POSIBNIK_1_KURS

.pdf

Ex.18. Scan the text bellow and give headlines to each paragraph.

The UK economy changes year after year. The UK government seeks to achieve many policies including economic growth, improving the standard of living of people within the country, controlling inflation and reducing unemployment. Its policies will determine the nature and type of decisions that it makes. The government controls the economy in a number of different ways. (0)

__________ . Another way is through the provision of subsidies that make goods or services available for people. A third way is through taxation. Taxes collected by HMRC* for the government fall under two headings: direct and indirect taxation.

(1) __________ . Income tax is paid upon a person's income or, for partnership businesses, upon the partners' incomes. Corporation tax is levied upon the profits of UK companies. HMRC also collects National Insurance contributions. Although these are not really a tax, they are often portrayed as one. National Insurance is the major source of funds used by the government to provide state benefits such as pensions and jobseekers' allowances.

Indirect taxation is not as noticeable as direct taxation. (2) __________ that consumers purchase. Value Added Tax (VAT) at a rate of 17.5% is added to the price of most goods that a consumer purchases. For example, the price of a DVD includes 17.5% VAT. There are, however, certain goods that are zero-rated. (3)

__________ . Governments have continually reviewed the main issues behind taxation. This especially involves deciding who pays the taxes. This process aims to develop a fair system that applies not just for individuals but also for companies.

321

A good communication system involves effectively transferring information between a sender and a receiver. HMRC has developed effective communication systems to ensure that the collection of tax revenues is efficient. (4) __________ . They use the latest technology to simplify the systems, provide an electronic form in an online version for self-employed people. On this electronic form the calculations are done for them. They also provide opportunities (5) __________ .

HMRC uses a variety of different media in order to publicise and inform self -employed people about their tax obligations. (6) __________ . These campaigns emphasise the need for self-employed people to comply with the law and give deadlines for completing the forms. A hotline has been set up for people to report anyone not registering as self-employed and evading paying tax.

*HMRS – Her Majesty’s Revenue and Customs – Британська Податкова Служба

Ex. 19. Read the text. Choose the best sentence A-F to fill each of the gaps 1-6. Do not use any letter more than once. There is an example at the beginning.

0 One way is through legal statute or legislation using an Act of Parliament that creates new laws.

A For example, VAT does not apply to food, baby clothes or prescription products.

BIndirect taxes are added to the price of the goods and services

Cfor feedback to clarify any queries.

DDirect taxation is levied upon incomes or the resources of individuals and organisations.

EThese include television, radio, newspapers and direct mail.

FThey are quick, secure and convenient.

Ex.20. Read the text again and decide whether the following statements are

true (T) or false (F). Correct the false statements.

322

1.Government can control the economy in a number of ways.

2.Income tax is an example of indirect taxation.

3.Taxes are not levied on partnerships and personal incomes.

4.National Insurance is the major source of funds used by the government to provide pensions and jobseekers' allowances.

5.VAT is added to absolutely all goods.

6.HMRC has developed effective communication systems for efficient tax collection.

7.Self-employed people choose a date for paying tax themselves.

8.Citizens can use a hotline to report anyone evading paying tax.

Ex.21. Answer the following questions. Refer to the text if needed.

1.What ways does the British government use to control the economy?

2.What is the difference between direct and indirect taxation?

3.What funds apart from tax revenues does the government use to provide social benefits?

4.What goods are zero-rated? What does it mean?

5.What communication systems does HMRC use to provide the efficient collection of taxes?

6.Are there any deadlines for paying taxes?

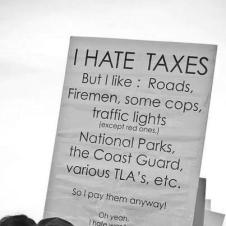

TEXT C: TAXES ARE GOOD

Before reading

Can you anticipate what arguments the author will use in favour of paying

taxes?

Reading

Read an extract from governmentisgood.com – a web project of Douglas J. Amy, Professor of

Politics at Mount Holyoke College, and do the tasks following the text.

(1)Oliver Wendell Holmes, an American physician, poet, professor, lecturer, and author (1809 – 1894), once said: 'I like to pay taxes. With them I buy civilization.'

(2)Most conservative criticisms about the ill-effects of taxes are exaggerated or untrue. Taxes are in fact good – they are dues we pay to enjoy the numerous vital benefits that government provides for our society.

(3)One of the reasons that some Americans do not have this more positive view of taxes is that they seem to ignore the basic connection between taxes and the beneficial programs they fund. What else could explain the fact that polls repeatedly reveal that many people support tax cuts while at the same time they support increasing government spending in many areas? Naturally, antigovernment and anti-tax advocates like to encourage this sense of disconnection between taxes and programs. That is why, for example, when conservatives talk about tax cuts, they rarely talk about the programs cuts that must necessarily follow. They focus on how money will be returned to tax payers, not how money will be taken away from needed government programs. To listen to them, tax cuts are all gains and no pain.

(4)This sense of disconnection is also helped along greatly by the political illusion that the benefits of many government programs are elusive and are often easy to ignore or take for granted. Unlike marketplace transactions, where what we get for our money is immediate and tangible – what we get for our taxes is often delayed and less tangible. When we draw clean water from our taps, we rarely stop to make the connection between this and the taxes we pay to ensure the purity of this vital resource. Also, many of the benefits that come to us from our taxes take the form of things that do not happen to us – like not getting mugged or not breathing dirty air – and these we hardly notice at all.

(5)Anti-government conservatives and libertarians are very good at taking advantage of the fact that while what government does for us often seems elusive,

324

the taxes we pay to government are all too real to most people. Consider, for example, the strategy employed by Arnold Schwarzenegger when he was running for governor of California. In his campaign, he complained loudly about how overtaxed Californians were: “From the time they get up in the morning and flush the toilet, they are taxed. When they go get a coffee, they are taxed. When they get in their car, they are taxed. When they go to the gas station, they are taxed. When they go to lunch, they are taxed. This goes on all day long. Tax. Tax. Tax. Tax.

Tax.” This is true – and it helped Schwarzenegger get elected – but it is a misleading half-truth. He leaves out the rest of the story: that we are also constantly benefiting from government programs throughout our day. He deliberately ignores the connection between taxes and the programs they fund. We may be taxed when we flush the toilet, but what we get is the efficient and easy way to dispose of our waste in a manner that does not poison our water or spread disease. We may be taxed when we buy a cup of coffee, but our taxes help pay for inspections of coffee houses and restaurants that ensure that their food and drinks are fit for human consumption. We may be taxed when we pay for gas, but what we get is the interstate highway system that many of us so frequently use. So the reality is really this: Tax. Benefit. Tax. Benefit. Tax. Benefit. Tax. Benefit. While government may be constantly taking from us in the form of taxes, it is also constantly giving back to us in the form of the various programs that improve our daily lives.

(6) Government bashers like Schwarzenegger can only succeed in making taxes seem onerous and unfair by completely ignoring what we get in return. This tactic may be bogus, but it has been a raging success. Conservatives have been winning this ideological fight in the United States in part because they have convinced most Americans to see themselves primarily as “taxpayers” not “beneficiaries.” In their rhetoric, they make sure to constantly refer to people as “taxpayers.” This is another attempt to frame the issue in a way that encourages us to think of government as bad – as a burden on us. “Taxpayers” is not a neutral term at all, but one loaded with powerful political meaning. It unconsciously

325

reinforces a view of citizen/government relations being one-way – from our wallets to its coffers. A recent poll revealed that 28% of Americans agreed with the statement: “I don’t like paying taxes because the government doesn’t do anything for people like me.” And as long as people continue to see themselves only as taxpayers and not beneficiaries, as long as they ignore the connection between our taxes and what they get back from government, they will be ripe for the picking by those who want to weaken government.

Task 1. Discuss what Oliver Wendell Holmes could mean when he said that with taxes he bought civilization. (para.1)

Task 2. Explain whether “anti-government and anti-tax advocates” (para.3) speak in favour of taxes or against taxes.

Task 3. If something is elusive (para.4), is it

a)very complicated and detailed;

b)difficult or impossible to achieve;

c)well-done and of high quality?

Task 4. How does the author argue with politicians who use anti-tax slogans in their election campaigns? (para.5)

Task 5. What does the author mean by “citizen/government relations being oneway”? (para.6) What disconnection does he focus on in the above text?

BUSINESS COMMUNICATION

IN COMPANY

A Describing companies

Ex.1. Fill in the tables below with the different word forms.

Verb (describing an |

Noun (for the company |

Noun (for the activity or |

activity) |

that is involved in this |

sector that a company is |

|

activity) |

involved in) |

|

|

|

to manufacture |

manufacturer |

manufacture/manufacturing |

|

|

|

|

producer |

|

|

|

|

to export |

|

export |

|

|

|

|

designer |

|

|

|

|

to distribute |

|

|

|

|

|

|

|

supply |

|

|

|

to provide |

|

provision |

|

|

|

|

trader |

|

|

|

|

|

|

publication/publishing |

|

|

|

|

importer |

|

|

|

|

to retail |

|

retail/retailing |

|

|

|

to manage |

|

|

|

|

|

|

insurer |

insurance |

|

|

|

to market |

marketing company, |

|

|

marketer (less frequent) |

|

|

|

|

to sell by wholesale/by |

|

wholesale/wholesaling |

the gross/in bulk |

|

|

|

|

|

Ex.2. Fill in the blanks with the correct noun or verb from the above table.

1.(manufacture) The company is a car ____________ in the USA.

2.(retail) Chopard is in the jewellery ____________ business.

3.(import) Europacific Ltd ____________ European shoes into Asian countries.

4.(export) This company is an ____________ of men’s sportswear.

5.(design) Our company is a leading website ____________ .

6.(publish) He works for the company that ____________ reference books.

327

7.(distribute) European __________ is handled from our centre in the Netherlands.

8.(manage) ____________ consulting is aimed at helping organizations improve their performance.

9.(market) She works in sales and ____________ .

10.( insure) Allianz is the world’s number two ____________ .

Ex.3. Match these well-known company names with their activities. Use these

words in sentences to describe what different companies do.

design of computer software |

IBM |

publishing |

Microsoft |

manufacture of consumer electronics |

Sony |

motor car manufacture |

Toyota |

computer hardware manufacture |

The Economist Group |

retailing of foods and consumer products |

Walmart |

advertising |

Aegis Group |

oil production |

BP Corporation |

broadcasting and Internet |

Ukrtelecom |

|

|

Ex.4. Read descriptions of different companies. Choose one of the nouns

below to describe each company.

Law firm, retailer, wholesaler, importer, finance company, website designer,

manufacturer, travel company, bank, exporter, transport company

a)Multimedia Solutions Incorporated has been designing and managing state- of-the-art commercial websites since 1993. The company provides e- commerce solutions for large and small companies in a number of sectors. At present, the company employs 200 full-time Internet consultants and web designers on their permanent staff. They provide consultancy and other services in the following sectors: financial services, insurance brokering and

328

underwriting, travel services, computer retailing, vehicle leasing. The company’s head office is in Guilford, near London. They also have offices in Birmingham, Manchester and Edinburgh, as well as agencies in Dublin, Paris, Rome and Madrid.

b)Established in 1967, Airbus is a leading aircraft manufacturer with the most modern and comprehensive family of airliners on the market, ranging in capacity from 100 to more than 500 seats. Airbus has delivered over 5,000 aircraft to 180 customers world-wide. Airbus is a global company with its central office in Toulouse and design and manufacturing facilities in France, Germany, the UK , and Spain as well as subsidiaries in the US, China and Japan.

c)Raiffeisen Bank International AG (RBI) regards both Austria, where it is a leading corporate and investment bank, and Central and Eastern Europe (CEE) as its home market. In CEE, RBI operates an extensive network of subsidiary banks, leasing companies and a range of other specialised financial service providers in 17 markets. As of 2013, around 55,000 employees served more than 14 million customers via roughly 3,000 branch offices, the great majority of which are located in CEE. The headquarters of the central institution of the Raiffeisen Banking Group, established in 1927, is in Vienna, Austria.

d)Allen & Overy is a global law firm headquartered in London, United Kingdom.

A member of the UK's Magic Circle of leading law firms, Allen & Overy is widely considered to be one of the world's elite law firms, advising national and multinational corporations, financial institutions, and governments. Since its founding in 1930, Allen & Overy has grown to become one of the largest law firms in the world, both by number of lawyers and revenue. With approximately 5,000 staff and 38 offices worldwide, the firm provides legal advice in Europe, the Americas, Asia, Australia, and the Middle East.

329

e)Marks and Spencer plc (also known as M&S or Your M&S; colloquially known as Marks and Sparks) is a British retailer headquartered in the City of Westminster, London. It has over 700 stores in the United Kingdom and over 300 stores spread across more than 40 countries with 76,250 employees. It specialises in the selling of clothing and luxury food products. M&S was founded in 1884 by Michael Marks and Thomas Spencer in Leeds. In 1998, it became the first British retailer to make a pre-tax profit of over £1 billion.

Ex.5. Read the above information about the companies again and make up a

company profile chart as shown below.

Company name |

Multimedia |

|

|

|

Solutions Inc |

|

|

|

|

|

|

Main area of |

|

|

|

business |

|

|

|

|

|

|

|

Products/services |

|

|

|

|

|

|

|

Customers |

|

|

|

|

|

|

|

Location: |

Head office in |

|

|

Head office |

Guilford, near |

|

|

Subsidiaries |

London; |

|

|

|

offices in |

|

|

|

Birmingham, |

|

|

|

Manchester and |

|

|

|

Edinburgh, as well |

|

|

|

as agencies in |

|

|

|

Dublin, Paris, |

|

|

|

Rome and Madrid |

|

|

|

|

|

|

When did it start |

|

|

|

up? |

|

|

|

|

|

|

|

330