111081-PDF-ENG

.PDF

9-111-081

D E C E M B E R 1 4 , 2 0 1 0

E D W A R D J . R I E D L

J E N N Y E V E R E T T

Restaurant Valuation: O’Charley’s and AFC

The two most important requirements for major success are: first, being in the right place at the right time, and second, doing something about it.

— Ray Kroc, Founder of McDonald’s1

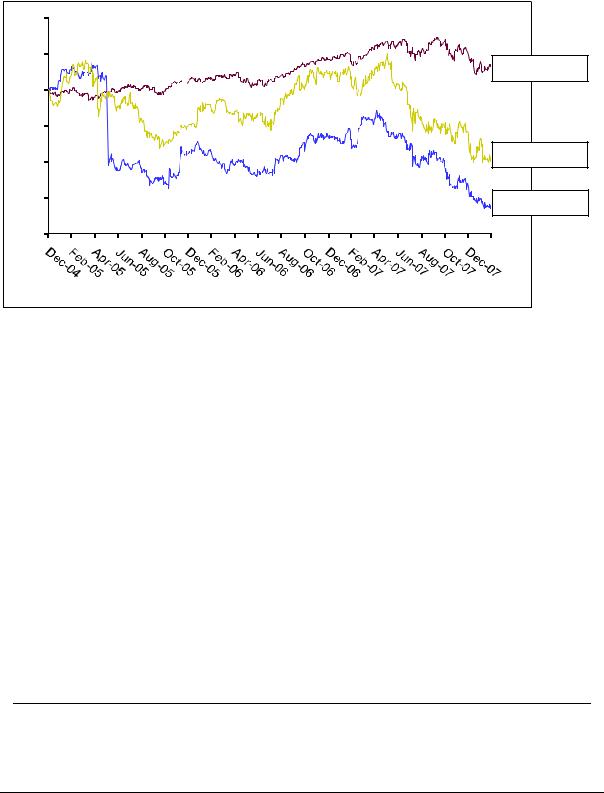

It was a late evening in mid-March 2008 and John Kimball was ready to celebrate his recent formation of Athena Investments, a New York-based search fund that would focus on purchasing significant ownership stakes in smallto mid-cap firms in the restaurant industry. After extensive review, Kimball identified two potential investment opportunities: O’Charley’s, a value-oriented fullservice restaurant chain with 365 locations; and AFC Enterprises (AFC), a quick-service restaurant chain with 1,905 locations (see Exhibit 1 for stock price performance). Kimball needed to understand not only both firms’ operations, but also how the recent and deepening economic downturn would affect each company. Until these questions were resolved, Kimball knew the celebration would have to be put on hold; a search fund was only as good as its first investment and this decision would make or break his career.

Restaurant Industry

Consumer Demand and Segment Overview2

According to the National Restaurant Association (NRA), U.S. restaurant industry sales reached $535 billion in 2007, representing a compound annual growth rate (CAGR) of 5.1% from 2002 to 2007. The industry was highly diverse, but broadly characterized by three segments. Full-service restaurants offered sit-down service at moderate to high prices with the average check exceeding $10 per person. Quick-service restaurants (QSRs) were characterized by orders taken at a cash register or a drive-through window, lower prices with an average check between $5-7 per person, and rapid food preparation with minimal table service. Specialty/managed service included food and drink service provided through contractors, hotels and restaurants, bars, and caterers.

1Gary Allen and Ken Albala, The Business of Food (Connecticut: Greenwood Press, 2007), p. 256.

2Data in this section comes from the National Restaurant Association, 2008 Restaurant Industry Forecast, December 2007.

________________________________________________________________________________________________________________

Professor Edward J. Riedl and Jenny Everett (MBA 2010) prepared this case. This case was developed from published sources. John Kimball and Athena Investments are fictional. HBS cases are developed solely as the basis for class discussion. Cases are not intended to serve as endorsements, sources of primary data, or illustrations of effective or ineffective management.

Copyright © 2010 President and Fellows of Harvard College. To order copies or request permission to reproduce materials, call 1-800-545-7685, write Harvard Business School Publishing, Boston, MA 02163, or go to www.hbsp.harvard.edu/educators. This publication may not be digitized, photocopied, or otherwise reproduced, posted, or transmitted, without the permission of Harvard Business School.

Purchased by: Elena Shakina elena_shakina@mail.ru on November 04, 2013

111-081 |

Restaurant Valuation: O’Charley’s and AFC |

In 2007, the full-service and QSR segments represented over 61% of industry revenue at $180 and $150 billion, respectively. Industry sales were expected to reach $558 billion in 2008, an increase of 4.4% over the previous year (see Exhibit 2 for industry revenue by segment). Many industry observers believed growth for 2008 to 2013 would continue at a moderate pace of 4-5%, driven by rising disposable income, greater focus on convenience, and willingness to purchase ready-made food. By 2010, consumers were expected to spend 53.0% of every food dollar on meals and beverages prepared away from home versus 48.5% in 2005.3

Overall, the restaurant industry was mature and highly competitive with approximately 8,000 restaurant concepts. In 2007, the three largest U.S. restaurant operators based on system-wide sales (including franchisee revenues) were McDonald’s, YUM! Brands (owner and franchisor of KFC, Pizza Hut, and Taco Bell), and Burger King.

Business Models4

Restaurant business models varied widely depending on the composition of company-owned versus franchised stores. Franchising in the restaurant industry was common and growing with franchisees operating more than 56% of all QSR and full-service restaurants. According to the International Franchise Association (IFA), franchisees operated more than 209,000 U.S. restaurants with $200 billion in output and a combined payroll of $47.7 billion for 4.2 million employees. Exhibit 3 provides 2001-2005 statistics for full-service and QSR franchises.

Franchising involved a long-term contractual relationship, typically spanning 15 to 20 years, between a franchisor (the parent company) and a franchisee (an individual business operator), where the latter typically paid initial fees and royalties to use the franchisor’s brand, operating, and management systems. Many restaurants chose to grow their concept through franchising to expand and leverage their brand name recognition without incurring the full cost of store operations and acquisition of real estate and equipment, which are borne by the franchisee. The two primary business models were direct franchising and multi unit franchising. Direct franchising included franchisees that own and operate own unit or multiple single-unit franchises. In contrast, multi unit franchising involved a franchisor that provided up front to the franchisee the rights to open and operate more than one unit through an Area Development Agreement or a Master Franchise. An Area Development Agreement provided the franchisee the right to open more than one unit during a specific time period within a specified geographic area, whereas a Master Franchise provided the master franchisee with the right to sell franchises to other people within the territory through sub franchising. As a result, the master franchisee usually assumed many of the typical roles of the franchisor such as providing support and training as well as receiving fees and royalties.

Accounting Practices

Franchise revenue typically included initial fees, development fees, and royalties. Statement of Financial Accounting Standards (SFAS) 45―Accounting for Franchise Fee Revenue stated initial fees and development fees were recorded as deferred revenue when received and recognized as revenue

3Mark Basham and Justin Menza, “Industry Surveys: Restaurants,” Standard & Poor’s (October 2007), accessed March 2010.

4Quantitative information in this section is from the International Franchise Association, “The Economic Impact of Franchised Businesses,” http://www.franchise.org/franchiseesecondary.aspx?id=37842, accessed March 2010. Qualitative data is from International Franchise Association, “Introduction to Franchising”, http://franchise.org/uploadedFiles/Franchise_Industry/ Resources/Education_Foundation/Intro%20to%20Franchising%20Student%20Guide.pdf, accessed March 2010.

2

Purchased by: Elena Shakina elena_shakina@mail.ru on November 04, 2013

Restaurant Valuation: O’Charley’s and AFC |

111-081 |

when the restaurants covered by the franchise agreement were opened or all material services had been substantially performed. Royalty revenue was to be recognized as earned.5

Goodwill and intangible assets with indefinite lives were annually tested for impairment in accordance with SFAS 142―Goodwill and Other Intangible Assets. Impairment evaluations included a comparison between fair value and carrying value at a reporting unit level. Fair value was typically determined using a discounted cash flow model or market price, if available. If a reporting unit’s carrying value exceeded its fair value, goodwill and intangible assets were written down to their implied fair value. Property and equipment was also tested for impairment on an annual basis or when circumstances suggested potential impairment. Fair value was typically measured by discounting estimated future cash flows on a site-by-site basis. If impaired, a restaurant was written down to its estimated fair value.6

Refranchising, the selling of company-owned restaurants to franchisees, was a common practice within the industry to generate cash and provide potential margin improvement. Any gains recorded on refranchising transactions were to be deferred if there was continuing involvement with the franchisee beyond the customary franchisor role (e.g., seller financing or real estate leasing), and then recognized over the remaining term of the continuing involvement.7

O’Charley’s

Background and Strategy8

O’Charley’s owned and operated restaurants under the O’Charley’s, Ninety Nine, and Stoney River Legendary Steaks (Stoney River) trade names. The three restaurants operated within the fullservice segment of the restaurant industry. O’Charley’s was a casual dining restaurant concept focused on providing a large variety of freshly prepared, cooked to order foods such steaks, BBQ baby-back ribs, seafood, and signature desserts in a neighborhood atmosphere. The typical restaurant was a free-standing building of 4,900 to 6,800 square feet, seating 163 to 275 guests, and an average check per guest of $12.65 in 2007. O’Charley’s served a broad range of guests from a diverse income base, including mainstream casual dining, value-oriented, and upscale dining customers. Ninety Nine was also a casual dining restaurant concept focused on wide selection of appetizers, beef, chicken, and seafood entrees, and desserts in a friendly neighborhood pub atmosphere. Restaurants were typically 5,800 square foot, free-standing buildings seating approximately 190 guests, with an average check per guest of $14.64 in 2007. Ninety Nine typically appealed to mainstream casual dining and value-oriented customers. In contrast, Stoney River was an upscale steakhouse serving premium Midwestern beef, fresh seafood, and other gourmet entrees in a “mountain lodge” environment. Restaurants were intended to appeal to casual dining and fine dining guests by offering high-quality food and service typical of high-end steakhouses at more moderate prices. The average check per guest was $44.62 in 2007.

Charlie Watkins founded the original O’Charley’s in Nashville, Tennessee in 1969. In 1984, the single restaurant was acquired by David K. Wachtel, the former President and CEO of Shoney’s, a Nashville-based family dinner house chain. By 1987, Wachtel had built O’Charley’s into a regional

5FASB, Statement of Financial Accounting Standards No. 45, Accounting for Franchise Fee Revenue, p. 463-465.

6AFC Enterprises, 2007 10-K (Georgia: AFC Enterprises, 2008), p. 32.

7AFC Enterprises, 2002 10-K (Georgia: AFC Enterprises, 2002), p. 42.

8Except where noted, information in this section is from O’Charley’s, 2007 10-K (Georgia: O’Charley’s, 2008), p. 3-4, and http://www.fundinguniverse.com/company-histories/OCharleys-Inc-Company-History.html.

3

Purchased by: Elena Shakina elena_shakina@mail.ru on November 04, 2013

111-081 |

Restaurant Valuation: O’Charley’s and AFC |

chain with 12 restaurants located throughout the Southeast stating, “we’ll concentrate on our current O’Charley’s cities in the Southeast which should keep us busy for three years but will interfere with my golf game.” To help fund the expansion effort, the Company completed an initial public offering in July 1990. While Wachtel relinquished his position in 1993 to devote more time to other projects, O’Charley’s announced an ambitious five-year growth strategy to increase its then-45 restaurant chain into one of the country’s largest casual dining operators with 100 units by 1998, which would exceed the expansion rate of previous years. After achieving its growth targets in 1998 primarily through new restaurant openings, O’Charley’s pursued growth through acquisition with Stoney River in May 2000 and Ninety Nine in January 2003. With respect to the Ninety Nine acquisition, Gregory L. Burns, then President of O’Charley’s, stated, “the remarkably similar operating philosophies and strategies of O’Charley’s and Ninety Nine as well as the wealth of new locations available in Ninety Nine’s core markets create a unique opportunity to sustain the historic growth of the Ninety Nine concept and diversify the growth of O’Charley’s.”

After flattening same-store sales and cost problems between 2000 and 2005, O’Charley’s launched a strategic turnaround and transformation plan focused on food and labor cost management, strengthening the executive team, and establishing profitability incentives. In late 2006, the Company launched Project RevO’lution’ and Project Dressed to the Nines’ for its O’Charley’s and Ninety Nine restaurants, respectively. These projects were significant rebranding initiatives to enhance the guest experience and improve profitability through store remodeling, staff training, and the introduction of new service standards, plateware, and uniforms. By the end of 2007, the Company completed 29 rebrandings at its O’Charley’s restaurants and 42 rebrandings at its Ninety Nine restaurants. In 2008, the Company intended to complete 70 O’Charley’s rebrandings and 40 Ninety Nine rebrandings.9

Operations and Financial Performance10

Of O’Charley’s 365 restaurants, over 97% were company-owned. As of 2007, the Company operated 229 O’Charley’s restaurants in sixteen states in the Southeast and Midwest, 115 Ninety Nine restaurants in nine Northeastern states, and 10 Stoney River restaurants in six states in the Southeast and Midwest. In addition, the Company had eleven franchised/joint venture O’Charley’s restaurants in several states, while Ninety Nine and Stoney River restaurants were not franchised (see Exhibit 4).

Historically, O’Charley’s grew through the opening of new company-owned restaurants or acquisition of existing restaurant concepts. However, the Company had been expanding its franchising program for O’Charley’s restaurants in areas that were outside of company-owned restaurant growth plans. The Company’s franchising strategy focused on selling franchises through exclusive, multi-unit area development agreements. Under its development agreements, franchisees paid between $25,000 to $50,000 in initial fees per restaurant with an up-front development payment at the agreement closing, which represented a portion of the fees associated with the anticipated restaurant openings. Franchisees were also required to pay royalties and marketing fund fees as a percentage of sales. At 2007, franchisees and joint venture partners had opened 11 restaurants out of a total 82 restaurants contracted for development. In 2008, the Company anticipated O’Charley’s to open three to five company-owned and one to three franchised restaurants, and Ninety Nine to open two to four company-owned restaurants.

Revenue increased from $930.2 million in 2005 to $989.5 million in 2006 driven by (i) the $21.2 million impact of the 53rd week in 2006 versus a 52 week year in 2005 and (ii) an increase in average check size per guest due to promotional coupon and program reductions. Revenue declined slightly

9O’Charley’s, 2007 10-K (Tennessee: O’Charley’s, 2008), p. 3 and p. 20.

10O’Charley’s, 2007 10-K (Tennessee: O’Charley’s, 2008).

4

Purchased by: Elena Shakina elena_shakina@mail.ru on November 04, 2013

Restaurant Valuation: O’Charley’s and AFC |

111-081 |

to $977.8 million in 2007 as the U.S. economic slowdown negatively impacted sales and guest counts. Same-store sales for 2007 declined 2.3% and 1.3% for O’Charley’s and Stoney River, respectively; and increased 0.9% for Ninety Nine. Net income declined significantly from $11.9 million in 2005 to $7.2 million in 2007, with the latter year reflecting $16.5 million in impairment and restructuring charges, including $10.2 million for supply chain changes and employee severance and $6.3 million for restaurant rebrandings and closures. For 2007, the weighted-average interest rate paid on its debt was 9.0%. Financial statements for O’Charley’s are provided in Exhibit 5.

AFC Enterprises11

Background and Strategy

AFC developed, operated, and franchised restaurants under the trade name Popeyes Chicken & Biscuits (“Popeyes”). Popeyes was founded by Al Copeland in Louisiana in 1972 and focused on a New Orleans cajun-style menu featuring spicy chicken, chicken sandwiches, fried shrimp, and other seafood. Most restaurants were in free-standing locations with drive-thru windows; other locations included strip mall end units, food courts, and non-traditional sites. Popeyes operated within the QSR segment of the restaurant industry, and was the world’s second largest quick-service chicken concept based on number of units. At 2007, AFC operated and franchised 1,905 Popeyes restaurants in 44 states, the District of Columbia, Puerto Rico, Guam, and 24 foreign countries.

In addition to Popeyes, AFC formerly operated and franchised a number of QSR concepts including Cinnabon®, Church’s Chicken®, and Seattle’s Best Coffee® with the primary objective to be the world’s Franchisor of Choice® by offering investment opportunities in highly recognizable brand names with strong franchisee support systems. The company completed an IPO in 2001, but traded on the Pink Sheets from August 2003 to August 2004 due to a significant restatement of earnings.12 By 2005, AFC had narrowed its business model from a multi-brand operator and franchisor to a singular focus on its Popeyes brand following the sale of its Church’s Chicken brand in December 2004, Cinnabon in November 2004, and Seattle’s Best Coffee in July 2003, and significantly restructured its operations through corporate staff reductions, office closures, and contract renegotiations.

In October 2007, Cheryl Bachelder, a former President and Chief Concept Officer of Kentucky Fried Chicken®, was named CEO to replace Frederick B. Beilstein, who held the position on an interim basis following the resignation of former CEO Ken Keymer. Two senior executives, Ralph Bower as Chief Operations Officer and Dick Lynch as Chief Marketing Officer, were added in February 2008. In early 2008, AFC’s management team announced a new five-year strategic plan to deliver earnings per share growth in the 12-15% range with best-in-industry EBITDA and free cash flow margins based on four pillars including (i) building a distinct relevant brand, (ii) running great restaurants, (iii) strengthening restaurant unit economics, and (iv) aligning people and resources. AFC also commenced a process to identify franchisees to purchase its company-owned restaurants.

Operations and Financial Performance

Popeye’s business model was heavily franchised with over 1,800 franchised restaurants representing 97% of the total restaurant base. Approximately 70% of franchised stores were located in Texas, California, Louisiana, Florida, Illinois, Maryland, New York, Georgia, Virginia, and

11Except where noted, information in this section comes from AFC Enterprises, 2007 10-K (Georgia: AFC Enterprises, 2008).

12Mark Smith, “AFC Enterprises Initiating Coverage,” Feltl and Company, via Thompson ONE Banker, accessed March 2010.

5

Purchased by: Elena Shakina elena_shakina@mail.ru on November 04, 2013

111-081 |

Restaurant Valuation: O’Charley’s and AFC |

Mississippi and 90% of company-owned stores were located in Georgia, Louisiana, and Tennessee. Exhibit 6 provides AFC’s system-wide store data and geographic footprint.

The company’s business strategy emphasized the promotion and growth of the Popeyes system through its franchising model focusing on area development agreements. Under domestic development agreements, franchisees paid a $7,500 non-refundable development fee per restaurant, a $30,000 non-refundable initial fee per restaurant, and a 5% royalty on net restaurant sales.13 In addition, franchisees typically contributed 3% of net sales to national and local advertising funds. In 2008, AFC anticipated opening 115 to 119 new restaurants and closing underperforming restaurants in an amount consistent with historical levels. Therefore, net openings were expected to range between 5 and 15 restaurants.14

Revenue increased from $143.4 million in 2005, to $153.0 million in 2006, to $167.3 million in 2007 Revenue growth from 2005 to 2006 was driven by new franchise openings, domestic same-store sales growth for both franchised and company-owned stores, and the acquisition of previously franchised restaurants. Profitability (excluding discontinued operations associated with the sale of Church’s Chicken) increased dramatically from 5.9% in 2005 to 14.6% in 2006, the result of a significant reduction in general and administrative costs. In contrast, the increase in revenue from 2006 to 2007 was driven primarily by company-owned restaurants including the reopening of New Orleans-based restaurants previously closed as a result of Hurricane Katrina, new openings, and the acquisition of previously franchised restaurants. However, profitability decreased to 13.8% in 2007 primarily due to the increased costs attributable to the increase in sales from company-owned restaurants relative to franchised restaurants. Financial statements for AFC are provided in Exhibit 7. For 2007, the weighted-average interest rate paid on its debt was 6.5%.

Purchase Recommendation

Kimball settled back into his office to compare the financial performance of the two companies (see Exhibit 8). In addition, Kimball gathered operating and financial data for several firms in the restaurant industry (see Exhibit 9). Kimball still had challenges distinguishing the different operational and accounting risks each company faced. Further, while Kimball believed the U.S. economic downturn was likely to continue, its relative effect on each firm was unclear. All of these factors would affect his final purchase recommendation.

13International development fees can reach $15,000 per restaurant and limited sub-franchising rights may be granted.

14AFC Enterprises F407 Earnings Conference Call Transcript, http://seekingalpha.com/article/68479-afc-enterprises-f4q07- quarter-end-1-31-2008-earnings-conference-call-transcript?page=6, accessed April 2010.

6

Purchased by: Elena Shakina elena_shakina@mail.ru on November 04, 2013

Restaurant Valuation: O’Charley’s and AFC |

111-081 |

Exhibit 1 Market Data

Panel A Stock Price Chart (1/1/2005 – 2/29/2008) for O’Charley’s, AFC, S&P 500 |

|||

140 |

Relative Daily Share Price Performance January 2005 - February 2008 (Indexed to 100) |

||

|

|

|

|

120 |

|

|

S&P 500 |

|

|

|

|

100 |

|

|

|

80 |

|

|

|

60 |

|

|

O’Charley’s |

|

|

|

|

40 |

|

|

AFC |

|

|

|

|

20 |

|

|

|

|

AFC |

S&P 500 Index |

O'Charley's |

Panel B Market Measures

O’Charley’s |

December 31, 2007 |

December 29, 2006 |

December 30, 2005 |

|

|

|

|

Price/Book |

0.9x |

1.3x |

1.0x |

Price/EPS (last 12 months) |

48.2x |

26.6x |

30.0x |

Beta (using 1/1/2005 - 2/29/2008) |

1.42 |

|

|

Share Price |

$ 14.98 |

$ 21.28 |

$ 15.51 |

Common Shares Outstanding |

23,148,313 |

23,655,100 |

22,988,401 |

Market Capitalization (millions) |

$ 346.8 |

$ 503.4 |

$ 356.6 |

AFC |

|

|

|

Price/Book |

N/M |

N/M |

N/M |

Price/EPS (last 12 months) |

13.4x |

23.3x |

3.0x |

Beta (using 1/1/2005 – 2/29/2008) |

1.32 |

|

|

Share Price |

$ 11.32 |

$ 17.67 |

$ 15.12 |

Common Shares Outstanding |

27,356,105 |

29,487,648 |

30,001,877 |

Market Capitalization |

$ 309.7 |

$ 521.0 |

$ 453.6 |

Treasury Bond – 30 year |

4.9% |

4.8% |

4.3% |

Source: Compiled by casewriters from Capital IQ.

7

Purchased by: Elena Shakina elena_shakina@mail.ru on November 04, 2013

111-081 -8-

Exhibit 2 Restaurant Industry Sales, 2002 to 2008 ($ Billions)

(Estimated) |

|

|

|

|

|

|

CAGR* |

% Growth |

2008 |

2007 |

2006 |

2005 |

2004 |

2003 |

2002 |

2002 to 2007 |

2007 to 2008 |

2013 04, November on ru.shakina@mail_elena Shakina Elena by: Purchased

Full-Service |

$187.4 |

$179.7 |

$172.5 |

$165.2 |

$156.9 |

$148.3 |

$141.9 |

4.8% |

4.3% |

|

Quick-Service |

$156.8 |

$150.2 |

$143.9 |

$136.9 |

$129.5 |

$120.5 |

$115.1 |

5.5% |

4.4% |

|

Specialty/Managed Service |

$214.1 |

$204.8 |

$194.8 |

$186.1 |

$177.1 |

$167.8 |

$160.6 |

5.0% |

4.5% |

|

Total Revenue |

|

$558.3 |

$534.7 |

$511.2 |

$488.2 |

$463.5 |

$436.6 |

$417.6 |

5.1% |

4.4% |

* Cumulative annual growth rate.

Source: Compiled by casewriters using data from National Restaurant Association as follows: 2008 and 2007 are from 2008 Industry Forecast; December 2007 and 2002-2006 data from Trendmapper, December 2007, at www.restaurant.org/trendmapper/data/nat_sales.xls, accessed March 2010.

Exhibit 3 Full-Service and Quick Service Restaurant (QSR) Franchise Economic Impact

|

|

|

|

|

|

% Change |

CAGR |

|

|

|

|

2001 |

2005 |

2001 to 2005 |

2001 to 2005 |

|

Full-Service Restaurants |

|

|

|

|

|

|

|

Jobs |

954,681 |

1,045,522 |

9.5% |

2.3% |

||

|

Payroll ($ billions) |

$ 11.3 |

$ 13.5 |

19.5% |

4.5% |

||

|

Output ($ billions) |

$ 37.2 |

$ 50.4 |

35.5% |

7.9% |

||

|

Establishments(1) |

38,961 |

42,285 |

8.5% |

2.1% |

||

|

Quick Service Restaurants (QSRs) |

|

|

|

|

|

|

|

Jobs |

2,736,566 |

3,153,207 |

15.2% |

3.6% |

||

|

Payroll ($ billions) |

$ 27.8 |

$ 34.2 |

23.0% |

5.3% |

||

|

Output ($ billions) |

$ 106.7 |

$ 152.1 |

42.5% |

9.3% |

||

|

Establishments(2) |

144,357 |

167,578 |

16.1% |

3.8% |

||

|

|

|

|

|

|

|

|

Notes:

(1)Consists of 19,226 franchisor-owned and 23,059 franchisee-owned restaurants in 2005.

(2)Consists of 71,524 franchisor-owned and 96,054 franchisee-owned restaurants in 2005.

Source: PriceWaterhouseCoopers, “The Economic Impact of Franchised Businesses,” downloaded from Building Opportunity website, http://www.buildingopportunity.com/download/Part1.pdf, accessed March 2010.

111-081 -9-

Exhibit 4 O’Charley’s System-Wide Store Data

Panel A Store Roll-Out

2013 04, November on ru.shakina@mail_elena Shakina Elena by: Purchased

|

|

|

O’Charley’s |

|

|

Ninety Nine |

Stoney River |

Total System |

|||||||

|

Company-Owned |

Franchised/JV |

Company-Owned |

Company-Owned |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2007 |

2006 |

2005 |

2007 |

2006 |

2005 |

2007 |

2006 |

2005 |

2007 |

2006 |

2005 |

2007 |

2006 |

2005 |

Restaurants, Beginning |

227 |

225 |

221 |

10 |

6 |

2 |

114 |

109 |

99 |

10 |

7 |

6 |

361 |

347 |

328 |

New Restaurants |

5 |

3 |

13 |

3 |

4 |

4 |

2 |

5 |

10 |

0 |

3 |

1 |

10 |

15 |

28 |

Closed Restaurants |

(3) |

(1) |

(9) |

(2) |

0 |

0 |

(1) |

0 |

0 |

0 |

0 |

0 |

(6) |

(1) |

(9) |

Restaurants, Ending |

229 |

227 |

225 |

11 |

10 |

6 |

115 |

114 |

109 |

10 |

10 |

7 |

365 |

361 |

347 |

Panel B Same Store Sales

|

2007 |

2006 |

2005 |

|

|

|

|

O’Charley’s |

-2.3% |

-0.8% |

0.0% |

Ninety Nine |

0.9% |

0.7% |

0.7% |

Stoney River |

-1.3% |

4.0% |

3.7% |

Source: O’Charley’s Annual Reports, 2006 and 2007.

111-081 |

Restaurant Valuation: O’Charley’s and AFC |

Exhibit 5a O’Charley’s Inc. Consolidated Balance Sheets

|

December 30, |

December 31, |

||

|

2007 |

2006 |

||

|

|

(in millions) |

|

|

ASSETS |

|

|

|

|

Current Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

10.0 |

$ |

19.9 |

Trade accounts receivable, less allowance for doubtful accounts of |

|

|

|

|

$0.092 in 2007 and $0.175 in 2006 |

|

17.4 |

|

14.9 |

Inventories |

|

18.4 |

|

30.9 |

Deferred income taxes |

|

13.8 |

|

12.0 |

Assets held for sale |

|

2.9 |

|

2.0 |

Other current assets |

|

3.3 |

|

4.8 |

Total current assets |

|

65.8 |

|

84.5 |

Property and Equipment, net |

|

435.8 |

|

464.1 |

Goodwill |

|

93.5 |

|

93.4 |

Intangible Assets |

|

25.9 |

|

25.9 |

Other Assets |

|

28.0 |

|

20.7 |

Total Assets |

$ |

649.0 |

$ |

688.6 |

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

Current Liabilities: |

|

|

|

|

Trade accounts payable |

$ |

10.8 |

$ |

17.5 |

Accrued payroll and related expenses |

|

17.8 |

|

21.3 |

Accrued expenses |

|

23.5 |

|

24.5 |

Deferred revenue |

|

17.8 |

|

19.8 |

Federal, state and local taxes |

|

8.6 |

|

17.4 |

Current portion of long-term debt and capitalized lease obligations |

|

8.5 |

|

9.8 |

Total current liabilities |

|

87.0 |

|

110.3 |

Other Liabilities |

|

59.8 |

|

52.9 |

Long-Term Debt, less current portion |

|

127.7 |

|

126.6 |

Capitalized Lease Obligations, less current portion |

|

9.0 |

|

18.0 |

Shareholders’ Equity: |

|

|

|

|

Common stock—No par value; authorized, 50,000,000 shares; issued |

|

175.0 |

|

193.7 |

and outstanding, 23,148,313 in 2007 and 24,492,124 in 2006 |

|

|

|

|

Retained earnings |

|

190.5 |

|

187.1 |

Total shareholders’ equity |

|

365.5 |

|

380.8 |

Total Liabilities and Shareholders’ Equity |

$ |

649.0 |

$ |

688.6 |

|

|

|

|

|

10

Purchased by: Elena Shakina elena_shakina@mail.ru on November 04, 2013