- •Знайдіть еквіваленти до наступних словосполучень: (Score – 8 points)

- •Закінчіть речення в лівому стовпчику за допомогою фраз з правого стовпчика: (Score – 8 points)

- •II. Знайдіть еквіваленти до наступних словосполучень: (Score – 9 points)

- •IV. Дайте відповіді на питання до тексту:

- •I. Закінчіть речення в лівому стовпчику за допомогою фраз з правого стовпчика: (Score – 7 points)

- •II. Закінчіть речення за допомогою фраз з правого стовпчика: (Score – 8 points)

II. Закінчіть речення за допомогою фраз з правого стовпчика: (Score – 8 points)

|

|

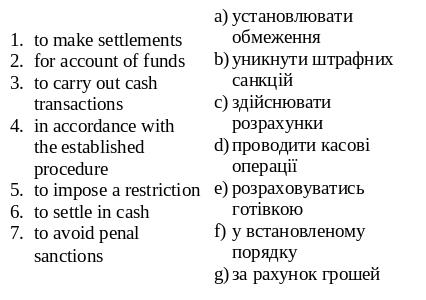

III. Знайдіть еквіваленти до наступних словосполучень: (Score – 7 points)

IV. Дайте відповіді на питання до тексту: (Score – 8 points)

What is the main document which regulates procedures and conditions for conducting business cash transactions in Ukraine?

What may an enterprise use sales proceeds for?

What restriction does Provision № 72 impose?

How are enterprises to settle in cash with each other and with individuals?

Where is the procedure of paying out cash on account regulated?

When is individual worker to compile a report on how the funds received were used and to the accounting department after a business trip?

What is the cash balance limit of a cash office?

What is an enterprise to do in order to fix a limit?

(Total Score – 65 points)

Unit 6. (Total Score – 42 points)

OFFSHORE AREAS AS A MEANS OF SAVING AND AUGMENTING CAPITAL (Score – 12 points)

The word „offshore” is interpreted literally.

In international practice, the definition „offshore” is used to characterise financial centres which carry out financial and credit operation jointly with foreign entrepreneurs on terms that are preferential for the entrepreneurs in a broader sense, „offshore areas” means countries or their territories where the government grants considerable taxation privileges to certain companies owned by foreigners in such areas, which are called offshore, accounting and audit requirements are decreased or absent and trade and customs limits are entirely or partially removed.

What are the advantages of offshore areas?

For countries where offshore areas are located, they are an excellent means of attracting foreign capital and developing their own industrial and social infrastructure.

For foreign entrepreneurs using offshore areas it is a method:

to save capital since funds are on account at reliable banks where payment for banking services is not high;

to effectively accrue capital. This is facilitated by the alleviation of taxes, as well as by the extent of a free capital flow. For example, in many offshore areas, currency restrictions or currency controls are practically absent. Also, an additional advantage (in the entrepreneurs’ opinion) is the presence on anonymity for businesses using offshore areas and confidentiality of information about those businesses (hereafter − offshore companies). In other words, the real owners of an offshore company may remain unknown by registering the company through trust companies using documents where they indicate the last names of nominal shareholders and people responsible for performing corporate duties and instructions. At the same time, the real owners, through power of attorney, transfer shares into the nominal shareholders’ control. The real owners also limit the scope of the security-related financial operations which may be carrier out by the people mentioned above.

We have already mentioned that offshore areas are only an advantage far certain kinds of companies. That is why, in offshore areas it is expedient to register:

insurance companies engaged in risk insurance or reinsurance;

shipping (ship owning) companies using their own, as well as charted vessels during transportation;

news agencies and companies rendering services in marketing, advertising, management, etc.;

holding companies.

The Ukrainian legislation provides for protection against the influence on the national economy by offshore areas. For instance, the Law of Ukraine “On the State Privatisation Program” dated May 18, 2000 №. 1723-III forbids companies registered in offshore areas from taking the role of an industrial investor while privatising state property.

Ukrainian entrepreneurs have a real opportunity to become owners of offshore companies overseas. Especially because at present there exists a rather developed market of services in registering companies in offshore areas (having a low taxation level or complete tax exemption).

It should be noted that the list of offshore areas promulgated in accordance with the resolution of the Cabinet of Ministers of Ukraine of March 14, 2001 №.79-p* is not complete. Actually, the number of offshore areas is much greater but domestic entrepreneurs pay attention to such areas Cyprus, the Bahama Island, the Isle of Man, etc.

The list of offshore areas

The British Isles regions |

|

|

|

|

|

|

|

|

|

The Middle East |

|

|

|

North, Central and South America |

|

|

|

|

|

|

Africa |

|

|

|

|

|

|

|

Pacific ocean region |

|

|

|

|

|

|

|

|

|

|

Caribbean region |

|

|

|

|

|

|

|

Words and word combinations (Score – 12 points)

|

офшорні зони |

|

примноження |

|

пільговий |

|

накопичувати |

|

зниження тиску податків |

|

анонімність |

|

на підставі доручення |

|

операції з цінними паперами |

|

перестрахування |

|

забороняти |

|

звільнення від податку |

|

оприлюднений |

Дайте відповіді на питання до тексту: (Score – 4 points)

What does the word „offshore” mean?

What are the advantages of offshore areas?

May the real owners of an offshore company remain unknown?

Have ukrainian entrepreneurs an opportunity to become owners of offshore companies overseas?

Прочитайте текст ще раз та складіть план тексту. (Score – 6 points)

Зробіть письмовий переклад 2, 3 абзаців. (Score – 6 points)

(Total Score – 42 points)