- •Знайдіть еквіваленти до наступних словосполучень: (Score – 8 points)

- •Закінчіть речення в лівому стовпчику за допомогою фраз з правого стовпчика: (Score – 8 points)

- •II. Знайдіть еквіваленти до наступних словосполучень: (Score – 9 points)

- •IV. Дайте відповіді на питання до тексту:

- •I. Закінчіть речення в лівому стовпчику за допомогою фраз з правого стовпчика: (Score – 7 points)

- •II. Закінчіть речення за допомогою фраз з правого стовпчика: (Score – 8 points)

Закінчіть речення в лівому стовпчику за допомогою фраз з правого стовпчика: (Score – 8 points)

A |

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

II. Знайдіть еквіваленти до наступних словосполучень: (Score – 9 points)

|

|

III. Назвіть речення, що відповідають змісту тексту. Виправте невірні твердження: (Score – 10 points)

Here are few steps to take and few hurdles to overcome in order to register a company in the UK.

Before launching a business you are to mail required documents to the Companies House.

Memorandum of association contains a company’s name, address and objectives.

A company’s memorandum must be signed by each subscriber without a witness.

In form 10 the company’s officers must give their birthdates, occupation and other management positions they have hold within the last five years.

A private company must have two officers and two secretaries.

The name of a public company must begin with the words “public limited company”.

The registration documents are usually submitted to the Companies House by mail.

After the registration of a company’s memorandum the registrar of companies gives a certificate.

A newly established company must be registered with the Inland Revenue as taxpayer.

IV. Дайте відповіді на питання до тексту: (Score – 10 points)

What is the difference in registration of a company in the UK and in Ukraine?

What should one submit in order to register a company?

What does memorandum of association contain?

Do articles of association specify the rules for a company’s internal affairs?

What must company’s officers give in form 10?

What is form 12?

How many officers must a private company have?

Are there any restrictions on the choice of the company name?

Where are the registration documents submitted to?

What is the Inland Revenue?

(Total Score – 75 points)

UNIT 3. (Total Score – 73 points)

THE ACCOUNTING SYSTEM OF GREAT BRITAIN AND NORTHERN IRELAND: IT'S GENERAL REGULATORY SCHEME IN RELATION TO UKRAINIAN ACCOUNTING (Score – 12 points)

In accounting as well as in all other spheres of activity, Great Britain's long-standing traditions and frugal attitude are unique at same time the British are still open to new trends and achievements in economic science and are ready to integrate them into their national accounting system.

When analyzing the British financial accounting model, one is to take into account that it traces its roots back to the Middle Ages. Its professional foundations have been forming for centuries. The United Kingdom's accounting school, later called the Anglo-Saxon accounting school, became the foundation of its accounting system. According to most specialists this model represents the prevailing paradigm of modern accounting standardization. The Anglo-Saxon system formed the basis for the International Accounting Standards (IAS). (In Ukraine these standards are usually abbreviated as МСБУ, and in Russian as МСФО.) Therefore, the headquarters of the International Accounting Standards Board (which has recently been called the Accounting Standards Committee) is located in the capital of Great Britain.

Because the IAS system is acknowledged by the European Community as the basis for further integration in accounting systems of member states; and because all companies whose shares have been sold on the European stock exchanges will have to represent financial reporting in IAS format beginning in 2005, one may conclude that the British accounting model will continue to prevail. This also affects Ukraine directly because of the Law on accounting and reporting, in which local accounting refers to international standards, it is important to note that the British often call their accounting rules generally accepted accounting principles" (GAAP). Since the USA uses the same abbreviation to designate its accounting system misunderstandings often occur while interpreting nuances in the processing of accountants' data within the national systems of financial reports. That's why the following abbreviations have recently been used more frequently: for Great Britain — UK GAAP and for the United States - US GAAP.

In practice, however, the standards created by public accounting organizations are a peculiar feature of the official management of British accounting. This situation generally reflects the British regulatory style in which both the state and society trust the professional community, who in turn strives to qualify this trust by providing maximum efficiency, clarity and democracy in their professional activities.

The legislative regulation of accounting issues on a national scale began only in 1981 when Great Britain started to implement the provisions of the Fourth Directive of the EQ. (This document contains basic rules of financial accounting, which must be followed by enterprises of European Union member states). The 1985 Act on Companies continued this implementation by uniting the Acts of 1947, 1948, 1967 and 1981. The 1989 Act on Companies reflected requirements of the Seventh Directive of the EU, which deals with the consolidated financial reporting, and the Eighth Directive of the EU, which refers to auditors' activities.

However, the regulation on the level of professional organizations began much earlier. In 1970 the Institute of Charted Accountants in England and Wales ((CAEW) formed the Accounting Standards Steering Committee (ASSC) whose tasks among others were to generalize accounting practices and improve accounting rules and methods.

Until 1976, along with the ICAEW, this committee also included the five most powerful organizations - the Institute of Chartered Accountants of Scotland, the Institute of

Chartered Accountants of Ireland, the Privileged Association of Chartered Accountants, the Privileged Institute of Management Accountants, and the Privileged Institute of Public Finances and Accountancy. The same year the committee changed its name to the Accounting Standards Committee (ASC). Draft standards were passed by the committee and then approved by all of its organizations. Later, each organization issued the Statement on Standard Accounting Practice (SSAP) for its members.

The Accounting Standards Board has been fulfilling the functions of the committee since August 1991. The committee managed to pass twenty-two SSAP standards, which were then approved for application by a newly created body. All of these standards are obligatory for members of the six above-mentioned organizations. The 1985 and 1989 Acts on Companies alluded to the compulsory application of these standards.

The Financial Reporting Standards (FRS) are used in England along with the SSAP Regulations.

The following standards of accounting and reporting are now valid in the United Kingdom:

SSAP 2 Disclosure of Accounting Policies,

SSAP 4 Accounting for Government Grants,

SSAP 5 Accounting for Value Added Tax,

SSAP 9 Inventories and long-term Contracts,

SSAP 13 Accounting for Research and Development,

SSAP 15 Accounting for Deferred Tax,

SSAP 17 Accounting for Post-balance Sheet Events,

SSAP 19 Accounting for Investment Properties,

SSAP 20 Foreign Exchange Translation;

SSAP 21 Accounting for Leases and Hire Purchase Contracts;

SSAP 24 Accounting for Pension Costs,

SSAP 25 Segmental Reporting,

FRS 1 Cash Flow Statement,

FRS 2 Accounting for Subsidiary Undertaking,

FRS 3 Reporting Financial Performance,

FRS 4 Capital Instruments,

FRS 5 Reporting the Substance of Transactions,

FRS 6 Acquisitions and Mergers,

FRS 7 Fair Values in Acquisition Accounting,

FRS 8 Related Party Transactions,

FRS 9 Associates and Joint Ventures,

FRS 10 Goodwill and Intangible Assets,

FRS 11 Impairment of Fixed Assets and Goodwill,

FRS 12 Provisions, Contingent Liabilities and Contingent Assets;

FRS 13 Derivatives and other Financial Instruments: Disclosure;

FRS 14 Earnings per share,

FRS 15 Tangible Fixed Assets,

A separate statute, the Financial Reporting Standard for Smaller Enterprises (FRSSE), exists for small business entities in the British accounting system.

All of the above-mentioned documents form an integral part of the accounting standards. But Great Britain has recommended standards in addition to those. Most important are the Statements of Recommended Practice (SORP). These documents do not relate to the majority of enterprises and are either concerned with particular problems in a specific industry or in other business situations.

Stock exchange rules are an additional source of accounting regulation. But these rules are applied only to those companies whose shares undergo an exchange listing.

After Ukraine had started a radical accounting reform in accordance with international standards, principal differences between Ukrainian and British financial accounting systems were eliminated. Today's concept of Ukrainian accounting conforms completely to generally accepted accounting principles.

As to the IAS system, Ukraine and Great Britain's national accounting systems preserve some peculiarities.

At the same time some differentiation within the limits of the general IAS concept is considered possible. As is known, IAS allows for the application of so-called alternative accounting methods. But national systems of financial accounting and reporting effect such possibilities in different ways.

Let's give a few examples of discrepancies between the accounting of Ukraine and the United Kingdom.

In accordance with paragraph 23 of IAS 2 "Inventories, "such an accounting method of inventories flow as LIFO ("last in -first out") is optional. The LIFO method is acknowledged as a standard way of accounting along with other generally accepted ways of inventories retirement evaluation in cl 20 of Accounting Standards of Ukraine (ASU). At the same time British standard SSAP 9 directly prohibits the usage of this method in the accounting practices of Great Britain. Despite this fact British companies doing business outside Great Britain through subsidiary enterprises may use the LIFO mechanism if it is permitted by local accounting regulations.

Thus, if an enterprise of British origin functions in Ukraine, it may freely use a method of inventories write-off evaluation in accordance with the "last in - first out" principle.

An interpretation of financial expenses incurred because of an acquisition of fixed assets is another example of different applications of IAS alternatives.

IAS 23 "Borrowing Costs" in paragraph 11 as an alternative approach allows for the amortization of borrowing costs incurred due to the entering of qualified assets into the books.

Ukraine has not accepted this alternative. CI.11 of UAS 8 "Intangible Assets" and cl.8 of ASU 7 "Fixed Assets" prohibit the inclusion of interest credit expenses into an intangible assets cost.

At the same time English FRS 15 permits in some situations to include such costs into the cost of fixed assets. But this method is deemed more an exception rather than a rule and is not encouraged as a primary approach. Thus, paragraph 19 of the standard says that an enterprise may make a decision to capitalize borrowing costs directly related to the building up of intangible assets as a part of the value of such assets. In connection with this, the total amount of the borrowing costs capitalized within a reporting period is not to exceed the total amount of borrowing costs incurred within this period.

There are also many discrepancies of a less conceptual character. For example, when evaluating fixed assets such as constructions erected by the enterprise itself (without hiring a general contractor) the British system highlights overspent costs. They are explained in the following way. If extraordinary expenses were incurred during construction, an enterprise is to find a guilty person. If the overspending occurred because of internal inefficiency, it is not to be included into the value of the building and is to be written off in the period of its occurrence. Excessive spending on building materials, which do not correspond to the nomenclature of the construction, by the internal supply dispatcher is an example of such situation. If overspending was caused by external factors (e. g. legislative increase in workers’ salary) underestimated expenses are to be capitalized by general standards. An interpretation of selling expenses in accounting illustrates another discrepancy. In accordance with ch. 11 SAS 16 selling expenses are not to be included into the production cost of goods sold.

In practice, British accounting follows the same rule. But this general principle loses validity in the case of good sold under the conditions “sale or return”. Thus, goods at a buyer’s warehouse remain a seller’s property. In such situations, a seller’s expenses for package and delivery of goods to a buyer are to be included into the cost of goods.

The British are also eccentric in some nuances of charging amortization. British standard FRS 15, along with generally accepted methods, comprises the so-called substitute method or renewals accounting. This method is based on the following precondition: some items of public infrastructure connected with water resources (water-mains, sewerage systems, reservoirs, dams, collectors) are not to be amortized, as such network systems are constantly maintained in an equally high-quality condition. Hence, these items have an unlimited usefulness.

A renewals accounting, whose annual costs necessary to maintain the said infrastructure are acknowledged as an amortization security, is applied to such assets. As long as these expenses occur, they are to be amortized. As a result, both the cost of water network items and the amounts of their amortization increase.

A forced expanded transformation of Ukrainian accounting to the general European format expanded professional interests of Ukrainian accounting personnel. This article was written to facilitate a familiarization with the British accounting experience.

Words and word combinations (Score – 37 points)

|

система бух. обліку |

|

|

регуляторна схема |

|

|

давні традиції |

|

|

дбайливе відношення |

|

|

нова тенденція |

|

|

прийняти до уваги |

|

|

міжнародні стандарти бух. обліку (МСБ) |

|

|

штаб-квартира |

|

|

комітет по міжнародним стандартам |

|

|

європейське співтовариство |

|

|

держава-учасник |

|

|

європейська біржа |

|

|

у форматі МСБ |

|

|

закон про бух. облік та звітність |

|

|

загально визначені принципи бух. обліку |

|

|

для позначення |

|

|

бухгалтерська обробка даних |

|

|

в рамках національної системи |

|

|

регулювання |

|

|

законодавче регулювання |

|

|

облікове питання |

|

|

інститут дипломованих бухгалтерів |

|

|

комітет з управління бухгалтерськими стандартами |

|

|

привілегірована асоціація сертифікованих бухгалтерів |

|

|

положення по стандартній бухгалтерській практиці |

|

|

посилатися на |

|

|

урядові дотації |

|

|

відстрочений податок |

|

|

облік подій після дати балансу |

|

|

переклад інвалютної звітності |

|

|

лізинг |

|

|

контракт на орендне придбання |

|

|

облік пенсійних витрат |

|

|

звіт про рух грошей |

|

|

дочірнє підприємство |

|

|

звіт про фінансову позицію |

|

|

звітність по суті операції |

|

Назвіть речення, що відповідають змісту тексту. Виправте невірні твердження: (Score – 8 points)

The British financial accounting model traces its roots back to the Middle Ages.

The Anglo-Saxon system formed the basis for the International Accounting Standards.

The legislative regulation of accounting issues on a national scale began in 1990.

The Financial Reporting Standards are not used in England.

Stock exchange rules are an additional source of accounting regulation.

British companies doing business outside Great Britain through subsidiary enterprises may use the LIFO mechanism.

The British are eccentric in some nuances of charging amortization.

A forced transformation of Ukrainian accounting to the general European format expanded professional interests of Ukrainian accounting personnel.

II. Заповніть пропуски в наступних реченнях. Перекладіть ці речення на українську мову: (Score – 7 points)

In 1976 the Accounting Standards Steering Committee (ASSC) changed its name to … .

A separate statute, …, exists for small business entries in the British accounting system.

After Ukraine had started … in accordance with international standards, principle differences between Ukrainian and British financial accounting systems were eliminated.

There are some … between the accounting of Ukraine and the United Kingdom.

If an enterprise of British origin functions in Ukraine, it may use a method of ... .

If extraordinary expenses were incurred during construction, an enterprise is to find ... .

If the overspending occurred because of ..., it is not to be included into the value of the building and is ... in the period if its occurrence.

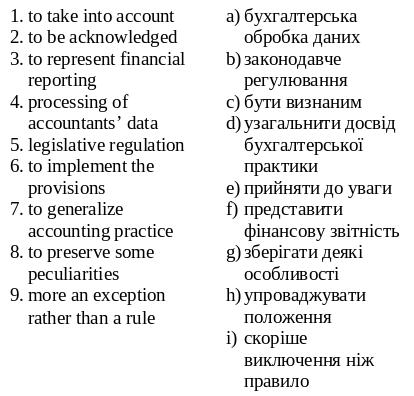

III. Знайдіть еквіваленти до наступних словосполучень: (Score – 9 points)