- •Узгоджено

- •Lesson 1 money and its functions

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •Lesson 2 types of money

- •2. Read and translate the text.

- •3. Complete the sentences using the text:

- •4. Answer the questions.

- •5. Match the following definitions using the previous texts:

- •Lesson 3 the sources of income

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •3. Complete the sentences using the text:

- •4. Answer the questions.

- •Lesson 4 gross domestic product and gross national product

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •Lesson 5 Finance

- •2. Read and translate the text.

- •3. Say whether these statements are true or false and if they are false, say why.

- •4. Answer the questions.

- •5. Match the synonyms:

- •Lesson 6 financing a business

- •2. Read and translate the text.

- •3. Answer the following questions:

- •4. Translate into English:

- •5. Fill in the blanks with appropriate words: "investors", capital, money, net worth, customers, bonds, a security exchange, long-term financing

- •Lesson 7

- •1. Read and translate the text in written form.

- •2. Fill in the blanks with appropriate words and word-combinations.

- •Lesson 8

- •Investments

- •1. Memorize the following words and word-combinations:

- •2. Analyze suffixes of different parts of speech, translate the following words:

- •3. Read and translate the text.

- •4. Answer the questions:

- •5. Give the definitions to the following statements using the text:

- •Lesson 9 the role of the financial manager (I)

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •3. Answer the questions, basing your answers on the text:

- •4. Complete the sentences using the text:

- •Lesson 10 the role of the financial manager (II)

- •1. Read and translate the text.

- •2. Say whether these statements are true or false and if they are false, say why.

- •Lesson 11 who is the financial manager?

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •3. Answer the questions.

- •4. Say whether these statements are true or false and if they are false, say why.

- •5. Match the synonyms:

- •Lesson 12 taxes

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •3. Complete the sentences using the text:

- •4. Answer the questions, basing your answers on the text:

- •5. Say whether these statements are true or false and if they are false, say why.

- •Lesson 13 Price

- •1. Memorize the following words and word-combinations:

- •2. Read and translate the text.

- •3. Complete the sentences using the text:

- •4. Answer the questions, basing your answers on the text:

- •5. Say whether these statements are true or false and if they are false, say why.

- •Lesson 14

- •1. Read and translate the text in written form.

- •2. Fill in the blanks with appropriate words and word-combinations.

- •Методичні вказівки та навчальні завдання

Lesson 9 the role of the financial manager (I)

-

1. Memorize the following words and word-combinations:

|

to trace |

відслідковувати |

прослеживать |

|

real assets |

дійсні активи |

реальные активы |

|

tangible |

матеріальний |

материальный |

|

financial security |

фінансове забезпечення |

финансовое обеспечение |

|

securities |

цінні папери |

ценные бумаги |

|

to purchase |

купувати, придбати |

покупать, приобретать |

|

stockholder |

акціонер |

акционер |

|

to generate |

виробляти, утворювати |

производить, образовывать |

|

cash inflows |

притік надходжень |

приток поступлений |

|

capital inflows |

притік капіталу |

приток капитала |

|

stock exchange |

фондова біржа |

фондовая биржа |

|

financial market |

ринок цінних паперів |

рынок ценных бумаг |

|

to scatter |

розкидати |

разбрасывать |

|

around-the-clock |

цілодобовий (-о) |

круглосуточный (-о) |

|

evaluate |

оцінювати |

оценивать |

|

currency |

валюта |

валюта |

|

a bundle of assets |

набір активів |

набор активов |

-

2. Read and translate the text.

To carry on business, corporations need an almost endless variety of real assets. Many of these assets are tangible, such as machinery, factories, and offices; others are intangible, such as technical expertise, trademarks, and patents. All of them need to be paid for. To obtain the necessary money, the corporation sells claims on its real assets and on the cash those assets will generate. These claims are called financial assets or securities. For example, if the company borrows money from the bank, the bank gets a written promise that the money will be repaid with interest. Thus the bank trades cash for a financial asset. Financial assets include not only bank loans but also shares of stock, bonds, and a dizzying variety of specialized securities.

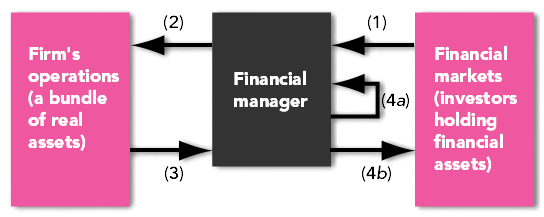

The financial manager stands between the firm’s operations and the financial (or capital) markets, where investors hold the financial assets issued by the firm. The financial manager’s role is illustrated in Figure 1, which traces the flow of cash from investors to the firm and back to investors again. The flow starts when the firm sells securities to raise cash (arrow 1 in the figure). The cash is used to purchase real assets used in the firm’s operations (arrow 2). Later, if the firm does well, the real assets generate cash inflows which more than repay the initial investment (arrow 3). Finally, the cash is either reinvested (arrow 4a) or returned to the investors who purchased the original security issue (arrow 4b). Of course, the choice between arrows 4a and 4b is not completely free. For example, if a bank lends money at stage 1, the bank has to be repaid the money plus interest at stage 4b.

|

Flow of cash between financial markets and the firm’s operations. Key: (1) Cash raised by selling financial assets to investors; (2) cash invested in the firm’s operations and used to purchase real assets; (3) cash generated by the firm’s operations; (4a) cash reinvested; (4b) cash returned to investors. |

Fig.1 |

Our diagram takes us back to the financial manager’s two basic questions. First, what real assets should the firm invest in? Second, how should the cash for the investment be raised? The answer to the first question is the firm’s investment, or capital budgeting, decision. The answer to the second is the firm’s financing decision.