by the Russian law. However, the East Siberia greenfields (group 1-2) are exempted from this for the first seven years from the start of the commercial production

▪MET will be applied at a reduced rate. For fields that will pay the tax on additional income from hydrocarbon production, the MET rate will be calculated as:

155

vk.com/id446425943

Renaissance Capital

20 June 2019

Russian oil & gas

MET = (P – 15) x 7.3 x 0.5 x “K” x “Exchange rate” – “Export duty” x “Exchange rate”,

Where:

“P” = Urals price;

“K” = the coefficient characterising the period of time elapsed from the date of the beginning of industrial oil production at the field, set as follows:

oFor groups 1 and 2, K is set at 0.4 during the first five years of commercial production, 0.6 during the sixth year, 0.8 during the seventh year, and 1.0 thereafter

oFor group 4, K is set at 0.5 during the first year of commercial production, 0.75 during the second year, and 1.0 thereafter

▪Tax-deductible transportation tariff for the crude oil and gas condensate will be – established by the Russian Federal Antimonopoly Service (FAS) for each region and will include the expenses for the transportation from the regional hub to the customers, including export sales. The expenses to bring the hydrocarbons from the field to the hub are excluded from the tariff and included in opex.

▪Tax-deductible opex and capex will be capped as follows: RUB7,140 per tonne of crude oil for 2019 and 2020 and RUB9,520 per tonne thereafter, adjusted for annual inflation. These form the basis for the minimum level of EPT. For fields in initial stages of commercial production, opex and capex on the field are not capped, so the minimum EPT is zero.

The key change introduced by the 27 November 2018 law in relation to the EPT regime was the increase in the level of initial recoverable reserves at the group 4 fields (West Siberian greenfields) from 10mnt to 30mnt per field and from 51mnt to 150mnt, cumulatively. These changes almost doubled the total number of the fields that can apply for the EPT from 11 to 26. In addition, the list of the pilot fields for the West Siberian brownfields (group 3) has increased from 35 to 39, without changing the cumulative production limit of 15mntpa.

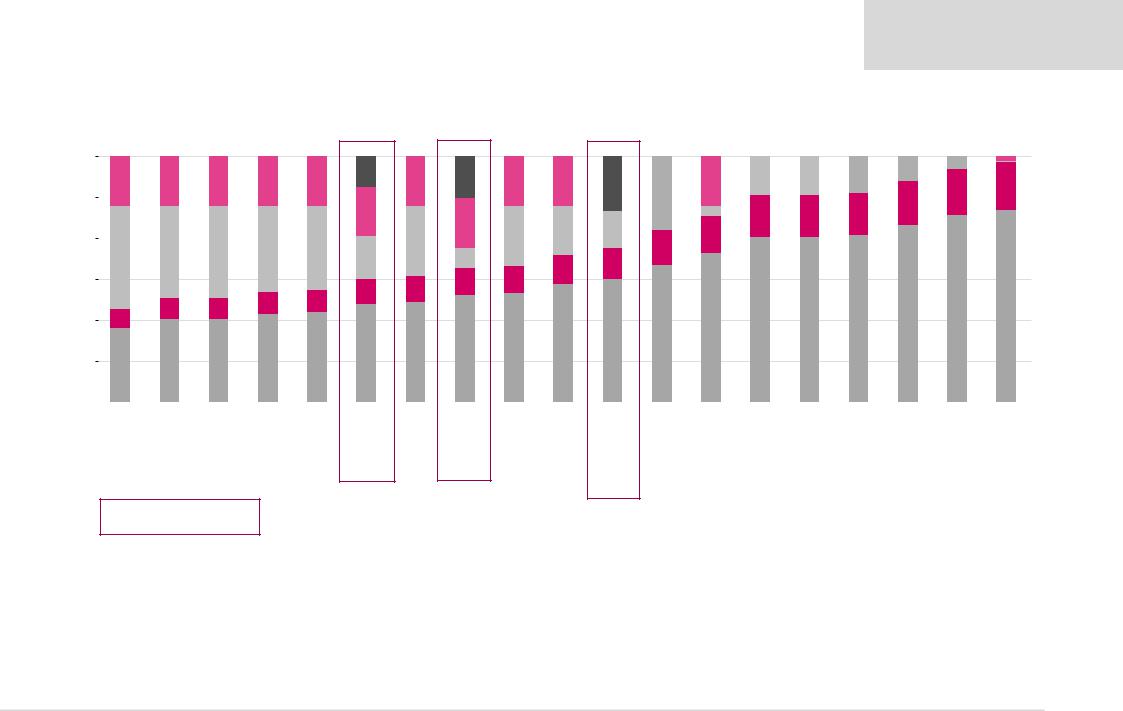

Figure 134 shows differences in effective tax take for EPT-eligible fields vs other available tax regimes in Russia. We calculate that, on average, the adoption of EPT will result in annual tax savings of 26% for the group 1-2 fields, 19% for group 4 fields and 13% for group 3 fields (using the maximum allowed level of deductible expenses of RUB7,140/t or approximately $14/bl) for EPT-applicable fields when compared with the legacy tax regime. However, we believe EPT is not as good as some of the more specific tax regimes introduced in recent years that give a higher amount of tax savings (for example, fields on the Russian continental shelf with a 75% existing tax benefit, or recently discovered East-Siberia fields with an effective discount of 53%).

Given the initial voluntary nature of the EPT adoption and limited companies disclosure it is not possible to calculate precisely the exact affected production volume, but Russia’s

Ministry of Energy previously estimated that approximately 27-33mn tpa (5-6% of

Russia’s crude output) may be affected. The list of group 3 fields (brownfields in West Siberia, so-called “pilot projects”) was capped at 15mn tpa (in terms of 2016 output), representing just 3% of Russia’s current oil output. We believe that Russian oil producers will chose to convert the following types of fields to the EPT regime from 2019:

156

vk.com/id446425943

Renaissance Capital

20 June 2019

Russian oil & gas

▪The full allocated 15mn tpa of existing brownfield production in West Siberia, as EPT allows for a higher amount of tax savings vs the legacy tax regime, we estimate.

▪Greenfields with expiring export duty exemptions, where conversion to EPT could extend the duration of applicable tax holidays. Key example of such field is Gazprom Neft’s Novoportovskoye field, which has transitioned to the EPT regime from 1 January 2019.

▪Greenfields with no export duty exemptions or those where MET benefits are coming to an end, where conversion to EPT could improve NPV vs existing tax plans. Key examples of such fields include the Yurubcheno-Takhomskoye, Suzun and Tagul fields.

On the opposite side, we believe companies will decide to continue to apply existing tax plans to those fields where export duty exemption is currently valid for a longer period of time (for example, the Prirazlomnoye and Filanovskogo fields) or those that have another dedicated tax regime with better economics (for example, the Samotlorskoye field).

157

vk.com/id446425943

Renaissance Capital

20 June 2019

Russian oil & gas

Figure 134: Russian oil taxation – government take vs producer netbacks calculated at a Urals oil price of $60/bl, $/bl

60

50

40

30

20

10

-

|

|

|

|

|

|

Netback |

|

|

Income tax |

|

|

Mineral Extraction Tax |

|

Export duty |

|

|

Royalty |

|

|

Excess profit tax |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

3 |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

0 |

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

||

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

9 |

9 |

|

|

|

|||

12 |

12 |

12 |

12 |

12 |

|

|

12 |

|

|

12 |

12 |

|

|

|

|

|

12 |

|

|

|

|

|

||||||

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

12 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

10 |

10 |

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

12 |

|

|

|

9 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|||

|

22 |

22 |

21 |

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

25 |

|

|

10 |

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

5 |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47 |

|

5 |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

46 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43 |

|

|||

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

40 |

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 |

|

36 |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

22 |

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

20 |

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legacy tax |

Tyumen |

Small |

Samotlor |

Depleted |

EPT Group 3 |

|

Low |

EPT Group 4 |

Low |

Extra-heavy |

EPT Group 1-2 Azov and Baltic |

Bazhenov, |

East-Siberia |

Nenets, |

Black (<100m |

Black (>100m |

Kara, North |

Extra viscous |

||||||||||

system |

suite |

fields |

|

fields |

(West Siberia |

permeability |

(West Siberia |

permeability |

(highly viscous, |

(East Siberia |

seas |

Abalak, |

tax holiday |

Yamal-Nenets |

depth), Pechora, |

depth), North |

Barents, East |

(viscosity > |

||||||||||

|

|

|

|

|

brownfields) |

(<2mD), |

greenfields) |

(<2mD), |

200 mPa*s |

greenfields or |

|

|

|

Khadum |

|

and |

White, South |

Okhotsk, South |

Arctic seas |

10,000 mPa*s) |

||||||||

|

|

|

|

|

|

|

producing |

|

|

|

producing |

<viscosity < |

fields specified |

|

|

|

and |

|

Yamal peninsula |

Okhotsk and |

Barents seas |

|

oil |

|||||

|

|

|

|

|

|

|

horizon >10m |

|

|

|

horizon |

10,000 mPa*s) |

in the Note to |

|

|

|

Domanik |

|

|

Caspian seas |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

<10m |

oil |

the Common |

|

|

|

suites |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customs Tariff |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

as of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

01.01.2018) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Fields eligible for excess profit tax regime

Source: Renaissance Capital

158

vk.com/id446425943

Oil product taxation

Exports

Renaissance Capital

20 June 2019

Russian oil & gas

Oil product exports are subject to export duties, reintroduced in 1999. These have been changed regularly since. In an attempt to enshrine these rates in law, the State Duma proposed that oil product export duties be varied in line with prevailing crude export duties. Hence, beginning from 1 January 2003, oil product export duty rates began to be denominated in dollars, and were set at the same time as crude oil export duty (every two months) at a level equivalent to 90% of the crude export duty levy. Oil product export duty rates had previously been denominated in euros.

However, in November 2003 the State Duma lifted the 90% cap. After this, officials at the MEDT, which ran the Federal Customs Service until early 2006, indicated that new formulas would be introduced after negotiations with industry. However, the duty levels charged immediately after the amendment continued to be set at 90% of those established for crude exports, at least until mid-2004. On 13 July 2004, however, the government’s Commission on Protective Measures in Foreign Trade decided to increase the duty on refined oil product exports by a smaller amount than the rise due on 1 August 2004 for crude, and also to introduce the increase at a later stage, around 1 September. Therefore, whereas the duty on crude oil exports rose to $69.9/t from August, from $41.6/t, due to the application of the tax bands discussed above, the duty on refined product exports only increased from $35.7/t to $45.4/t.

A member of the Commission told newswires at the time that the new rate entailed pegging the duty rate at some 65% of export duties levied on crude. Encouragingly, the decision was reportedly made on the basis of a broad understanding that a higher duty would have damaged refined product exports without bringing down domestic product prices. Yet this understanding lasted for only a short time. By October 2005, the oil companies came under intense political pressure because of runaway product price rises in the domestic market, although this was merely a result of rampant international prices and the lower export duties imposed.

At first, political coercion led to some price restraint and matters calmed down, but by April 2005 officials took matters into their own hands and introduced a new oil price-linked export duty scale for refined products. The new product export duty calculation scale levied no export duty on products if crude prices (Urals) were below $15/bl. Beyond this level, the duty was calculated based on the crude price minus a base of $15/bl, multiplied by a coefficient of 0.32 (and also multiplied by 7.3bl/t). The resulting figure was then multiplied by 0.7 in order to establish duties for dirty products (fuel oil) and multiplied by 1.3 for clean products (gas oil/diesel mainly, and also for gasoline and jet-kero). This has led to meaningfully higher duties since, yet they remained much lower than those imposed on crude exports.

A further minor change for refined products export duties took place in October 2006. Basically, whereas crude export duties were governed by a strict formula that results in new rates on the first day of every even-numbered month, the formula governing refined products had been applied haphazardly. Tax Code changes approved in 2006 synchronised export-duty changes for crude and refined products.

In October 2008, the Russian government reduced the export duties lag, and oil product export duties have been revised monthly since (vs a two-month revision cycle previously), in line with the revised approach to the calculation of export duties on crude.

In 2003, the oil product export duty was linked and capped at 90% of the crude duty

The cap was removed in late 2003, and more benign taxation adopted from August 2004

New formula introduced in 2005, subsidising refined product exports in general, and fuel oil exports in particular

159

vk.com/id446425943

|

Renaissance Capital |

|

20 June 2019 |

|

Russian oil & gas |

Significant growth in the oil price over subsequent years resulted in substantial growth in |

|

New rates from 2011 |

|

the absolute level of the export tax benefit, applied to oil products (in particular, fuel oil) vs |

|

crude. Therefore, the government ruled in 2010 to gradually change the export duties on |

|

oil products, linking them to the crude export duty rate with a coefficient of 0.67 (from |

|

2011), 0.64 (from 2012) and 0.60 (from 2013) for light products. The approved multiples |

|

for heavy products were 0.467 (from 2011), 0.529 (from 2012) and 0.60 (from 2013). |

|

However, during 2011 the government adopted a more aggressive plan to converge |

|

export duties on crude and oil products. According to its new decision, from 1 October |

|

2011 the rates were set in accordance with the following rules: |

|

▪ The export duty rates for middle distillates and heavy oil products were set equal |

|

to 66% of the corresponding crude export duty rate. |

|

▪ The export duty rates for gasoline and naphtha were set equal to 90% of the |

|

crude export duty rate. This essentially extended the “temporary” 90% rate that |

|

was originally introduced in May 2011 to force a reduction in gasoline exports |

|

and an increase in gasoline supplies to the domestic market. |

|

In December 2013, the government approved the so-called tax manoeuvre, which |

2014 saw the start tax manoeuvre |

envisaged rebalancing of the sector’s tax burden between export duty and MET, and |

|

between upstream and downstream. The 2013 plan was further accelerated in November |

|

2014 and has resulted overall in an increase in the absolute levels of export duties for oil |

|

products, but a rebalancing towards a relatively lower export duty rate on light oil products |

|

and a relatively higher rate on heavy oil products, as shown in Figure 132. |

|

As part of the final phase of the tax manoeuvre, introduced from 1 January 2019, the structure of product export duties, calculated as a percent of crude oil export duty, has not changed, but their absolute level will gradually decline to zero by 2024 as crude oil export duty gets eliminated.

Domestic sales

In addition, following the abolition of the fuel tax at the end of 2000, another specific charge is levied on oil products sold in the domestic market. Excise is charged on a range of oil products (gasoline, diesel, and lubricants) at the rates shown in Figure 135.

Figure 135: Excise tax applied to domestic oil products, RUB/t

Product export duties will disappear from 2024

Excise is charged on a range of oil products

|

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

2019 |

2020 |

2021 |

||

|

1H |

2H |

1H |

2H |

Jan-May Jun-Dec |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Gasoline low octane |

1,512 |

2,192 |

2,460 |

2,657 |

2,657 |

2,657 |

2,657 |

2,657 |

2,923 |

5,995 |

7,725 |

7,725 |

8,225 |

10,100 |

10,100 |

11,110 |

7,300 |

13,100 |

13,100 |

13,100 |

13,100 |

13,100 |

13,100 |

13,624 |

Gasoline Euro-3 |

|

|

|

|

|

|

|

|

|

|

5,672 |

7,382 |

7,882 |

9,750 |

9,750 |

10,725 |

|

|

|

|

|

|

|

|

Gasoline Euro-4 |

|

|

|

|

|

|

|

|

|

|

5,143 |

6,822 |

6,822 |

8,560 |

8,960 |

9,416 |

|

|

|

|

|

|

|

|

Gasoline Euro-5 |

|

|

|

|

|

|

|

|

|

|

5,143 |

6,822 |

5,143 |

5,143 |

5,750 |

5,657 |

5,300 |

10,130 |

10,130 |

11,213 |

8,213 |

12,314 |

12,752 |

13,262 |

Gasoline high octane |

1,850 |

2,072 |

3,004 |

3,360 |

3,629 |

3,629 |

3,629 |

3,629 |

3,629 |

3,992 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diesel |

550 |

616 |

893 |

1,000 |

1,080 |

1,080 |

1,080 |

1,080 |

1,080 |

1,188 |

2,753 |

4,098 |

4,300 |

5,860 |

5,860 |

6,446 |

3,450 |

5,293 |

6,800 |

7,665 |

5,665 |

8,541 |

8,835 |

9,188 |

Diesel Euro-3 |

|

|

|

|

|

|

|

|

|

|

2,485 |

3,814 |

4,300 |

5,860 |

5,860 |

6,446 |

|

|

|

|

|

|

|

|

Diesel Euro-4 |

|

|

|

|

|

|

|

|

|

|

2,247 |

3,562 |

3,562 |

4,934 |

5,100 |

5,427 |

|

|

|

|

|

|

|

|

Diesel Euro-5 |

|

|

|

|

|

|

|

|

|

|

2,247 |

3,562 |

2,962 |

4,334 |

4,500 |

4,767 |

|

|

|

|

|

|

|

|

Lubricants |

1,500 |

1,680 |

2,436 |

2,732 |

2,951 |

2,951 |

2,951 |

2,951 |

2,951 |

3,246 |

4,681 |

6,072 |

6,072 |

7,509 |

7,509 |

8,260 |

6,500 |

6,000 |

5,400 |

5,400 |

5,400 |

5,400 |

5,616 |

5,841 |

Source: Tax Code

The regulation has been going back and forth with respect to the way in which oil product excises are calculated and collected. Prior to 2003 and from 2007, oil refiners bear all the responsibility for collecting these from the resellers and forwarding them to the state. Over 2003-2006, the payers of oil product excise tax were the companies that actually sell the petroleum products to the consumers, while the producers and intermediaries accrued the excise tax and subsequently recovered it if certain conditions set by the legislation were met.

160

vk.com/id446425943

Following a quiet period during 2004-2009 when excise taxes were kept flat (taming inflation, in our view), the government started raising the tax in earnest from 2010. From 2011, the government started to differentiate oil product excise taxes to encourage consumers and producers to use higher-quality (and cleaner) products, but this has become a less pressing issue post-2014 as a result of the widespread upgrades of

Russia’s refining capacity and resulting improvements in product quality. This has also corresponded with Russia’s transition to Euro-5 fuel specification standards from July 2016, as discussed on pages 62-63. Following significant growth in domestic gasoline and diesel prices in April-May 2018, the government has temporary reduced excise taxes for both products by RUB 3,000/t between June-Dec 2018, but then reverted to statutory levels from 1 January 2019.

Reverse excise and the damper

The introduction of the final phase of the tax manoeuvre from 1 January 2019 has resulted in reduced export duty benefit (also formerly known as the implied subsidy) to the oil products, compared to the previous tax regime. After consultations with the industry, the government has decided to offset this reversal with the introduction of the oil excise tax, which is a reverse (negative) tax paid to qualified oil refiners in Russia by the government in order to continue stimulating the refining industry as the current export duty subsidy on refined products eventually disappears in 2024.

Qualified oil refiners include those more sophisticated refineries that produce gasoline or naphtha and supply it to the domestic market (or those that have entered into a modernisation agreement with the Russian government), as well as those refineries that are at least 50% owned by Russian oil companies or individuals that are subject to foreign sanctions, an exception tailor-made to include NOVATEK’s Ust Luga refinery, we think.

Starting from 1 January 2019, reverse excise tax is calculated as follows:

Reverse excise = ((Urals – 182.5) * 30% + 29.2) * export duty reduction factor * regional coefficient * (refining throughput – 55% * volume of naphtha –

30% * volume of light products excl. naphtha – 6.5% * volume of petroleum coke – volume of fuel oil) + Damper;

The regional (logistical) coefficient was introduced to differentiate the applicable negative oil excise tax for remote refineries by a factor of between 1.0-1.5x, depending on their geographical location and proximity to export routes. It will be applied to five major refineries, as well as possibly several mini-refineries (assuming they qualify for the negative excise tax in the first place). These are: Achinsk (owned by Rosneft, qualifies for a regional coefficient of 1.5), Khabarovsk (NNK, 1.5), Angarsk (Rosneft, 1.4), Ukhta (LUKOIL, 1.3) and Omsk (Gazprom Neft, 1.05).

Federal Law No. 424-FZ On amending part two of the Tax Code of the Russian Federation and certain fiscal legislative acts, dated 27 November 2018 has also introduced a dampening coefficient (damper) that will be applied to the calculation of the reverse excise tax.

The dampening mechanism was introduced to allow the government to control retail petrol prices in Russia. It will be used to increase or reduce the amount of reverse excise tax to reduce volatility of end-prices, compensating the oil companies with 60% (in 2019) and 50% (thereafter) of the difference between the export netback and the target price within a 10% range of the targeted level (set as RUB56,000/t for gasoline and RUB50,000/t for diesel in nominal 2019 prices). If the actual netback exceeds the target

Renaissance Capital

20 June 2019

Russian oil & gas

161

vk.com/id446425943

price, the reverse oil excise will increase, reducing the tax burden for the refineries. Conversely, if the actual netback price is below the target price, the size of the reverse oil excise will be reduced, thus increasing the tax take for the government at the expense of the customer. Should the positive difference exceed 10% (i.e., actual wholesale prices are more than 10% above the target prices), the dampening mechanism will not apply and we understand the government can revert to more draconian measures, such as the introduction of the prohibitive 90% export duty rate in accordance with the powers given by Federal Law No. 305-FZ On amending article 3.1 of the Custom Law of the Russian Federation, dated 3 August 2018. Should the negative difference exceed 10% (i.e., actual prices are less than 10% below the target price), the original version of the law assumed no action, while the 27 November 2018 version has no downside limit for the dampening mechanism, effectively meaning that retail petrol prices in Russia will never be reduced: if the oil price goes down, the government’s tax take will increase via a reduction of the reverse oil excise tax.

Starting from 1 January 2019, damper is calculated as follows:

Damper = compensation coefficient * (volume of EURO-5 gasoline sold to domestic market * (gasoline export alternative price – gasoline indicative price + gasoline export surplus) + volume of EURO-5 diesel sold to domestic market * (diesel export alternative price – diesel indicative price + diesel export surplus)), where

▪compensation coefficient is set at 60% in 2019 and 50% after 2019

▪export alternative price = ((Rotterdam price – export duty - transportation expenses to the Northwest Russian port) * exchange rate + excise) * (1 + VAT)

▪gasoline indicative price is RUB56,000 per tonne in 2019, RUB58,800 per tonne in 2020, RUB61,740 per tonne in 2021

▪diesel indicative price is RUB50,000 per tonne in 2019, RUB52,500 per tonne in 2020, RUB55,125 per tonne in 2021

▪gasoline and diesel export surpluses in the amount of RUB5,600 per tonne and RUB5,000 per tonne, respectively, are applicable only when the export alternative is higher than the indicative price; overwise, the export surplus is zero;

Despite its superficial simplicity, the mathematics behind the calculation of the dampening mechanism is quite complex, as the government and the oil companies have each tried to negotiate a favourable outcome for themselves. Therefore, there are several balancing coefficients, kickers and compensatory mechanisms, which, among other things, have resulted in the damper factors being introduced to the calculation of the seemingly unrelated MET. According to the law, this coefficient will kick in if indicative prices are below export netback and thus the export surpluses are non-zero. It will amount to RUB125 per tonne in 2019 and RUB105 per tonne post 2019 for gasoline and RUB110 per tonne in 2019 and RUB92 per tonne for diesel post 2019, which constitutes approximately $0.5/bl or 2% of our estimated average 2019 statutory MET rate, on our estimates. In essence, the rationale behind this approach is to redistribute some of the cost of the damper mechanism from the government to the upstream segment when export prices are too high, relative to the target domestic price level.

The experience of the first few months in 2019 has demonstrated the inefficiencies of the dampening mechanism, for two reasons. First, the presence of gasoline and diesel export surpluses in the above formula can result an unpredictable step-change in the value of damper within a small range of external parameters. Second, the volatility of international

Renaissance Capital

20 June 2019

Russian oil & gas

162

vk.com/id446425943

Renaissance Capital

20 June 2019

Russian oil & gas

oil product prices and exchange rates reduce the efficiency of the damper, which has not been able to cover the intended losses of Russian oil producers that were supplying the domestic market at effectively controlled prices. After intense industry discussions, local media reported during April-June 2019 that the government would amend the damper formula by removing the surpluses, lowering the indicative price, and increasing the compensation coefficient while increasing MET and excise taxes in return. However no firm decisions were made as of the date of this report.

163