- •Contents

- •Foreword

- •Industry snapshot

- •Industry snapshot

- •Reserves

- •Oil output

- •Oil output

- •Gas output

- •Gas output

- •Refining

- •Refining

- •Upstream

- •Upstream

- •Oil output

- •Gas output

- •New wells

- •Well-stock management

- •Well productivity

- •Reserves

- •Reserves

- •Oil reserves

- •Gas reserves

- •Reserve replacement

- •Reserve replacement

- •Refining

- •Refining

- •Capacity, throughput, utilisation

- •Light products yield

- •Complexity

- •Complexity

- •Modernisation plans

- •Capex

- •Capex

- •Oil & gas sector capex

- •Crude exports

- •Crude exports

- •Crude exports by market, company and direction

- •Russian crude exports in the FSU context

- •Crude export proceeds

- •Refined products exports

- •Refined products exports

- •Analysis by product

- •Gas balance

- •Gas balance

- •Domestic sales

- •UGSS balance

- •Appendix I: Reserves classifications

- •Appendix I: Reserves classifications

- •Russian reserves definitions

- •Western reserves definitions

- •Appendix II: Pricing

- •Appendix II: Pricing

- •Monthly pricing trends

- •International crude oil pricing

- •Domestic crude oil pricing

- •Domestic product pricing

- •International gas pricing

- •Domestic gas pricing

- •Gas tariffs

- •Appendix III: Regulation and tax

- •Appendix III: Regulation and tax

- •Regulatory overview

- •Licensing

- •Environmental protection

- •Oil and product transportation

- •Transportation costs

- •Typical crude export route costs

- •Volume and price controls for gas

- •Tax regime

- •Mineral Extraction Tax (MET)

- •Crude-export duty

- •Excess profits tax

- •Specific taxes applied to natural gas

- •Taxation of offshore projects – special treatment

- •Appendix IV: Sanctions

- •Appendix IV: Sanctions

- •Summary

- •Appendix V: Who’s Who

- •Appendix V: Who’s Who

- •Key policymakers

- •Company heads

- •Disclosures appendix

vk.com/id446425943

Reserve replacement

Methodology

This section aims to compare the upstream performance of Russian oils with worldwide benchmarks. In order to achieve this aim, we have used IFRS data for the Russian companies, as well as the group of international oil super-majors (which includes ExxonMobil, BP, Royal Dutch Shell, Total and Chevron) and the two subsets of alternative global emerging market oil companies, namely Chinese oil companies (Petrochina, Sinopec and CNOOC) and Latin American oil companies (including Petrobras, Ecopetrol and YPF), as well as Sasol, which produces synthetic oil from its vast coal reserves in South Africa.

The information examined in this section has been compiled from supplemental disclosures about oiland gas-producing activities, in accordance with FASB ASC 032.

There are certain challenges in this work due to inconsistencies in historical reserves definitions, which generally follow the Petroleum Resources Management System (PRMS) – formerly, the Society of Petroleum Engineers (SPE) – for the Russian sample, vs the US Securities and Exchange Commission (SEC) definitions for the majors. However, in examining the economics of producing a barrel of oil equivalent, and fiveyear averages for this, the inconsistencies in reserves definitions, in our view, are not a significant problem. In addition, the PRMS standards, introduced in 2007, are much closer to the SEC than the historical SPE rules.

The super-major sample covers some 13.3mn boe/d of oil & gas production last year and 77.2bn boe of proved reserves at YE18. The Chinese sample covers some 6.5mn boe/d of production last year and 28.5bn boe of proved reserves at YE18. Finally, the LatAm sample covers some 3.5mn boe/d of production last year and 12.4bn boe of proved reserves at YE18. Sasol’s volumes are small at just 182kboe/d of output and 1.4bn boe of proved reserves at the end of its fiscal 2018.

The numbers for the 2018 Russian sample include Rosneft, LUKOIL, Gazprom Neft and NOVATEK, all of which have consistently reported IFRS figures for the five-year period (2014-2018) that contained FASB ASC 032 disclosures. Surgutneftegas abandoned US GAAP reporting after 2001, and its IFRS accounts (resumed in 2013) do not provide supplemental disclosure; while Tatneft stopped reporting this data from 2012. Our Russian sample for 2018 covers 9.6mn boe/d of production and YE18 proved reserves of 80.8bn boe.

Renaissance Capital

20 June 2019

Russian oil & gas

This section aims to compare the upstream performance of Russian oils with worldwide benchmarks…

…thanks to FASB ASC 032 disclosures

Russian sample includes Rosneft, LUKOIL, Gazprom Neft and NOVATEK

Per-barrel economics

Per-barrel economics

The common disclosures enable us to compare the upstream netback (wellhead price) with the oil price (we use Brent as a benchmark). Additionally, we can check, in unit terms, production costs, taxes other than on income, DD&A, exploration expenses and income taxes. Implicitly, we can also compare the unit (per boe produced) result of oil & gas activities, cash flow and capex.

Reserve replacement

For these calculations we define reserve replacement costs (RRC) as total costs incurred (on proved and unproved property acquisitions, and exploration and development costs), divided by the total oil equivalent reserve changes associated with discoveries and extensions, revisions in estimates, improved recovery and purchases of proved reserves.

Per-barrel comparative analysis provides insight

Reserves replacement performance

is a particularly valuable indicator...

37

vk.com/id446425943

Renaissance Capital

20 June 2019

Russian oil & gas

Reserve replacement ratios (RRR) are calculated by dividing a company’s production for the period into the total reserve changes used in the denominator for computing RRC, less the volumes sold during the period.

In a similar vein, finding and development costs (F&DC) per boe are defined as the total costs incurred, minus the costs of proved property acquisitions, divided by the total oil equivalent reserve changes for the period associated with discoveries and extensions, revisions in estimates and improved recoveries. Finding and development replacement ratios (F&DRR) are calculated by dividing the companies’ production for the period into the total reserve changes associated with discoveries and extensions, revisions in estimates and improved recoveries.

We note that single-year data on F&DC and RRC have shortcomings, reflecting the significant lag between outlays on capex, the purchase of prospective acreage and the discovery (or just booking) of reserves. Accordingly, we think five-year weighted-average results are much more meaningful.

Full-cycle cash flow

With the information garnered from the two exercises above, we can also compare the full-cycle cash flow for the Russian oils vs the selected international oil peer group. In order to make this as reliable as possible, we have used five-year per boe revenue, cash costs and reserve replacement costs.

On a production-weighted basis, international oil super-majors benefited from an average realised oil price of $41/bl in 2014-2018: Chinese oils saw an average of $49/bl, LatAm oils $51/bl and the Russian oils sample realised only $29/bl, affected by lower domestic crude prices in Russia. The netback at the wellhead is also much lower for the Russian companies than for the others. In 2014-2018, access to oil & gas markets cost the international super-majors an average of $23/boe, if one compares the difference between Brent and booked wellhead revenue. It cost the Chinese oils a somewhat lower $15/boe, similar to $13/bl for LatAm oil companies. For the Russian oils, this was a much higher $35/boe, primarily reflecting high export duties and transportation costs. Sasol’s average revenue for the period were $68.7/boe, the highest in the sample, due to low market access costs.

...enabling full-cycle cash flows to be compared

Five-year realised unit revenue in

Russia is low…

The production (lifting) costs of the Russian oils remain consistently below worldwide |

…but so are cash costs |

averages, with a 2014-2018 average of $4.1/boe, vs $11.6/boe for the super-majors, |

|

$13.0/boe for Chinese oils and $18.4/boe for LatAm oils. This advantage continues, with the |

|

Russian companies seeing costs of just $3.8/boe in the last reported year (2018), compared |

|

with $9.9/boe for the super-majors, $12.8/boe for Chinese oils, $20.2/boe for LatAm oils and |

|

$22.2/boe for Sasol. The Russian companies face very low depreciation charges ($4.2/boe |

|

in 2014-2018, vs $16.7/boe for the super-majors, $18.3/boe for Chinese oils, $10.8/boe for |

|

LatAm oils and $8.3/boe for Sasol). Low unit DD&A in Russia reflects their low capitalised |

|

costs per barrel of proved reserves, a ratio that is also shown in Figure 40. The Russian oils |

|

also benefit from very low exploration risk, as illustrated by exploration expenses in 2014- |

|

2018 of just $0.2/boe, vs $2.2/boe for the international oil super-majors, $2.7/boe for |

|

Chinese oils, $1.8/boe in LatAm and a similarly low $0.4/boe for Sasol. Most of the reserve |

|

replacement is still coming from the re-evaluation of existing fields in Russia, which |

|

significantly reduces exploration costs and risks. More expensive technology will be needed |

|

in Russian fields as the share of hard-to-recover reserves rises, but we think recovery rates |

|

could increase by enough to offset this in per-barrel terms. Income tax is not particularly |

|

onerous for Russian producers, either in unit terms, per boe produced or in tax-rate terms. |

|

This compensates for the significantly higher producer taxes paid by the Russian oils |

|

compared with other companies in our survey. |

|

38

vk.com/id446425943

Renaissance Capital

20 June 2019

Russian oil & gas

In all, the average profit of oil & gas operations for the Russian oils in 2014-2018 was $6.1/boe, vs $6.9/boe for the super-majors, $7.5/boe for Chinese oils, $9.2/boe for LatAm oils and a high of $11.8/boe for Sasol, which benefits from having no production-related taxes in South Africa. Results for 2018 reveal the Russian companies achieving $9.0/boe in profit, compared with $12.9/boe for the super-majors, $11.7/boe for the Chinese oils $12.4/boe for LatAm producers and $8.9/boe for Sasol. This shows the lack of gearing to the oil price for the Russian upstream producers, due to the tax regime leaving so little upside on the table. However, this dynamic should change from 2019 following the completion of the tax manoeuvre and higher resulting domestic oil prices.

Overall, sub-par unit profit and operating cash flow, but we expect a change from 2019

39

vk.com/id446425943

Renaissance Capital

20 June 2019

Russian oil & gas

Figure 40: Upstream performance – a global perspective, $mn (unless otherwise stated)

|

International super-majors |

|

Chinese oils |

|

|

LatAm oils |

|

|

Sasol |

|

|

Russian oils |

|

|||||||

|

2016 |

2017 |

2018 |

5-Year |

2016 |

2017 |

2018 |

5-Year |

2016 |

2017 |

2018 |

5-Year |

2016 |

2017 |

2018 |

5-Year |

2016 |

2017 |

2018 |

5-Year |

Production (kboe/d) |

12,435 |

12,765 |

13,274 |

- |

6,363 |

6,368 |

6,480 |

- |

3,732 |

3,692 |

3,523 |

- |

209 |

181 |

182 |

- |

9,099 |

9,363 |

9,553 |

- |

Proved reserves (mn boe) |

72,140 |

73,172 |

77,229 |

- |

27,703 |

28,324 |

28,509 |

- |

12,383 |

12,340 |

12,413 |

- |

1,217 |

1,197 |

1,407 |

- |

78,916 |

80,725 |

80,878 |

- |

Reserve life (years) |

15.9 |

15.7 |

15.9 |

- |

11.9 |

12.2 |

12.1 |

- |

9.1 |

9.2 |

9.7 |

- |

15.9 |

18.1 |

21.1 |

- |

23.7 |

23.6 |

23.1 |

- |

Revenues |

130,491 |

168,687 |

219,384 |

924,546 |

79,687 |

97,457 |

124,391 |

572,151 |

50,910 |

61,787 |

76,958 |

344,528 |

2,597 |

2,926 |

3,461 |

19,333 |

70,477 |

94,892 |

127,147 |

487,609 |

Production costs |

(49,685) |

(46,028) |

(48,160) |

(259,416) |

(27,874) |

(28,217) |

(30,242) |

(152,033) |

(21,150) |

(23,680) |

(26,002) |

(123,646) |

(1,450) |

(1,430) |

(1,740) |

(7,973) |

(12,174) |

(13,875) |

(13,370) |

(69,581) |

Taxes other than on income |

(11,554) |

(14,705) |

(20,649) |

(76,560) |

(4,608) |

(5,938) |

(8,982) |

(55,316) |

(5,938) |

(9,045) |

(12,086) |

(51,008) |

- |

- |

- |

- |

(27,953) |

(45,936) |

(63,404) (227,356) |

|

Exploration expense |

(7,563) |

(7,511) |

(6,224) |

(49,621) |

(5,561) |

(6,198) |

(6,413) |

(31,604) |

(2,214) |

(1,401) |

(1,178) |

(12,029) |

(16) |

(21) |

(34) |

(131) |

(382) |

(517) |

(446) |

(3,684) |

DD&A |

(76,083) |

(77,001) |

(68,716) |

(373,921) |

(45,408) |

(46,131) |

(41,526) |

(214,623) |

(17,426) |

(14,373) |

(13,248) |

(72,161) |

(579) |

(597) |

(573) |

(2,981) |

(10,728) |

(14,295) |

(14,987) |

(70,756) |

EBT |

(14,394) |

23,442 |

75,635 |

165,028 |

(3,763) |

10,974 |

37,229 |

118,576 |

4,181 |

13,288 |

24,446 |

85,684 |

552 |

878 |

1,114 |

8,248 |

19,240 |

20,269 |

34,939 |

116,231 |

Income taxes |

2,086 |

(5,905) |

(37,203) |

(94,598) |

(124) |

(4,155) |

(8,735) |

(29,818) |

(518) |

(4,841) |

(8,559) |

(24,331) |

(112) |

(178) |

(229) |

(2,287) |

(3,632) |

(4,107) |

(7,054) |

(22,604) |

Result of operations |

(7,928) |

36,921 |

62,241 |

153,722 |

(4,147) |

7,088 |

27,557 |

88,041 |

3,710 |

8,600 |

15,937 |

61,652 |

(247) |

726 |

593 |

4,241 |

16,986 |

18,095 |

31,456 |

102,995 |

Cash flow |

75,718 |

121,433 |

137,181 |

577,264 |

46,822 |

59,417 |

75,496 |

334,267 |

23,350 |

24,374 |

30,362 |

145,842 |

348 |

1,344 |

1,200 |

7,353 |

28,096 |

32,906 |

46,889 |

177,435 |

Capex |

132,113 |

92,179 |

108,496 |

611,114 |

33,601 |

38,867 |

46,015 |

235,636 |

19,463 |

18,658 |

16,504 |

121,188 |

879 |

362 |

434 |

3,641 |

32,755 |

35,043 |

28,507 |

152,941 |

of which F&D |

114,231 |

57,024 |

61,818 |

475,694 |

32,884 |

37,963 |

45,010 |

227,070 |

18,830 |

17,192 |

15,373 |

115,477 |

878 |

362 |

382 |

3,511 |

20,270 |

27,807 |

26,207 |

124,150 |

Revenues ($/boe) |

28.75 |

36.20 |

45.28 |

41.25 |

34.31 |

41.93 |

52.59 |

48.75 |

37.37 |

45.86 |

59.84 |

51.31 |

33.90 |

44.27 |

51.89 |

53.84 |

21.16 |

27.69 |

36.37 |

29.09 |

Production costs ($/boe) |

-10.95 |

-9.88 |

-9.94 |

-11.58 |

-12.00 |

-12.14 |

-12.79 |

-12.96 |

-15.53 |

-17.57 |

-20.22 |

-18.42 |

-18.93 |

-21.64 |

-26.09 |

-22.20 |

-3.66 |

-4.05 |

-3.82 |

-4.15 |

Taxes other than on income ($/boe) |

-2.55 |

-3.16 |

-4.26 |

-3.42 |

-1.98 |

-2.55 |

-3.80 |

-4.71 |

-4.36 |

-6.71 |

-9.40 |

-7.60 |

0.00 |

0.00 |

0.00 |

0.00 |

-8.39 |

-13.40 |

-18.13 |

-13.56 |

Exploration expense ($/boe) |

-1.67 |

-1.61 |

-1.28 |

-2.21 |

-2.39 |

-2.67 |

-2.71 |

-2.69 |

-1.63 |

-1.04 |

-0.92 |

-1.79 |

-0.20 |

-0.32 |

-0.50 |

-0.36 |

-0.11 |

-0.15 |

-0.13 |

-0.22 |

DD&A ($/boe) |

-16.76 |

-16.53 |

-14.18 |

-16.68 |

-19.55 |

-19.85 |

-17.56 |

-18.29 |

-12.79 |

-10.67 |

-10.30 |

-10.75 |

-7.56 |

-9.03 |

-8.59 |

-8.30 |

-3.22 |

-4.17 |

-4.29 |

-4.22 |

EBT ($/boe) |

-3.17 |

5.03 |

15.61 |

7.36 |

-1.62 |

4.72 |

15.74 |

10.10 |

3.07 |

9.86 |

19.01 |

12.76 |

7.21 |

13.28 |

16.71 |

22.97 |

5.78 |

5.91 |

9.99 |

6.93 |

Income taxes ($/boe) |

0.46 |

-1.27 |

-7.68 |

-4.22 |

-0.05 |

-1.79 |

-3.69 |

-2.54 |

-0.38 |

-3.59 |

-6.66 |

-3.62 |

-1.46 |

-2.69 |

-3.43 |

-6.37 |

-1.09 |

-1.20 |

-2.02 |

-1.35 |

Result of operations ($/boe) |

-1.75 |

7.92 |

12.85 |

6.86 |

-1.79 |

3.05 |

11.65 |

7.50 |

2.72 |

6.38 |

12.39 |

9.18 |

-3.23 |

10.99 |

8.89 |

11.81 |

5.10 |

5.28 |

9.00 |

6.14 |

Cash flow ($/boe) |

16.68 |

26.06 |

28.31 |

25.76 |

20.16 |

25.56 |

31.92 |

28.48 |

17.14 |

18.09 |

23.61 |

21.72 |

4.54 |

20.34 |

17.98 |

20.48 |

8.44 |

9.60 |

13.41 |

10.58 |

Capex ($/boe) |

29.11 |

19.78 |

22.39 |

27.27 |

14.47 |

16.72 |

19.45 |

20.08 |

14.29 |

13.85 |

12.83 |

18.05 |

11.51 |

5.49 |

6.53 |

10.14 |

9.86 |

10.25 |

8.18 |

9.12 |

of which F&D ($/boe) |

25.17 |

12.24 |

12.76 |

21.23 |

14.16 |

16.33 |

19.03 |

19.35 |

13.82 |

12.76 |

11.95 |

17.20 |

11.46 |

5.47 |

5.73 |

9.78 |

6.09 |

8.11 |

7.50 |

7.41 |

Capitalised costs/proved reserves ($/boe) |

10.90 |

10.59 |

10.12 |

- |

9.45 |

9.16 |

8.50 |

- |

12.36 |

12.46 |

11.60 |

- |

4.46 |

5.17 |

4.51 |

- |

2.09 |

2.38 |

2.15 |

- |

Source: Company data, Renaissance Capital

40

vk.com/id446425943

Renaissance Capital

20 June 2019

Russian oil & gas

Figure 41: Reserve replacement – a global perspective, $/boe (unless otherwise stated)

|

|

International super-majors |

|

|

Chinese oils |

|

|

LatAm oils |

|

|

Sasol |

|

|

Russian oils |

|

|||||

|

2016 |

2017 |

2018 |

5-Year |

2016 |

2017 |

2018 |

5-Year |

2016 |

2017 |

2018 |

5-Year |

2016 |

2017 |

2018 |

5-Year |

2016 |

2017 |

2018 |

5-Year |

RRC ($/boe) |

81.9 |

10.4 |

9.2 |

21.0 |

141.0 |

13.1 |

17.6 |

26.8 |

60.4 |

14.3 |

9.6 |

32.6 |

- |

8.1 |

1.6 |

4.7 |

5.4 |

6.5 |

6.0 |

6.7 |

RRR (%) |

35.5 |

190.5 |

243.3 |

129.9 |

10.3 |

127.6 |

110.5 |

74.9 |

23.7 |

97.1 |

133.8 |

55.4 |

(3.0) |

67.6 |

415.6 |

217.9 |

183.2 |

158.5 |

135.6 |

136.0 |

F&D ($/boe) |

- |

7.9 |

6.2 |

21.4 |

138.1 |

12.8 |

18.6 |

26.4 |

68.5 |

13.2 |

8.9 |

32.4 |

- |

8.1 |

1.4 |

4.5 |

5.5 |

7.8 |

6.4 |

7.0 |

F&DRR (%) |

(27.8) |

155.3 |

205.8 |

99.0 |

10.3 |

127.5 |

102.4 |

73.3 |

20.2 |

96.7 |

133.8 |

53.1 |

(3.0) |

67.6 |

415.6 |

217.9 |

111.5 |

103.8 |

117.0 |

106.0 |

Acquisition ($/boe) |

1.8 |

10.5 |

17.0 |

9.1 |

- |

- |

0.2 |

18.9 |

5.1 |

194.7 |

- |

23.4 |

- |

- |

- |

- |

4.3 |

3.0 |

0.8 |

3.6 |

Note: RRC = Reserves Replacement Costs, RRR = Reserves Replacement Rate, F&DC = Finding and Development Costs, F&DRR = Finding and Development Replacement Rate.

Source: Company data, Renaissance Capital

Figure 42: Measure of discounted future net cash flows, $/boe

|

International super-majors |

|

Chinese oils |

|

|

LatAm oils |

|

|

Sasol |

|

|

Russian oils |

|

||

|

2016 |

2017 |

2018 |

2016 |

2017 |

2018 |

2016 |

2017 |

2018 |

2016 |

2017 |

2018 |

2016 |

2017 |

2018 |

Future cash inflows |

18.8 |

24.4 |

32.5 |

33.1 |

39.7 |

46.1 |

36.4 |

43.5 |

59.2 |

37.1 |

44.7 |

37.4 |

22.4 |

24.6 |

38.4 |

Future production and development costs |

(13.2) |

(13.6) |

(16.2) |

(17.9) |

(19.9) |

(21.2) |

(25.1) |

(25.7) |

(29.9) |

(30.5) |

(37.8) |

(31.5) |

(13.8) |

(15.8) |

(26.1) |

Future income tax expenses |

(2.2) |

(4.3) |

(6.4) |

(2.7) |

(3.7) |

(5.1) |

(4.3) |

(5.8) |

(10.3) |

(2.4) |

(2.8) |

(2.4) |

(1.4) |

(1.4) |

(2.8) |

Future net cash flows |

3.4 |

6.4 |

9.8 |

12.5 |

16.2 |

19.8 |

7.0 |

12.0 |

19.0 |

4.2 |

4.1 |

3.5 |

7.2 |

7.3 |

9.4 |

Discounting effects |

(1.4) |

(2.8) |

(4.3) |

(6.3) |

(8.1) |

(9.2) |

(2.7) |

(5.0) |

(7.2) |

(2.5) |

(2.7) |

(2.3) |

(4.5) |

(4.5) |

(5.7) |

Associates |

0.9 |

1.3 |

1.7 |

0.2 |

0.2 |

0.3 |

0.0 |

0.1 |

0.2 |

- |

- |

- |

0.1 |

0.1 |

0.2 |

Minorities' share |

(0.0) |

(0.1) |

(0.1) |

(0.0) |

(0.0) |

(0.0) |

- |

- |

- |

- |

- |

- |

(0.1) |

(0.2) |

(0.2) |

Discounted future net cash flows |

3.0 |

4.9 |

7.1 |

6.4 |

8.3 |

11.0 |

4.4 |

7.1 |

11.9 |

1.6 |

1.5 |

1.2 |

2.7 |

2.8 |

3.7 |

Source: Company data, Renaissance Capital

41

vk.com/id446425943

Renaissance Capital 20 June 2019

Russian oil & gas

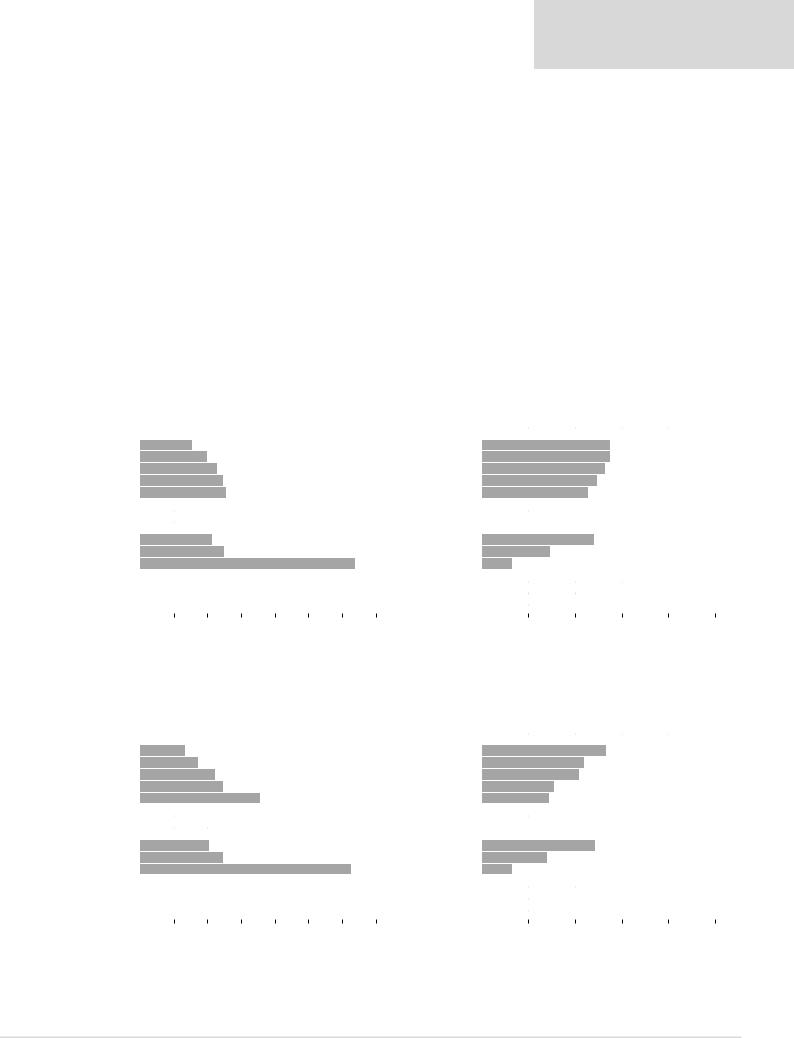

Upstream performance – RRC

Figure 41 shows selective reserves replacement data for the Russian oils as a whole and their international peers, while Figures 43-46 illustrate individual company performances. In 2014-2018, the Russian oils in the sample delivered an RRC of $6.7/boe, compared with $21.0/boe for the super-majors, $26.8/boe for Chinese oils, $32.6/boe for LatAm oils, and $4.7/boe for Sasol. The RRR was 136% for the Russian oils, 130% for the supermajors, 75% for Chinese oils, just 55% for LatAm oils and 218% for Sasol. We attribute the cost advantage of Russian companies to relatively favourable geological conditions (most of the reserves are still being added onshore) and de facto regulated access to reserve acquisitions, with limited competition domestically and almost none from outside. Sasol benefits from 37 years of 2P coal reserves and low development costs for coal, which it uses for the production of synthetic oil.

However, the long reserve lives and acquisition opportunities (particularly in the case of Rosneft) have meant more modest drill-bit reserve replacement ratios. Specifically, the Russian oils had an F&DRR of 106% in 2014-2018, compared with 99% for the international oil super-majors, 73% for Chinese oils, 53% for LatAm oils and 218% for Sasol.

High reserves replacement at low costs – a major competitive advantage

Figure 43: RRC, 2014-2018, $/boe |

|

|

|

|

|

|

|

|

|

|

|

|

Figure 44: RRR, 2014-2018, $/boe |

|

|

|

|

|

|

|

|

|

|

||||||||||

Sasol |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sasol |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

ExxonMobil |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RoyalDutchShell |

|

|

|

|

|

|

|

|

|

|

|

|

|

Chevron |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chevron |

|

|

|

|

|

|

|

|

|

|

|

|

|

RoyalDutchShell |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ExxonMobil |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

BP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BP |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ecopetrol |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YPF |

|

|

|

|

|

|

|

|

|

|

|

|

|

YPF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ecopetrol |

|

|

|

|

|

|

|

|

|

|

|

|

|

Petrobras |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petrobras |

|

|

|

|

|

|

|

|

|

|

|

|

|

CNOOC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CNOOC |

|

|

|

|

|

|

|

|

|

|

|

|

|

Petrochina |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petrochina |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sinopec |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sinopec |

|

|

|

|

|

|

|

|

|

|

|

|

|

NOVATEK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOVATEK |

|

|

|

|

|

|

|

|

|

|

|

|

|

Rosneft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rosneft |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gazprom Neft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gazprom Neft |

|

|

|

|

|

|

|

|

|

|

|

|

|

LUKOIL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LUKOIL |

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

10 |

|

|

20 |

30 |

40 |

50 |

60 |

70 |

- |

50 |

100 |

150 |

200 |

250 |

||||||||||||||||||

Note: We define reserve replacement costs (RRC) as total costs incurred (on proved and unproved property acquisitions, and exploration and development costs), divided by the total oil equivalent reserve changes associated with discoveries and extensions, revisions in estimates, improved recovery and purchases of proved reserves.

Source: Company data, Renaissance Capital

Note: Reserves replacement ratios (RRR) are calculated by dividing a company’s production for the period into the total reserves changes used in the denominator for computing RRC, less the volumes sold during the period.

Source: Company data, Renaissance Capital

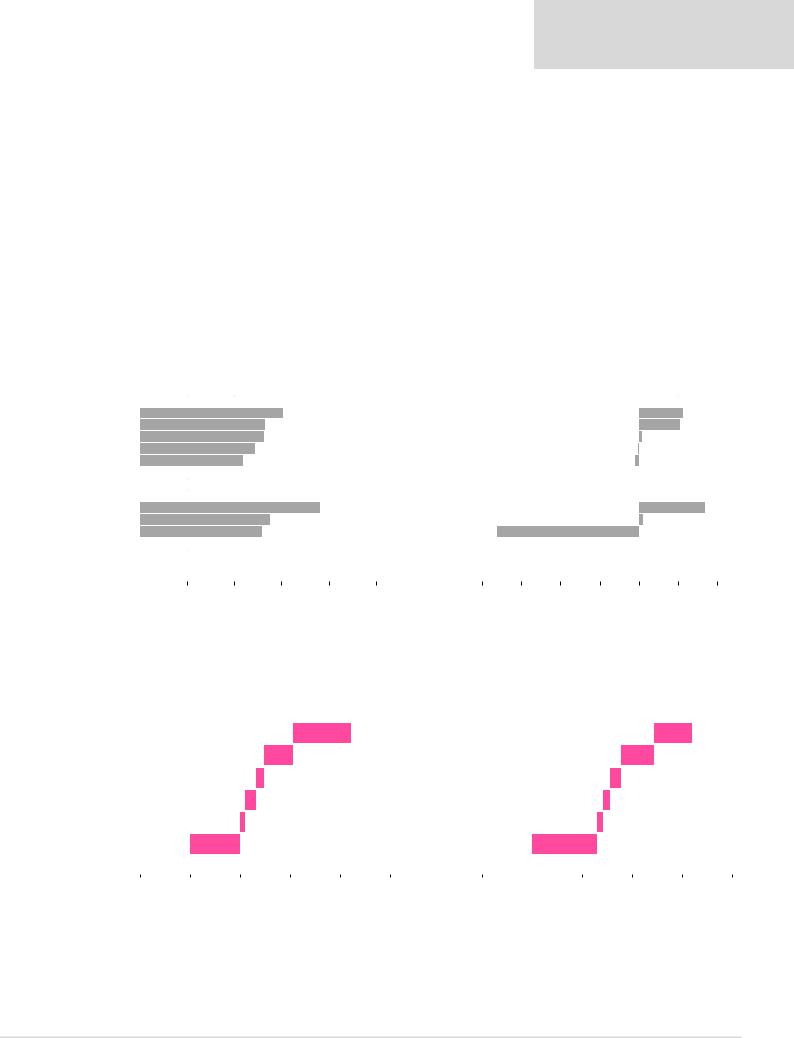

Figure 45: F&DC, 2014-2018, $/boe |

|

|

|

|

|

|

|

|

|

|

|

|

Figure 46: F&DRR, 2014-2018, $/boe |

|

|

|

|

|

|

|

|

|

|

|||||||||||

Sasol |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sasol |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

ExxonMobil |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chevron |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chevron |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ExxonMobil |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RoyalDutchShell |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RoyalDutchShell |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ecopetrol |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YPF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YPF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ecopetrol |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petrobras |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petrobras |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CNOOC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CNOOC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petrochina |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petrochina |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sinopec |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sinopec |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOVATEK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rosneft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rosneft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gazprom Neft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gazprom Neft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOVATEK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LUKOIL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LUKOIL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

10 |

|

|

20 |

30 |

40 |

50 |

60 |

70 |

- |

50 |

|

100 |

150 |

200 |

250 |

||||||||||||||||||

Note: Finding and development costs (F&DC) per boe are defined as the total costs incurred, minus the costs of proved property acquisitions, divided by the total oil equivalent reserve changes for the period associated with discoveries and extensions, revisions in estimates, and improved recoveries.

Source: Company data, Renaissance Capital

Note: Finding and development replacement ratios (F&DRR) are calculated by dividing the companies’ production for the period into the total reserve changes associated with discoveries and extensions, revisions in estimates, and improved recoveries.

Source: Company data, Renaissance Capital

42

vk.com/id446425943

Renaissance Capital 20 June 2019

Russian oil & gas

Full-cycle cash flow

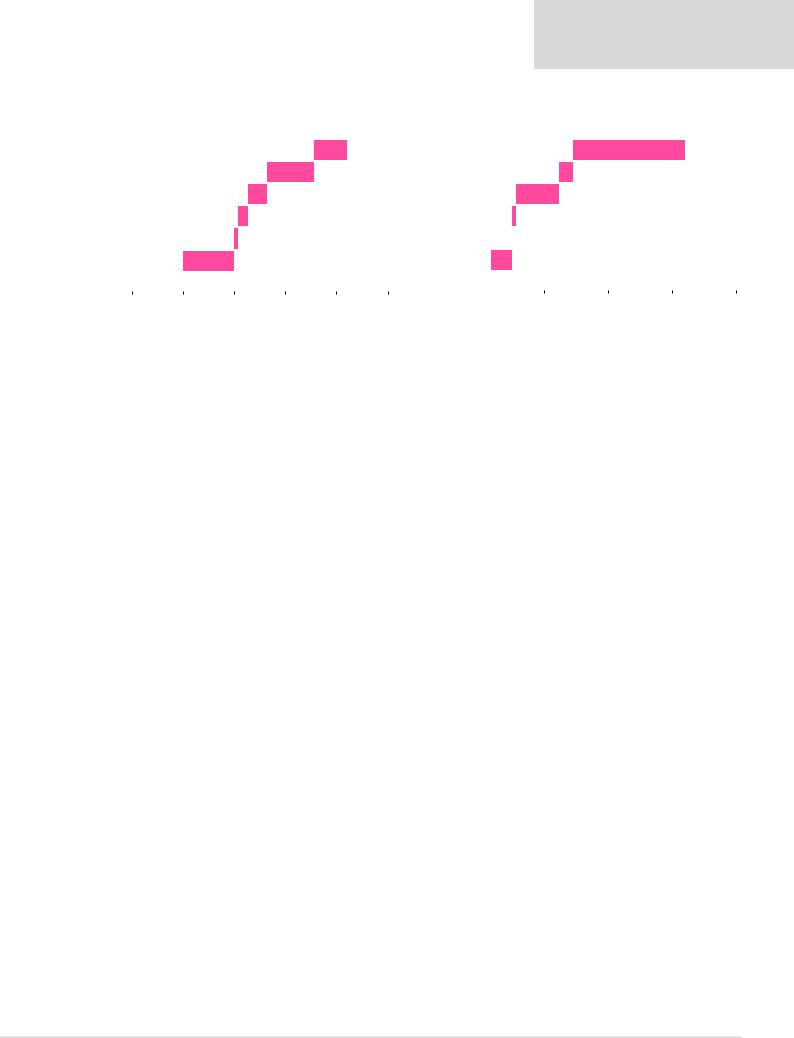

Below we illustrate the competitive full-cycle cash flow that the Russian oils benefit from. Figures 47-48 show this on a company-by-company basis. Over five years, the Russian oils have displayed unit profitability inferior to that of the super-majors. Lower DD&A and exploration expenses also mean lower unit cash flows from operations ($10.6/boe for 2014-2018, vs $25.8/boe for the international oil super-majors, $28.5/boe for Chinese oils, $21.7/boe for LatAm oils and $20.5/boe for Sasol, as detailed on a company-by-company basis in Figure 47). However, the Russian oils are helped by their remarkably low RRC. This remains the crux of the matter, in our view, with no significant change to this pattern over the years. After the cost of replacing a barrel is taken into consideration, the Russian oils generated FCF of $3.1/boe in 2014-2018 (Figure 52). This result is much higher compared with -$-1.2/boe attributable to the international oil super-majors, $-1.0/boe for Chinese oils and -$-12.7/boe for LatAm oils (this is driven by very high average RRC due to Petrobras’s reserves writedown in 2015). At the same time, the Russian result is dwarfed by Sasol’s $15.8/boe for Sasol, which benefits from both lack of production taxes and low RRC.

Superior full-cycle cash flow due to low RRC

Figure 47: Company universe full-cycle upstream CFFO, 2014-2018, $/boe |

|

|

Figure 48: Company universe full-cycle upstream FCF, 2014-2018, $/boe |

|

|

||||||||||||||||||||||||

Sasol |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sasol |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Chevron |

|

|

|

|

|

|

|

|

|

|

|

|

|

ExxonMobil |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ExxonMobil |

|

|

|

|

|

|

|

|

|

|

|

|

|

Chevron |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BP |

|

|

|

|

|

|

|

|

|

|

|

|

|

BP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RoyalDutchShell |

|

|

|

|

|

|

|

|

|

|

|

|

|

RoyalDutchShell |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petrobras |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ecopetrol |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ecopetrol |

|

|

|

|

|

|

|

|

|

|

|

|

|

YPF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YPF |

|

|

|

|

|

|

|

|

|

|

|

|

|

Petrobras |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CNOOC |

|

|

|

|

|

|

|

|

|

|

|

|

|

CNOOC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sinopec |

|

|

|

|

|

|

|

|

|

|

|

|

|

Petrochina |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petrochina |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sinopec |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LUKOIL |

|

|

|

|

|

|

|

|

|

|

|

|

|

NOVATEK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gazprom Neft |

|

|

|

|

|

|

|

|

|

|

|

|

|

Rosneft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rosneft |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gazprom Neft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOVATEK |

|

|

|

|

|

|

|

|

|

|

|

|

|

LUKOIL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

10 |

20 |

30 |

40 |

50 |

(40) |

(30) |

(20) |

(10) |

- |

10 |

20 |

|||||||||||||||||

Note: Cash flow from operations (CFFO) is defined as the result of oiland gas-producing operations (including associates) plus DD&A, plus exploration expenses.

Source: Company data, Renaissance Capital

Note: Free cash flow (FCF) is defined as the result of oiland gas-producing operations (including associates) plus DD&A, plus exploration expenses, less reserve replacement costs.

Source: Company data, Renaissance Capital

Figure 49: Full-cycle upstream FCF 2014-2018, super-majors, $/boe |

|

|

|

|

Figure 50: Full-cycle upstream FCF 2014-2018, Chinese oils, $/boe |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated Brent |

|

|

|

|

|

|

|

|

|

|

Dated Brent |

|

|

|

|

|

|

|

|

|

|

|

Netback costs |

|

|

|

|

|

|

|

|

|

|

Netback costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Production costs |

|

|

|

|

|

|

|

|

|

|

Production costs |

|

|

|

|

|

|

|

|

|

|

|

Production taxes |

|

|

|

|

|

|

|

|

|

|

Production taxes |

|

|

|

|

|

|

|

|

|

|

|

Income taxes |

|

|

|

|

|

|

|

|

|

|

Income taxes |

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

RRC |

|

|

|

|

|

|

|

|

|

|

RRC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Free cash flow |

|

|

|

|

|

|

|

|

|

|

Free cash flow |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(20) |

- |

20 |

40 |

60 |

80 |

(20) |

- |

|

20 |

40 |

60 |

80 |

||||||||||

Note: Super-majors include BP, Chevron, ExxonMobil, Royal Dutch Shell and Total. |

|

|

|

|

Note: Chinese oils include CNOOC, Petrochina and Sinopec. |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

Source: Company data, Renaissance Capital |

|

|

|

|

|

|

Source: Company data, Renaissance Capital |

||||||||||

43

vk.com/id446425943

Renaissance Capital 20 June 2019

Russian oil & gas

Figure 51: Full-cycle upstream FCF 2014-2018, LatAm oils, $/boe |

|

|

|

|

Figure 52: Full-cycle upstream FCF 2014-2018, Russian oils, $/boe |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Dated Brent |

|

|

|

|

|

|

|

|

|

|

Dated Brent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Netback costs |

|

|

|

|

|

|

|

|

|

|

|

Netback costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Production costs |

|

|

|

|

|

|

|

|

|

|

|

Production costs |

|

|

|

|

|

|

|

|

|

Production taxes |

|

|

|

|

|

|

|

|

|

|

|

Production taxes |

|

|

|

|

|

|

|

|

|

Income taxes |

|

|

|

|

|

|

|

|

|

|

|

Income taxes |

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

RRC |

|

|

|

|

|

|

|

|

|

|

|

RRC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Free cash flow |

|

|

|

|

|

|

|

|

|

|

|

Free cash flow |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(20) |

- |

|

20 |

40 |

60 |

80 |

- |

20 |

40 |

60 |

80 |

||||||||||

Note: LatAm oils include Petrobras, Ecopetrol and YPF |

|

|

|

|

|

|

|

|

Note: Russian oils include Rosneft, LUKOIL, Gazprom Neft and NOVATEK |

|

|

|

|

||||||||

|

|

|

|

|

|

Source: Company data, Renaissance Capital |

|

|

|

|

|

Source: Company data, Renaissance Capital |

|||||||||

44