- •Contents

- •Foreword

- •Industry snapshot

- •Industry snapshot

- •Reserves

- •Oil output

- •Oil output

- •Gas output

- •Gas output

- •Refining

- •Refining

- •Upstream

- •Upstream

- •Oil output

- •Gas output

- •New wells

- •Well-stock management

- •Well productivity

- •Reserves

- •Reserves

- •Oil reserves

- •Gas reserves

- •Reserve replacement

- •Reserve replacement

- •Refining

- •Refining

- •Capacity, throughput, utilisation

- •Light products yield

- •Complexity

- •Complexity

- •Modernisation plans

- •Capex

- •Capex

- •Oil & gas sector capex

- •Crude exports

- •Crude exports

- •Crude exports by market, company and direction

- •Russian crude exports in the FSU context

- •Crude export proceeds

- •Refined products exports

- •Refined products exports

- •Analysis by product

- •Gas balance

- •Gas balance

- •Domestic sales

- •UGSS balance

- •Appendix I: Reserves classifications

- •Appendix I: Reserves classifications

- •Russian reserves definitions

- •Western reserves definitions

- •Appendix II: Pricing

- •Appendix II: Pricing

- •Monthly pricing trends

- •International crude oil pricing

- •Domestic crude oil pricing

- •Domestic product pricing

- •International gas pricing

- •Domestic gas pricing

- •Gas tariffs

- •Appendix III: Regulation and tax

- •Appendix III: Regulation and tax

- •Regulatory overview

- •Licensing

- •Environmental protection

- •Oil and product transportation

- •Transportation costs

- •Typical crude export route costs

- •Volume and price controls for gas

- •Tax regime

- •Mineral Extraction Tax (MET)

- •Crude-export duty

- •Excess profits tax

- •Specific taxes applied to natural gas

- •Taxation of offshore projects – special treatment

- •Appendix IV: Sanctions

- •Appendix IV: Sanctions

- •Summary

- •Appendix V: Who’s Who

- •Appendix V: Who’s Who

- •Key policymakers

- •Company heads

- •Disclosures appendix

vk.com/id446425943

International gas pricing

Following substantial renegotiations of European gas supply contracts during 2010-2015, Gazprom’s current portfolio is dominated by hybrid contracts, where the selling price is, on the one hand, still determined by the oil price link (with an average sixto nine-month lag), but on the other hand needs to fall within a rather narrow band (such as +/-5% for example) set by the relevant spot hub. We estimate that spot prices account for c. 80% in

Gazprom’s total gas sales in Europe, either as a result of direct gas sales on the spot market, or having a spot price component in the long-term contract.

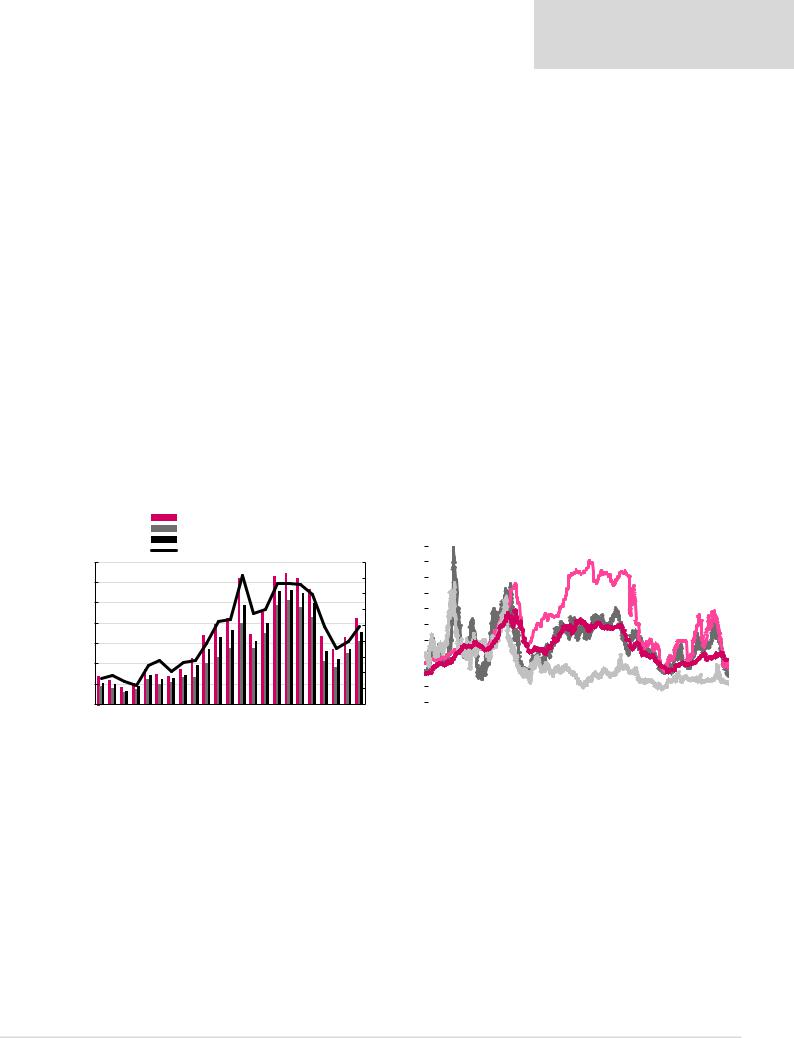

Figure 121 shows the historical relationship between the Brent price, Mediterranean quotes for heating oil (gas oil) and fuel oil, all with a lag of nine months, and the average non-FSU export price derived from Gazprom’s IFRS accounts. Figure 122 shows

Gazprom’s contract price (approximated by the German border price, BAFA) plotted against various spot market indicators. Both charts show a strong correlation – including in more recent years – suggesting that the overall correlation between the European spot natural gas price and the oil price has increased.

A stronger oil price and increased gas demand in 2018 lead to a 28% YoY increase in Asia LNG price to $9.8/mmbtu in 2018. UK’s NBP price grew 35% to $7.9/mmbtu, while Gazprom’s delivered price to the German border increased 17% YoY to $5.9/mmbtu. We note that prices have significantly deteriorated since the start of 2019, with the Asia LNG price down 50% YtD to $6.1/mmbtu on the back of increased LNG production globally. Warmer weather in Europe, combined with higher gas storage levels YoY, have caused a more sizable reduction in NPB price of 53% YtD to $5.4/mmbtu, while Gazprom’s delivered price to German border is down 10% to $5.8/mmbtu as of the date of this report.

Renaissance Capital

20 June 2019

Russian oil & gas

Hybrid contracts with spot price prevalent

Figure 121: Lagged oil and product prices ($/bl) vs the non-FSU gas export price Figure 122: European gas prices – Gazprom vs spot prices, $/mmbtu of Gazprom ($/mcm, rhs)

Heating Oil (LHS) |

|

|

Fuel Oil (LHS) |

|

|

Brent (LHS) |

20 |

|

Non-FSU Gas Export Price (RHS) |

||

|

140 |

450 |

18 |

|

120 |

400 |

16 |

|

|

|

||

100 |

350 |

14 |

|

300 |

12 |

||

|

|||

80 |

250 |

10 |

|

60 |

200 |

8 |

|

40 |

150 |

6 |

|

100 |

4 |

||

|

|||

20 |

50 |

2 |

|

|

|||

- |

- |

0 |

|

|

1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 |

|

Source: Bloomberg, Gazprom, Renaissance Capital

|

|

NBP |

|

LNG Asia |

|

|

|

||

|

|

Henry Hub |

|

Germany BAFA import price |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Bloomberg, Renaissance Capital

117