- •Узгоджено

- •Lesson 1 money and its functions

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •Lesson 2 types of money

- •2. Read and translate the text.

- •3. Complete the sentences using the text:

- •4. Answer the questions.

- •5. Match the following definitions using the previous texts:

- •Lesson 3 the sources of income

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •3. Complete the sentences using the text:

- •4. Answer the questions.

- •Lesson 4 gross domestic product and gross national product

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •Lesson 5 Finance

- •2. Read and translate the text.

- •3. Say whether these statements are true or false and if they are false, say why.

- •4. Answer the questions.

- •5. Match the synonyms:

- •Lesson 6 financing a business

- •2. Read and translate the text.

- •3. Answer the following questions:

- •4. Translate into English:

- •5. Fill in the blanks with appropriate words: "investors", capital, money, net worth, customers, bonds, a security exchange, long-term financing

- •Lesson 7

- •1. Read and translate the text in written form.

- •2. Fill in the blanks with appropriate words and word-combinations.

- •Lesson 8

- •Investments

- •1. Memorize the following words and word-combinations:

- •2. Analyze suffixes of different parts of speech, translate the following words:

- •3. Read and translate the text.

- •4. Answer the questions:

- •5. Give the definitions to the following statements using the text:

- •Lesson 9 the role of the financial manager (I)

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •3. Answer the questions, basing your answers on the text:

- •4. Complete the sentences using the text:

- •Lesson 10 the role of the financial manager (II)

- •1. Read and translate the text.

- •2. Say whether these statements are true or false and if they are false, say why.

- •Lesson 11 who is the financial manager?

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •3. Answer the questions.

- •4. Say whether these statements are true or false and if they are false, say why.

- •5. Match the synonyms:

- •Lesson 12 taxes

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •3. Complete the sentences using the text:

- •4. Answer the questions, basing your answers on the text:

- •5. Say whether these statements are true or false and if they are false, say why.

- •Lesson 13 Price

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •3. Complete the sentences using the text:

- •4. Answer the questions, basing your answers on the text:

- •5. Say whether these statements are true or false and if they are false, say why.

- •Lesson 14

- •1. Read and translate the text in written form.

- •2. Fill in the blanks with appropriate words and word-combinations.

- •Методичні вказівки та навчальні завдання

Lesson 11 who is the financial manager?

-

1. Memorize the following words and word-combinations:

|

advertising |

реклама, рекламування |

реклама, рекламирование |

|

to pay off |

повністю розрахуватись |

полностью рассчитаться |

|

to make decision |

приймати рішення |

принимать решение |

|

treasurer |

скарбник |

казначей |

|

to look after |

слідкувати, наглядати |

следить, присматривать |

|

to maintain |

підтримувати |

поддерживать |

|

executive |

керівник, адміністратор |

руководитель, администратор |

|

controller |

контролер, головний бухгалтер |

контролер, главный бухгалтер |

|

financial statement |

фінансовий звіт |

финансовый отчет |

|

to manage |

керувати, завідувати |

руководить, заведовать |

|

accounting |

бухгалтерський облік, офіційна звітність |

бухгалтерский учет, официальная отчетность |

|

tax obligation |

податкові зобов'язання |

налоговые обязательства |

|

financial issue |

фінансове питання |

финансовый вопрос |

|

chief financial officer (CFO) |

головний фінансовий директор |

главный финансовый директор |

|

to oversee |

наглядати, спостерігати |

надзирать, наблюдать |

|

product development |

розробка товару |

разработка товара |

|

to supervise |

наглядати, завідувати |

наблюдать, заведовать |

|

to draw into |

залучати |

вовлекать |

|

board of directors |

рада директорів |

совет директоров |

|

capital budgeting |

розрахунок рентабельності капіталовкладень |

расчет рентабельности капиталовложений |

-

2. Read and translate the text.

The term financial manager refers to anyone responsible for a significant investment or financing decision. But only in the smallest firms is a single person responsible for all financial decisions. In most cases, responsibility is dispersed. Top management is of course continuously involved in financial decisions. The marketing manager who commits to a major advertising campaign is also making an important investment decision. The campaign is an investment in an intangible asset that is expected to pay off in future sales and earnings.

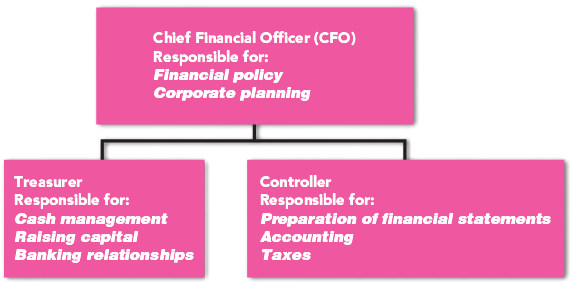

Nevertheless there are some managers who specialize in finance. Their roles are summarized in Figure 2. The treasurer is responsible for looking after the firm’s cash, raising new capital, and maintaining relationships with banks, stockholders, and other investors who hold the firm’s securities.

For small firms, the treasurer is likely to be the only financial executive. Larger corporations also have a controller, who prepares the financial statements, manages the firm’s internal accounting, and looks after its tax obligations. You can see that the treasurer and controller have different functions: The treasurer’s main responsibility is to obtain and manage the firm’s capital, whereas the controller ensures that the money is used efficiently.

Fig.2

Still larger firms usually appoint a chief financial officer (CFO) to oversee both the treasurer’s and the controller’s work. The CFO is deeply involved in financial policy and corporate planning. Often he or she will have general managerial responsibilities beyond strictly financial issues and may also be a member of the board of directors.

The controller or CFO is responsible for organizing and supervising the capital budgeting process. However, major capital investment projects are so closely tied to plans for product development, production, and marketing that managers from these areas are inevitably drawn into planning and analyzing the projects. If the firm has staff members specializing in corporate planning, they too are naturally involved in capital budgeting.

Because of the importance of many financial issues, ultimate decisions often rest by law or by custom with the board of directors.