- •Meaning and goals of macroeconomic.

- •Gross National Product / Gross Domestic Product.

- •Gdp: expenditures and income approaches.

- •5. System of national accounts.

- •6.Measuring Unemployment

- •7. Types of unemployment:

- •8. Levels of unemployment. «Full-employment».

- •9. Economic costs of unemployment.

- •10. Inflation: meaning and measurement. Rule of 70.

- •11. Types of inflation

- •15. Economic growth: definition and ingredients.

- •16. The theories of economic growth.

- •17. Aggregate demand (ad). Ad curve.

- •19. Aggregate supply (as); Determinants of as.

- •20. Segments of as curve.

- •21. As: the Keynesian vs. Classical Debate.

- •22. Equilibrium - classical model. Ratchet effect.

- •31. Multiplier effect of Taxation. Multiplier effect of Government Purchases. ?

- •32. Discretionary Fiscal Policy.

- •33. Cases of discretionary fiscal policy: expansionary and conctractionary policy.

- •34. Nondiscretionary Fiscal Policy. Built-in stabilizers.

- •35. Problems and complications of fiscal policy. ?

- •36. Money: functions and types.

- •37. Supply for money.

- •38. The role of banking sector - creation process.

- •39. Money – creation system. Money multiplier.

- •40. Monetary policy: goals and instruments.

- •41. Types of monetary policy.

- •42. Effectiveness of monetary policy. ?

- •44. The Phillips curve.

- •45. The adaptive and rational expectations theories.

- •46. Supply – side economics. Laffer curve.

- •47. International trade. Comparative advantage.

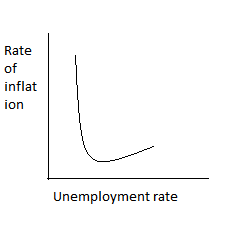

44. The Phillips curve.

Shows a stable relationship between the rate of inflation and the unemployment rate.

This curve is available for short-run period. In the long-run the economy automatically gravitates to its natural rate of unemployment. The Philips curve is vertical.

45. The adaptive and rational expectations theories.

The adaptive expectations theory

Assumes people form their expectations of future inflation on the basis of previous and present rates of inflation. When people do, the U rate return to the natural rate.

The long-run Phillips Curve is therefore vertical.

The rational expectations theory

Assumes that increases in nominal wages lag behind increases in the price level because the increases in the price level are not anticipated.

Workers will anticipate the inflationary effects of monetary and fiscal policy and will build these expectations into their wage demands.

As a result, not even a short-run Phillips curve will exist.

The economy will simply move along its vertical long-run Phillips Curve when government undertakes expansionary policies.

46. Supply – side economics. Laffer curve.

Changes in AS must be recognized as active forces in determining the levels of both inflation and unemployment.

Tax- Transfer disincentive.

The growth of tax-transfer system has negatively affected incentives to work, invest, innovate.

Supply-side economists believe.

How long and how hard individuals work depends on how much additional after-tax earnings they derive from work

So, government should reduce marginal tax rates on earned incomes.

The existence of a wide variety of public transfer programs has eroded incentives to work

Lower marginal tax rates encourage saving and investing

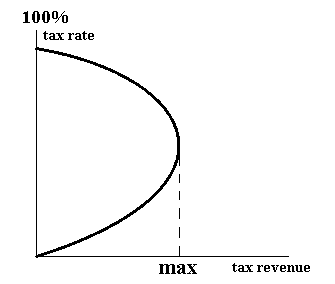

Laffer Curve

The main idea: Lower tax rates are compatible with constant or even engaged tax revenues.

Up to “max”-large tax revenue,

Then-tax revenues will decline.

Tax rates can be lowered without producing budget deficits for two reasons:

-Less tax evasion. It declines when are reduced

-Reduced transfers

47. International trade. Comparative advantage.

The principle of comparative advantages: Total output will be greatest when each good is produced by that nation which has the lowest domestic opportunity cost for that good.

Comparative advantage: Suppose the word economy is composed of just 2 nations: Russia and Brazil. The “word” clearly is not economizing in the use of its resources, if a specific product is produced by high-cost producer, when it could have been produced by low-cost producer.

Specialization according to comparative advantage results in:

a more efficient allocation of word resources

larger outputs of both products and therefore available to both nations