- •Meaning and goals of macroeconomic.

- •Gross National Product / Gross Domestic Product.

- •Gdp: expenditures and income approaches.

- •5. System of national accounts.

- •6.Measuring Unemployment

- •7. Types of unemployment:

- •8. Levels of unemployment. «Full-employment».

- •9. Economic costs of unemployment.

- •10. Inflation: meaning and measurement. Rule of 70.

- •11. Types of inflation

- •15. Economic growth: definition and ingredients.

- •16. The theories of economic growth.

- •17. Aggregate demand (ad). Ad curve.

- •19. Aggregate supply (as); Determinants of as.

- •20. Segments of as curve.

- •21. As: the Keynesian vs. Classical Debate.

- •22. Equilibrium - classical model. Ratchet effect.

- •31. Multiplier effect of Taxation. Multiplier effect of Government Purchases. ?

- •32. Discretionary Fiscal Policy.

- •33. Cases of discretionary fiscal policy: expansionary and conctractionary policy.

- •34. Nondiscretionary Fiscal Policy. Built-in stabilizers.

- •35. Problems and complications of fiscal policy. ?

- •36. Money: functions and types.

- •37. Supply for money.

- •38. The role of banking sector - creation process.

- •39. Money – creation system. Money multiplier.

- •40. Monetary policy: goals and instruments.

- •41. Types of monetary policy.

- •42. Effectiveness of monetary policy. ?

- •44. The Phillips curve.

- •45. The adaptive and rational expectations theories.

- •46. Supply – side economics. Laffer curve.

- •47. International trade. Comparative advantage.

21. As: the Keynesian vs. Classical Debate.

The Classical theory: The fundamental principle of the classical theory is that the economy is self-regulating. Classical economists maintain that the economy is always capable of achieving the natural level of real GDP or output, which is the level of real GDP that is obtained when the economy's resources are fully employed. The classical doctrine—that the economy is always at or near the natural level of real GDP—is based on two firmly held beliefs: Say's Law and the belief that prices, wages, and interest rates are flexible.

The Keynesian theory: Keynes's theory of the determination of equilibrium real GDP, employment, and prices focuses on the relationship between aggregate income and expenditure. Keynes used his income-expenditure model to argue that the economy's equilibrium level of output or real GDP may not correspond to the natural level of real GDP. In the income-expenditure model, the equilibrium level of real GDP is the level of real GDP that is consistent with the current level of aggregate expenditure. If the current level of aggregate expenditure is not sufficient to purchase all of the real GDP supplied, output will be cut back until the level of real GDP is equal to the level of aggregate expenditure. Hence, if the current level of aggregate expenditure is not sufficient to purchase the natural level of real GDP, then the equilibrium level of real GDP will lie somewhere below the natural level.

22. Equilibrium - classical model. Ratchet effect.

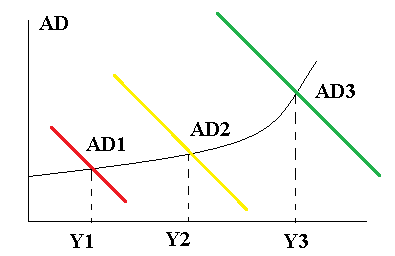

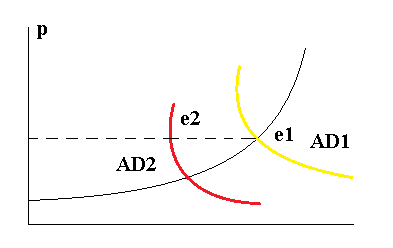

Equilibrium – the intersection of the AD and AS curves determines the economy’s equilibrium price level and equilibrium real domestic output.

Beyond

full-employment (Y3)

Beyond

full-employment (Y3)

inflation, low unemployment

Below full-employment (Y1)

negative growth, negative inflation

At full employment (Y2)

stable prices, low inflation, low unemployment steady,

economic growth

Ratchet effect – is the commonly observed phenomenon that some processes can not go backwards once certain things happened. The producers observe that shifting-down AD leads to changes in equilibrium, but not in the price level. Prices are stable.

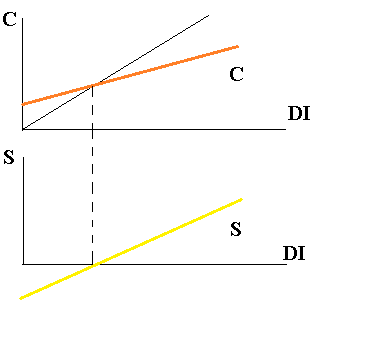

23. Consumption and Saving.

Consumption savings – DL is the basic determinant of consumption and personal savings. Households can consume more than their incomes by liquidating accumulated wealth or by borrowing – C0.

the

45 degree line represents DI=C, if households were to consumer 100%

of their DI at every level of DI.

the

45 degree line represents DI=C, if households were to consumer 100%

of their DI at every level of DI.

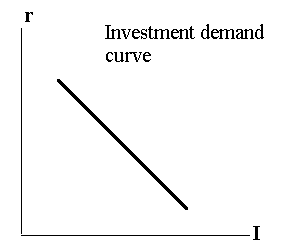

24. Investment. Investment demand curve.

Determinants:

Expected rate of return: businesses buy capital goods only when they expect such purchases to be profitable

The real interest rate: the financial cost of borrowing the money capital required to purchase the real capital

The curve is downsloping, reflecting an inverse relationship between the real interest rate and quantity of investment demanded.

25. Equilibrium GDP: Expenditures – Output approach. ?

26. Multiplier effect of Investment.

The change in investment leads to a larger change in output and income.

The ratio of a change in equilibrium GDP to the inital change in investment spending .

Mi=GDP/i or Mi=1/(1-MPC)=1/MPC

27. Equilibrium GDP: Leakage – Injections.

A part of Dl may be saved not consumed by households. Saving represents a leakage of spending from income – expenditures stream. Saving is what keeps consumption short of total output or GDP. Investment – a potential replacement for leak stage of saving. Equilibrium GDP- at the point where the amount households save and the amount businesses plan to invest is equal.

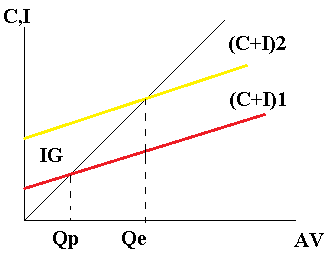

28. Recessionary Gap.

t he

level of equilibrium GDP is less than full-employment GDP. This is

amount by which aggregate expenditures at the full-employment GDP

fall short of those required to achieve the full-employment GDP.

he

level of equilibrium GDP is less than full-employment GDP. This is

amount by which aggregate expenditures at the full-employment GDP

fall short of those required to achieve the full-employment GDP.

This lack of spending contracts or depresses the economy.

Q(e) – equilibrium GDP

Q(p) – potential GDP

29. Inflationary Gap.

is the amount by which an economy` s aggregate expenditures exceed those just necessary to achieve the full employment GDP. This effect will pull output prices. Nominal GDP will rise because of a higher price level, but real GDP will not.

30. Fiscal Policy: meaning, tools, goals.

Fiscal policy- is the means by which a government adjusts its levels of spending in order to monitor and influence a nation` s economy.

Tools: 1) Government spending

2) Government taxing. They are directly related to the economy` s total output, income and employment levels.

Goals : 1) increase government spending- Increasing G pushes the economy out of recession. Real GDP rises;

2) Reduce taxes- AE=C+I;

C is determined by Dl.

To increase initial consumption by specific amount, government must reduce taxes by more, than that amount.

Tax reduction :

C1=Co+MPC

C2=Co+MPC

BUT Fiscal policy during recession or depression should create a government budget deficit – government spending in excess of tax revenues.

3) Use some combination of the two.