Учебное пособие 800338

.pdfCharles: One of their senior people is supposed to be here. A chap by the name of Vince Newman. I’d like to meet him.

Paul:He’s going to be at this session, so you’ll get your opportunity. Charles: That’s good. Anyway, we’d better get cracking, it’s due to start.

Лексика

attend a conference – присутствовать на конференции approach (v.) – подходить (к кому – л.)

auditorium - аудитория

Not that I’m aware of... - Мне, во всяком случае, ничего об этом не известно.

badge - значок, эмблема

be supposed / due to do smth - предполагается (ожидается), что…

Catch you later - Увидимся позже...

chap (разг.) - парень

Do you mind if...? - Не возражаете, если...?

emergency support team - группа поддержки на случай чрезвычайных обстоятельств

fellow delegate - участник (той же конференции, что и вы) get cracking - (нам лучше) поспешить

have a lot in common - иметь много общего

involvement - (зд.) (иметь) отношение (к какой-л. компании)

IT (Information Technology) - информационная технология

make one’s way (to) – направляться к (двигаться по направлению к) run smth – руководить

registration formalities - регистрация representative - представитель session - заседание

state (v.) - излагать; заявлять towards - по направлению к

Задание 3. Restore the word order.

1. at the NEC / Paul Lodge / in Birmingham / a conference / is attending....................................................................................................................................

2.and introduces himself / A fellow delegate, / Vince Newman, / offers his

hand.................................................................................................................................

3.in the main auditorium / the integrated / going to / systems session / They are both...................................................................................................................

4.Paul / approaches / Another fellow delegate, / of Charles Shearer, / by the name...........................................................................................................................

5.whether / with Americom / Paul / Charles asks / any involvement / he has....................................................................................................................................

101

Задание 4. Categorize in terms of:

Formal Introduction (a), Standard Introduction (b), Informal Introduction (c)

1.«John, I’d like you to met Colin Harper.» John: «Pleased to meet you,

Colin»

2.«Peter, this is Angela.»Peter: «Hello, Angela.»

3.«Ian, I’d like to introduce you to Jan King.»

Ian: «Nice to meet you, Jan.»

4.«Susy, meet Joe.» Susy: «Hi, Joe!»

Beware of body language!

If 60% of communication is non-verbal, gestures can be dangerous! They don’t travel uniformly across borders and the wrong one can land you in hot water. George Bush got caught out in Australia by giving the victory salute with his palm inwards. The meaning? Rather less polite than he intended!

|

Лексика |

beware of smth. |

стеречься, остерегаться |

border (s.) |

граница |

catch out (get caughr out) (зд.) обнаружить, поймать кого–л. на чем-л.

inwards |

внутрь |

land sb. In not water |

оказаться в трудной ситуации |

palm |

ладонь |

uniform (ly) |

одинаковый (одинаково) |

victory salute |

приветствие, отдание чести |

Задание 5. Replace the italicised words and phrases with the ones from the

text.

1.Things can sometimes go wrong.................................................................

2.See you later................................................................................................

3.He’s a nice man...........................................................................................

4.We’d better hurry.......................................................................................

5.Be careful of body language!......................................................................

6.The wrong gesture can get you into trouble.

...............................................................................................................................

102

Business etiquette

On the whole, the German speaker will find fewer differences when conducting business in the UK and in the US than with the business cultures of other countries. A less formal approach may be adopted in some areas – Americans will usually apply first name terms – but there are many similarities. Punctuality is expected – particularly in the US – and lateness will meet with disapproval. The personal zone – that is, the distance we feel most comfortable with when standing next to someone at a social engagement or business meeting – is similar, at between 50 cm and 120 cm.

In the UK, there will be some small talk before turning to business matters; in the US, they will quickly get down to business. In the UK and in the US, the hand is generally offered in greeting, only on the first introduction and not at subsequent encounters.

|

Лексика |

adopt |

принимать, усваивать, занимать; (зд.) вести себя |

apply first name terms |

обращаться к кому-л. по имени |

business matter |

деловые вопросы; вопросы, связанные с бизнесом |

conduct business |

заниматься бизнесом; осуществлять бизнес |

disapproval |

неодобрение |

encounter (s) |

встреча |

engagement |

дело, занятие, встреча; (зд.) прием, вечеринка |

get down to business |

перейти к обсуждению деловых вопросов |

introduction |

(первое) знакомство |

les formal approach |

(вести себя) менее официально; |

менее официальный подход |

|

meet with disapproval |

вызвать неодобрение |

on the whole |

в целом |

personal zone |

так называемое личное пространство- |

расстояние между вами и вашим собеседником |

|

social engagement |

прием, неформальная встреча, вечеринка |

subsequent последующий

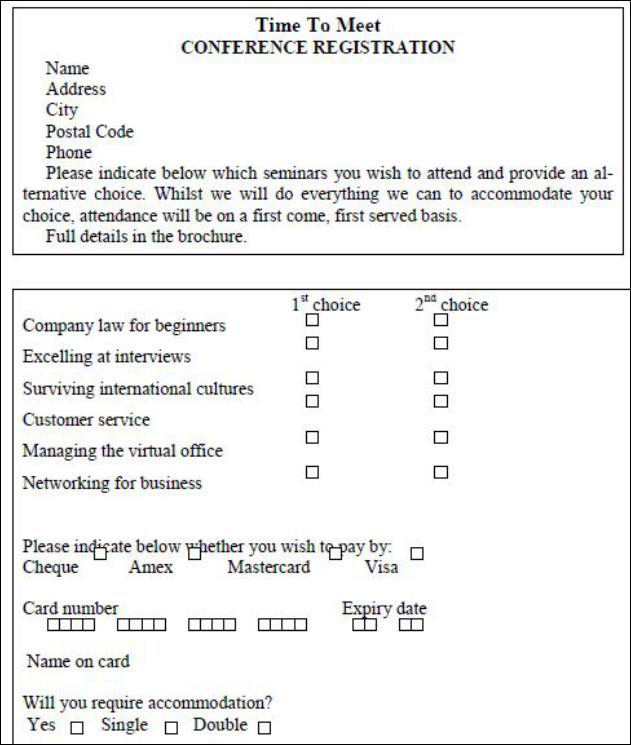

Задание 6. Fill out the Registration form.

103

|

Лексика |

accommodation |

жилье, гостиница |

excel |

превосходить; превзойти; преуспеть |

expiry date |

дата истечения срока действия |

first come, first served |

«первым прибыл – первым обслужен» |

104

Five Ways to Get Rich

It is widely believed that the most important reason to start a business is to make a lot of money. My personal feeling is that the possibility of financial gain is one reason to start a company, but not necessarily the most important.

A recent survey of about 500 successful male entrepreneurs showed that the prospect of making a lot of money ranked sixth in importance in a list of 10 reasons for starting a business. A similar survey of 113 women entrepreneurs showed the prospects for large financial rewards ranked 11th in list of 16 reasons.

Each fall Forbes magazine devotes almost an entire issue to listing the 400 wealthiest people in the United States. Rush to your nearest library to get a copy - it is fascinating. About half of the top 100 people on the 1991 Forbes list made their fortune by starting their own businesses. Here are a few names you may recognize.

Though not all of them make the Forbes list, it is estimated that about 2 million U.S. men and millionaires and that nearly 90 percent made their fortunes by starting their own companies.

The point here is to emphasize the unarguable fact that by starting a company it is possible to make an amount of money that stagger the imagination. It has been done, it is being done now, and it will continue to be done in the future. The potential financial rewards of entrepreneurship are huge.

How about the downside?

At RF Communication each of the four founders invested $5.000. That does not sound like much now, but in 1961 it was about one-third of a year's salary. And, worse yet, none of us had $5.000. We borrowed, put the touch on relatives, cashed insurance policies, etc. As difficult as it was to scrape up the money and as uncomfortable as it felt at the time, the situation was not all bad.

We knew exactly what our downside financial risk was -$5.000. Since this represented about two or three years of saving we concluded that it was an acceptable risk. Most important the ratio of potential financial reward to known

financial risk was high.

As it turned out, eight years later RF Communication merged with Harris Corp. and the four of us made a great deal of money, far more then we would have dared dream when we started the company.

I emphasize this point to my entrepreneurship classes by giving a short exam. I ask the class to list the best ways to get rich. These are my answers:

1)The best way to rich is born rich. No close second. On the Forbes list more people who did тое start companies became rich by inheritance.

2)The second best way, also by wide margin, is to marry rich. This is a problem since most people are quite young when they marry and aren't experienced enough to recognize the importance of picking a wealthy mate.

3)Third place is to win a state lottery. Unfortunately, the probability of winning a state lottery is far lower than the probability of being born rich.

4)Fourth place, in a close finish, is show business. Be an Elizabeth Taylor, a Johnny Carson, or a Michael Jackson. Show business, unfortunately, also requires that you have some talent. Incidentally, both Elizabeth Taylor and Johnny Carson seem determined to do the best they can to help a number of people marry rich.

5)The fifth way is to start a company. And the reality is that this is the only way available to most of us, and clearly has the best odds.

Several years ago I decided to do a bit of rigorous scientific research on this subject in an attempt to confirm the above premise. The research was conducted at the Rochester Yacht Club where I am a member and where I docked my 44-foot sailboat. Using the boat population of the club as my sample I first ascertained that the crossover between a "small" boat and a "big" boat occurred at about 35 feet. Almost with-out exception the "big" boats were owned by people who had started their own companies. The "small" boat were owned by Ph. D. chemists from Kodak.

There is no doubt in my mind that the only opportunity available to most people to make a lot of money is to start a company. The prospect for large financial reward may not de your primary motivation for starting a company but it certainly has a lot of appeal. Be aware that the potential for huge returns is there and the downside, in comparison, can be acceptably low.

UNIT 15

BANKS AND FINANCES

A bank is an establishment for keeping money, valuables safely, the money being paid out on customer’s order (by means of cheques).

105

Banks are different in different countries. Let's speak about the banks in the United States of America. There, commercial banks are classified into two main groups. First, there are national banks. They are charted and supervised by the Federal Government. Secondly there are state banks. They are charted and supervised by the state in which they are operated. All commercial banks can make loans to borrowers.

Major Commercial banks in such cities as Tokyo, Paris, Rio cooperate with each other. In this way they finance imports and exports between countries.

An importer buys merchandise from another country using the currency of that country. For that purpose he buys this currency from the foreign exchange department of this bank. And in the same way if an exporter receives foreign money from sales to other countries, he sends this currency to his bank. By this method the currency of any country can usually be exchanged.

Задание 1. Прочитайте и запомните слова.

commercial bank – коммерческий банк |

|

|

national bank — национальный банк |

|

|

to charter – учреждать, создавать |

|

|

to supervise – заведовать, контролировать |

|

|

state bank – государственный банк |

|

|

merchandise – товары |

|

|

currency – валюта, деньги |

|

|

foreign exchange department — отдел обмена валюты |

|

|

to exchange currency – обменивать валюту |

|

|

to attract |

— привлекать, притягивать |

|

to deal with |

— иметь дело с |

|

currency |

— валюта, деньги |

|

to vary |

— менять (ся), изменять (ся) |

|

lodging |

— жилье |

|

toll-free |

— свободный от налога |

|

identification (ID) — удостоверение личности |

|

|

denomination [— стоимость (денежных единиц) branch |

— отрасль |

|

to bounce — возвращаться через банк (про чек, из-за отсутствия средств на счету плательщика)

Задание 2. Прочитайте, переведите и обсудите информацию: Read and discuss the text.

BANKS AND BUSINESS

A bank is a place of business that safeguards, lends, exchanges, and issues money and carries on a number of other financial dealings. The money is being paid out on customer`s order (by means of cheques.). Banks are different in different countries. In

106

the United States of America commercial banks are classified into two main groups. First, there are national banks. They are charted and supervised by the Federal Government. Secondly, there are state banks. They are charted and supervised by the state in which they are operated. All commercial banks can make loans to borrowers. Major commercial banks in such cities as Tokyo, Paris, Rio cooperate with each other. In this way they finance imports and exports between countries. An importer buys merchandise from another country using the currency of that country. For that purpose he buys this currency from the foreign exchange department of this bank. And in the same way if an exporter receives foreign money from sales to other countries, he sells this currency to his bank. By this method the currency of any country can usually be exchanged.

Most banks in the US open at 9:00 and close between 3:00 and 5:00, but stay open later on Fridays. Some banks have longer hours in order to attract customers.

What's the best way to carry money safely while you are travelling? There are three possibilities — personal checks from your country, traveler's checks and credit cards. Some American banks accept foreign checks such as Eurocheques, the problem is that only banks, which are used to dealing with foreigners will know what Eurocheques are.

It may be more convenient to carry traveller's checks, which are insured against loss. They should be in dollars, because only a few banks do much business in foreign currencies. If your checks are not in dollars, it may take you a long time to find a bank that will exchange them. You can use traveller's checks almost anywhere — in restaurants, stores or ticket offices — without having to go to a bank. If you run out of them, you can buy more at most banks. Their service charge will vary, though, so ask what it is before you buy your checks. Americans would say the best way to carry money it is to have a major credit card like Visa, Master Card or American Express. Credit cards can be cancelled if they are lost or stolen. And because they are widely accepted in the US, it is easy to use them to pay for lodging, transportation, meals and things you want to buy from larger stores.

Of course, you can't get along without cash, but you don't need to carry much with you.

Задание 3. Найдите ответы на вопросы в прочитанном тексте. Answer the questions.

1.What are the opening hours in most banks of the USA?

2.Which bank sells traveller's checks?

3.Is it a good idea to have a credit card when you travel in the USA?

4.What is the best way to carry cash?

5.What currency should traveller's checks be in?

6.Is it convenient to carry them in Euro?

7.Where should you go if you want to cash a Eurocheque?

8.Can you buy traveller's checks in banks?

9.What is to be done when a credit card is lost?

10.Why is it not convenient to have personal cheques from your country?

107

Задание 4. Найдите в тексте английские эквиваленты. Give the English for: Привлекать клиентов, наилучший способ путешествовать, возможность,

принимать чеки, иметь дело с иностранцами, утрата, обменивать, заканчивать-

ся, воровать, носить.

Задание 5. Закончите предложения. Complete the following.

1.The working hours for most banks in the USA__________.

2. The best way to carry money .

3.If your cheques are not in dollars ______.

4. |

Traveller's cheques can be used |

. |

5.If you run out of them .

6.Credit cards can be cancelled- .

7.Credit cards are widely accepted in the USA, so___________.

8.You can't get along without cash___________.

9.To have a major card like Visa, MasterCard and American Express________.

Задание 6. Подберите к словам из левой колонки определение из правой:

Match the expressions on the left with the definitions on the right. For example: deposit a check, means = pay a check into your account.

blank check |

ask a bank not to pay a cheque you |

|

bouncing check |

have written |

|

exchange a cheque for cash |

||

sign a check |

||

sign on the front of a check to show |

||

check card |

||

that you authorize the bank t to pay |

||

|

||

cash a check. |

the money from your account |

|

stop a check |

check which cannot be cashed be- |

|

|

cause the person writing it has not |

|

|

enough money in the account to pay it |

|

|

plastic card from a bank which guar- |

|

|

antees payment of a check |

|

|

check with the amount of money and |

|

|

the payee left blank, but signed by the |

|

|

drawer |

Задание 7. Дайте английские определения словам. Give English definitions as in the model:

Model: safely — without risk.

Travel, traveller’s cheque, accepts, to deal with, currency, charge, lodging.

108

Задание 8. Прочитайте и обсудите текст. Read and discuss the text:

Peter lost his traveller's cheques. He went to the traveller's cheques office and they told him that he had to call New York before they could do anything. They let him use their phone — it was a toll-free number. The clerk asked him how much he had lost and what the cheque numbers were. Luckily, he had them written down. Then the clerk wanted to know where he bought the cheques and if he had any ID. Peter gave him his passport number. The clerk gave Peter «a file number» and told him where the nearest refund office was. Peter told the clerk he had already been there and the clerk spoke to the agent. After that, Peter filled out a form with all the same information on it. Then finally, the agent okayed the thing, the supervisor initiated it and Peter got his cheques.

Задание 9. Ответьте на вопросы к тексту. Answer the questions:

1.What happened to David?

2.Where did he go then?

3.What did he want the traveller's cheques company to do when he went to their office?

4.What did he have to do first?

5.Did he have to pay for the phone call?

6.What were the four things the clerk in New York wanted to know?

7.Why was it easy for David to get new checks?

8.What would have made it more difficult?

Задание 10. Заполните бланк о потере чека:

Fill out this lost traveler's check form.

Name ____________________________________________

Address _________________________________________

Date, location and circumstances of loss ______________

Documents of identification lost ____________________

Currency of checks _______________________________

Amount of loss _________________________________

The lost traveller's checks were:

Check one:

·Signed by me only in the upper right corner

·Signed by me in the upper right corner and countersigned by me in the lower left corner

·Neither signed or countersigned by me in the upper

right or lower left corner Date of purchase

Amount of purchase ______________________________

109

Задание 11. Закончите предложения. Complete the following.

1.Peter lost .

2.In the traveller's check office he was told_____________.

3.The clerk asked Peter __.

4.The clerk also wanted to know__.

5.Peter gave the clerk __.

6.Peter filled out the form __.

7.Peter got his checks after __.

Задание 12. Прочтите и обсудите текст. Read and discuss the text.

American money comes in coins worth 1 (pennies), 5 (nickels), 10 (dimes), 25 (quarters), and 50, though half dollars aren't very common. Paper money is in denominations of 1, 5, 10 and 20 dollars. Two, fifty and one-hundred dollar bills exist, but they are not common, so don't be surprised if a store clerk looks very closely at a hundred dollar bill to make sure it's real.

When you pay for something with your credit card, the salesman will take your card and fill out a form using a computer. He will ask you to sign the form and then give you a copy. The credit card company will send you a bill once a month, showing the purchases you've made.

If you write a personal cheque and it bounces, you'll have to pay the bank a high service charge. So be sure you have enough money in your bank account to cover any cheques you write.

Задание 13. Ответьте на вопросы по тексту. Answer the questions.

1.What American coins do you know?

2.What are the denominations of American paper money?

3.Are fifty and one-hundred dollar bills common?

4.What is the procedure of paying with a credit card?

5.Why are the bills sent by a credit card company? How large is the interest the companies charge?

6.Why is it necessary to have enough money in your account if you have a

credit card?

7.What happens if your cheque bounces?

Задание 14. Вставьте предлоги. Insert the prepositions.

1.American money comes…coins.

2.Paper money is in denominations … 1, 5, 10, 20 dollars.

3.If your traveller's check is lost, you'll have your money ...

4.The clerk looked closely ... the bill.

5.He paid.... the purchase… his credit card.

6.Do you have enough money ... your account?

Задание 15. Закончите предложения, используя информацию из текста. Complete the following.

1.American money comes in coins ___.

2.Half dollars__ .

3.Don't be surprised if _ .

110