- •THE BANK OF THE FUTURE

- •The ABCs of Digital Disruption in Finance

- •Contents

- •The Bank of the Future

- •A is for Artificial Intelligence and Automation

- •B Is for BigTech, Especially in Asia and Emerging Markets

- •C Is for Core Banking, Cloud, and Challengers

- •Where in the World?

- •Disruption by Product and Geography

- •Re-imaging versus Re-engineering Finance

- •Bank of the Future

- •Interview with Exponential View: Azeem Azhar

- •About Azeem Azhar

- •Evolution of AI – Why Now?

- •Industrialization of AI – Spending and Investing More

- •Banking & Securities Is the Largest Non-Tech Industry for AI

- •Interview with Citi Ventures: Ramneek Gupta

- •About Citi Ventures

- •About Ramneek Gupta

- •AI-driven Applications in Banking

- •Use Cases in Consumer Banking

- •Interview with Active.Ai: Ravi Shankar

- •About Active.AI

- •About Ravi Shankar

- •Use Cases in Commercial Banking

- •Use Cases in Capital Markets Banking

- •Interview with Behavox: Erkin Adylov

- •About Behavox

- •About Erkin Adylov

- •AI Enables FTE Reduction, Optimizes Distribution

- •Chinese BigTech and Financial Services

- •[A] Ant Financial Builds an Empire of Services

- •[B] Tencent's WeChat Is China's App for Everything

- •Interview with Kapronasia: Zennon Kapron

- •About Kapronasia

- •About Zennon Kapron

- •China and India on Different FinTech Paths

- •India on the Frontline of Digital Finance

- •India's Transformation Towards Digital

- •Google's m-wallet (Tez) Sees Early Success

- •New RBI Directive Could Threaten Digital Payments

- •About Aditya Menon

- •GAFAs at the Gate with PSD2; But Do Bank Clients Care?

- •What is PSD2?

- •The New Banking Model under PSD2

- •U.K.'s Open Banking Standard

- •Impact of PSD 2/Open Banking on Banks – Risk of Disintermediation?

- •Chapter C: Core Banking, Cloud and Challengers

- •Challenge of Legacy Core Banking Systems

- •Banks Face Multiple Pain Points

- •Do Banks Need To Update Core Systems?

- •IT Change: Incumbents, Neobanks and Vendors’ Views

- •[A] The Incumbent Banks’ View

- •[B] The Neobanks’ View

- •Case Study: Leveris Banking Core

- •Journey to the Cloud

- •Cloud Ecosystem – The Vision for Hardware, Applications and Data

- •There Are Many Different Ways to Move Applications to the Cloud…

- •Some Application Workloads Are Easier to Move to Cloud than Others

- •And Core Banking Applications Are the Hardest to Address

- •Interview with Ping An: Jonathan Larsen

- •About Jonathan Larsen

- •Chapter D: Digital Assets

- •Bitcoin, Blockchain and All Things Crypto

- •Internet vs. Blockchain Financial Value Capture

- •2017: The Year of Crypto

- •Who is Buying Bitcoins?

- •2018: The Year of Second-Layer Protocols?

- •About PwC – FinTech and RegTech Team

- •About Henri Arslanian

- •Blockchain Applications

- •A.] The Power of Smart Contracts

- •B.] KYC-Chain and Digital Identity

- •C.] Reg-Tech

- •D.] ICOs – A Risky New Paradigm?

- •Regulatory approach to ICOs differ significantly across countries

- •Regulatory Approaches to Bitcoin

- •About King & Wood Mallesons

- •About Urszula McCormack

- •What is Ripple? How is it Different?

- •Ripple XRP – The Cryptocurrency

- •Banks and the Ripple Protocol

- •How Are Central Bank Cryptocurrencies Different

- •What Are Central Bankers Saying on CBCCs?

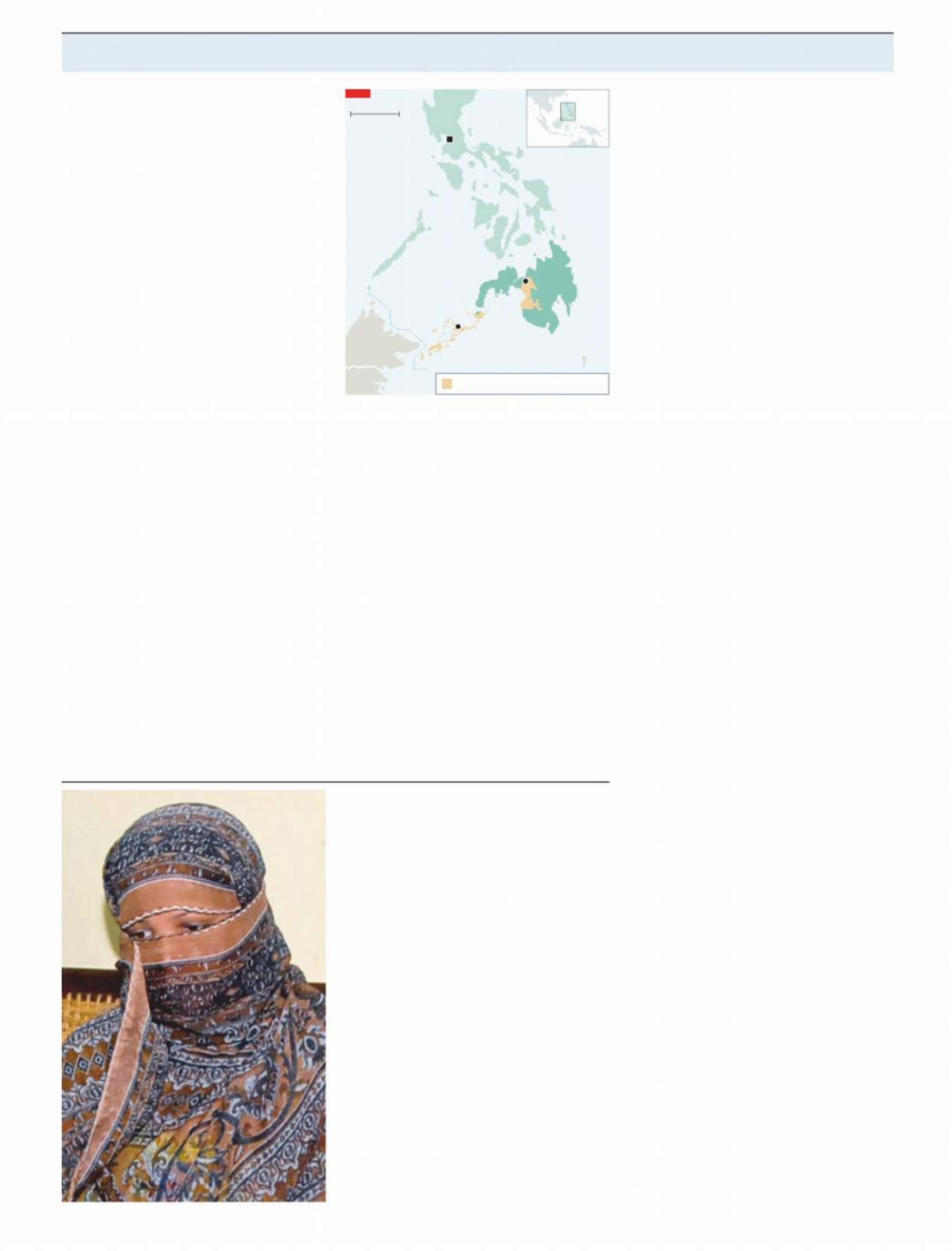

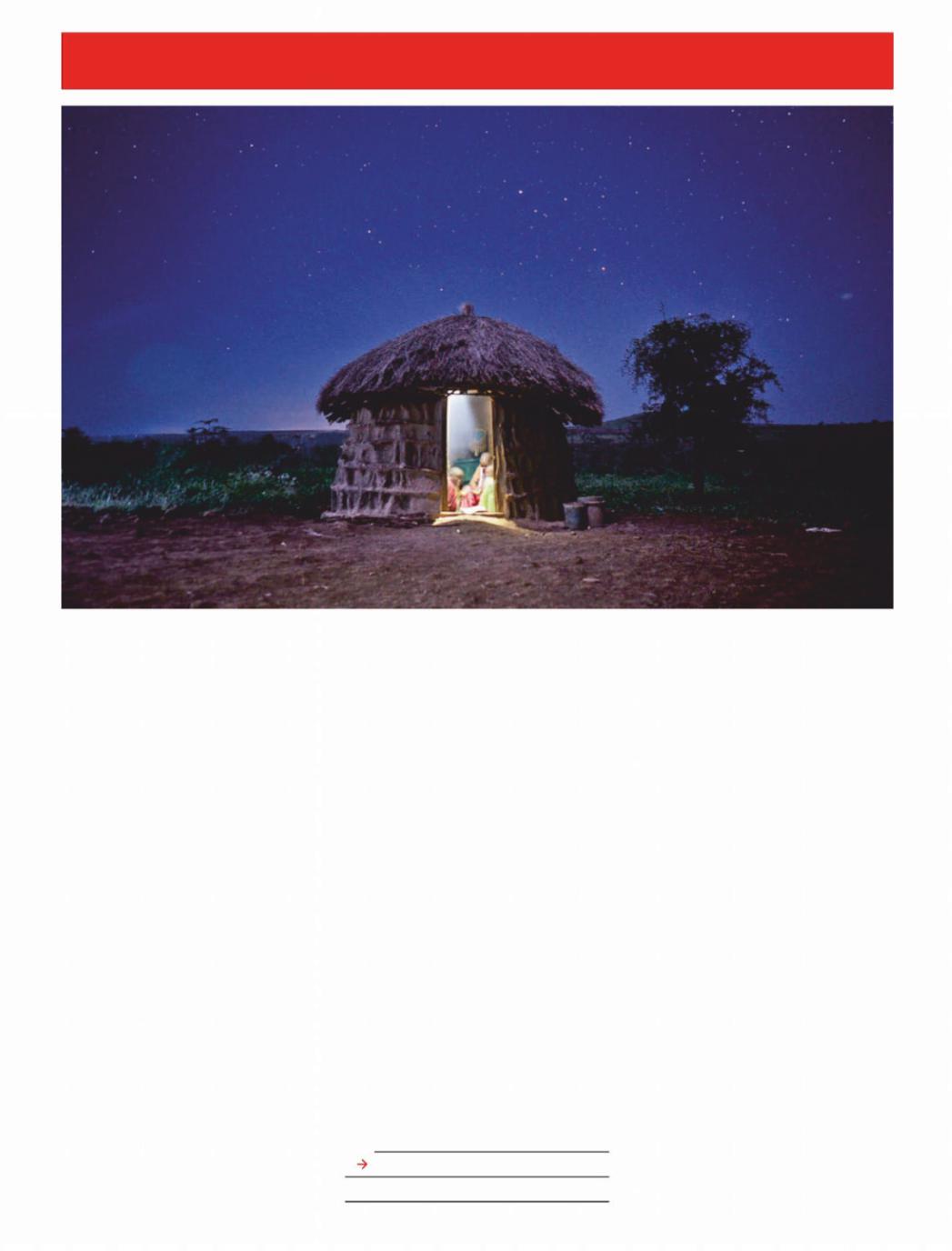

- •Epilogue: Emerging Market BRATs beyond China and India

- •Introducing the BRATs

- •A.] Share Unique Banking Sector Characteristics

- •B.] Favorable Demographics

- •C.] Technology Enablers

- •FinTech Investments Trends

- •About Vostok Emerging Finance

- •About David Nangle

- •NOW / NEXT

- •Contents

- •Investment summary

- •Reporting schedule

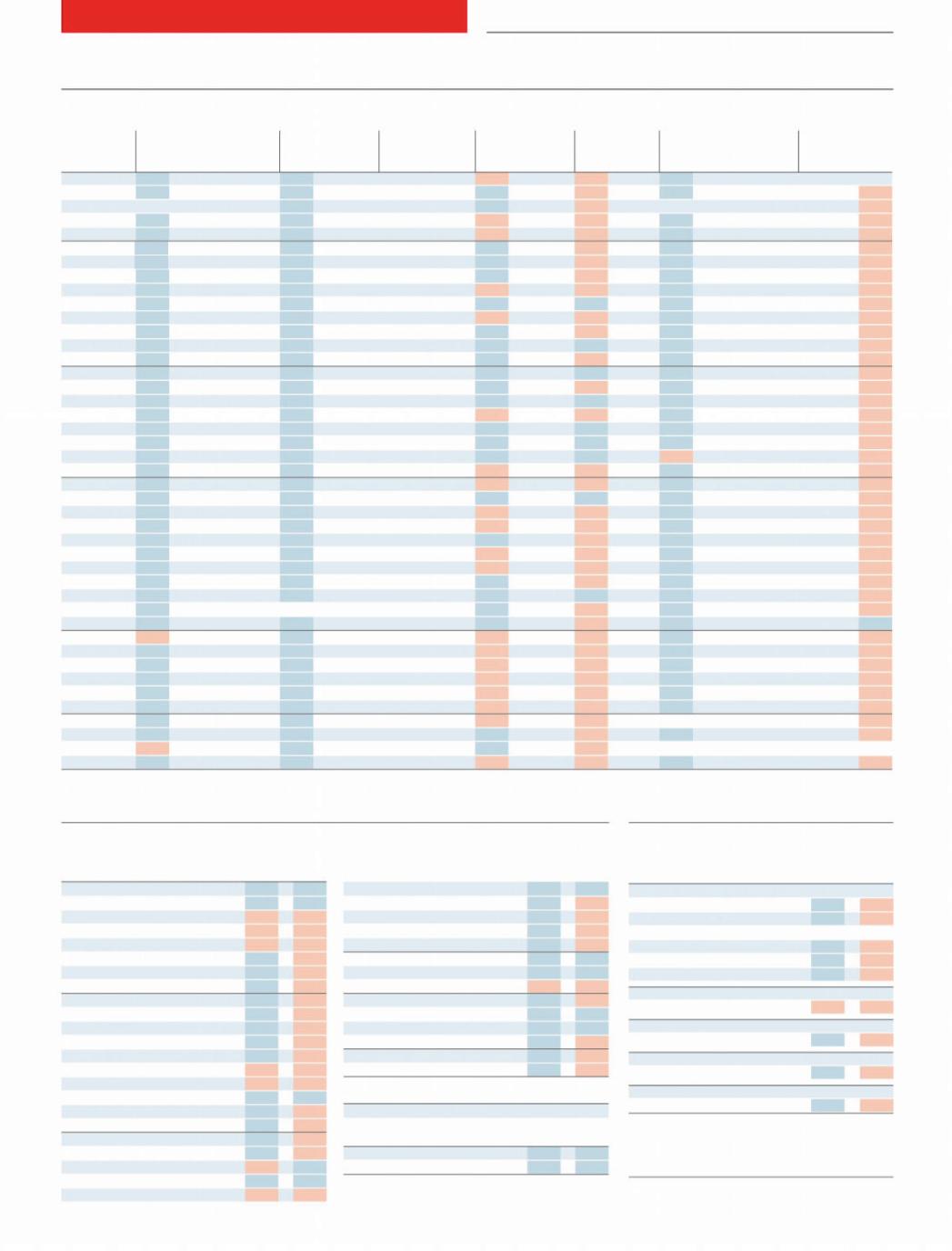

- •Earnings revisions

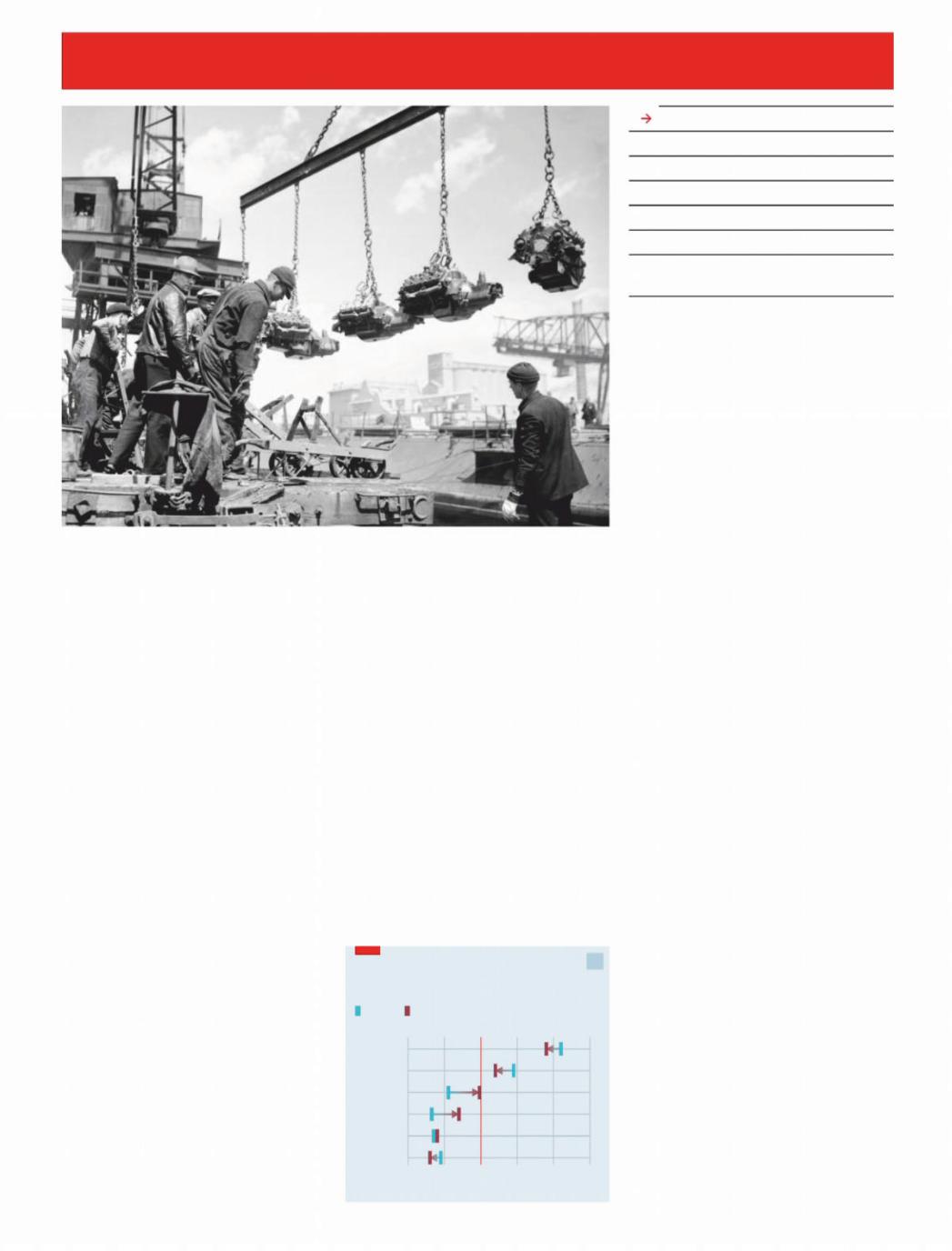

- •Reporting trends: 2H18E vs 2H17

- •Reporting trends 2H18E vs 1H18

- •Results previews

- •Commodity price and exchange rate forecasts

- •Peer comp charts

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Acron

- •PhosAgro

- •Evraz

- •Disclosures appendix

vk.com/id446425943

Disclosures appendix

Renaissance Capital

6 February 2019

Metals & Mining

Analysts certification

This research report has been prepared by the research analyst(s), whose name(s) appear(s) on the front page of this document, to provide background information about the issuer or issuers (collectively, the “Issuer”) and the securities and markets that are the subject matter of this report. Each research analyst hereby certifies that with respect to the Issuer and such securities and markets, this document has been produced independently of the Issuer and all the views expressed in this document accurately reflect his or her personal views about the Issuer and any and all of such securities and markets. Each research analyst and/or persons connected with any research analyst may have interacted with sales and trading personnel, or similar, for the purpose of gathering, synthesizing and interpreting market information. If the date of this report is not current, the views and contents may not reflect the research analysts’ current thinking.

Each research analyst also certifies that no part of his or her compensation was, or will be, directly or indirectly related to the specific ratings, forecasts, estimates, opinions or views in this research report. Research analysts’ compensation is determined based upon activities and services intended to benefit the investor clients of Renaissance Securities (Cyprus) Limited and any of its affiliates (“Renaissance Capital”). Like all of Renaissance Capital’s employees, research analysts receive compensation that is impacted by overall Renaissance Capital profitability, which includes revenues from other business units within Renaissance Capital.

Important issuer disclosures

Important issuer disclosures outline currently known conflicts of interest that may unknowingly bias or affect the objectivity of the analyst(s) with respect to an issuer that is the subject matter of this report. Disclosure(s) apply to Renaissance Securities (Cyprus) Limited or any of its direct or indirect subsidiaries or affiliates (which are individually or collectively referred to as “Renaissance Capital”) with respect to any issuer or the issuer’s securities.

A complete set of disclosure statements associated with the issuers discussed in this Report is available using the ‘Stock Finder’ or ‘Bond Finder’ for individual issuers on the Renaissance Capital Research Portal at: http://research.rencap.com/eng/default.asp

Investment ratings

Investment ratings may be determined by the following standard ranges: Buy (expected total return of 15% or more); Hold (expected total return of 0-15%); and Sell (expected negative total return). Standard ranges do not always apply to emerging markets securities and ratings may be assigned on the basis of the research analyst’s knowledge of the securities.

Investment ratings are a function of the research analyst’s expectation of total return on equity (forecast price appreciation and dividend yield within the next 12 months, unless stated otherwise in the report). Investment ratings are determined at the time of initiation of coverage of an issuer of equity securities or a change in target price of any of the issuer’s equity securities. At other times, the expected total returns may fall outside of the range used at the time of setting a rating because of price movement and/or volatility.

Such interim deviations will be permitted but will be subject to review by Renaissance Capital’s Research Management.

Where the relevant issuer has a significant material event with further information pending or to be announced, it may be necessary to temporarily place the investment rating Under Review. This does not revise the previously published rating, but indicates that the analyst is actively reviewing the investment rating or waiting for sufficient information to re-evaluate the analyst’s expectation of total return on equity.

Where coverage of the relevant issuer is due to be maintained by a new analyst, on a temporary basis the relevant issuer will be rated as Coverage in Transition. Previously published investment ratings should not be relied upon as they may not reflect the new analysts’ current expectations of total return. While rated as Coverage in Transition, Renaissance Capital may not always be able to keep you informed of events or provide background information relating to the issuer.

If issuing of research is restricted due to legal, regulatory or contractual obligations publishing investment ratings will be Restricted. Previously published investment ratings should not be relied upon as they may no longer reflect the analysts’ current expectations of total return. While restricted, the analyst may not always be able to keep you informed of events or provide background information relating to the issuer.

Where Renaissance Capital has neither reviewed nor revised its investment ratings on the relevant issuer for a period of 180 calendar days, coverage shall be discontinued.

Where Renaissance Capital has not provided coverage of an issuer for a period of 365 calendar days, coverage shall be discontinued.

Where Renaissance Capital has not expressed a commitment to provide continuous coverage and/or an expectation of total return, to keep you informed, analysts may prepare reports covering significant events or background information without an investment rating (Not Covered).

Your decision to buy or sell a security should be based upon your personal investment objectives and should be made only after evaluating the security’s expected performance and risk.

Renaissance Capital reserves the right to update or amend its investment ratings in any way and at any time it determines.

http://new.guap.ru/i04/contacts |

75 |

|

vk.com/id446425943

Renaissance Capital

6 February 2019

Metals & Mining

Renaissance Capital equity research distribution of ratings

Investment Rating Distribution |

|

Investment Banking Relationships* |

Renaissance Capital Research |

|

Renaissance Capital Research |

Buy |

138 |

49% |

Hold |

99 |

35% |

Sell |

33 |

12% |

Under Review |

4 |

1% |

Restricted |

0 |

0% |

Cov. in Trans. |

10 |

4% |

Buy |

6 |

75% |

Hold |

2 |

25% |

Sell |

0 |

0% |

Under Review |

0 |

0% |

Restricted |

0 |

0% |

Cov. in Trans. |

0 |

0% |

284 8

*Companies from which RenCap has received compensation within the past 12 months. NR – Not Rated

UR – Under Review

http://new.guap.ru/i04/contacts |

76 |

|

vk.com/id446425943

Renaissance Capital research team

Head of Research – Eurasia |

Daniel Salter |

+44 (207) |

005-7824 |

DSalter@rencap.com |

Head of Research – Africa |

Johann Pretorius |

+27 (11) |

750-1450 |

JPretorius2@rencap.com |

Head of Research – Sub-Saharan Africa |

Yvonne Mhango |

+27 (11) |

750-1488 |

YMhango@rencap.com |

Head of Research – MENA |

Ahmed Hafez |

+20 (122) |

774-4911 |

AHafez@rencap.com |

Name |

|

Telephone number |

Coverage |

|

Macro |

|

|

|

|

Charles Robertson |

+44 |

(207) |

005-7835 |

Global |

Yvonne Mhango |

+27 |

(11) |

750-1488 |

Sub-Saharan Africa |

Oleg Kouzmin |

+7 (495) |

258-7770 x4506 |

Russia/CIS |

|

Equity Strategy

Name |

Telephone number |

Coverage |

|

Oil & Gas |

|

|

|

Alexander Burgansky |

+44 (207) |

005-7982 |

Russia/CIS, Africa |

Temilade Aduroja |

+234 (1) |

448-5300 x5363 |

Sub-Saharan Africa |

Oleg Chistyukhin |

+7 (495) |

258-7770 x4073 |

Russia/CIS |

Richard Wisentaner |

+44 (207) |

005-7954 x8954 |

Russia/CIS, Africa |

Daniel Salter |

+44 |

(207) |

005-7824 |

Global |

Metals & Mining |

|

|

|

|

Charles Robertson |

+44 |

(207) |

005-7835 |

Global |

Johann Pretorius |

+27 |

(11) |

750-1450 |

South Africa |

Vikram Lopez |

+44 |

(207) |

005-7974 |

Global |

Steven Friedman |

+27 |

(11) |

750-1481 |

South Africa |

|

|

|

|

|

Kabelo Moshesha |

+27 |

(11) |

750-1472 |

South Africa |

Fixed Income Strategy |

|

|

|

|

Siphelele Mhlongo |

+27 |

(11) |

750-1420 |

South Africa |

Gregory Smith |

+44 |

(207) |

005-7761 |

Frontier/Emerging Markets |

Derick Deale |

+27 |

(11) |

750-1458 |

South Africa |

Oleg Kouzmin |

+7 (495) |

258-7770 x4506 |

Russia/CIS |

|

|

|

|

|

|

|

|

|

|

|

Consumer/Retail/Agriculture |

|

|

|

|

Financials |

|

|

|

|

David Ferguson |

+7 (495) |

641-4189 |

Russia/CIS, Africa |

|

Ilan Stermer |

+27 |

(11) |

750-1482 |

South Africa |

Kirill Panarin |

+7 (495) |

258-7770 x4009 |

Russia/CIS, Africa |

|

Phago Rakale |

+27 |

(11) |

750-1498 |

South Africa |

Adedayo Ayeni |

+234 (1) |

448-5390 |

Sub-Saharan Africa |

|

Olamipo Ogunsanya |

+234 (1) |

448-5300 x5368 |

Sub-Saharan Africa |

Robyn Collins |

+27 |

(11) |

750-1480 |

South Africa |

|

Metin Esendal |

+44 |

(207) |

005-7925 |

Europe/Georgia |

Metin Esendal |

+44 |

(207) |

005-7925 |

Turkey |

Oluwatoyosi Oni |

+234 (1) |

448-5300 x5356 |

Sub-Saharan Africa |

Hadeel El Masry |

+01(00) |

388-0822 |

MENA |

||

Ivan Kachkovski |

+44 |

(207) |

005-7862 |

Russia/Kazakhstan/Georgia |

|

|

|

|

|

Nancy Fahmy |

+20 |

(122) |

255-7445 |

MENA |

Healthcare |

|

|

|

|

|

|

|

|

|

Robyn Collins |

+27 |

(11) |

750-1480 |

South Africa |

Telecoms/Transportation |

|

|

|

Alexander Kazbegi |

+41 |

(78) |

883-4527 |

Georgia/Russia |

|

Alexander Kazbegi |

+41 |

(78) |

883-4527 |

Global |

Metin Esendal |

+44 |

(207) |

005-7925 |

Turkey/Georgia |

Artem Yamschikov |

+7 (495) |

258-7770 x7511 |

Russia/CIS |

|

|

|

|

|

|

Mikhail Arbuzov |

+7 (495) |

258-7770 x4594 |

Russia/CIS |

Diversified/Industrials |

|

|

|

|

|

Metin Esendal |

+44 |

(207) |

005-7925 |

Pakistan |

Brent Madel |

+27 |

(11) |

750-1160 |

South Africa |

|

|

|

|

|

Metin Esendal |

+44 |

(207) |

005-7925 |

Turkey |

Real Estate |

|

|

|

|

|

|

|

|

|

David Ferguson |

+7 (495) |

641-4189 |

Russia/CIS, Africa |

Materials |

|

|

|

|

|

Kirill Panarin |

+7 (495) |

258-7770 x4009 |

Russia/CIS, Africa |

Temilade Aduroja |

+234 (1) |

448-5300 x5363 |

Sub-Saharan Africa |

||

Phago Rakale |

+27 |

(11) |

750-1498 |

South Africa |

|

|

|

|

|

|

|

|

|

|

Utilities |

|

|

|

|

Media/Technology |

|

|

|

|

Ahmed Hafez |

+20 |

(122) |

774-4911 |

Egypt |

David Ferguson |

+7 (495) |

641-4189 |

Russia/CIS, Africa |

Sergey Beiden |

+7 (495) |

258-7770 x4205 |

Russia |

||

Kirill Panarin |

+7 (495) |

258-7770 x4009 |

Russia/CIS, Africa |

|

|

|

|

|

|

Renaissance Capital research is available via the following platforms: |

|

Renaissance research portal: research.rencap.com |

Thomson Reuters: thomsonreuters.com/financial |

Bloomberg: RENA <GO> |

Factset: www.factset.com |

Capital IQ: www.capitaliq.com |

|

http://new.guap.ru/i04/contacts

vk.com/id446425943

Renaissance Capital |

Renaissance Capital Ltd. |

Renaissance Capital |

Moscow |

London |

Johannesburg |

T + 7 (495) 258-7777 |

T + 44 (203) 379-7777 |

T +27 (11) 750-1400 |

Renaissance Securities (Nigeria) Ltd. |

Renaissance Capital |

Renaissance Capital |

Lagos |

Nairobi |

Cape Town |

T +234 (1) 448-5300 |

T +254 (20) 368-2000 |

T +27 (11) 750-1164 |

Renaissance Securities (Cyprus) Ltd. |

Renaissance Capital Egypt for Promoting |

|

Nicosia |

and Underwriting of Securities S.A.E. |

|

T + 357 (22) 505-800 |

Cairo |

|

© 2019 Renaissance Securities (Cyprus) Limited, a subsidiary of Renaissance Financial Holdings Limited ("Renaissance Capital"), which together with other subsidiaries operates outside of the USA under the brand name of Renaissance Capital, for contact details see Bloomberg page RENA, or contact the relevant office. All rights reserved. This document and/or information has been prepared by and, except as otherwise specified herein, is communicated by Renaissance Securities (Cyprus) Limited, regulated by the Cyprus Securities and Exchange Commission (License No: KEPEY 053/04).

This document is for information purposes only. The information presented herein does not comprise a prospectus of securities for the purposes of EU Directive 2003/71/EC or Federal Law No. 39-FZ of 22 April 1994 (as amended) of the Russian Federation "On the Securities Market". Any decision to purchase securities in any proposed offering should be made solely on the basis of the information to be contained in the final prospectus published in relation to such offering. This document does not form a fiduciary relationship or constitute advice and is not and should not be construed as an offer, or a solicitation of an offer, or an invitation or inducement to engage in investment activity, and cannot be relied upon as a representation that any particular transaction necessarily could have been or can be effected at the stated price. This document is not an advertisement of securities. Opinions expressed herein may differ or be contrary to opinions expressed by other business areas or groups of Renaissance Capital as a result of using different assumptions and criteria. All such information and opinions are subject to change without notice, and neither Renaissance Capital nor any of its subsidiaries or affiliates is under any obligation to update or keep current the information contained herein or in any other medium.

Descriptions of any company or companies or their securities or the markets or developments mentioned herein are not intended to be complete. This document and/or information should not be regarded by recipients as a substitute for the exercise of their own judgment as the information has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. The application of taxation laws depends on an investor’s individual circumstances and, accordingly, each investor should seek independent professional advice on taxation implications before making any investment decision. The information and opinions herein have been compiled or arrived at based on information obtained from sources believed to be reliable and in good faith. Such information has not been independently verified, is provided on an ‘as is’ basis and no representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness, reliability, merchantability or fitness for a particular purpose of such information and opinions, except with respect to information concerning Renaissance Capital, its subsidiaries and affiliates. All statements of opinion and all projections, forecasts, or statements relating to expectations regarding future events or the possible future performance of investments represent Renaissance Capital’s own assessment and interpretation of information available to them currently.

The securities described herein may not be eligible for sale in all jurisdictions or to certain categories of investors. Options, derivative products and futures are not suitable for all investors and trading in these instruments is considered risky. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. Some investments may not be readily realisable since the market in the securities is illiquid or there is no secondary market for the investor’s interest and therefore valuing the investment and identifying the risk to which the investor is exposed may be difficult to quantify. Investments in illiquid securities involve a high degree of risk and are suitable only for sophisticated investors who can tolerate such risk and do not require an investment easily and quickly converted into cash. Foreign-currency-denominated securities are subject to fluctuations in exchange rates that could have an adverse effect on the value or the price of, or income derived from, the investment. Other risk factors affecting the price, value or income of an investment include but are not necessarily limited to political risks, economic risks, credit risks, and market risks. Investing in emerging markets such as Russia, other CIS, African or Asian countries and emerging markets securities involves a high degree of risk and investors should perform their own due diligence before investing.

Excluding significant beneficial ownership of securities where Renaissance Capital has expressed a commitment to provide continuous coverage in relation to an issuer or an issuer’s securities, Renaissance

Capital and its affiliates, their directors, representatives, employees (excluding the US broker-dealer unless specifically disclosed), or clients may have or have had interests in the securities of issuers described in the Investment Research or long or short positions in any of the securities mentioned in the Investment Research or other related financial instruments at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale, of any such securities or other financial instruments from time to time in the open market or otherwise, in each case as principals or as agents. Where Renaissance Capital has not expressed a commitment to provide continuous coverage in relation to an issuer or an issuer’s securities,

Renaissance Capital and its affiliates (excluding the US broker-dealer unless specifically disclosed) may act or have acted as market maker in the securities or other financial instruments described in the Investment Research, or in securities underlying or related to such securities. Employees of Renaissance Capital or its

affiliates may serve or have served as officers or directors of the relevant companies. Renaissance Capital and its affiliates may have or have had a relationship with or provide or have provided investment banking, capital markets, advisory, investment management, and/or other financial services to the relevant companies, and have established and maintain information barriers, such as ‘Chinese Walls’, to control the flow of information contained in one or more areas of Renaissance Capital, into other areas, units, groups or affiliates of the Firm.

The information herein is not intended for distribution to the public and may not be reproduced, redistributed or published, in whole or in part, for any purpose without the written permission of Renaissance Capital, and neither Renaissance Capital nor any of its affiliates accepts any liability whatsoever for the actions of third parties in this respect. This information may not be used to create any financial instruments or products or any indices. Neither Renaissance Capital and its affiliates, nor their directors, representatives, or employees accept any liability for any direct or consequential loss or damage arising out of the use of all or any part of the information herein

Bermuda: Neither the Bermuda Monetary Authority nor the Registrar of Companies of Bermuda has approved the contents of this document and any statement to the contrary, express or otherwise, would constitute a material misstatement and an offence.

EEA States: Distributed by Renaissance Securities (Cyprus) Limited, regulated by Cyprus Securities and Exchange Commission, or Renaissance Capital Limited, member of the London Stock Exchange and regulated in the UK by the Financial Conduct Authority (“FCA”) in relation to designated investment business (as detailed in the FCA rules).

Cyprus: Except as otherwise specified herein the information herein is not intended for, and should not be relied upon by, retail clients of Renaissance Securities (Cyprus) Limited. The Cyprus Securities and Exchange Commission Investor Compensation Fund is available where Renaissance Securities (Cyprus) Limited is unable to meet its liabilities to its retail clients, as specified in the Customer Documents Pack.

United Kingdom: Approved and distributed by Renaissance Capital Limited only to persons who are eligible counterparties or professional clients (as detailed in the FCA Rules). The information herein does not apply to, and should not be relied upon by, retail clients; neither the FCA’s protection rules nor compensation scheme may be applied.

Kenya: Distributed by Renaissance Capital (Kenya) Limited, regulated by the Capital Markets Authority.

Nigeria: Distributed by RenCap Securities (Nigeria) Limited, authorised dealing member of The Nigerian Stock Exchange, or Renaissance Securities (Nigeria) Limited, entities regulated by the Securities and Exchange Commission.

Russia: Distributed by Renaissance Broker Limited regulated by the Central Bank of Russia.

South Africa: Distributed by Rencap Securities (Proprietary) Limited, an authorised Financial Services Provider and member of the JSE Limited. The information contained herein is intended for Institutional investors only.

United States: Distributed in the United States by RenCap Securities, Inc., member of FINRA and SIPC, or by a non-US subsidiary or affiliate of Renaissance Financial Holdings Limited that is not registered as a US broker-dealer (a "non-US affiliate"), to major US institutional investors only. RenCap Securities, Inc. accepts responsibility for the content of a research report prepared by another non-US affiliate when distributed to US persons by RenCap Securities, Inc. Although it has accepted responsibility for the content of this research report when distributed to US investors, RenCap Securities, Inc. did not contribute to the preparation of this report and the analysts authoring this are not employed by, and are not associated persons of, RenCap Securities, Inc. Among other things, this means that the entity issuing this report and the analysts authoring this report are not subject to all the disclosures and other US regulatory requirements to which RenCap Securities, Inc. and its employees and associated persons are subject. Any US person receiving this report who wishes to effect transactions in any securities referred to herein should contact RenCap Securities, Inc., not its non-US affiliate. RenCap Securities, Inc. is a subsidiary of Renaissance Financial Holdings Limited and forms a part of a group of companies operating outside of the United States as "Renaissance Capital.". Contact: RenCap Securities, Inc., 780 Third Avenue, 20th Floor, New York, New York 10017, Telephone: +1 (212) 824-1099.

Other distribution: The distribution of this document in other jurisdictions may be restricted by law and persons into whose possession this document comes should inform themselves about, and observe, any such restriction.

Renaissance Capital equity research disclosures (Stocks)

http://new.guap.ru/i04/contacts

vk.com/id446425943

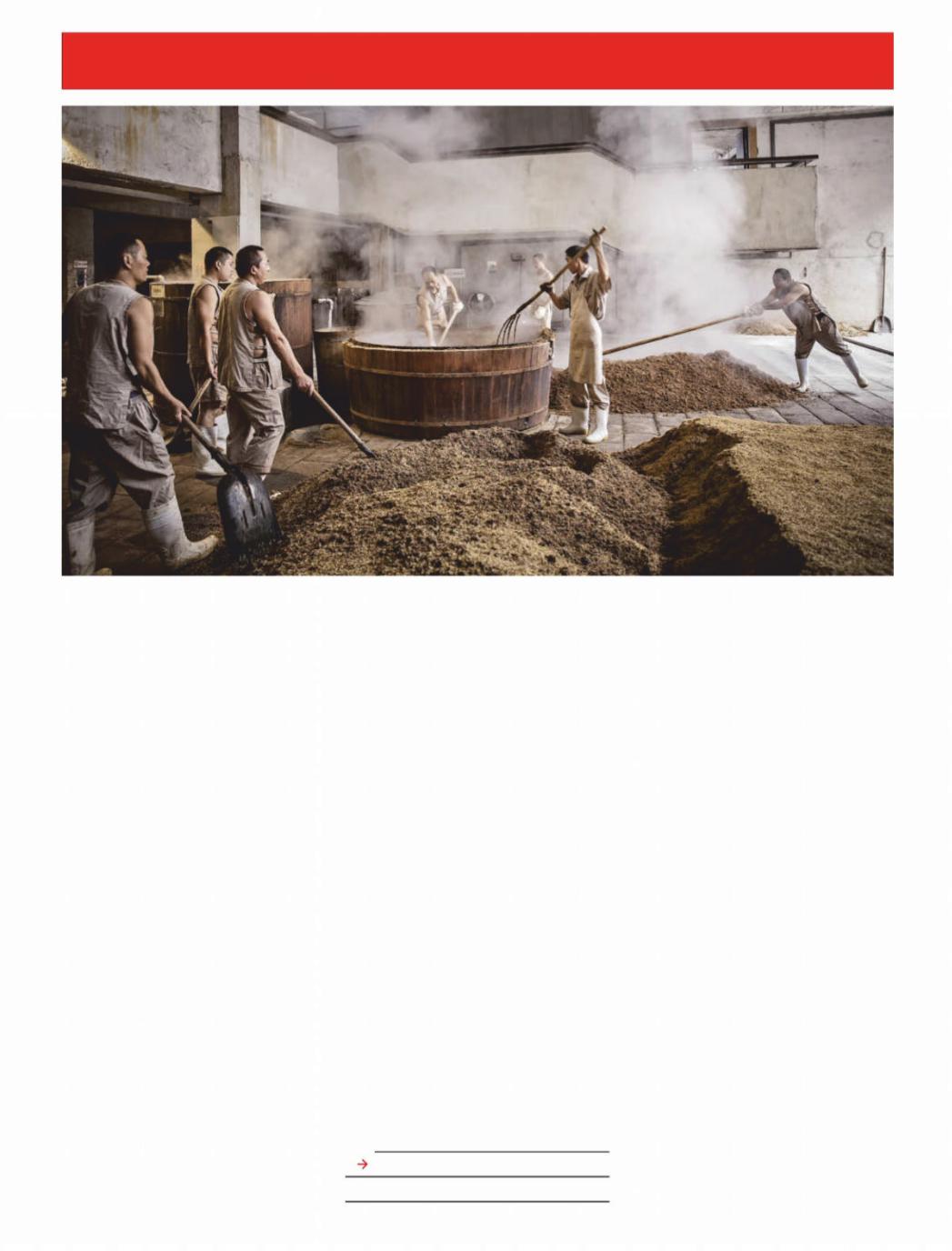

Rusal

Resuming coverage

Rusal has been removed from the Office of Foreign Assets Control's (OFAC) Specially Designated Nationals List. We resume coverage on Rusal with a TP of HKD6.0 and a BUY rating (previously Suspended). We have a positive outlook on the aluminium market, and believe Rusal’s medium-term deleveraging and longer-term dividend yield potential could be positive catalysts.

Deleveraging and dividends driven by attractive FCF yield

We forecast Rusal’s FCF to equity shareholders (FCFE) yield at 25% on average over the next three years, after capex of $700-850mn. Deleveraging the balance sheet is a strategic priority for Rusal and its medium-term dividend policy is to pay up to 15% of EBITDA plus dividends from its investment in Norilsk Nickel (BUY, TP $24.0, CP $20.7). Despite this conservative policy, we calculate supportive dividend yields of 6.5% on average over the next three years. We forecast net debt falling from $7.6bn in FY17, to $4.7bn at the end of FY20, implying comfortable net debt/(EBITDA + Norilsk dividend) of 1.5x.

Favourable cost position and strategy to improve margins

Rusal’s operations are competitively positioned in the first half of the aluminium cost curve. The company’s strategy to enhance margins further include: increasing the share of value-added products to achieve higher sales realisations; expanding sales in Russia and the CIS; achieving self-sufficiency in raw materials to be independent from third-party suppliers; pursuing R&D projects to develop new aluminium alloys and products; introducing innovative technologies to improve operating efficiency; ensuring a secure supply of energy through access to competitive sources; and maintaining secure transport via optimal logistics.

Risks

Our discounted cash flow (DCF) valuation is calculated using a weighted average cost of capital (WACC) of 12.5%, which reflects an equity risk premium of 8%. We employ a higher equity risk premium for Rusal than for other diversified miners under coverage to account for risks and uncertainties that we may not have reflected in our cash-flow forecasts. Key risks to our positive investment stance on Rusal are: 1) lower-than-forecast aluminium, nickel, palladium and copper prices; 2) a stronger- than-forecast rouble; 3) value destruction through low returns on capital expenditure; 4) risks associated with a potential “shoot-out” price auction between Rusal and

Vladimir Potanin’s investment companies for up to 30% of Norilsk Nickel; 5) potential higher taxes or government requirements for increased investment in social infrastructure; 6) the potential for regulation to result in higher electricity tariffs (major input cost) for industrial consumers; and 7) sanctions.

Resumption of coverage

BUY (previously Suspended) TP: HKD6.0 (previously Suspended)

Metals & Mining Russia

Johann Pretorius +27 (11) 750-1450

JPretorius2@rencap.com

Steven Friedman +27 (11) 750-1481

SFriedman@rencap.com

Kabelo Moshesha +27 (11) 750-1472

KMoshesha@rencap.com

Siphelele Mhlongo +27 (11) 750-1420

SMhlongo@rencap.com

Derick Deale

+27 (11) 750-1458 DDeale@rencap.com

Report date: |

|

5 February 2019 |

||

Current price, HKD |

|

|

|

3.3 |

Upside/downside, % |

|

|

|

88.2 |

MktCap, $mn |

|

|

|

6,350.9 |

Average daily volume, $mn |

|

|

3.2 |

|

Free float, $mn |

|

|

|

628.1 |

Bloomberg |

|

|

|

486 HK |

|

|

|

||

Summary valuation and financials |

|

|

||

IFRS |

2017 |

2018E |

2019E |

2020E |

Underlying EPS, $ |

0.08 |

0.13 |

0.09 |

0.12 |

EPS growth, % |

3.6 |

56.9 |

-29.2 |

36.9 |

DPS, $ |

0.02 |

0.03 |

0.02 |

0.03 |

Dividend yield, % |

3.4 |

6.9 |

5.1 |

6.3 |

EBITDA margin, % |

21.3 |

22.1 |

17.4 |

20.7 |

Capex/EBITDA, % |

26 |

24 |

33 |

22 |

FCF yield, % |

10.4 |

12.0 |

15.5 |

18.8 |

RoCE, % |

12.6 |

13.3 |

8.8 |

12.3 |

RoE, % |

32.9 |

39.4 |

23.4 |

26.4 |

Net debt/EBITDA, x |

2.4 |

2.2 |

2.3 |

1.5 |

P/E, x |

7.2 |

3.0 |

4.7 |

3.4 |

EV/EBITDA, x |

6.0 |

3.9 |

4.7 |

3.5 |

BVPS, $ |

0.3 |

0.3 |

0.4 |

0.5 |

Priced at market close on 1 February 2019

Source: Company data, Renaissance Capital estimates

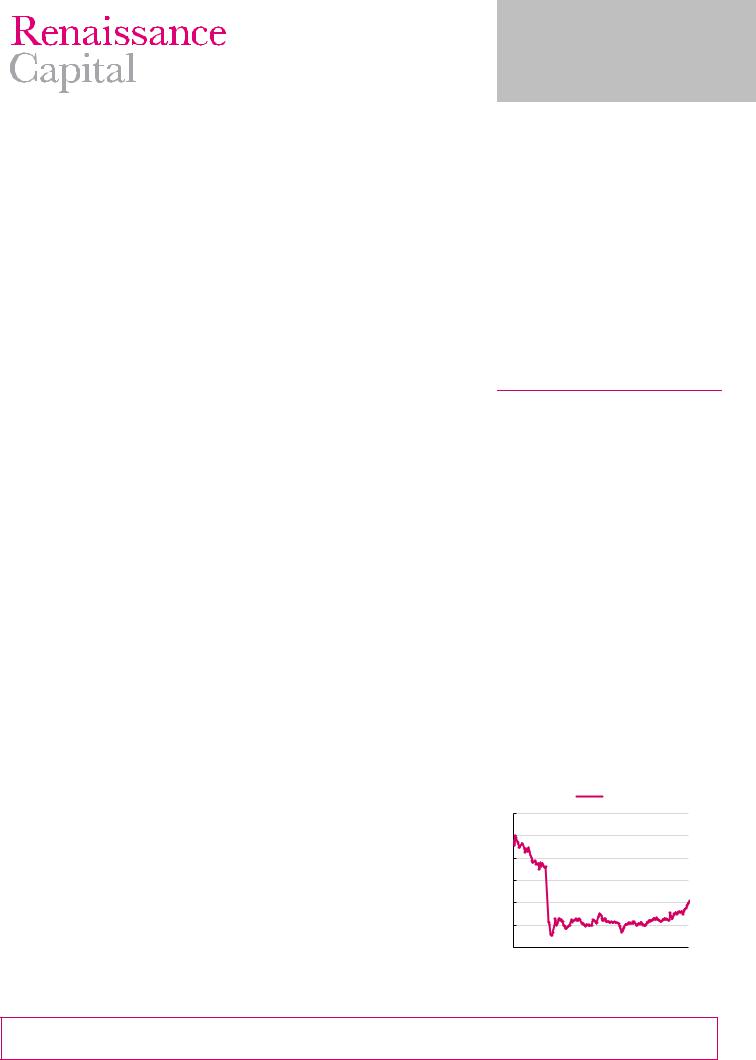

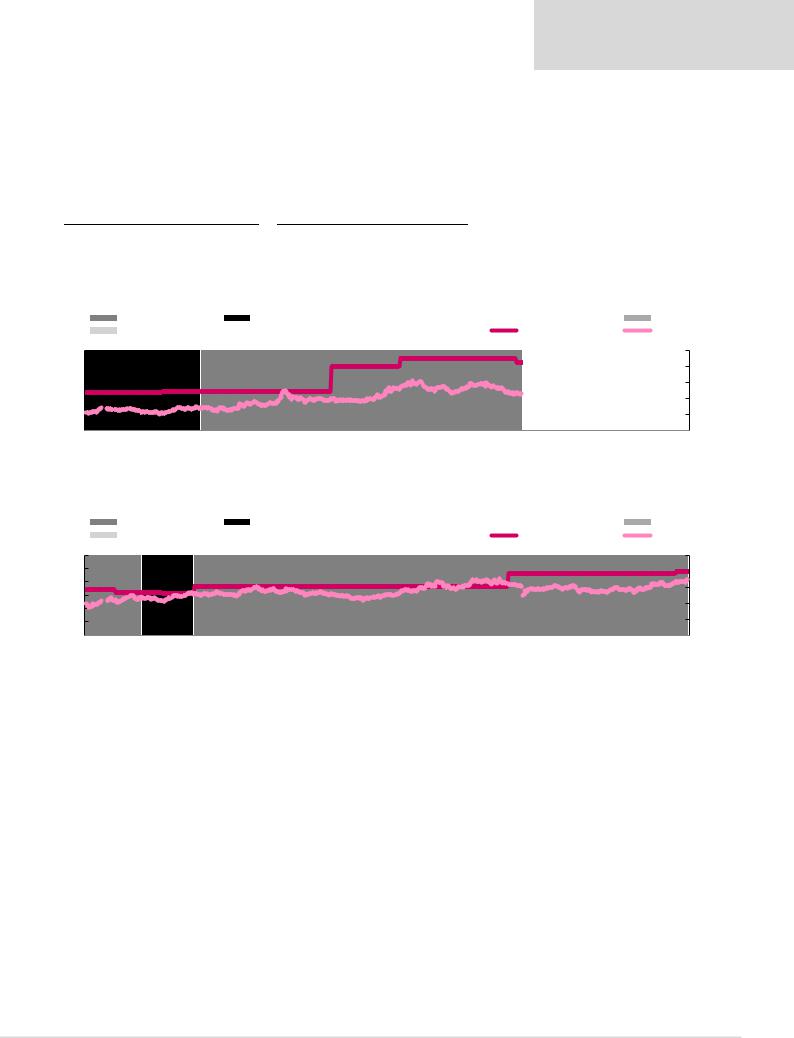

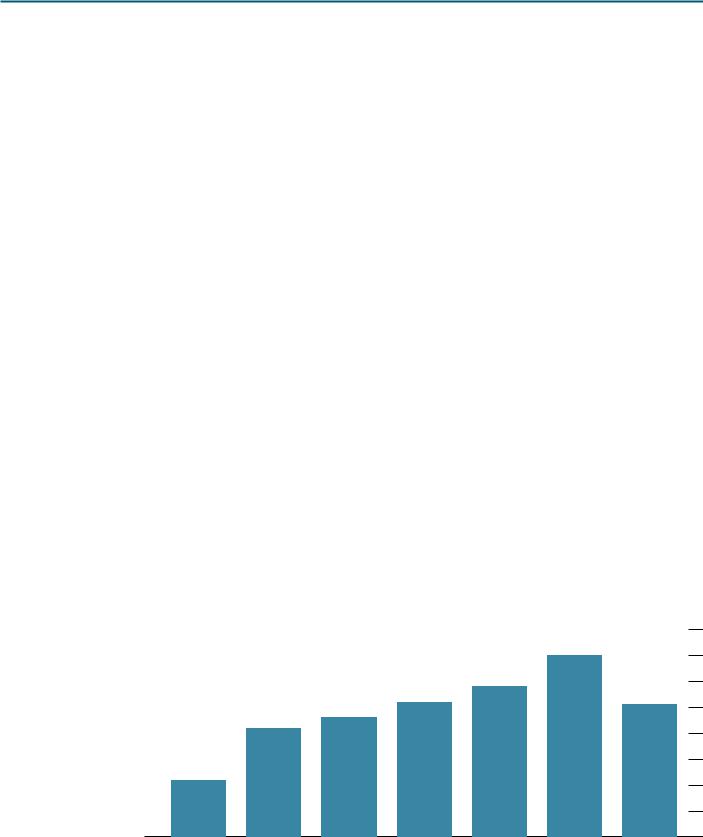

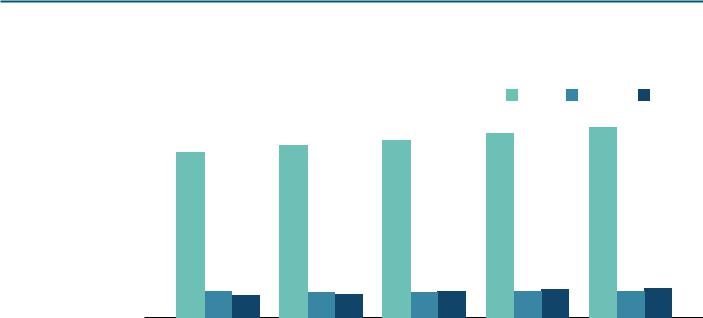

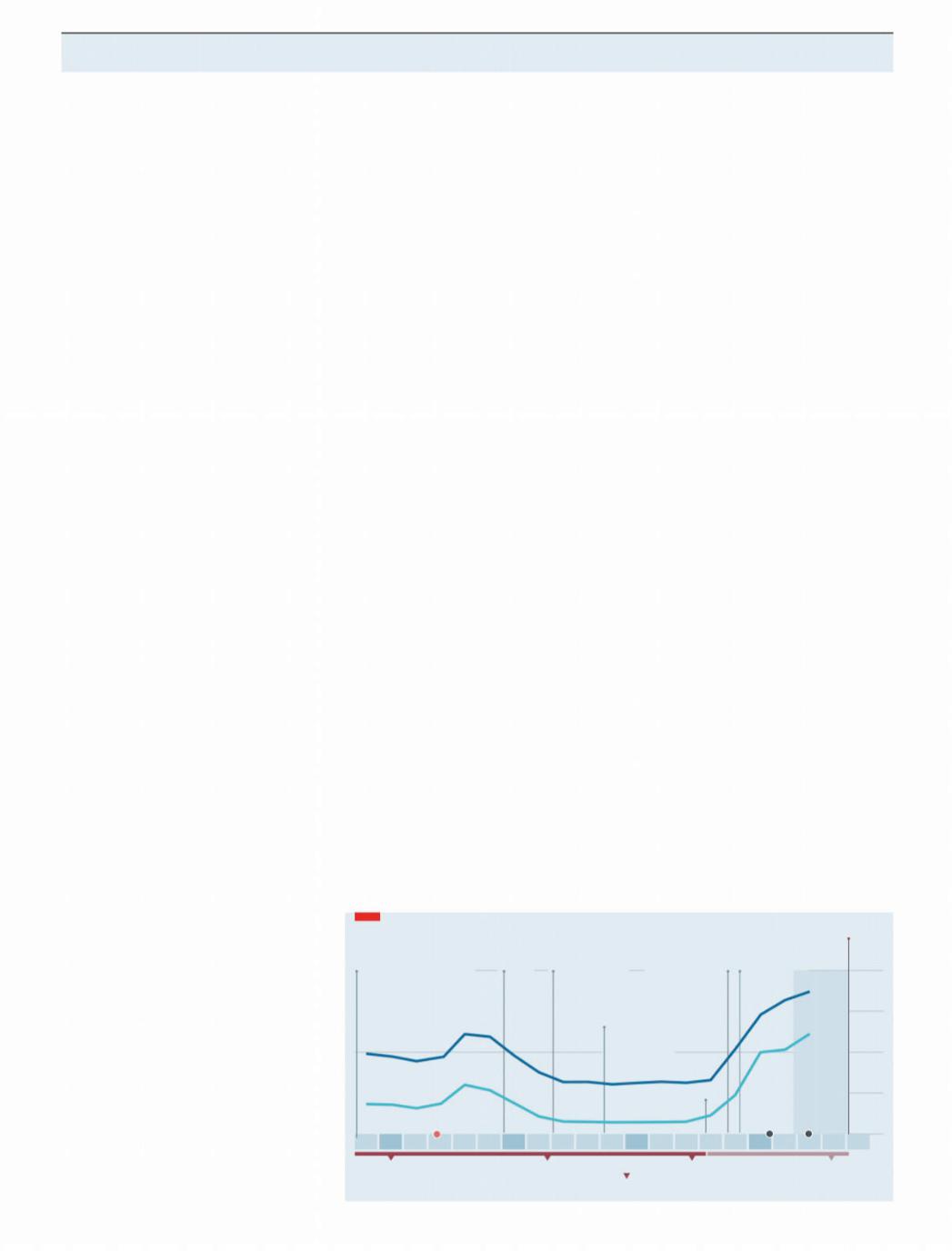

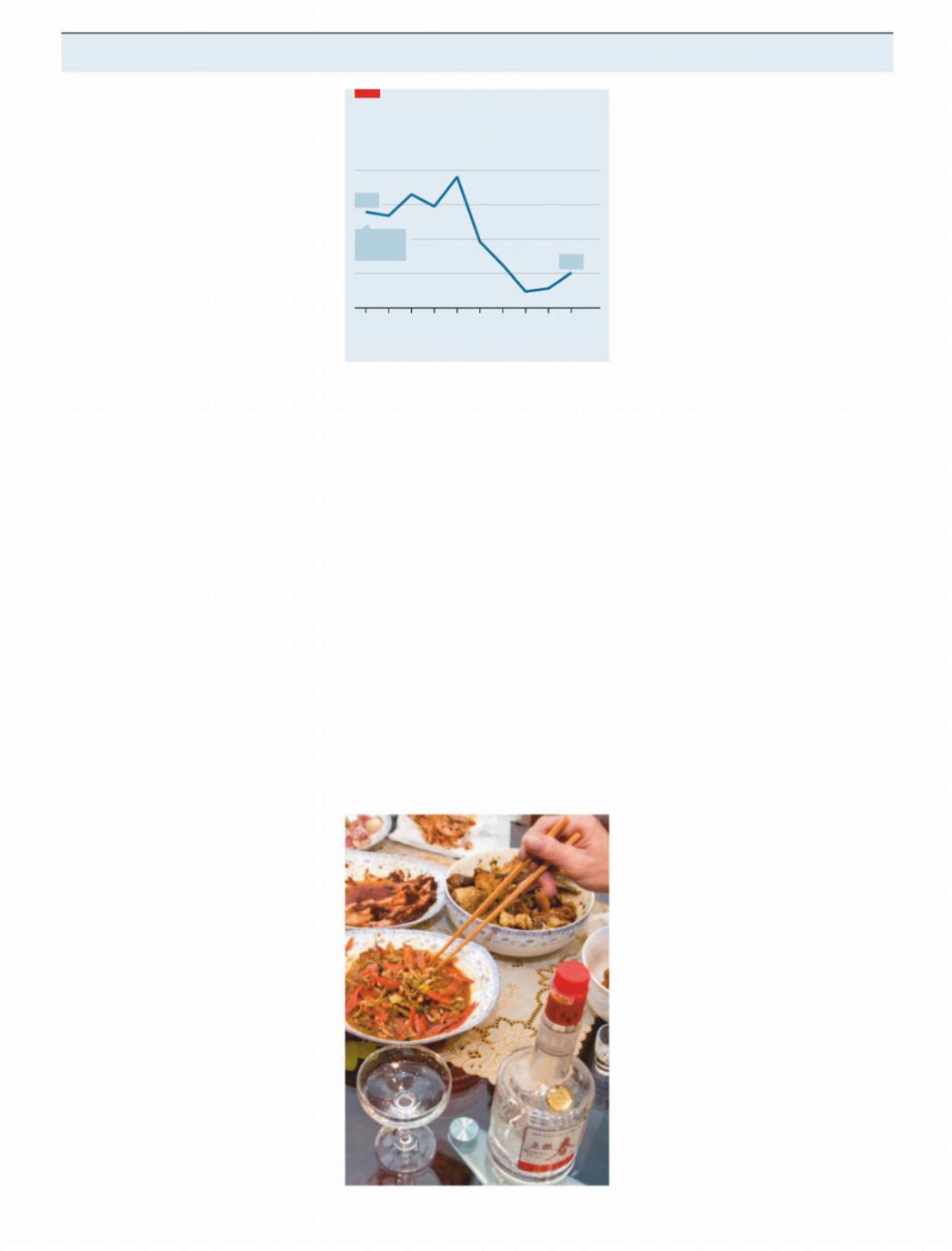

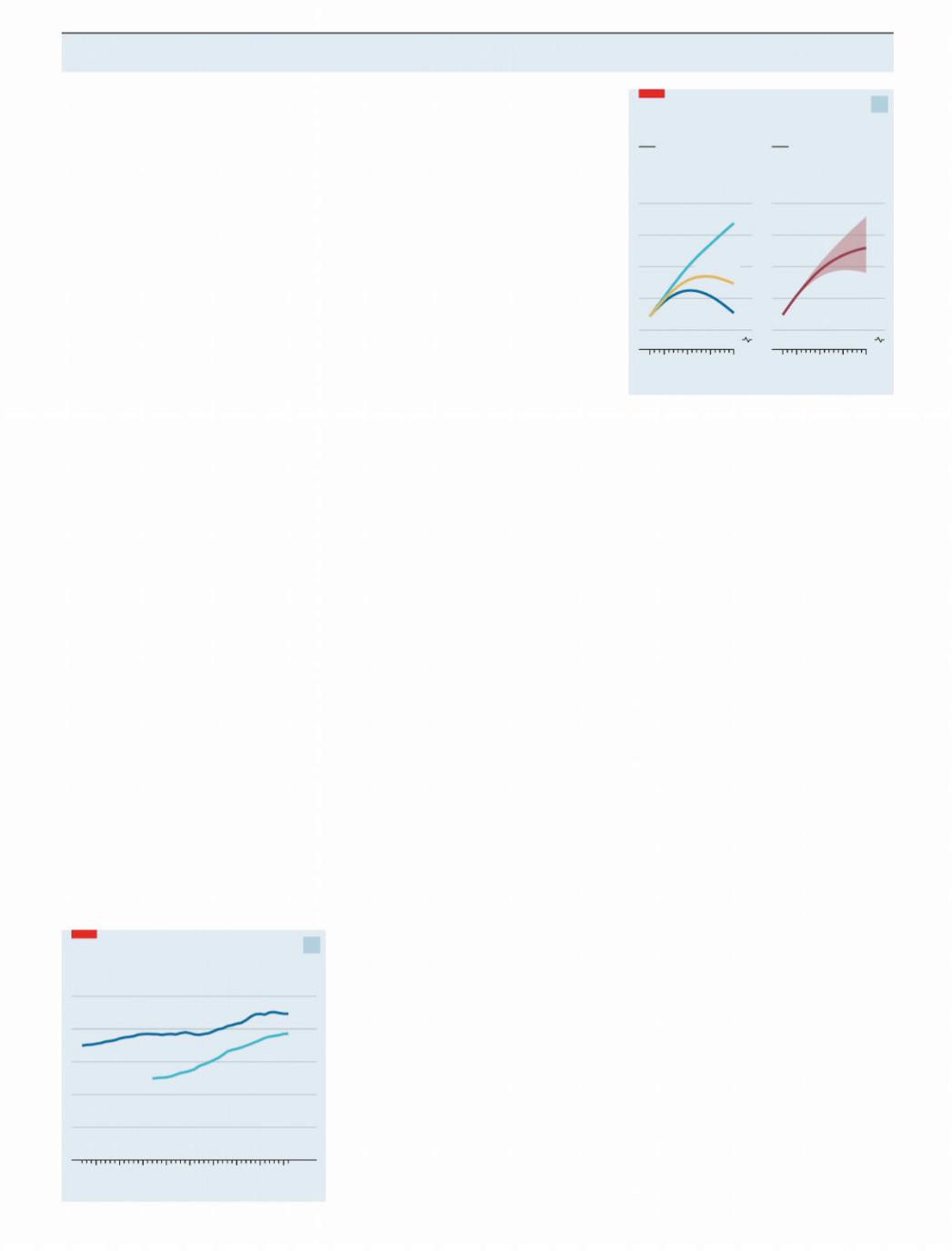

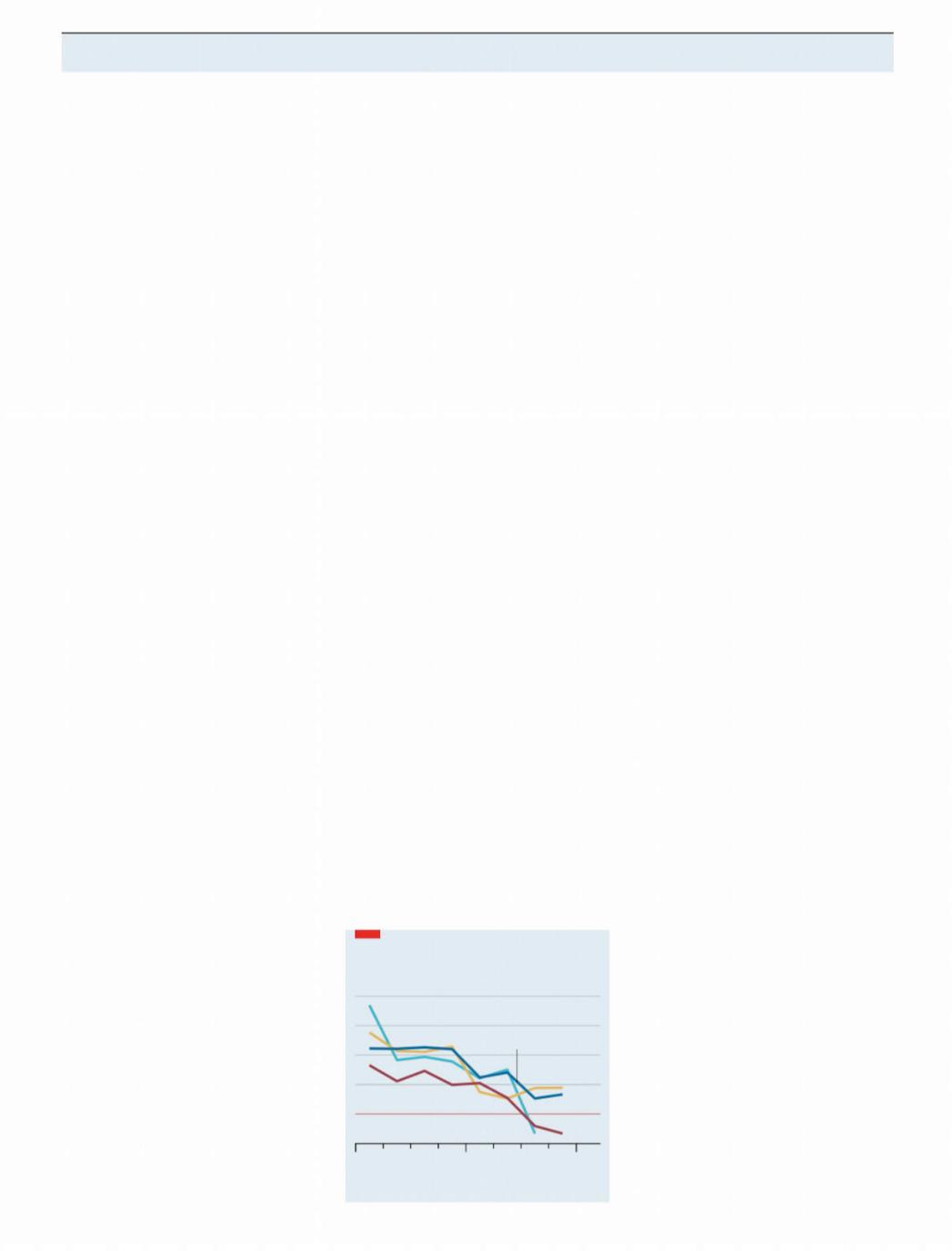

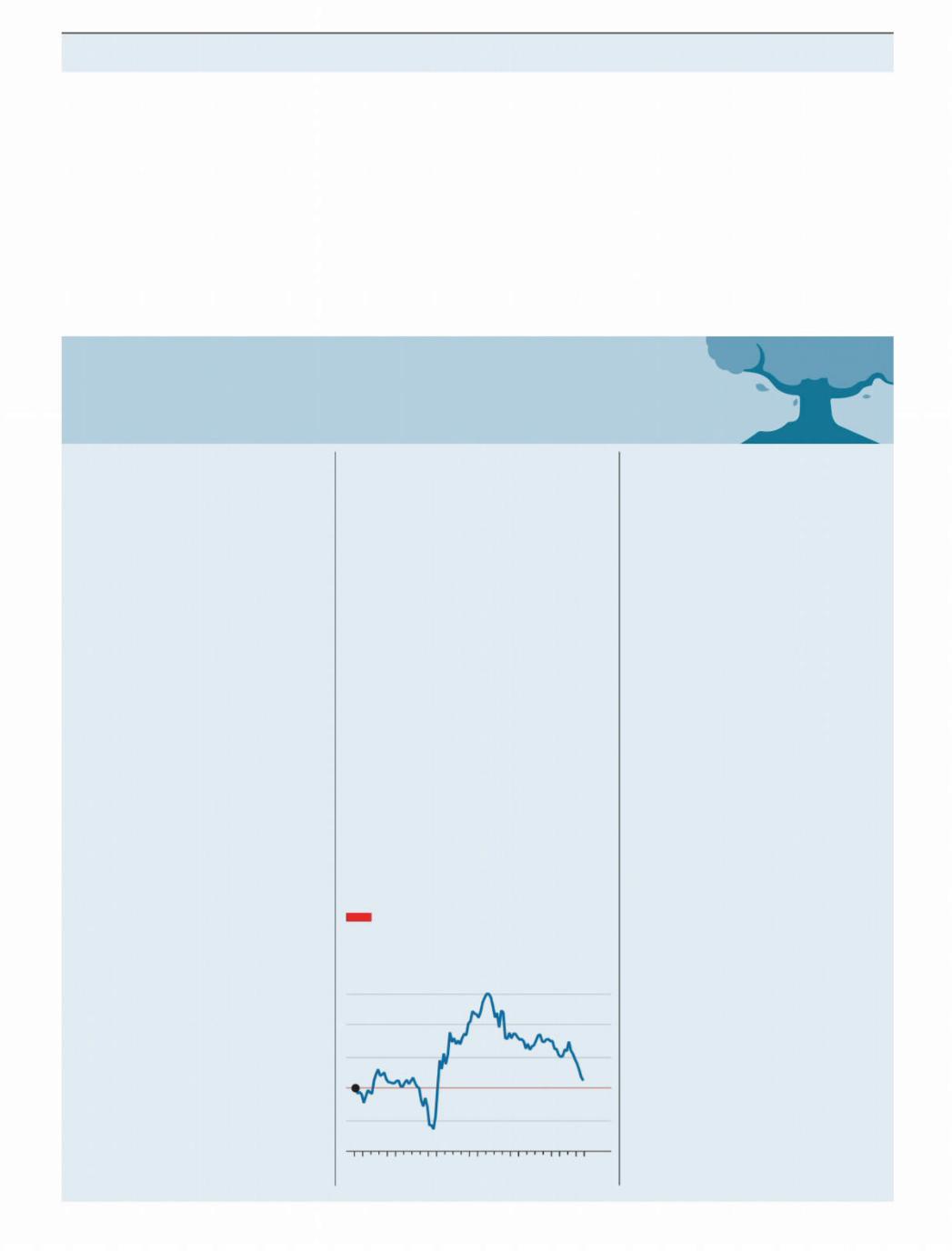

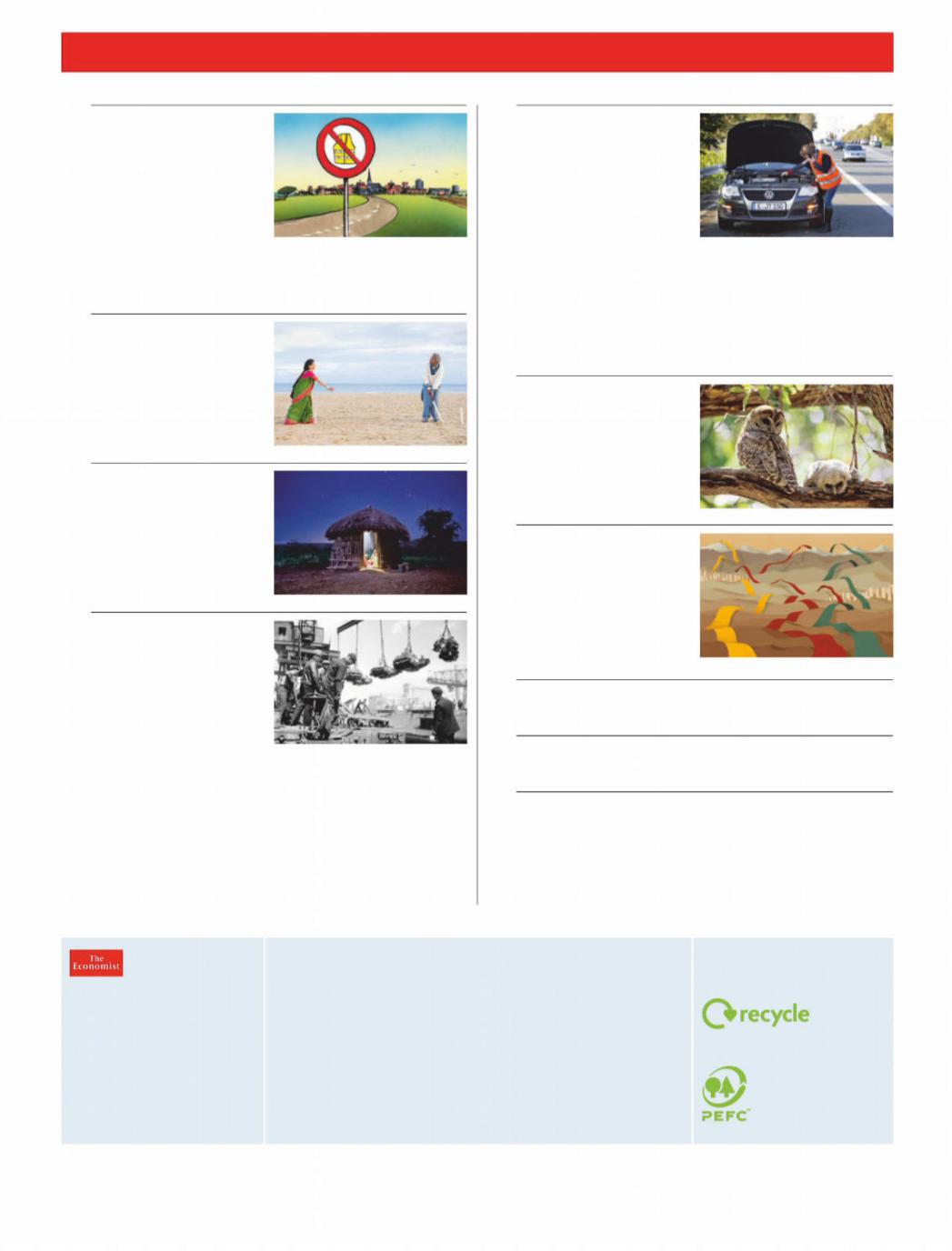

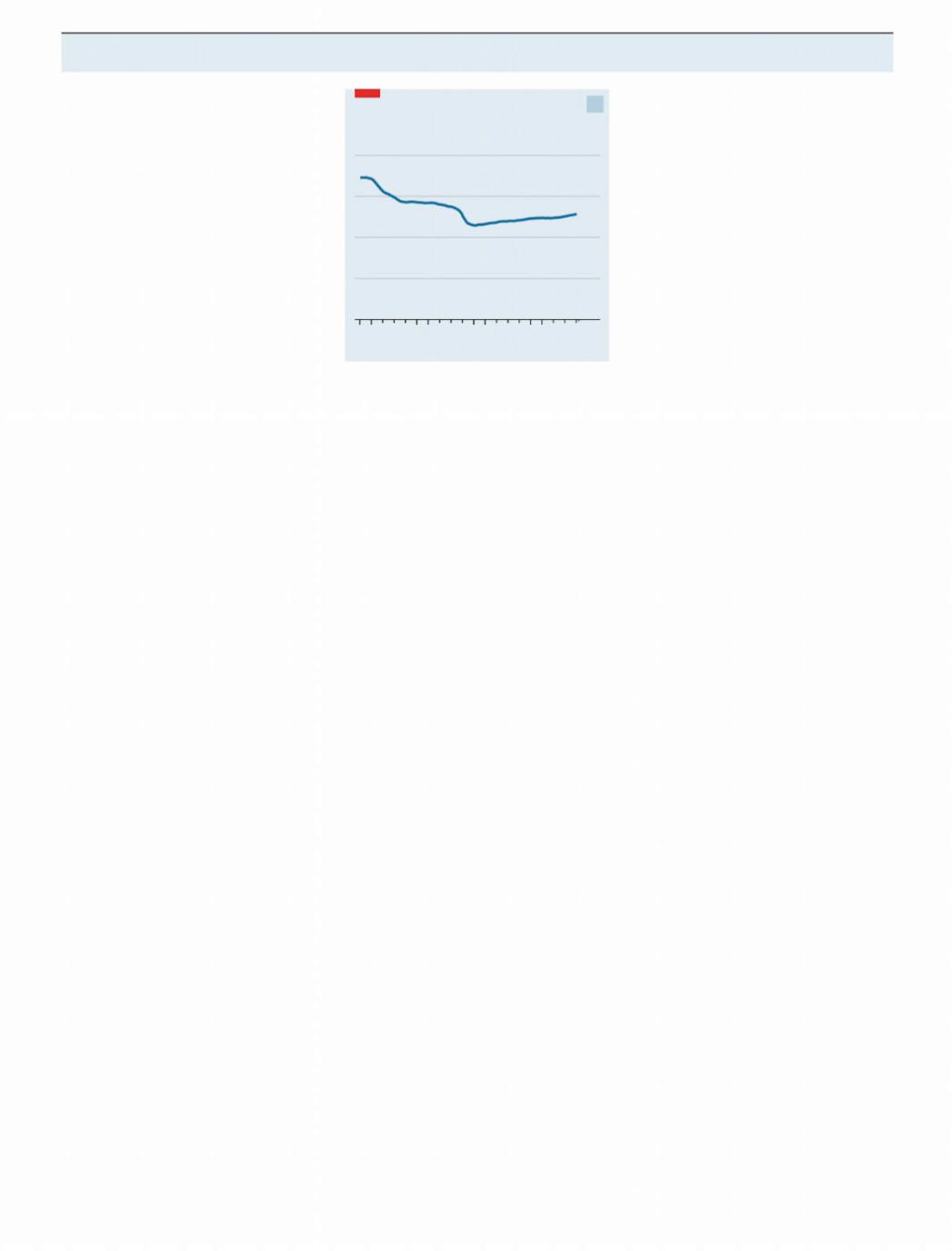

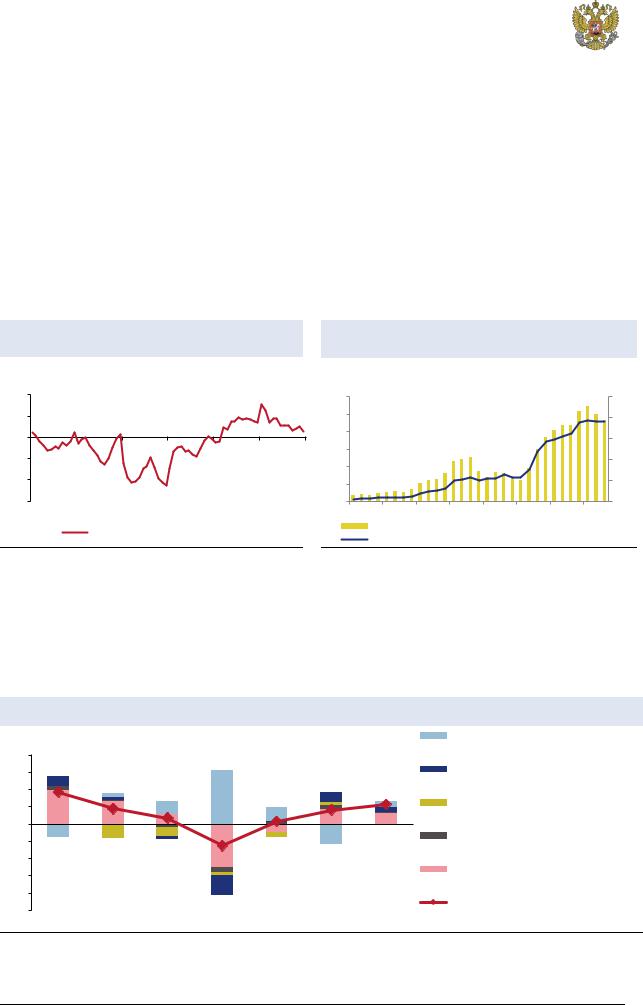

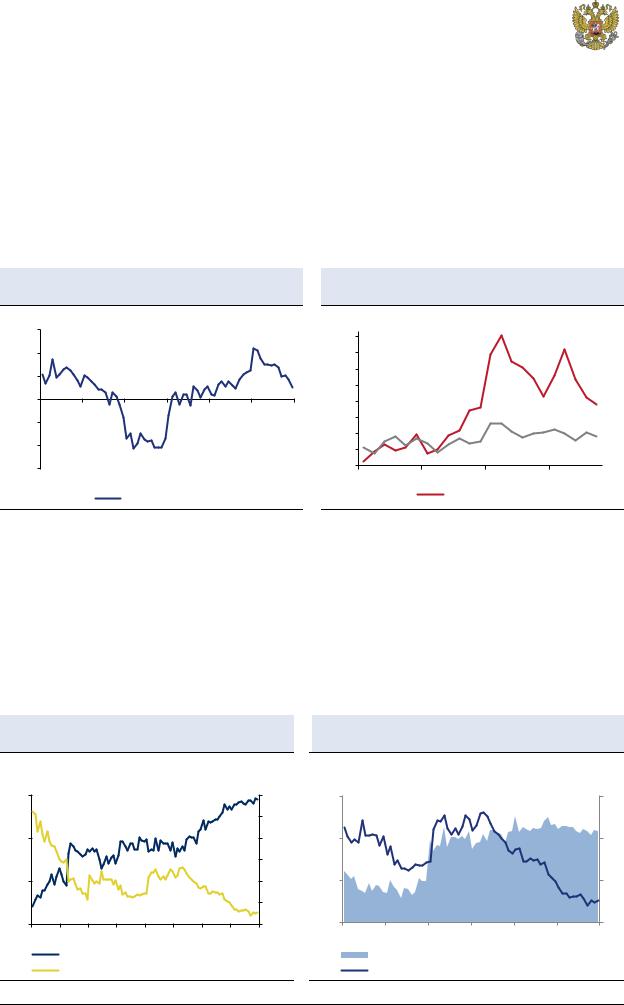

Figure 1: Price performance – 52 weeks, HKD

486 HK

7 |

|

|

|

|

|

|

6 |

|

|

|

|

|

|

5 |

|

|

|

|

|

|

4 |

|

|

|

|

|

|

3 |

|

|

|

|

|

|

2 |

|

|

|

|

|

|

1 |

|

|

|

|

|

|

Jan |

Mar |

May |

Jul |

Sep |

Nov |

Jan |

Source: Bloomberg

Important disclosures are found at the Disclosures Appendix. Communicated by Renaissance Securities (Cyprus) Limited, regulated by the Cyprus Securities & Exchange

Commission, which together with non-US affiliates operates outside of the USA under the brand name of Renaissance Capital.

http://new.guap.ru/i04/contacts

vk.com/id446425943

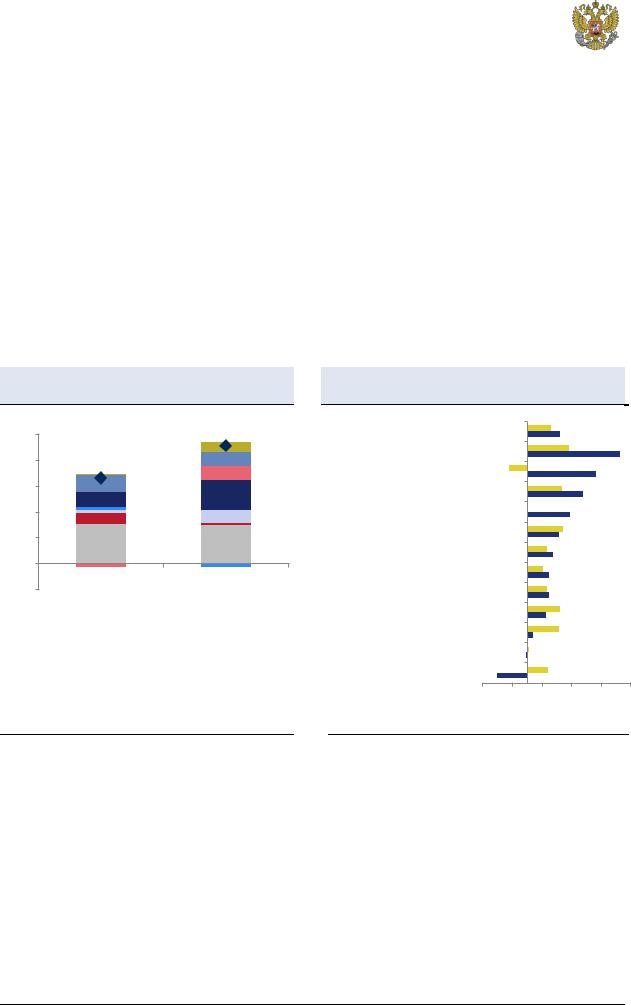

Miners ranked by potential returns

Renaissance Capital

5 February 2019

Rusal

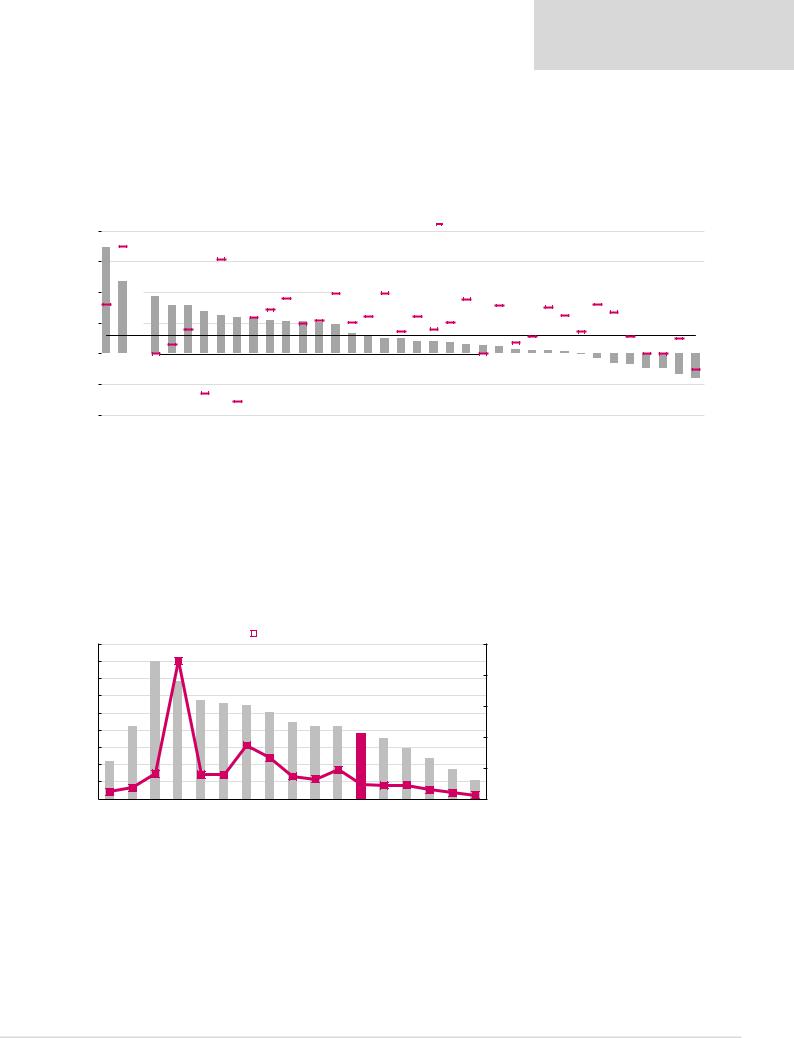

Figure 2 shows the companies under our coverage ranked by potential 12-month returns, based on our TPs.

Rusal offers a total potential one-year return of 88.2% based on our TP of HKD6.0 and our forecast one-year forward rolling dividend yield of 5.3%.

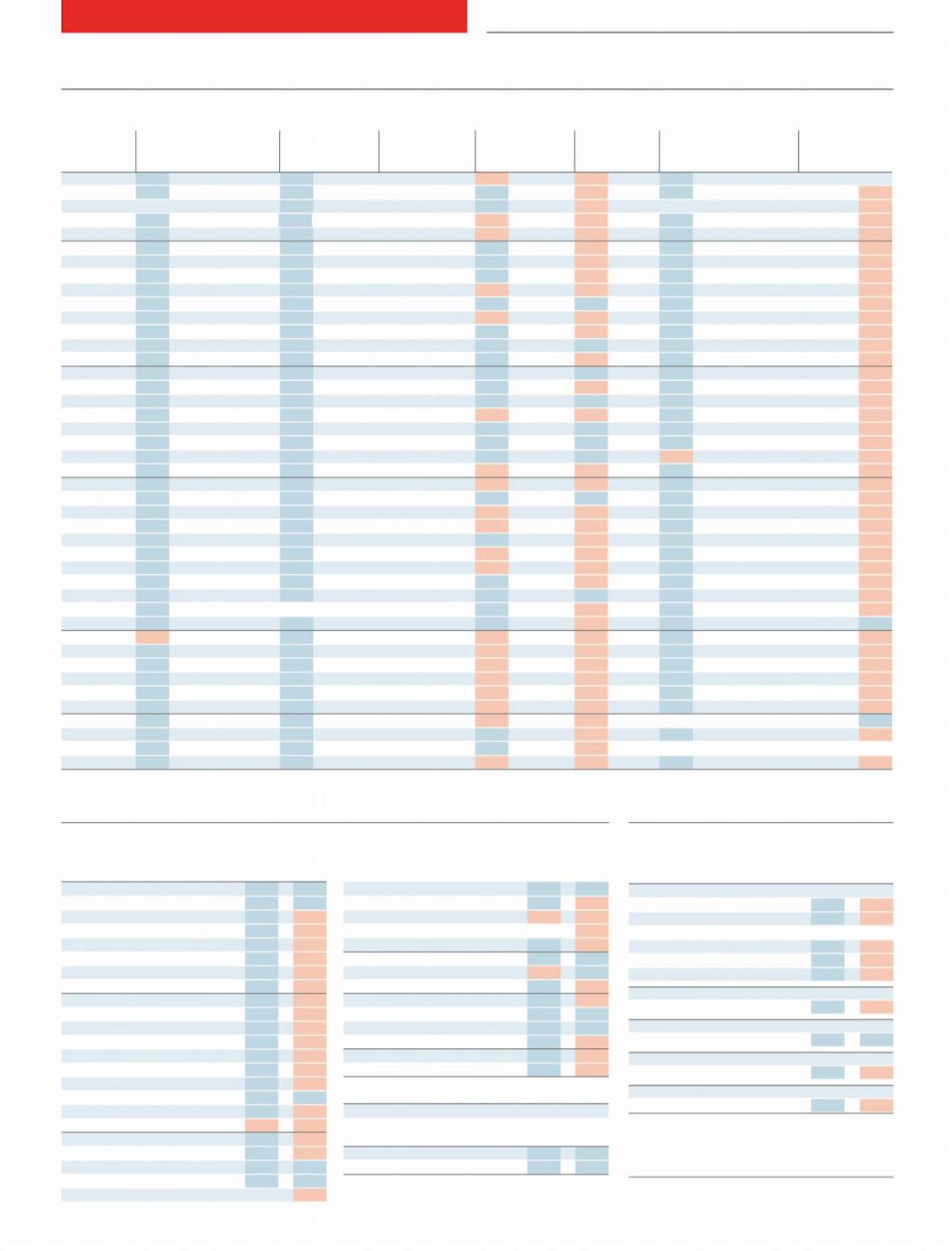

Figure 2: Summary sector ratings and TPs (ranked by total potential 12M return, including estimated dividends)

|

Unit |

12M TP |

Previous |

Current |

12M target |

12M fwd |

Total 12M |

12M forward |

Rating |

|

12M TP |

price* |

capital return |

dividend yield |

return |

rolling P/E |

|||

|

|

|

|

||||||

Rusal |

HKD |

6.0 |

Susp |

3.3 |

82.9% |

5.3% |

88.2% |

4.5x |

BUY |

Evraz |

GBp |

640.0 |

640.0 |

507.6 |

26.1% |

14.1% |

40.2% |

6.1x |

BUY |

Severstal |

$ |

18.1 |

18.1 |

15.4 |

17.2% |

11.9% |

29.1% |

8.1x |

BUY |

Phosagro |

$ |

16.0 |

16.0 |

13.5 |

18.8% |

7.7% |

26.4% |

6.5x |

BUY |

Norilsk |

$ |

24.0 |

24.0 |

20.8 |

15.6% |

10.4% |

26.0% |

9.8x |

BUY |

NLMK |

$ |

27.0 |

27.0 |

24.0 |

12.5% |

12.9% |

25.4% |

8.4x |

BUY |

MMK |

$ |

10.1 |

10.1 |

8.6 |

17.2% |

6.6% |

23.8% |

12.4x |

BUY |

Alrosa |

RUB |

109.0 |

109.0 |

99.5 |

9.5% |

13.0% |

22.6% |

7.3x |

BUY |

Polyus |

RUB |

6,300.0 |

6,300.0 |

5,521.5 |

14.1% |

6.0% |

20.1% |

7.1x |

BUY |

Rio Tinto |

GBP |

48.0 |

48.0 |

42.3 |

13.5% |

6.3% |

19.7% |

9.6x |

BUY |

Exxaro |

ZAR |

170.0 |

170.0 |

156.5 |

8.6% |

9.8% |

18.4% |

5.8x |

BUY |

ARM |

ZAR |

160.0 |

160.0 |

147.3 |

8.6% |

9.6% |

18.2% |

5.9x |

BUY |

Impala Platinum |

ZAR |

45.0 |

45.0 |

38.8 |

16.1% |

0.0% |

16.1% |

8.1x |

BUY |

ArcelorMittal SA |

ZAR |

4.0 |

4.0 |

3.5 |

15.9% |

0.0% |

15.9% |

-139.9x |

HOLD |

South32 |

ZAR |

37.0 |

37.0 |

33.9 |

9.0% |

6.7% |

15.7% |

11.4x |

HOLD |

BHP |

ZAR |

315.0 |

315.0 |

297.3 |

6.0% |

9.2% |

15.2% |

11.7x |

HOLD |

Fortescue |

AUD |

6.0 |

6.0 |

5.8 |

2.7% |

8.7% |

11.4% |

7.6x |

BUY |

Glencore |

ZAR |

55.0 |

55.0 |

53.1 |

3.7% |

6.7% |

10.3% |

11.6x |

HOLD |

Vale |

$ |

13.6 |

13.6 |

12.6 |

8.2% |

0.0% |

8.2% |

6.3x |

HOLD |

Polymetal |

GBP |

8.6 |

8.6 |

8.6 |

-0.1% |

6.6% |

6.5% |

7.7x |

HOLD |

Acron |

RUB |

4,600.0 |

4,600.0 |

4,670.0 |

-1.5% |

6.9% |

5.4% |

7.8x |

HOLD |

Anglo American |

ZAR |

340.0 |

340.0 |

345.2 |

-1.5% |

6.0% |

4.5% |

8.9x |

HOLD |

Assore |

ZAR |

320.0 |

320.0 |

346.8 |

-7.7% |

8.6% |

0.8% |

6.6x |

HOLD |

Sibanye - Stillwater |

ZAR |

11.1 |

11.1 |

12.1 |

-8.3% |

0.2% |

-8.1% |

5.6x |

HOLD |

Kumba Iron Ore |

ZAR |

270.0 |

270.0 |

340.6 |

-20.7% |

12.3% |

-8.4% |

8.2x |

SELL |

RBPlats |

ZAR |

25.0 |

25.0 |

28.8 |

-13.0% |

0.0% |

-13.0% |

8.2x |

SELL |

Anglo American Platinum |

ZAR |

540.0 |

540.0 |

636.0 |

-15.1% |

1.9% |

-13.2% |

15.7x |

HOLD |

Gold Fields |

ZAR |

43.0 |

43.0 |

53.8 |

-20.0% |

3.2% |

-16.8% |

9.7x |

SELL |

Northam |

ZAR |

40.0 |

40.0 |

48.5 |

-17.5% |

0.0% |

-17.5% |

13.1x |

SELL |

Harmony |

ZAR |

21.0 |

21.0 |

26.9 |

-22.0% |

3.6% |

-18.5% |

4.1x |

SELL |

Lonmin |

ZAR |

7.0 |

7.0 |

9.6 |

-26.8% |

0.0% |

-26.8% |

1.7x |

SELL |

AngloGold |

ZAR |

110.0 |

110.0 |

190.0 |

-42.1% |

1.1% |

-41.0% |

8.4x |

SELL |

Note: Priced at market close on 1 February 2019

Source: Thomson Reuters Datastream, Renaissance Capital estimates

http://new.guap.ru/i04/contacts |

2 |

|

vk.com/id446425943

Renaissance Capital

5 February 2019

Rusal

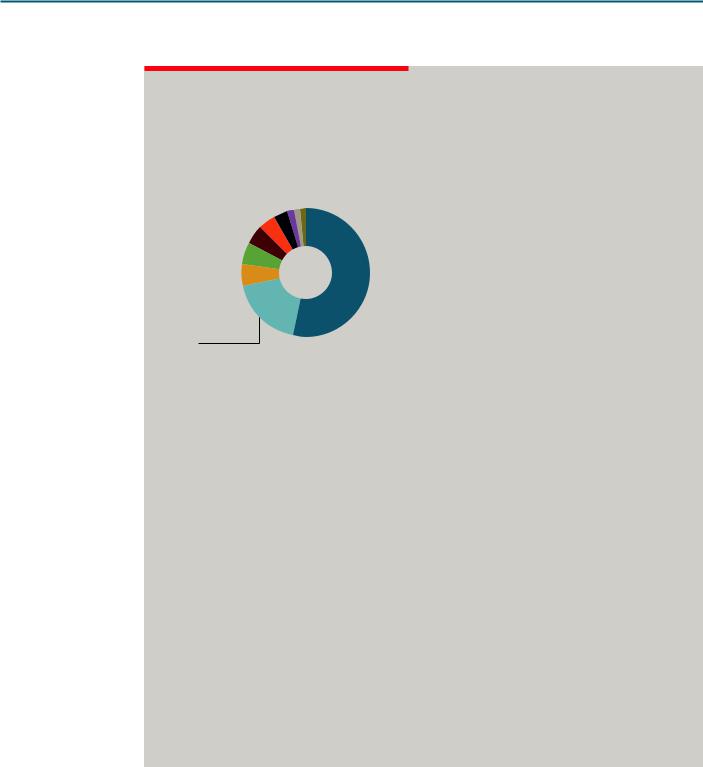

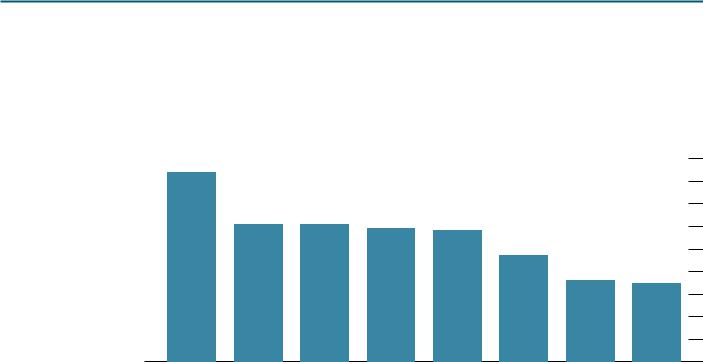

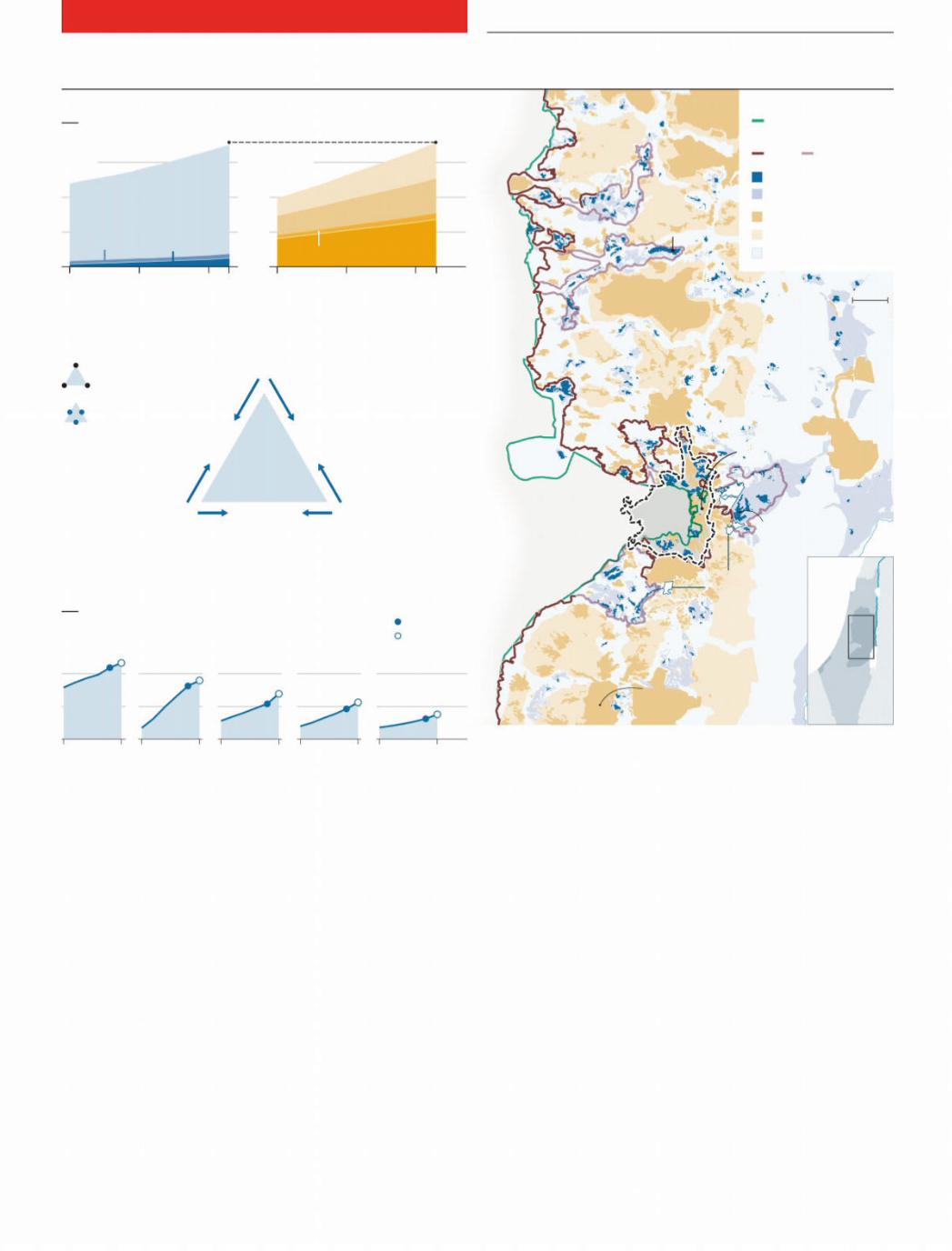

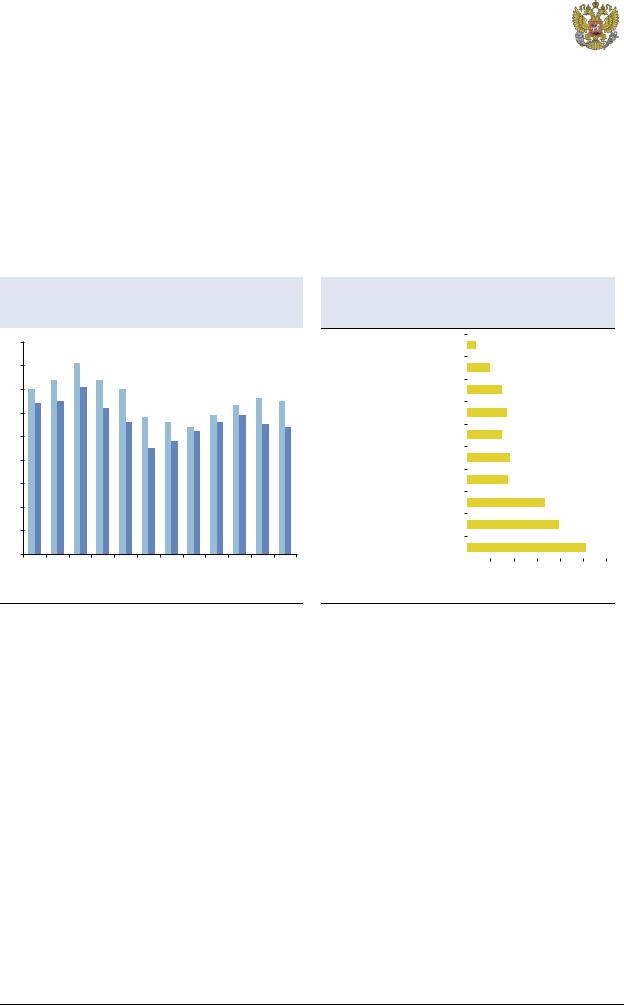

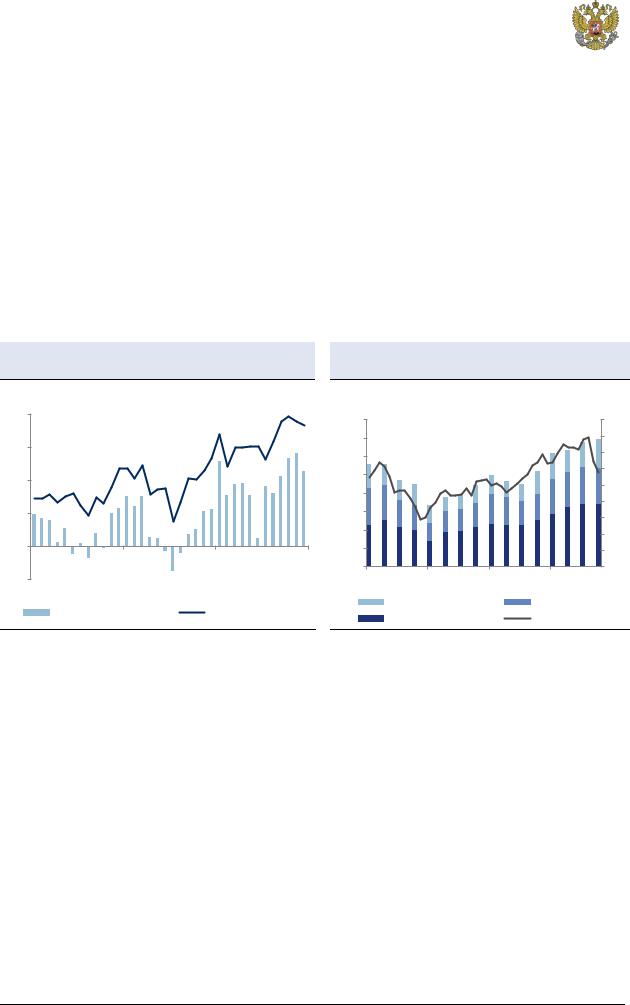

Favourable cost curve position

Rusal’s operations are competitively positioned in the first half of the aluminium cost curve.

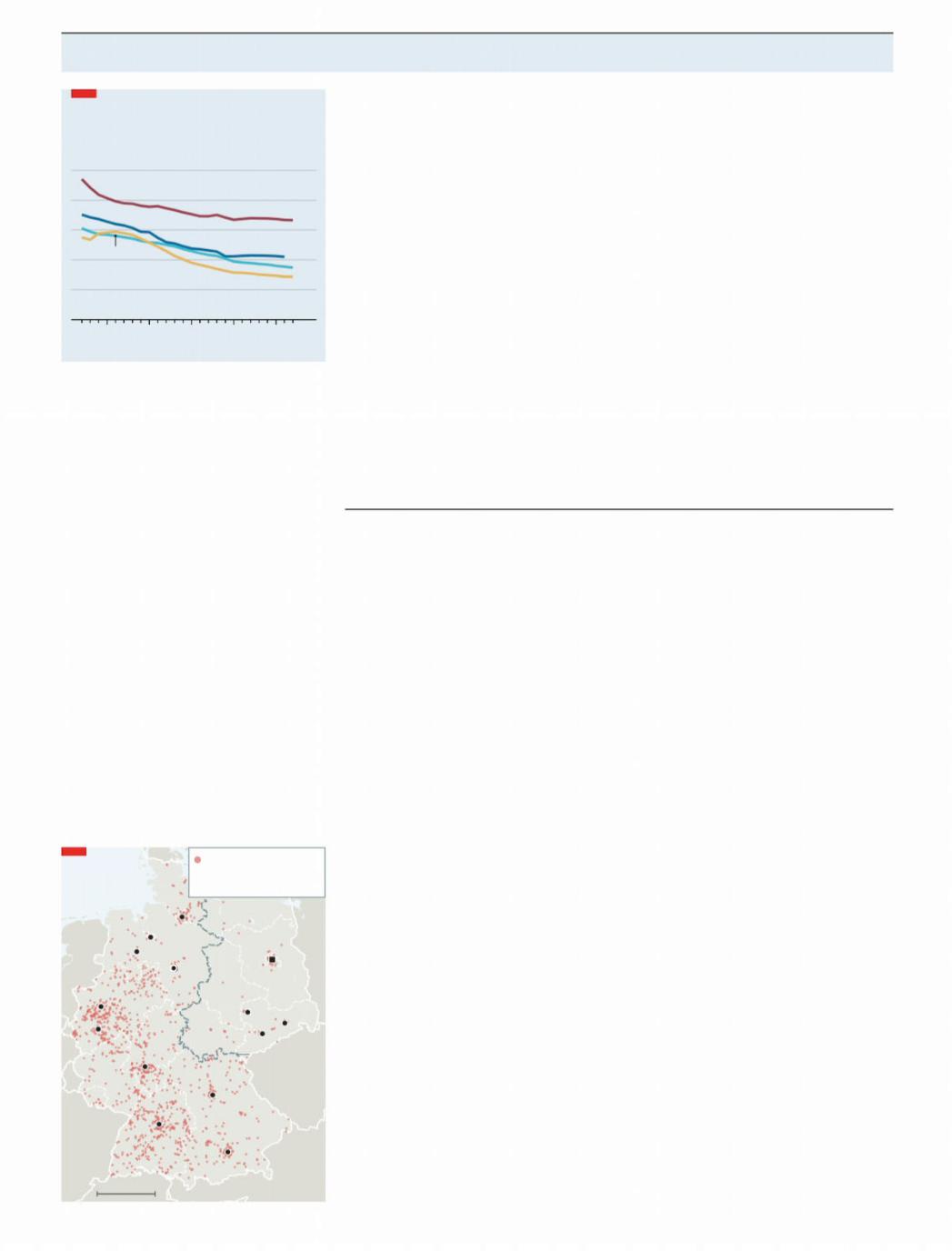

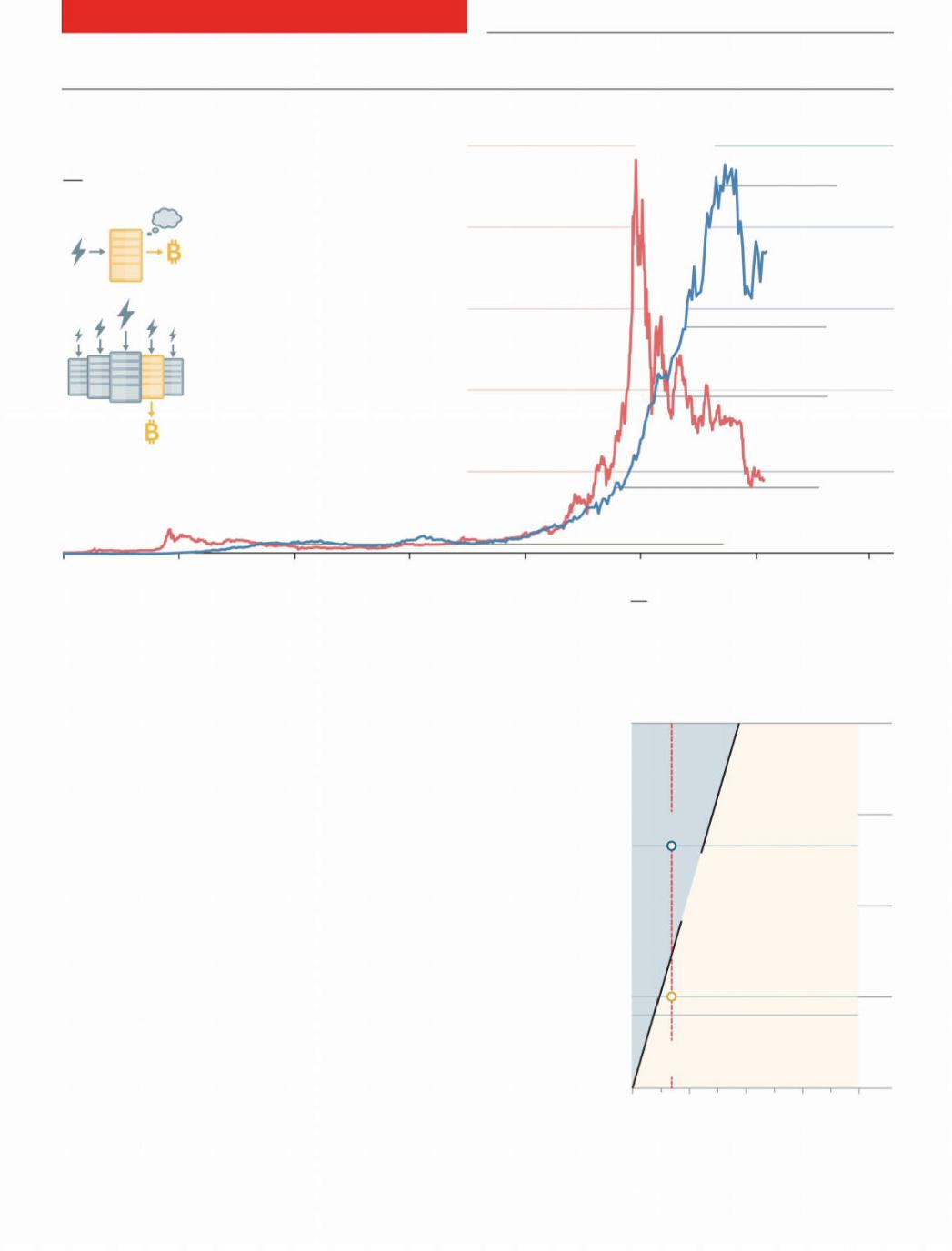

Figure 3 shows our calculation of the estimated breakeven price per tonne of aluminium for Rusal in FY18 relative to the aluminium industry.

Figure 3: 2018E aluminium cash costs plus sustaining capex (reflecting 67.5mnt supply), $/t

3,500

3,000 |

Incentive price: $3,000/t |

|

|

|

|

||

2,500 |

|

|

|

|

|

|

90th percentile: $2,231/t |

|

|

|

70th percentile: $2,072/t |

2,000 |

Average cash cost: $1,927/t |

|

|

|

Spot price: $1,892/t* |

50th percentile: $1,939/t |

|

|

South32,1,783 |

||

1,500 |

1,530Tinto, |

1,658Rusal, |

|

|

|

|

|

1,000 |

Rio |

|

|

500

Note: Priced as at 1 February 2019

Source: Bloomberg, CRU, Renaissance Capital estimates

We believe Rusal and Norilsk’s favourable cost-curve positions would allow for positive

FCF generation through the cycle.

http://new.guap.ru/i04/contacts |

3 |

|

vk.com/id446425943

Renaissance Capital

5 February 2019

Rusal

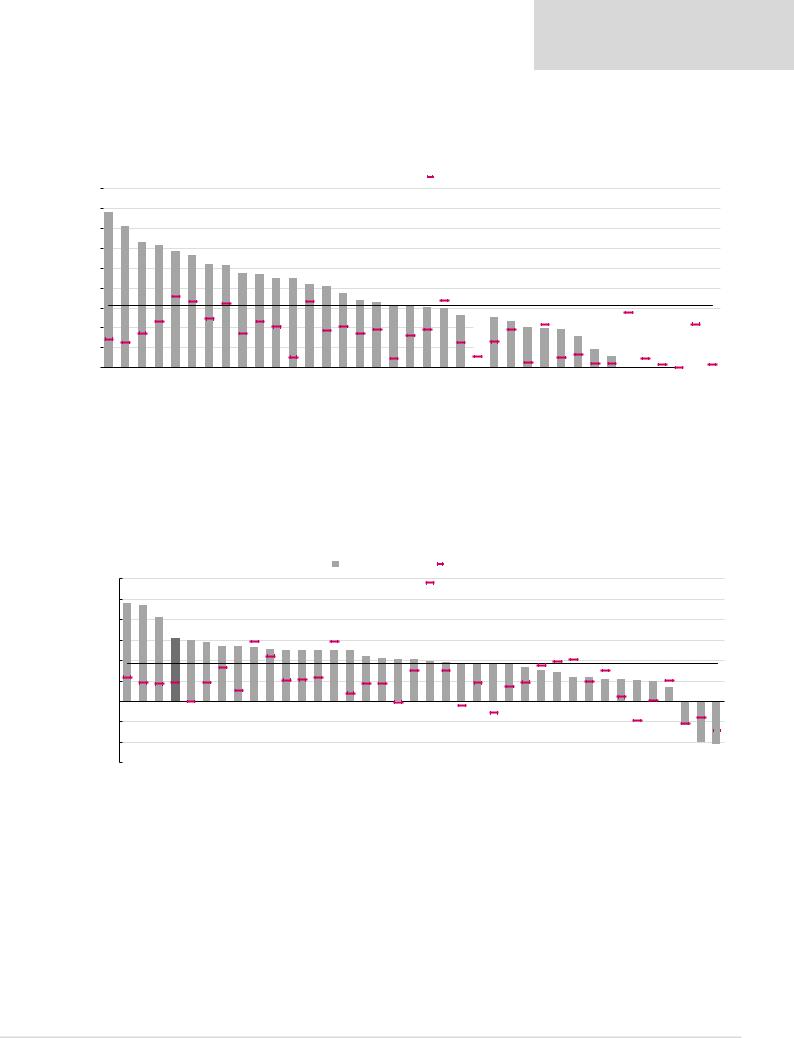

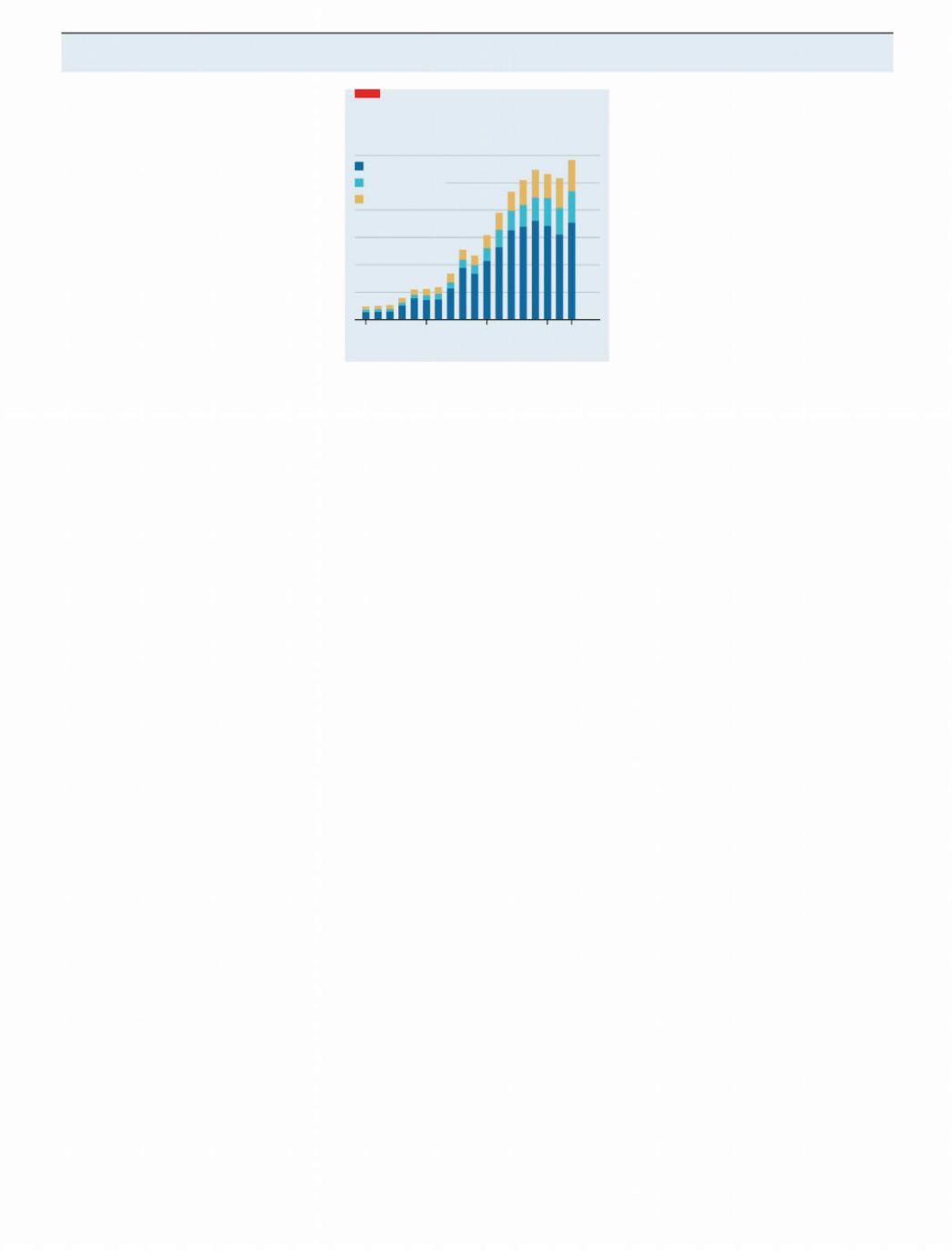

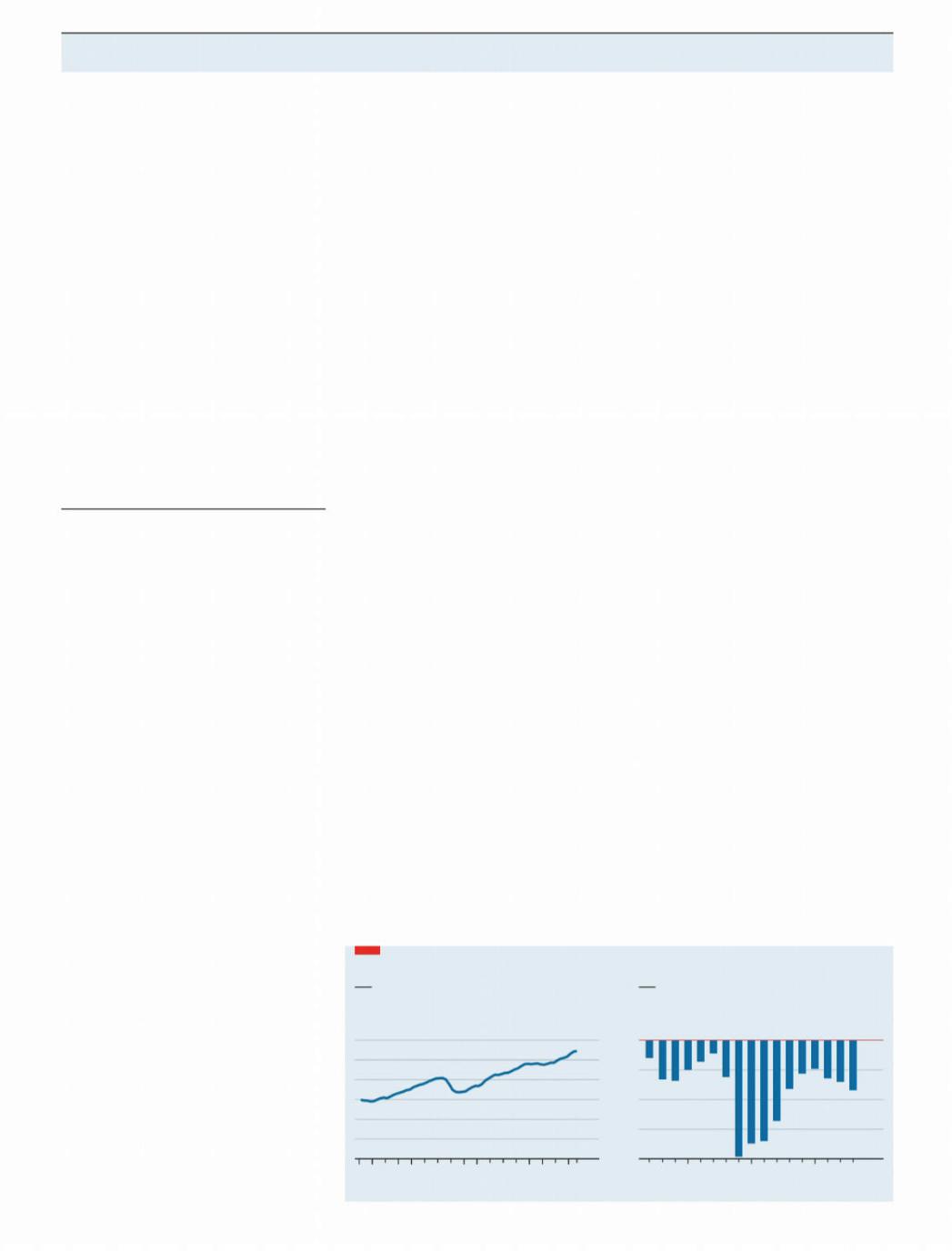

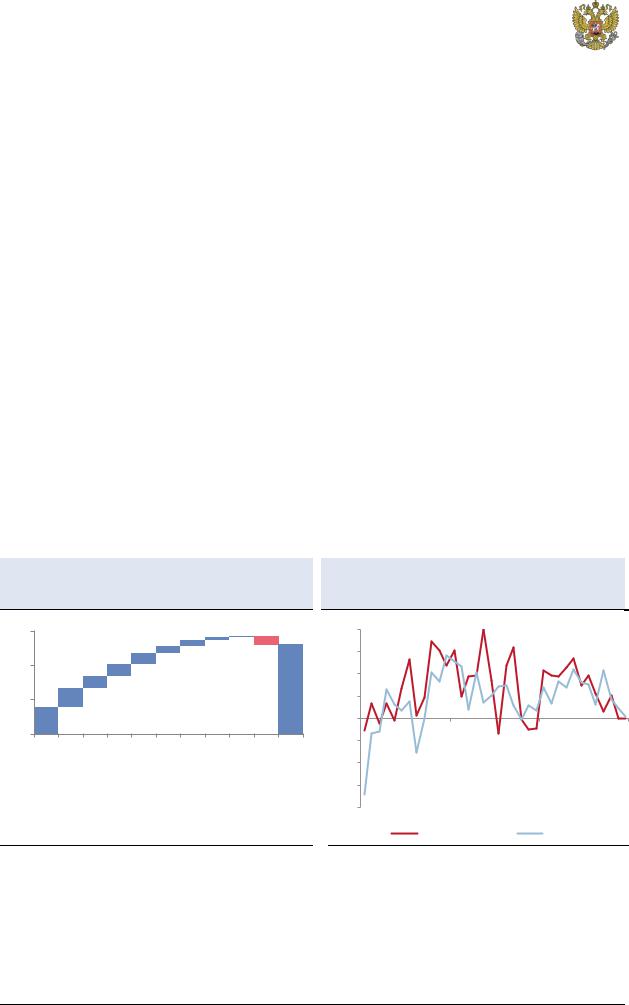

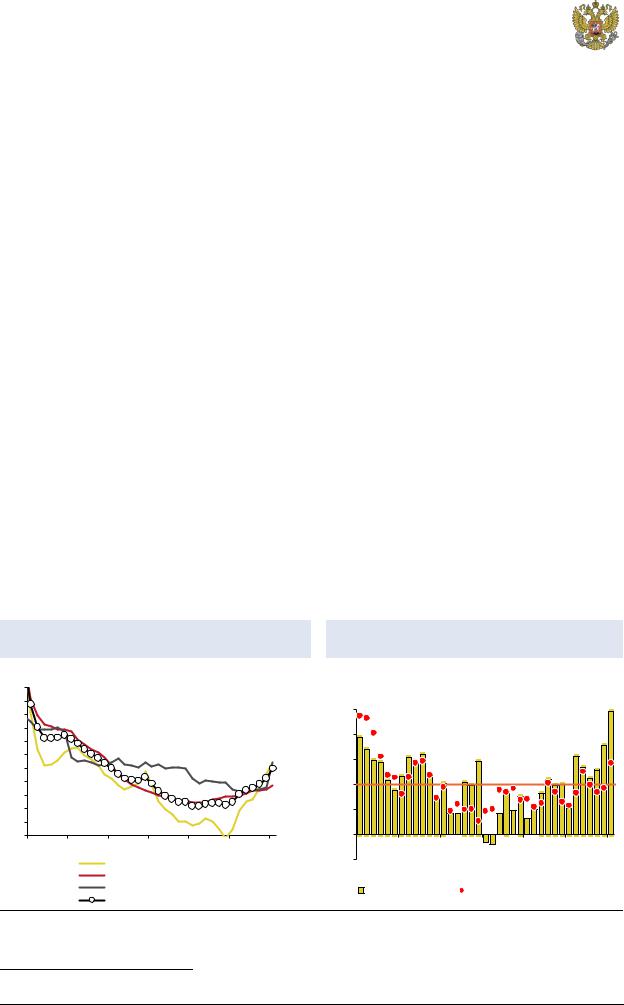

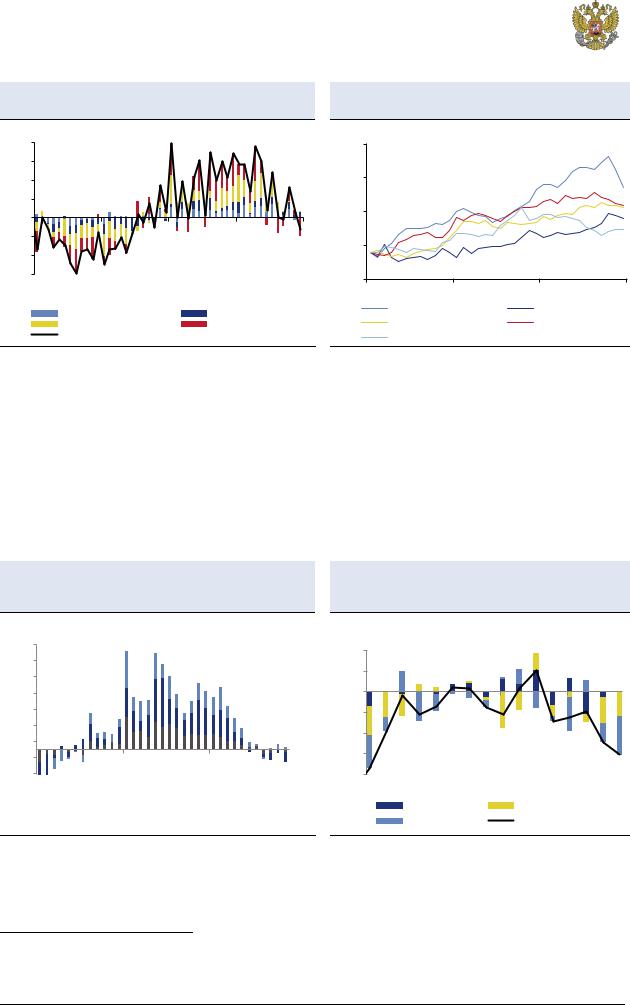

Deleveraging and dividends

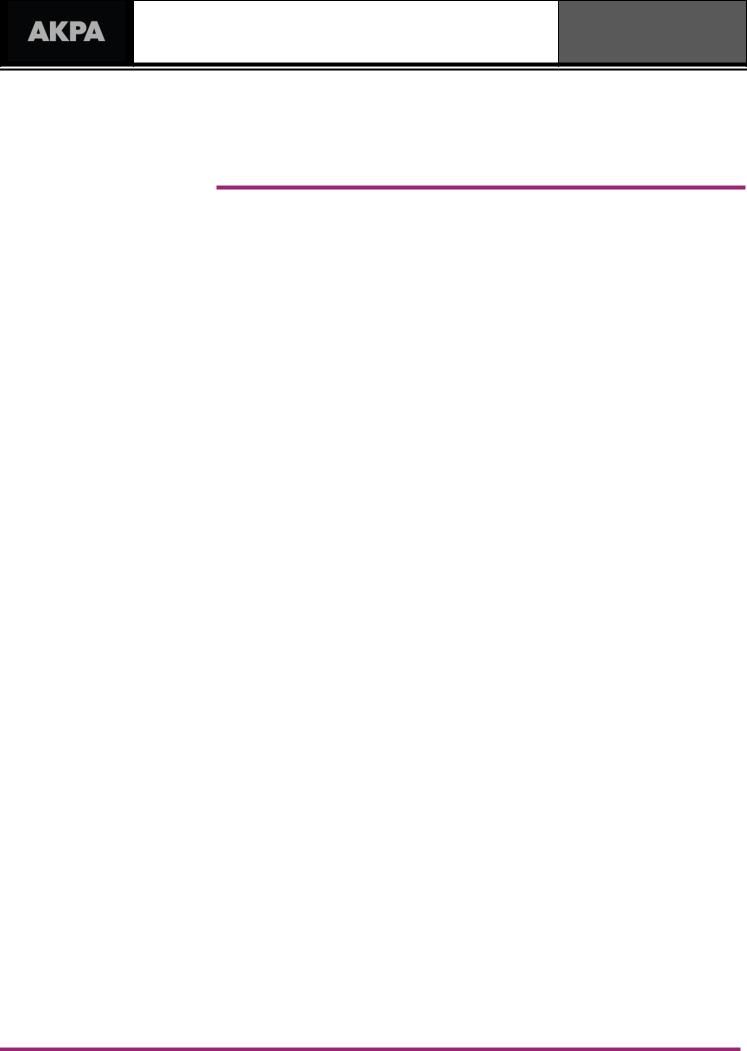

We forecast Rusal’s net debt/(EBITDA + Norilsk dividends) at around 2.3x at the end of

FY19E, which is among the highest in our coverage universe. However, this is based on below mid-cycle EBITDA, which in turn is based on our average aluminium price forecast of $1,953/t.

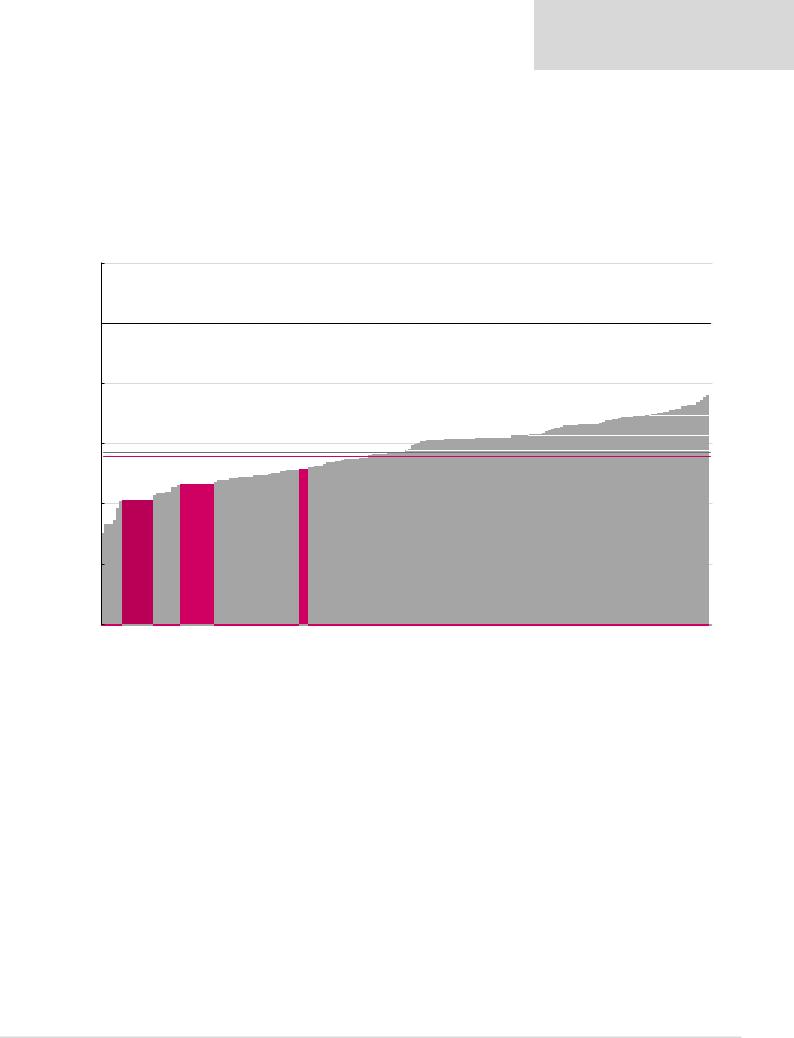

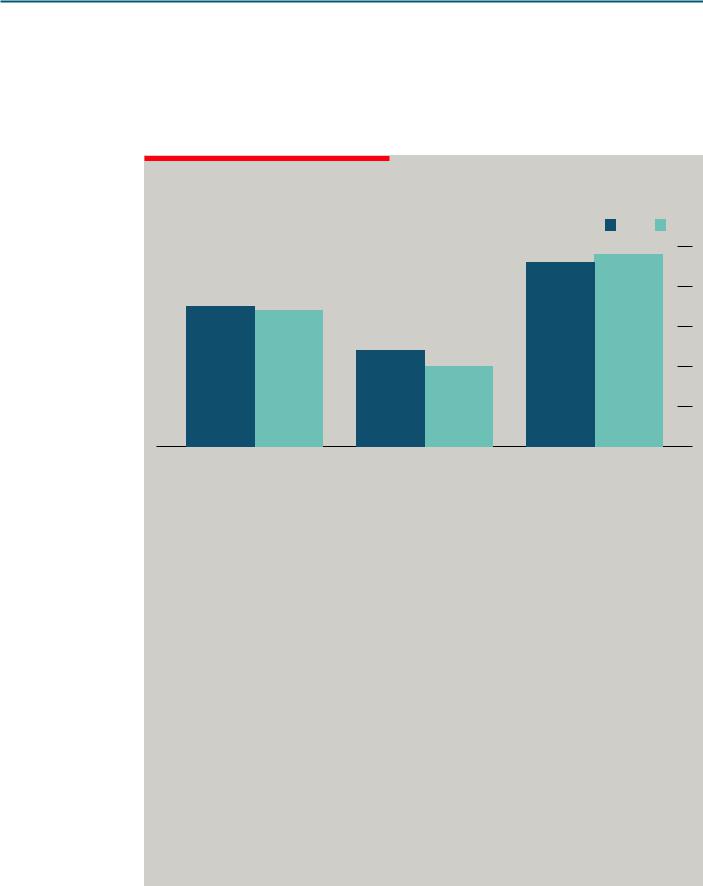

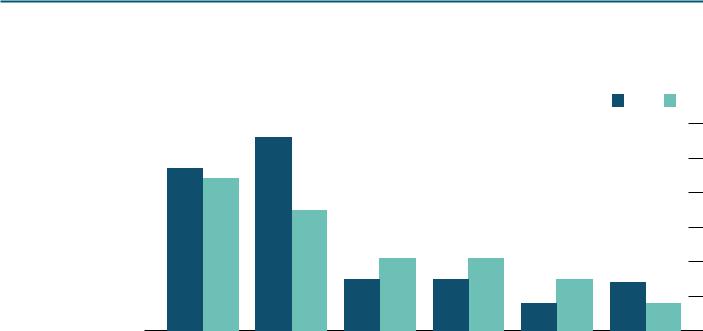

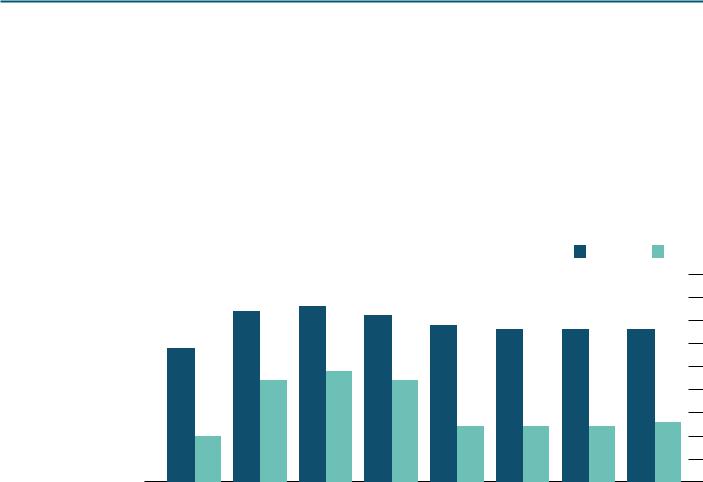

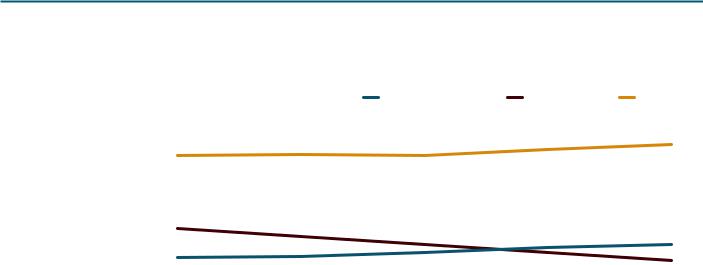

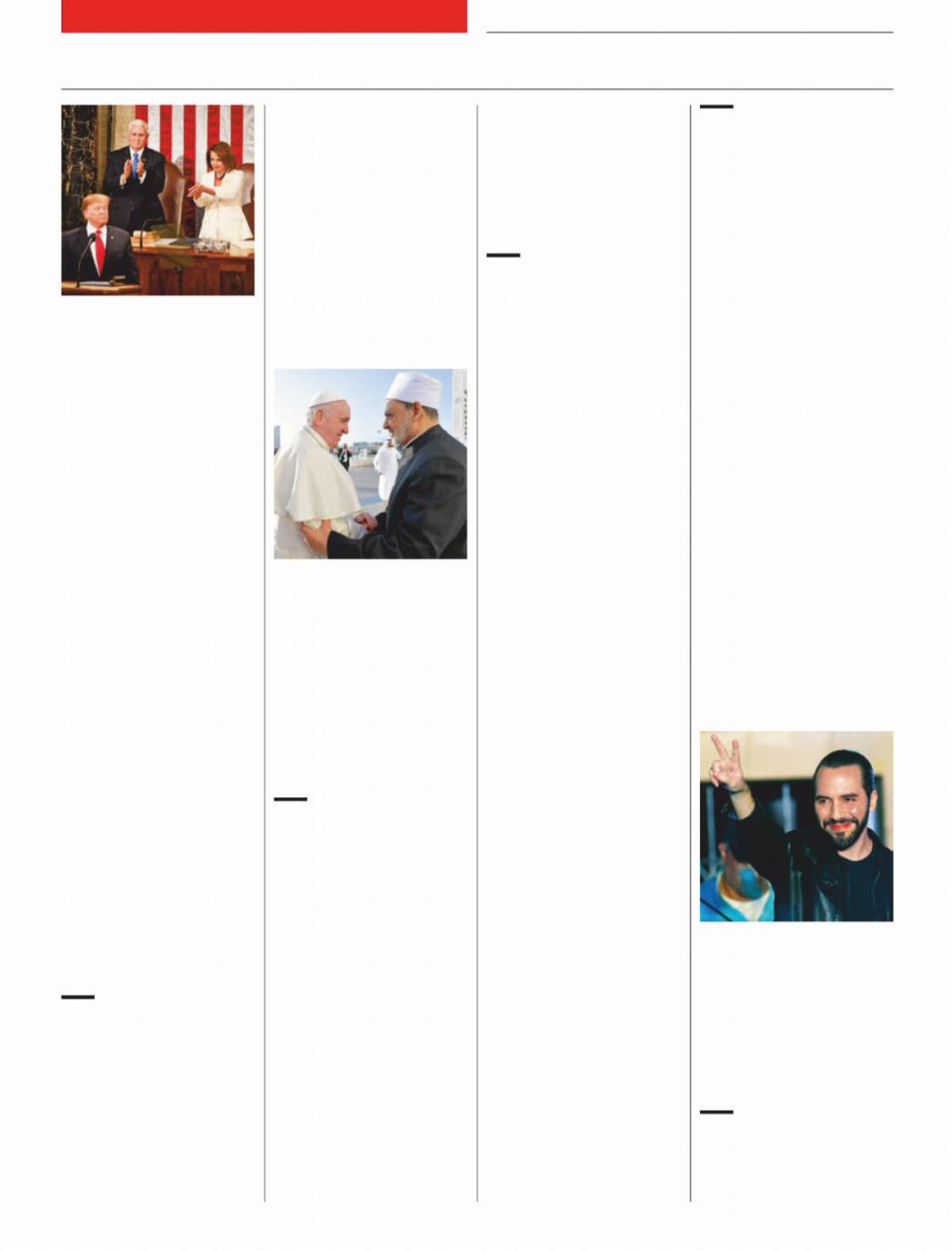

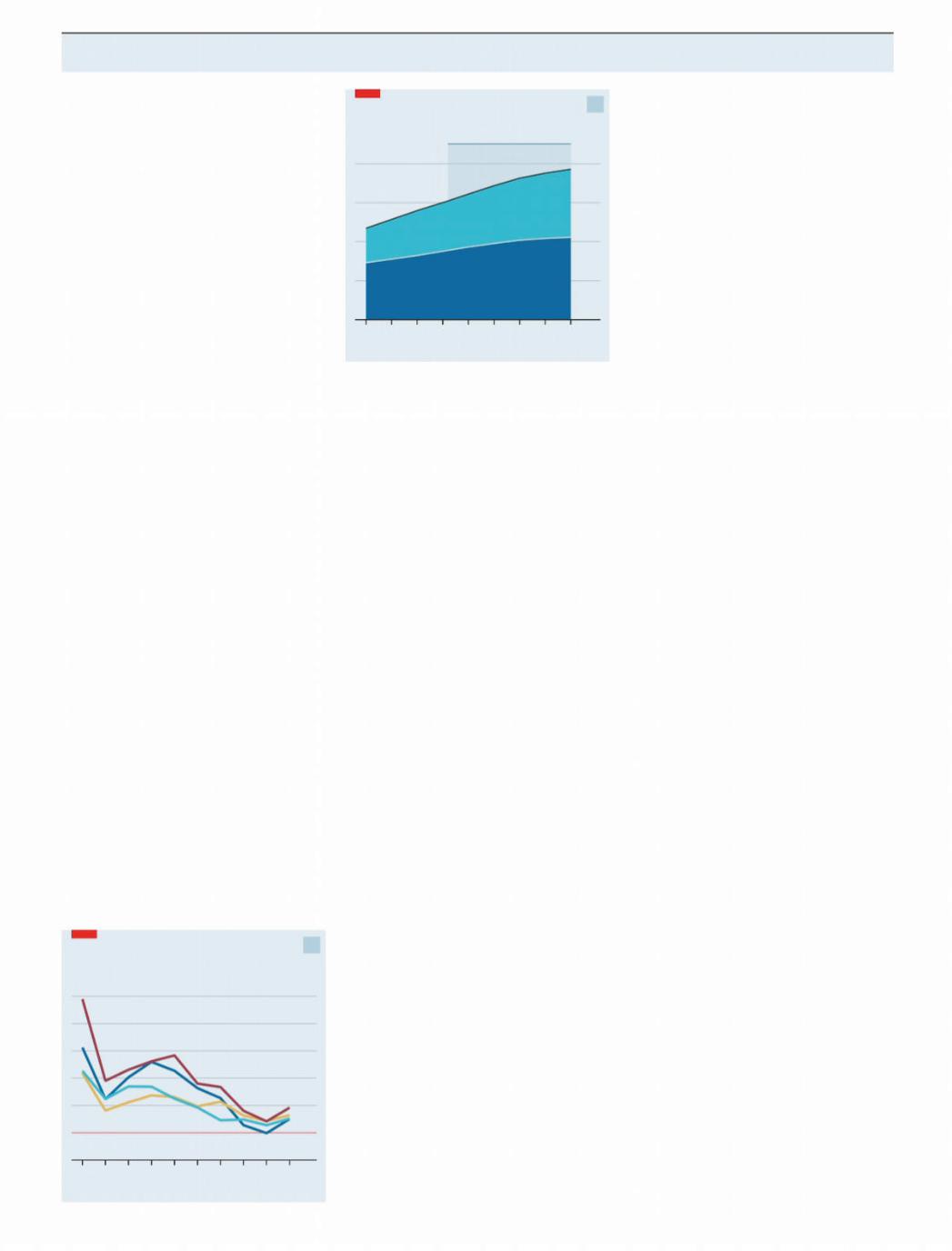

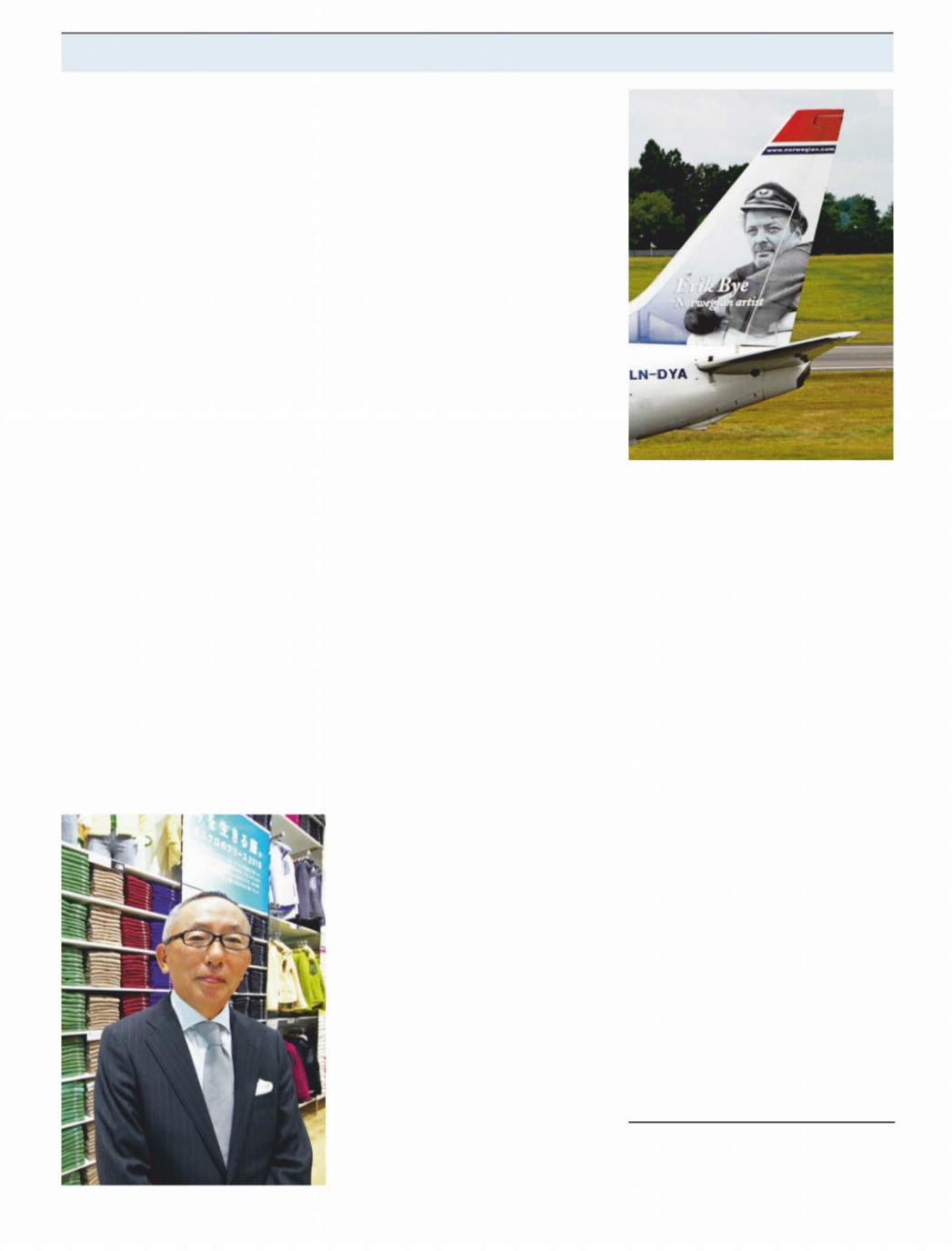

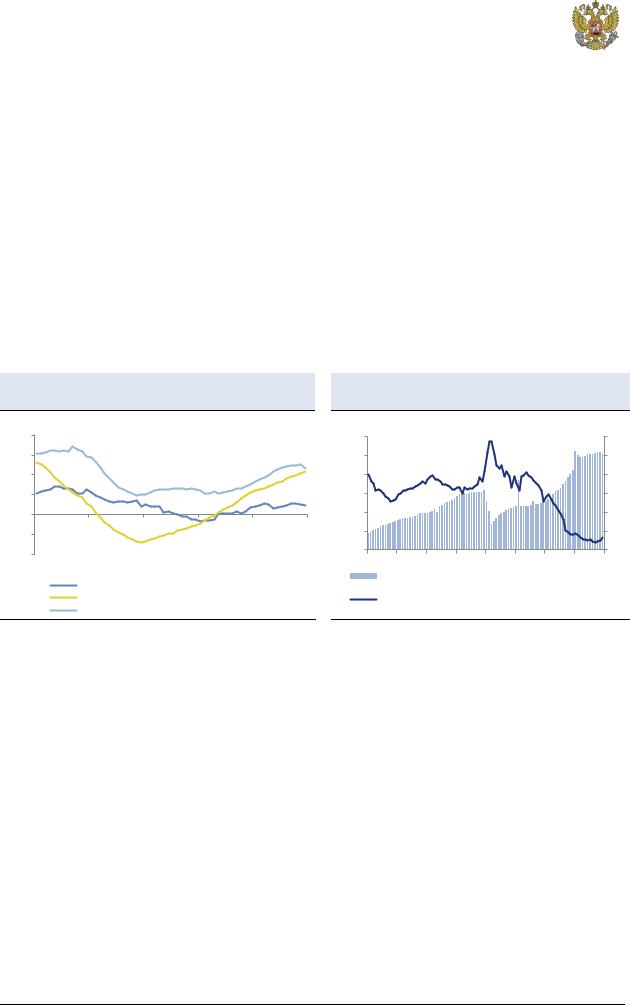

Figure 4: Miners ranked by CY19E net debt/EBITDA compared with their historical averages

4x |

|

3.5x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

3x |

|

|

|

|

|

|

|

|

|

2x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.4x |

|

2.3x |

1.9x |

1.6x |

1.6x |

1.4x |

||

|

|

|

|||||||

1x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-1x |

|

|

|

|

|

|

|

|

|

-2x |

|

Northam Glencore |

Rusal* |

Sappi |

Sasol |

Norilsk |

RBPlats |

||

|

|||||||||

|

|

||||||||

Note: Priced at market close on 1 February 2019

|

CY19E Net debt/EBITDA |

|

LT average |

|

|

1.3x |

1.2x |

1.1x |

1.1x |

1.1x |

1.1x |

1.0x |

1.0x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.7x |

0.6x |

0.5x |

0.5x |

0.4x |

0.4x |

0.4x |

0.3x |

0.3x |

0.2x |

0.1x |

0.1x |

0.1x |

0.1x |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sector average, 0.6x |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.0x |

-0.1x |

-0.3x |

-0.4x |

-0.5x |

-0.5x |

-0.7x |

-0.8x+ |

||||

Evraz |

AMSA |

PhosAgro |

Mondi |

Polymetal |

Polyus |

Sibanye |

Russian* |

Gold Fields |

Severstal |

Fortescue |

Others* |

AngloGold |

BHP |

NLMK |

Alrosa |

Harmony |

Vale |

Exxaro* |

Impala |

MMK |

Anglo |

Rio Tinto |

Hulamin |

Amplats |

Merafe |

Kumba |

South32 |

ARM* |

Assore* |

||||||||

Source: Company data, Renaissance Capital estimates

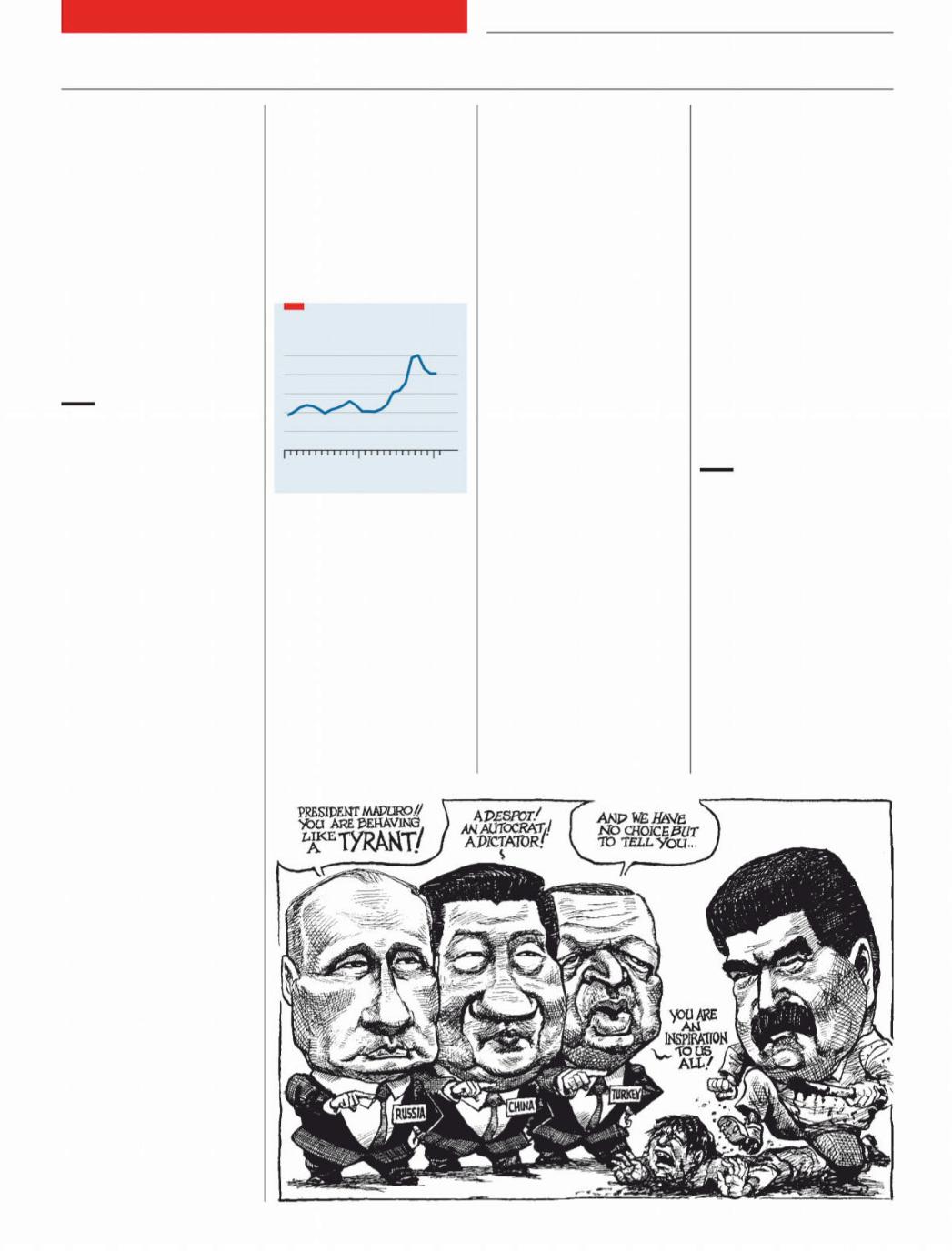

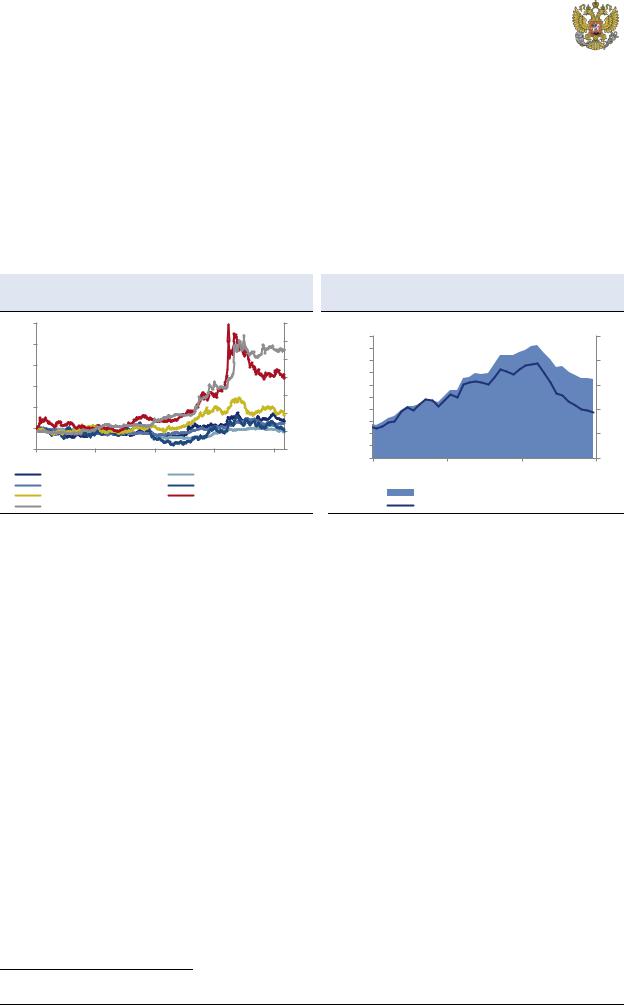

Deleveraging the balance sheet is a strategic priority for Rusal and its medium-term dividend policy is to pay up to 15% of EBITDA plus dividends from Norilsk. We forecast net debt falling from $7.6bn in FY17 to $4.7bn at the end of FY20, implying comfortable net debt/(EBITDA + Norilsk dividend) of 1.5x.

Figure 5: Rusal’s net debt and net debt/(EBITDA plus Norilsk dividends)

|

Net debt, $mn |

|

|

|

Net debt/(EBITDA+dividends from associates) |

18,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25.0x |

16,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20.0x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12,000 |

|

|

|

|

|

|

|

|

|

|

7,648 |

|

|

|

|

|

|

10,000 |

|

|

|

|

|

|

|

|

|

|

6,982 |

|

|

|

|

15.0x |

|

|

|

|

|

|

|

|

|

|

|

5,937 |

|

|

|

|

|||

8,000 |

|

|

|

|

|

|

|

|

|

|

4,740 |

|

|

10.0x |

|||

|

|

|

|

|

|

|

|

|

|

|

3,393 |

|

|||||

6,000 |

|

|

|

|

|

|

|

|

|

|

2,172 |

|

|||||

4,000 |

|

|

|

|

|

|

|

|

|

|

5.0x |

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

2,000 |

|

|

|

|

|

|

|

|

|

|

2.4x |

2.2x |

2.3x |

1.5x 1.0x |

0.7x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

2018E |

2019E |

2020E |

2021E |

2022E |

0.0x |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

|||||

Source: Company data, Renaissance Capital estimates

http://new.guap.ru/i04/contacts |

4 |

|

vk.com/id446425943

Renaissance Capital

5 February 2019

Rusal

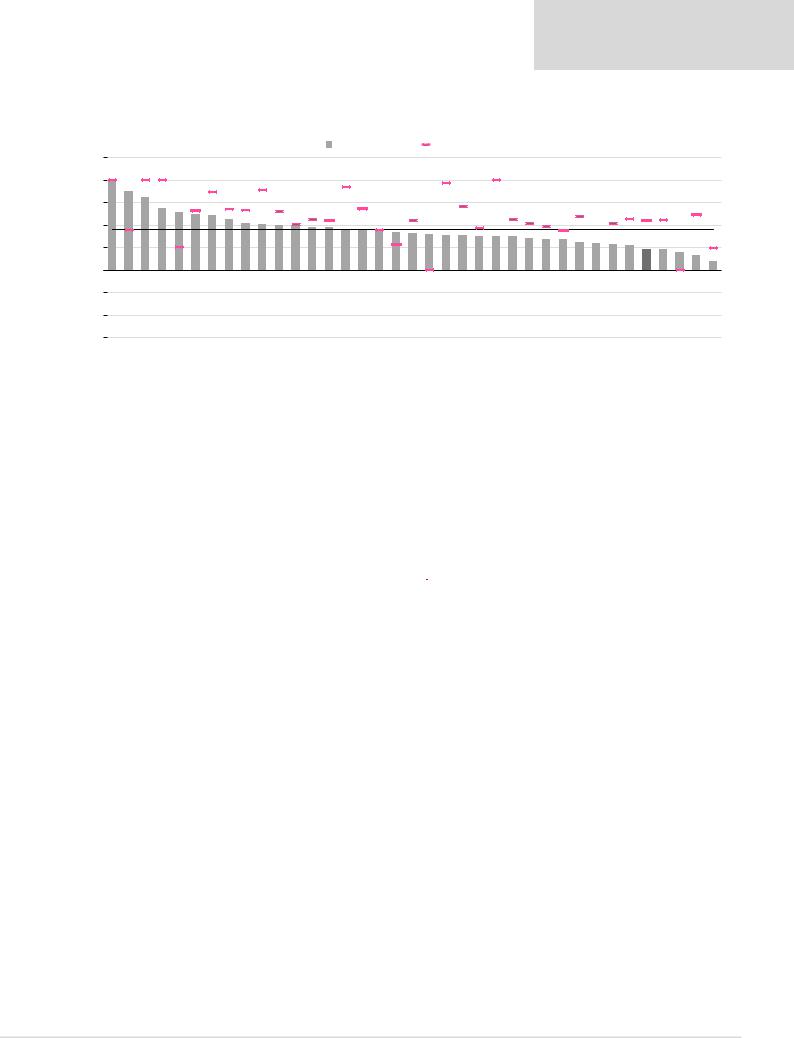

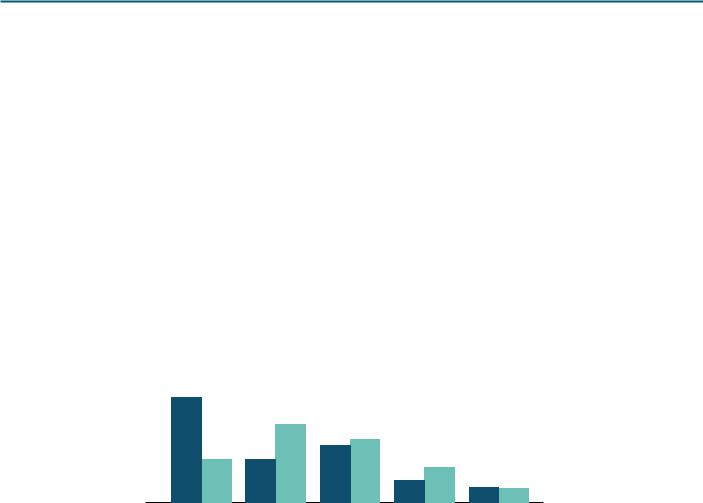

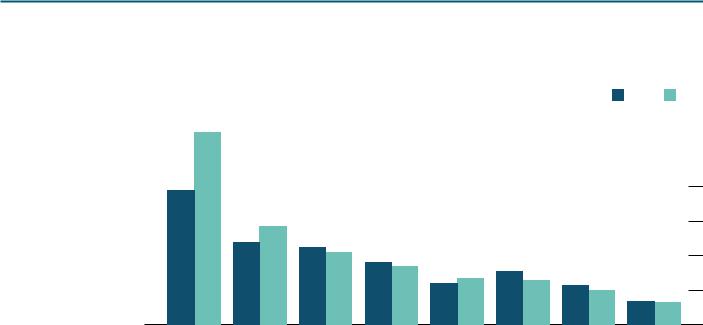

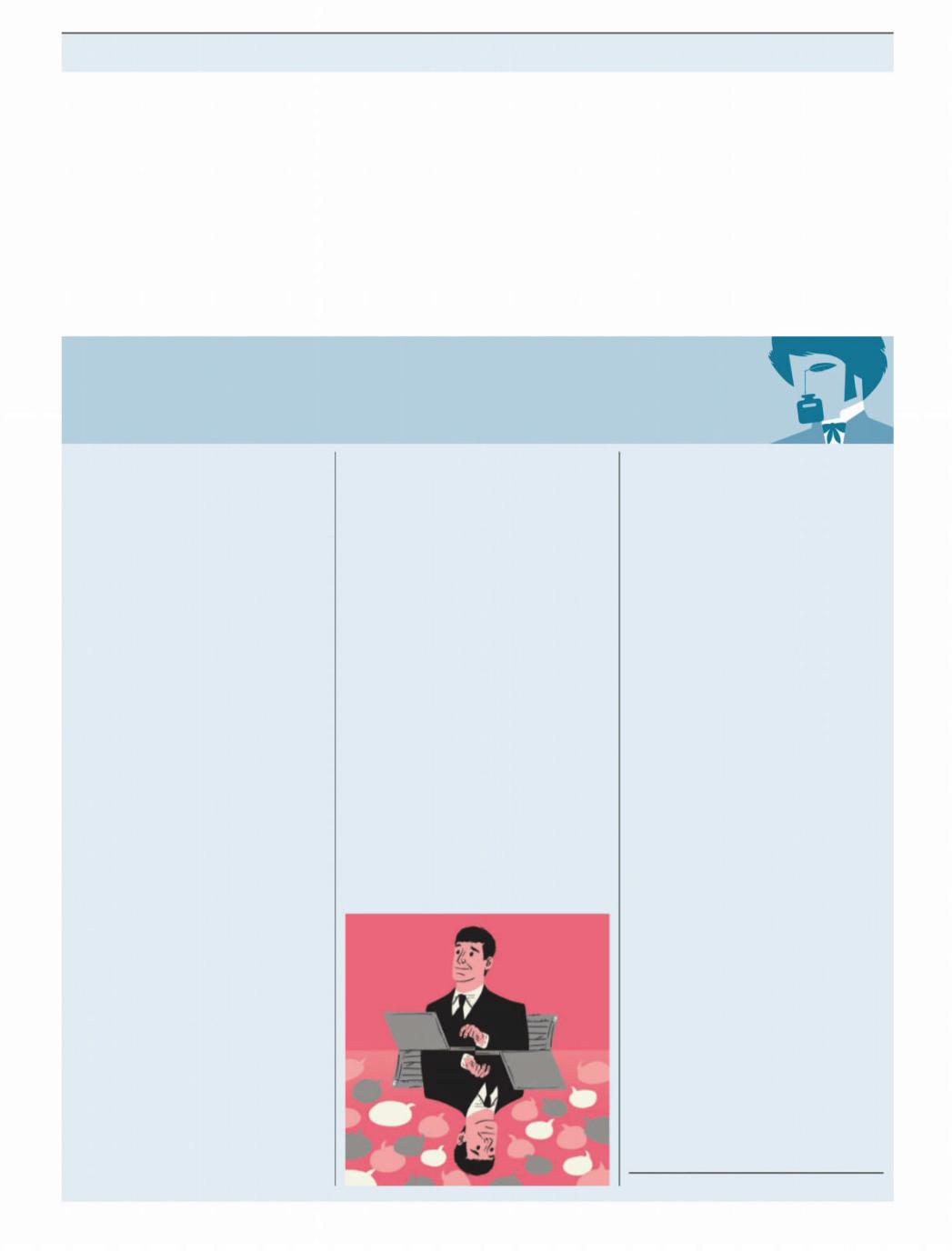

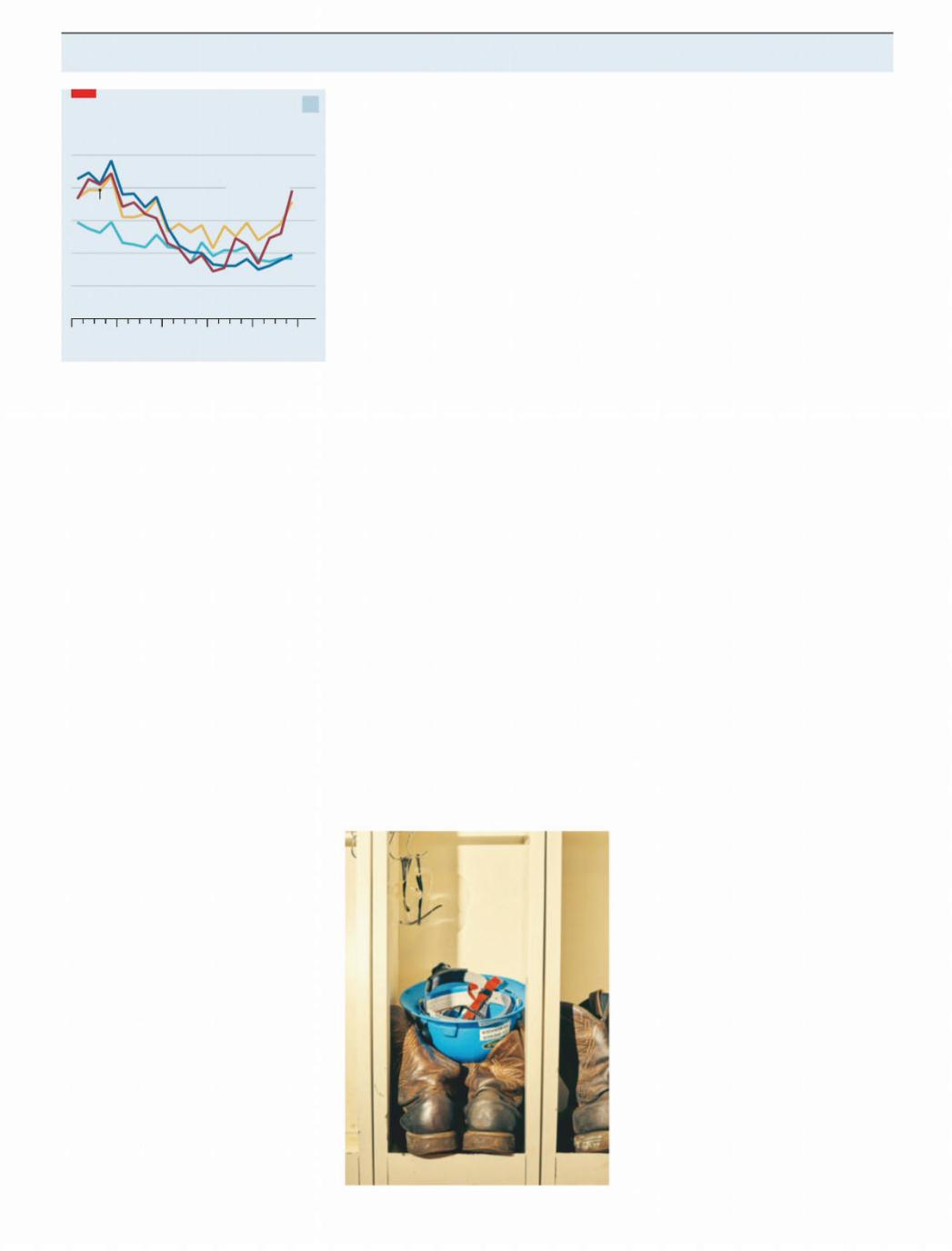

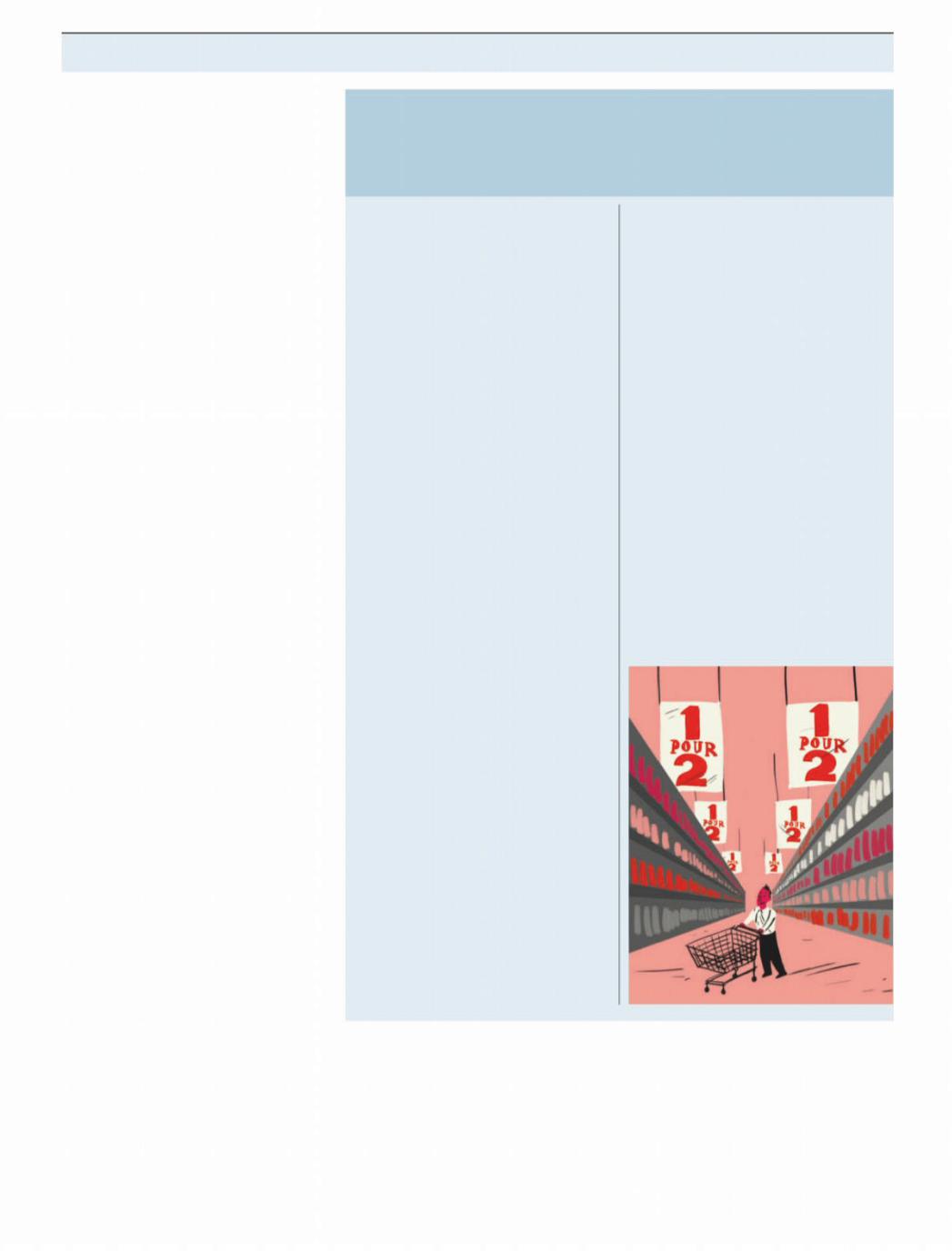

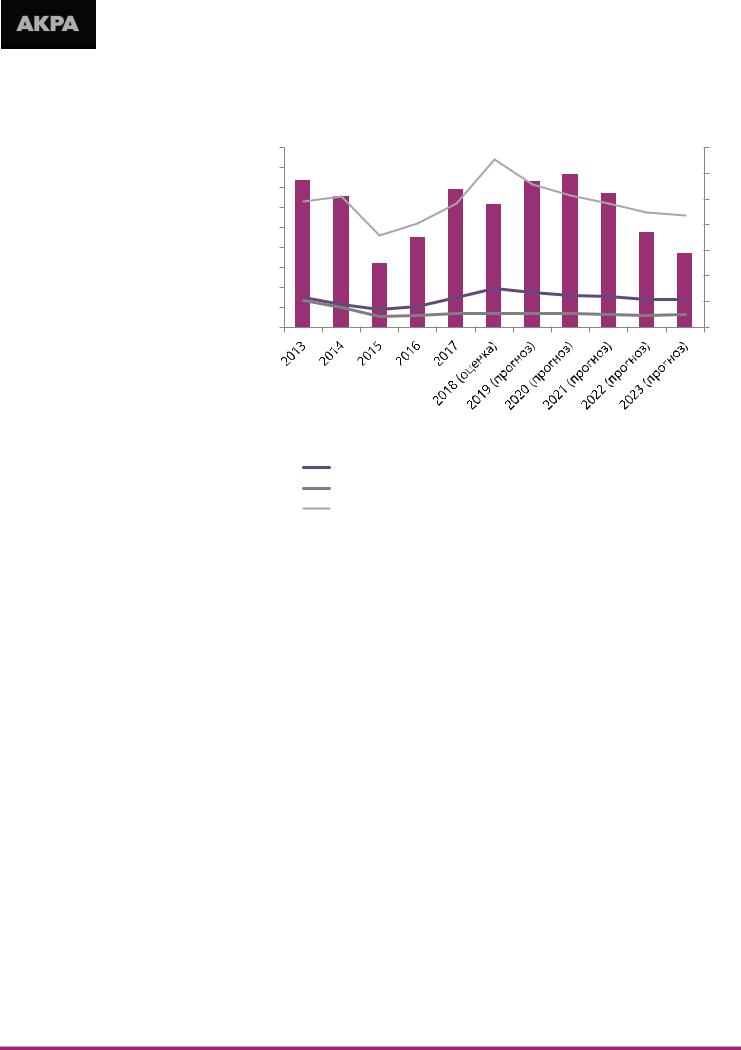

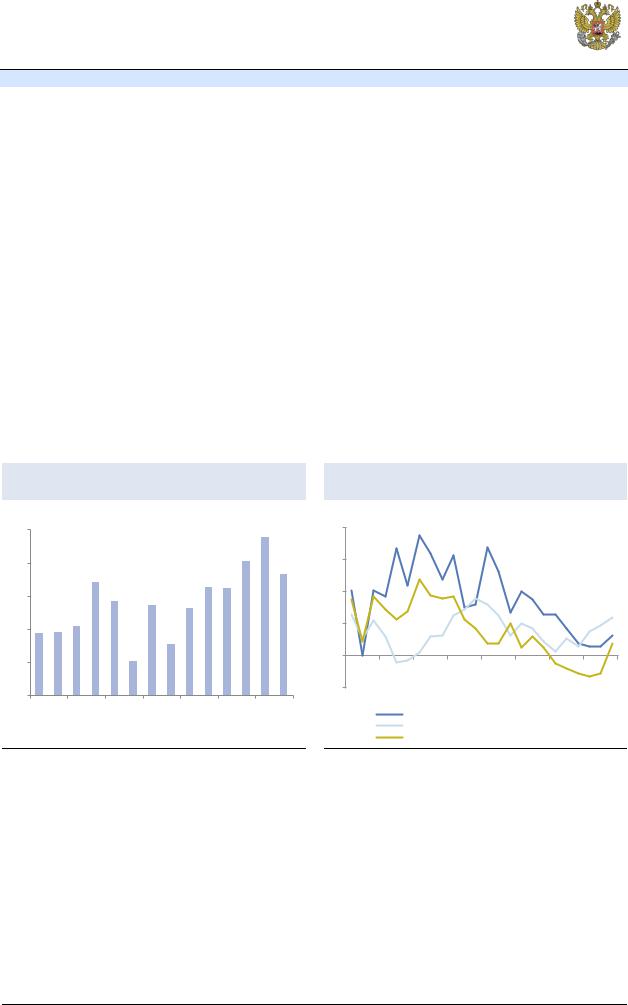

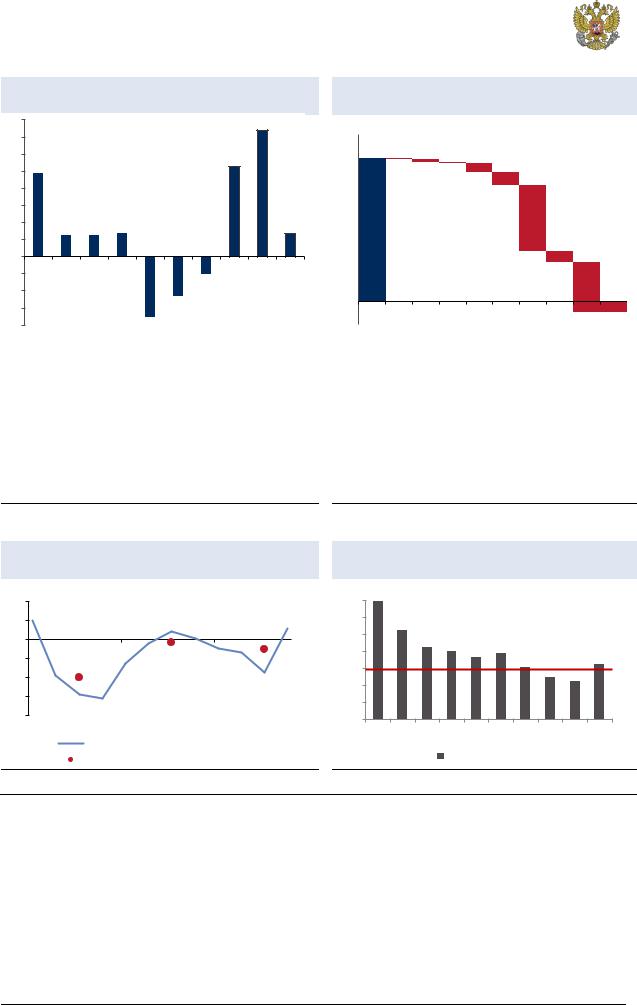

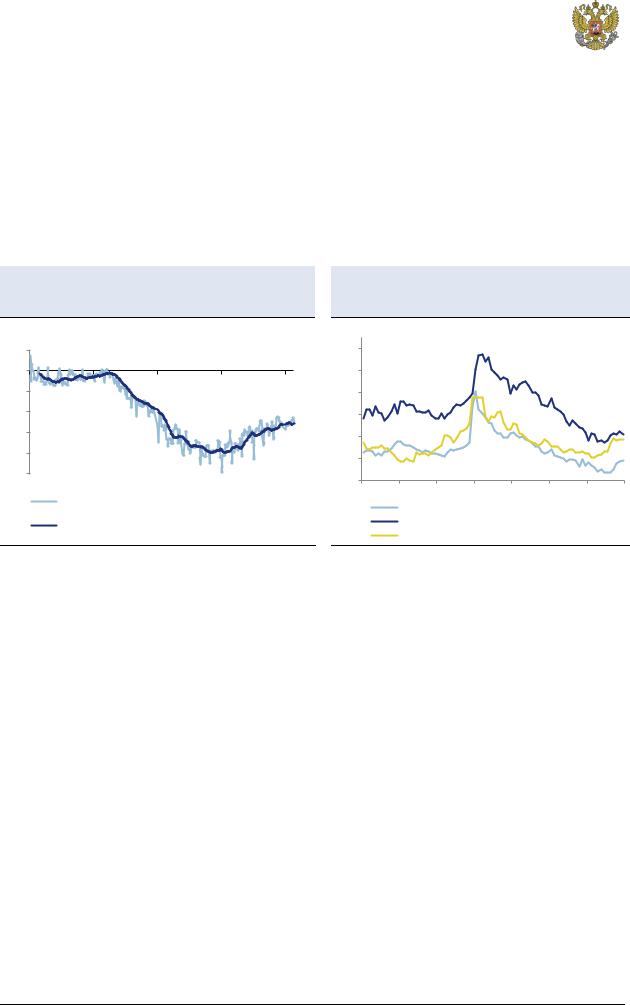

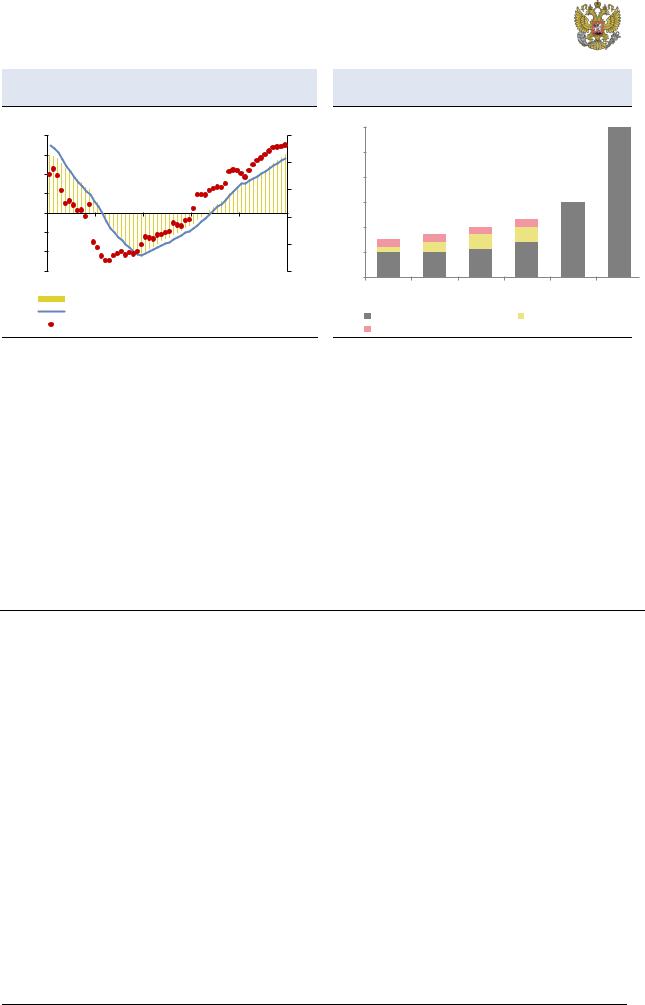

Despite Rusal’s conservative dividend policy, we forecast a supportive FY19E dividend yield of 5.1%. We forecast Rusal’s dividend yield over the next three years to be 6.5% on average.

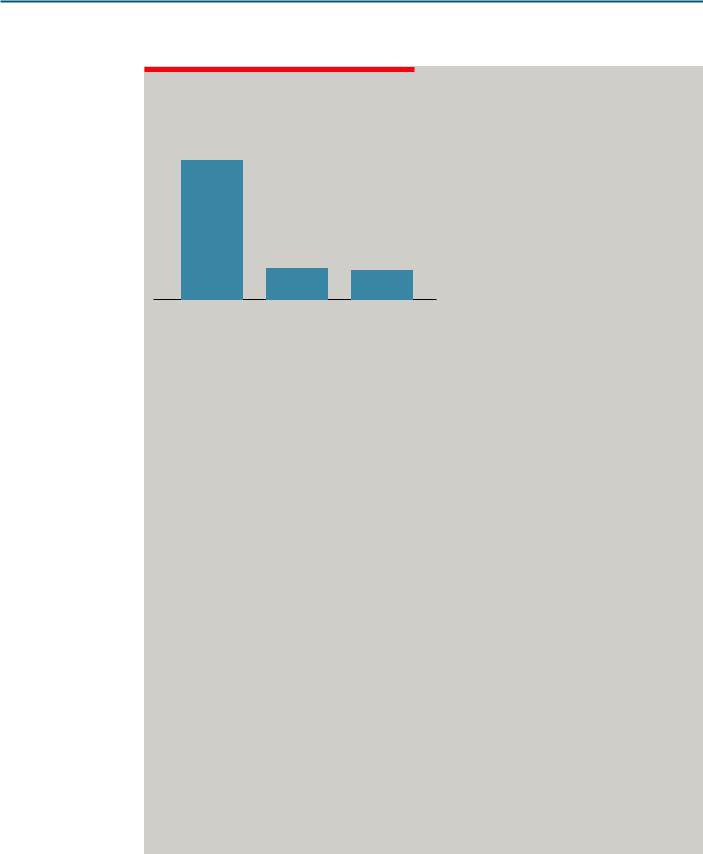

Figure 6: Miners ranked by CY19E dividend yield compared with their historical averages

18% |

|

15.6% |

14.2% |

12.6% |

12.3% |

11.7% |

11.3% |

|

|||||||

16% |

|

||||||

|

|

|

|

|

|

|

|

14% |

|

|

|

|

|

|

|

12% |

|

|

|

|

|

|

|

10% |

|

|

|

|

|

|

|

8% |

|

|

|

|

|

|

|

6% |

|

|

|

|

|

|

|

4% |

|

|

|

|

|

|

|

2% |

|

|

|

|

|

|

|

0% |

|

Merafe |

Evraz |

Alrosa |

NLMK |

Severstal |

Kumba |

|

|||||||

|

|

Note: Priced at market close on 1 February 2019

10.4% |

10.3% |

9.5% |

9.4% |

9.0% |

8.9% |

8.4% |

|

|

CY19E Dividend yield |

|

|

LT average |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

8.2% |

7.5% |

6.8% |

6.6% |

6.3% |

6.2% |

6.1% |

5.9% |

5.2% |

5.1% |

5.1% |

4.6% |

4.0% |

4.0% |

3.8% |

3.1% |

1.9% |

1.1% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sector average, 6.2% |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Russian* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impala |

|

|

|

|

|

Exxaro |

Norilsk |

ARM |

Fortescue |

Hulamin |

PhosAgro |

Assore |

BHP |

MMK |

Polymetal |

South32 |

Glencore |

Rio Tinto |

Polyus |

Anglo |

Rusal |

Others* |

Sasol |

Sappi |

Mondi |

Harmony |

Gold Fields |

Amplats |

AngloGold |

Vale |

Northam |

RBPlats |

Sibanye |

AMSA |

|||||||

Source: Company data, Renaissance Capital estimates

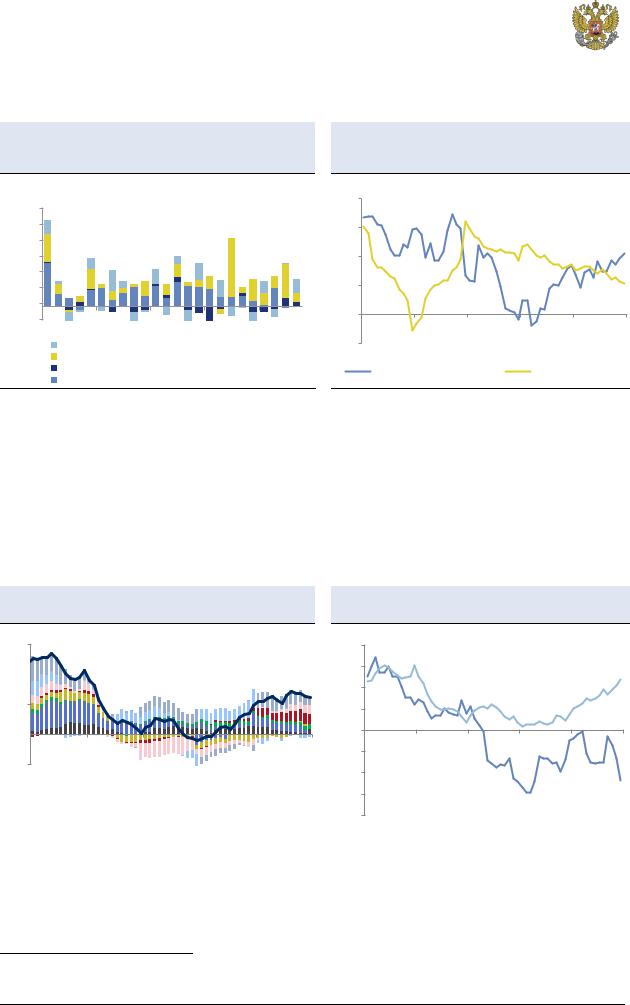

Attractive valuation relative to peers

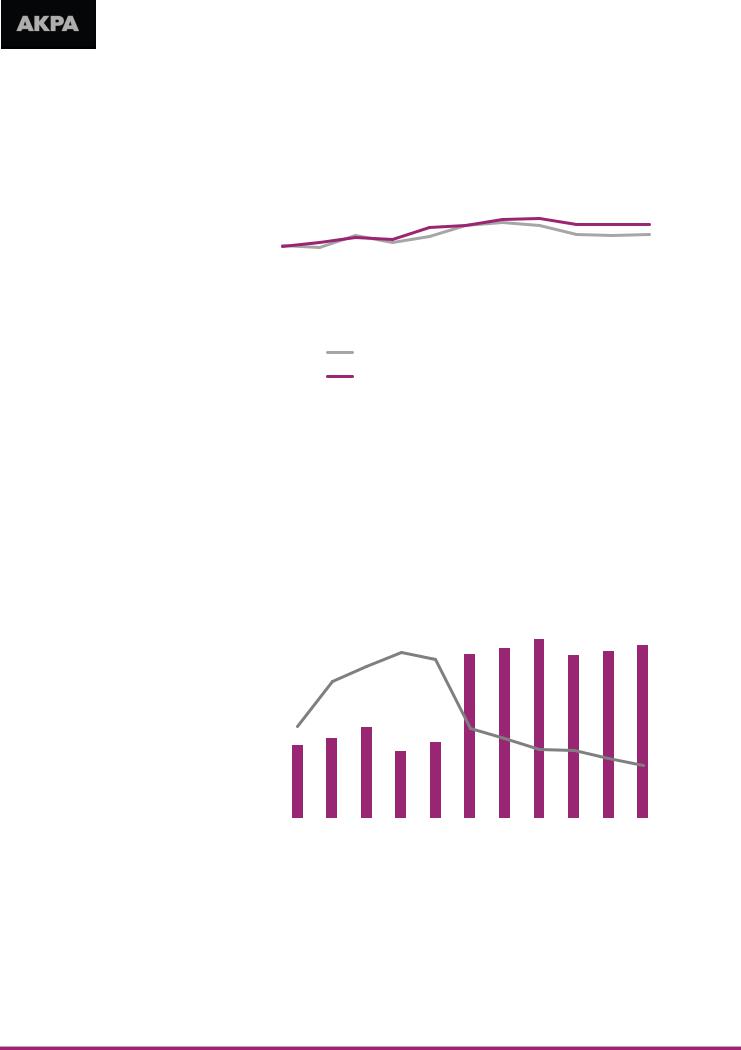

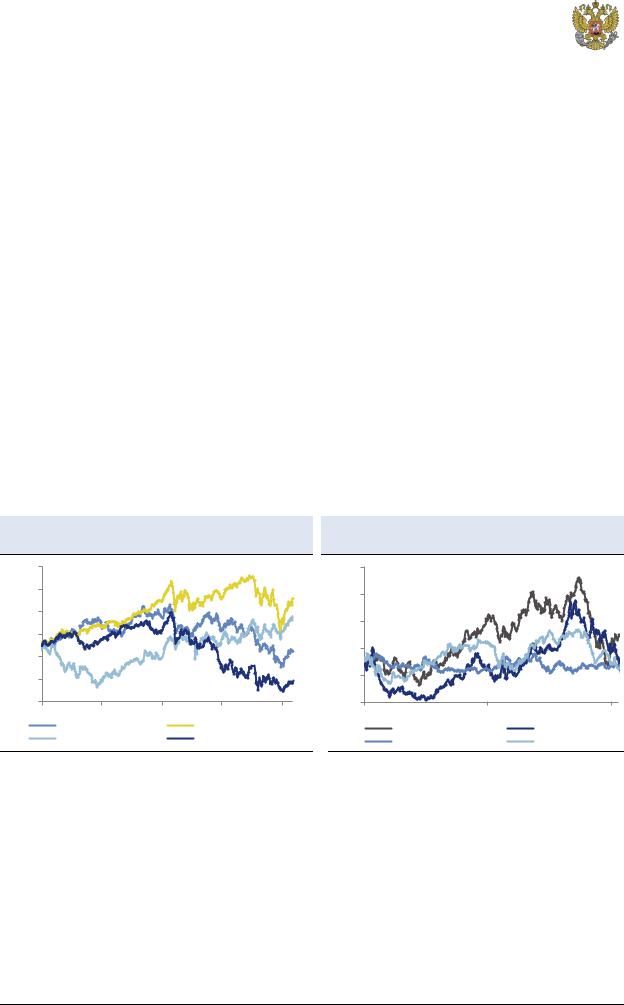

Rusal’s CY19E FCF yield of 15.5% is well above the sector average of 9.4%.

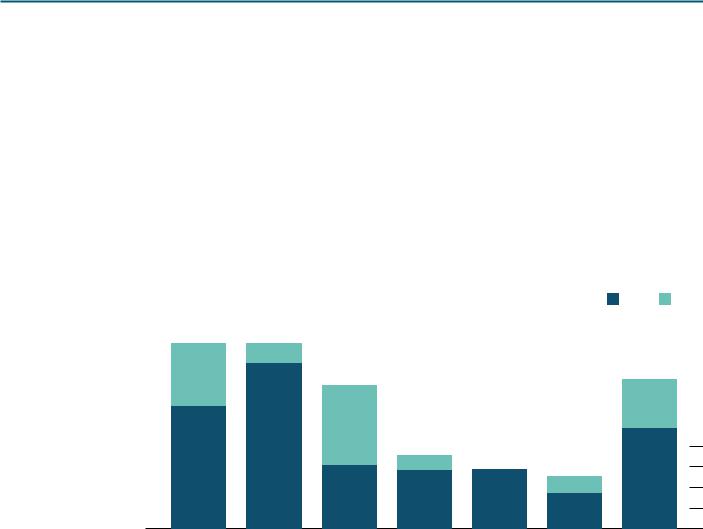

Figure 7: Companies ranked by CY19E FCF yield compared with their historical averages

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0% -5.0% -10.0% -15.0%

24.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

CY19E FCF yield |

|

|

LT average |

|

|

|

|

|

|

|

|

|

|

||||||

23.4% |

20.5% |

15.5% |

15.0% |

14.4% |

13.5% |

13.4% |

13.2% |

12.8% |

12.5% |

12.4% |

12.4% |

12.4% |

12.4% |

11.0% |

10.4% |

10.2% |

10.2% |

9.8% |

9.4% |

9.4% |

9.3% |

9.2% |

9.1% |

8.4% |

7.6% |

7.2% |

|

|

|

Sector average, 9.4% |

|||

5.9% |

5.9% |

5.4% |

5.3%+ |

4.8% |

3.5% |

||||||||||||||||||||||||||||

5.1% |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

-6.0% |

-10.0% |

-10.5% |

|

|

Hulamin ARM Merafe Rusal Harmony Exxaro Fortescue AngloGold Alrosa Kumba Anglo NLMK Assore Evraz Gold Fields BHP Polyus PhosAgro Russian* South32 Rio Tinto Impala Polymetal Sibanye Others* Vale Glencore MMK Severstal Mondi Norilsk Amplats Northam Sasol Sappi Lonmin |

RBPlats |

AMSA |

||

*Proportionately consolidated **Excluding marketing business

Source: Company data, Renaissance Capital estimates

http://new.guap.ru/i04/contacts |

5 |

|

vk.com/id446425943

Renaissance Capital

5 February 2019

Rusal

Rusal’s CY19E P/E multiple of 4.7x is well below the sector average of 9.1x.

Figure 8: Companies ranked by CY19E P/E multiples compared with their historical averages

15.x |

|

20.0x |

17.6x |

16.2x |

13.6x |

12.8x |

12.5x |

||

25.x |

|

|

|

|

|

|

|

|

|

20.x |

|

|

|

|

|

|

|

|

|

10.x |

|

|

|

|

|

|

|

|

|

5.x |

|

|

|

|

|

|

|

|

|

0.x |

|

|

|

|

|

|

|

|

|

-5.x |

|

|

|

|

|

|

|

|

|

-10.x |

|

|

|

|

|

|

|

|

|

-15.x |

|

AMSA |

Fortescue |

Amplats |

Northam |

South32 |

MMK |

||

|

|||||||||

|

|

||||||||

Note: Priced at market close on 1 February 2019

|

|

|

|

|

|

|

|

CY19E P/E multiple |

LT average |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

12.1x |

11.3x |

10.5x |

10.1x |

10.0x |

9.8x |

9.6x |

9.4x |

9.0x |

8.9x |

8.9x |

8.3x |

8.2x |

7.9x |

7.8x |

7.7x |

7.6x |

7.6x |

7.5x |

7.0x |

6.8x |

6.8x |

6.2x |

5.9x |

5.7x |

5.6x |

4.7x |

4.6x |

3.9x |

3.4x |

2.0x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sector average, 9.1x |

|

|

|

||||

GoldRio GlencoreBHPMondiFieldsNorilskTintoAngloOthers*AngloGoldNLMKKumbaSasolSeverstalSappiImpalaPolymetalAlrosaRBPlatsRussian*PolyusValeAssoreEvrazSibanyeMerafeARMRusalExxaroHarmonyHulaminPhosAgro

Source: Company data, Renaissance Capital estimates

Rusal’s earnings sensitivity to aluminium prices and rouble

The figures below show Rusal’s FY19 earnings per share and P/E multiples on a range of aluminium prices and RUB/$ exchange rates. We use our base case earnings for Norilsk in all cases.

Figure 9: Rusal’s FY19E EPS at different aluminium prices and exchange rates, USc

|

|

RUB/$ |

57 |

60 |

64 |

67 |

70 |

74 |

77 |

|

$/t |

1,367 |

-7.5 |

-5.4 |

-3.6 |

-2.0 |

-0.5 |

0.8 |

2.0 |

|

price, |

1,562 |

-3.8 |

-1.8 |

0.0 |

1.7 |

3.1 |

4.4 |

5.6 |

|

1,757 |

-0.1 |

1.9 |

3.7 |

5.3 |

6.7 |

8.1 |

9.3 |

|

|

|

|

|

|

|

|

|

||

|

Aluminium |

1,953 |

3.5 |

5.6 |

7.3 |

8.9 |

10.4 |

11.7 |

12.9 |

|

|

2,148 |

7.2 |

9.2 |

11.0 |

12.5 |

14.0 |

15.3 |

16.5 |

|

|

2,343 |

10.8 |

12.8 |

14.6 |

16.2 |

17.6 |

18.9 |

20.1 |

|

|

2,538 |

14.4 |

16.4 |

18.2 |

19.8 |

21.2 |

22.5 |

23.7 |

Source: Bloomberg, Renaissance Capital estimates

Figure 10: Rusal’s FY19E P/E multiple at different aluminium prices and exchange rates

|

RUB/$ |

57 |

60 |

64 |

67 |

70 |

74 |

77 |

||

$/t |

1,367 |

-5.6 |

-7.7 |

-11.5 |

-20.7 |

-77.7 |

53.5 |

21.0 |

||

price, |

1,562 |

-11.0 |

-23.5 |

1112.3 |

25.1 |

13.4 |

|

9.4 |

7.4 |

|

1,757 |

-340.8 |

22.0 |

11.3 |

|

7.9 |

6.2 |

|

5.2 |

4.5 |

|

Aluminium |

1,953 |

11.9 |

7.5 |

5.7 |

4.7 |

4.0 |

|

3.6 |

3.2 |

|

|

2,148 |

5.8 |

4.6 |

3.8 |

3.3 |

3.0 |

2.7 |

2.5 |

||

|

2,343 |

3.9 |

3.3 |

2.9 |

2.6 |

2.4 |

2.2 |

2.1 |

||

|

2,538 |

2.9 |

2.5 |

2.3 |

2.1 |

2.0 |

1.9 |

1.8 |

||

Note: Priced as at market close on 1 February 2019

Source: Bloomberg, Renaissance Capital estimates

http://new.guap.ru/i04/contacts |

6 |

|

vk.com/id446425943

Commodity price and exchange rate forecasts

Figure 11 sets out our average commodity price and exchange rate forecasts per calendar year.

Renaissance Capital

5 February 2019

Rusal

Figure 11: Average commodity prices and exchange rates*

Average per calendar year |

2016 |

2017 |

2018 |

2019E |

2020E |

2021E |

2022E |

2023E |

LT real |

Precious commodities |

|

|

|

|

|

|

|

|

|

Gold, $/oz |

1,248 |

1,258 |

1,269 |

1,350 |

1,338 |

1,311 |

1,337 |

1,364 |

1,250 |

Silver, $/oz |

17 |

17 |

16 |

17 |

18 |

19 |

19 |

20 |

18 |

Platinum, $/oz |

988 |

950 |

880 |

870 |

1,070 |

1,153 |

1,177 |

1,200 |

1,100 |

Palladium, $/oz |

614 |

871 |

1,030 |

1,216 |

1,088 |

1,049 |

1,070 |

1,091 |

1,000 |

Rhodium, $/oz |

694 |

1,108 |

2,218 |

2,379 |

2,163 |

2,097 |

2,139 |

2,182 |

2,000 |

3PGM basket (57% Pt, 36% Pd, 7% Rh), $/oz |

833 |

933 |

1,028 |

1,100 |

1,153 |

1,182 |

1,206 |

1,230 |

1,127 |

Rough diamond index, $/ct |

197 |

198 |

202 |

202 |

208 |

215 |

219 |

224 |

205 |

Base metals |

|

|

|

|

|

|

|

|

|

Aluminium, $/t |

1,604 |

1,968 |

2,110 |

1,953 |

2,166 |

2,254 |

2,300 |

2,346 |

2,150 |

Bauxite, $/t |

40 |

43 |

42 |

41 |

49 |

51 |

52 |

53 |

48 |

Copper, $/t |

4,867 |

6,170 |

6,532 |

6,000 |

6,367 |

6,606 |

6,739 |

6,875 |

6,300 |

Copper, USc/lb |

221 |

280 |

296 |

272 |

289 |

300 |

306 |

312 |

286 |

Nickel, $/t |

9,599 |

10,404 |

13,130 |

11,530 |

14,285 |

14,680 |

14,975 |

15,277 |

14,000 |

Nickel, USc/lb |

435 |

472 |

596 |

523 |

648 |

666 |

679 |

693 |

635 |

Zinc, $/t |

2,091 |

2,891 |

2,923 |

2,543 |

2,732 |

2,831 |

2,888 |

2,946 |

2,700 |

Zinc, USc/lb |

95 |

131 |

133 |

115 |

124 |

128 |

131 |

134 |

122 |

Lead, $/t |

1,867 |

2,314 |

2,241 |

2,033 |

2,459 |

2,548 |

2,599 |

2,652 |

2,430 |

Cobalt (99.8%), $/lb |

12 |

25 |

33 |

25 |

26 |

26 |

27 |

27 |

25 |

Steelmaking materials |

|

|

|

|

|

|

|

|

|

Iron ore fines (62% Fe, CIF China), $/t |

58 |

71 |

66 |

75 |

67 |

65 |

66 |

68 |

62 |

Iron ore fines (58% Fe, CIF China), $/t |

48 |

52 |

45 |

54 |

52 |

51 |

52 |

53 |

48 |

Iron ore lump premium (62% Fe), $/t |

10 |

15 |

20 |

17 |

13 |

14 |

14 |

14 |

13 |

Freight charges, $/t |

|

|

|

|

|

|

|

|

|

- Australia to China |

4.5 |

6.7 |

7.6 |

8.1 |

7.6 |

7.4 |

7.5 |

7.7 |

7.0 |

- Brazil to China |

9.1 |

14.8 |

18.4 |

19.5 |

18.5 |

17.8 |

18.2 |

18.5 |

17.0 |

- South Africa to China |

6.8 |

11.2 |

13.8 |

14.4 |

13.7 |

13.2 |

13.5 |

13.7 |

12.6 |

Hard coking coal - spot, $/t |

144 |

188 |

206 |

178 |

160 |

157 |

160 |

164 |

150 |

Manganese ore (44%, CIF China), $/mtu |

4.30 |

6.00 |

7.11 |

5.48 |

5.33 |

5.45 |

5.56 |

5.67 |

5.20 |

Ferrochrome (EU), $/lb |

1.0 |

1.5 |

1.4 |

1.2 |

1.3 |

1.3 |

1.3 |

1.4 |

1.3 |

Steel |

|

|

|

|

|

|

|

|

|

China HRC, $/t |

377 |

508 |

564 |

471 |

471 |

484 |

494 |

504 |

461 |

China export Rebar, $/t |

348 |

517 |

580 |

445 |

449 |

460 |

469 |

478 |

438 |

Energy |

|

|

|

|

|

|

|

|

|

Brent crude oil, $/bl |

45 |

55 |

72 |

65 |

60 |

63 |

64 |

65 |

60 |

WTI oil, $/bl |

43 |

51 |

65 |

62 |

57 |

60 |

61 |

62 |

57 |

Henry Hub (US) gas, $/MMBtu |

2.5 |

3.0 |

3.2 |

3.4 |

3.5 |

4.2 |

4.3 |

4.4 |

4 |

Thermal coal (FOB Richard's Bay), $/t |

64 |

85 |

98 |

93 |

86 |

84 |

86 |

87 |

80 |

Uranium, $/lb |

26 |

22 |

25 |

33 |

43 |

47 |

48 |

49 |

45 |

Chemicals |

|

|

|

|

|

|

|

|

|

Ethane (US), $/t |

146 |

184 |

244 |

260 |

374 |

419 |

428 |

436 |

400 |

Ethylene (US), $/t |

585 |

613 |

402 |

548 |

831 |

944 |

963 |

982 |

900 |

Paper & packaging |

|

|

|

|

|

|

|

|

|

Testliner, EUR/t |

432 |

476 |

534 |

532 |

507 |

494 |

499 |

504 |

482 |

Uncoated fine paper, EUR/t |

824 |

815 |

869 |

898 |

873 |

860 |

869 |

878 |

840 |

Fertilisers |

|

|

|

|

|

|

|

|

|

MOP Potash Soluble FOB Saskatchewan, $/t |

228 |

230 |

261 |

289 |

283 |

283 |

289 |

295 |

270 |

Baltic sea Urea granular, $/t |

202 |

220 |

251 |

263 |

269 |

273 |

278 |

284 |

260 |

Baltic DAP, $/t |

357 |

358 |

421 |

434 |

429 |

430 |

439 |

447 |

410 |

Black sea 16-16-16, $/t |

324 |

321 |

318 |

340 |

347 |

353 |

360 |

367 |

337 |

Currency exchange rates |

|

|

|

|

|

|

|

|

|

ZAR/$ |

14.70 |

13.31 |

13.24 |

14.31 |

14.14 |

14.17 |

14.45 |

14.74 |

13.00 |

$/AUD |

0.74 |

0.77 |

0.75 |

0.72 |

0.78 |

0.80 |

0.80 |

0.80 |

0.80 |

$/EUR |

1.11 |

1.13 |

1.18 |

1.17 |

1.21 |

1.22 |

1.22 |

1.22 |

1.20 |

CLP/$ |

676 |

649 |

642 |

689 |

674 |

673 |

687 |

701 |

630 |

BRL/$ |

3.49 |

3.19 |

3.65 |

3.78 |

3.50 |

3.42 |

3.49 |

3.56 |

3.20 |

COP/$ |

3,053 |

2,952 |

2,956 |

3,193 |

3,031 |

3,015 |

3,138 |

3,265 |

2,800 |

RUB/$ |

67 |

58 |

63 |

67 |

68 |

67 |

66 |

66 |

58 |

Inflation |

|

|

|

|

|

|

|

|

|

US consumer price index |

240 |

245 |

251 |

256 |

261 |

266 |

272 |

277 |

|

US inflation |

1.3% |

2.1% |

2.5% |

2.0% |

2.0% |

2.0% |

2.0% |

2.0% |

|

*The above amounts represent the average per calendar year

Source: Bloomberg, Thomson Reuters Data stream, Renaissance Capital estimates

http://new.guap.ru/i04/contacts |

7 |

|

vk.com/id446425943

Rusal – BUY

Renaissance Capital

5 February 2019

Rusal

Figure 12: Rusal, $mn (unless otherwise noted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rusal |

|

0486.HK |

|

|

|

|

|

Target price, HKD: |

|

|

6.0 |

|||

Market capitalisation, $mn: |

|

6,351 |

|

|

|

|

|

Share price, HKD: |

|

|

3.3 |

|||

Enterprise value, $mn: |

|

13,999 |

|

|

|

|

|

Potential 12-month return: |

|

88% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec-YE |

|

2016 |

2017 |

2018E |

2019E |

2020E |

Dec-YE |

2016 |

2017 |

|

2018E |

2019E |

2020E |

|

Income statement |

|

|

|

|

|

|

|

Balance sheet |

|

|

|

|

|

|

Revenue |

|

7,983 |

9,969 |

10,136 |

9,588 |

10,694 |

|

Net operating assets |

11,377 |

12,139 |

|

12,303 |

12,287 |

12,548 |

Underlying EBITDA |

|

1,489 |

2,120 |

2,240 |

1,671 |

2,209 |

|

Financial instruments |

32 |

-50 |

|

-36 |

-36 |

-36 |

Underlying EBIT |

|

1,024 |

1,607 |

1,738 |

1,154 |

1,634 |

|

Equity |

2,988 |

4,441 |

|

5,285 |

6,315 |

7,772 |

EBIT |

|

1,068 |

1,523 |

1,572 |

1,154 |

1,634 |

|

Minority interest |

0 |

0 |

|

0 |

0 |

0 |

Net interest |

|

-860 |

-855 |

-534 |

-626 |

-576 |

|

Net debt |

8,421 |

7,648 |

|

6,982 |

5,937 |

4,740 |

Equity accounted income |

|

848 |

620 |

1,049 |

918 |

979 |

|

Balance sheet ratios |

|

|

|

|

|

|

Taxation |

|

-175 |

-66 |

-170 |

-90 |

-180 |

|

|

|

|

|

|

|

|

Other |

|

298 |

0 |

0 |

0 |

0 |

|

Gearing (net debt/(net debt+equity)) |

73.8% |

63.3% |

|

56.9% |

48.5% |

37.9% |

Net profit for the year |

|

1,179 |

1,222 |

1,917 |

1,357 |

1,857 |

|

Net debt/(EBITDA+dividends from associat |

4.7x |

2.4x |

|

2.2x |

2.3x |

1.5x |

Underlying earnings |

|

1,179 |

1,222 |

1,917 |

1,357 |

1,857 |

|

RoCE |

8.8% |

12.6% |

|

13.3% |

8.8% |

12.3% |

Underlying EPS, USc |

|

7.76 |

8.04 |

12.62 |

8.93 |

12.22 |

|

RoIC (after tax) |

5.7% |

10.3% |

|

10.8% |

7.5% |

10.3% |

|

|

RoE |

56.3% |

32.9% |

|

39.4% |

23.4% |

26.4% |

||||||

Thomson Reuters consensus EPS, USc |

|

|

|

12.49 |

12.91 |

13.69 |

|

|

|

|

|

|

|

|

DPS declared, USc |

|

1.65 |

1.97 |

2.61 |

2.15 |

2.63 |

|

Cash flow statement |

1,331 |

2,869 |

|

2,365 |

2,754 |

2,786 |

Income statement ratios |

|

|

0.036471 |

|

|

|

|

Operating cash flow |

|

|||||

|

|

|

|

|

|

|

Capex |

-575 |

-842 |

|

-770 |

-850 |

-700 |

|

EBITDA margin |

|

19% |

21% |

22% |

17% |

21% |

|

Other FCF |

508 |

-311 |

|

-65 |

0 |

0 |

EBIT margin |

|

13% |

15% |

16% |

12% |

15% |

|

FCF |

1,264 |

1,717 |

|

1,530 |

1,904 |

2,086 |

EPS growth |

|

111% |

4% |

57% |

-29% |

37% |

|

Equity shareholders' cash |

201 |

1,072 |

|

1,062 |

1,372 |

1,597 |

Dividend payout ratio |

|

21% |

24% |

21% |

24% |

22% |

|

Dividends and share buy backs |

-250 |

-299 |

|

-396 |

-327 |

-400 |

Input assumptions |

|

|

|

|

|

|

|

Surplus (deficit) cash |

-49 |

773 |

|

666 |

1,045 |

1,197 |

|

|

|

|

|

|

|

Cash flow ratios |

|

|

|

|

|

|

|

Aluminium, $/t |

|

1,604 |

1,968 |

2,110 |

1,953 |

2,166 |

|

|

|

|

|

|

|

|

Alumina, $/t |

|

283 |

376 |

485 |

391 |

412 |

|

Working capital days |

77 |

64 |

|

81 |

74 |

72 |

RUB/$ |

|

67 |

58 |

63 |

67 |

68 |

|

Cash conversion |

0.2x |

0.9x |

|

0.6x |

1.0x |

0.9x |

Estimated aluminium breakeven price, $/t |

|

1,341 |

1,588 |

1,658 |

1,629 |

1,719 |

|

FCF yield |

9.3% |

10.4% |

|

12.0% |

15.5% |

18.8% |

Production volumes, kt |

|

|

|

|

|

|

|

Equity shareholders' yield |

3.8% |

12.2% |

|

18.4% |

21.6% |

25.1% |

|

|

|

|

|

|

|

Capex/(EBITDA+Norilsk dividends) |

32.3% |

26.0% |

|

24.3% |

32.5% |

21.9% |

|

Aluminium |

|

|

|

|

|

|

|

Valuation |

|

|

|

|

|

|

Russia Aluminium |

|

3,562 |

3,584 |

3,622 |

3,632 |

3,670 |

|

|

|

|

|

|

|

|

Other |

|

161 |

144 |

148 |

147 |

147 |

|

SoTP DCF valuation and calculation of target price |

|

|

|

$mn |

HKD/sh |

|

Total |

|

3,723 |

3,728 |

3,770 |

3,779 |

3,818 |

|

Aluminium |

|

|

|

|

10,901 |

5.6 |

|

|

|

|

|

|

|

|

Norilsk Nickel |

|

|

|

|

8,493 |

4.4 |

Alumina |

|

|

|

|

|

|

|

Total enterprise value |

|

|

|

|

19,394 |

10.0 |

Ireland |

|

1,967 |

1,938 |

1,925 |

1,970 |

1,970 |

|

Net debt as at 31 December 2017 |

|

|

|

|

-7,648 |

-3.9 |

Jamaica |

|

608 |

582 |

601 |

615 |

615 |

|

Cash used in share buy-backs |

|

|

|

|

0 |

0.0 |

Ukraine |

|

1,510 |

1,675 |

1,693 |

1,733 |

1,733 |

|

Other investments |

|

|

|

|

-50 |

-0.0 |

Russia |

|

2,730 |

2,821 |

2,844 |

2,911 |

2,911 |

|

Minority interest |

|

|

|

|

0 |

0.0 |

Australia (JV) |

|

760 |

755 |

754 |

772 |

772 |

|